PakAlumni Worldwide: The Global Social Network

The Global Social Network

Lower Import Duties Rattle Pakistan's Mobile Handset Makers

Pakistan Federal Board of Revenue has recently announced that “Sales Tax and Income Tax at import stage has been drastically reduced in case of smartphones of Rs15,000 or below". This action was apparently taken after Digital Pakistan Initiative led by Tania Aidrus asked for it. It has come under fire from the country's nascent mobile phone and smartphone manufacturing industry which is producing low-cost mobile phones. Pakistan's mobile handset market is the 8th largest in the world. Current annual demand is for about 40 million units of which 13 million are assembled in Pakistan while the rest are imported, according to a report by Dunya News. The import bill for Fiscal Year 2020 is expected to be about $1.2 billion. Boosting it will save billions of dollars of precious foreign exchange. It will create tens of thousands of jobs and spawn new auxiliary manufacturing industries for chargers, headphones, USB cables, cases, etc. In future, Pakistan could become a significant exporter of mobile handsets.

Mobile Phone Demand:

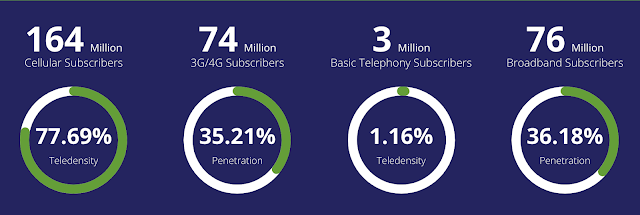

There are currently 164 million mobile phone users in Pakistan, the 8th largest in the world. The current annual demand for mobile phones in the country is estimated at about 40 million units, according to Pakistan Telecommunication Authority (PTA). The fastest growing demand is for 4G smartphones.

According to Pakistan Bureau of Statistics, mobile-phone imports (HS Code: 8517.1219) reached $498 million in 5 months period from July to November 2019, 64% jump over the prior year. Fiscal 2019-20 imports are expected to reach $1.2 billion.

Earlier, the growth rate for 4G handsets jumped from 16% in 2018 to 29% in 2019. Imports of mobile handsets soared 69% from $ 364 million in 2018 to $ 615.7 million in 2019. Pakistan is world's seventh largest handset importer and the 8th largest mobile phone market.

Domestic Manufacturing:

Pakistan Telecommunication Authority (PTA) has granted permission to 26 local companies for manufacturing out of which 15 are currently in production. Among those currently producing mobile handsets in Pakistan are: E-Tachi, GFive, Haier, Infinix and Tecno. They are producing 13 million mobile phones.

Domestic manufacturers claim that they can meet 80% of demand for mobile handsets over the next 2 to 3 years if they are sufficiently protected by higher tariffs on imports.

Domestic mobile phone manufacturing industry will save billions of dollars of precious foreign exchange. It will create tens of thousands of jobs and spawn new auxiliary manufacturing industries for parts, chargers, headphones, USB cables, cases, etc. In future, Pakistan could become a significant exporter of mobile handsets.

Summary:

Pakistan's mobile handset market is the 8th largest in the world. Current annual demand is for 40 million units. Domestic plants produce 13 million units while the rest are imported. The import bill for Fiscal Year 2020 is expected to be about $1.2 billion. The country's nascent mobile handset manufacturing industry fears a serious early setback if the FBR decision to lower duties on imports of foreign made mobile phones is not reversed. It is being blamed on Tania Aidrus, Prime Minister Imran Khan's advisor on Digital Pakistan Initiative, who would like to increase availability of mobile handsets. Domestic mobile phone manufacturing industry will save billions of dollars of precious foreign exchange. It will create tens of thousands of jobs and spawn new auxiliary manufacturing industries for chargers, headphones, USB cables, cases, etc. In future, Pakistan could become a significant exporter of mobile handsets.

