PakAlumni Worldwide: The Global Social Network

The Global Social Network

Pakistan Economy "Not in a Good Place"? Atif Mian's Gloom Justified?

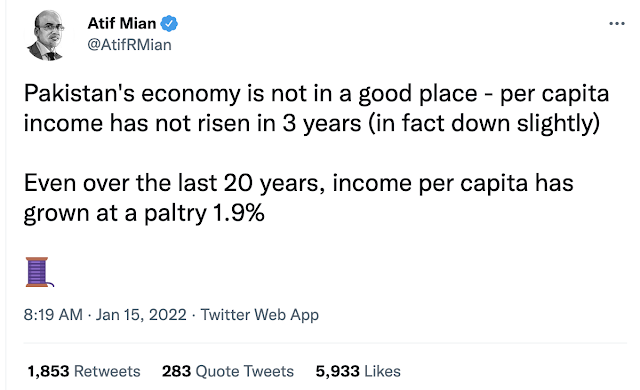

Pakistani-American economist Atif Mian has recently analyzed Pakistan's economy in a series of tweets. He has said "Pakistan's economy is not in a good place", adding that the nation's "per capita income has not risen in 3 years (in fact down slightly)". He has particularly mentioned the country's "exaggerated external demand driven by its rentier economy", "flawed energy policy" and "a broken economic decision system" among the main causes for poor economic performance. Is Atif Mian's diagnosis correct? Is the official reported data Atif Mian using accurate? What is the current PTI government doing or not doing to correct the problems identified by Mr. Mian? Let's try and assess the situation.

|

| Economist Atif Mian's Tweet on Pakistan Economy |

Per Capita Income:

Pakistan's officially reported GDP and per capita incomes are grossly understated. These are based on the last economic census that was done from April 2003 to December 2003 and published in 2005. The last agriculture census was in 2010, and livestock census in 2006, according to Dr. Ishrat Husain, former governor of The State Bank of Pakistan. The country's economy has changed significantly since then, adding several new economic activities while others have become less important. For example, the Quantum Index of Large Scale Manufacturing (QIM) with 2005-06 base year gives a weight to textiles of 20.9% (Yarn 13.7 and cloth 7.2). But the textile industry has moved up to higher value added products as reflected in its exports. The value added textiles (non-yarn and non-cloth) now make almost 80% of the total textile exports. These changes are not reflected in current GDP calculations.

In its 2014 annual report, the State Bank of Pakistan talked about a number of new sectors that are either under-reported or not covered at all: "In terms of LSM growth, a number of sectors that are showing strong performance; (for example, fast moving consumer goods (FMCG) sector; plastic products; buses and trucks; and even textiles), are either under reported, or not even covered. The omission of such important sectors from official data coverage, probably explains the apparent disconnect between overall economic activity in the country and the hard numbers in LSM."

Bangladesh just rebased its GDP in 2020-21 to 2015-16. This has boosted its per capita income by double digits for every year since 2015-16. Bangladesh's per capita income for the 2015-16 fiscal year has now gone up to $1,737 from $1,465 in the old calculation. For the 2019-2020 fiscal, the per capita income has gone up to $2,335 from $2,024. The new GDP estimate covers 21 sectors, up from 15 sectors previously. India last rebased its GDP in 2015, a change that bumped up its per capita GDP by double digits. Nigeria's last rebasing in 2012 increased the size of its economy (GDP) by nearly 90%. Pakistan's current base year is 2005-6. Rebasing which is now long overdue will almost certainly increase Pakistan's per capita income by double digits.

In this age of big data, it is important for Pakistan to ensure that its bureaucracy at Pakistan Bureau of Statistics (PBS) keeps the national economic data as current as possible. PBS should release the results of the Census of Manufacturing Industries CMI 2015-16 and the finance ministry should rebase Pakistan's economy to year 2015-16 to better reflect the current economic realities. This data is extremely important for businesses, investors, lenders and policymakers.

