PakAlumni Worldwide: The Global Social Network

The Global Social Network

Pakistan Economy "Not in a Good Place"? Atif Mian's Gloom Justified?

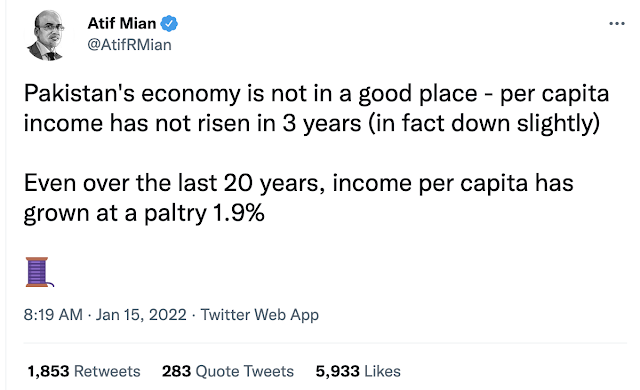

Pakistani-American economist Atif Mian has recently analyzed Pakistan's economy in a series of tweets. He has said "Pakistan's economy is not in a good place", adding that the nation's "per capita income has not risen in 3 years (in fact down slightly)". He has particularly mentioned the country's "exaggerated external demand driven by its rentier economy", "flawed energy policy" and "a broken economic decision system" among the main causes for poor economic performance. Is Atif Mian's diagnosis correct? Is the official reported data Atif Mian using accurate? What is the current PTI government doing or not doing to correct the problems identified by Mr. Mian? Let's try and assess the situation.

|

| Economist Atif Mian's Tweet on Pakistan Economy |

Per Capita Income:

Pakistan's officially reported GDP and per capita incomes are grossly understated. These are based on the last economic census that was done from April 2003 to December 2003 and published in 2005. The last agriculture census was in 2010, and livestock census in 2006, according to Dr. Ishrat Husain, former governor of The State Bank of Pakistan. The country's economy has changed significantly since then, adding several new economic activities while others have become less important. For example, the Quantum Index of Large Scale Manufacturing (QIM) with 2005-06 base year gives a weight to textiles of 20.9% (Yarn 13.7 and cloth 7.2). But the textile industry has moved up to higher value added products as reflected in its exports. The value added textiles (non-yarn and non-cloth) now make almost 80% of the total textile exports. These changes are not reflected in current GDP calculations.

In its 2014 annual report, the State Bank of Pakistan talked about a number of new sectors that are either under-reported or not covered at all: "In terms of LSM growth, a number of sectors that are showing strong performance; (for example, fast moving consumer goods (FMCG) sector; plastic products; buses and trucks; and even textiles), are either under reported, or not even covered. The omission of such important sectors from official data coverage, probably explains the apparent disconnect between overall economic activity in the country and the hard numbers in LSM."

Bangladesh just rebased its GDP in 2020-21 to 2015-16. This has boosted its per capita income by double digits for every year since 2015-16. Bangladesh's per capita income for the 2015-16 fiscal year has now gone up to $1,737 from $1,465 in the old calculation. For the 2019-2020 fiscal, the per capita income has gone up to $2,335 from $2,024. The new GDP estimate covers 21 sectors, up from 15 sectors previously. India last rebased its GDP in 2015, a change that bumped up its per capita GDP by double digits. Nigeria's last rebasing in 2012 increased the size of its economy (GDP) by nearly 90%. Pakistan's current base year is 2005-6. Rebasing which is now long overdue will almost certainly increase Pakistan's per capita income by double digits.

In this age of big data, it is important for Pakistan to ensure that its bureaucracy at Pakistan Bureau of Statistics (PBS) keeps the national economic data as current as possible. PBS should release the results of the Census of Manufacturing Industries CMI 2015-16 and the finance ministry should rebase Pakistan's economy to year 2015-16 to better reflect the current economic realities. This data is extremely important for businesses, investors, lenders and policymakers.

