PakAlumni Worldwide: The Global Social Network

The Global Social Network

Pakistan Garment Industry Becoming More Cost Competitive With Bangladesh's?

Low wages and trade preferential deals with Western nations have helped Bangladesh, currently designated "Least Developed Country" (LDC), build a $30 billion ready-made garments (RMG) industry that accounts for 80% of country's exports. Bangladesh is the world's second largest RMG exporter after China. With its designation as LDC (Least Developed Country), garments made in Bangladesh get preferential duty-free access to Europe and America. Rising monthly wages of Bangladesh garment worker in terms of US dollars are now catching up with the minimum wage in Pakistan, especially after recent Pakistani rupee devaluation. Minimum monthly wage in Pakistan has declined from $136 last year to $107 now while Bangladesh has seen it increase from $64 last year to $95 today. Western garment buyers, known for their relentless pursuit of the lowest labor costs, will likely diversify their sources by directing new investments to Pakistan and other nations. Competing on low cost alone may prove to be a poor long term exports strategy for both countries. Greater value addition with diverse products and services will be necessary to remain competitive as wages rise in both countries.

|

| Minimum Monthly Wages in US$ Market Exchange Rate |

Wage Hike in Bangladesh:

The government in Dhaka announced in September that the minimum wage for garment workers would increase by up to 51% this year to 8,000 taka ($95) a month, up from $64 a year ago, according to Renaissance Capital. But garment workers union leaders say that increase will benefit only a small percentage of workers in the sector, which employs 4 million in the country of 165 million people, according to Reuters. Bangladesh government promised this week it would consider demands for an increase in the minimum wage, after clashes between police and protesters killed one worker and wounded dozens.

| Monthly Minimum Wages in US$. Source: Renaissance Capital |

Pakistan Wage Decline:

Pakistani currency has seen about 25% decline in value against the US dollar since January 2018. As a result of this devaluation, the minimum monthly wage in Pakistan has dropped from $136 last year to $107 now while Bangladesh has seen it increase from $64 last year to $95 today. Renaissance Capital projects a further 10% depreciation in Pakistani rupee this year.

Race to the Bottom?

Competing on cost alone is like engaging in the race to the bottom. Neither Pakistan nor Bangladesh can count on being lowest cost producers in the long run. What must they do to grow their exports in the future? The only viable option for both is to diversify their products and services and add greater value to justify higher prices.

Pakistan's Export Performance:

|

|

|

|

| Top 10 Textile Exporters. Source: WTO |

|

| Top 10 Garment Exporters. Source: WTO |

Pakistan's Role:

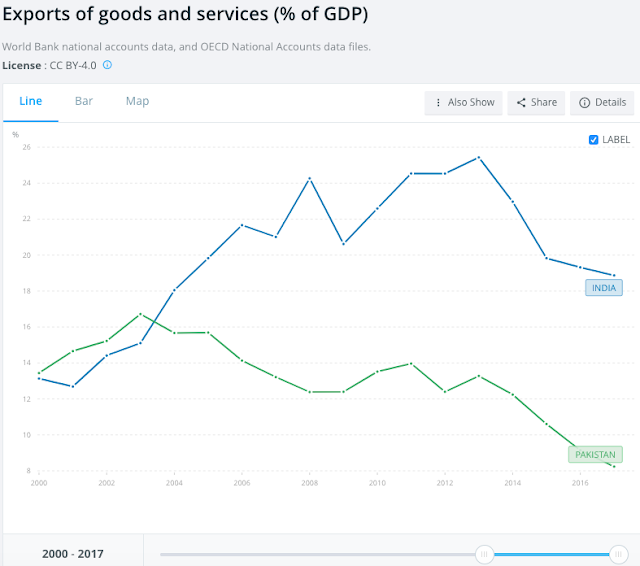

Pakistani currency has seen about 25% decline in value against the US dollar since January 2018. As a result of this devaluation, the minimum monthly wage in Pakistan has dropped from $136 last year to $107 now while in Bangladesh has seen it increased from $64 last year to $95 today. Renaissance Capital projects a further 10% depreciation this year. While this can help Pakistan's RMG exports in the short term, it is not good long term strategy. Competing on cost alone is a race to the bottom. Pakistan's manufactured exports per capita have declined in the last decade. Pakistan's exports have declined from about 15% of GDP to about 8% since 2003. The nation's trade deficits are growing at an alarming rate as the imports continue to far outstrip exports. This situation is not sustainable. Chinese Ambassador Yao Jing has offered a helping hand to increase Chinese investment and trade in Pakistan. Pakistan's new government led by Prime Minister Imran Khan should take the Chinese Ambassador's plan seriously. Finance Minister Asad Umar needs to form a high-powered team of top bureaucrats and leading businessmen on a comprehensive plan to attract investments in export-oriented industries and diversify and grow high-value exports to China and other countries.

-

Comment by Riaz Haq on January 13, 2019 at 10:50am

-

Bangladesh workers' wages rise in 6 grades

RMG workers' pay structure revised after PM's directive amid unrest for eight days

https://www.thedailystar.net/business/bangladesh-garment-workers-sa...After eight days of labour unrest, the government yesterday announced a revised pay structure, with a slight increase in both basic and gross wages in six of the seven grades in the RMG sector.

In the new pay scale, which comes after years, the yearly increment has been fixed at 5 percent.

Workers had been demanding pay raise in three grades in particular -- grade 3, 4 and 5.

The decision came following directives of the prime minister after an event-packed day, on which workers continued their protests, factory owners threatened to shut down their units and a tripartite committee held almost a daylong meeting to reach a consensus on the hike.

