PakAlumni Worldwide: The Global Social Network

The Global Social Network

Pakistan in 2016: Economy, Security & Relations With India, US

Did Pakistan’s internal security improve in 2016? If do, how? And by how much? How was it done? By Zarb e Azb military operation? Did Pakistan implement the National Action Plan to address extremism and radicalization in society?

|

| Source: South Asia Terrorism Portal |

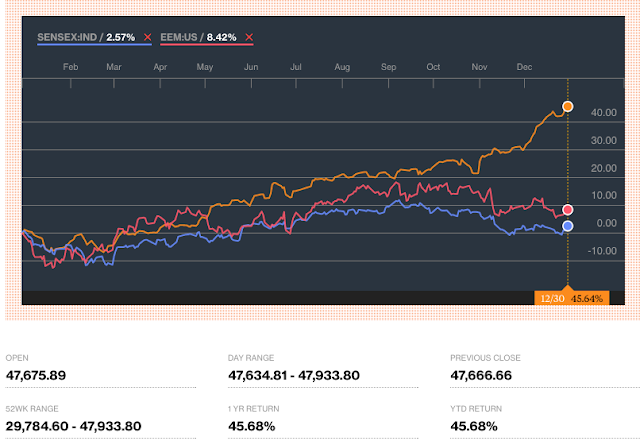

How did Pakistan’s economy do? And how did the stock market do? Did improved security help? Did China Pakistan Economic Corridor (CPEC) investments help boost investor confidence in the country?

|

| Source: Bloomberg |

What caused deterioration in India-Pakistan ties? Was it the murder of Burhan Wani and India’s attempt to blame it on “cross-border terrorism” from Pakistan? Did Indian PM Modi succeed in isolating Pakistan?

How will Obama’s exit and Trump’s presidency affect US-Pakistan relations? Will these be as bad as under Obama? Or better? Or worse under Trump? How will Pakistan’s close ties with China and warming relations with Russia play into this?

Did the Obama administration initially condoned the rise of ISIS in Syria as claimed by President-elect Donal Trump's national security advisor General Michael Flynn in an interview with Mehdi Hasan of Aljazeera? Will Russia-Turkey-Iran succeed in bringing peace to Syria?

Viewpoint From Overseas host Faraz Darvesh discusses these questions with panelists Misbah Azam and Riaz Haq (www.riazhaq.com)

https://youtu.be/87m_t7D8ftY

https://vimeo.com/197727259

Related Links:

Haq's Musings

Pakistan KSE100 Stock Index Among World's Top Performers

Obama's Parting Shot: New Sanctions on Pakistan NESCOM

700,000 Indian Soldiers vs 10 Million Kashmiris

Is Modi Succeeding in Isolating Pakistan?

China Pakistan Economic Corridor: 2 Million New Jobs

Impact of Trump Appointments on US Policy

Pakistan-China-Russia vs India-US-Japan

Did the West Sow the Seeds of ISIS in Iraq and Syria?

-

Comment by Riaz Haq on January 5, 2017 at 8:04am

-

As #India Lags, The #Pakistan #ETF NYSE:PAK Is At All-Time Highs

http://etfdailynews.com/2017/01/05/as-india-lags-the-pakistan-etf-i...

From Zacks: For investors seeking momentum, MSCI Pakistan ETF (PAK – Free Report) is probably on their radar now. The fund just hit a 52-week high and is up about 50.2% from its 52-week low price of $12.00/share.

But are more gains in store for this ETF? Let’s take a quick look at the fund and the near-term outlook on it to get a better idea on where it might be headed:

PAK in Focus

This product offers exposure to the large and liquid companies in Pakistan by tracking the MSCI All Pakistan Select 25/50 Index. Financials, materials and energy are the top three sectors of the fund with double-digit weight each. The fund charges 0.68% in expense ratio (see: Broad Emerging Market ETFs).

Why the Move?

This Pakistan ETF has been picking up momentum lately on improved capital mobility and liquidity. The country has been working on a turnaround. The country’s economy is growing at a decent rate of approximately 4.5% per annum. The country’s young population could act as a key catalyst to long-term growth.

More Gains Ahead?

It seems that PAK might continue with its strength given a high weighted alpha of 44.10%. As a result, there is definitely still some promise for risk-aggressive investors who want to ride on this surging ETF.