Related Links:

Public Sector IT Projects in Pakistan

Pakistan's Gig Economy 4th Largest in the World

Afiniti and Careem: Tech Unicorns Made in Pakistan

Pakistani American Heads Silicon Valley's Top Incubator

Silicon Valley Pakistani-Americans

Digital BRI and 5G in Pakistan

Pakistan's Demographic Dividend

Pakistan EdTech and FinTech Startups

State Bank Targets Fully Digital Economy in Pakistan

Fintech Revolution in Pakistan

The Other 99% of the Pakistan Story

-

Comment by Riaz Haq on April 11, 2022 at 10:23am

-

It’s an era of mobile phone and telecom technologies. With its ever-increasing demand, the mobile phone has already become a basic need for almost every person. Especially, after the COVID-19 pandemic, when the lockdown was imposed and the most convenient way to connect with others or perform our daily tasks was through the mobile phones, the demand for this gadget and related applications reached its maximum level. During the pandemic, the overall data usage also increased which in return, helped the telecom companies to gather more revenue hence contributing to the positive growth of the IT and telecom sector.

https://www.phoneworld.com.pk/from-global-to-local-what-mobile-manu...

Pakistan itself has seen tremendous growth in the IT and telecom sectors over the past few years. No doubt, the inception of 3G/4G services in Pakistan has opened new avenues of growth and innovation in the country. With 191 million cellular subscribers, teledensity has reached 86.71% whereas, 3G/4G penetration stands at 49.94%. . According to the Pakistan Bureau of Statistics (PBS), Pakistan’s mobile imports witnessed an increase of 7.63 per cent in the first eight months from (July-February) the current fiscal year by reaching the value of $1311.493 million to $1,411.619 million.

So far, the establishment of local manufacturing plants has brought an investment of over $126 million to the country

To boost the telecom sector, the Government approved the local mobile phone manufacturing policy back in 2020. Pakistan Telecommunication Authority (PTA) in light of the policy issued Mobile Device Manufacturing (MDM) Regulations on January 28, 2021.

PTA has issued MDM authorization to 30 companies enabling them to manufacture mobile devices in Pakistan. The establishment of these manufacturing plants has brought an investment of over $126 million.

The Mobile Device Manufacturing Policy set a 49 per cent localization target by June 2023, including 10 per cent localization of parts of the motherboard and 10 per cent localization of batteries. As soon as the companies started manufacturing the mobile devices in the country, the mobile phone manufacturing industry saw significant growth in revenues and an affirmative decline in imports.

With a more than 200 million population and the ever-increasing sustainable demand for technology, Pakistan has become a very promising market for the IT and Telecom industry

According to the data revealed by PTA, Pakistan produced 24.66 million handsets in 2021. It is up from 13.05 million in the calendar year 2020, representing an 88 per cent increase. Moreover, the 4G assembled smartphones reached 10.06 million in 2021.

However, commercial imports reached 10.26 million in 2021. However, the local manufacturing plants have manufactured/assembled 1.53 million mobile phones including 0.86 million 2G and 0.67 million smartphones in January 2022.

The increase in local manufacturing has resulted in a decline in the imports of mobile phones. According to PBS, the imports of mobile phones decreased by 21.45 per cent in February 2022 as compared to the previous month of January.

As a result of the Mobile Phone Manufacturing Policy, which contains duty incentives for enhancing mobile phone assembling in Pakistan, the majority of phones cheaper than $200, are now assembled in Pakistan.

To achieve this milestone, various Chinese mobile phone manufacturers have played a key role. According to PTA, till November 2021, Itel topped the list by producing 3.91 million mobile devices followed by VGO Tel at 2.97 million, Infinix at 2.65 million Vivo at 2.45 million, Tecno at 1.87 million, QQMEE at 0.86 million, and Oppo 0.67 million. But these are not the only ones.

