PakAlumni Worldwide: The Global Social Network

The Global Social Network

India in Crisis: Unemployment and Hunger Persist After Waves of COVID

India lost 6.8 million salaried jobs and 3.5 million entrepreneurs in November alone. Many among the unemployed can no longer afford to buy food, causing a significant spike in hunger. The country's economy is finding it hard to recover from COVID waves and lockdowns, according to data from multiple sources. At the same time, the Indian government has reported an 8.4% jump in economic growth in the July-to-September period compared with a contraction of 7.4% for the same period a year earlier. This raises the following questions: Has India had jobless growth? Or its GDP figures are fudged? If the Indian economy fails to deliver for the common man, will Prime Minister Narendra Modi step up his anti-Pakistan and anti-Muslim rhetoric to maintain his popularity among Hindus?

|

| Labor Participation Rate in India. Source: CMIE |

Unemployment Crisis:

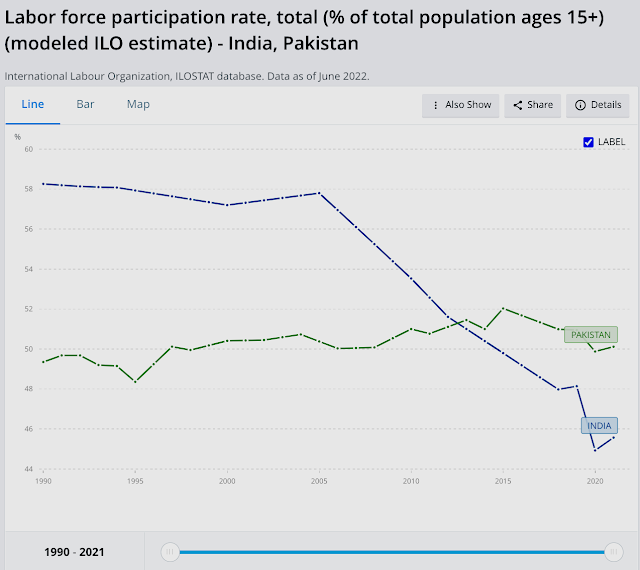

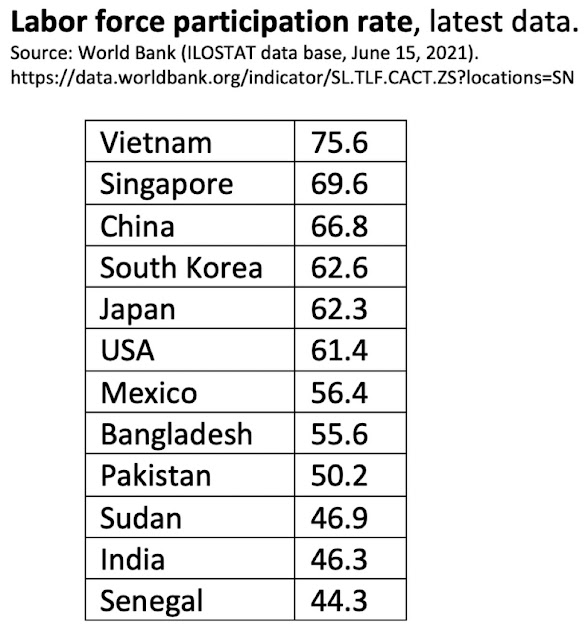

India lost 6.8 million salaried jobs and its labor participation rate (LPR) slipped from 40.41% to 40.15% in November, 2021, according to the Center for Monitoring Indian Economy (CMIE). In addition to the loss of salaried jobs, the number of entrepreneurs in India declined by 3.5 million. India's labor participation rate of 40.15% is lower than Pakistan's 48%. Here's an except of the latest CMIE report:

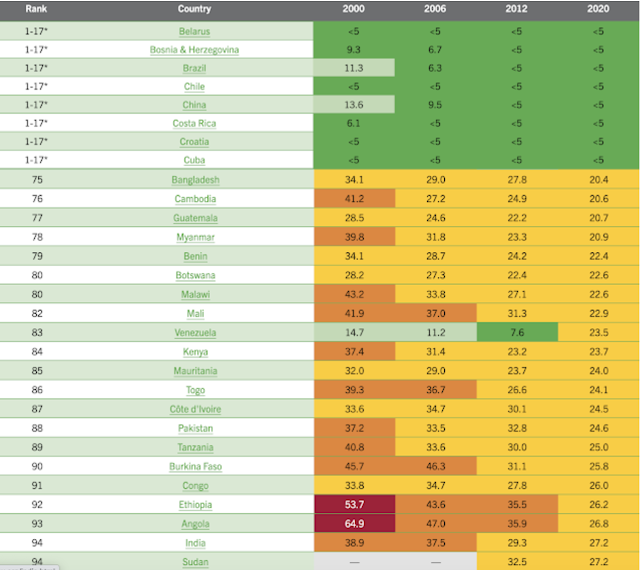

"India’s LPR is much lower than global levels. According to the World Bank, the modelled ILO estimate for the world in 2020 was 58.6 per cent (https://data.worldbank.org/indicator/SL.TLF.CACT.ZS). The same model places India’s LPR at 46 per cent. India is a large country and its low LPR drags down the world LPR as well. Implicitly, most other countries have a much higher LPR than the world average. According to the World Bank’s modelled ILO estimates, there are only 17 countries worse than India on LPR. Most of these are middle-eastern countries. These are countries such as Jordan, Yemen, Algeria, Iraq, Iran, Egypt, Syria, Senegal and Lebanon. Some of these countries are oil-rich and others are unfortunately mired in civil strife. India neither has the privileges of oil-rich countries nor the civil disturbances that could keep the LPR low. Yet, it suffers an LPR that is as low as seen in these countries".

|

| Labor Participation Rates in India and Pakistan. Source: World Bank... |

|

| Labor Participation Rates for Selected Nations. Source: World Bank/ILO |

Youth unemployment for ages15-24 in India is 24.9%, the highest in South Asia region. It is 14.8% in Bangladesh 14.8% and 9.2% in Pakistan, according to the International Labor Organization and the World Bank.

|

| Youth Unemployment in Bangladesh, India and Pakistan. Source: ILO, WB |

In spite of the headline GDP growth figures highlighted by the Indian and world media, the fact is that it has been jobless growth. The labor participation rate (LPR) in India has been falling for more than a decade. The LPR in India has been below Pakistan's for several years, according to the International Labor Organization (ILO).

|

| Indian GDP Sectoral Contribution Trend. Source: Ashoka Mody |

|

| Indian Employment Trends By Sector. Source: CMIE Via Business Standard |

|

| World Hunger Rankings 2020. Source: World Hunger Index Report |

Hunger and malnutrition are worsening in parts of sub-Saharan Africa and South Asia because of the coronavirus pandemic, especially in low-income communities or those already stricken by continued conflict.

India has performed particularly poorly because of one of the world's strictest lockdowns imposed by Prime Minister Modi to contain the spread of the virus.

Hanke Annual Misery Index:

Pakistan's Real GDP:

Vehicles and home appliance ownership data analyzed by Dr. Jawaid Abdul Ghani of Karachi School of Business Leadership suggests that the officially reported GDP significantly understates Pakistan's actual GDP. Indeed, many economists believe that Pakistan’s economy is at least double the size that is officially reported in the government's Economic Surveys. The GDP has not been rebased in more than a decade. It was last rebased in 2005-6 while India’s was rebased in 2011 and Bangladesh’s in 2013. Just rebasing the Pakistani economy will result in at least 50% increase in official GDP. A research paper by economists Ali Kemal and Ahmad Waqar Qasim of PIDE (Pakistan Institute of Development Economics) estimated in 2012 that the Pakistani economy’s size then was around $400 billion. All they did was look at the consumption data to reach their conclusion. They used the data reported in regular PSLM (Pakistan Social and Living Standard Measurements) surveys on actual living standards. They found that a huge chunk of the country's economy is undocumented.