Global X MSCI Pakistan ETF (NYSE:PAK) was trading at $17.96 per share on Thursday morning, down $0.06 (-0.33%). Year-to-date, PAK has gained 2.63%, versus a 1.30% rise in the benchmark S&P 500 index during the same period.

PAK currently has an ETF Daily News SMART Grade of A (Strong Buy), and is ranked #11 of 77 ETFs in the Emerging Markets Equities ETFs category.

-

Comment by Riaz Haq on January 9, 2017 at 7:13pm

-

#Terrorism data trackers report big decline in #Pakistan violence: 28% fewer incidents, 45% fewer deaths in 2016.

http://mobile.nytimes.com/aponline/2017/01/09/world/asia/ap-as-paki...

Two Pakistani research groups have noted that the country saw a significant drop in militant violence last year, crediting the military for the decrease in attacks.

The two Islamabad-based groups say that large-scale military operations in the lawless tribal regions bordering Afghanistan, in the chaotic port city of Karachi and the sparsely populated Baluchistan province are behind the drop. But for the trend to continue, they say, authorities need to disband sectarian and anti-Indian extremists based in the populous Punjab province.

The findings, which are based on the groups' records, were released last week and on Sunday.

One of the groups, the Center for Research and Security Studies, said there was a 45 percent drop in violence-related deaths in 2016, compared to the previous year. The Pakistan Institute for Peace Studies, which tallies violent incidents, registered a 28 percent drop in attacks in 2016, compared to 2015.

Still, both organizations tempered the findings by warning that the trend could be halted unless militant groups are disbanded and called for improving relations with neighboring India and Afghanistan.

Prime Minister Nawaz Sharif echoed some of those sentiments last week, when he told a writers' conference that Pakistan needs to create an effective narrative that promotes tolerance.

"We are forgetting how to speak of mutual love, integrity, compassion and empathy," he said. His government introduced legislation in 2016 outlawing hate speech and denying clerics from rival Islamic sects the right to use their loudspeakers at their mosques.

However, Sharif's government has not succeeded in disbanding outlawed sectarian groups that re-emerge later under a different name.

Also, lawmakers from his own Pakistan Muslim League have been seen on campaign platforms with members of the outlawed Sunni extremist group Sipah-e-Sahabah, which has links to the banned Lashkar-e-Jhangvi, another violent Sunni extremist group that has been blamed for several attacks last year, particularly in southwestern Baluchistan.

"A government that is going into an election next year doesn't want to lose votes," said Imtiaz Gul, executive director of the Center for Research and Security Studies, which authored one of the reports. "The banned outfits have madrassas that still operate, they have sympathies and influence."

A mostly Sunni Muslim country, Pakistan has for years been convulsed by brutal sectarian violence that has killed thousands. Most of the victims have been minority Shiite Muslims.

Asadullah Khan, an analyst with Pakistan's Institute of Strategic Studies says that "it isn't enough to ban" militant groups, which then surface under a new name.

"We have to get rid of them altogether," Khan said.

Prominent on the militant landscape dotting Pakistan are also the Afghan Taliban, Pakistan's own Taliban group and its splinters, as well as the feared Haqqani network. Then there are several anti-Indian groups, labelled terrorists by the United States and India — such as Lashkar-e-Taiba, which was banned but remerged as Jamaat-ud-Daawa and Jaish-e-Mohammed.

Pakistan has fought three wars with archrival India, most often over the disputed Himalayan region of Kashmir.

-

Comment by Riaz Haq on January 9, 2017 at 7:31pm

-

#Pakistan Beats #India using its strategic geographic location to extract benefits from #America and #China. @forbes

http://www.forbes.com/sites/panosmourdoukoutas/2017/01/09/pakistan-...

After beating India in equity markets, Pakistan beat India in another metric recently: Geopolitics.

The country's leaders have skillfully leveraged Pakistan's strategic geographic location to extract a series of benefits from America and China.

In fact, the performance of Pakistan's equity markets and geopolitics isn’t reflective of their independence from each other. Geopolitics has been, and will be, a major driver for the country's financial markets.

Back in 2001, Pakistan leveraged its proximity to Afghanistan to extract a big benefit from America: a write off for a big part of its foreign debt--the spark of Pakistan's fifteen-year bull market.