-

Comment by Riaz Haq on April 11, 2022 at 10:24am

-

Samsung has also officially started manufacturing smartphones in Pakistan. The company is hoping to manufacture around 3million devices per year in the country. Similarly, 2.5 to 3 million sets of Xiaomi would be produced per year in Pakistan in collaboration with Airlink Communication.

https://www.phoneworld.com.pk/from-global-to-local-what-mobile-manu...

The import of manufactured or Completely Built Units (CBU) is on the decline while that of mobile phone components (CKD) is on the rise. From July-November 2021, the import of CBU decreased by 73% to USD$ 179 million as compared to USD 661 million during the same period last year. This saved USD$ 410 million in foreign exchange. In contrast, the import of mobile phone components for local assembly increased by 407% to USD$ 674 million from USD 133 million last year.

The successful implementation of the Device Identification Registration and Blocking System (DIRBS) along with conducive government policies including the mobile manufacturing policy has created a favourable environment for mobile device manufacturing in Pakistan. It has also contributed positively to the mobile ecosystem of Pakistan by eliminating the counterfeit device market while providing a level playing field for commercial entities and has created trust amongst consumers due to the formulation of standardized legal channels for all sorts of device imports.

Local mobile phone manufacturing has not only helped the telecom sector by increasing its revenue growth. But it also helped the country in many different ways. For instance, the local manufacturing industry had created almost 50,000 jobs already. Samsung aims to use labour-power for the manufacturing of mobile phones instead of machines which in return will produce millions of jobs for unemployed people of the country. It is also estimated that by increasing localization, production, and exports around 200,000 to half-million jobs in the country would have been created.

According to PTA, only 53% of the population of the country is using smartphones. The remaining 47% population is still using 2G devices. This also indicates that Pakistan is still lagging behind in the 5G race. As per GSMA, this number is still low and by 2025, 74% of the population of Pakistan will be able to use smartphones. One of the main reasons for this is the high mobile prices. The lower class does not have the capacity to buy expensive or even midrange phones. The local mobile manufacturing will definitely lower the mobile prices and the availability of cheaper phones will increase which in return, will increase the smartphone penetration in the country. If the mobile manufacturing industry keeps on going at this pace, in the near future, internet penetration

will also increase. Hence, the whole digitalization process will speed up.

Although, the mobile phone manufacturing industry is playing a good job of aggregating revenue growth. But there are still many ways to boost this growth. According to PBS, during the first five months of the fiscal year 2021-22, Pakistan earned $1051.050 million by offering various information technology IT services exports to other countries. Whereas, in August 2021, Pakistan has exported 5,500 units of 4G smartphones carrying the “manufactured in Pakistan” tag to the United Arab Emirates (UAE). Although it was a big achievement for the country, the number of exported devices is still very low. If the companies managed to increase this number, the revenue growth will also increase.

The government has plans to export the locally assembled phones to the markets like Africa, Central Asian Republics, and Afghanistan. It is a good initiative because Pakistan is currently manufacturing low-end mobile phones and it will be appropriate to export the phones to those countries that are preferably using the low-end phones.

-

Comment by Riaz Haq on April 11, 2022 at 10:24am

-

Despite local manufacturing of mobile phones, the import bill is rising. The reason behind this is the import of high-end phones priced above $1000, a market segment that is not being manufactured in Pakistan currently. . The PBS data says that mobile phones worth $1.41 billion were imported during the first eight months (July-February) of the current fiscal year as compared to $1.31 billion during the same period of last year, registering a growth of 7.63 per cent. So, if the country starts producing high-end smartphones, the import bill will decline.

https://www.phoneworld.com.pk/from-global-to-local-what-mobile-manu...

The current government has proposed the Finance bill 2021-22 recently which indicates a great tax hike. In the new bill, the government has restored the 17 per cent sales tax on computer and IT equipment imports. Mobile phones worth more than $200 that are imported in CBU condition are also subject to a 17 per cent sales tax.