Pakistan's service sector which contributes more than 50% of the country's GDP is mostly cash-based and least documented. There is a lot of currency in circulation. According to the State Bank of Pakistan (SBP), the currency in circulation has increased to Rs. 7.4 trillion by the end of the financial year 2020-21, up from Rs 6.7 trillion in the last financial year, a double-digit growth of 10.4% year-on-year. Currency in circulation (CIC), as percent of M2 money supply and currency-to-deposit ratio, has been increasing over the last few years. The CIC/M2 ratio is now close to 30%. The average CIC/M2 ratio in FY18-21 was measured at 28%, up from 22% in FY10-15. This 1.2 trillion rupee increase could have generated undocumented GDP of Rs 3.1 trillion at the historic velocity of 2.6, according to a report in The Business Recorder. In comparison to Bangladesh (CIC/M2 at 13%), Pakistan’s cash economy is double the size. Even a casual observer can see that the living standards in Pakistan are higher than those in Bangladesh and India.

Related Links:

Haq's Musings

South Asia Investor Review

Pakistan Among World's Largest Food Producers

Food in Pakistan 2nd Cheapest in the World

Indian Economy Grew Just 0.2% Annually in Last Two Years

Pakistan to Become World's 6th Largest Cement Producer by 2030

Pakistan's 2012 GDP Estimated at $401 Billion

Pakistan's Computer Services Exports Jump 26% Amid COVID19 Lockdown

Coronavirus, Lives and Livelihoods in Pakistan

Vast Majority of Pakistanis Support Imran Khan's Handling of Covid1...

Pakistani-American Woman Featured in Netflix Documentary "Pandemic"

Incomes of Poorest Pakistanis Growing Faster Than Their Richest Cou...

Can Pakistan Effectively Respond to Coronavirus Outbreak?

How Grim is Pakistan's Social Sector Progress?

Pakistan Fares Marginally Better Than India On Disease Burdens

Trump Picks Muslim-American to Lead Vaccine Effort

COVID Lockdown Decimates India's Middle Class

Pakistan Child Health Indicators

Pakistan's Balance of Payments Crisis

How Has India Built Large Forex Reserves Despite Perennial Trade De...

Conspiracy Theories About Pakistan Elections"

PTI Triumphs Over Corrupt Dynastic Political Parties

Strikingly Similar Narratives of Donald Trump and Nawaz Sharif

Nawaz Sharif's Report Card

Riaz Haq's Youtube Channel

-

Comment by Riaz Haq on June 12, 2022 at 1:45pm

-

Pakistan's female labor participation rate of 21.4% (LFS 20290-21) is higher than India's 16.1% (Reuters report)

----------------

Pakistan Labor Force Survey 2020-21

Refined Activity (Participation) Rate (%)

Pakistan Total 44.9 Male 67.9 Female 21.4

Rural 48.6 Male 69.1 Female 28.0

Urban Male 65.9 Female 10.0

-----------

India's female labour participation rate falls to 16.1% as pandemic hits jobs

According to World Bank estimates, India has one of the lowest female labour force participation rates in the world. Less than a third of women – defined in the report as 15 or older – are working or actively looking for a job.

The female labour participation rate in India had fallen to 20.3% in 2019 from more than 26% in 2005, according to World Bank estimates, compared with 30.5% in neighbouring Bangladesh and 33.7% in Sri Lanka.

https://www.reuters.com/world/india/indias-female-labour-participat....

-

Comment by Riaz Haq on June 13, 2022 at 10:27am

-

India’s Economy Is Growing Quickly. Why Can’t It Produce Enough Jobs?

The disconnect is a result of India’s uneven growth, powered and enjoyed by the country’s upper strata.

By Emily Schmall and Sameer Yasir

https://www.nytimes.com/2022/06/13/business/economy/india-economy-j...

Among the job seekers despairing over the lack of opportunities is Sweety Sinha, who lives in Haryana, a northern state where unemployment was a staggering 34.5 percent in April.

As a child, Ms. Sinha liked to pretend to be a teacher, standing in front of her village classroom with fake eyeglasses and a wooden baton, to fellow students’ great amusement.

Her ambition came true years later when she got a job teaching math at a private school. But the coronavirus upended her dreams, as the Indian economy contracted 7.3 percent in the 2020-21 fiscal year. Within months of starting, she and several other teachers were laid off because so many students had dropped out.

Ms. Sinha, 30, is again in the market for a job. In November, she joined thousands of applicants vying for much-coveted work in the government. She has also traveled across Haryana seeking jobs, but turned them down because of the meager pay — less than $400 a month.

