PakAlumni Worldwide: The Global Social Network

The Global Social Network

Pakistan in 2016: Economy, Security & Relations With India, US

Did Pakistan’s internal security improve in 2016? If do, how? And by how much? How was it done? By Zarb e Azb military operation? Did Pakistan implement the National Action Plan to address extremism and radicalization in society?

|

| Source: South Asia Terrorism Portal |

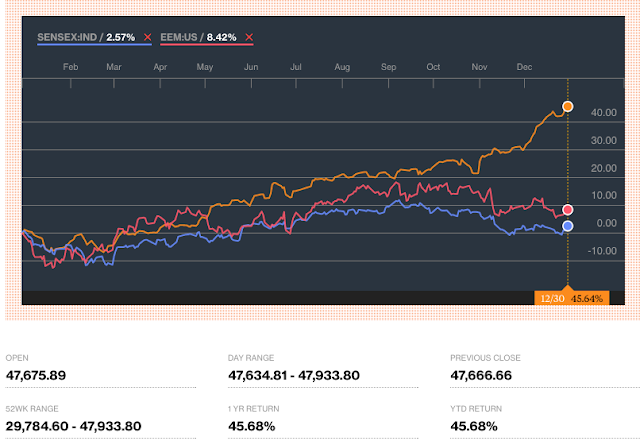

How did Pakistan’s economy do? And how did the stock market do? Did improved security help? Did China Pakistan Economic Corridor (CPEC) investments help boost investor confidence in the country?

|

| Source: Bloomberg |

What caused deterioration in India-Pakistan ties? Was it the murder of Burhan Wani and India’s attempt to blame it on “cross-border terrorism” from Pakistan? Did Indian PM Modi succeed in isolating Pakistan?

How will Obama’s exit and Trump’s presidency affect US-Pakistan relations? Will these be as bad as under Obama? Or better? Or worse under Trump? How will Pakistan’s close ties with China and warming relations with Russia play into this?

Did the Obama administration initially condoned the rise of ISIS in Syria as claimed by President-elect Donal Trump's national security advisor General Michael Flynn in an interview with Mehdi Hasan of Aljazeera? Will Russia-Turkey-Iran succeed in bringing peace to Syria?

Viewpoint From Overseas host Faraz Darvesh discusses these questions with panelists Misbah Azam and Riaz Haq (www.riazhaq.com)

https://youtu.be/87m_t7D8ftY

https://vimeo.com/197727259

Related Links:

Haq's Musings

Pakistan KSE100 Stock Index Among World's Top Performers

Obama's Parting Shot: New Sanctions on Pakistan NESCOM

700,000 Indian Soldiers vs 10 Million Kashmiris

Is Modi Succeeding in Isolating Pakistan?

China Pakistan Economic Corridor: 2 Million New Jobs

Impact of Trump Appointments on US Policy

Pakistan-China-Russia vs India-US-Japan

Did the West Sow the Seeds of ISIS in Iraq and Syria?

-

Comment by Riaz Haq on January 17, 2017 at 5:18pm

-

17 predictions for Pakistan’s economy in 2017

by Wali Zahid http://tribune.com.pk/story/1297634/17-predictions-pakistans-econom...

As Pakistan continues its march from being a frontier economy to becoming an emerging market, 2017 may be the best year in the country’s 70-year-long history. From increase in foreign investment, creation of Export-Import Bank to likely changes in the auto industry, here’s what we predict will happen to Pakistan’s economy this year.

GDP growth: Although gross domestic product (GDP) growth forecasts by International Monetary Fund, World Bank and federal budget vary, Pakistan’s GDP is likely to grow by 4.7 per cent this year. The annual GDP may increase from $270 billion to around $300 billion and for the first time, the Purchasing Power Parity may cross the $1trillion mark. Pakistan is currently 40th largest economy in the world and our ranking may improve by a point or two.

WEF report: Pakistan leaves India behind in IDI

Debt: National debt, currently at $73 billion, will continue to grow.

Debt-to-GDP ratio: Currently at 64.8 per cent, it may decline slightly.

Foreign exchange: Reserves will continue to be in the region of $23-24 billion.