The meeting of the 20-member committee, which has representation of the workers, owners and the government, approved wage increase in grade 1-6. The hike ranges from a token Tk 15 to a modest Tk 747.

The raise is effective from December last year and will be adjusted from February.

The gross pay in grade 7 remains unchanged at Tk 8,000, which was Tk 5,300 in the previous pay structure announced in 2013.

The government will publish a new gazette of the revised wage in the next three to four days, said Labour and Employment Secretary Afroza Khan, who heads the tripartite committee.

The committee was considering pay hikes in the three “most problematic” grades -- 3, 4 and 5.

But at a meeting at Gono Bhaban on Saturday night, Sheikh Hasina instructed officials to revise the latest pay structure, originally announced in September last year, for all grades, sources said.

The workers will receive the arrear with their pay for February, Commerce Minister Tipu Munshi told reporters after the meeting.

“We were mainly concerned about the pay in grade 3, 4 and 5. But we eventually revised the wages six grades so workers get a little more,” he said, announcing the decision at a press conference at the ministry.

Amirul Haque Amin, president of the National Garment Workers Federation, said, “We welcome the revision and the new wage structure.”

He was speaking on behalf of the trade union leaders who are on the tripartite committee.

Reaction among the workers were mixed.

Alamgir Kabir, who works at a Ha-Meem Group factory, said he was happy and that he would join work today.

Another worker, however, said he was not satisfied. But still he would go back to work, if his colleagues did so.

Incidents of labour unrest over the pay structure made headlines in early December, just two months after the pay package was announced.

That protest died down ahead of the general election.

However, when workers drew their salary for January, they spotted a huge disparity -- in some cases, their gross wages came down instead of going up, triggering the latest bout of protest.

After yesterday's announcement, trade union leaders hope the workers will join work.

“We, the trade union orgainsations, do not approve of the anarchy that we have seen over the last few days,” said Amirul of the National Garment Workers Federation.

He also said they would have no objection if the government took action against any wrongdoers.

“We are requesting the workers to go back to work from tomorrow [today]. We are also calling them to cooperate with the factory managements so they can make up for the loss incurred in the last few days,” he said.

Meanwhile, BGMEA President Siddiqur Rahman yesterday threatened to shut down all factories if the workers did not join work.

"No work, no pay," he told an emergency press conference at the BGMEA office.

Police use water cannon to disperse workers in Ashulia's Jamgora area on January 12, 2019. Star file photo

Police use water cannon to disperse workers in Ashulia's Jamgora area on January 12, 2019. Star file photoUNREST CONTINUES

At least 10 garment workers were injured in clashes with police during protest in different areas of Ashulia on Dhaka-Tangail highway yesterday.

The protestors vandalised at least five vehicles, burned tyres and wooden objects on the road, halting traffic for around one and a half hours.

The protest for pay hike continued for the 8th day yesterday, even as a tripartite committee representing workers, owners and the government sat in a meeting to consider their demand.

Protestors at Jamgara and Narsinghpur said they would not leave the streets until the government announced the revised wage structure.

They began their demonstration in the area around 8:00am, blocking a number of roads.

Police quickly rushed to the spots and charged batons to clear the roads. Police also used water cannons and teargas shells on them.

Vehicular movement was halted until 9:30am, creating a huge tailback.

“We dispersed the workers by firing teargas and using water cannons as they blocked at least 10 points of the highway and its adjacent roads,” said Sana Shaminur Rahman, superintendent of Dhaka Industrial Police-1.

At least 50 factories in Ashulia area were closed as workers of these factories continued their protests.

In Gazipur, most factories were closed because of the unrest.

As a result, the sector is incurring a huge loss, said owners and officials of several factories.

[Our Savar and Gazipur correspondents contributed to the report.]

-

Comment by Riaz Haq on January 13, 2019 at 8:17pm

-

Rise of #Bangladesh. CLSA's Chris Wood believes Bangladesh's reliance on #garments sector is obstacle to future growth as it faces the risk of lower #wage alternatives in #Africa, #automation & loss of duty-free #market access when it loses #LDC status. https://asia.nikkei.com/Spotlight/Cover-Story/The-rise-and-rise-of-...

"Exiting LDC status gives us some kind of strength and confidence, which is very important, not only for political leaders but also for the people," she (Shaikh Hasina) told the Nikkei Asian Review in an exclusive interview in December. "When you are in a low category, naturally when you discuss terms of projects and programs, you must depend on others' mercy. But once you have graduated, you don't have to depend on anyone because you have your own rights."

Hasina says Bangladesh's strong economic growth will not just continue, but accelerate. "In the next five years, we expect annual growth to exceed 9% and, we hope, get us to 10% by 2021," she said.

"I always shoot for a higher rate," she laughs. "Why should I predict lower?"

On many fronts, Bangladesh's economic performance has indeed exceeded even government targets. With a national strategy focused on manufacturing -- dominated by the garment industry -- the country has seen exports soar by an average annual rate of 15-17% in recent years to reach a record $36.7 billion in the year through June. They are on track to meet the government's goal of $39 billion in 2019, and Hasina has urged industry to hit $50 billion worth by 2021 to mark the 50th anniversary of what Bangladeshis call their Liberation War.

A vast community of about 2.5 million Bangladeshi overseas workers further buoys the economy with remittances that jumped an annual 18% to top $15 billion in 2018. But Hasina also knows the country needs to move up the industrial value chain. Political and business leaders echo her ambitions to shift from the old model of operating as a low-cost manufacturing hub partly dependent on remittances and international aid.