Although this increase in taxation is uncalled for it creates an opportunity for local manufacturers as high taxation discourages imports. Therefore, when the devices are manufactured locally, there will be no tax and the prices of the phones will automatically drop and people will prefer locally manufactured phones instead of imported ones.

The lack of a component ecosystem is also a hurdle in the way of boosting the manufacturing industry in the country. Many electronic and non-electronic components are required to make a smartphone. Each phone needs component parts and many of the manufacturers of these parts already have deals with other brands. It is currently difficult to manufacture the phone from scratch. The assemblers are importing mobiles in semi-knocked down (SKD) condition, which are then assembled in Pakistan.

It’s not only the local production of cellphones but also a host of opportunities that it brings. From employment to investment and from export opportunities to local capacity building, it carries immense potential. If the growth rate keeps on increasing at this pace, in no time, Pakistan will be considered one of the leading smartphone manufacturing hubs just like China and India. This will attract foreign investment, save foreign exchange on mobile phone imports, earn foreign exchange via exports and create job opportunities for local people.

-

Comment by Riaz Haq on May 12, 2022 at 7:51am

-

Pakistan has exported its first vehicle – made by Master Changan Motors – under the new Auto Industry Development and Export Policy (AIDEP 2021-26), according to a press release issued by the company on Thursday.

https://tribune.com.pk/story/2356278/pakistan-exports-its-first-suv...

The press release stated that under the new auto policy, all OEMs would require to initiate vehicle exports to help develop the local industry and expand the export capability of the country. The Changan Oshan X7, which is the country’s first export unit under the new policy, is the first vehicle to be launched through a global RHD premiere earlier in March 2022.

Pakistan is the only country outside of China to produce the latest model of Changan Oshan X7.

The press release quoted the company's CEO Danial Malik in a ceremony in Karachi, “We are delighted and proud to lead Pakistan into a new chapter for the auto industry and make its mark on a global level”.

“The Changan Oshan X7 is the first of many more vehicles to be exported under our vision to stay Future Forward, Forever and the Auto Industry Development and Export Policy (AIDEP 2021-26)”, he added.

The company further added that Pakistan is Changan’s first and only RHD manufacturing base and is helping the brand expand globally.

It added that the state-of-the-art plant was completed in a record time of just 13 months and now has the capacity to produce 50,000 vehicles annually.

“Master Changan is our first RHD production base and we are very happy to export our RHD Oshan X7 SUV from Pakistan”, Steven Zhao – Vice CEO Master Changan Motors Limited stated.

-

Comment by Riaz Haq on May 22, 2022 at 7:04am

-

#Pakistan Manufactured 9.72m #MobilePhones Locally in First 4 months of 2022. 53 % of mobile devices are #smartphones and 47 % are 2G. Pakistan imported mobile phones worth $1.810 billion in first 10 months of FY22 compared to $1.684 billion in FY21 https://www.phoneworld.com.pk/locally-manufactured-phones-2022/

In the month of April, the units manufactured/assembled 2.56 million mobile phones against 0.25 million imports. In 2021, Pakistan has manufactured/assembled 24.66 million mobile phones locally as compared to 13.05 million in 2020.

The country also witnesses a decline in the imports of mobile phones. In 2021, the country imported 10.26 million mobile phones compared to 24.51 million in 2020.

Among the 9.72 million mobile phones, 5.69 million are 2G and 4.03 million are smartphones. According to PTA data, 53 % of mobile devices are smartphones and 47 % are 2G on the Pakistan network.

Although the industry has seen significant growth in mobile phone production, still we are lagging behind in some terms. For instance, Pakistan imported mobile phones worth $1.810 billion during the first ten months (July-April) of 2021-22 compared to $1.684 billion during the same period of last year, registering a growth of 7.43 per cent.

According to the Pakistan Bureau of Statistics (PBS), the overall telecom import increased by 14.05 per cent from (July-April) 2021 to 22.

