PakAlumni Worldwide: The Global Social Network

The Global Social Network

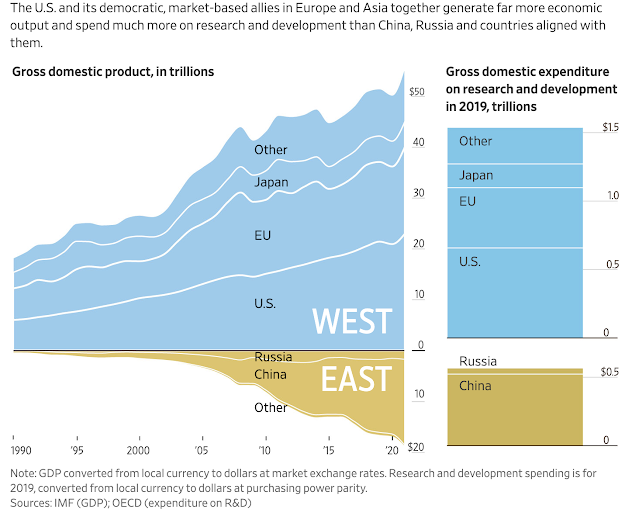

The West's Technological Edge in Geopolitical Competition

The US and its allies enjoy a significant technological advantage over China and Russia. The Chinese are working hard to catch up but the West is not standing still. It is making huge investments in research and development to maintain this edge as it becomes increasingly clear that the outcome of the ongoing international geopolitical competition will largely be determined by technology.

|

| East-West Comparison of GDP, R&D. Source: IMF (GDP), OECD (R&am... |

In 2019, the United States and its allies invested $1.5 trillion in research and development, far outpacing the combined Chinese and Russian R&D investment of half a trillion USD. This gap will likely narrow if the East's GDP continues to grow faster than the West's, allowing for higher investment in technology.

After the Russian invasion of Ukraine, the US, EU, Japan, South Korea and Taiwan have made it clear that the Western allies can and will use technology sanctions to control the behavior of China and Russia.

Taiwan Semiconductor Manufacturing Company (TSMC) will no longer fabricate computer chips for Russia, according to media reports. The ban will particularly affect Russia's Elbrus and Baikal processors, unless China agrees to step in to manufacture these chips, and risk additional US sanctions itself. Both Russian processors use mature 28 nm technology. The world's most advanced TSMC fabrication technology today is 5 nanometers. The best US-based Intel can do today is 7nm technology. China's SMIC (Semiconductor Manufacturing International Corporation) has the capability to produce chips using 14 nm technology. Semiconductor chips form the core of all modern systems from automobiles to airplanes to smartphones, computers, home appliances, toys, telecommunications and advanced weapons systems.

There is no question that the current western technology sanctions can seriously squeeze Russia. However, overusing such sanctions could backfire in the long run if the US rivals, particularly China and Russia, decide to invest billions of dollars to build their own capacity. This would seriously erode western technology domination and result in major market share losses for the US tech companies, particularly those in Silicon Valley.

Related Links:

Pakistani-American Banker Heads SWIFT, the World's Largest Interban...

Pakistani-Ukrainian Billionaire Zahoor Sees "Ukraine as Russia's Af...

Ukraine Resists Russia Alone: A Tale of West's Broken Promises

Ukraine's Lesson For Pakistan: Never Give Up Nuclear Weapons

Has Intel's Indian Techie Risked US Lead in Semiconductor Technology?

-

Comment by Riaz Haq on July 9, 2023 at 7:29am

-

The future of war: A special report

https://www.economist.com/weeklyedition/2023-07-08

Big wars are tragedies for the people and countries that fight them. They also transform how the world prepares for conflict, with momentous consequences for global security. Britain, France and Germany sent observers to the American civil war to study battles like Gettysburg. The tank duels of the Yom Kippur war in 1973 accelerated the shift of America’s army from the force that lost in Vietnam to the one that thumped Iraq in 1991. That campaign, in turn, led China’s leaders to rebuild the People’s Liberation Army into the formidable force it is today.

