PakAlumni Worldwide: The Global Social Network

The Global Social Network

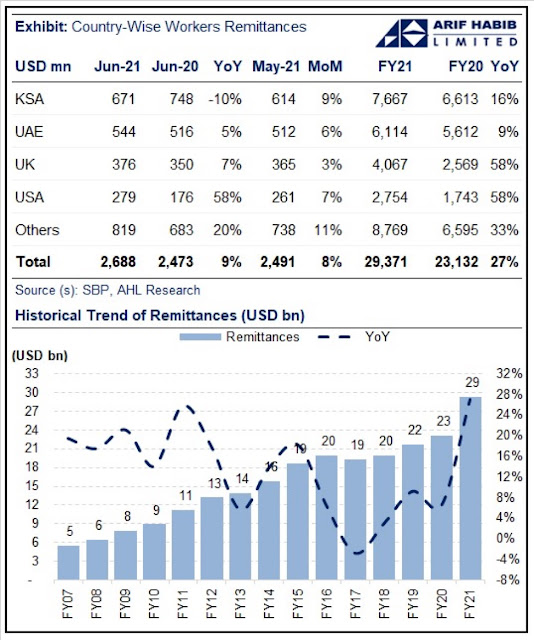

Pakistan's Demographic Dividend: Record Remittances From Overseas Workers

Pakistan has received nearly $30 billion in worker remittances in fiscal year 2020-21, according to the State Bank of Pakistan. This is a new record representing about 10% of the country's gross domestic product (GDP). This money helps the nation cope with its perennial current account deficits. It also provides a lifeline for millions of Pakistani families who use the money to pay for food, education, healthcare and housing. This results in an increase in stimulus spending that has a multiplier effect in terms of employment in service industries ranging from retail sales to restaurants and entertainment.

|

| Overseas Pakistani Workers' Remittances. Source: Arif Habib |

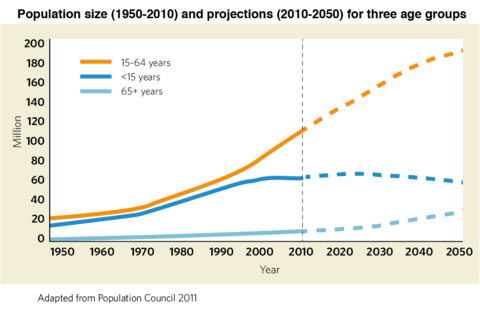

Pakistan's share of working age population (15-64 years) is growing as the country's birth rate declines, a phenomenon called demographic dividend. This dividend is manifesting itself in high levels of worker exports and record remittances pouring into the country. Saudi Arabia and the United Arab Emirates(UAE) are the top two sources of remittances but the biggest increase (58%) in remittances is seen this year from Pakistanis in the next two sources: the United Kingdom and the United States.

|

| Pakistani Workers Going Overseas. Source: Bureau of Emigration |

|

| Projected Population Decline in Emerging Economies. Source: Nikkei ... |

Haq's Musings

South Asia Investor Review

Pakistan is the 7th Largest Source of Migrants in OECD Nations

Pakistani-Americans: Young, Well-educated and Prosperous

Inspirational Story of Karachi Rickshaw Driver's Daughters

Pakistan Remittance Soar 21X

Pakistan's Growing Human Capital

Two Million Pakistanis Entering Job Market Every Year

Pakistan Most Urbanized in South Asia

Hindu Population Growth Rate in Pakistan

Do South Asian Slums Offer Hope?

-

Comment by Riaz Haq on April 14, 2025 at 5:37pm

-

Pakistan's remittances reach all-time high of $4.1b in March 2025 | The Express Tribune

https://tribune.com.pk/story/2539793/pakistans-remittances-reach-al...

Pakistan received a record $4.1 billion in remittances in March 2025, the highest monthly inflow on record, State Bank of Pakistan (SBP) Governor Jameel Ahmad said on Monday.

Addressing an event at the Pakistan Stock Exchange (PSX), Ahmad confirmed that the surge in inflows provided crucial support to the economy, foreign exchange reserves, and liquidity for importers.