-

Comment by Riaz Haq on July 13, 2022 at 4:12pm

-

Can #Pakistan become the next #tech #manufacturing hub? #Samsung is now assembling all its top #smartphones, except for the foldable Z-Series, in Pakistan. Pak can save some of over $2 billion spent on #mobile #phone imports last year.#technology @TRTWorld https://www.trtworld.com/magazine/can-pakistan-become-the-next-tech...

A number of smartphone companies, including Samsung, have set up assembly plants in Pakistan in the past year. But this nascent industry is facing local challenges.

Along a dusty pot-holed road in Korangi industrial estate, one of Karachi’s designated factory zones, sewage runs in open drains, rag pickers collect plastic bottles, and car mechanics sweat at makeshift workshops.

It’s a June day with a temperature topping 35 degrees Celsius. Tempers flare up easily. Trucks loaded with textiles and chemicals zoom past, leaving a cloud of dust in their wake.

Incessant and prolonged electricity breakdowns mean many factory workers are sleep-deprived. Few can afford to lose daily wages in Pakistan, where the government struggles to bring in much-needed foreign investment to stabilise its fragile economy.

But amid this chaos, men and women donning blue and pink coats and special slippers walk through a passageway of one of the factories where a ventilation system blows dust specks off their clothes before they enter a long corridor flanked by different workstations. This is where Premier Code, a Pakistani company, manufactures smartphones.

“We need to be very careful about the environment in which we work. Karachi’s weather is different. There’s a lot of dust. So we make sure everything is clean. Our workers are not even allowed to bring water bottles where the phones are assembled,” says Nauman Amjad, the factory manager.

“We import parts from China and then assemble them here. But we have our own SOPs (Standard Operating Procedures), which employees follow to put the components together,” he tells TRT World.

Workers skillfully attach charging jacks and cameras to the motherboard as the phones — known as Dcode in the market — move along the assembly line. Plumes of cold air seep out of air humidifiers placed at various workstations.

Just a few years back, all mobile phones in Pakistan were imported. That changed two years ago when the then-government introduced a policy incentivising local assembly of the phones via tax rebates and other measures.

In 2021, local manufacturers produced 24.66 million handsets and imports drastically decreased, according to the Pakistan Telecommunication Authority (PTA), the industry regulator.

Samsung, the world’s largest smartphone maker, now assembles all its top brands, except for the foldable Z-Series, locally.

Local manufacturing and contract assembly mean Islamabad can slow the drain on its foreign exchange reserves. Pakistanis spent more than $2 billion on importing cell phones last year.

A high import bill and debt repayments have depleted official coffers and forced policymakers to try and negotiate a loan with the IMF.

With more than 114 million 3G and 4G subscribers, Pakistan has a large young population hooked on apps like TikTok and PUBG, which has increased the demand for smartphones.

Imposition of high tax on the import of mobile phone sets and tax rebates for local assembly has encouraged investment, according to industry professionals.

The PTA has issued licences to more than two dozen companies to assemble phones for the domestic market.

Contract manufacturing, wherein large brands such China’s Xiaomi outsource the assembly of phones to companies in countries like Vietnam, is not new.

Vietnam has emerged as one of the leading countries in the assembly and export of smartphones and other tech products in the past decade.

Apple recently moved part of its iPad manufacturing to Vietnam from China, where Covid lockdowns have disrupted supply chains.

-

Comment by Riaz Haq on July 13, 2022 at 4:13pm

-

In Pakistan, Samsung’s local outsourcing contractor is Lucky Motors, which assembles KIA cars and is part of a large business conglomerate.

“It’s only in the last five to seven years that the smartphone business has mushroomed in developing countries like ours,” says Quentin D’Silva, the head of Lucky's smartphone division, adding that smartphone usage has surged in the country following the introduction of 3G and 4G cellular services in 2014.

A matter of training

When D’Silva was helping set up the assembly unit in Bin Qasim, a special economic zone on the fringes of Karachi, he and his team had to follow Samsung's strict guidelines to uphold its manufacturing standards.