To that end, Hasina launched a "Digital Bangladesh" strategy in 2009 backed by generous incentives. Now Dhaka, the nation's capital, is home to a small but growing technology sector led by CEOs who talk boldly about "leapfrogging" neighboring India in IT. Pharmaceutical manufacturing -- another Indian staple -- is also on the rise.

Behind the impressive numbers and bold ambitions, however, are daunting hurdles ranging from structural problems to deep political divisions, which have come to the fore ahead of national elections on Dec. 30.

Bangladeshi politics have been dominated for years by the bitter rivalry between Hasina and former Prime Minister Khaleda Zia, whose family histories go back to opposing sides of the liberation struggle, when Bangladesh was known as East Pakistan. Both women have been in and out of power -- and prison -- over the past three decades. Khaleda Zia, who chairs the opposition Bangladesh Nationalist Party, is in jail on corruption charges that she says are false.

Since 1981, Hasina has led the ruling Awami League, founded by her father, Sheikh Mujibur Rahman, the country's first president, who was killed by army personnel along with most of his family in 1975. The party enjoyed strong support in some past elections. But opposition activists and human rights groups have voiced concern about potential polling fraud and intimidation tactics. After two consecutive five-year terms for the ruling party, analysts point to a palpable "anti-incumbency" sentiment among some voters. Yet from an economic standpoint, many agree that a ruling party victory would support further development.

"If the polling passes without too much strife and the status quo is maintained, then [Bangladesh] would seem an attractive long-term story," said Christopher Wood, managing director and chief strategist at Hong Kong-based brokerage CLSA.

-

Comment by Riaz Haq on January 13, 2019 at 8:39pm

-

Rise of #Bangladesh. CLSA's Chris Wood believes Bangladesh's reliance on #garments sector is obstacle to future growth as it faces the risk of lower #wage alternatives in #Africa, #automation & loss of duty-free #market access when it loses #LDC status.

https://asia.nikkei.com/Spotlight/Cover-Story/The-rise-and-rise-of-...

DHAKA -- Bangladesh defies economic and political gravity. Since its 1971 war of independence with Pakistan, the country has been known for its tragedies: wrenching poverty, natural disasters and now one of the world's biggest refugee crises, after the influx of 750,000 Rohingya Muslims fleeing persecution in neighboring Myanmar.

Yet, with remarkably little international attention, Bangladesh has also become one of the world's economic success stories. Aided by a fast-growing manufacturing sector -- its garment industry is second only to China's -- Bangladesh's economy has averaged above 6% annual growth for nearly a decade, reaching 7.86% in the year through June.

From mass starvation in 1974, the country has achieved near self-sufficiency in food production for its 166 million-plus population. Per capita income has risen nearly threefold since 2009, reaching $1,750 this year. And the number of people living in extreme poverty -- classified as under $1.25 per day -- has shrunk from about 19% of the population to less than 9% over the same period, according to the World Bank.

Earlier this year, Bangladesh celebrated a pivotal moment when it met United Nations criteria for graduating from "least developed country" status by 2024. To Prime Minister Sheikh Hasina, the elevation to "developing economy" means a significant boost to the nation's self-image.

"Exiting LDC status gives us some kind of strength and confidence, which is very important, not only for political leaders but also for the people," she told the Nikkei Asian Review in an exclusive interview in December. "When you are in a low category, naturally when you discuss terms of projects and programs, you must depend on others' mercy. But once you have graduated, you don't have to depend on anyone because you have your own rights."

Despite its automation push, Giant Group still employs thousands of workers. (Photo by Akira Kodaka)

Despite its automation push, Giant Group still employs thousands of workers. (Photo by Akira Kodaka)Hasina says Bangladesh's strong economic growth will not just continue, but accelerate. "In the next five years, we expect annual growth to exceed 9% and, we hope, get us to 10% by 2021," she said.

"I always shoot for a higher rate," she laughs. "Why should I predict lower?"

On many fronts, Bangladesh's economic performance has indeed exceeded even government targets. With a national strategy focused on manufacturing -- dominated by the garment industry -- the country has seen exports soar by an average annual rate of 15-17% in recent years to reach a record $36.7 billion in the year through June. They are on track to meet the government's goal of $39 billion in 2019, and Hasina has urged industry to hit $50 billion worth by 2021 to mark the 50th anniversary of what Bangladeshis call their Liberation War.

A vast community of about 2.5 million Bangladeshi overseas workers further buoys the economy with remittances that jumped an annual 18% to top $15 billion in 2018. But Hasina also knows the country needs to move up the industrial value chain. Political and business leaders echo her ambitions to shift from the old model of operating as a low-cost manufacturing hub partly dependent on remittances and international aid.

To that end, Hasina launched a "Digital Bangladesh" strategy in 2009 backed by generous incentives. Now Dhaka, the nation's capital, is home to a small but growing technology sector led by CEOs who talk boldly about "leapfrogging" neighboring India in IT. Pharmaceutical manufacturing -- another Indian staple -- is also on the rise.

The government is now implementing an ambitious scheme to build a network of 100 special economic zones around the country, 11 of which have been completed while 79 are under construction.

The concept neatly capitalizes on Bangladesh’s record population density, leveraging what Faisal Ahmed, chief economist at Bangladesh Bank, calls the “density dividend. “The proximity of our population also helped us design and spread social and economic ideas such as microfinance and low-cost health care. But we need to better manage our scarce land resources, and part of the answer is to develop well-functioning industrial parks and SEZs,” he said.

Behind the impressive numbers and bold ambitions, however, are daunting hurdles ranging from structural problems to deep political divisions, which have come to the fore ahead of national elections on Dec. 30.