“Sometimes, during nights, I really get scared: What if I am not able to get anything?” she said. “All of my friends are suffering because of unemployment.”

---------

The struggles of working-class Indians, and the millions of unemployed, may eventually cause a drag on growth, economists say.

--------

NEW DELHI — On paper, India’s economy has had a banner year. Exports are at record highs. Profits of publicly traded companies have doubled. A vibrant middle class, built over the past few decades, is now shelling out so much on movie tickets, cars, real estate and vacations that economists call it post-pandemic “revenge spending.”

Yet even as India is projected to have the fastest growth of any major economy this year, the rosy headline figures do not reflect reality for hundreds of millions of Indians. The growth is still not translating into enough jobs for the waves of educated young people who enter the labor force each year. A far larger number of Indians eke out a living in the informal sector, and they have been battered in recent months by high inflation, especially in food prices.

The disconnect is a result of India’s uneven growth, which is powered by the voracious consumption of the country’s upper strata but whose benefits often do not extend beyond the urban middle class. The pandemic has magnified the divide, throwing tens of millions of Indians into extreme poverty while the number of Indian billionaires has surged, according to Oxfam.

The concentration of wealth is in part a product of the growth-at-all-costs ambitions of Prime Minister Narendra Modi, who promised when he was re-elected in 2019 to double the size of India’s economy by 2024, lifting the country into the $5 trillion-or-more club alongside the United States, China and Japan.

The government reported late last month that the economy had expanded 8.7 percent in the last year, to $3.3 trillion. But with domestic investment lackluster, and government hiring slowing, India has turned to subsidized fuel, food and housing for the poorest to address the widespread joblessness. Free grains now reach two-thirds of the country’s more than 1.3 billion people.

Those handouts, by some calculations, have pushed inequality in India to its lowest level in decades. Still, critics of the Indian government say that subsidies cannot be used forever to paper over inadequate job creation. This is especially true as tens of millions of Indians — new college graduates, farmers looking to leave the fields and women taking on work — are expected to seek to flood the nonfarm work force in the coming years.

“There is a historical disconnect in the Indian growth story, where growth essentially happens without a corresponding increase in employment,” said Mahesh Vyas, the chief executive of the Center for Monitoring Indian Economy, a data research firm.

-

Comment by Riaz Haq on June 13, 2022 at 10:27am

-

India’s Economy Is Growing Quickly. Why Can’t It Produce Enough Jobs?

The disconnect is a result of India’s uneven growth, powered and enjoyed by the country’s upper strata.

By Emily Schmall and Sameer Yasir

https://www.nytimes.com/2022/06/13/business/economy/india-economy-j...

But for Indian politicians, a high unemployment rate “is not a showstopper,” said Mr. Vyas, the economist, adding that they were far more concerned with inflation, which affects all voters.

India’s reserve bank and finance ministry have tried to tackle inflation, which is battering many countries because of pandemic-related supply chain problems and the war in Ukraine, by restricting exports of wheat and sugar, raising interest rates and cutting taxes on fuel.

The bank, after raising borrowing rates in May for the first time in two years, increased them again on Wednesday, to 4.9 percent. As it did so, it forecast that inflation would reach 6.7 percent over the next three quarters.

Reserve bank officials have also employed an array of fiscal and monetary tactics to continue supporting growth, which cooled in the first quarter of 2022, falling to 4.1 percent. Household consumption, a major driver of India’s economy, has dropped in the last few months.

“We are committed to containing inflation,” said the bank’s governor, Shaktikanta Das. “At the same time, we have to keep in mind the requirements of growth. It can’t be a situation where the operation is successful and the patient is dead.”

While the Bank of England and the Federal Reserve in the United States have said their countries need to accept lower growth rates because of high commodity prices, India’s reserve bank is not in that camp, said Priyanka Kishore, an analyst at Oxford Economics. “Growth matters a lot for India,” she said. “There’s a political agenda.”

The ban on food exports is a sharp turnabout for Mr. Modi. In response to Russia’s blockade on Ukrainian ports, which has led to a global shortage of grains, he had said in April that Indian farmers could help feed the world. Instead, with the global wheat shortfalls driving up prices, the Indian government imposed an export ban to keep domestic prices low.