America needed Pakistan as an ally in its war against Afghanistan. And Pakistan's leadership offered to do just that in exchange for the US brokering debt relief for their large external debt - 60 percent of the country’s GDP, with debt serving counting for 30 percent of exports.

“A unilateral default seemed almost inevitable,” writes Marko Dimitrijevic in Frontier Investor (New York: Columbia Business School, 2017). “However, the United States’ post-9/11 collaboration with the Musharraf government to fight terrorism provided an environment conducive for Pakistan to request the rescheduling of its debt.”

Indeed, in December 2001, the Paris club did just that, cutting Pakistan’s debt by $12 billion, with IMF providing the country additional funding.

The rest is history. Pakistan’s currency strengthened as foreign expatriate remittances and foreign capital flowed into the country, with a good chunk of it ending in financial markets -- which took off, until the 2008-9 financial crisis.

Then China came along to re-ignite Pakistan’s market, once again.

Beijing needed a western route to the Middle East, and Africa--China's second continent. Ideologically that is, which can explain why Beijing committed $46 billion to China-Pakistan Economic Corridor (CPEC). In addition, China has been investing in Pakistan’s infrastructure companies.

In a sense, Pakistan’s gain is India’s loss, as China cannot appease both countries at the same time. In fact, it has done quite the opposite: repeatedly blocking India's efforts to join the Nuclear Supplier Group (NSG).

And it has sided openly with Pakistan in the India-Pakistan Kashmir impasse, as evidenced by statements by China’s senior officials on the sidelines of the ongoing 71st session of United Nations General Assembly in New York, as previously discussed in a piece here.

-

Comment by Riaz Haq on January 10, 2017 at 7:27am

-

#Pakistan predicted to be world’s fastest-growing #Muslim #economy in 2017

http://www.economist.com/node/21604509?fsrc=scn/tw/te/bl/ed/economi...

http://tribune.com.pk/story/1290084/pakistan-predicted-worlds-faste...

Pakistan has been forecasted to be the world’s fastest-growing Muslim economy in 2017 ahead of Indonesia, Malaysia, Turkey and Egypt, according to London’s The Economist magazine.

Pakistan’s estimated GDP growth – 5.3% – is also ahead of 4% GDP growth of Israel. This makes Pakistan world’s fifth fastest-growing economy in the world, only behind India and China and two other countries.

The live data, which is updated twice-daily, is published on The Economist website in the form of an interactive table of economic and financial indicators. This data reinforces a Harvard University study which predicted Pakistan to grow by more than 5% in the next decade.

The 2017 forecast of 5.3% growth is, however, lower than the 2016’s 5.7% forecasted growth rate, which means Finance Minister Ishaq Dar must take steps to put economy on the path of irreversible growth.

In 2014, The Economist had forecasted Pakistan to be world’s sixth fastest-growing country.

The 2017 forecast of 5.3% growth is, however, lower than the 2016’s 5.7% forecasted growth rate, which means Finance Minister Ishaq Dar must take steps to put economy on the path of irreversible growth.

In 2014, The Economist had forecasted Pakistan to be world’s sixth fastest-growing country.

-

Comment by Riaz Haq on January 11, 2017 at 9:05am

-

#Remittances to #Pakistan $9.46 bn in July-Dec 2016, down 2.37% in 1st half FY17. $1.58 bn in Dec, 16, down 2%.

http://www.dawn.com/news/1307609/remittances-declined-24pc-in-july-dec

KARACHI: Overseas Pakistanis sent home $9.46 billion in the first half of 2016-17, down 2.37 per cent from a year ago.

According to data released by the State Bank of Pakistan (SBP) on Tuesday, remittances received in December alone amounted to $1.58bn, which reflects a decline of 2pc on both monthly and annual bases.

Remittances provide the current account balance with critical support. Inflows from overseas increased 6.4pc year-on-year to almost $20bn in 2015-16. But growth in remittances turned negative in the beginning of the current fiscal year, with the transfer of funds from the Gulf region, United States and United Kingdom registering notable declines.

The central bank has dubbed the subdued growth in remittances “the new normal”.