Stock market: Pakistan will enter MSCI’s Emerging Markets category in May, meaning larger amounts will inflow. MSCI is a leading provider of international investment decision support tools. In 2016, Pakistan Stock Exchange (PSX) provided 46 per cent returns. KSE-100 benchmark index is also likely to cross 55,000 points from current nearly 48,000 points. Forty per cent stakes in PSX will go to Chinese consortium and this is likely to bring large institutional investors from other countries.

Retail: More large shopping malls will be built or become operational across major urban centres. Superstore chains will open new stores in unprecedented three-digit numbers.

Over 78% American companies say willing to invest more in Pakistan

Tax filers: Number of active tax payers/filers may reach 1.2 million.

Exports: Although IT exports are picking up, Pakistani exports will continue its declining trend, mostly because of poor cotton production, our low global competitiveness and travel advisories.

Export-Import Bank: The bank may be functional before June to facilitate exporters and importers after State Bank of Pakistan licenses it.

Foreign Direct Investment: FDI this year may cross the $1-billion mark.

Remittances: After a drop in 2016, remittances may pick up to reach $20billion mark.

Inflation: It may remain between four and five per cent as low oil prices are expected to stay stable.

Agriculture: Agriculture sector will continue to remain affected because of declining cotton production.

Chinese firms willing to invest in Pakistan

Finance: The sector will increase focus on financial inclusion, generating opportunities for micro-finance and commercial banks.

Banking: Smart banking, mobile banking and branchless banking will increase.

Ease of doing business index: Pakistan, at 144 out of 190 countries, was among top 10 global improvers in World Bank’s 2017 Doing Business rankings. In the 2018 ranking, it will improve further.

Auto industry: Pakistan may need additional 100,000 trucks to meet the CPEC-related material and freight transport needs and it is unlikely that this demand is planned and met in time. Demand for locally manufactured new and imported used cars will continue to rise. Although there’s interest from Volkswagen, Kia, Renault and Nissan for manufacturing plants in Pakistan, the production will not start this year which also means prices of cars will not come down as current producers – Toyota, Honda and Suzuki – remain in monopolistic situation.

-

Comment by Riaz Haq on January 20, 2017 at 9:02am

-

#Pakistan’s obsession with #infrastructure at the expense of #education, #healthcare. #CPEC #China http://econ.st/2iNW9nd via @TheEconomist

Lijian Zhao, a Chinese diplomat, says China is all too aware that Pakistan needs more than just big-ticket infrastructure if it is to flourish. Disarmingly, he praises the efforts of Britain and other countries to improve Pakistan’s “software”, such as education and the rule of law. “But China’s expertise is hardware,” says Mr Zhao.

-

Comment by Riaz Haq on January 22, 2017 at 10:22pm

-

Inter-sectoral imbalances

JAWAID BOKHARI —https://www.dawn.com/news/1310067/inter-sectoral-imbalances

The growth rate and the share of the three sectors — agriculture, industry and service — varies from year to year but their contribution to GDP, by and large, remains within a narrow range: close to 55pc for services, less than 25pc for agriculture and just over 20pc for industry.

But over the three successive years, industrial growth has equaled or outstripped expansion in the services sector as well as the GDP growth rate in 2016. To quote the State Bank of Pakistan’s data, industry grew at the same pace as services (4.5pc) in FY14 but exceeded the latter’s rate in FY15 (4.8pc against 4.3pc) and with a much wider margin (6.8pc against 5.7pc) in fiscal year 2016. The industrial expansion at 6.7pc surpassed the real GDP growth rate of 4.7pc last year.

In the first quarter of this fiscal year large scale manufacturing remained subdued with a growth rate of 2.2pc down from 3.9pc in the same period of last year but rebounded in November 2016 with an annualised growth rate of 8pc.

The latest trend is likely to continue because of fiscal stimulus provided in the current year’s federal budget, the recent surge in imports of machinery for balancing and modernisation of existing manufacturing facilities, and improvements in the security situation and energy supply.

The manufacturing sector has also received an impetus from an Rs180bn export package announced earlier this month by Prime Minister Nawaz Sharif.

On the other hand, agricultural growth — which remained stable at 2.5pc in FY2014 and FY2015 — dropped to minus 0.2pc in FY2016, mainly because of the failure of cotton crop in Punjab.

The various incentives and subsidies by the federal and provincial governments are reversing the negative growth trend in agriculture this fiscal year. Under pressure by farmers, the official announcement for discontinuation of cash subsidy to growers last week was annulled within 72 hours.