Temporary interventions like these are easier than addressing the fundamental problem of large-scale unemployment.

“You have wheat in your godowns and you can ship it out to households and get instant gratification,” Mr. Vyas said, referring to storage facilities, “whereas trying certain policies for employment is far more protracted and intangible.”

Those policies, analysts say, could include greater efforts to build up India’s underdeveloped manufacturing sector. They also say that India should ease regulations that often make it difficult to do business, as well as reducing tariffs so manufacturers have an easier time securing components not made in India.

Exports have been a source of strength for the Indian economy, and the rupee has depreciated by about 4 percent against the U.S. dollar since the beginning of the year, which would normally boost exports.

But inflation in the United States and war in Europe have started to affect sales for Indian-made clothes, said Raja M. Shanmugam, the president of a trade association in Tiruppur, a textile hub in the state of Tamil Nadu.

“All the input cost is increasing. Even earlier this industry worked on wafer-thin margins, but now we are working on loss,” he said. “So a situation which is normally a happy situation for the exporters is not so anymore.”

The struggles of working-class Indians, and the millions of unemployed, may eventually cause a drag on growth, economists say.

Zia Ullah, who drives an auto-rickshaw in Tumakuru, an industrial city in the southern Indian state of Karnataka, said his income was still only about a quarter of what it was before the pandemic.

The $20 he used to earn daily was enough to cover household expenses for his family of five, and school fees for his three children.

“Customers are preferring to walk,” he said. “No one seems to have money these days to take an auto.”

-

Comment by Riaz Haq on June 13, 2022 at 10:40am

-

Female labor force participation rate in India has recently fallen to just 19%, the second lowest after Afghanistan's 15% in the South Asia region. By contrast, Pakistan's women's labor force participation rate is 21%, Sri Lanka's 31% and Bangladesh's 35%. Prime Minister Narendra Modi's mishandling of the COVID19 pandemic has hit Indian women particularly hard, with 90% of those who lost their jobs now shut out of the workforce.

https://www.riazhaq.com/2022/06/indian-womens-labor-force-participa...

-

Comment by Riaz Haq on June 17, 2022 at 7:18am

-

India asked Washington not to bring up China’s border transgressions: Former US ambassador

Kenneth Juster made the statement on a Times Now show when asked why the United States had not made any statement about Beijing’s aggression.

https://scroll.in/latest/1018580/india-asked-washington-not-to-ment...

India and China have been locked in a border standoff since troops of both countries clashed in eastern Ladakh along the Line of Actual Control in June 2020. Twenty Indian soldiers were killed in the hand-to-hand combat. While China had acknowledged casualties early, it did not disclose details till February 2021, when it said four of its soldiers had died.

After several rounds of talks, India and China had last year disengaged from Pangong Tso Lake in February and from Gogra, eastern Ladakh, in August.

Juster, who was the envoy to India between 2017 and 2021, had said in January 2021 that Washington closely coordinated with Delhi amid its standoff with Beijing, but left it to India to provide details of the cooperation.

----------

Former United States Ambassador to India Kenneth Juster has said that Delhi did not want Washington to mention China’s border aggression in its statements.

“The restraint in mentioning China in any US-India communication or any Quad communication comes from India which is very concerned about not poking China in the eye,” Juster said on a Times Now show.

The statement came in response to news anchor and Times Now Editor-in-Chief Rahul Shivshankar’s queries on whether the US had made any statements about Beijing’s aggression.

------------

During the TV show, defence analyst Derek Grossman claimed that Moscow was not a “friend” of India, saying that Russian President Vladimir Putin met his Chinese counterpart Xi Jinping at the Beijing Olympics. Grossman told the news anchor that Putin and Xi had then said that their friendship had “no limits”.

He claimed that India’s strategy to leverage Russia against China did not have any effects. “In fact, Russia-China relations have gotten only stronger.”

To this, Shivshankar said that before passing any judgement on India and Russia’s relationship, he must ask if US President Joe Biden had condemned China’s aggression at the borders along the Line of Actual Control or mentioned Beijing in a joint statement with Prime Minister Narendra Modi.

Grossman said: “To my understanding, the US has asked India if it wanted us to do something on the LAC but India said no – that it was something that India can handle on its own.”

