PakAlumni Worldwide: The Global Social Network

The Global Social Network

British Government Lists Pakistan Among Top 3 Money Laundering Sources

British National Crime Agency (NCA) has identified Pakistan, Nigeria and Russia as the top source countries for money laundering in the United Kingdom, according to British media reports. The NCA report says the UK is a prime destination for foreign corrupt and politically exposed people (politicians and their families) to launder money.

NCA Report Highlights:

In its annual assessment of serious and organized crime, the NCA says: “Investment in UK property, particularly in London, continues to be an attractive mechanism to launder funds....As the UK moves towards exiting the EU in March 2019, UK-based businesses may look to increase the amount of trade they have with non-EU countries....We judge this will increase the likelihood that UK businesses will come into contact with corrupt markets, particularly in the developing world, raising the risk they will be drawn into corrupt practices.”

Here are some of the key excerpts of the UK NCA report titled "National Strategic Assessment of Serious and Organized Crime 2018":

1. "The UK is a prime destination for foreign corrupt PEPs (politically exposed persons, a euphemism for politicians and their family member) to launder the proceeds of corruption. Investment in UK property, particularly in London, continues to be an attractive mechanism to launder funds. The true scale of PEPs investment in the UK is not known, however the source countries that are most commonly seen are Russia, Nigeria and Pakistan".

2. "The overseas jurisdictions that have the most enduring impact on the UK across the majority of the different money laundering threats are: Russia, China, Hong Kong, Pakistan, and the United Arab Emirates (UAE). Some of these jurisdictions have large financial sectors which also make them attractive as destinations or transit points for the proceeds of crime."

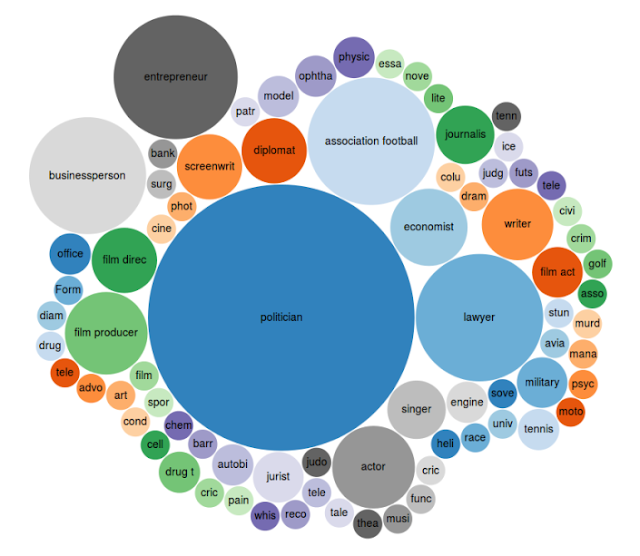

Politicians Dominate Panama Papers |

Panama Papers Leak:

The NCA report says there are "professional enablers from the banking, accounting and legal world" who facilitate the legitimization of criminal finances and are perpetuate the problem by refinancing further criminality.

In fact, there is an entire industry made up of lawyers and accountants that offers its services to help hide illicit wealth. Mossack Fonseca, the law firm that made headlines with "Panama Leaks", is just one example of companies in this industry.

Mossack Fonseca's 11.5 million leaked internal files contained information on more than 214,000 offshore entities tied to 12 current or former heads of state, 140 politicians, including Pakistan's now ex Prime Minister Nawaz Sharif's family. Icelandic Prime Minister resigned voluntarily and Pakistani Prime Minister was forced out by the country's Supreme Court.

The Panama list included showbiz and sports celebrities, lawyers, entrepreneurs, businessmen, journalists and other occupations but it was heavily dominated by politicians.

Trade Based Money Laundering (TBML):

The report singles out trade as one of the key mechanisms used in money laundering. It says: "Trade based money laundering (TBML) is a complex global issue and a key method of money laundering impacting on the UK".

It is not just greedy politicians, unscrupulous businessmen and corrupt officials in developing countries who rely on fraudulent manipulation of trade invoices; all kinds of drug traders, terrorists and criminals also use TBML (trade-based money laundering).