Bangladeshi politics have been dominated for years by the bitter rivalry between Hasina and former Prime Minister Khaleda Zia, whose family histories go back to opposing sides of the liberation struggle, when Bangladesh was known as East Pakistan. Both women have been in and out of power -- and prison -- over the past three decades. Khaleda Zia, who chairs the opposition Bangladesh Nationalist Party, is in jail on corruption charges that she says are false.

Since 1981, Hasina has led the ruling Awami League, founded by her father, Sheikh Mujibur Rahman, the country's first president, who was killed by army personnel along with most of his family in 1975. The party enjoyed strong support in some past elections. But opposition activists and human rights groups have voiced concern about potential polling fraud and intimidation tactics. After two consecutive five-year terms for the ruling party, analysts point to a palpable "anti-incumbency" sentiment among some voters. Yet from an economic standpoint, many agree that a ruling party victory would support further development.

"If the polling passes without too much strife and the status quo is maintained, then [Bangladesh] would seem an attractive long-term story," said Christopher Wood, managing director and chief strategist at Hong Kong-based brokerage CLSA.

The crowded streets of Dhaka (Photo by Akira Kodaka)

The crowded streets of Dhaka (Photo by Akira Kodaka) A shopping mall in Dhaka: Bangladesh is on track to become a "developing country" in 2024. (Photo by Akira Kodaka)

A shopping mall in Dhaka: Bangladesh is on track to become a "developing country" in 2024. (Photo by Akira Kodaka)Speaking at her official residence in central Dhaka, the prime minister rejected local and international criticism of creeping authoritarianism. Her party, she insisted, is "committed to protecting democracy in Bangladesh."

Business seems largely on the ruling party's side -- if only for stability's sake. In recent interviews in Dhaka, executives and political analysts dismissed suggestions that political turbulence could derail the country's growth trajectory.

"We feel relieved that all political parties are participating in the elections," said Faruque Hassan, managing director of Giant Group, a leading garment manufacturer, and senior vice president of the Bangladesh Garment Manufacturers and Exporters Association. "We feel positive that despite political differences we can continue to keep economic issues separate -- although we know that without political stability you can't grow, and you could scare international customers."

Tailoring its industrial policy

The ready-made garment industry is a key factor in the country's phenomenal success story. The industry is the country's largest employer, providing about 4.5 million jobs, and accounted for nearly 80% of Bangladesh's total merchandise exports in 2018.

It has undergone seismic changes since the watershed Rana Plaza disaster in 2013, when a multi-story garment factory complex collapsed, killing more than 1,130 workers. In the aftermath, the industry was forced by international apparel brands to implement sweeping reforms, including factory upgrades, inspections and improved worker conditions.

A visit to one of Giant Group's gleaming factories brings home the industry's rapidly changing dynamics. In a vast room a handful of workers oversees a fully automated operation that feeds fabric and thread into a huge machine that cuts, stitches and turns out finished garments. In another space nearby, about 300 workers, mostly women, operate machines that embroider and add applique to garments.

Giant Group has introduced a high level of automation at its garment factories. (Photo by Akira Kodaka)

Giant Group has introduced a high level of automation at its garment factories. (Photo by Akira Kodaka) Giant Group says it aims to move into more value-added areas, such as embroidery and high-performance materials. (Photo by AKira Kodaka)

Giant Group says it aims to move into more value-added areas, such as embroidery and high-performance materials. (Photo by AKira Kodaka)"Our entire industry changed in just 90 seconds in April 2013, generally for the better," said Hassan of Giant. "We don't actually want 100% automation -- hopefully we can offset the impact by shifting more workers into value-added fields, applique, embroidery and so on."

Further investment is needed if Bangladesh's garment industry is to remain competitive.

"Bangladesh is still dominated by more basic products and cotton, whereas growth worldwide has been in man-made fibers. We need more investment in these areas, not to produce more cotton shirts," he said.

Bangladesh's textile industry could gain if China's garment exports are hit by a prolonged U.S.-China trade war. But other garment centers are also taking aim at a vulnerable China, including Vietnam, Turkey, Myanmar and Ethiopia.

Intensifying international competition has already sparked consolidation in Bangladesh's garment industry, reducing the number of factories by 22% in the last five years to 4,560, according to the BGMEA.

CLSA's Wood believes that Bangladesh's reliance on the garment sector is a potential obstacle to future growth. "This sector on a 10-year view faces the risk of cheap wage alternatives such as Africa, automation and the loss of duty-free market access if Bangladesh transitions from LDC status [as scheduled for 2024]," he said.

"For now the challenge is to develop other sectors, with pharmaceuticals and business process outsourcing being two areas of promise. But this will require much more foreign investment," he said.

FDI is not Bangladesh's strong point. While it nearly tripled during Hasina's nine years in office, from $961 million in fiscal 2008 to nearly $3 billion in the year to June 30, this compares poorly with other Asian countries, including Vietnam and Myanmar.

Government officials partly blame the country's consistently low rankings in the World Bank's annual "Ease of Doing Business" survey, which they fear deters foreign investors. The latest survey, issued in December, put Bangladesh at 176th of 190 countries, citing excessive red tape, poor infrastructure and transport.

The government has moved to streamline the investment process with the creation of a "one-stop" investor service intended to replicate similar services in Singapore and Vietnam. But this has yet to gain momentum.

More successful is Hasina's digital push. With her son, a U.S.-educated tech expert, as a key adviser, the program has introduced generous tax breaks for the information and communications technology sector and a sweeping scheme to build 12 high-tech parks across the country.