Energy Mix:

|

| Pakistan Power Generation Fuel Mix. Source: Third Pole |

Hydroelectric dams contributed 37,689 GWH of electricity or 27.6% of the total power generated, making hydropower the biggest contributor to power generated in the country. It is followed by coal (20%), LNG (19%) and nuclear (11.4%).

|

| Cost Per Unit of Electricity in Pakistan. Source: Arif Habib |

Nuclear offers the lowest cost of fuel for electricity (one rupee per KWH) while furnace oil is the most expensive (Rs. 22.2 per KWH).

|

| Pakistan Exports Trend 2011-21. Courtesy of Ali Khizer |

|

| Pakistan Textile Exports Trend 2011-21. Courtesy of Ali Khizer |

|

|

|

|

| Pakistan's Current Account Balance vs International Oil Prices. Sou... |

Recent history shows that Pakistan's current account deficits vary with international oil prices. Pakistan's trade deficits balloon with rising imported energy prices. One of the keys to managing external account balances lies in reducing the country's dependence on foreign oil and gas.

Related Links:

Haq's Musings

South Asia Investor Review

Pakistan Among World's Largest Food Producers

Food in Pakistan 2nd Cheapest in the World

Indian Economy Grew Just 0.2% Annually in Last Two Years

Pakistan to Become World's 6th Largest Cement Producer by 2030

Has Bangladesh Surged Past India and Pakistan in Per Capita Income?

Pakistan's Computer Services Exports Jump 26% Amid COVID19 Lockdown

Coronavirus, Lives and Livelihoods in Pakistan

Vast Majority of Pakistanis Support Imran Khan's Handling of Covid1...

Pakistani-American Woman Featured in Netflix Documentary "Pandemic"

Incomes of Poorest Pakistanis Growing Faster Than Their Richest Cou...

Can Pakistan Effectively Respond to Coronavirus Outbreak?

How Grim is Pakistan's Social Sector Progress?

Double Digit Growth in Pakistan's Energy Consumption Confirms Econo...

Trump Picks Muslim-American to Lead Vaccine Effort

COVID Lockdown Decimates India's Middle Class

Pakistan to be World's 7th Largest Consumer Market by 2030

Pakistan's Balance of Payments Crisis

How Has India Built Large Forex Reserves Despite Perennial Trade De...

Conspiracy Theories About Pakistan Elections"

PTI Triumphs Over Corrupt Dynastic Political Parties

Strikingly Similar Narratives of Donald Trump and Nawaz Sharif

Nawaz Sharif's Report Card

Riaz Haq's Youtube Channel

-

Comment by Riaz Haq on February 17, 2022 at 7:34am

-

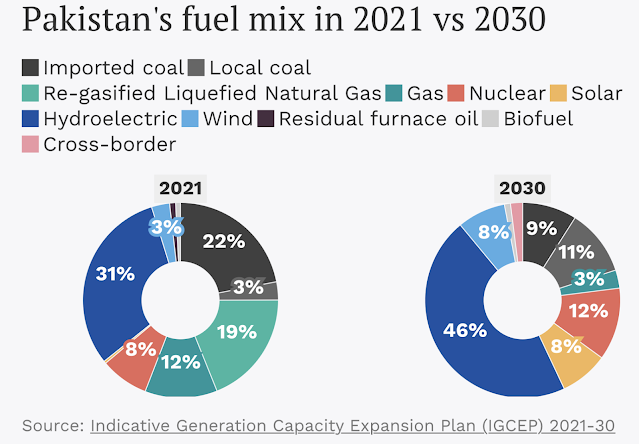

The landmark IGCEP document that covers a planning period of 10 years would be revised every year. It would act as a primary document for adding new capacity for power generation to meet future demand “in a scientific and systematic manner thus avoiding the boom and bust cycle which we have experienced in the past”, a statement said on Friday.

https://www.thenews.com.pk/print/895082-nepra-approves-igcep-2021-3...

According to the IGCEP, the energy mix of the country which was currently highly skewed towards imported fuels including coal, furnace oil and RLNG, would be substituted with indigenous resources including hydel, local coal, bagasse, wind and solar on least cost basis.The use of furnace oil would be reduced to 2 percent only from the current usage of 19 percent. Similarly, the use of RLNG and imported coal would be decreased to 11 percent and 8 percent from their current usage of 17 percent and 11 percent, respectively.

At the same time, the document envisions massive increase in the contribution of hydropower and other renewable energy resources, including bagasse, wind and solar.

The contribution of hydel, wind and solar, which currently stands at 28 percent, 4 percent and 1 percent, respectively would be increased to 39 percent, 8 percent and 13 percent, thereby increasing the total share of RE to the tune of more than 60 percent.

It is pertinent to mention that on the recommendations of NEPRA, Council of Common Interest (CCI) has approved inclusion of hydro in the RE category, which has resulted in immediate increase in the foot print of RE of Pakistan to 34 percent.

