PakAlumni Worldwide: The Global Social Network

The Global Social Network

India in Crisis: Unemployment and Hunger Persist After Waves of COVID

India lost 6.8 million salaried jobs and 3.5 million entrepreneurs in November alone. Many among the unemployed can no longer afford to buy food, causing a significant spike in hunger. The country's economy is finding it hard to recover from COVID waves and lockdowns, according to data from multiple sources. At the same time, the Indian government has reported an 8.4% jump in economic growth in the July-to-September period compared with a contraction of 7.4% for the same period a year earlier. This raises the following questions: Has India had jobless growth? Or its GDP figures are fudged? If the Indian economy fails to deliver for the common man, will Prime Minister Narendra Modi step up his anti-Pakistan and anti-Muslim rhetoric to maintain his popularity among Hindus?

|

| Labor Participation Rate in India. Source: CMIE |

Unemployment Crisis:

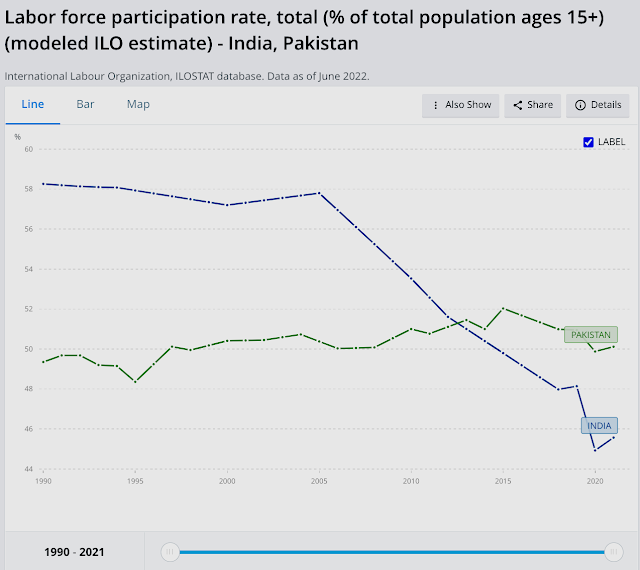

India lost 6.8 million salaried jobs and its labor participation rate (LPR) slipped from 40.41% to 40.15% in November, 2021, according to the Center for Monitoring Indian Economy (CMIE). In addition to the loss of salaried jobs, the number of entrepreneurs in India declined by 3.5 million. India's labor participation rate of 40.15% is lower than Pakistan's 48%. Here's an except of the latest CMIE report:

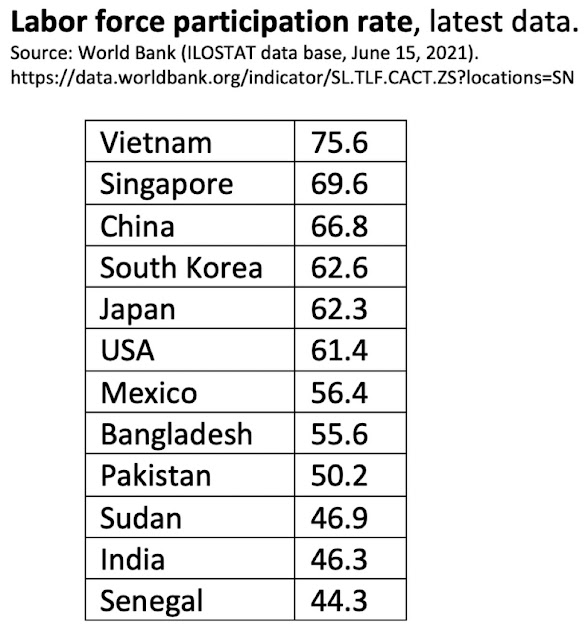

"India’s LPR is much lower than global levels. According to the World Bank, the modelled ILO estimate for the world in 2020 was 58.6 per cent (https://data.worldbank.org/indicator/SL.TLF.CACT.ZS). The same model places India’s LPR at 46 per cent. India is a large country and its low LPR drags down the world LPR as well. Implicitly, most other countries have a much higher LPR than the world average. According to the World Bank’s modelled ILO estimates, there are only 17 countries worse than India on LPR. Most of these are middle-eastern countries. These are countries such as Jordan, Yemen, Algeria, Iraq, Iran, Egypt, Syria, Senegal and Lebanon. Some of these countries are oil-rich and others are unfortunately mired in civil strife. India neither has the privileges of oil-rich countries nor the civil disturbances that could keep the LPR low. Yet, it suffers an LPR that is as low as seen in these countries".