Juster then backed Grossman’s contention.

-

Comment by Riaz Haq on June 19, 2022 at 10:21am

-

Why Multinational companies are quitting #India? 8 years after #Modi first urged foreign companies to “Make in India”, #Indian #economy is seeing thousands of foreign firms leaving. #MakeinIndia #Islamophobia #Hindutva #BJP #bigotry #violence #hate

https://www.deccanherald.com/business/business-news/why-mncs-are-qu...

Eight years after Prime Minister Narendra Modi first urged multinational companies to “Make in India”, Asia’s third-largest economy is seeing many foreign firms give up on the country

A slew of big names including German retailer Metro AG, Swiss building-materials firm Holcim, US automaker Ford, UK banking major Royal Bank of Scotland, US bikemaker Harley-Davidson and US banking behemoth Citibank have chosen to

pull the plug on their operations in India or downsize their presence here in recent years. That is a worrying trend at a time when India is trying to position itself as an alternative to China, in a post-Covid world where many MNCs are looking to diversify their supply chain.

A total of 2,783 foreign companies with registered offices or subsidiaries in India closed their operations in the country between 2014 and November 2021, Commerce and Industry Minister Piyush Goyal told Parliament late last year. That is not a small figure, given that there are only 12,458 active foreign subsidiaries operating in India.

------

This might also explain why some of the world’s biggest chipmakers have not warmed up to India despite its government rolling out a red carpet for them by approving a $10 billion incentive plan last year to establish chip and display industries in the

in the country.

----------

When asked if he would consider setting up a factory in India, Tesla CEO Elon Musk tweeted last month that the automaker would not set up a manufacturing plant “in any location where we are not allowed first to sell & service cars”.

Musk will instead look for potential opportunities in Indonesia, known for its business-friendly policy and production of nickel, a critical ingredient in making EV batteries.

-

Comment by Riaz Haq on June 22, 2022 at 6:32am

-

#India's emerging twin #deficit problem: Rising fiscal deficit & growing trade deficit. If unchecked, both deficits could cause a serious #economic crisis, including Balance of Payments crisis. #poverty #unemployment #hunger #Modi #BJP https://indianexpress.com/article/explained/everyday-explainers/ind... via @IndianExpress

In its latest ‘Monthly Economic Review’, the Ministry of Finance has painted an overall optimistic picture of the state of the domestic economy. “The World is looking at a distinct possibility of widespread stagflation. India, however, is at low risk of stagflation, owing to its prudent stabilization policies,” it states.

The economic growth outlook is likely to be affected by several factors owing to the trade disruptions, export bans and the resulting surge in global commodity prices —all of which will continue to stoke inflation — as long as the Russia-Ukraine conflict persists and global supply chains remain unrepaired. “However, the momentum of economic activities sustained in the first two months of the current financial year augurs well for India continuing to be the quickest growing economy among major countries in 2022-23,” states the Finance Ministry report.

But, given the uncertainties, the report highlights two key areas of concern for the Indian economy: the fiscal deficit and the current account deficit (or CAD).

The report states that “as government revenues take a hit following cuts in excise duties on diesel and petrol, an upside risk to the budgeted level of gross fiscal deficit has emerged”.

The fiscal deficit is essentially the amount of money that the government has to borrow in any year to fill the gap between its expenditures and revenues. Higher levels of fiscal deficit typically imply the government eats into the pool of investible funds in the market which could have been used by the private sector for its own investment needs. At a time when the government is trying its best to kick-start and sustain a private sector investment cycle, borrowing more than what it budgeted will be counter-productive.

The report underscores the need to trim revenue expenditure (or the money government spends just to meet its daily needs). “Rationalizing non-capex expenditure has thus become critical, not only for protecting growth supportive capex but also for avoiding fiscal slippages,” it states. “Capex” or capital expenditure essentially refers to money spent towards creating productive assets such as roads, buildings, ports etc. Capex has a much bigger multiplier effect on the overall GDP growth than revenue expenditure.

Current account deficit

The current account essentially refers to two specific sub-parts:

* Import and Export of goods — this is the “trade account”.

* Import and export of services — this is called the “invisibles account”.