Energy Mix:

|

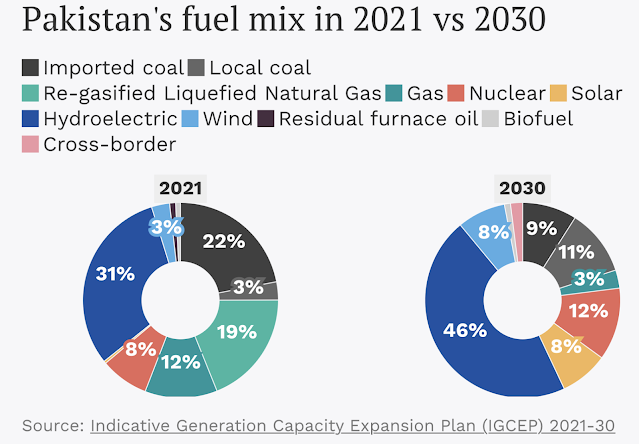

| Pakistan Power Generation Fuel Mix. Source: Third Pole |

Hydroelectric dams contributed 37,689 GWH of electricity or 27.6% of the total power generated, making hydropower the biggest contributor to power generated in the country. It is followed by coal (20%), LNG (19%) and nuclear (11.4%).

|

| Cost Per Unit of Electricity in Pakistan. Source: Arif Habib |

Nuclear offers the lowest cost of fuel for electricity (one rupee per KWH) while furnace oil is the most expensive (Rs. 22.2 per KWH).

|

| Pakistan Exports Trend 2011-21. Courtesy of Ali Khizer |

|

| Pakistan Textile Exports Trend 2011-21. Courtesy of Ali Khizer |

|

|

|

|

| Pakistan's Current Account Balance vs International Oil Prices. Sou... |

Recent history shows that Pakistan's current account deficits vary with international oil prices. Pakistan's trade deficits balloon with rising imported energy prices. One of the keys to managing external account balances lies in reducing the country's dependence on foreign oil and gas.

Related Links:

Haq's Musings

South Asia Investor Review

Pakistan Among World's Largest Food Producers

Food in Pakistan 2nd Cheapest in the World

Indian Economy Grew Just 0.2% Annually in Last Two Years

Pakistan to Become World's 6th Largest Cement Producer by 2030

Has Bangladesh Surged Past India and Pakistan in Per Capita Income?

Pakistan's Computer Services Exports Jump 26% Amid COVID19 Lockdown

Coronavirus, Lives and Livelihoods in Pakistan

Vast Majority of Pakistanis Support Imran Khan's Handling of Covid1...

Pakistani-American Woman Featured in Netflix Documentary "Pandemic"

Incomes of Poorest Pakistanis Growing Faster Than Their Richest Cou...

Can Pakistan Effectively Respond to Coronavirus Outbreak?

How Grim is Pakistan's Social Sector Progress?

Double Digit Growth in Pakistan's Energy Consumption Confirms Econo...

Trump Picks Muslim-American to Lead Vaccine Effort

COVID Lockdown Decimates India's Middle Class

Pakistan to be World's 7th Largest Consumer Market by 2030

Pakistan's Balance of Payments Crisis

How Has India Built Large Forex Reserves Despite Perennial Trade De...

Conspiracy Theories About Pakistan Elections"

PTI Triumphs Over Corrupt Dynastic Political Parties

Strikingly Similar Narratives of Donald Trump and Nawaz Sharif

Nawaz Sharif's Report Card

Riaz Haq's Youtube Channel

-

Comment by Riaz Haq on May 7, 2022 at 12:57pm

-

Karot Hydropower connects unit one to national grid. It is a 720 MW plant constructed on river Jhelum, #Pakistan , in collaboration with one of the largest state-owned #Chinese power companies, #China Three Gorges Corporation. #CPEC Global Village Space

https://www.globalvillagespace.com/karot-hydropower-connects-unit-o...

Pakistan’s first Hydel power generation project – Karot Hydropower – under the China-Pakistan Economic Corridor (CPEC) connected unit one to the national grid on 30 April, kick-starting the operations at full capacity, reported Developing Pakistan, a Pakistan based digital media platform. By connecting unit one of the Karot Hydropower, the project pumps 180 MW of electricity into the national grid. Karot Hydropower Project is a 720 MW constructed on river Jhelum, Pakistan, in collaboration with one of the largest state-owned Chinese power companies, the China Three Gorges Corporation, more commonly known as the CTG. The rest of the three units will be connected to the national grid in the upcoming months.