|

| Labor Participation Rates in India and Pakistan. Source: World Bank... |

|

| Labor Participation Rates for Selected Nations. Source: World Bank/ILO |

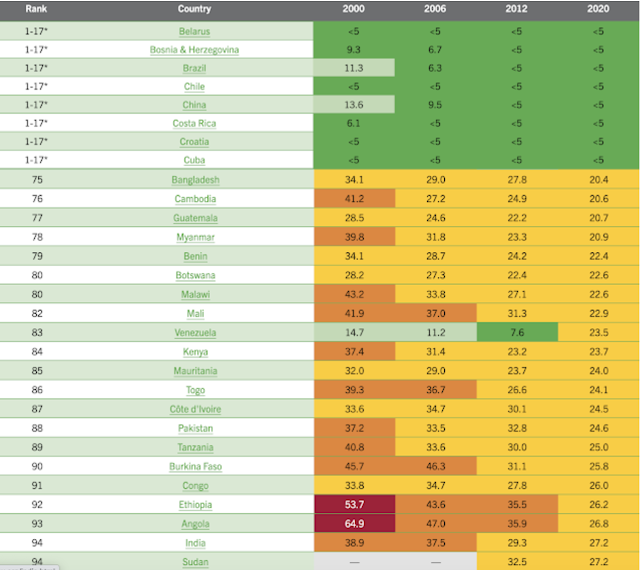

Youth unemployment for ages15-24 in India is 24.9%, the highest in South Asia region. It is 14.8% in Bangladesh 14.8% and 9.2% in Pakistan, according to the International Labor Organization and the World Bank.

|

| Youth Unemployment in Bangladesh, India and Pakistan. Source: ILO, WB |

In spite of the headline GDP growth figures highlighted by the Indian and world media, the fact is that it has been jobless growth. The labor participation rate (LPR) in India has been falling for more than a decade. The LPR in India has been below Pakistan's for several years, according to the International Labor Organization (ILO).

|

| Indian GDP Sectoral Contribution Trend. Source: Ashoka Mody |

|

| Indian Employment Trends By Sector. Source: CMIE Via Business Standard |

|

| World Hunger Rankings 2020. Source: World Hunger Index Report |

Hunger and malnutrition are worsening in parts of sub-Saharan Africa and South Asia because of the coronavirus pandemic, especially in low-income communities or those already stricken by continued conflict.

India has performed particularly poorly because of one of the world's strictest lockdowns imposed by Prime Minister Modi to contain the spread of the virus.

Hanke Annual Misery Index:

Pakistan's Real GDP:

Vehicles and home appliance ownership data analyzed by Dr. Jawaid Abdul Ghani of Karachi School of Business Leadership suggests that the officially reported GDP significantly understates Pakistan's actual GDP. Indeed, many economists believe that Pakistan’s economy is at least double the size that is officially reported in the government's Economic Surveys. The GDP has not been rebased in more than a decade. It was last rebased in 2005-6 while India’s was rebased in 2011 and Bangladesh’s in 2013. Just rebasing the Pakistani economy will result in at least 50% increase in official GDP. A research paper by economists Ali Kemal and Ahmad Waqar Qasim of PIDE (Pakistan Institute of Development Economics) estimated in 2012 that the Pakistani economy’s size then was around $400 billion. All they did was look at the consumption data to reach their conclusion. They used the data reported in regular PSLM (Pakistan Social and Living Standard Measurements) surveys on actual living standards. They found that a huge chunk of the country's economy is undocumented.

Pakistan's service sector which contributes more than 50% of the country's GDP is mostly cash-based and least documented. There is a lot of currency in circulation. According to the State Bank of Pakistan (SBP), the currency in circulation has increased to Rs. 7.4 trillion by the end of the financial year 2020-21, up from Rs 6.7 trillion in the last financial year, a double-digit growth of 10.4% year-on-year. Currency in circulation (CIC), as percent of M2 money supply and currency-to-deposit ratio, has been increasing over the last few years. The CIC/M2 ratio is now close to 30%. The average CIC/M2 ratio in FY18-21 was measured at 28%, up from 22% in FY10-15. This 1.2 trillion rupee increase could have generated undocumented GDP of Rs 3.1 trillion at the historic velocity of 2.6, according to a report in The Business Recorder. In comparison to Bangladesh (CIC/M2 at 13%), Pakistan’s cash economy is double the size. Even a casual observer can see that the living standards in Pakistan are higher than those in Bangladesh and India.