Over one-fourth of remittances received during the six months originated from Saudi Arabia. Inflows from Pakistani workers based in the oil-rich nation in July-Dec amounted to $2.73bn, down 5.5pc from a year ago.

The second-largest contribution to remittances was from workers based in the United Arab Emirates. They sent home $2.12bn, although the figure is 2.5pc smaller than the funds received in the same six months of the preceding year.

Remittances sent by workers based in the United States declined 10.8pc year-on-year to $1.16bn. The transfer of funds from UK-based workers remained $1.1bn, down 12.5pc from a year ago. These two countries – along with six Gulf nations, namely Saudi Arabia, UAE, Bahrain, Kuwait, Qatar and Oman — form the main corridor of remittances.

In a recent publication, the SBP blamed low international oil prices and the tightening of US-backed anti-money laundering/anti-terrorist financing laws for global correspondent banking, which is at the centre of the global remittance transfer business, for the recent disruption in the flow of funds from overseas.

As for remittances from the United Kingdom, the central bank noted the “sizable depreciation” in the British currency post-Brexit means inflows from the European nation will be lower in dollar terms even if Pakistani workers keep sending the same amount.

With regard to the decline in remittances from the Gulf countries, the SBP believes the effects of fiscal consolidation in oil-rich nations are becoming visible on the pattern of fund transfers.

Limited construction activities in the Gulf region are likely to leave a long-term impact on remittances sent by Pakistani workers. Data shows the gross number of Pakistanis who went to the Gulf countries declined 16.4pc in July-Sept last year on an annual basis.

The restrained fiscal spending in the Arab world is expected to dampen demand for low-skilled labourers, according to the SBP, whereas the “localisation requirements” will limit opportunities for high-skilled migrants.

-

Comment by Riaz Haq on January 11, 2017 at 11:37am

-

#Pakistan gasoline consumption up 18% in 2016. http://www.platts.com/latest-news/oil/singapore/asian-gasoline-crac... …

Pakistan's gasoline demand averaged 557,000 mt/month over July-October, according to latest government data. This was up sharply from 365,000 mt/month over the full fiscal year 2015-2016 (July-June).

The country (Pakistan) imported 4.2 million mt of gasoline over January-November this year, 18% higher than the same period of 2015.

India's gasoline demand rose 12.6% year on year to 21.69 million mt (483,000 b/d) over January-November 2016 and is expected to maintain the same pace in 2017. India exported 15 million mt (334,500 b/d) of gasoline over the same period, up 4.7% year on year.

-

Comment by Riaz Haq on January 11, 2017 at 5:21pm

-

#WorldBank raises #Pakistan’s #GDP growth forecast to 5.2% in FY17, 5.5% in 2018 and 5.8% in 2019

http://tribune.com.pk/story/1291709/world-bank-revises-pakistans-gr...

ISLAMABAD: The World Bank has revised Pakistan’s growth rate upwards to 5.2% for fiscal year 2017 and 5.5% for 2018.

It previously estimated growth in Pakistan’s gross domestic product (GDP) at 5% and 5.4% for FY17 and FY18, respectively.

The report ‘Global Economic Prospects; weak investment in uncertain times’, states that the uptake in activity is spurred by a combination of low commodity prices, increasing infrastructure spending, and reforms that lifted domestic demand and improved the business climate.

In Pakistan, growth is forecast to accelerate from 5.5% in fiscal year 2018 to 5.8% in fiscal year 2019-20, reflecting improvements in agriculture, infrastructure, energy and external demand.

The report further mentioned the successful conclusion of the IMF Extended Fund Facility (EFF), aimed at supporting reforms and reducing fiscal and external sector vulnerabilities, lifted consumer and investor confidence.

The China-Pakistan Economic Corridor (CPEC) project is also tipped to increase investment in the medium-term, and alleviate transportation bottlenecks and electricity shortages.

Earlier in November, whilst releasing its report ‘Pakistan Development Update – Making growth matter’ the World Bank had projected Pakistan’s economy to grow at 5% in the ongoing fiscal year, meaning that the country was to miss the government-set target of 5.4%.

The Washington-based lender, in that report, added that the country’s economy could see a growth of 5.4% in FY18 on the back of continued mushroom growth in the services sector, recovery of agriculture and uptick in infrastructure investment.