The power regulatory authority feels extremely satisfied that proposed IGCEP was based on exploration of indigenous and RE resources for generation of low cost environment-friendly electricity.

The authority appreciates the efforts of the young engineers of the planning department of NTDC which developed the IGCEP using indigenous capability.

Further, NEPRA recognises the efforts of all other stakeholders, especially the energy departments of the provinces and Power Division of Ministry of Energy which have provided their very useful input in preparing this IGCEP and improving the same.

The authority also recognised and congratulated CCI for approving the initial assumptions for this IGCEP which paved the way for its speedy approval by the regulator.

-

Comment by Riaz Haq on February 17, 2022 at 7:36am

-

In a major development for the power sector, the Senate passed on Thursday the Weighted Average Cost of Gas (WACOG) bill.

The development was announced by Federal Minister for Energy Hammad Azhar who said the bill is a "historic reform", which will ensure Pakistan’s energy security.

“WACOG bill has been passed today by Senate as well. It is a historic and long-pending reform that will ensure the energy security of Pakistan,” said Azhar in a tweet.

https://www.brecorder.com/news/40155128

The federal minister was of the view that the development would allow the government to embark upon the reform of the “gas pricing structure, remove anomalies and enhance supplies of imported gas”.

Azhar said that the reform is as significant as the approval a couple of months ago of Indicative Generation Capacity Expansion Plan (IGCEP) model for power purchase.

“Both historic reforms in power and petroleum sector have been carried out by PTI govt in the last six months,” he added.

-

Comment by Riaz Haq on March 12, 2022 at 12:37pm

-

What is the PPP of Pakistan?

The economy of Pakistan is the 18th largest in terms of purchasing power parity (PPP), and 43rd largest in terms of nominal gross domestic product.

...

Economy of Pakistan.

Statistics

Population 207.68 million (5th) (2017 national census)

GDP $347 billion (nominal; 2021). $1.5 trillion (PPP; Jun 2021)

-

Comment by Riaz Haq on March 19, 2022 at 9:14am

-

Pakistan creating #export miracles under #imrankhanPTI. #Pakistan`s monthly exports soared by 51.23% in Feb 2022 compared to February 2021. Pakistan`s #exports witnessed an increase of 32.77% during the first 8 months of the current fiscal year from the same period last year.

http://en.ce.cn/Insight/202203/19/t20220319_37417208.shtml

Editor's note: Cheng Xizhong, Visiting Professor at Southwest University of Political Science and Law,Special Commentator of China Economic Net, former Defense Attache in South Asian countries. The article reflects the author's opinions and not necessarily the views of Gwadar Pro.

Pakistani Prime Minister Imran Khan's series of policies to encourage exports are now producing great achievements. Over the past year, despite the severe pandemic and the downturn of the world economy, Pakistan's exports of various commodities and services have increased significantly, which reflects the wise and correct decision-making of the Imran Khan administration.

According to the latest report of the Pakistan Bureau of Statistics (PBS), Pakistan`s exports witnessed an increase of 32.77% during the first eight months of the current fiscal year as compared to the corresponding period of the last fiscal year.

Among various export commodities and services, textile exports rose sharply by 26.08% during the first eight months of the current fiscal year as compared to the corresponding period of the last fiscal year. The exports of information technology (IT) services shot up by 32.63% during the first seven months of the current fiscal year as compared to the corresponding period of the last fiscal year, earning $1,486.89 million.

It was another miracle that last month, Pakistan`s exports soared by 51.23% as compared to February 2021.

In my point of view, in addition to the export stimulus policies, these amazing achievements are closely related to the Imran Khan administration's correct macroscopic equilibrium between pandemic prevention and control and economic development, export-oriented industry development, and continuous successful expansion of China-Pakistan Economic Corridor (CPEC) and Special Economic Zones (SEZs).

I have noted that in terms of specific measures, the Pakistani government has launched drastic reforms with the Asaan Karobar Programme as a historic and nationwide reform drive to improve the ease of doing business in Pakistan. In recent years, three rounds of reforms have been successively introduced. Around 167 reform measures have been taken up with federal and provincial departments, of which 115 reform measures have already been implemented involving 75 departments, benefitting more than 30 business sectors.