Related Links:

Haq's Musings

South Asia Investor Review

Pakistan Among World's Largest Food Producers

Food in Pakistan 2nd Cheapest in the World

Indian Economy Grew Just 0.2% Annually in Last Two Years

Pakistan to Become World's 6th Largest Cement Producer by 2030

Pakistan's 2012 GDP Estimated at $401 Billion

Pakistan's Computer Services Exports Jump 26% Amid COVID19 Lockdown

Coronavirus, Lives and Livelihoods in Pakistan

Vast Majority of Pakistanis Support Imran Khan's Handling of Covid1...

Pakistani-American Woman Featured in Netflix Documentary "Pandemic"

Incomes of Poorest Pakistanis Growing Faster Than Their Richest Cou...

Can Pakistan Effectively Respond to Coronavirus Outbreak?

How Grim is Pakistan's Social Sector Progress?

Pakistan Fares Marginally Better Than India On Disease Burdens

Trump Picks Muslim-American to Lead Vaccine Effort

COVID Lockdown Decimates India's Middle Class

Pakistan Child Health Indicators

Pakistan's Balance of Payments Crisis

How Has India Built Large Forex Reserves Despite Perennial Trade De...

Conspiracy Theories About Pakistan Elections"

PTI Triumphs Over Corrupt Dynastic Political Parties

Strikingly Similar Narratives of Donald Trump and Nawaz Sharif

Nawaz Sharif's Report Card

Riaz Haq's Youtube Channel

-

Comment by Riaz Haq on June 25, 2022 at 10:54am

-

India’s Fintech Reckoning Arrives

Regulators are cracking down on financial technology firms—many backed by foreign capital—that were flourishing in the gray areas

https://www.wsj.com/articles/indias-fintech-reckoning-arrives-11655...

After a period of unbridled growth, India’s fintech industry faces a regulatory reckoning.

Things may not get as bad as they did in India’s rival China—but investors should still proceed with extreme caution until the dust settles.

On Monday, India’s central bank banned the loading of so-called prepaid payment instruments (PPIs)—essentially prepaid purchasing cards—using credit lines, jeopardizing several fintech buy-now-pay-later business models. Players such as Slice and Uni Cards—which are funded by Tiger Global, Accel, General Catalyst and Insight Partners—are likely to be affected.

Fintech players have issued hundreds of thousands of such cards with the aid of PPI licenses, and then loaded them using credit lines from banks and nonbanking financial institutions, according to brokerage Macquarie. These new-age credit cards—essentially a way to make an end run around strict credit card regulations—were targeted toward younger Indians, many of whom don’t have a long credit history.

Monday’s move indicates that the Reserve Bank of India is solidly against such a rent-a-license model where fintech startups tie up with banks and nonbanking financial institutions to sell products—a common practice in India.

In the past 18 months, the country’s financial technology sector—which has become systemically important to India—has absorbed about $14 billion of investment capital, according to data shared by Tracxn. The top global venture-capital firms have exposure—including Sequoia Capital, Y Combinator, AngelList, Accel and LetsVenture.

The RBI has in fact been advocating for tighter regulations for months: Earlier in 2022 it said it had formed a new fintech department. Monday’s circular is probably the beginning of a wider crackdown on fintech. And protecting vulnerable borrowers at a time of high inflation, tight liquidity and slowing growth is high on the RBI’s agenda. Companies in good standing with the regulator will likely emerge in better shape.

In the coming months, the Bank will likely introduce formal rules for India’s loosely regulated digital-lending ecosystem, including collection practices, data privacy, disclosures and capital-adequacy requirements. Fintech lending companies doubled disbursements in the financial year ending in March 2022 to a total of $2.3 billion, according to a report by the Fintech Association for Consumer Empowerment (FACE). Needless to say, all this will probably weigh on profitability.

Amid India’s tech IPO boom, shares of India’s top fintech company Paytm continue to languish. This is due not only to the lack of a sustainable and profitable business model but also to the RBI’s scrutiny. Several of Paytm’s peers will now appear likely to face much more scrutiny, too.