The project’s financial close was achieved in March 2017, and construction work began the same year. The mechanical, electrical, and other technical works of the project were completed around February 2022, and internal testing began in the same month. Work pertaining to transmitting power to the national grid was mostly completed by January however was not completed till April 30. The project is the first of three hydropower projects under China Pakistan Economic Corridor, and the estimated cost to get the plant operational stands at around $1.42 billion. According to the Managing Director of the Private Power and Infrastructure Board, the other two include “the 870MW Sukhi Kenari HPP and 1,124MW Kohala HPP.” Work on Sukhi Kerani is underway, whereas the construction of the Kohala Hydropower Project is yet to be initiated. The Kohala HPP is also being constructed on the Jhelum river, and a tripartite agreement was signed for its construction in June 2020; however, due to tax issues, the work on the construction site of the said river has still not begun.

It is pertinent to mention that according to the National Electric Power Regulator Authority state industry report 2021, Hydel sources of electricity generation account for 27.02 percent of the country’s electricity, significantly more than any other source except for thermal.

Separately, to address the energy demands of the country, Pakistani authorities have also engaged the World Bank to facilitate the set up of a 300 MW floating solar project at the Tarbela – Ghazi Barotha complex. The project’s projected cost is proposed to be around $346.5 million. Under the project, a 150 MW floating solar subproject will be deployed in the Ghazi Barrage headpond and another floating project of similar capacity at the Forebay of the existing Ghazi Barotha Hydropower plant. The project would greatly enhance the electricity supply and help meet the rising demand for electricity in a climate-smart manner.

-

Comment by Riaz Haq on May 26, 2022 at 5:05pm

-

Pakistan Private Sector Energy Project

@PFAN_PPSE

#Pakistan can get up to 20% of total power capacity from variable renewable energy simply by focusing on existing substations, mainly resulting in a series of small solar projects - according to

@WorldBank

https://twitter.com/PFAN_PPSE/status/1529715190018760706?s=20&t...

https://blogs.worldbank.org/endpovertyinsouthasia/expanding-solar-a...

Rooftop solar can be delivered quickly and at a relatively low cost, while avoiding the need for additional transmission & distribution infrastructure.

Perhaps there can be a silver lining from the current load shedding--or planned power cuts due to insufficient supply--that is affecting the electricity sector in Pakistan: the immediate implementation of competitive bidding for new solar and wind capacity. For the last few years, the dominant narrative around the electricity sector has been one of “surplus capacity”, which has been used to justify postponing the procurement of new solar and wind. One of the concerns is that because the power sector must pay legacy fossil fuel generators regardless of whether they generate power (this is called “capacity payments”, for the capacity they provide to the system), adding additional capacity will further harm the financial viability of the sector. However, the current crisis illustrates the folly of such short-term thinking.

As highlighted in a report just published by the World Bank – “Variable Renewable Energy Competitive Bidding Study” – competitive bidding, whereby the government contracts for new power supplies through a reverse auction process based on the tariffs offered by different private sector developers, must start in 2022 to meet the requirements of the government’s Indicative Generation Capacity Expansion Plan 2021-2030. This envisages 2 Gigawatts of additional solar and wind capacity coming online from 2024 onwards, with further additions in subsequent years. Previous analysis published by the World Bank suggests that the IGCEP 2021-2030 targets are not ambitious enough, with scope for a more aggressive expansion of variable renewable energy. Considering the heavy reliance on expensive fossil fuels – which have dramatically increased in cost over the last few months – Pakistan would be saving money right now if it had been more ambitious in the past, even allowing for capacity payments.

Pakistan can get up to 20% of total power capacity from variable renewable energy simply by focusing on existing substations.

wind power

Implementation of competitive bidding will need to be taken forward by both the federal government (under the auspices of the Alternative Energy Development Board) and the provincial governments through a coordinated process. In addition to launching a competitive bidding process for the existing “Category 3” projects (those for which Letters of Intent have been issued under the previous policy regime), there is huge potential for quick wins by identifying substations that have surplus integration capacity and then designing a competitive bidding process involving a large number of such sites. As noted by the World Bank in our last study on this topic, the country can get up to 20% of total power capacity from variable renewable energy simply by focusing on existing substations, mainly resulting in a series of relatively small solar projects spread across all provinces.