If a country imports more goods (everything from cars to phones to machinery to food grains etc) than it exports, it is said to have a trade account deficit. A deficit implies that more money is going out of the country than coming in via the trade of physical goods. Similarly, the same country could be earning a surplus on the invisibles account — that is, it could be exporting more services than importing.

If, however, the net effect of a trade account and the invisibles account is a deficit, then it is called a current account deficit or CAD. A widening CAD tends to weaken the domestic currency because a CAD implies more dollars (or foreign currencies) are being demanded than rupees.

The Ministry’s worry is that costlier imports such as crude oil and other commodities will not only widen the CAD but also put downward pressure on the rupee. A weaker rupee will, in turn, make future imports costlier. There is one more reason why the rupee may weaken. If, in response to higher interest rates in the western economies especially the US, foreign portfolio investors (FPI) continue to pull out money from the Indian markets, that too will hurt the rupee and further increase CAD.

-

Comment by Riaz Haq on June 23, 2022 at 9:01pm

-

#Indian Stock market in bear territory. Its value is already down nearly 20% from its January peak of about $3.7 trillion. Foreign investors have been selling Indian stocks at a record pace, withdrawing about $32 billion since September 2021. #Modi #BJP https://www.business-standard.com/article/markets/three-charts-show...

As surging inflation and the end of global easy-money policies send Indian stocks spiraling down from all-time highs, three charts show the pain is unlikely to end anytime soon.

The S&P BSE Sensex Index has fallen more than 15% from its October high, nearing the 20% loss that denotes a bear market. The selloff comes as climbing costs and a record plunge in the rupee have forced the nation’s central bank to join global peers in raising interest rates.

The Indian stock market’s value is already down nearly 20% from its January peak of about $3.7 trillion dollars. The unsupportive economic backdrop combined with an unprecedented exodus of foreign investors and earnings estimates that appear poised to tumble cloud the outlook for a rebound.

“We expect the markets to further correct from here,” said Benaifer Malandkar, chief investment officer at Raay Global Investments Pvt. “Expectation is that by the second quarter, most negative news, the outcome of the Fed’s actions will get priced in.”

Foreigner Flight

Overseas investors have been selling Indian stocks at a record pace, withdrawing about $32 billion from the market since September. The retreat of foreigners is part of a wave hitting nations including South Korea and Taiwan as well.

“India is not in isolation since it’s part of the emerging market basket, and clearly the EMs are out of favor,” said Raay Global’s Malandkar. “Until the US Fed rate is at its peak, we will see redemptions happening across EMs.”

Rosy Estimates

The drop in Indian equities has mainly been caused by valuation contraction so far. Earnings estimates for the NSE Nifty 50 Index are yet to clock a meaningful decline like that seen in MSCI Inc.’s broadest measure for Asian equities.

Over the past few weeks, strategists at Sanford C. Bernstein Ltd., Bank of America Corp. and JPMorgan Chase & Co. have expressed concerns about the earnings optimism that has surrounded India. Pending any rebound in valuations, estimate cuts are likely to pull stocks down further.

Suffering Small-Caps

Smaller stocks have been hit harder by investor risk aversion, with gauges of small and mid-cap Indian shares having already entered bear markets. Market breadth has weakened, with just 16% of S&P BSE 500 Index stocks trading above their 200-day average level, the lowest level in two years.

-

Comment by Riaz Haq on June 24, 2022 at 7:43am

-

Explained: What FPIs’ market exit means

Foreign portfolio investors have pulled out Rs 42,000 crore this month amid rising inflation and monetary policy tightening in the US. How does this impact the market and the rupee, and what should you do?

https://indianexpress.com/article/explained/fpi-exit-stock-market-g...

Sustained capital outflows from the capital market have unnerved the stock markets and led to a weakening of the rupee amid rising inflation across the globe. With the US Federal Reserve set to hike rates further, outflows are likely to continue, putting pressure on the Indian currency.