The war in Ukraine is the largest in Europe since 1945. It will shape the understanding of combat for decades to come. It has shattered any illusions that modern conflict might be limited to counterinsurgency campaigns or evolve towards low-casualty struggles in cyberspace. Instead it points to a new kind of high-intensity war that combines cutting-edge tech with industrial-scale killing and munitions consumption, even as it draws in civilians, allies and private firms. You can be sure that autocratic regimes are studying how to get an edge in any coming conflict. Rather than recoiling from the death and destruction, liberal societies must recognise that wars between industrialised economies are an all-too-real prospect—and start to prepare.

As our special report explains, Ukraine’s killing fields hold three big lessons. The first is that the battlefield is becoming transparent. Forget binoculars or maps; think of all-seeing sensors on satellites and fleets of drones. Cheap and ubiquitous, they yield data for processing by ever-improving algorithms that can pick out needles from haystacks: the mobile signal of a Russian general, say, or the outline of a camouflaged tank. This information can then be relayed by satellites to the lowliest soldier at the front, or used to aim artillery and rockets with unprecedented precision and range.

This quality of hyper-transparency means that future wars will hinge on reconnaissance. The priorities will be to detect the enemy first, before they spot you; to blind their sensors, whether drones or satellites; and to disrupt their means of sending data across the battlefield, whether through cyber-attacks, electronic warfare or old-fashioned explosives. Troops will have to develop new ways of fighting, relying on mobility, dispersal, concealment and deception. Big armies that fail to invest in new technologies or to develop new doctrines will be overwhelmed by smaller ones that do.

Even in the age of artificial intelligence, the second lesson is that war may still involve an immense physical mass of hundreds of thousands of humans, and millions of machines and munitions. Casualties in Ukraine have been severe: the ability to see targets and hit them precisely sends the body-count soaring. To adapt, troops have shifted mountains of mud to dig trenches worthy of Verdun or Passchendaele. The consumption of munitions and equipment is staggering: Russia has fired 10m shells in a year. Ukraine loses 10,000 drones per month. It is asking its allies for old-school cluster munitions to help its counter-offensive.

Eventually, technology may change how this requirement for physical “mass” is met and maintained. On June 30th General Mark Milley, America’s most senior soldier, predicted that a third of advanced armed forces would be robotic in 10-15 years’ time: think of pilotless air forces and crewless tanks. Yet armies need to be able to fight in this decade as well as the next one. That means replenishing stockpiles to prepare for high attrition rates, creating the industrial capacity to manufacture hardware at far greater scale and ensuring that armies have reserves of manpower. A nato summit on July 11th and 12th will be a test of whether Western countries can continue to reinvigorate their alliance to these ends.

-

Comment by Riaz Haq on July 9, 2023 at 7:30am

-

The future of war: A special report

https://www.economist.com/weeklyedition/2023-07-08

The third lesson—one that also applied for much of the 20th century—is that the boundary of a big war is wide and indistinct. The West’s conflicts in Afghanistan and Iraq were fought by small professional armies and imposed a light burden on civilians at home (but often lots of misery on local people). In Ukraine civilians have been sucked into the war as victims—over 9,000 have died—but also participants: a provincial grandmother can help guide artillery fire through a smartphone app. And beyond the old defence-industrial complex, a new cohort of private firms has proved crucial. Ukraine’s battlefield software is hosted on big tech’s cloud servers abroad; Finnish firms provide targeting data and American ones satellite comms. A network of allies, with different levels of commitment, has helped supply Ukraine and enforce sanctions and an embargo on Russian trade.

New boundaries create fresh problems. The growing participation of civilians raises legal and ethical questions. Private companies located outside the physical conflict zone may be subject to virtual or armed attack. As new firms become involved, governments need to ensure that no company is a single point of failure.

No two wars are the same. A fight between India and China may take place on the rooftop of the world. A Sino-American clash over Taiwan would feature more air and naval power, long-range missiles and disruptions to trade. The mutual threat of nuclear use has probably acted to limit escalation in Ukraine: nato has not directly engaged a nuclear-armed enemy and Russia’s threats have been bluster so far. But in a fight over Taiwan, America and China would be tempted to attack each other in space, which could lead to nuclear escalation, especially if early-warning and command-and-control satellites were disabled.