This marks the first time that remittances have crossed the $4-billion threshold in a single month. The inflow represents a 37% increase year-on-year compared to $2.95 billion in March 2024. Month-on-month, remittances rose by nearly 30%, up from $3.12 billion in February 2025.

Between July 2024 and March 2025, Pakistan received $28 billion in workers’ remittances, reflecting a 33.2% increase from the $21.04 billion recorded in the same period of the previous fiscal year.

SBP governor projected that foreign exchange reserves would exceed $14 billion by June. He added that while foreign debt obligations for FY25 stand at $26 billion, the government expects $16 billion to be rolled over or refinanced, reducing net repayment pressure to around $10 billion.

The SBP governer further noted early signs of economic recovery, but said overall GDP growth for FY25 was now expected to be around 3%, down from earlier projections of over 4.2%, largely due to a weaker-than-expected agricultural season.

In January, Ahmad had said that Pakistan’s macroeconomic targets were on track, with debt levels and the balance of payments under control.

The central bank attributed the increase to enhanced formal banking channels, seasonal factors such as Ramadan-related giving, and exchange rate stability which encouraged legal transfers.

Remittances continue to play a critical role in supporting Pakistan’s external account, stabilising foreign reserves, and supplementing household incomes.

Remittances from other Gulf and European countries also contributed to the surge, though in smaller volumes.

The record inflow offers some short-term relief for Pakistan’s economy, which continues to face external financing pressures and inflationary challenges. Higher remittances are expected to support foreign exchange reserves, strengthen the rupee, and ease the trade and current account deficits.

The inflows are used by households to cover living expenses, healthcare, education, and housing, while also playing a critical role in mitigating external financing gaps.

The SBP also reported improved performance of digital and formal banking channels, noting that increased awareness campaigns and crackdowns on hawala/hundi networks have also redirected inflows through official routes.

-----------------------

Arif Habib Limited

@ArifHabibLtd

Remittances surged to an all-time high of USD 28.0 bn in 9MFY25, setting a new record for the nine-month period.

https://x.com/ArifHabibLtd/status/1911674210008641892

-

Comment by Riaz Haq on May 10, 2025 at 8:42am

-

Pakistan’s remittances hit record $31.2 billion in current fiscal year, led by Saudi inflows

In April alone, Pakistan received $3.2 billion, showing a 13.1 percent year-on-year increase. The inflows were mainly sourced from Saudi Arabia ($725.4 million), United Arab Emirates ($657.6 million), United Kingdom ($535.3 million) and the United States ($302.4 million).

https://www.arabnews.com/node/2600122/business-economy

KARACHI: Prime Minister Shehbaz Sharif on Friday lauded the contribution of overseas Pakistanis as workers’ remittances surged to a record $31.2 billion during the first ten months of the current fiscal year, with Saudi Arabia emerging as the top source of inflows.

According to data released by the State Bank of Pakistan (SBP), remittances rose by 30.9 percent during July-April FY25 compared to $23.9 billion received in the same period last year.

In April alone, Pakistan received $3.2 billion, showing a 13.1 percent year-on-year increase. The inflows were mainly sourced from Saudi Arabia ($725.4 million), United Arab Emirates ($657.6 million), United Kingdom ($535.3 million) and the United States ($302.4 million).

“Prime Minister Shehbaz Sharif expressed satisfaction over a 31 percent increase in remittances during the first 10 months of fiscal year 2025 compared to the previous year,” a statement issued by his office said.

“Remittances reaching a record level is a reflection of the confidence of overseas Pakistanis in government policies,” it quoted him as saying.

Remittances form a vital pillar of Pakistan’s external sector, helping stabilize the current account, fueling domestic consumption and easing the country’s reliance on external borrowing.

Earlier this year, in March, the SBP recorded an all-time monthly high of $4.1 billion in remittance inflows, driven by seasonal factors and improved formal channel usage.