Official policies are now helping commodity producers gain some lost ground, but producers need to stand on their feet to make bigger strides towards achieving a more balanced inter-sectoral growth and improving economic fundamentals.

-

Comment by Riaz Haq on February 9, 2017 at 10:53am

-

Forget #India, Its Neighbors #Pakistan, #Bangladesh & #SriLanka Are the Next Big Thing. #Economy http://www.barrons.com/articles/forget-india-its-neighbors-are-the-... … via @barronsonline

Forget India. Investors looking for the next big thing should look to its South Asia neighbors instead – Pakistan, Bangladesh and Sri Lanka.

With a combined 390 million people, the three countries represent what Morgan Stanley chief global strategist Ruchir Sharma calls “the quiet rise of South Asia” as opposed to India which has been “flattered by spasms of hype for years”. While overshadowed by their larger neighbor, the trio is enjoying fast-paced growth, embracing much needed reforms, and look set to enjoy a demographic dividend over the long term. “A substantially higher economic growth rate than in many other economies globally, coupled with fantastic demographics that will continue supporting growth for many years ahead”, East Capital fund manager Adrian Pop tells Barron’s Asia. The Stockholm-based firm manages nearly EUR3 billion in frontier markets.

Pakistan is the flag bearer of the positive changes taking place in the South Asian nations. Since coming to power five years ago, Prime Minister Nawaz Sharif has got inflation under control, cut the budget deficit and reined in the current account deficit. But more importantly, terrorism finally appears to be on the back-foot given more assertive action by the army. Chinese investment has also poured in: $50 billion will be spent on new roads, transport links and energy projects. “More power capacity is key for Pakistan to move to an even higher economic growth rate,” says Pop. That will benefit stocks in materials and energy. In December, the Pakistan Stock Exchange sold 40% of itself to consortium of Chinese investors.

The Karachi stock index is up by about 50% since the start of last year, propelled by index compiler MSCI’s decision to bump up the country to emerging markets status. That will bring in hundreds of millions of dollars from passive funds into the Pakistani benchmark. The rally in stocks has arguably left the market looking a little pricey as the KSE 100 index trades at over 12 times earnings, its heftiest valuation since late 2009. That’s still about a 15% discount to the MSCI emerging markets index, however, plus Pakistani stocks yield an attractive 4%-plus dividend.Bangladesh’s rise has so far been more tempered. The country, which split from Pakistan in the early 1970s, benefits from a growing working age population and rising labor costs elsewhere in Asia. Garment manufacturing for Western clothing companies has increasingly moved from China to places like Bangladesh, where wages are lower. The government’s also investing billions in upgrading the country’s patchy power supply, which will address energy shortages and boost manufacturing.

Still, foreign participation in Bangladesh’s stock market is small. HSBC estimates foreigners make up only 2% of the Dhaka stock index’s market cap. The market does however look quite cheap on a historical basis, trading at 15 times trailing earnings. Return on equity, or profit generated as percentage of shareholder equity, is high at almost 20%.

Sri Lanka’s more understated still. The economy could slow in the short-term after an International Monetary Fund bailout in 2016 prompted by a huge budget deficit. Some of the reforms to balance the budget, like higher value-added taxes, will probably hit consumption. The government’s also been prodded to reform and privatize state-owned enterprises. “We view these measures as necessary for a healthier and more sustainable macro environment,” even if growth suffers in the meantime, says Pop. Tourism remains a bright spot, as arrivals continue to grow.

Could the election of Donald Trump halt the quiet rise of South Asia? Trump wants to bring blue collar jobs back to the States and penalize American companies that manufacture overseas. Some are sanguine, though. “We do not believe that these companies will move production back to their home countries,” says East Capital’s Pop, reasoning that the spread between wages in the West and in markets like Bangladesh is too big to realistically think about moving these jobs back.

Another threat is the rising price of oil. Crude prices have risen by about 50% from their 2016 lows, which isn’t great news for all three countries, as they’re all net importers of the black stuff. Higher oil prices can cause higher inflation, a hot button issue in lots of developing countries, and bigger trade deficits. Pop argues that higher oil prices can also be a positive given the huge number of South Asians work employed in the oil-rich Gulf nations. A rosier economic outlook in these countries boosts the flow of remittances back to workers’ home countries.