As investors in Chinese fintech recently discovered, once your industry gets on the bad side of regulators—even if a given company isn’t an initial target—things can go downhill fast. Investors would be wise to steer clear of any Indian fintech firms which have been bending the rules until there is more clarity on how far this crackdown will run.

-

Comment by Riaz Haq on July 1, 2022 at 7:30am

-

India Can’t Be a Superpower If It Can’t Create Jobs

The country’s military can serve as a tool to project power or a scheme to generate employment, but it’s going to be very difficult to do both.

https://www.bloomberg.com/opinion/articles/2022-06-30/modi-s-attemp...

India’s attempt to reform military recruitment — which has set off political convulsions that show no signs of abating — once again shows that its aspirations to superpower status are no match for a below-par economy.

India’s military — particularly its army — is antiquated in organization and manpower-heavy. After some ill-advised, populist and expensive tinkering with pensions early in its tenure, the government found it was spending all its military budget on personnel, leaving very little for modernization or for hardware.

Meanwhile, for more than two decades, its own strategists have been calling for a leaner and younger army. The average Indian soldier is 32 or 33, making its army one of the oldest in the world.

And so, after two years in which the army suspended its typical annual enlistment of 60,000 young men on 20-year contracts, the government announced it was shifting to a tour-of-duty type system in which new recruits will be taken on for four years and then sent off with a handsome and tax-free discharge bonus of $15,000.

This has set off a firestorm of protest. Literally, in some cases, as angry would-be army recruits set trains — a very visible symbol of the central government even the most remote parts of India — alight.

The problem is that, for many young men in the most economically disadvantaged parts of India, the army is their only hope of a career ‑ or, for that matter, of getting married, given that years of sex-selective abortions have caused the gender ratio in those parts of India to skew heavily male. These men — or boys, since they’re mostly teenagers — have spent years running and practicing drills in hopes of getting selected.

Before the new recruitment system was announced, a typical applicant told a reporter for the Print: “If I don’t get a job in the army, my chances of living with dignity in my society are very low. My chances of marrying go down. People will mock me at every function.” Those who do return to their villages after their 20 years of service, on the other hand, tend to be respected and wind up in positions of local leadership.

It’s telling that the protests, and the anger, have largely been limited to the poorest parts of India, where other employment opportunities are scarce. The government has tried to emphasize the $15,000 payout the four-year men will receive and claimed that army training will make them more attractive on the job market. That argument holds less sway in areas where there’s little prospect of finding a good job today or four years from now.

The government has done itself no favors by obscuring its real motivations. Everyone knows this is about reducing the amount the military spends on salaries and creating an army that is younger and more agile technologically. At the same time, the government won’t reveal its plans for military transformation. Forget about detailing how much money the program would save; we don’t even know for certain how many people are currently employed by India’s military. For some reason, that’s treated as a state secret. (It’s estimated to be around 1.4 million, about half as many again as in China.)

Indian Prime Minister Narendra Modi is generally credited with having an instinctive understanding of what voters want. Yet it’s astounding how often his government designs policies in secret that then elicit a furious public reaction. While military reform was inevitable and overdue, surely it could have been discussed in public so that at least the current generation of aspirants would have known better than to run kilometers a day to get themselves in shape.

-

Comment by Riaz Haq on July 1, 2022 at 7:31am

-

India Can’t Be a Superpower If It Can’t Create Jobs

The country’s military can serve as a tool to project power or a scheme to generate employment, but it’s going to be very difficult to do both.

https://www.bloomberg.com/opinion/articles/2022-06-30/modi-s-attemp...

As with farmer-led protests last year, there’s a chance the government will be forced to retreat in the face of this unwavering hostility in areas that remain politically powerful, if economically weak.

A reversal would carry its own costs, however. In an aspiring superpower the military should be an instrument designed to project power, ensure domestic security and respond to emerging threats. What India is learning is that, given its failure to create jobs, its army must also remain something of an employment generation scheme. If the country wants to play a bigger role in its region and in the world, it will first need to fix its economy.

-

Comment by Riaz Haq on July 1, 2022 at 4:43pm

-

#India's #manufacturing activity hits 9-month low in June 2022. S&P Global India Manufacturing Purchasing Managers’ Index (PMI) fell to 53.9 in June from 54.6 in May, the weakest pace of growth since last September. #unemployment #jobs #Modi #BJP #economy https://www.business-standard.com/article/economy-policy/india-s-ma...