In Dhaka, a new generation of IT entrepreneurs talks about beating India -- which leapt onto the global map with its basic outsourcing industry -- by focusing on AI, robotics and disruptive technologies.

Bangladesh's exports of software and IT services reached nearly $800 million in the year to June 30 and are on track to exceed $1 billion this fiscal year. The government's target of reaching $5 billion in ICT-related exports by 2021 is "very, very challenging but achievable," said Habibullah Karim, CEO of software company Technohaven and a co-founder of the Bangladesh Association of Software & Information Services, an industry body.

"From $800 million to $5 billion is a sixfold increase in three years. That's tough in itself. The second challenge is that the global outsourcing market is actually shrinking," Karim said. "Many tasks, such as airline and hotel reservations and insurance claims ... are now fully automated."

There have been outstanding homegrown tech successes, such as ride-sharing service Pathao, which received a $2 million investment from Indonesian unicorn Go-Jek, and mobile financial services group bKash, in which Alipay, an arm of China's Alibaba Group Holding, took a 20% stake in April.

But go-ahead industries badly need more financing, said Khalid Quadir, CEO and co-founder of Brummer & Partners (Bangladesh), which manages Frontier Fund, the country's only private equity fund. He argues that innovation thrives on a strong private equity industry that can channel funds to promising companies and help them list.

After decades of turmoil, Bangladesh has become South Asia's fastest-growing economy. (Photo by Akira Kodaka)

After decades of turmoil, Bangladesh has become South Asia's fastest-growing economy. (Photo by Akira Kodaka) Employees work at of Technohaven's office in Dhaka. (Photo by Akira Kodaka)

Employees work at of Technohaven's office in Dhaka. (Photo by Akira Kodaka)"We have invested nearly $200 million over the years in areas including communications infrastructure, garments and pharmaceuticals. It's a drop in the ocean compared to the growth opportunities on offer. But to attract more capital of this kind, regulation could be more investor-friendly," he said, citing three-year lockup provisions on investments in newly listed companies.

Shameem Ahsan, chairman of IT company eGeneration and a former head of BASIS, sees Bangladesh's tech niche at the cutting edge of IT. "Forty years ago, the garment industry started with a few companies. Now Bangladesh is exporting $30 billion-plus worth and is second only to China. We want to do the same thing in the IT industry," he said.

Bangladesh is hoping to challenge India in pharmaceuticals, too. With its "least developed country" status, the country has enjoyed a waiver on drug patents. This has fueled intensifying competition between India and Bangladesh in the field of generic and bulk drugs. Among local star performers is Incepta Pharmaceuticals, Bangladesh's second-largest generics maker, which exports to about 60 countries, and Popular Pharmaceuticals, which is eyeing an eventual listing.

"When you look at U.S. and Europe ... their manufacturing plants are closing and they are coming to Asia. Why? Because of quality, affordable drugs," said Syed Billah, senior general manager at Incepta. "We have the quality and recognition from international regulatory bodies, and are very good at finished products. But in [bulk drugs], we are far behind, and seeking technology for that from China."

One of Bangladesh's competitive disadvantages is its poor infrastructure, and the country has turned to China for help. Under its Belt and Road Initiative, China has financed various megaprojects in Bangladesh, including most of the nearly $4 billion Padma Bridge rail link, which will connect the country's southwest with the northern and eastern regions. In all, China has committed $38 billion in loans, aid and other assistance for Bangladesh.

China's heavy infrastructure investment has drawn criticism of its "debt diplomacy" in other countries, including Pakistan and Sri Lanka. But local economists dismiss such concerns.

"I don't think Bangladesh is being pulled too far into China's orbit like Pakistan or even Sri Lanka," said Faiz Sobhan, senior director of research at the Bangladesh Enterprise Institute, an independent think tank, noting that the country is also reliant on Japanese infrastructure investment.

Hasina said the government is taking a more proactive role in the financing alongside international partners such as China, Japan and international financial institutions. "We have undertaken to establish our own sovereign wealth fund, worth $10 billion, to bankroll long-term physical infrastructure development. This is possible because our foreign exchange reserves stand at more than $32 billion now, from $7.5 billion 10 years ago."

Chinese investors also bought 25% of the Dhaka Stock Exchange in 2018, and Bangladesh is now the second-largest importer of Chinese military hardware after Pakistan.

While some may question so much investment from Beijing, Hasina said it is simply a fact that China is set to play a bigger role in the region.

"Our foreign policy is very clear: friendly relations with everyone," she said. "What China and U.S. are doing, it is between them."

Additional reporting by Nikkei staff writers Mitsuru Obe and Yuji Kuronuma, and Dhaka contributor Abu Anas

-

Comment by Riaz Haq on January 14, 2019 at 9:55am

-

World Bank's Poverty and Shared Poverty Report 2018 compares the annual income growth rate of the bottom 40% of the population with the average income growth of the entire population for 91 countries for years 2010-2015. Here's the data for a few selected countries:

Country Bottom 40% income growth vs Average Income Growth

Pakistan 2.7% vs 4.3%

Bangladesh 1.4% vs 1.5%

Iran 1.3% vs -1.3%

Indonesia 4.8% vs 4.8%

Sri Lanka 4.8% vs 5.3%

Vietnam 5.2% vs 3.8%

Thailand 5.0% vs 3.0%

Malaysia 8.3% vs 6.0%

China 9.1% vs 7.4%

http://www.worldbank.org/en/publication/poverty-and-shared-prosperity

People experience poverty differently even within the same household. Traditional measures haven’t been able to capture variations because the surveys stop at the household level. Measuring poverty as experienced by individuals requires considering how resources are shared among family members. While data are limited, there is evidence that women and children are disproportionately affected by poverty in many — but not all — countries. Sex differences in poverty are largest during the reproductive years, when, because of social norms, women face strong trade-offs between reproductive care and domestic responsibilities on the one hand and income-earning activities on the other hand. Worldwide, 104 women live in poor households for every 100 men. However, in South Asia, 109 women live in poor households for every 100 men. Children are twice as likely as adults to live in poor households. This primarily reflects the fact that the poor tend to live in large households with more children.