-

Comment by Riaz Haq on July 8, 2022 at 7:23am

-

Sindh govt plans to launch floating solar power project on Keenjhar Lake

Solar panels to generate 500MW of electricity after two years

https://tribune.com.pk/story/2365112/sindh-govt-plans-to-launch-flo...

"Work on the feasibility report of the project is in full swing and it is hoped that the project will start generating electricity in two years time after going through the approval stages," said Sindh Energy Minister Imtiaz Ahmed Shaikh, adding that Go Company, which was working on the project, was expected to invest US$400 million in the project.

The energy minister’s statement came during his talk with officials from power companies.

He said that this was a unique floating solar power plant project for Pakistan which would not only provide 500 MW of environmentally friendly electricity but would also create employment opportunities in the province.

"Keenjhar Lake will promote tourism and help in controlling load shedding," he added.

Imtiaz Shaikh said that the 500 MW eco-friendly power project was another milestone of the achievements of the Sindh government.

In recent months, Pakistan has seen efforts to increase the instalment and use of solar panels. The government worked towards a comprehensive solar energy package comprising tax waivers and concessionary loans for consumers in a bid to overcome the prolonged power outages that have stalled life in the country.

The solar package would include a short-term plan for shifting government offices to solar energy. It involves the preparation of a plan for helping small consumers to switch over to solar energy with the help of subsidies or concessionary loans.

The government is also planning to waive the general sales tax on all the components used in generating solar energy.

The energy task force, chaired by Shahid Khaqan Abbasi, reviewed the solar power plan in a recent meeting. The prime minister constituted the task force on solar energy initiatives with a vision to promote sustainable and green energy.

-

Comment by Riaz Haq on August 3, 2022 at 4:55pm

-

Solar plant to replace 300MW Gwadar coal power project

The project was conceived under the CPEC and approved in 2016

https://www.thenews.com.pk/print/976586-solar-plant-to-replace-300m...

The Power Division has decided to abandon the 300MW imported coal-based power plant at Gwadar and replace it with a solar plant.

The project was conceived under the CPEC and approved in 2016, but its formal construction had not started. Now the government wants China to install a solar power plant of the same capacity after the government decided not to install any new power plant based on imported fuel in the future.

“We have decided to abandon the project, but we will have to take up the issue at various CPEC forums with our Chinese counterparts. CPEC projects have sensitivity and importance which is why the Power Division’s decision to replace the imported coal-based project at Gwadar with a solar plant is being kept at a low profile,” an official said.

Federal Minister for Power Division Khurram Dastgir Khan also hinted the government wanted the Chinese power plant at Gwadar to be replaced with a solar power plant of 300MW. Talking to The News, he also added that the government had decided to ban new power plants based on imported fuel and would add new capacity to electricity generation based on local fuel, such as Thar coal, wind, solar, and hydel. “However, the government will continue the policy to install more nuclear power plants,” he added.

More importantly, the minister said, the government has also decided to convert the existing imported coal-based power plants of 3,960MW, including the Port Qasim plant, Sahiwal power plant and China Hub plant, each having the capacity to generate 1,320MW of electricity, to local coal. The fuel import bill had eaten up almost $20 billion in the first 11 months of the last fiscal 2021-22. The initiative is being taken to scale down the fuel import bill and reduce reliance on imported fuel for power generation. The minister said the process to convert the three projects to local coal would take investment and time as boilers of the plants would need some specific changes for calibration with Thar coal.

The Joint Cooperation Committee (JCC) for the CPEC had decided in its 6th meeting held in Beijing in December 2016 that a 300MW imported coal-fired power project must be developed on a fast-track basis at Gwadar. The tariff of the project was determined in September 2019, land for the project was acquired in February 2020 and the project management was signed on April 8, 2021. The Nepra also issued a generation licence to the project management. However, the financial close of the project has not yet been completed as it is still under process. The project is still on the list of under-construction CPEC projects. However, its construction has not started yet. That is why top officials of the Power Division have decided to abandon the project and replace it with a solar power plant under its new policy not to install a new power plant base on imported coal in future.