India’s manufacturing sector activity eased to a nine-month low in June as growth of total sales and production moderated amid intense price pressures, a monthly survey said on Friday.

The seasonally adjusted S&P Global India Manufacturing Purchasing Managers’ Index (PMI) fell to 53.9 in June from 54.6 in May, the weakest pace of growth since last September.

The June PMI data pointed to an improvement in overall operating conditions for the twelfth straight month. In PMI parlance, a print above 50 means expansion while a score below 50 denotes contraction.

“The Indian manufacturing industry ended the first quarter of fiscal year 2022/23 on a solid footing, displaying encouraging resilience on the face of acute price pressures, rising interest rates, rupee depreciation and a challenging geopolitical landscape,” said Pollyanna De Lima, Economics Associate Director at S&P Global Market Intelligence.

Factory orders and production rose for the twelfth straight month in June, but in both cases the rates of expansion eased to nine-month lows. Increases were commonly attributed to stronger client demand, although some survey participants indicated that growth was restricted by acute inflationary pressures, the survey said.

According to the survey, monitored firms reported increase for a wide range of inputs — including chemicals, electronics, energy, metals and textiles — which they partly passed on to clients in the form of higher selling prices.

Lima further said there was a broad-based slowdown in growth across a number of measures such as factory orders, production, exports, input buying and employment as clients and businesses restricted spending amid elevated inflation.

According to the survey, inflation concerns continued to dampen business confidence, with sentiment slipping to a 27-month low. Elsewhere, input delivery times shortened for the first time since the onset of Covid-19.

“Fewer than 4 per cent of panellists forecast output growth in the year ahead, while the vast majority (95 per cent) expect no change from present levels. Inflation was the main concern among goods producers,” the survey said.

On the job front, employment rose for the fourth successive month, albeit at a slight pace that was broadly in line with those seen over this period.

Meanwhile, the Reserve Bank of India (RBI) in its financial stability report released on Thursday said persistently high inflation globally is to stay longer than anticipated as the ongoing war and sanctions take a toll on economies, threatening a further slowdown to global trade volumes.

The global economic outlook is clouded by the ongoing war in Europe and the pace of monetary policy tightening by central banks in response to mounting inflationary pressures, the RBI report said.

-

Comment by Riaz Haq on July 2, 2022 at 4:59pm

-

Foreign #investors flee #India, putting pressure on #Indian #currency. #Modi government raises #import taxes on #gold to preserve #forex reserves, support #INR, amid rising #inflation and twin current account and fiscal deficits. #BJP #Hindutva #economy

https://economictimes.indiatimes.com/news/economy/indicators/india-...

Investors reeling from the brutal emerging markets selloff over the past six months again fled the rupee as India’s currency hit new lows, prompting the government to curb gold imports and oil exports to arrest a widening deficit.

The government raised import taxes on gold, while increasing levies on exports of gasoline and diesel in an attempt to control a fast-widening current account gap. The moves sent Reliance Industries Ltd NSE -7.20 %. and other energy exporters tumbling, bringing down the benchmark index by as much as 1.7%. The rupee fell again.

The actions underscore how emerging economies, specially with twin current account and fiscal deficits, are increasingly facing pressures on their currencies as forceful rate hikes by the Federal Reserve accentuate outflows. Despite having the world’s fourth-biggest reserve pile, the rupee has hit a succession of record lows in recent weeks. The Indonesian rupiah, the other high-yielder in Asia, fell to its lowest in two years on Friday.

Policy makers in many emerging markets face stark choices as they battle soaring inflation and capital flight as the Fed tightens policy: raise rates and risk hurting growth, spend reserves that took years to build to defend currencies, or simply step away and let the market run its course.

New Delhi’s move also underscores the economic challenges faced by Prime Minister Narendra Modi’s government as inflation in the world’s sixth-largest economy accelerates and external finances worsen. The central bank has been battling to slow the currency’s decline, and runaway rupee depreciation will worsen price pressures, and may spur more rate hikes that weigh on growth.

The measures “aim to reduce the impending pressure on the current account deficit and thus the currency,” said Madhavi Arora, lead economist at Emkay Global Financial Services. “Complementary policy efforts from both fiscal and monetary side essentially reflects the looming pain on the balance of payments deficit this year.”