Silicon Valley and the Somme

For liberal societies the temptation is to step back from the horrors of Ukraine, and from the vast cost and effort of modernising their armed forces. Yet they cannot assume that such a conflict, between large industrialised economies, will be a one-off event. An autocratic and unstable Russia may pose a threat to the West for decades to come. China’s rising military clout is a destabilising factor in Asia, and a global resurgence of autocracy could make conflicts more likely. Armies that do not learn the lessons of the new kind of industrial war on display in Ukraine risk losing to those that do. ■

-

Comment by Riaz Haq on September 5, 2023 at 4:43pm

-

A new Huawei phone has defeated US chip sanctions against China

https://qz.com/a-new-huawei-phone-has-defeated-us-chip-sanctions-ag...

The new Kirin 9000s chip in Huawei’s latest phone uses an advanced 7-nanometer processor fabricated in China by the country’s top chipmaker, Semiconductor Manufacturing International Corp. (SMIC), according to a teardown of the phone that TechInsights conducted for Bloomberg.

Huawei’s latest smartphone, the Mate 60 Pro, offers proof that China’s homegrown semiconductor industry is advancing despite the US ban on chips and chipmaking technology.

The new Kirin 9000s chip in Huawei’s latest phone uses an advanced 7-nanometer processor fabricated in China by the country’s top chipmaker, Semiconductor Manufacturing International Corp. (SMIC), according to a teardown of the phone that TechInsightsconducted for Bloomberg

A brief recent timeline of US chip sanctions against China

August 2022: The US Congress passes the CHIPS and Science Act, a law that approves subsidies and tax breaks to help jumpstart the production of advanced semiconductors on American soil.

September 2022: The Biden administration bans federally funded US tech firms from building advanced facilities in China for a decade.

October 2022: The US commerce department bars companies from supplying advanced chips and chipmaking equipment to China, calling it an effort to curb China’s ability to produce cutting-edge chips for weapons and other defense technology, rather than a bid to cripple the country’s consumer electronics industry.

November 2022: The US bans the approval of communications equipment from Chinese companies like Huawei Technologies and ZTE, claiming that they pose “an unacceptable risk” to the country’s national security.

May 2023: Beijing bans its “operators of critical information infrastructure” from doing business with Micron Tech, an Idaho-based chipmaker.

“In the AI garden, the seeds are the AI software frameworks—which China already has access to. The plants in the garden are the AI models in use, which again are already available to Chinese AI companies. Nvidia provides the best shovels and pruning shears to tend the garden, but not the only means to tend it. So it doesn’t make sense to try to build a high wall around it...[T]o over-regulate these chips creates the risk that the US could fumble away its technology leadership. Would you rather have Chinese AI customers continue to fuel Nvidia’s growth and success? Or would you rather they spend their yuan to fuel the growth and success of Chinese suppliers?”

—Patrick Moorhead, a tech analyst, writing in Forbes in July 2023

One big number: China’s hoard of Nvidia chips

$5 billion: The value of orders that China’s tech giants have placed with Nvidia for its A800 and A100 chips, to be delivered this year, according to an August report by the Financial Times. The biggest internet giants—Baidu, ByteDance, Tencent, and Alibaba—have placed orders totalling $1 billion to buy around 100,000 A800 processors. Given that the US is mulling new export controls, Chinese companies are rushing to hoard the best chips on the market to train their AI models and run their data centers.

-

Comment by Riaz Haq on December 3, 2023 at 10:29am

-

Arnaud Bertrand

@RnaudBertrand

Incredible, Gina Raimondo implores US industry to respect her sanctions because: "America leads the world in AI… America leads the world in advanced semiconductor design. That’s because of our private sector. No way are we going to let [China] catch up."

https://scmp.com/news/world/united-states-canada/article/3243657/us...