John A. Cassara, former US intelligence official with expertise in money laundering, submitted written testimony for a US Congressional hearing on “Trading with the Enemy: Trade-Based Money Laundering is the Growth Industry in Terror Finance” to the Task Force to Investigate Terrorism Financing Of the House Financial Services Committee February 3, 2016. Here's an except from it:

"Not long after the September 11 attacks, I had a conversation with a Pakistani entrepreneur. This businessman could charitably be described as being involved in international grey markets and illicit finance. We discussed many of the subjects addressed in this hearing including trade-based money laundering, terror finance, value transfer, hawala, fictitious invoicing, and counter-valuation. At the end of the discussion, he looked at me and said, “Mr. John, don’t you know that your adversaries are transferring money and value right under your noses? But the West doesn’t see it. Your enemies are laughing at you.”"

Trade Misinvoicing:

Washington-based Global Financial Integrity (GFI) defines trade misinvoicing as "fraudulently manipulating the price, quantity, or quality of a good or service on an invoice submitted to customs" to quickly move substantial sums of money across international borders.

How does trade miscinvoicing work? Here's an example:

Let's say an exporter in Pakistan exports goods worth $1 million to a foreign country and invoices it at $500,000 through an offshore middleman. The middleman invoices and collects $1 million from the end customer, sends $500,000 to Pakistan and deposits $500,000 in an offshore account. The result: Pakistan is deprived of the $500,000 in foreign exchange.

Similarly, imports of goods worth $1 million to Pakistan are overinvoiced at $1.5 million through an offshore middleman and the difference is kept in an overseas account. The result: Pakistan loses another $500,000 in foreign exchange. Meanwhile, the Pakistani traders and the officials facilitating misinvoicing together pocket $1 million or 50% on the two trades. Pakistan's trade and current account deficits grow and the foreign exchange reserves are depleted, forcing Pakistan to go back to the International Monetary Fund (IMF) for yet another bailout with tough conditions.

Foreign Residency(Iqama):

Assets held by people in offshore tax havens are tracked by their country of residence, not by their citizenship, under OECD sponsored Agreement On Exchange of Information on Tax Matters. Pakistan is a signatory of this international agreement. When Pakistan seeks information from another country under this agreement, the nation's FBR gets only the information on asset holders who have declared Pakistan as their country of residence. Information on those Pakistanis who claim residency (iqama) in another country is not shared with Pakistani government. This loophole allows many Pakistani asset holders with iqamas in other countries to hide their assets. Many of Pakistan's top politicians, bureaucrats and businessmen hold residency visas in the Middle East, Europe and North America.

Loss of Tax Revenue:

Customs duties in developing countries often make up a huge part of the tax revenue collected by the governments. Trade Misinvoicing not only increases current account deficits but also worsen budget deficits by cutting tax receipts. Raymond Baker, author of Capitalism's Achilles Heel, has written about it as follows:

"The Pakistan government's largest source of revenues is customs duties, and therefore evasion of duties is a national pastime. Isn't there a way to tap into this major income stream, pretending to fight customs corruption and getting rich at he same time? Of course; we can hire a reputable (or disreputable, as the case maybe) inspection company, have the government pay the company about one percent fee to do price checking on imports, and get multi-million dollar bribes paid to us upon award of the contracts. Societe de Generale de Surveillance (SGS), headquartered in Switzerland, and its then subsidiary Cotecna, the biggest group in the inspection business, readily agree to this subterfuge. Letters in 1994 promised "consultancy fees", meaning kickbacks, of 6 percent and 3 percent to British Virgin Island (BVI) companies, Bomer Finance Inc. and Nassam Overseas Inc., controlled by (Benazir) Bhutto and (Asif) Zardari. Payments of $12 million were made to Swiss bank accounts of the BVI companies."

Aid in Reverse:

Some have called London the "Money Laundering Capital of the World" where corrupt leaders from developing nations use wealth looted from their people to buy expensive real estate and other assets. Private individuals and businesses from poor nations also park money in the west and other off-shore tax havens to hide their incomes and assets from the tax authorities in their countries of residence.

The multi-trillion dollar massive net outflow of money from the poor to the rich countries has been documented by the US-based Global Financial Integrity (GFI). This flow of capital has been described as "aid in reverse". It has made big headlines in Pakistan and elsewhere since the release of the Panama Papers and the Paradise Leaks which revealed true owners of offshore assets held by anonymous shell companies. Bloomberg has reported that Pakistanis alone own as much as $150 billion worth of undeclared assets offshore.

Impact on Economic Growth:

There's a direct relationship between investment and GDP. Flight of capital reduces domestic investment and depresses economic growth in poor countries. Lower tax revenues also impact spending on education, health care and infrastructure, resulting in poor socioeconomic indicators.