Pakistan is currently importing 30 to 70MW of electricity from Iran under an agreement of 110MW. Sometimes, Pakistan has some fluctuation in electricity import because of demand in Iran. Pakistan had inked a new agreement of importing 100MW electricity for which a transmission line would be laid from Polan (Iran) to Gwadar by the end of 2022, or the start of 2023. The government has also increased its emphasis on laying its own infrastructure in Balochistan and the NTDC will lay a high transmission line of 500kv from Makran coast to Gwadar.

-

Comment by Riaz Haq on August 6, 2022 at 6:40pm

-

SECMC has already commissioned a study for converting the China-Pakistan Economic Corridor coal plants in Hub, Jamshoro and Sahiwal to indigenous lignite. A 105km long Thar Rail project is being planned to connect Thar coal fields with Main Line at the New Chhor Halt Station to transport lignite to the power plants in the rest of the country.

The transportation of lignite by trucks to Karachi and Kallar Kahar shows its movement by road and rail is feasible and safe despite higher moisture. “Transportation is manageable; no combustion encountered during mining or transportation,” he adds.

https://www.dawn.com/news/1702647————“The (Lucky)power plant has been designed to operate on Thar Lignite Coal, subject to its availability; however, during the interim period, it will mainly operate on imported Lignite Coal till the completion of Phase III of Sindh Engro Coal Mining Company (SECMC), which is expected in the second quarter of CY 2023,” read the notice.————The government has decided to convert 3,960 MW of electricity generated from imported coal onto local coal of Thar to stop consuming the costly foreign exchange reserves for the import of coal, which is no longer available at low prices. The coal price has shot up to $400 per metric ton, a senior official at the Energy Ministry told The News.—————-The (2nd CPEC coal power) project is likely to start its full commercial operations by the end of the current month. With the launch of the new power plant, 990 MWs of Thar coal-based electricity is being produced to overcome the power shortfall in the country.

-

Comment by Riaz Haq on August 24, 2022 at 4:26pm

-

Answering Pakistan’s Burning Question: How To Ignite Lignite?

Amy KoverBuried 1,000 feet below the parched Thar Desert in Pakistan lies more fuel energy than all the known oil in Iran and Saudi Arabia combined. Just a small fraction of this 175-billion-ton lignite coal reserve is plentiful enough to supply one-fifth of Pakistan’s current energy levels for 50 years. This would significantly bolster the energy supply to Pakistan’s 200 million residents, who per capita have access to roughly just 3 percent of the electricity a typical American consumes. As a local resource, it would also lower hefty bills for imported oil and coal, diminishing Pakistan’s reliance on outside sources for energy.

The problem is that lignite is about as combustible as soggy logs in a fireplace. Composed of more than 50 percent water, as well as other impurities, lignite is known as low-caloric fuel — an ideal description for diet products, but not so much for an electricity resource. That’s partly why Thar’s reserve has gone largely untapped since its accidental discovery in 1992 by geologists searching for drinkable water. Even nine years ago, when the private-public partnership Sindh Engro Coal Mining Company purchased 1 percent of the reserve for mining, one question continued to confound power plant operators: How to ignite lignite?

Last month, an answer arrived. GE Power — which has experience burning a similar form of lignite coal in Europe and the U.S. — will bring its boiler and steam turbine technology to Pakistan. Chinese contractor SEPCOIII announced plans, in June, to use GE Power’s systems as part of its new power plant near Karachi. Known as “Qasim-Lucky,” the plant will generate 660 megawatts of electricity to power 1.3 million Pakistani homes and businesses when Lucky Power begins commercial operations in 2021. “As the first lignite-fueled ultra-supercritical power plant across the Middle East, North Africa and Turkey region, the project will help to set new industry benchmarks in Pakistan,” Qin Xubao, project director at SEPCOIII, said recently.

“Ultra-supercritical (USC)” is the operative term here — it describes the titanic pressures GE achieves inside the steam turbine — but first some background. This groundbreaking process begins with GE Power’s mill, known as the Beater Wheel, grinding lignite coal so it’s as fine as baby powder. With more surface area exposed, the tiny particles of coal dry more easily as hot air blows the dust into the combustion chamber. There, even hotter air — temperatures averaging 650 degrees Fahrenheit (340 degrees Celsius) — combusts the pulverized lignite into flue gas.