This is an incredible admission because the Biden administration's messaging - or shall I say propaganda - on their semiconductors sanctions has so far always been that it isn't to gain or maintain a competitive advantage over China, but solely to prevent China's military from accessing to certain technologies. See for instance what Janet Yellen said on exactly this: "[the sanctions are] tailored toward the specific national security objective of preventing the advancement of highly sensitive technologies that are critical to the next generation of military innovation and [are] not designed for us to gain a competitive economic advantage over any other country." (Src: https://washingtonpost.com/opinions/2023/11/06/china-relationship-g... )

Our Anthony Blinken: "One of the important things for me to do on this trip [to China] was to disabuse our Chinese hosts of the notion that we are seeking to economically contain them... However, what is clearly in our interest is making sure that certain specific technologies that China may be using to, for example: advance its very opaque nuclear weapons program, to build hypersonic missiles, to use technology that may have repressive purposes – it’s not in our interest to provide that technology to China. And I also made that very clear. So, the actions that we’re taking, that we’ve already taken, and as necessary that we’ll continue to take are narrowly focused, carefully tailored to advance and protect our national security. And I think that’s a very important distinction." (src: https://china.usembassy-china.org.cn/secretary-of-state-antony-j-bl... )

Pretty much everyone knew this was 100% bullshit and all done for the purpose of America maintaining a competitive advantage in the technologies of the future, like AI. But now we have the Secretary of Commerce, who implemented these sanctions, say exactly that.

https://x.com/RnaudBertrand/status/1731126664661459367?s=20

-

Comment by Riaz Haq on June 12, 2024 at 8:40pm

-

Why America Is Losing the Tech War with China | The National Interest

by David P. Goldman Deputy Editor Asia Times

https://nationalinterest.org/blog/techland/why-america-losing-tech-...

After the Trump administration banned sales of high-end U.S. semiconductors to Huawei in 2020, Western media predicted that China’s 5G rollout would grind to a halt. The Nikkei Asian Review wrote, for example: “Huawei Technologies and ZTE, China’s two largest telecoms equipment providers, have slowed down their 5G base station installation in the country, the Nikkei Asian Review has learned, a sign that Washington’s escalating efforts to curb Beijing's tech ambitions are having an effect.”

On the contrary: the number of 5G base stations in China doubled in 2021 to 1.43 million, and rose to 2.31 million in 2022, out of a world total of 3 million. Huawei simply built the 5G base stations with mature chips (with a 28-nanometer gate width rather than the 7-nanometer chips banned by Washington). Energy consumption was higher than optimal, but the system worked. Without access to the newer chips, Huawei’s handset business, the world’s largest in the second quarter of 2020, shrank drastically, because 5G handsets need powerful, energy-efficient processors.

Now it appears that Huawei can design its own high-end chips and manufacture them in China. Chinese research firms report that Huawei will reenter the 5G handset market in the second half of 2023. Reuters reported on July 12 that, “Huawei should be able to procure 5G chips domestically using its own advances in semiconductor design tools along with chipmaking from Semiconductor Manufacturing International Co (SMIC), three third-party technology research firms covering China’s smartphone sector told Reuters.” Caixin Global Dailyreported in March that Huawei had co-developed Electronic Design Automation software with local firms for older 14-nanometer chips. It isn't clear whether SMIC can make enough 7-nanometer chips to meet Huawei's requirements, or whether the reported new 5G chips use another technology, for example, “stacking” two 14-nanometer chips in a “chiplet” to achieve 7-nanometer performance.

-

Comment by Riaz Haq on June 19, 2024 at 11:12am

-

America’s assassination attempt on Huawei is backfiring

The company is growing stronger—and less vulnerable

https://www.economist.com/briefing/2024/06/13/americas-assassinatio...

America’s assault continues. In May, for instance, regulators revoked a special permit allowing Intel and Qualcomm, two American tech groups, to sell Huawei chips for laptops. Yet Huawei has not just survived; it is thriving once again. In the first quarter of this year net profits surged by 564% year on year to 19.7bn yuan ($2.7bn). It has re-entered the handset business. Its telecoms-equipment sales are rising again. And it has achieved this in large part by replacing foreign technology in its wares with home-grown parts and programmes, making it much less vulnerable to American hostility in future. Having failed to kill Huawei, Uncle Sam’s attacks have only made it stronger.

Mr Ren, a former soldier, started Huawei in 1987 in his flat in Shenzhen, importing foreign telecoms gear to sell to Chinese customers. An engineer by training, he quickly started making his own equipment. As China’s telecoms market grew, so did Huawei. By 2020 it had become not only the world’s biggest smartphone maker, but also the leading provider of mobile-network gear, with a market share of 30%.