In Pakistan, for example, it takes investment of about 4% of GDP to grow the economy by 1%. Lower levels of investments in the country has kept its GDP growth below par relative to the rest of South Asia. Any reduction in the outflow of capital to offshore tax havens will help boost economic growth in Pakistan to close the gap with its neighbors, particularly Bangladesh and India whose economies are both growing 1-2% faster than Pakistan's.

Summary:

UK's National Crime Agency (NCA) has listed Pakistan among the top three sources of money laundering in the United Kingdom. The report has identified trade misinvoicing as a key mechanism for money laundering. It singles out politicians as the main culprits. Pakistan's exports have declined significantly since former Prime Minister Nawaz Sharif's PMLN party assumed power in 2013. They are down from about $25 billion in 2013-14 to about $20 billion in 2016-17. Overvaluation of the Pakistani currency is often cited as a reason for it. The other, probably more important reason, may be increasing underinvoicing of exports facilitated by the people in power. Trade misinvoicing is the largest component of illicit financial outflows from developing countries as measured by New York- based Global Financial Integrity (GFI) which tracks such flows.

Related Links:

Did Musharraf Steal Pakistani People's Money?

Pakistan Economy Hobbled By Underinvestment

Raymond Baker on Corruption in Pakistan

Culture of Corruption in Pakistan

US Investigating Microsoft Bribery in Pakistan

Zardari's Corruption Probe in Switzerland

-

Comment by Riaz Haq on December 23, 2020 at 9:49am

-

Dirty money flowing from #Pakistan to #UK. Latest #British crime agency report: “corrupt foreign elites continue to be attracted to the UK property market, especially in London, to disguise their corruption proceeds”. It names Pakistan among top sources. https://www.thenews.com.pk/print/762991-dirty-money-continues-to-fl...

---------------

National risk assessment of

money laundering and terrorist

financing 2020The UK continues to have close economic links to Pakistan, including

significant remittance flows between both jurisdictions, which according to

estimates equated to approximately $1.7 billion in 2017.

12 These linkages

also enable and disguise illicit funds to be transferred between the UK and

Pakistan, including through illegal informal value transfers. Criminals

continue to purchase high value assets, such as real estate, precious gems

and jewellery to launder illicit funds which are transferred from Pakistan to

the UK and vice versa. This includes proceeds from corruption and drug

trafficking. The risk from cash-based money laundering from the UK to

Pakistan via smuggled cash and MSBs also persists.

-------------HMRC visited a well-established cash and carry specialising in toiletries

and household products. Records selected for testing showed the

business accepted £4 million in relevant cash payments from export

customers based in high-risk jurisdictions, in particular Ghana,

Pakistan, Nigeria and Sierra Leone. The risks posed by these customers

had not been identified or addressed and no consideration given to

prohibitions in place surrounding movements of cash from these

countries. For example, the removal of cash from Ghana exceeding

$10,000 is prohibited, however the business accepted £2.4 million in

cash payments from its customers over a 2-year period. As well as

direct movements, unknown third parties resident in the UK delivered

cash on behalf of the overseas customers without considering the

origins of the cash or how the third parties were reimbursed. The

business’s policies, controls and procedures were insufficient to

mitigate the risks of money laundering and terrorist financing.

https://assets.publishing.service.gov.uk/government/uploads/system/...

-

Comment by Riaz Haq on October 9, 2021 at 7:59am

-

Pandora Papers and the economic impact of high-level corruption by Javed Hasan

https://www.arabnews.pk/node/1944396

While owning offshore companies or bank accounts per se does not automatically imply culpability, it is incumbent on all the named, especially those holding senior governmental positions, to provide evidence of transparent money trails and of the declaration of such assets with the tax authorities in Pakistan.

-----------

Welcoming the release of the Pandora Papers, Prime Minister Imran Khan stated that it once again exposed “the ill-gotten wealth of elites, accumulated through tax evasion & corruption & laundered out to financial ‘havens’… ”. He also highlighted that the UN Secretary General’s panel on International Financial Accountability, Transparency and Integrity (FACTI) estimates that as much as $7 trillion of stolen assets are parked in largely offshore tax havens. The Papers include names of politicians in high office as well as retired military officials, businessmen and media owners.

.... In a move that lives up to his crusade against corruption, Prime Minister Imran Khan set up a high-level cell under the Inspection Commission to investigate the matter with the objective of holding “everyone involved in the Pandora leaks accountable” and promised to make the investigation public. It would also be consistent with the PM’s earlier stance that those implicated in the leaks should not be in positions that can in any manner influence the investigation while it is being carried out.