“The services sector, which comprises more than half of the economy, is expected to be the primary source of growth,” stated report.

Additionally World Bank Country Director for Pakistan, Patchamuthu Illangovan, has stressed on the need for increased investment in social sectors like health, education and nutrition. “All this would lead to a vibrant and dynamic society as well as the economy,” he has stated.

-

Comment by Riaz Haq on January 13, 2017 at 4:57pm

-

#India dismayed at #UK support to #China-#Pakistan Economic Corridor. #CPEC http://www.deccanherald.com/content/591240/india-dismayed-uk-suppor... …

India will convey its disappointment with the United Kingdom’s support to the proposed China-Pakistan Economic Corridor (CPEC).

India will voice its concerns about the British government's move to encourage UK companies to invest in projects along the CPEC.

Corridor areas

New Delhi is opposed to the CPEC as it is set to pass through areas, which India accused Pakistan of illegally occupying in Kashmir, sources told DH.

The UK formally expressed interest in the CPEC during the recent visit to Pakistan of Alok Sharma, Parliamentary Under Secretary of State to the Foreign and Commonwealth Office (Minister for Asia and the Pacific) of British government.

-

Comment by Riaz Haq on January 14, 2017 at 8:16am

-

Top marks in 1st term see #NawazSharif eyeing 2018 re-election in #Pakistan- #economy #security Nikkei Asian Review

http://asia.nikkei.com/Politics-Economy/Policy-Politics/Top-marks-i...

In August, the country completed the International Monetary Fund's Extended Fund Facility program, which provided $6.4 billion in financial aid over three years on condition the country undertakes certain reforms, including fiscal austerity and privatization measures. Macroeconomic indexes are up across the board, and relations with the U.S. and the wider international community have improved.Public order, which has long plagued the entire country, is normalizing thanks to the military's anti-terrorism campaign.

Although it can only be described as reaching the halfway point in its efforts to promote exports and manufacturing, reform the tax code and privatize state-run companies, Pakistan's recovery is undoubtedly gathering pace.

Gross domestic product growth fell short of the country's 5% target for fiscal 2016 -- which ended in June -- due mainly to a poor harvest of the primary agricultural product, cotton. But for fiscal 2017, the country is confidently projecting growth above 5%. The consumer price index, which for a time saw double-digit annual growth, fell to 2.9% on average in fiscal 2016. The government's annual deficit has fallen from 8.2% in fiscal 2013 to 4.6% of GDP.

Under Sharif, the ruling Pakistan Muslim League (Nawaz) party, or PML-N has focused on building infrastructure and public transportation systems. It has also made certain progress, mainly in its stronghold of Punjab, developing agricultural areas and addressing unemployment.

The centerpiece of its political campaign is the China Pakistan Economic Corridor project, a comprehensive infrastructure program relying on financial help from China. Investment in CPEC projects totals $51 billion, mainly for the building of power plants, but also encompassing roads, ports, railroads and airports, and offers hope of spurring industry nationwide.

"There's a significant improvement both on the economic and security sides. Democracy is also taking root," said Arif Habib, CEO of leading conglomerate Arif Habib group, when asked about the performance of the Sharif administration. "The media is free, and the judiciary system is also improving."

Abdul Aleem, secretary-general of the Overseas Investors Chamber of Commerce and Industry, comprising 195 foreign companies and other organizations, said "The government is very strong," although "commodity prices, especially oil, are the biggest risk." As for the sustainability of the anti-terrorism strategy, he said, "I don't think the Army's policy will change. And the relationship with the civilian government will be better.""The current government is spending a lot of money on infrastructure and energy, which is deeply requisite for business growth and development," commented Shahrukh Hasan, group managing director of leading media company Jang group, which owns news channel Geo TV and the English-language paper The News.

Foreign policy decisions in Pakistan are often intertwined with the priorities of the military, especially with regard to the U.S. and India. Asked about new Army Chief Gen. Qamar Javed Bajwa, Hasan sees positive signals in his attitude toward relations with India.

Another positive for Hasan is the appointment of a former Karachi Corps Commander, "a good person with an open mind and liberal views," as director general of the military's powerful Inter-Services Intelligence agency.