In order to constantly improve the business environment for expanding imports, the Pakistani Ministry of Commerce launched an online portal aimed at identifying and then removing regulatory obstacles and problems through active involvement of private sectors and business associations. The State Bank of Pakistan, Securities and Exchange Commission of Pakistan, and Federal Board of Revenue all coordinated their efforts in ensuring a business-friendly environment in the country.

I believe that the sustained and substantial increase in exports will enhance Pakistan's financial capacity for further promoting industrialization and modernization and improving people's livelihood.

-

Comment by Riaz Haq on March 20, 2022 at 11:58am

-

Arif Habib Limited

@ArifHabibLtd

Cost of Power Generation down by 26.9% MoM during Feb’22Feb’22: PKR 8.94/KWh, +89.6% YoY | -26.9% MoM

8MFY22: PKR 7.79/KWh, +77.7% YoYhttps://twitter.com/ArifHabibLtd/status/1505560053415219206?s=20&am...

-

Comment by Riaz Haq on March 22, 2022 at 9:23am

-

#China, #Pakistan agree to enhance pragmatic ties in #agriculture, #economy and #trade, #finance and information #technology. Joint statement by #Chinese FM Wang Yi & Pak FM Shah Mahmood Qureshi in #Islamabad. #OICInPakistan #OIC #CPEC https://www.devdiscourse.com/article/international/1972202-china-pa...

During the meeting ahead of the Organization of Islamic Cooperation (OIC) on Tuesday, Wang said that China is willing to work with Pakistan to further synergize their development strategies, conduct systematic exchanges on governance experience and improve long-term cooperation plans. Noting that the Pakistan-China relations are at their best in history, Qureshi described that Pakistani Prime Minister Imran Khan's recent visit to China was very successful, and the leaders of the two countries have reached a large number of important consensus, Xinhua News Agency reported.

The Pakistan-China friendship is the cornerstone of Pakistan's foreign policy, he said, adding that as all-weather strategic partners, Pakistan and China have stood together through thick and thin, helped and supported each other, as well as stood firmly together at critical moments. The Pakistani side stands ready to work with China to implement the consensus reached between the leaders of the two countries, and expand practical cooperation in various fields including agriculture, economy and trade, finance and information technology, Qureshi said while calling for increased investment from China to help push Pakistan's industrialization process, Chinese news agency said.

It further reported that Wang said that the Pakistan-China All-Weather Strategic Cooperative Partnership is unique and time-tested, and the two countries have become good neighbours, good friends, good partners and good brothers who trust each other. The traditional friendship between China and Pakistan is rock-solid, which is a precious treasure for both sides, he added. China hopes that Pakistan will get more deeply involved in China's new development landscape with a further convergence of interests, Wang said.

China is willing to expand imports from Pakistan and support Chinese enterprises in investing in Pakistan, so as to help Pakistan enhance its capacity of independent development. Qureshi welcomed Wang who had come over to attend the 48th session of the Council of Foreign Ministers of the Organization of Islamic Cooperation (OIC), saying that the first time participation by a Chinese foreign minister in the meeting is of historical significance, which shows China's support for Pakistan and that China attaches great importance to Islamic countries.

As an OIC founding member, Pakistan is willing to push the OIC to deepen its friendly ties with China, he said, according to Xinhua News Agency. Wang arrived in the Pakistani capital on Monday to attend the 48th session of the Council of Foreign Ministers of the Organization of Islamic Cooperation. (ANI)

-

Comment by Riaz Haq on March 24, 2022 at 7:05pm

-

#German Deutsche Bank: “Pakistan will be in good shape” longer term, partly on rising exports, and that many multinational firms are bullish on the country and a few rank Pakistan among their top five destinations" #Pakistan #economy #imrankhanPTI #FDI https://www.bloomberg.com/news/articles/2022-03-24/deutsche-bank-sa...

Pakistan’s currency could be weakened as the surge in energy and commodities prices deepens the nation’s current account deficit, according to Deutsche Bank AG’s country head, referring to the broadest measure of trade.

“That’s a key concern for the economy and for the business community,” the bank’s chief country officer, Syed Kamran Zaidi, said in an interview. “That is obviously something which the banks are also cautious about.”

The South Asian nation, which imports most of its fuel needs, saw its energy bill rise to $13 billion in the first eight months of the year that started in July, more than double the same period of the last fiscal, according to government data. Costs could increase further as oil prices have since surged above $100 a barrel amid supply concerns following Russia’s invasion of Ukraine.