----

...It is also argued that Pakistan’s anti-corruption campaign is ineffective and used more as an instrument of political victimization than toward improving overall governance. While there is some validity in questioning the effectiveness and motives of the anti-corruption efforts, the ‘greasing the wheels’ reasoning, in toto, does not stand up to scrutiny.

In China it has been argued that corruption — euphemistically also called access money — has helped speed up economic growth. However, the renowned political scientist, Yuen Yuen Ang, who has extensively examined the matter, states in a recent article that corruption “spurred government officials to promote construction and investment aggressively, regardless of whether it was sustainable. Luxury properties that enriched colluding state and business elites have mushroomed across the country, while affordable housing remains in short supply…”. More ominously she points out that “Corruption, inequality and financial meltdowns can trigger social unrest and erode the legitimacy of the Chinese Communist Party...”.

----

Corruption has distorted incentives and market forces, and acted as a tax on business that has raised production costs and reduced the profitability of investments. Even more perversely it has dissuaded international investors from considering Pakistan as an investment destination, thereby suppressing the inflow of foreign direct investment (FDI) into the country. On the basis of a survey of 390 senior executives in 14 countries, a PricewaterhouseCoopers study reported that 45 percent of respondents refused to enter markets where corruption risks were perceived to be high.

Corruption’s corrosive influence on the overall governance and business environment as well as the extraction of resources into offshore accounts such as those disclosed in Pandora Papers has undermined Pakistan’s growth prospects and poverty alleviation efforts. It has denuded already scarce resources available for investment in health and education, thereby limiting human capital development and enhancement of its productive capabilities. It is therefore indisputable that all forms of corrupt practices, both direct and indirect, must be eliminated. While some of that will require structural change and take time, in the near-term international enforcement mechanisms must be mobilized to shut down avenues that facilitate illicit financial flows.

-

Comment by Riaz Haq on March 6, 2022 at 10:11am

-

Financial crime watchdog adds UAE to 'grey' money laundering watch list

https://www.reuters.com/world/middle-east/fatf-adds-uae-grey-money-...

DUBAI, March 4 (Reuters) - Global financial crime watchdog the Financial Action Task Force (FATF) on Friday said Middle East business hub the United Arab Emirates had been included on a list of jurisdictions subject to increased monitoring, known as its 'grey' list.

In addition to further FATF scrutiny, countries on the 'grey' list risk reputational damage, ratings adjustments, trouble obtaining global finance and higher transaction costs, experts say

The UAE, the region's financial capital and a gold trading hub, will work to implement a FATF action plan to strengthen the effectiveness of its anti-money laundering and counter terrorism financing regime, the Paris-based body said in a statement.

In response to the listing, the UAE government said it had a "strong commitment" to working closely with FATF on areas for improvement.

"Robust actions and ongoing measures taken by the UAE government and private sector are in place to secure the stability and integrity of the country's financial system," the UAE said in a statement.

The UAE, an oil and gas exporter that touts open-for-business credentials and enables glitzy expatriate lifestyles, has in recent years tightened regulations to overcome an image as a hotspot for illicit money.

The designation is a blow for the country as economic competition accelerates with Gulf neighbour Saudi Arabia, the world's top oil exporter and biggest Arab economy.

"The UAE has inherent vulnerabilities to illicit finance due to its role as a regional commercial and financial hub," said Katherine Bauer, senior fellow at The Washington Institute for Near East Policy and a former U.S. Treasury off

Emirati authorities have made considerable efforts to shore up its anti-money laundering regime and in combating the financing of terrorism, especially since its 2020 assessment by FATF, she said.

"The outstanding items included in the FATF statement today show that there’s still a fair amount to be done. These are not changes that can happen overnight."

A 2020 evaluation by the watchdog called for "fundamental and major improvements" by the UAE. Last year, it founded an Executive Office for Anti-Money Laundering and Counter Terrorism Financing after passing an anti-money laundering and terrorism financing law in 2018.

FATF said the UAE has made "significant progress" since the 2020 report on issues around terrorism financing, money laundering, confiscating criminal proceeds and engaging in international cooperation.

"Additionally, the UAE addressed or largely addressed more than half of the key recommended actions from the mutual evaluation report," it said.

The Gulf state must now demonstrate progress on facilitating international anti-money laundering investigations, on managing risks in certain industries including real estate agents and precious stones and metal dealers, and on identifying suspicious transactions in the economy, FATF said.