An “ultra supercritical” steam turbine at the RDK8 power plant in Germany. The water pressure inside reaches 4,000 pounds per square inch, more than what’s exerted when a bullet strikes a solid object. The water, which exists in a “supercritical state,” is heated to 1,112 degrees Fahrenheit (600 degrees Celsius). Top: The boilers of an ultra-supercritical power plant in Neurath, Germany. Images credit: GE Steam Power.

When it comes to combusting lignite, size matters. Every square centimeter of the boiler must fill evenly with gas. Since different fuels burn at different temperatures, GE designs its boilers with Goldilocks dimensions: neither so small that the fuel overheats nor so big that it won’t combust. Just as crucial is the positioning of each component in the boiler. “The way you inject the air into the flame, the way you manage the size of the flame and positioning of the flame, it all impacts how the lignite will react and burn,” explains Sacha Parneix, commercial general manager for GE’s Steam Power business in the Middle East, North Africa and Turkey (MENAT). “We have a lot of design features to make sure that we manage to truly burn this fuel that does not want to completely burn easily.”

Flue gas then travels up to the steam boiler, where its heat transforms water stored in tubes into steam power. The steam’s mechanical energy spins enormous turbines to power electricity generators. It’s also when another kind of engineering magic — GE Power’s steam turbine — kicks in. GE’s ultra-supercritical science puts steam under pressure of roughly 4,000 pounds per square inch — the same impact as a bullet striking a solid object — and heats to 1,112 degrees Fahrenheit (600 degrees Celsius). The heat and pressure turn steam into a supercritical fluid, a phenomenon where a substance no longer has specific liquid and gas phases but exhibits properties of both at the same time. In this state, the steam can get turbines spinning faster than any other system in operation, more than 20 percent above the world-average net thermal-efficiency rate of coal-fired power plants — a measure of how well the plant converts fuel into heat. That kind of efficiency gobbles up less fuel, reducing both operating expenses and carbon dioxide emissions per kilowatt-hour generated.

Though Lucky Power plans to rely on lignite mined from Thar (with some exports for backup), the plant itself is situated 276 miles (445 kilometers) away in the outskirts of densely populated Karachi. That’s a significant boon to Qasim. “On top of being designed for local Pakistani Thar coal, the project’s location ensures easy connectivity to the national grid and very low transmission and distribution losses in supplying affordable power to the major load center of the city of Karachi,” Parneix says.

All of this further augments GE Power’s work to help Pakistan diversify its power grid. Last May, the company achieved commercial operation for two HA gas turbines for the Bhikki combined-cycle plant in Lahore to power up to 2.4 million homes. GE’s HA gas turbines are planned for operation at two other power plants in Pakistan: Balloki, near Chunian, and Haveli Bahadur Shah, in Jhang. The Haveli Bahadur Shah plant alone is expected to add the electricity capacity needed for another 2.5 million homes. GE also worked with Hawa Energy to launch a 50-megawatt wind farm along the Gharo-Keti Bandar wind corridor in Jhimpir. So far, a quarter of Pakistan’s electricity flows through fuel-agnostic GE-built technologies, supporting Pakistan’s fuel-diversification power-generation strategy.

If things go as planned at Qasim, Thar-mined lignite will get to play a starring role in this story of “How Pakistan Got Its Electric Groove On.”

-

Comment by Riaz Haq on August 27, 2022 at 12:02pm

-

The National Transmission and Dispatch Company (NTDC) connected the fourth 330MWs mine-mouth power plant built under China-Pakistan Economic Corridor (CPEC) initiative at Thar coal Block II with the national grid.

https://pakobserver.net/ntdc-connects-330mws-thal-nova-plant-with-n...

“We successfully provided back feed supply/seller’s interconnection facility for Thal Nova power plant through 500kV Thal Nova-Matiari transmission line,” NTDC said according to a report published by Gwadar Pro on Friday. The back feed supply energized the power plant for testing its electrical equipment, the statement added. After completion of the testing, the power plant will start contributing cheaper electricity to the national grid, NTDC said.

-

Comment by Riaz Haq on December 27, 2022 at 10:26am

-

Green investment on rise, Pakistan to get 30 % renewable energy - Pakistan Observer

https://pakobserver.net/green-investment-on-rise-pakistan-to-get-30...