While the Reserve Bank of India has been seeking to smooth out the rupee’s 6% decline this year, banks have reported dollar shortages as investors and companies rushed to swap the rupee for other assets or to pay for imports. The latest measures were spurred by a sudden surge of gold imports in May and June, the Finance Ministry said Friday.

The government raised the import duty on gold to 12.5%, reversing a cut last year. The higher taxes on shipments of gasoline and diesel sent shares of Reliance Industries, a key exporter, down by as much as 8.9%.

India is the world’s second-biggest gold consumer and local futures rose as much as 3% in Mumbai, the biggest intraday jump in almost four months, due to the higher import costs.

Finance Minister Nirmala Sitharaman said on Friday that India is seeking to discourage gold imports as it helps preserve foreign exchange. She added “extraordinary times” require such measures including the imposition of a windfall tax on fuel exports.

“The challenges are emanating from the same source, which is higher commodity prices,” said Rahul Bajoria, senior economist, Barclays Bank Plc. “India can neither find supply onshore nor we will be able to cut back the consumption of oil. That makes the whole situation a lot more unpredictable both in terms of how this plays out and how long this continues for.”

For the broader fuel market, a drop in Indian exports could further tighten global markets that are grappling with reduced supply from Russia and rising post-pandemic demand.

-

Comment by Riaz Haq on July 3, 2022 at 5:04pm

-

Sonam Srivastava of Wright Research sees slowdown in IT, infra, but bets on auto, FMCG

https://www.moneycontrol.com/news/business/markets/daily-voice-sona...

The mood in the market has improved in the last couple of weeks, but this could be a short-term rebound. We did see a slight easing in European inflation. While the recession in the west is more of a reality, many expect the pain to be over sooner. Nevertheless, we cannot rule out another correction.

Sonam Srivastava, founder of Wright Research, expects some early signs of a slowdown in the quarterly earnings from next week with margin pressure intensifying in IT and infrastructure. She, however, is bullish on auto and FMCG companies.

The recent tax hike on oil exports is a harsh step by the government, but it is warranted by their commitment to controlling the excessive inflationary pressures the economy is facing. "It might impact ONGC and Oil India earnings for FY23 by 36 percent and 24 percent, so we could see more pain in these scrips in the medium term," she shares in an interview to Moneycontrol.

Q: Do you think the consistent consolidation and possibility of another round of major market correction can spoil the mood of domestic institutional investors and retail investors?

A: The mood in the market has improved in the last couple of weeks, but this could be a short-term rebound. We did see a slight easing in European inflation. While the recession in the west is more of a reality, many expect the pain to be over sooner. Nevertheless, we cannot rule out another correction.

I believe that while a minority of new investors will get discouraged and quit, the equity market has gained a large set of sticky long-term investors in the past few years who will continue to support the market.

Q: Any themes that you are buying aggressively?

A: We are excited about the rising consumer demand and reopening themes. We expect FMCG to keep reaping the benefit of good monsoons and easing crude prices. On the other hand, hotels, multiplexes and travel stocks also look attractive.

Auto has been a powerful theme in the last few months, but we are cautiously optimistic given that there has already been a strong rally. IT, which has corrected massively, has started to look exciting, and we are picking some stocks in this basket.

We are also excited about the new India stocks gaining from the government production linked incentive (PLI) schemes, which we expect to outperform as soon as the switch happens towards growth.

Q: Do you think the market has made the final bottom by hitting lows in June and waiting for a trigger to see a sharp move?

A: It is tough to say we have reached the bottom. Many in the market are calling for the worst time to be over, but you can never confidently say that, given the type of uncertainty we have seen in the last year. The Fed rate hikes are priced in, and we are now just waiting for positive triggers like the easing of inflation or the end of the conflict in Ukraine.

A triangular pattern formation on the charts and the price movement in the subsequent few trading sessions will be essential and confirm either a positive breakout or a negative trend.

Q: Is there any possibility of another round of correction in the metal sector/stocks before any bottom formation?

A: Metal prices are increasingly governed by the Chinese economy, which has started showing signs of recovery after a long time. If the recovery in China persists, we could see some strength in the Metal prices at rock bottom right now.

A sustained long-term recovery in meal prices will only come after the current global environment calms down and focus shifts to infrastructure spending.