Other areas for improvement include using financial intelligence against money laundering, increasing investigations and prosecutions of money laundering cases "consistent with UAE's risk profile", and proactively identifying and combating sanctions evasion.

-

Comment by Riaz Haq on June 19, 2022 at 8:54pm

-

From CBS 60 Minutes on "Londongrad" aired June 19, 2022:

For years, Britain actively courted Russian billionaires, ignoring reports that some of their wealth was suspect. Today, there's so much Russian cash in Britain, the capital has been nicknamed "Londongrad." British Intelligence has warned that oligarchs' money is propping up Putin's regime – and helping to fund the war in Ukraine. As we first reported in April, the U.K. is under pressure to show its Western allies it can stop the flood of corrupt money.

https://www.cbsnews.com/news/londongrad-united-kingdom-russian-olig...

Dominic Grieve: Money has been flowing into the United Kingdom — absolutely no doubt about this — which often has had what I can only describe as a tainted source. But then Russia is a mafia state.

Dominic Grieve is a former conservative member of Parliament, who served as attorney general and chaired Britain's intelligence committee. His 2019 report on Russian interference in U.K. politics, found Britain was awash in Russian oligarchs' money — much of it from untraceable sources.

---------------

This is Belgravia. These neighborhoods around Eaton Square are some of the most expensive on Earth. Once the exclusive preserve of dukes and barons, now…

---------

Oliver Bullough: There was a general feeling that if the money was coming here and paying taxes that was building schools and building roads and building hospitals, then we didn't care where it came from.

-

Comment by Riaz Haq on July 4, 2022 at 10:49am

-

Asset declarations to be made public under IMF condition

Govt can exempt judiciary, armed forces’ members from disclosure

https://tribune.com.pk/story/2334492/asset-declarations-to-be-made-...

The government is walking a tight rope to implement all conditions by end of this month, if it is keen to get the IMF Board’s approval for the loan tranche on January 12.

The sources said that the IMF has imposed another condition that the high-level public office holders and the civil servants of basic pay scale (BPS) 17 and above, their spouses, children or benamidars, or any person in relation to whom these persons are beneficial owners will file their asset declarations with the Federal Board of Revenue. These assets will be then made public.

The government has also defined the high-level public officials who will be required to file their declarations which will be made public. An amendment is being drafted where only politically exposed persons defined by a rule, regulation, executive order or instrument; or under any law for the time being in force would be required to file their declarations, the sources said.

The government had resisted the demand to ensure compulsory declaration on the grounds that these people were already required to submit their asset details in the Establishment Division. However, the IMF did not agree to it and instead asked Pakistan that such declarations should be filed with the tax authorities.

However, many bureaucrats did not file their asset declarations, nor did they submit their annual income tax returns, including many taxmen.

The IMF’s view was that any important position holder drawing salary from the budget should disclose assets to ensure transparency.

“The disclosure of information in respect of high-level public officials is proposed in line with the requirements of the development partners, rule of law and integrity,” the note sent by the FBR chairman to the finance adviser about changes being made in the tax laws read.

However, the government has found a way out where the declarations filed by members of the armed forces would not be made public, the sources said, adding that the exception has been created by Law Minister Barrister Farogh Naseem.

Barrister Naseem was not available for comments.

The sources said that the requirement of non-disclosure of the asset declarations would not be applicable on those who were currently exempted from the applicability of the National Accountability Ordinance.

A proviso is likely to be inserted in the law that will state that nothing in clause (t) shall apply to those who are expressly exempted under clause (iv) of sub-section (m) of Section 5 of the National Accountability Ordinance, 1999.

What Clause 5 (m) (iv) says?

A person who is holding, or has held, an office or post in the service of Pakistan, or any service in connection with the affairs of the Federation, or of a province, or of a local council constituted under any federal or provincial law relating to the constitution of local councils, or in the management of corporations, banks, financial institutions, firms, concerns, undertakings or any other institution or organisation established, controlled or administered by or under the federal government or a provincial government, other than a person who is a member of any of the armed forces of Pakistan, or for the time being is subject to any law relating to any of the said forces, except a person who is, or has been a member of the said forces and is holding, or has held, a post or office in any public corporation, bank, financial institution, undertaking or other organisation established, controlled or administered by or under the federal government or a provincial government.

-

Comment by Riaz Haq on June 3, 2023 at 1:52pm

-

Why two luxury London homes are at the centre of Pakistan’s turmoil

https://www.theguardian.com/business/2023/jun/03/why-two-luxury-lon...