There is evidence from studies in several countries that resources are not shared equally within poor households, especially when it comes to more prized consumption items. There is also evidence of complex dynamics at work within households that go beyond gender and age divides. More surveys are needed to capture consumption patterns of individuals so that governments can implement policies to bridge the inequalities within households.

-

Comment by Riaz Haq on January 15, 2019 at 10:26am

-

1000s of #Bangladesh #garment workers clash with police. Min #wages rose by a little over 50% this month to 8,000 taka ($95) a month. But mid-level tailors said their rise was paltry and failed to reflect the rising costs of living, especially in housing. https://www.theguardian.com/world/2019/jan/14/bangladesh-strikes-th...

Thousands of garment workers in Bangladesh who make clothes for top global brands have clashed with police as strike action over low wages entered a second week.

Police said water cannon and tear gas were fired on Sunday to disperse huge crowds of striking factory workers in Savar, a garment hub just outside the capital, Dhaka.

“The workers barricaded the highway. We had to drive them away to ease traffic conditions,” said police director Sana Shaminur Rahman. “So far 52 factories, including some big ones, have shut down operations due to the protests.”

On Tuesday, one worker was killed when police fired rubber bullets and tear gas at 5,000 protesting workers.

Bangladesh is dependent on garments stitched by millions of low-paid tailors on factory floors across the emerging south Asia economy of 165 million people.

Roughly 80% of its export earnings come from clothing sales abroad, with global retailers H&M, Primark, Walmart, Tesco and Aldi among the main buyers.

Union leader Aminul Islam blamed factory owners for resorting to violence to control striking workers. “But they are more united than ever,” he told AFP. “It doesn’t seem like they will leave the streets, until their demands are met.”

The protests are the first major test for prime minister Sheikh Hasina since winning a fourth term in last month’s elections, which were marred by violence, thousands of arrests and allegations of vote rigging and intimidation.

Late on Sunday, the government announced a pay rise for mid-level factory workers after meeting manufacturers and unions. Not all unions have signalled they will uphold the agreement.

Babul Akhter, a union leader present at the meeting, said the deal should appease striking workers. “They should not reject it, and peacefully return to work,” he said.

Minimum wages for the lowest-paid garment workers rose by a little over 50% this month to 8,000 taka ($95) a month. But mid-level tailors said their rise was paltry and failed to reflect the rising costs of living, especially in housing.

Bangladesh’s 4,500 textile and clothing factories shipped more than $30bn worth of apparel last year.

The Bangladesh Garment Manufacturers and Exporters’ Association, which wields huge political influence, warned all factories might shut if tailors did not return to work immediately. “We may follow the ‘no work, no pay’ theory, according to the labour law,” association president Siddikur Rahman told reporters.

Last year Bangladesh was the second-largest global apparel exporter after China. It has plans to expand the sector into a $50bn-a-year industry by 2023.

But despite their role in transforming the impoverished nation into a major manufacturing hub, garment workers remain some of the lowest paid in the world.

-

Comment by Riaz Haq on January 15, 2019 at 11:00am

-

Access to #electricity: #Pakistan 99%, #India 84%, #Bangladesh 76%. Source: World Bank 2016

https://twitter.com/theworldindex/status/1085029776556023808

-

Comment by Riaz Haq on January 17, 2019 at 7:18am

-

#Foreign direct #investment (FDI) in #Pakistan hits six-month high. #FDI increased 17% to $319.2 million in Dec 2018 compared to $272.8 million in Dec, 2017. It's the second consecutive month that the FDI inflow rose in FY2018-19 https://tribune.com.pk/story/1889903/2-foreign-direct-investment-pa...

Pakistan achieved a six-month high foreign investment in different productive sectors of the economy in December 2018 after the country finished a year-long exercise of letting the rupee depreciate against the US dollar to create an equilibrium.

Foreign direct investment (FDI) increased 17% to $319.2 million in December 2018 compared to $272.8 million in the same month last year, the State Bank of Pakistan (SBP) reported on Wednesday.

This is also for the second consecutive month that the FDI has continued to surge on a month-on-month basis.

“The pending rupee devaluation was one of the biggest concerns of foreign direct investors. Now when Pakistan has addressed the concern, it has regained foreign investors’ trust on the country,” Overseas Investors Chamber of Commerce and Industry (OICCI) Secretary General M Abdul Aleem told The Express Tribune.

Despite heavy inflow from China, FDI fails to pick up in FY18

The SBP has devalued the rupee by a whopping 32% in the last 13 months to Rs138.90 to the US dollar on Wednesday.

Besides, the political uncertainty linked to the July 2018 general elections has come to an end and investors have gradually built trust on the recently installed government in the country as well, he added.

In the recent months, the foreigners squeezed investment in wait for clarity on economic policies of the new government. “The government has taken tough decisions over rupee devaluation and (key) interest rate hike. The initiatives have apparently won the investors’ confidence,” he said.

Unlink the previous five months when China remained the only healthy foreign investor in Pakistan, Netherlands and Norway also appeared as significant foreign direct investors in December 2018, according to SBP.