Pakistan has focused on boosting exports and remittances in recent years as part of broader efforts to strengthen its external sector and address economic vulnerabilities.

The central bank has also revised its FY25 remittance projection upward from $36 billion to $38 billion, citing current trends.

-

Comment by Riaz Haq on July 9, 2025 at 7:37am

-

Arif Habib Limited

@ArifHabibLtd

Remittances increased by 27% YoY to USD 38.2bn during FY25 (the highest ever)Remittances by overseas Pakistani increased by 8% YoY to USD 3.4bn during Jun'25 compared to USD 3.2bn during Jun’24. On MoM basis, remittances decreased by 8%.

In FY25, remittances increased by 27%YoY to USD 38.3bn, highest ever level.

https://x.com/ArifHabibLtd/status/1942854485262430587

----------

Mohammed Sohail

@sohailkarachi

Record Remittances When Most NeededIn a year marked by economic challenges, overseas workers stepped up:

🇵🇰 *Pakistan* received a record USD 38.3 billion in remittances in FY25 — up 27%

🇧🇩 Bangladesh also saw record inflows of USD 30 billion — up 26%A big source of support for both economies, helping bridge external gaps and boosting household incomes.

https://x.com/sohailkarachi/status/1942852719619781015

------------

https://english.news.cn/20250709/50a96ca778634b2b8a3dc7e3c89b6e46/c...

Remittances sent by overseas Pakistani workers rose by 26.6 percent to a record 38.3 billion U.S. dollars in fiscal year 2024-25 (FY25), up from 30.3 billion dollars in FY24, the State Bank of Pakistan said Wednesday.

The sharp rise was driven by higher inflows from key host countries including Saudi Arabia, the United Arab Emirates (UAE), the United Kingdom, and the United States, according to official data.

In June 2025 alone, remittances stood at 3.41 billion dollars, following 3.69 billion in May and 3.18 billion in April.

Saudi Arabia led with 823.2 million dollars in June, followed by the UAE with 717.2 million dollars, the UK with 537.7 million dollars, and the U.S. with 281.2 million dollars.

Significant contributions also came from Gulf Cooperation Council countries such as Qatar and Oman, and European countries including Italy, Spain, and Germany. Italy alone accounted for 129.3 million dollars in June.

Economists say strong remittance inflows will help ease pressure on the external account and bolster Pakistan's foreign exchange reserves.

Remittances remain a key source of external financing for the country. ■

Comment

- ‹ Previous

- 1

- 2

- 3

- 4

- Next ›

Twitter Feed

Live Traffic Feed

Sponsored Links

South Asia Investor Review

Investor Information Blog

Haq's Musings

Riaz Haq's Current Affairs Blog

Please Bookmark This Page!

Blog Posts

PIA Privatization: Can it Bring Back Pakistan National Airline's Glory Days?

After decades of failed attempts, the Government of Pakistan has finally privatized the Pakistan International Airline (PIA) under intense pressure from the International Monetary Fund (IMF). Nonetheless, it is a deal that will give the national airline not only a chance to survive but to thrive in the long run. As part of structuring the sale for Rs. 135 billion, the government has assumed Rs. 654…

ContinuePosted by Riaz Haq on December 25, 2025 at 10:30am

Pakistan Pharma Begins Domestic Production of GLP-1 Weight Loss Drugs

Several Pakistani pharmaceutical companies have started domestic production of generic versions of GLP-1 (Glucagon-Like Peptide-1) drugs Ozempic/Wegovy (Semaglutide) and Mounjaro/Zeptide (Tirzepatide). Priced significantly lower than the branded imports, these domestically manufactured generic drugs will increase Pakistanis' access and affordability to address the obesity crisis in the country, resulting in lower disease burdens and improved life quality and longer life expectancy. Obesity…

ContinuePosted by Riaz Haq on December 19, 2025 at 10:00am — 1 Comment

© 2025 Created by Riaz Haq.

Powered by

![]()

You need to be a member of PakAlumni Worldwide: The Global Social Network to add comments!

Join PakAlumni Worldwide: The Global Social Network