The NCA said it had reached a settlement with Malik Riaz that included the house and £140m in funds, then valued at £50m, that were suspected to be recoverable under the Proceeds of Crime Act. Malik Riaz highlighted on Twitter that the NCA said the settlement “does not represent a finding of guilt”. Lawyers for the Riaz family and Bahria Town said their position “was, and always has been, that the property was legitimate and there was no reasonable basis for suspecting that it was recoverable”. Thanks to the settlement “there never was any finding that any of the property was recoverable”, they said.

The fate of that money has become a matter of huge controversy in Pakistan. Khan was arrested on allegations that in late 2019 he and his wife, Bushra Bibi, received more than 20 hectares of land and millions of rupees in exchange for allowing the roughly £180m in settlement money – which was returned to the state of Pakistan – to be used by Malik Riaz’s company to pay its own supreme court settlement.

Khan, who came to power after captaining his country’s cricket team to world cup victory over England in 1992, has vehemently denied corruption allegations against him and his wife, and has vowed to take on the military establishment.

Lawyers for the Riaz family said: “Under the agreement, the funds previously frozen would be paid against the judgment debt owed by [Bahria Town].” There was never “any order, or agreement, that the ownership of any property should pass to the state of Pakistan”.

They added: “The whole point of the agreement was to reach an amicable settlement in relation to the property, and returning the property to Pakistan to settle the judgment debt was the most satisfactory outcome for all concerned. The property was not judged to be the proceeds of crime and ownership of the property did not pass to the state of Pakistan.”

The recent turmoil in Pakistan had raised serious questions for the NCA over its role in obtaining funds from the settlement for the benefit of a wealthy property tycoon, anti-corruption campaigners say.

Susan Hawley, executive director of Spotlight on Corruption, a charity, said: “The NCA’s settlement on secret terms with Malik Riaz Hussain showed an appalling lack of judgment by the agency which is now coming home to roost. The deal raised very serious questions at the time about whether it allowed Malik Riaz to benefit personally from its terms, and whether it represented a robust enough response to allegations of wrongdoing. The fact that it has now become central to the political turmoil taking place currently in Pakistan should give the NCA reason to review whether settlements in cases of kleptocracy are ever really suitable.”

Malik Riaz’s family still appears to be linked to other properties in London. The NCA’s original application to freeze the bank accounts related to Malik Riaz has been obtained by Spotlight. In the application – withdrawn after settlement was reached – NCA officers highlighted funds held on behalf of Fortune Event Limited, a British Virgin Islands company. Ahmed Ali Riaz, the son of Malik Riaz and the chief executive of Bahria Town, was named by the NCA as an ultimate beneficial owner of the company. The same company is listed on the UK’s Land Registry as the owner of nine apartments in grand Victorian stucco-fronted houses on Lancaster Gate, also overlooking Hyde Park. Title documents for two of the properties list an email address containing part of Ali Riaz’s name.

Comment

- ‹ Previous

- 1

- 2

- 3

- 4

- Next ›

Twitter Feed

Live Traffic Feed

Sponsored Links

South Asia Investor Review

Investor Information Blog

Haq's Musings

Riaz Haq's Current Affairs Blog

Please Bookmark This Page!

Blog Posts

Pakistani Prosthetics Startup Aiding Gaza's Child Amputees

While the Israeli weapons supplied by the "civilized" West are destroying the lives and limbs of thousands of Gaza's innocent children, a Pakistani startup is trying to provide them with free custom-made prostheses, according to media reports. The Karachi-based startup Bioniks was founded in 2016 and has sold prosthetics that use AI and 3D scanning for custom designs. …

ContinuePosted by Riaz Haq on July 8, 2025 at 9:30pm

Indian Military Begins to Accept Its Losses in "Operation Sindoor" Against Pakistan

The Indian military leadership is finally beginning to slowly accept its losses in its unprovoked attack on Pakistan that it called "Operation Sindoor". It began with the May 31 Bloomberg interview of the Indian Chief of Defense Staff General Anil Chauhan in Singapore where he admitted losing Indian fighter aircraft to Pakistan in an aerial battle on May 7, 2025. General Chauhan further revealed that the Indian Air Force was grounded for two days after this loss. …

ContinuePosted by Riaz Haq on July 5, 2025 at 10:30am — 5 Comments

© 2025 Created by Riaz Haq.

Powered by

![]()

You need to be a member of PakAlumni Worldwide: The Global Social Network to add comments!

Join PakAlumni Worldwide: The Global Social Network