A weaker rupee may be among the factors that pressure the central bank to raise borrowing costs, he added, estimating the benchmark target rate to increase between 50 and 100 basis points in the next few meetings, after being left unchanged for the previous two.

“The market has already incorporated this change as can be seen by secondary market yields of Treasury Bills and Pakistan Investment Bonds” that reflect short- and long-tenor instruments, said Zaidi.

Pakistan’s short-term bond yields have increased by at least 150 basis points in the past month, according to central bank data. Meanwhile, Pakistan’s rupee slipped for a seventh day to a record low 181.73 per dollar on Tuesday. Zaidi declined to share a forecast for the rupee.

The current account last month was a $545 million deficit, narrower than the $2.5 billion record shortfall in January, but still more than 16-times larger than the same month last year, according to central bank data.

The Frankfurt-based firm, which has been in Pakistan for 60 years, has described itself as one of the largest custodian businesses in the country and facilitates more than 40% of onshore institutional investment flows. It only offers corporate and not consumer banking in Pakistan. It has also launched a new foreign exchange trading platform for corporate clients in Pakistan.

Zaidi added that “Pakistan will be in good shape” longer term, partly on rising exports, and that many multinational firms are bullish on the country and a few rank Pakistan among their top five destinations. At least two of those companies are planning new factories in Pakistan, he said, declining to provide details as the information is private.

-

Comment by Riaz Haq on March 28, 2022 at 12:56pm

-

Federal Minister for Industries and Production Makhdum Khusro Bakhtyar said LSM growth grew by 8.2 percent in February 2022, mean while, it posted growth of 7.6 percent during July-Jan FY22. He added that all major industries including automobile and fertilizer industry had showed remarkable growth in this duration, said a statement issued here on Saturday.

https://dailytimes.com.pk/904514/lsm-growth-up-8-2pc-in-feb-2022-kh...

The Minister noted that growth of LSM is imperative to enhance manufacturing base and job creation in the country.

He said recently Prime Minister of Pakistan Imran Khan announced Industrial Promotion Package which would not only revitalize industrialization in the country but also enhance our manufacturing sector. According to PBS data reported on Friday, the industry output increased by 8.2 percent during the month of January 2022 compared to the growth of January 2021 on year on year basis.

The major sectors that showed positive growth during July-January (2021-22) included textile (2.9pc), food (3.4pc), beverages (2.5pc), tobacco (21.9pc), wearing apparel (18.3pc), leather products (4.5pc), wood products (172.2pc), paper and board (8.2pc), coke and petroleum products (0.5pc), chemicals (5.4), Chemical products (15.5pc), automobiles (63.5pc), iron and steel products (17.52pc), furniture (553.pc),automobiles (63.5pc) and other manufacturing (22.2pc).

---------

LSM growth jumps 7.6 pc in 7 months

https://www.app.com.pk/business/lsm-growth-jumps-7-6-pc-in-7-months/

ISLAMABAD, Mar 18 (APP): Large Scale Manufacturing Industries (LSMI) production grew by 7.6 percent during the first seven months of the current fiscal year as compared to the corresponding period of last year, Pakistan Bureau of Statistics (PBS) reported Friday.

The LSMI Quantum Index Number (QIM) was recorded at 120 points during July-January (2021-22) against 111.5 points during July-January (2020-21), showing growth of 7.6 percent, according to latest PBS data.

The highest increase of 9.7 percent was witnessed in the indices monitored by the Provincial Board of Statistics (BOS), followed by 6.9 percent increase in indices monitored by Ministry of Industries and 0.5 percent increase in the products monitored by the Oil Companies Advisory Committee (OCAC).

On year-on-year basis (YoY), the industry rose by 8.2 percent during the month of January 2022 compared to the growth of January 2021, according to PBS latest data.

The major sectors that showed positive growth during July-January (2021-22) included textile (2.9%), food (3.4%), beverages (2.5%), tobacco (21.9%), wearing apparel (18.3%), leather products (4.5%), wood products (172.2%), paper and board (8.2%), coke and petroleum products (0.5%), chemicals (5.4), Chemical products (15.5%), automobiles (63.5%), iron and steel products (17.52%), furniture (553.%),automobiles (63.5%) and other manufacturing (22.2%).

The commodities that witnessed negative growth included pharmaceuticals (3.5%), rubber products (25.5%) and electrical equipment (1.2%).