Mr Ren has never been short of ambition for Huawei. Its name is a contraction of the phrase “China has promise”. Its headquarters in Shenzhen are impossibly grand and imposing. A palatial meeting hall features ornamentation worthy of Versailles: marble columns, inlaid floors and oil paintings of bucolic scenes across the ceiling. In a nearby manufacturing city the company has built a European-style town around a lake, complete with life-size replicas of castles that serve as meeting rooms and libraries.

Mend of an empire

In retrospect, America’s blitz only briefly shook this empire. Huawei’s sales last year, of about $100bn, are twice those of Oracle, an American tech firm. It is half the size of Samsung, a South Korean phonemaker, but outspends it on research and development. In fact its r&d budget of $23bn in 2023 was exceeded only by America’s biggest tech firms: Alphabet (the parent of Google), Amazon, Apple and Microsoft (see chart 1). Last year’s profits, of about $12.3bn, put it on a par with Cisco Systems, an American communications group, and vastly exceed those of Ericsson and Nokia, its main rivals in the mobile-networks business. And whereas Ericsson and Nokia are laying off staff, Huawei’s headcount is growing. It now has 12,000 more workers than it did in 2021.

Huawei’s core business remains telecoms-network equipment, which brought in about half of its revenues last year. In recent years this division has also formed teams of engineers to take on consulting projects, helping to re-wire and so streamline all sorts of businesses, from ports to coal mines. These new initiatives have pitted it against Western rivals such as Cisco Systems, Siemens and Honeywell.

Bric-a-brac from the dead

The consumer division, which generates a third of sales, makes all manner of devices that can connect with 5g. It has begun releasing fancy smartphones again, but also makes watches, televisions and the systems that control many Chinese electric vehicles (evs). Revenue from consumer devices grew by about 17% in 2023, thanks mainly to the new smartphones.

A cloud-computing unit accounts for almost a tenth of revenues. Its sales grew by 22% last year. As Microsoft shrinks its operations in China, owing to American tech sanctions, Huawei is said to be scooping up its engineers. Another fast-growing unit focuses on energy, including ev charging networks and photovoltaic inverters, which turn the direct current produced by solar panels into the alternating sort that flows through the grid.

-

Comment by Riaz Haq on September 1, 2024 at 10:26pm

-

China's chip capabilities just 3 years behind TSMC, teardown shows

Analysis reveals limited impact of U.S. tech curbs on consumer products

By KOTARO HOSOKAWA, Nikkei staff writer

August 31, 2024 23:01 JST

https://asia.nikkei.com/Business/Tech/Semiconductors/China-s-chip-c...

TOKYO -- An analysis of China's current semiconductor technology revealed that the country is approaching a level three years behind industry leader Taiwan Semiconductor Manufacturing Co., showing the limitations of U.S. efforts to stem Beijing's development of cutting-edge chips.

Hiroharu Shimizu, CEO of Tokyo-based TechanaLye, a semiconductor research company that disassembles 100 electronic devices a year, told Nikkei about China's capabilities.

Shimizu showed semiconductor circuit diagrams for two application processors, the brains of a smartphone: one from Huawei Technologies' Pura 70 Pro, released in April, and one from a top-of-the-line Huawei smartphone from 2021.

The Kirin 9010 -- the newest phone's chip -- was designed by Huawei subsidiary HiSilicon and mass-produced by major Chinese contract chipmaker Semiconductor Manufacturing International Corp. (SMIC). The 2021 phone's Kirin 9000 chip was also designed by HiSilicon, but mass-produced by TSMC.

SMIC, which is subject to U.S. measures to suppress advanced chip technology, is capable of producing 7-nanometer chips. TSMC supplied 5-nm processors to Huawei for the 2021 phone.

Generally, the smaller the nanometer size, the higher the performance and the smaller the chip. However, SMIC's 7-nm mass-produced chip is 118.4 square millimeters, while TSMC's 5-nm chip is 107.8 sq. mm. The two chips have similar areas and performance levels.