Back in August, Barron’s Asia recommended readers buy three Pakistan blue-chips ahead of the country’s inclusion in the MSCI Emerging Markets index. They’ve risen by 20% on average and now trade near recent historical peaks on a price-to-earnings basis. In other words, they look expensive. We’ve found two new overlooked Pakistani stocks investors should consider, as well as picks for Bangladesh and Sri Lanka.

PAKISTAN

Oil & Gas Development Co

In August we tipped downstream firm Pakistan State Oil (PSO.PK), which has since risen 10%. It’s worth hanging onto that stock, but we’d add upstream exploration player Oil & Gas Development (OGDC.PK) to the mix too.

Shares in the Islamabad-based company have powered up 45% in the last year, and could rise by a further 30%. Oil & Gas Development will benefit from any further recovery in oil prices, which have roughly doubled since hitting their nadir last February. Earnings per share should rise by 17% in full-year 2017 and 20% in full-year 2018.

Oil & Gas Development trades at eight times forward earnings, which is toward the higher end of its historical valuation. That multiple is more compelling than exploration peer Pakistan Petroleum (PPL.PK), however, which trades at 10 times next 12 months’ earnings.

Oil & Gas Development also pays a 3% dividend.

DG Khan Cement

Lahore’s DG Khan Cement (DGKC. PK) is one of the country’s largest cement producers, with a capacity of more than four million tons a year. The stock also makes a good foundation for a Pakistan portfolio.

The firm should benefit from billions of dollars of new infrastructure in the South Asia country, much of it coming courtesy of investment from China. At the end of December, the countries jointly announced a $14 billion dam project close to DG Khan’s HQ in northern Pakistan. The dam will need about a million tons of cement.

Shares in the company have returned a solid 50% over the last year. DG Khan’s valuations looks a bit less stretched than that of rival Lucky Cement (LUCKY.PK), which we told investors to pour into their portfolio over summer. DG Khan trades at 10 times forward earnings, compared to Lucky’s 16 times. Its dividend yield of 2.6% is also bigger than its rival. Brokers think DG Khan can rise by as much as 25%.

BANGLADESH

BRAC Bank

BRAC Bank is one of Bangladesh’s biggest lenders, specializing in credit to small-to-medium-sized businesses. More than a third of the country’s entire SME loan book goes through BRAC, according to estimates.

Some of BRAC’s strengths include its large retail and ATM network, while the bank’s also well-positioned to comply with Basel III requirements within the next couple of years. Analysts think BRAC is unlikely to have to raise more capital and dilute investors as a result.

The most exciting aspect of the stock, however, is its mobile payments platform. Bangladesh is one of the world’s fastest-growing markets in the use of mobile payments, and BRAC’s bKash platform has the vast majority of market share, with 17 million users. The platform’s been profitable since 2014.

In the last year BRAC Bank’s shares have returned over 40% and the stock also yields about 4%. BRAC is thinly covered by sell-side analysts, but recent target price estimates suggest the stock could rise by almost 15% this year.

SRI LANKA

John Keells Holdings

Colombo’s John Keells Holdings (JKH.LK) is Sri Lanka’s top conglomerate, with interests spanning transport, food, property and plantations. It’s also the biggest component of the local index, at about 8% of market capitalization. The shares could rise by 15% in the next year.

The shares haven’t performed well of late, though. John Keells has slipped almost 3% in the last year, compared to an almost 20% rise in Sri Lanka’s benchmark stock index. Catalysts for a turnaround include new consumer offerings in underpenetrated areas like ice cream and soda. John Keells is also bidding to operate a proposed new container port on the island.

The shares look quite cheap at 12 times forward earnings, compared to their five-year average of 16 times. Another option is rival conglomerate Hemas Holdings (HEMS.LK), but the stock trades at a chunkier 15 times next 12 months’ earnings. John Keells also pays a 3% dividend.

-

Comment by Riaz Haq on March 10, 2017 at 4:09pm

-

#London #FTSE composite index includes six #Pakistan companies.Additional $57 million expected to flow into #Karachi

https://tribune.com.pk/story/1344303/ftse-includes-six-pakistani-co...

KARACHI: The Pakistan Stock Exchange (PSX) continued to attract international attention, as six of its listings were taken on board by the Financial Times Stock Exchange (FTSE) index.

FTSE is a London-based provider of indexes, which helps international investors track their funds at bourses worldwide.