-

Comment by Riaz Haq on January 16, 2017 at 10:39am

-

78% of #US companies in #Pakistan plan to increase #investment in 2017: survey. #FDI http://www.pakistantoday.com.pk/2017/01/16/78-of-us-companies-in-pa... … via @epakistantoday

A perception survey conducted by the American Business Council showed that there was an improvement of over 30% in the law and order situation from 2015-16.

Over 78% of respondents have indicated that they plan to invest in Pakistan over the next 12 months as compared to 65% in 2015 and 83% are optimistic about the long term economic climate.

The members have however separately commented about the government’s tendency to introduce mini budgets as well as sudden changes in policies or rules during the course of a fiscal year. “Such steps negatively impact new as well as existing investments,” the members stated.

The perception survey allowed ABC members to rate their satisfaction on various economic, regulatory and political factors that affect the performance and growth of businesses operating in Pakistan over 2015-16.

The business climate was rated on each of the various factors influencing it, including implementation and consistency of trade and competition policies, government development budget, domestic market, internal and external political climate, and law and order.

For 2015-16, the vast majority of respondents rated the business climate of Pakistan as satisfactory with only 8% giving it a poor rating. This is a marked improvement over 2014-15 when 11% of participants rated the business climate as poor. The overall positive perception of American investors reveals an expectation of some economic stability and an improvement in Pakistan’s economic environment.

The participants were also asked to rate the performance of various ministries directly affecting the business climate. In this regard, the overall trend reflects a slight improvement in the performance of various ministries from last year.

The Ministry of Petroleum and Natural Resource showed a marked improvement with 78% of participants reporting the performance as fair and 16% reporting it as poor. In 2014-15, 46% rated the performance of this ministry as fair and 51% rated it poorly.

American Business Council of Pakistan President Sami Ahmed said, “Our members are positive and remain committed to Pakistan.” Ahmed added that international standing and perception is extremely important as Pakistan competes with other Asian players to attract foreign capital in the form of trade exports, human resources, and most importantly, direct foreign investment.

The ABC is one of the largest investor groups in Pakistan with 67 members, most of whom represent Fortune 500 companies. They operate in various sectors including healthcare, financial services, information technology, chemicals & fertilizers, energy, FMCG, food & beverage, oil, and others.

ABC members have cumulative revenues of US $4.0 billion. Their contribution to the National Exchequer, through direct/indirect taxes is approximately Rs 102 billion. They exported goods worth Rs 6.60 billion during 2015, and directly employ over 34,000 people, with 140,000 dependents, and indirectly employ approximately 1 million people through their networks of agents, distributors, contractors, etc.

The ABC is affiliated with the Federation of Pakistan Chambers of Commerce & Industry (FPCCI) and is a member of the US Chamber of Commerce (USCC), Washington D C and the Asia-Pacific Council of American Chambers of Commerce (APCAC). ABC also has a close working relationship with the US-Pakistan Business Council, Washington, which is a component of the USCC.

Comment

- ‹ Previous

- 1

- 2

- 3

- Next ›

Twitter Feed

Live Traffic Feed

Sponsored Links

South Asia Investor Review

Investor Information Blog

Haq's Musings

Riaz Haq's Current Affairs Blog

Please Bookmark This Page!

Blog Posts

Pakistanis' Insatiable Appetite For Smartphones

Samsung is seeing strong demand for its locally assembled Galaxy S24 smartphones and tablets in Pakistan, according to Bloomberg. The company said it is struggling to meet demand. Pakistan’s mobile phone industry produced 21 million handsets while its smartphone imports surged over 100% in the last fiscal year, according to …

ContinuePosted by Riaz Haq on April 26, 2024 at 7:09pm

Pakistani Student Enrollment in US Universities Hits All Time High

Pakistani student enrollment in America's institutions of higher learning rose 16% last year, outpacing the record 12% growth in the number of international students hosted by the country. This puts Pakistan among eight sources in the top 20 countries with the largest increases in US enrollment. India saw the biggest increase at 35%, followed by Ghana 32%, Bangladesh and…

ContinuePosted by Riaz Haq on April 1, 2024 at 5:00pm

© 2024 Created by Riaz Haq.

Powered by

![]()

You need to be a member of PakAlumni Worldwide: The Global Social Network to add comments!

Join PakAlumni Worldwide: The Global Social Network