“My production manager, who worked for Reckitt Benckiser, visited a Samsung facility in Indonesia and he tells me they run it like a pharmaceutical company,” where extreme hygiene and cleanliness standards are maintained, he says.

A smartphone like Samsung’s S22 comprises thousands of intricate components such as chipsets designed and manufactured at sophisticated facilities in South Korea and a handful of other countries.

Putting the components together is the relatively easy part. Workers can be trained over a few weeks to follow the SOPs of Apple or Samsung correctly. Motor skills and speed are built gradually over time.

A bigger challenge in a country like Pakistan was changing the mindset of the nearly 700 people the company employs, says D’Silva.

“I’m not going to oversimplify the assembly part. But the training starts off with the concept of quality,” he asserts.

Customer satisfaction is a top priority for the South Korean tech giant and that means workers need to make sure the finished product is packed neatly without even a bubble of air or a speck of dust on its wrapping, he notes.

Samsung started production in Pakistan late last year and between January and May, 2022, it produced 1.2 million smartphones, including the S22 Ultra, the latest in the series.

Depending on the model, it takes workers between 13 and 18 seconds to put together a Samsung phone as it moves along an assembly line, according to D’Silva

"Our production drops if, for instance, our workers go for lunch and are 10 minutes late. That’s where the discipline comes in.”

Moving beyond

Mobile phone assembly in Pakistan picked up its pace two years ago when the government increased taxes on smartphone imports. Simultaneously, the local industry was encouraged to import spare parts and assemble them domestically for the local market.

More recently, mobile phone imports have been banned as Islamabad tries to halt the rupee depreciation — one of the consequences of imports outweighing the revenue from exports.

Contract manufacturing generates employment and cuts down imports. But some local companies want to create brands and design their own products in the long run.

Premier Code says it’s investing approximately two to four percent of its revenue on research and development to gear up for the future.

“It’s not possible to localise production of all the components. Only a handful of companies make LCDs (the screens). Chipset manufacturing is primarily done in Taiwan, South Korea, Japan, the US and to a lesser extent in China,” says Muhammad Naqi, Premier Code’s CEO.

His company focuses on the design side of things, such as the layout of the printed circuit boards (PCBs), investing in proprietary software and the exterior look of the phones.

At the company’s factory, Dcode mobiles are subject to strict testing. Random samples are picked from each finished batch to undergo a durability test, which includes dropping spherical metal balls onto the phone’s screen and then dropping the device on the marble floor.

Naqi says his company is not a contract manufacturer. “We want to develop our own brand and products at the same time” — even if the components are shipped from elsewhere.

-

Comment by Riaz Haq on July 13, 2022 at 4:13pm

-

Pakistani companies have been building PCBs — the green-coloured boards on which chips and resistors are mounted — for years for appliances such as televisions and air conditioners.

“But you need to understand that their layout is really big. When it comes to smartphones, it's a very small layout, which requires precision engineering. Our machines are not able to do that,” says Naqi.

High-tech machines used for making PCBs for mobile phones will mean higher capital costs and a thin factory workforce — undermining a vital goal of the government's policy, which is to create employment.

Nevertheless, a few tech companies are trying to challenge that view. One of them is located not far from Premier Code’s facility.

All about small steps

Elite Lighting manufactures parts for LED lights. Their products are nowhere close to the technologically advanced components that smartphone manufacturing requires.

But Yousuf Farooq, a young director at the company, has big dreams.

“Pakistan imports 100 million LED lights annually. It’s a huge market that we can capture,” he says.

Founded in November 2020, the company designs and fabricates PCBs for things like LED lights, watches and circuits that go into petrol pump dispensers.

“People were importing LED parts and putting them together here. We said, “Why don’t we build them here?”

At his 50-employee factory, workers place blue and black cylindrical components on the PCBs and solder them together. Known as ‘through-hole components’ such as resistors and capacitors, they are mostly imported from China.