-

Comment by Riaz Haq on July 3, 2022 at 5:05pm

-

Sonam Srivastava of Wright Research sees slowdown in IT, infra, but bets on auto, FMCG

https://www.moneycontrol.com/news/business/markets/daily-voice-sona...

Q: Among commodities, do you think oil is the last to collapse?

A: In an inflationary environment, there is a supply-side constraint on commodities, and the bankers are trying to bring down demand to match that. So while the recent correction in commodity prices might end with oil, we can see commodity inflation revive again while inflation is roaring. So the short term might be negative for commodities, but we could see a resurgence in the prices in the medium term.

Q:Companies will start releasing their first-quarter earnings scorecard in the current month. What are your general expectations?

A:We expect early signs of a slowdown in the earnings from next week. The IT sector will show margin pressure, high attrition and low hiring patterns. Infrastructure, realty and other cyclical might show early signs of a slowdown.

On the other hand, the auto sector could show good numbers, and FMCG could also show encouraging numbers. We expect the commentary for most companies to become more cautious and sombre given the global situation.

-

Comment by Riaz Haq on July 4, 2022 at 8:21am

-

#India Hit By Emerging Market #Investor #Exodus As #India #Rupee Tumbles. Investors reeling from the brutal emerging markets selloff over the past six months again fled the rupee as India's currency hit new lows. #Modi #BJP #Hindutva #economy https://www.ndtv.com/business/indian-economy-hit-by-selloff-in-emer...

Investors reeling from the brutal emerging markets selloff over the past six months again fled the rupee as India's currency hit new lows, prompting the government to curb gold imports and oil exports to arrest a widening deficit.

The government raised import taxes on gold, while increasing levies on exports of gasoline and diesel in an attempt to control a fast-widening current account gap. The moves sent Reliance Industries Ltd. and other energy exporters tumbling, bringing down the benchmark index by as much as 1.7%. The rupee fell again.

The actions underscore how emerging economies, specially with twin current account and fiscal deficits, are increasingly facing pressures on their currencies as forceful rate hikes by the Federal Reserve accentuate outflows. Despite having the world's fourth-biggest reserve pile, the rupee has hit a succession of record lows in recent weeks. The Indonesian rupiah, the other high-yielder in Asia, fell to its lowest in two years on Friday.

Policy makers in many emerging markets face stark choices as they battle soaring inflation and capital flight as the Fed tightens policy: raise rates and risk hurting growth, spend reserves that took years to build to defend currencies, or simply step away and let the market run its course.

New Delhi's move also underscores the economic challenges faced by Prime Minister Narendra Modi's government as inflation in the world's sixth-largest economy accelerates and external finances worsen. The central bank has been battling to slow the currency's decline, and runaway rupee depreciation will worsen price pressures, and may spur more rate hikes that weigh on growth.

The measures “aim to reduce the impending pressure on the current account deficit and thus the currency,” said Madhavi Arora, lead economist at Emkay Global Financial Services. “Complementary policy efforts from both fiscal and monetary side essentially reflects the looming pain on the balance of payments deficit this year.”

While the Reserve Bank of India has been seeking to smooth out the rupee's 6% decline this year, banks have reported dollar shortages as investors and companies rushed to swap the rupee for other assets or to pay for imports. The latest measures were spurred by a sudden surge of gold imports in May and June, the Finance Ministry said Friday.

Commodity Pressures

The government raised the import duty on gold to 12.5%, reversing a cut last year. The higher taxes on shipments of gasoline and diesel sent shares of Reliance Industries, a key exporter, down by as much as 8.9%.

India is the world's second-biggest gold consumer and local futures rose as much as 3% in Mumbai, the biggest intraday jump in almost four months, due to the higher import costs.

Finance Minister Nirmala Sitharaman said on Friday that India is seeking to discourage gold imports as it helps preserve foreign exchange. She added “extraordinary times” require such measures including the imposition of a windfall tax on fuel exports.

“The challenges are emanating from the same source, which is higher commodity prices,” said Rahul Bajoria, senior economist, Barclays Bank Plc. “India can neither find supply onshore nor we will be able to cut back the consumption of oil. That makes the whole situation a lot more unpredictable both in terms of how this plays out and how long this continues for.”