Until now, renewable energy sources make up a very minor fraction of Pakistan’s overall power generation mix. According to a recent report of the National Electric Power Regulatovry Authority, the installed capacity for wind and solar accounts for roughly 4.2% (1,831 MW) and 1.4% (630 MW) of a total of 43,775 MW, respectively.

China is already the biggest investor in green energy in Pakistan. Currently, out of the $144 million in foreign investment in solar PV plants in Pakistan, $125 million is from China, accounting for nearly 87% of the total.

Thanks to Chinese investments, a few weeks ago Federal Power Minister Khurram Dastgir Khan inaugurated two new wind energy projects in Jhimpir, Thatta District, Sindh, with an aim to produce cheaper and clean electricity through indigenous energy sources. Wind projects in this region have been one of several renewable energy projects to have received Chinese investment in recent years. Around 90 kilometers from Karachi, Jhimpir is the heartland of the country’s largest ‘Wind corridor’, which has the potential to produce 11,000 megawatts (MW) of energy from green resources.

-

Comment by Riaz Haq on May 20, 2023 at 1:41pm

-

#Pakistan #Hydro #power: 1530MW #Tarbela 5th Extension Project to start power generation in 2025. It's financed by World Bank ($390 million) and Asian Infrastructure Investment Bank ($300 million). #RenewableEnergy #electricity https://www.nation.com.pk/20-May-2023/1530mw-tarbela-5th-extension-... via @the_nation

Tarbela 5th Extension Hydropower Project, having a cumulative generation capacity of 1530MW, will start power generation in 2025.

While briefing Chairman WAPDA Engr Lt Gen (r) Sajjad Ghani during his visit to Tarbela 5th Extension Hydropower Project, it was informed that electricity generation from the project would start in 2025. Masood Ahmed from World Bank also accompanied the chairman. GM Tarbela Dam Zakir Ateeq, PD Tarbela 5th Extension Hydropower Project and representatives of the consultants and the contractor, made detailed presentation on progress of the project. It was briefed that construction activities are underway on five sites. Recovery plan to match the completion schedule of the project was also discussed in detail during the briefing.

Earlier, the chairman witnessed construction work on various sites including intake, penstock and outlet, power house, tailrace culvert and switch yard. Member (Power) WAPDA Jamil Akhtar, GM (Power) Tarbela Nasrum Minallah, GM (HRD) Brig Hamid Raza (Retd) and GM (Security) Brig Muhammad Tufail (Retd) were also present on the occasion.

During his interaction with the project management, the chairman said that green, clean and affordable hydel electricity is all the more important to rationalise the tariff and stabilise the economy. This necessitates timely completion of hydropower projects, he added. The Chairman urged the project management to gear up their efforts and complete Tarbela 5th Extension Hydropower Project in accordance with the schedule.

WAPDA is constructing Tarbela 5th Extension Hydropower Project on Tunnel No. 5 of Tarbela Dam. World Bank and Asian Infrastructure Investment Bank (AIIB) are providing financial assistance for the project to the tune of $390 million and $300 million respectively. Cumulative generation capacity of the project stands at 1530MW with three generating units of 510MW each. The project will provide 1.347 billion units of environment friendly and low-cost hydel electricity to the national grid on the average every year. With completion of Tarbela 5th Extension Project, installed capacity at Tarbela Dam will increase from 4888 MW to 6418 MW. Chairman WAPDA also visited intake structure of Tarbela 4th Extension Hydel Power Station and discussed operation and maintenance (O&M) activities of the power station. Commissioned in 2018 with funding of the World Bank, the 1410 MW-Tarbela 4th Extension Hydel Power Station has so far provided 18.67 billion units of electricity to the national grid.

-

Comment by Riaz Haq on June 17, 2023 at 6:24pm

-

The Evolution of Pakistan’s Energy Market: A Comprehensive Overview

https://www.energyportal.eu/news/the-evolution-of-pakistans-energy-...

Pakistan’s energy market has come a long way since the country’s inception in 1947. At that time, the energy sector was primarily dependent on imported oil and coal, with limited domestic production. Over the years, the government has made concerted efforts to develop indigenous resources, such as natural gas, hydropower, and more recently, renewable energy. Today, Pakistan’s energy mix comprises a diverse array of sources, including oil, natural gas, coal, hydropower, nuclear, and renewables.