China alone has invested net FDI worth $120.6 million in December, while Norway and Netherlands have appeared as the second and third largest investor with $65.2 million and $47.6 million, respectively.

Sector-wise, it was financial business which attracted the single highest investment worth $137.3 million in the month. This was followed by chemicals with $50.9 million and construction $45.1 million.

Cumulatively in the first six months (July-December) of the current fiscal year, FDIs have dropped 19% to $1.31 billion compared to $1.63 billion in the same period last year.

“The investment attracted in the six months is not bad keeping in view the then political uncertainty and investors waited for clarity on the government economic policies,” Aleem said.

“However, the much-awaited jump in FDIs is yet to come,” he said.

Clarity and confidence on the new government are gradually increasing. “The full-year FDIs should be much higher than $2.8 billion achieved in the previous fiscal year (ended June 30, 2018),” he said.

“The country may attract more foreign investment in oil and gas exploration, telecom, consumer goods, and CPEC-related new investment,” said the official, adding that CPEC-related investments had slowed down over the last seven-eight months.

The total foreign investment, including portfolio investment and public and private external debt, has dropped by a whopping 77% to $899.5 million in the six months compared to $3.95 billion in the same period last year.

The massive drop is seen due to adjustment of the debt Pakistan raised through sale of Sukuk and Eurobond worth $2.5 billion November 2017. The government has not raised debt during July-December 2018 period.

-

Comment by Riaz Haq on January 17, 2019 at 7:37am

-

#Pakistan wriggles out of #IMF clutches. As a result, in geopolitical terms, #Washington’s capacity to leverage Pakistani policies is significantly diminishing. #Saudi-Pak ties are moving on to new level of dynamism. https://indianpunchline.com/pakistan-wriggles-out-of-imf-clutches/

Without doubt, this is a major development in the region. The Saudi-Pakistan relationship, which has been traditionally close and fraternal, is moving on to a new level of dynamism. The Saudi investment decision can be taken as signifying a vote of confidence in the Pakistani economy as well as in Prime Minister Imran Khan’s leadership. It comes on top of the $6 billion package that Saudi Arabia had pledged last year (which included help to finance crude imports) to help Pakistan tide over the current economic difficulties.

The visiting Saudi minister Khalid al-Falih told reporters in Gwadar, “Saudi Arabia wants to make Pakistan’s economic development stable through establishing an oil refinery and partnership with Pakistan in the China Pakistan Economic Corridor.” This remark highlights that Saudi Arabia is openly linking up with the China-Pakistan Economic Corridor (CPEC). China has welcomed this development, but countries that oppose the CPEC such as the US and India will feel disappointed.

From the Indian perspective, the Saudi investment in Gwadar becomes a game changer for the port city, which was struggling to gain habitation and a name. Inevitably, comparisons will be drawn with Chabahar. India has an added reason to feel worried that its Ratnagiri Refinery project, which has been described as the “world’s largest refinery-cum-petrochemical project” is spluttering due to the agitation by farmers against land acquisition. The Saudi Aramco was considering an investment in the project on the same scale as in Gwadar. Will Gwadar get precedence over Ratnagiri in the Saudi priorities? That should be the question worrying India.

The Saudi energy minister disclosed that Crown Prince Mohammed bin Salman will be visiting Pakistan in February and the agreement on the Gwadar project is expected to be signed at that time. Of course, it signifies that Saudi Arabia is prioritizing the relations with Pakistan. The fact remains that Saudi Arabia has come under immense pressure of isolation following the killing of Jamal Khashoggi.

There is much uncertainty about the dependability of the US as an ally and security provider. Riyadh is diversifying its external relations and a pivot to Asia is under way. Suffice to say, under the circumstances, a China-Pakistan-Saudi axis should not look too far-fetched. There is also some history behind it.

To be sure, Iran will be watching the surge in Saudi-Pakistani alliance with growing trepidation. The Saudi presence in Pakistan’s border region with Iran (such as Gwadar) has security implications for Tehran. Iran has been facing cross-border terrorism.

-

Comment by Riaz Haq on January 17, 2019 at 4:08pm

-

#American #agribusiness giant Cargill to grow #Pakistan business with US$200 million investment for expansion across its #agriculture trading and supply chain, edible #oils, #dairy, #meat and animal feed businesses while ensuring safety, food traceability. https://www.thenews.com.pk/latest/420270-cargill-to-grow-pakistan-b...

Cargill renewed its long standing commitment to Pakistan by announcing plans to invest more than US$200 million in the next three-to-five years.

The announcement was made soon after Cargill’s global executive team, led by Marcel Smits, head of Global Strategy and Chairman, Cargill Asia Pacific region, and Gert-Jan van den Akker, president, Cargill Agricultural Supply Chain, met with the Prime Minister Imran Khan and other senior government officials to discuss the company’s future investment plans.

Being a global food and agriculture producer with a strong focus on Asia, Cargill aims to partner on Pakistan’s growth by bringing its global expertise and investment into the country.

The company’s strategy includes expansion across its agricultural trading and supply chain, edible oils, dairy, meat and animal feed businesses while ensuring safety and food traceability.Cargill will bring world class innovations to support the flourishing dairy industry in Pakistan, which is already moving toward modernization, as well as the rising demand for edible oils backed by evolving consumption patterns and a growing market for animal feed driven by sustained progress made by the poultry industry in Pakistan.

Cargill’s proposed investments will support Pakistan’s overall economic development and contribute to local employment.

The visiting delegation informed the Prime Minister that M/s Cargill intended to invest in Pakistan as back as 2012 but were discouraged by mismanagement, corruption and non-availability of level playing field during the previous governments. However, investor’s confidence has restored after the incumbent Government and the policies being pursued by it.