But Farooq says his company can make them locally as the company grows and more orders come in.

“We started off by placing 9,000 components an hour on the PCBs. Now we can place 25,000 components. Almost all our workers were unskilled. We trained them over a period of 6 months.”

The Pakistani rupee’s depreciation, which has involved a 30 percent loss against the US dollar since July 2021, has made it feasible for local manufacturers to compete with importers.

LED light sellers pay their Chinese suppliers 60 to 90 days before the shipments arrive, says Farooq.

“Imagine if we can deliver the same product in 15 days and we deal in cash. So what has happened is that it improves the cash cycle of our customers.”

“Our customer can also just walk into my office and talk to me if something goes wrong. He doesn’t have to worry about learning Chinese,” he chuckles.

Rising wages in China have also made local manufacturers competitive. On average, Lucky and Premier pay between Rs30,00 and Rs35,000 (around $165) a month to their workers.

But the nascent industry is already facing a crisis. In recent weeks, banks have refused to extend credit which companies need to import components. That’s because of the fast-depleting foreign currency reserves that Islamabad is trying to preserve.

Lucky Motors, Samsung’s contract assembler, hasn’t been able to manufacture a single phone in almost a month.

“To say that Samsung people are upset is going to be an understatement,” says D’Silva, the CEO.

-

Comment by Riaz Haq on July 20, 2022 at 4:25pm

-

Pakistan’s Mobile Imports Decline by 4% to $1.9 Billion in FY22

https://propakistani.pk/2022/07/20/pakistans-mobile-imports-decline...

Pakistan imported mobile phones worth $1.978 billion during the fiscal year 2021–22 compared to $2.065 billion during the same period last year, registering a negative growth of 4.19 percent, according to the Pakistan Bureau of Statistics (PBS).

The overall telecom imports into the country during the period under review, i.e., fiscal year 2021–22, increased by 3.52 percent by going up from $2.593 billion in June–July 2020–21 to $2.684 billion during the same period last year.

On a month-on-month basis, imports of mobile phones into Pakistan decreased by 76.52 percent during June 2022 and stood at $32.221 million when compared to $137.213 million imported in May 2022, according to the PBS data.

Furthermore, on a year-on-year basis, mobile phones witnessed an 84.26 percent negative growth when compared to $204.677 million in June 2021.

On a month-on-month basis, the overall telecom imports into the country decreased by 52.80 percent during June 2022 and stood at $86.843 million, when compared to the imports of $183.985 million in May 2022.

Likewise, on a year-on-year basis, overall telecom imports witnessed 66.11 percent negative growth when compared to $256.255 million in June 2021. Other apparatus imports during July-June 2021-22 increased by 33.65 percent and stood at $705.945 million compared to $528.190 million in July-June 2020-21.

Other apparatus imports registered 16.78 percent growth on a month-on-month basis and stood at $54.622 million in June 2022 compared to $46.772 million in May 2022 and registered 5.90 percent growth when compared to $51.578 million in June 2022.

-

Comment by Riaz Haq on August 1, 2022 at 6:46pm

-

Pakistan Institute of Development Economics (PIDE)

@PIDEpk

Pakistan’s mobile phone manufacturing industry has shown its potential to increase domestic production of

handsets, after implementation of new Mobile Devise Manufacturing Policy (2020) & Devise Identification Registration & Blocking System

PIDE KB: https://pide.org.pk/research/from-imports-to-exports-an-achievement...

https://twitter.com/PIDEpk/status/1554012708273545216?s=20&t=LW...

------------

The mobile device manufacturing is one of the top five industries in the world that plays an important role in impelling economic growth. Pakistan has a huge market for mobile phones but majority of those handsets were being imported in Pakistan since 2020-21 (table 2). Almost 51% increase in imports of handsets was observed in FY 2020-21 (PBS). Side by side, Pakistan’s trade sector discovered some potential and tried its best to encourage Mobile phone industry to be able to become an exporter through certain quick reforms. To serve the purpose, Mobile Device Manufacturing Policy (2020) set three key targets: Localization, Production and Exports (See figure 4[1]). The right policy measures showed fruitful results and Pakistan became an exporter of handsets (see figure 1).