FTSE, in its semi-annual review, included Habib Bank, Mari Petroleum, Searle Pakistan, Engro Fertilizers, Fauji Cement and Nishat Mills from Pakistan into its Global Equity Index Series Asia Pacific excluding Japan.

“The changes will be effective after the close of business on Friday, March 17, 2017 (i e on Monday, March 20, 2017),” FTSE Russell reported on its official website.

The PSX witnessed a bull ride on Thursday, as its benchmark KSE 100-Index surged 1.44%, or 703.92 points, and closed at 49,696.08 points.

Invest and Finance Securities said in a note, “we do highlight the news item as a major sentiment booster, which should aid the market to continue ascending northward.”

The development is believed to trace additional foreign funds into the PSX.

“Since approximately $67.25 billion funds track FTSE Global Equity Index Series, based on the assigned weightages we estimate a total of $56.8 million to enter Pakistan,” the brokerage firm said.

“This [estimated] flow is in addition to the expected $771 million inflow (passive: $374 million and active: $396 million), which we estimated post-MSCI inclusion,” it added.

Earlier, MSCI – another world leading indices provider – announced in June 2016 to upgrade Pakistan into the MSCI Emerging Markets Index in May 2017.

The FTSE website added the FTSE World Asia-Pacific excluding Japan Index is one of a range of indexes designed to help investors to benchmark their Asia-Pacific investments. The index comprises large- and mid-cap stocks providing coverage of the developed and advanced emerging markets in Asia-Pacific excluding Japan.

“The index is derived from the FTSE Global Equity Index Series (GEIS), which covers 98% of the world’s investable market capitalisation,” it said. The FTSE Global Equity Index Series covers around 7,400 securities in 47 different countries-covering every equity and sector relevant to international investors’ needs.

Indexes within the FTSE Global Equity Index Series are designed for the creation of a broad range of financial products, such as index tracking funds, derivatives and exchange traded funds, as well as being performance benchmarks.

-

Comment by Riaz Haq on March 10, 2017 at 4:17pm

-

"Besides, valuations of Pakistan's stock market being at a 50% discount to major emerging markets such as India, Indonesia and Malaysia, it offers a favourable risk-reward ratio," said Martinsson of Tundra Fonder. On its inclusion, Pakistan will command a weight of around 0.2% in the MSCI EM index. This could lead to $250-275 million flowing into Pakistan's equity market. The FTSE's inclusion of six Pakistani stocks will translate into an inflow of $56 million. These flows are badly needed follo ..

What's also exciting investors is a surge in auto sales, offtake in cement, rise in property prices, benign inflation and lower interest rates. "Last 30 years Pakistan has suffered due to violence and terrorism that cost its economy $20 billion," said Amin Hashwani, former president of the Pakistan-India CEOs Business Forum. "Today, a comparatively better security environment, heavy investment related to CPEC, increased domestic investment and enhanced overseas remittances have triggered growth. ..

-

Comment by Riaz Haq on April 10, 2017 at 7:55pm

-

Thomas Hobbes’s mythic Leviathan was a metaphor for the role of the state

in an anarchic context—the great power to overawe all others and create the

peace necessary for the development of an ordered civil society. Without effective

government, Hobbes suggests, we could not sleep at night

https://www.usnwc.edu/getattachment/a145d982-b450-4dd9-b118-1b81383...

HOBBES VERSUS LOCKE –

REDEFINING THE WAR ON

TERROR

BY

COLONEL NICO W. TAK

Royal Netherlands Army

This paper draws upon the European experiences with terrorism in order to draw

lessons for today’s strategic environment. The central thesis is that the current

approach to terrorism is flawed. The West has developed a myopic view and has lost

sight of wider strategic interests. Terrorism has replaced the wider security framework

wholesale and plays an overly dominant role in policy formulation. The continued pursuit

of terrorists by primarily military means will lead to a Hobbesian state of nature which is

not in the interest of the Western World. A return to a broader view of the strategic

environment, with a more constrained use of state violence, is recommended.

--------

Starting with the run up to the present situation in the War on Terror, the paper

describes some of the experiences with the German Red Army Faction (RAF) in the

1970s. It draws lessons from this episode and applies them to the War on Terror. The

central thesis is that the current approach to terrorism is flawed. The West has

developed a myopic view on terrorism and has lost sight of wider strategic interests.