It is pertinent to mention here that the provisional QIM is being computed on the basis of the latest production data received from sources, including OCAC, Ministry of Industries and Production (MoIP), and PBS.

-

Comment by Riaz Haq on April 17, 2022 at 4:44pm

-

Pakistan’s Political Crisis Has Been an Energy Crisis, Too

Successive governments have failed to back renewables, cutting the country off from the cheapest source of indigenous energy. The new prime minister could change all that.

https://www.bloomberg.com/opinion/articles/2022-04-17/pakistan-s-po...

The political crisis that pitched Pakistan’s prime minister Imran Khan from office wasn’t just about the failure of his anti-corruption agenda and mismanagement of an economy where inflation running at nearly 13% has driven months of opposition protests. It’s also, as with so many of Pakistan’s political crises, about energy and exchange rates.

For decades, heavy dependence on imported energy has constrained growth. To break out of its chronic pattern of stagnation, Pakistan needs more power for its industrial, household and transport sectors. Whenever that has happened in the past, however, a rising bill for imported fossil fuels has prompted one of its periodic balance-of-payments crises. The International Monetary Fund bailout that’s widely expected within months would be Pakistan’s 19th since the early 1970s.

-

Comment by Riaz Haq on April 18, 2022 at 3:50pm

-

Soaring prices of liquefied natural gas (LNG) and coal on the international markets have left Pakistan, the world’s fifth-most populous nation, with having to cut electricity supply to households and industry as the country in a deep political and economic crisis cannot afford to buy more of the expensive fossil fuels.

https://oilprice.com/Latest-Energy-News/World-News/High-Energy-Pric...

Pakistan—whose population is the fifth largest in the world after China, India, the United States, and Indonesia—started to feel the pinch of high energy prices as early as last autumn, when it was struggling to procure imported LNG for its power plants. Pakistan’s predicament came amid a global natural gas crunch and surging prices for the fuel in Europe and Asia, months before prices shot up again as a consequence of the Russian invasion of Ukraine.

As global energy prices remain elevated and highly volatile with the Russian war in Ukraine, Pakistan—dependent on imports with relatively poor state finances—is especially hard hit.

The energy crisis, and the political crisis with last week’s ousting of Imran Khan as prime minister of the country, which has nuclear weapons, have combined to throw the Pakistani state budget and finances into disarray.

Now Pakistan cannot afford to buy more LNG and coal, on which its power plants rely to generate electricity, Bloomberg reported on Monday.

In the middle of last week, on April 13, a total of 7,140 megawatts (MW) capacity plants were shut either due to fuel shortage or technical faults, Miftah Ismail tweeted. Ismail has been picked to serve as a finance minister by new Prime Minister-designate Shehbaz Sharif.

According to Bilal Kayani, Assistant Secretary General at the Pakistani party PMLN, foreign exchange reserves at the State Bank of Pakistan (SBP) amounted to just $10.8 billion on 8 April, a day before Imran Khan was ousted through the vote of no confidence. That’s less than 2 months of import cover. Reserves declined rapidly by $5.4 billion in just 5 weeks, Kayani said.

Twitter Feed

Live Traffic Feed

Sponsored Links

South Asia Investor Review

Investor Information Blog

Haq's Musings

Riaz Haq's Current Affairs Blog

Please Bookmark This Page!

Blog Posts

Pakistani Student Enrollment in US Universities Hits All Time High

Pakistani student enrollment in America's institutions of higher learning rose 16% last year, outpacing the record 12% growth in the number of international students hosted by the country. This puts Pakistan among eight sources in the top 20 countries with the largest increases in US enrollment. India saw the biggest increase at 35%, followed by Ghana 32%, Bangladesh and…

ContinuePosted by Riaz Haq on April 1, 2024 at 5:00pm

Agriculture, Caste, Religion and Happiness in South Asia

Pakistan's agriculture sector GDP grew at a rate of 5.2% in the October-December 2023 quarter, according to the government figures. This is a rare bright spot in the overall national economy that showed just 1% growth during the quarter. Strong performance of the farm sector gives the much needed boost for about …

ContinuePosted by Riaz Haq on March 29, 2024 at 8:00pm

© 2024 Created by Riaz Haq.

Powered by

![]()

You need to be a member of PakAlumni Worldwide: The Global Social Network to add comments!

Join PakAlumni Worldwide: The Global Social Network