One of the key drivers of Pakistan’s energy market evolution has been the growing demand for electricity. With a rapidly expanding population and increasing urbanization, the country’s electricity consumption has surged over the past few decades. To meet this burgeoning demand, the government has pursued an aggressive capacity expansion program, focusing on both conventional and renewable energy sources. Consequently, Pakistan’s installed power generation capacity has witnessed a significant increase, from a mere 60 MW in 1947 to over 37,000 MW in 2021.

The liberalization of Pakistan’s energy market has also played a crucial role in its development. In the early 1990s, the government embarked on a series of reforms aimed at deregulating the power sector and encouraging private sector participation. These reforms included the establishment of an independent regulatory authority, the unbundling of state-owned utilities, and the introduction of competitive bidding for power projects. As a result, the private sector now accounts for a substantial share of Pakistan’s power generation capacity, with several local and international companies operating in the market.

Foreign investment has been another critical factor in the evolution of Pakistan’s energy market. Over the years, the country has attracted significant investment in various energy projects, particularly in the power generation and oil and gas exploration sectors. Notably, the China-Pakistan Economic Corridor (CPEC), a flagship initiative under China’s Belt and Road Initiative, has emerged as a game-changer for Pakistan’s energy landscape. Under CPEC, several energy projects, including coal-fired power plants, hydropower projects, and transmission lines, have been completed or are under construction, significantly boosting Pakistan’s energy infrastructure.

Despite these achievements, Pakistan’s energy market continues to face several challenges. One of the most pressing issues is the affordability of electricity, as high tariffs and circular debt have put a strain on consumers and the national exchequer. Additionally, the country’s heavy reliance on imported fossil fuels has raised concerns about energy security and vulnerability to global price fluctuations.

Moreover, the environmental impact of Pakistan’s energy choices cannot be ignored. The country’s growing dependence on coal, particularly under CPEC, has raised alarm bells among environmentalists and climate change experts. With Pakistan being one of the most vulnerable countries to climate change, there is an urgent need to shift towards cleaner and more sustainable energy sources.

In recent years, the government has taken several steps to address these challenges. For instance, it has introduced policies to promote renewable energy, such as solar and wind, and set ambitious targets for their share in the energy mix. Furthermore, efforts are being made to improve energy efficiency and reduce transmission and distribution losses, which would help lower electricity costs and enhance system reliability.

In conclusion, the evolution of Pakistan’s energy market has been a fascinating tale of progress, diversification, and resilience. While the country has made significant strides in developing its energy resources and infrastructure, the journey is far from over.

Twitter Feed

Live Traffic Feed

Sponsored Links

South Asia Investor Review

Investor Information Blog

Haq's Musings

Riaz Haq's Current Affairs Blog

Please Bookmark This Page!

Blog Posts

Indian Military Begins to Accept Its Losses in "Operation Sindoor" Against Pakistan

The Indian military leadership is finally beginning to slowly accept its losses in its unprovoked attack on Pakistan that it called "Operation Sindoor". It began with the May 31 Bloomberg interview of the Indian Chief of Defense Staff General Anil Chauhan in Singapore where he admitted losing Indian fighter aircraft to Pakistan in an aerial battle on May 7, 2025. General Chauhan further revealed that the Indian Air Force was grounded for two days after this loss. …

ContinuePosted by Riaz Haq on July 5, 2025 at 10:30am

Trump Administration Seeks Pakistan's Help For Promoting “Durable Peace Between Israel and Iran”

US Secretary of State Marco Rubio called Pakistan Prime Minister Shehbaz Sharif to discuss promoting “a durable peace between Israel and Iran,” the State Department said in a statement, according to Reuters. Both leaders "agreed to continue working together to strengthen Pakistan-US relations, particularly to increase trade", said a statement released by the Pakistan government.…

ContinuePosted by Riaz Haq on June 27, 2025 at 8:30pm — 4 Comments

© 2025 Created by Riaz Haq.

Powered by

![]()

You need to be a member of PakAlumni Worldwide: The Global Social Network to add comments!

Join PakAlumni Worldwide: The Global Social Network