The sole issue of terrorism has replaced the wider security framework wholesale and

therefore plays too dominant a role in policy making. Furthermore, the War on Terror

instigated the invasion of Iraq which has discredited the West in a major way. Although

justifiably started as a military operation, the continued pursuit of terrorism by primarily

military means will lead to a Hobbesian state of nature, which is not in the interest of the

Western world.

-------

Granting a leading role to the military element of power in

the struggles against an age old phenomenon will lead to a perpetual state of war,

thereby realizing a Hobbesian state of nature, but – in absence of an authoritarian world

government – without a Leviathan “to keep them all in awe.”36 John Locke, in contrast,

attributed man with “calm reason and conscience,” which would constrain the use of

violence.37 This philosophy seems better befitting Western leaders in the return to a

policy where the use of force is truly a last resort

----------

-

Comment by Riaz Haq on May 4, 2017 at 11:24am

-

Book excerpt: #Obama’s #drone war in #Pakistan was bigger than people think. 353 drone strikes vs #Bush's 48. #FATA

http://foreignpolicy.com/2017/05/04/book-excerpt-obamas-drone-war-i...

he following is an excerpt from Counter Jihad: America’s Military Experience in Afghanistan, Iraq and Syria, by Brian Glyn Williams, by permission of the author and publisher. Copyright 2017 University of Pennsylvania Press.

[T]he incoming Obama administration had come to see these drone strikes as a vital component of its war against terrorism in Pakistan and Afghanistan. Like the Bush administration before it, the Obama administration felt that the public relations fallout in Pakistan (where reports of civilian deaths from the drones were wildly exaggerated) was worth the disruptive effect the drones had on Al Qaeda and Taliban, who were planning new terrorist attacks from their FATA sanctuary. In fact Obama (who came to be known as “Obomba” in Pakistan) ordered 353 drones strikes in Pakistan by October 2015, compared to just 48 under President Bush (i.e. Obama launched more than seven times as many as Bush).

While his Republican critics described Obama as “weak” on counter-terrorism and accused him of being “anti-war,” former Secretary of Homeland Security, Janet Napolitano, pushed back on this notion stating, “President Obama has authorized more military actions in Muslim countries than any previous president and that the most conservative estimate identifies more than 3,000 drone strike fatalities during his tenure, including much of Al Qaeda’s leadership. He is the first president since the Civil War to authorize the assassination of another American — Anwar al-Awlaki, himself.” Jeffrey Goldberg of The Atlantic similarly defended Obama saying, “this president who has this reputation [of being weak] is the greatest terrorist hunter in the history of the American presidency. I mean, we just saw in the last week the 150 militants in Somalia wiped out by a U.S. strike. Who ordered that strike?”

Obama’s drone campaign decimated the Taliban and Al Qaeda’s ranks and kept them wondering who was next and hiding, instead of planning new terrorist outrages. The Taliban and Al Qaeda came to have a tremendous fear for the high-tech drones that struck out of the blue without warning and with uncanny precision

The CIA’s ability to hit its targets in Pakistan increased in 2007 with the introduction of a much improved drone known as the MQ-9 Reaper. The Reaper had a much larger engine, allowing it to travel three times the speed of the earlier drone, known as the Predator, and carry far more armament. This ordnance included GBU-12 Paveway II laser laser-guided bombs and Sidewinder missiles. Like the more primitive Predator, the Reaper could loiter over its intended target for over twenty four hours, using high high-resolution cameras to track militants’ “pattern of life” movements from up to two miles away. Then, when the target was tracked leaving crowded areas, it could fire its deadly mini-missiles (often at targets in moving vehicles) to destroy them in the open and thus avoid civilian bystander casualties known as “collateral damage.”

It has also been reported that the Predators and Reapers were aided by secret electronic transmitter chips placed on or near targets by tribesmen working for CIA bounties. These cigarette lighter-sized homing beacons helped account for the drones’ success in taking out dozens of high high-value Al Qaeda and Taliban targets, while usually avoiding civilians. In essence, the drones’ Hellfire missiles could home in on the beacons and precisely destroy Taliban and Al Qaeda cars or buildings where they were meeting.