Although a difference in yield still exists, SMIC's capabilities are approaching a level three years behind TSMC, based purely on performance of the chips that were shipped. HiSilicon's design capabilities have also improved, as shown by its ability to produce chips with comparable performance as TSMC's 5-nm products, despite their wider circuit width.

Huawei's Pura 70 Pro is equipped with a total of 37 semiconductors that support memory, sensors, cameras, power supply and display functions. Of these, 14 were from HiSilicon, 18 from other Chinese manufacturers and just five from foreign manufacturers, including South Korea's SK Hynix for DRAM and Germany's Bosch for motion sensors. Some 86% of the phone's chips were made in China.

"In effect, the only semiconductors subject to the U.S. regulations are cutting-edge server chips for artificial intelligence and other applications," Shimizu said. "As long as the chips do not pose a military threat, the U.S. is probably allowing their development."

Chinese players made 34.4% of global chipmaking equipment purchases in 2023, roughly double the figure for South Korea and Taiwan, according to industry group SEMI. The country is expanding its mass-production capabilities by focusing on equipment that is not targeted by export restrictions on cutting-edge technologies.

Given this trend, the fact that SMIC's 7-nm chips now rival TSMC's 5-nm chips in processing capability could have major implications for the industry. TSMC also faces growing hurdles to stay ahead of Chinese rivals technologically as miniaturizing circuits become increasingly difficult.

"The U.S. regulations so far have only slightly delayed Chinese innovation, while sparking efforts by the Chinese chip industry to boost domestic production," Shimizu said.

-

Comment by Riaz Haq on September 2, 2024 at 10:19am

-

Stronger Semiconductor Export Controls on China Will Likely Harm Allied Semiconductor Competitiveness | ITIF

https://itif.org/publications/2023/10/12/stronger-semiconductor-exp...

It’s finally clear to most in Washington that the United States faces a major competitor in China in defense, advanced technology industries, and other realms. There also appears to be a growing bipartisan consensus that the United States needs to limit China’s advancement. But that’s where the consensus breaks down. How to limit China’s relative advancement over the United States is a matter of controversy.

Many, including the Biden administration, have landed on export controls on semiconductors and advanced chip-making equipment as a critical weapon to limit China’s advancement, at least militarily. Toward that end, the administration released sweeping export controls designed to limit China’s capabilities in producing advanced semiconductors last October. And they are expected shortly to release updated regulations intended, in part, to tighten “holes” in the last round of rules. China hawks of both parties widely support these restrictions, and the administration is supposedly considering even tighter controls, in part after Huawei recently announced the production of an advanced 7nm chip for its new cell phone using legacy equipment.

It would be one thing if these controls could hamstring China’s production of chips. In that case, they would do less harm to allied-based semiconductor companies because other foreign companies would produce products with advanced chips. But the reality is that these export controls, particularly on semiconductors (rather than on truly choke-point semiconductor manufacturing equipment), will hurt U.S. and allied semiconductor firms. Not only do U.S. export controls limit U.S. chip sales (that’s why they are called export controls), but they will likely be met with a retaliatory response by the Chinese government that will hurt U.S. technology interests. On top of that, they accelerate the time by which China becomes self-sufficient, at least in a wide array of semiconductors. It’s time for the Biden administration to take a strategic pause and ensure that future export controls effectively hamper China but not damage Western firms.

Whether for political reasons or because they honestly believe it, the administration portrays semiconductor export controls not as commercial protectionism but as keeping China from gaining military advantage. Some semiconductors enable this advantage, but China’s military weapons are already sophisticated, and many of them use chips widely available in China. If it were clear that semiconductor export controls would really hamper Chinese military expansion, that would be one thing, but the administration has provided little evidence for this view. As the Rand Corporation wrote last year, the reality is that most weapons systems do not use the kinds of chips the administration seeks to control. The most advanced chips are for advanced computing, not for weapons systems (though there are certainly exceptions to this point, such as chips used in high-performance computers that perform roles such as modeling the impacts of nuclear detonations).

-

Comment by Riaz Haq on September 9, 2024 at 11:06am

-

The US won't tolerate China as peer competitor' – DW – 09/23/2020

https://www.dw.com/en/chinas-rise-and-conflict-with-us/a-55026173

John Mearsheimer sees international relations as a "nasty and dangerous business." His theory, "offensive realism," is based on the premise that states are the main actors in international politics and their ultimate goal is survival.