For the broader fuel market, a drop in Indian exports could further tighten global markets that are grappling with reduced supply from Russia and rising post-pandemic demand.

-

Comment by Riaz Haq on July 4, 2022 at 8:21am

-

#India Hit By Emerging Market #Investor #Exodus As #India #Rupee Tumbles. Investors reeling from the brutal emerging markets selloff over the past six months again fled the rupee as India's currency hit new lows. #Modi #BJP #Hindutva #economy https://www.ndtv.com/business/indian-economy-hit-by-selloff-in-emer...

Big Reserves

Friday's measures highlight the central bank has a tough fight on the external front in coming months. RBI Governor Shaktikanta Das has said the central bank uses a multi-pronged intervention approach to minimize actual outflows of dollars and won't allow a runaway rupee depreciation.

And while investors have been put on watch over emerging-market stress by Sri Lanka's struggle with a dollar crunch leading to hyperinflation, the RBI has close to $600 billion of foreign-exchange reserves. But those reserves are depleting as the central bank steps up its fight to stop the slide in the rupee amid capital outflows and a current account gap that is expected to double this year.

“Investors should expect the currency to still depreciate,” said Arvind Chari, chief investment officer at Quantum Advisors Pvt. in Mumbai. “Will more taxes on exports impact corporate activity? Maybe not in the short term but it could in the medium to long term.”

-

Comment by Riaz Haq on July 15, 2022 at 10:33am

-

#India’s World-Beating Growth Isn’t Creating #Jobs. #Unemployment rate is hovering around 7% or 8%, up from about 5% five years ago. The labor force participation rate has dropped to just 40% of the 900 million #Indians of legal age. #Modi #BJP #Hindutva

https://www.bloomberg.com/news/articles/2022-07-15/why-india-s-worl...

No other major economy has been expanding as fast as India lately, beating both China and the US. But beyond the headlines lies the grim reality of rising unemployment. The nation of 1.4 billion people isn’t creating enough jobs for its growing workforce, despite campaign promises by Prime Minister Narendra Modi to make it a priority. Output is increasing as a result of pandemic-related government spending while the private sector sits on the fence, deterred by dim conditions for new investment. Meanwhile, pandemic-related disruptions and rising inflation are making it harder for everyone to get by. Tensions boiled over in June when angry youth facing bleak job prospects blocked rail traffic and highways in many states for days, even setting some trains on fire.

The unemployment rate in India has been hovering around 7% or 8%, up from about 5% five years ago, according to the Centre for Monitoring Indian Economy, a private research firm. At the same time, the workforce shrank as millions of people dejected over weak job prospects pulled out, a situation that was exacerbated by Covid-19 lockdowns. The labor force participation rate -- meaning people who are working or looking for work -- has dropped to just 40% of the 900 million Indians of legal age, from 46% six years ago, according to the CMIE. By comparison, the participation rate in the US was 62.2% in June.

Twitter Feed

Live Traffic Feed

Sponsored Links

South Asia Investor Review

Investor Information Blog

Haq's Musings

Riaz Haq's Current Affairs Blog

Please Bookmark This Page!

Blog Posts

Pakistani Prosthetics Startup Aiding Gaza's Child Amputees

While the Israeli weapons supplied by the "civilized" West are destroying the lives and limbs of thousands of Gaza's innocent children, a Pakistani startup is trying to provide them with free custom-made prostheses, according to media reports. The Karachi-based startup Bioniks was founded in 2016 and has sold prosthetics that use AI and 3D scanning for custom designs. …

ContinuePosted by Riaz Haq on July 8, 2025 at 9:30pm

Indian Military Begins to Accept Its Losses in "Operation Sindoor" Against Pakistan

The Indian military leadership is finally beginning to slowly accept its losses in its unprovoked attack on Pakistan that it called "Operation Sindoor". It began with the May 31 Bloomberg interview of the Indian Chief of Defense Staff General Anil Chauhan in Singapore where he admitted losing Indian fighter aircraft to Pakistan in an aerial battle on May 7, 2025. General Chauhan further revealed that the Indian Air Force was grounded for two days after this loss. …

ContinuePosted by Riaz Haq on July 5, 2025 at 10:30am — 6 Comments

© 2025 Created by Riaz Haq.

Powered by

![]()

You need to be a member of PakAlumni Worldwide: The Global Social Network to add comments!

Join PakAlumni Worldwide: The Global Social Network