The prime minister welcomed investment plans of M/s Cargill in the area of agriculture development, import substitution and enhancement of agricultural products.

He highlighted the efforts of the government towards ensuring transparency, providing the business community with level playing field and improving ease of doing business in the country.

The PM assured the delegation full support from the government.

-

Comment by Riaz Haq on January 19, 2019 at 9:55am

-

#Egyptian billionaire Naguib Sawiris offers to build 100,000 housing units in #Pakistan as part of #PMImranKhan’s Naya Pakistan #housing initiative. http://www.arabnews.pk/node/1437706/pakistan

Egyptian billionaire Naguib Sawiris has offered to build 100,000 housing units in Pakistan to help realize Prime Minister Imran Khan’s dream of an ‘ambitious’ housing project, officials said on Friday.

“Naguib Sawiris has expressed his will to invest in 100,000 units of affordable housing to help prime minister (Imran Khan) in his vision toward Pakistan,” Tarek Hamdy, Chief Executive officer of Elite Estates — a partnership between Ora Developer and Saif Holding — told Arab News in an exclusive interview.

Owned by Sawiris, Ora Developers is already engaged in the construction of a multibillion-dollar housing scheme named ‘Eighteen’ which was launched in 2017 in Islamabad with local partners, Saif Group and Kohistan Builders.

Sawiris’ first investment in Pakistan was in Mobilink, a cellular operator.

PM Khan in October 2018 had launched ‘Naya’ (New) Pakistan Housing Project in line with his party’s election manifesto, which promised fivr million houses for the poor.

Hamdy says they have “set rules or guidelines of the way of doing things” that apply to every real estate projects — whether they are affordable or high value units.

“We will use our experience and knowhow to deliver this properly to the people of Pakistan,” he added.

Since the announcement of the low-cost housing project for the poor, the scheme has been at the heart of all political and economic discourses with several calling it too ambitious.

“This scheme is very ambitious yet very promising for the people of Pakistan. I think all the developers should help in this scheme. You cannot solely rely on the government to build five million houses,” Hamdy said.

Recently, the governor of Pakistan’s central bank had said that the massive housing project would require financing of upto Rs 17 trillion.

Hamdy believes that the promise of building five million affordable housing units cannot be realized in a short span of time. “I think the plan is right but it has to be in stages, has to be in steps. It could be achievable obviously that is not the project (to be achieved) in one or two years... may take few good years, may be couple of decades to be achieved,” he said.

In the Islamabad project the Ora Developers own a 60 percent stake in the project comprising a five-star hotel, 1,068 housing units, 921 residential apartments, business parks, hospitals, schools and other educational facilities and 13 office buildings, and a golf course. The networth of the project is $2 billion.

The next cities on the radar for real estate projects are Lahore, Karachi, and Faisalabad. “We intend to do more, we intend to invest more. I think that our portfolio of real estate could come to $10 billion worth of investments in the next five to 10 years including all the projects that we intent to do,” Hamdy said.

Pakistan’s housing sector is marred by frauds, scams and unfinished schemes which has been discouraging many potential investors from venturing into the sector. However, Hamdy says he is confident of delivering the promise by 2021.

Analysts say that Pakistan’s housing sector offers great opportunities for investment due to increasing demand. “According to estimates, the current real estate market value is around Rs900 billion which is three times that of the GDP,” Saad Hashmey, an analyst at Topline Securities, told Arab News, adding that the PM’s housing project is the need of the hour.

Pakistan faces a shortage of nearly 12 million housing units that may require a massive investment of around $180 billion, according to the former Chairman of the Association of Builders and Developers, Arif Yousuf Jeewa.Pakistan expects to attract more than $40 billion foreign direct investment in the next five years in oil refining, petrochemical, mining, renewable energy, and real estate sectors. “We estimate that roughly around $40 billion investment will be made by three countries (Saudi Arabia, the UAE, and China) during the next three to five years,” Pakistan Board of Investment BoI chief, Haroon Sharif had told Arab News earlier, adding that “the investment would start materializing within the next two years”.

Twitter Feed

Live Traffic Feed

Sponsored Links

South Asia Investor Review

Investor Information Blog

Haq's Musings

Riaz Haq's Current Affairs Blog

Please Bookmark This Page!

Blog Posts

Trump Administration Seeks Pakistan's Help For Promoting “Durable Peace Between Israel and Iran”

US Secretary of State Marco Rubio called Pakistan Prime Minister Shehbaz Sharif to discuss promoting “a durable peace between Israel and Iran,” the State Department said in a statement, according to Reuters. Both leaders "agreed to continue working together to strengthen Pakistan-US relations, particularly to increase trade", said a statement released by the Pakistan government.…

ContinuePosted by Riaz Haq on June 27, 2025 at 8:30pm — 4 Comments

Clean Energy Revolution: Soaring Solar Energy Battery Storage in Pakistan

Pakistan imported an estimated 1.25 gigawatt-hours (GWh) of lithium-ion battery packs in 2024 and another 400 megawatt-hours (MWh) in the first two months of 2025, according to a research report by the Institute of Energy Economics and Financial Analysis (IEEFA). The report projects these imports to reach 8.75 gigawatt-hours (GWh) by 2030. Using …

ContinuePosted by Riaz Haq on June 14, 2025 at 10:30am — 3 Comments

© 2025 Created by Riaz Haq.

Powered by

![]()

You need to be a member of PakAlumni Worldwide: The Global Social Network to add comments!

Join PakAlumni Worldwide: The Global Social Network