As part of the realist school of thought, Mearsheimer believes that the international system is anarchic, and that no state can know the intention of another with certainty. This uncertainty drives states to maximize their power and security and achieve dominance to preempt challenges from other states.

Becoming a global hegemon today is nearly impossible. And therefore, states rather seek to dominate as regional hegemons.

Mearsheimer concluded in 2001 that China's strategic goal was to become Asia's hegemon and that the United States would try to prevent that. His book, The Tragedy of Great Power Politics, predicted many things we see today in US-China relations.

Both countries consider the other as a primary threat. China has become a regional hegemon in Asia, and is building military capacity to back this up. Southeast and East Asian nations are spending more and more money on defense, and are under pressure to choose a side — either China or the US.

DW asked Mearsheimer about how this rivalry could develop further — and what that means for Asia and the world.

DW: Under President Xi Jinping, China's approach to projecting its power has become more aggressive. Will China confront the US in the near future?

John Mearsheimer: I think, from China's point of view, it's best not to confront the US in any serious way right now. China will be in a much better position to confront the US in 20 years.

But two factors are pushing China towards aggression. One, it is almost impossible for any country as it grows more powerful, not to become somewhat more aggressive in its foreign policy.

This is exactly what's happening with China. A lot of people like to blame it on Xi Jinping, but I don't think it's his personality or his interests that really matter here.

He inherited a China that's much more powerful than it was in the 1990s. And he can throw his weight around in ways that his predecessors could not.

The second factor is that China's neighbors and the US are pushing back. The US began to contain China regionally with the 2011 pivot to Asia. This created a spiral mechanism that is now in play: the Americans and their Asian allies are pushing back against China, and China is responding.

You mentioned the pivot to Asia. How serious was this engagement by the US? Many Southeast Asian countries feel they have been left to fend for themselves?

I think there's no question that, when former US Secretary of State Hillary Clinton announced the pivot to Asia in 2011, the US was just beginning to think about containing China. During the Barack Obama presidency, not much was done.

----

Some argue that the US cannot stop China from becoming a regional hegemon. It may be true in 40 years that China's power relative to the US means China cannot be stopped from becoming a regional hegemon.

But I doubt that it will be the final outcome. There's every reason to think that the US will be able to contain China for the foreseeable future.

Alliances and coalitions play an important role in international politics. How do you see Asia in this regard?

When you look at China's neighbors, most of them will ally with the US against China in a balancing coalition. There will be two alliance structures for sure, much like there were two alliance structures during the Cold War: NATO on one side, and the Warsaw Pact on the other.

Pakistan, North Korea, Cambodia, Laos and probably Myanmar will likely side with China. Japan, India, Singapore and Vietnam will be allied with the US.

-

Comment by Riaz Haq on February 22, 2025 at 8:45am

-

2024 Research Leaders: Leading academic institutions | Nature Index

https://www.nature.com/nature-index/research-leaders/2024/instituti...

https://www.tiktok.com/t/ZT2PGR4Yo/

Position Institution Share 2022 Share 2023 Count 2023 Change in Adjusted Share* 2022–2023