---------------

Aggressive rate hike by the US Federal Reserve, coupled with elevated inflation and high valuation of equities continued to keep foreign investors at bay from the Indian stock market as they pulled out Rs 31,430 crore in this month so far. With this, net outflow by Foreign Portfolio Investors (FPIs) from equities reached Rs 1.98 lakh crore so far in 2022, data with depositories showed. Going forward, FPI flows to remain volatile in the emerging markets on account of rising geopolitical risk, rising inflation, tightening of monetary policy by central banks, among others, Shrikant Chouhan, Head - Equity Research (Retail), Kotak Securities, said. According to the data, foreign investors withdrew a net amount of Rs 31,430 crore from equities in the month of June (till 17th).

http://www.millenniumpost.in/business/fpis-withdraw-rs-31430-crore-...

The massive selling by FPIs continued in June too as they have been incessantly withdrawing money from Indian equities since October 2021. Shrikant attributed latest selling to rising inflation, tight monetary policy by global central banks and elevated crude oil prices. Global investors are reacting to increased risks of a global recession as the US Federal Reserve was forced to raise interest rates by 75 basis points due to persistently elevated inflation. Moreover, it also indicated to continue its aggressive stance to contain stubbornly high inflation. "Strengthening of the dollar and rising bond yields in US are the major triggers for FPI selling. Since the Fed and other central banks like Bank of England and Swiss central bank have raised rates, there is synchronised rate hikes globally, with rising yields. Money is moving from equity to bonds," V K Vijayakumar, Cheif Investment Strategist at Geojit Financial Services, said.

On the domestic side as well, inflation has been a cause for concern, and to tame that, RBI has also been increasing rates

-

Comment by Riaz Haq on June 24, 2022 at 9:41pm

-

#Indian startups laid off over 10,000 #employees in the first 6 months of 2022. At least 27 startups fired workers across #India. As investors put pressure on #startups in India to cut costs, employees are collateral damage. #Ola #Blinkit #Modi #BJP https://qz.com/india/2181236/ola-blinkit-and-others-laid-off-10000-...

In a widely-circulated 2020 memo, marquee investor Sequoia had warned portfolio companies to keep their staffing levels sustainable. US-based startup accelerator, Y Combinator, also asked founders of its portfolio companies to “plan for the worst.”

The startups, though, seem to have botched it up. They have mostly cited cost-cutting and extended cash runways as reasons for slashing headcount. Macroeconomic uncertainties surely didn’t help.

“War in Europe, impending recession fears, and Fed rate hikes have led to inflationary pressures with massive correction in stocks globally and in India as well,” Vamsi Krishna, CEO of e-learning platform Vedantu, wrote in a May 18 blogpost. “Given this environment, capital will be scarce for upcoming quarters.”

There are myriad other ways to curb spending—a hiring freeze, curtailed marketing, saving on real estate—but laying off is evidently quick and easy. This is particularly so at tech startups which typically tend to over-hire while business is brisk.

Worryingly, the correction is far from over. Experts estimate that the layoff count will rise to 60,000 in the next six-to-nine months.

Twitter Feed

Live Traffic Feed

Sponsored Links

South Asia Investor Review

Investor Information Blog

Haq's Musings

Riaz Haq's Current Affairs Blog

Please Bookmark This Page!

Blog Posts

Pakistani Prosthetics Startup Aiding Gaza's Child Amputees

While the Israeli weapons supplied by the "civilized" West are destroying the lives and limbs of thousands of Gaza's innocent children, a Pakistani startup is trying to provide them with free custom-made prostheses, according to media reports. The Karachi-based startup Bioniks was founded in 2016 and has sold prosthetics that use AI and 3D scanning for custom designs. …

ContinuePosted by Riaz Haq on July 8, 2025 at 9:30pm

Indian Military Begins to Accept Its Losses in "Operation Sindoor" Against Pakistan

The Indian military leadership is finally beginning to slowly accept its losses in its unprovoked attack on Pakistan that it called "Operation Sindoor". It began with the May 31 Bloomberg interview of the Indian Chief of Defense Staff General Anil Chauhan in Singapore where he admitted losing Indian fighter aircraft to Pakistan in an aerial battle on May 7, 2025. General Chauhan further revealed that the Indian Air Force was grounded for two days after this loss. …

ContinuePosted by Riaz Haq on July 5, 2025 at 10:30am — 6 Comments

© 2025 Created by Riaz Haq.

Powered by

![]()

You need to be a member of PakAlumni Worldwide: The Global Social Network to add comments!

Join PakAlumni Worldwide: The Global Social Network