-

Comment by Riaz Haq on May 25, 2017 at 8:08am

-

#Trump Administration Proposes to Cut #CSF for #Pakistan by $100 Million to $800 Million for FY18. http://www.ndtv.com/world-news/donald-trump-administration-proposes... … via @ndtv

WASHINGTON: The Trump administration has proposed to give Pakistan US $800 million as reimbursement for its military and logistical support in counter-terrorism operations in the next fiscal, a defence department official has said.

The administration has proposed the amount - a cut of US $100 million compared to the previous time - in its annual budget proposals under the Coalition Support Fund (CSF), a Pentagon programme to reimburse US allies that have incurred costs in supporting counter-terrorist and counter-insurgency operations.

Pakistan is one of the largest recipient under the fund and has received US $14 billion since 2002. But for the past two years, the US Congress has imposed conditions on disbursal of money under the fund.

"The FY 2018 budget proposal seeks US $800 million in CSF for Pakistan. The CSF authority is not security assistance, but reimbursements to key cooperating nations for logistical, military, and other support provided to US combat operations," Adam Stump, Defence Department spokesman for Afghanistan, Pakistan and Central Asia told news agency PTI yesterday.

For 2016 fiscal year, Pakistan was authorised to receive up to US $900 million under CSF.

"The deputy secretary of defence signed the authorisation to disburse US $550 million in fiscal year 2016 coalition support fund to Pakistan for logistical, military, and other support provided to the US operations in Afghanistan for the period of January-June 2015," Mr Stump said.

"The Department recognises the significant sacrifices the Pakistan military has made in the fight against terrorism, and appreciates Pakistan's continued support for transit of materiel to coalition forces in Afghanistan," he said in response to a question

"Disbursement of the remaining US $350 million requires the Secretary of Defence to certify that Pakistan has taken sufficient action against the Haqqani Network. The Secretary has not yet made a decision on certification," Mr Stump said.

For the first time in 2016, then Secretary of Defence Ashton Carter had declined to certify that Pakistan met the certification requirement, resulting in the loss of US $300 million fund for it. This amount was reprogrammed by the Pentagon for Department of Defence's Overseas Contingency Operations Funding, a second defence department official said.

In its latest budget, the Department of Defence has attached no conditions for disbursement of CSF to Pakistan. However, it was only the US Congress which imposes such strict conditions on giving CSF money to Pakistan.

Justifying the need to give such a huge amount of money to Pakistan, the Pentagon said Pakistan has served as a key ally in operation 'Enduring Freedom' since 2001 and will continue to play a key role in maintaining stability in the region.

"Pakistan's security forces regularly engage enemy forces, arrest and kill Taliban and al-Qaeda forces, and provide significant support to US forces operating in Afghanistan. Pakistan continues to meet the enemy insurgency and has made enormous sacrifices in support of these operations," it said.

"The expenses Pakistan incurs to conduct operations against al-Qaeda and Taliban forces include providing logistical support for its forces, manning observation posts along the Afghanistan border, and conducting maritime interdiction operations and combat air patrol," the Pentagon said.

Comment

- ‹ Previous

- 1

- 2

- 3

- Next ›

Twitter Feed

Live Traffic Feed

Sponsored Links

South Asia Investor Review

Investor Information Blog

Haq's Musings

Riaz Haq's Current Affairs Blog

Please Bookmark This Page!

Blog Posts

Pakistanis' Insatiable Appetite For Smartphones

Samsung is seeing strong demand for its locally assembled Galaxy S24 smartphones and tablets in Pakistan, according to Bloomberg. The company said it is struggling to meet demand. Pakistan’s mobile phone industry produced 21 million handsets while its smartphone imports surged over 100% in the last fiscal year, according to …

ContinuePosted by Riaz Haq on April 26, 2024 at 7:09pm

Pakistani Student Enrollment in US Universities Hits All Time High

Pakistani student enrollment in America's institutions of higher learning rose 16% last year, outpacing the record 12% growth in the number of international students hosted by the country. This puts Pakistan among eight sources in the top 20 countries with the largest increases in US enrollment. India saw the biggest increase at 35%, followed by Ghana 32%, Bangladesh and…

ContinuePosted by Riaz Haq on April 1, 2024 at 5:00pm

© 2024 Created by Riaz Haq.

Powered by

![]()

You need to be a member of PakAlumni Worldwide: The Global Social Network to add comments!

Join PakAlumni Worldwide: The Global Social Network