1 Harvard University, United States of America (USA) 1169.58 1143.43 3763 -3.1%

2 University of Chinese Academy of Sciences (UCAS), China 598.85 635.81 3227 5.2%

3 University of Science and Technology of China (USTC), China 586.57 631.20 1858 6.7%

4 Peking University (PKU), China 562.29 617.17 2349 8.8%

5 Nanjing University (NJU), China 565.57 609.45 1448 6.8%

6 Zhejiang University (ZJU), China 479.35 595.37 1540 23.1%

7 Tsinghua University, China 529.08 593.45 1946 11.2%

8 Sun Yat-sen University (SYSU), China 437.07 492.47 1266 11.7%

9 Shanghai Jiao Tong University (SJTU), China 439.68 488.94 1449 10.2%

10 Massachusetts Institute of Technology (MIT), United States of America (USA) 479.97 484.86 2032 0.1%

11 Stanford University, United States of America (USA) 592.62 474.13 1929 -20.7%

12 Fudan University, China 429.84 461.26 1333 6.4%

13 Sichuan University (SCU), China 327.62 413.63 768 25.2%

14 The University of Tokyo (UTokyo), Japan 398.90 389.36 1239 -3.2%

15 University of Oxford, United Kingdom (UK) 423.50 388.35 1625 -9.1%

16 University of Michigan (U-M), United States of America (USA) 372.55 380.50 1415 1.2%

17 University of Cambridge, United Kingdom (UK) 428.91 368.12 1436 -14.9%

18 Swiss Federal Institute of Technology Zurich (ETH Zurich), Switzerland 353.52 346.26 1042 -2.9%

19 Yale University, United States of America (USA) 380.20 342.16 1402 -10.8%

20 Nankai University (NKU), China 316.97 337.67 797 5.6%

21 Wuhan University (WHU), China 276.30 334.72 768 20.1%

22 University of Toronto (U of T), Canada 366.05 334.38 1192 -9.4%

23 University of California, San Diego (UC San Diego), United States of America (USA) 335.22 331.74 1062 -1.9%

24 Columbia University in the City of New York (CU), United States of America (USA) 342.91 330.31 1232 -4.5%

25 University of Pennsylvania (Penn), United States of America (USA) 374.65 323.65 1118 -14.4%

26 Cornell University, United States of America (USA) 302.76 320.47 1070 4.9%

27 University of California, Los Angeles (UCLA), United States of America (USA) 341.25 313.78 1214 -8.8%

28 Huazhong University of Science and Technology (HUST), China 248.29 312.65 725 24.8%

29 University of California, Berkeley (UC Berkeley), United States of America (USA) 350.71 312.19 1358 -11.8%

30 Shandong University (SDU), China 263.71 309.49 951 16.3%

31 University of Washington (UW), United States of America (USA) 305.50 295.93 1452 -4.0%

32 Northwestern University (NU), United States of America (USA) 313.12 295.49 904 -6.4%

33 Johns Hopkins University (JHU), United States of America (USA) 351.93 294.65 1358 -17.0%

34 Xiamen University (XMU), China 262.58 289.61 569 9.3%

35 Soochow University, China 246.72 289.15 614 16.2%

36 Southern University of Science and Technology (SUSTech), China 295.49 279.54 770 -6.2%

37 Jilin University (JLU), China 247.88 268.37 601 7.3%

38 National University of Singapore (NUS), Singapore 250.00 253.94 904 0.7%

39 Central South University (CSU), China 189.42 252.70 582 32.2%

40 Washington University in St. Louis (WUSTL), United States of America (USA) 261.57 251.01 804 -4.9%

Comment

- ‹ Previous

- 1

- …

- 6

- 7

- 8

- Next ›

Twitter Feed

Live Traffic Feed

Sponsored Links

South Asia Investor Review

Investor Information Blog

Haq's Musings

Riaz Haq's Current Affairs Blog

Please Bookmark This Page!

Blog Posts

Trump Administration Seeks Pakistan's Help For Promoting “Durable Peace Between Israel and Iran”

US Secretary of State Marco Rubio called Pakistan Prime Minister Shehbaz Sharif to discuss promoting “a durable peace between Israel and Iran,” the State Department said in a statement, according to Reuters. Both leaders "agreed to continue working together to strengthen Pakistan-US relations, particularly to increase trade", said a statement released by the Pakistan government.…

ContinuePosted by Riaz Haq on June 27, 2025 at 8:30pm — 3 Comments

Clean Energy Revolution: Soaring Solar Energy Battery Storage in Pakistan

Pakistan imported an estimated 1.25 gigawatt-hours (GWh) of lithium-ion battery packs in 2024 and another 400 megawatt-hours (MWh) in the first two months of 2025, according to a research report by the Institute of Energy Economics and Financial Analysis (IEEFA). The report projects these imports to reach 8.75 gigawatt-hours (GWh) by 2030. Using …

ContinuePosted by Riaz Haq on June 14, 2025 at 10:30am — 3 Comments

© 2025 Created by Riaz Haq.

Powered by

![]()

You need to be a member of PakAlumni Worldwide: The Global Social Network to add comments!

Join PakAlumni Worldwide: The Global Social Network