Initial data evidence shows an enormous accomplishment as the country was mainly an importer of mobile phones till 2021 and almost importing mobile phones of worth $2,065 billion in 2020-21(PBS). After realizing potential in market, the country decided to move towards exports of mobile phones and recently managed to export 5,500 units of 4G smart mobile sets to UAE (Haider, 2021)[2].

Government of Pakistan assessed potential in mobile phone manufacturing and decided to provide a policy framework that aims essentially to promote local manufacturing of PTA approved mobile devices in country. The “Mobile Device Manufacturing Policy 2020” addressed the central issues faced by mobile device manufacturers and to provide an attractive tariff environment over the policy period, besides other non-tariff[4] initiatives to promote “Make in Pakistan” strategy for mobile devices.

Import Data Facts:

Pakistan imported mobile phones worth $2.065 billion during 2020-21 compared to $1.369 billion during 2019-20, showing growth of 50.75 percent. The overall telecom imports into the country during the period under review (July-June) 2020-21 increased by 39.33 percent by going up from $1.861 billion in 2019-20 to $2.593 billion during 2020-21. The manufacturers produced 12.27 million mobile phones while importers brought in almost 8.29m units during 2021[5].

Pakistan has a benefit of low-cost labor availability, a fairly large home market having more than 178 million subscribers, which have increased approximately “1 percent” per month during last year alone, 83.3 percent tele-density and useful Device Identification, Registration and Blocking System (DIRBS)[6]. DIRBS has not directly resulted in export of mobile handsets but Pakistan provides an attractive arena/ market for in house mobile assembling. Initiating of DIRBS has become very advantageous in terms of encouraging legal imports and local manufacturing.

Mobile Device Manufacturing Policy (2020) Policy targets:

The Mobile Device Manufacturing Policy set a 49 percent localization target by June 2023, including 10 percent localization of parts of the motherboard and 10 percent localization of batteries. Currently Pakistan is concentrating on low-end mobile phone sets and soon expected to be able to start getting into high-end phones with world class companies .

After achieving a milestone in manufacturing, Pakistan is trying exports to regional countries and Africa. one or two containers have already moved out of the country. Pakistan is looking forward to target markets in Afghanistan, the Central Asian Republics and Africa, UAE (figure 4) and then more diversification into the higher end market. The target is to penetrate low-end of export market and move up the value chain.

Twitter Feed

Live Traffic Feed

Sponsored Links

South Asia Investor Review

Investor Information Blog

Haq's Musings

Riaz Haq's Current Affairs Blog

Please Bookmark This Page!

Blog Posts

Pakistanis' Insatiable Appetite For Smartphones

Samsung is seeing strong demand for its locally assembled Galaxy S24 smartphones and tablets in Pakistan, according to Bloomberg. The company said it is struggling to meet demand. Pakistan’s mobile phone industry produced 21 million handsets while its smartphone imports surged over 100% in the last fiscal year, according to …

ContinuePosted by Riaz Haq on April 26, 2024 at 7:09pm

Pakistani Student Enrollment in US Universities Hits All Time High

Pakistani student enrollment in America's institutions of higher learning rose 16% last year, outpacing the record 12% growth in the number of international students hosted by the country. This puts Pakistan among eight sources in the top 20 countries with the largest increases in US enrollment. India saw the biggest increase at 35%, followed by Ghana 32%, Bangladesh and…

ContinuePosted by Riaz Haq on April 1, 2024 at 5:00pm

© 2024 Created by Riaz Haq.

Powered by

![]()

You need to be a member of PakAlumni Worldwide: The Global Social Network to add comments!

Join PakAlumni Worldwide: The Global Social Network