PakAlumni Worldwide: The Global Social Network

The Global Social Network

Pakistan's Fiscal Year 2022 GDP Reaches $1.62 Trillion in Purchasing Power Parity (PPP) Terms

Economic Survey of Pakistan 2021-22 confirms that the nation's GDP grew nearly 6% in the current fiscal year, reaching $1.62 Trillion in terms of purchasing power parity (PPP). It first crossed the trillion dollar mark in 2017. In nominal US$ terms, the size of Pakistan's economy is now $383 billion. In terms of the impact of economic growth on average Pakistanis, the per capita average daily calorie intake jumped to 2,735 calories in FY 2021-22 from 2,457 calories in 2019-20. Pakistan experienced broad-based economic growth across all key sectors in FY 21-22; manufacturing posted 9.8% growth, services 6.2% and agriculture 4.4%. The 4.4% growth in agriculture is particularly welcome; it helps reduce rural poverty. The country's per capita income is $1,798 in nominal terms and $7,551 in PPP dollars. These figures do not yet show up in Google searches. Under former Prime Minister Imran Khan's leadership, Pakistan succeeded in achieving outstanding economic growth and nutritional improvements in spite of surging global food prices amid the Covid19 pandemic. Increasing energy consumption and soaring global energy prices have rapidly depleted Pakistan's forex reserves, forcing the country to seek yet another IMF bailout. History tells us that these bailouts have been forced whenever Pakistan's GDP growth has exceeded 5%. The best way for Pakistan to accelerate its growth beyond 5% in a sustainable manner is to boost its exports by investing in export-oriented industries, and by incentivizing higher savings and investments.

|

| Pakistan Economic Data. Source: IMF April 2022 |

The IMF (International Monetary Fund) has updated its website in April, 2022 with data reported for FY 2020-21. It's not unusual for the IMF data reporting to lag by a year or more. Pakistan's Economic Survey 2021-22 was published in June, 2022.

|

| Sector-wise Economic Growth. Source: Economic Survey of Pakistan 20... |

Pakistan experienced broad-based economic growth across all key sectors in FY 21-22; manufacturing posted 9.8% growth, services 6.2% and agriculture 4.4%. The 4.4% growth in agriculture is particularly welcome; it helps reduce rural poverty.

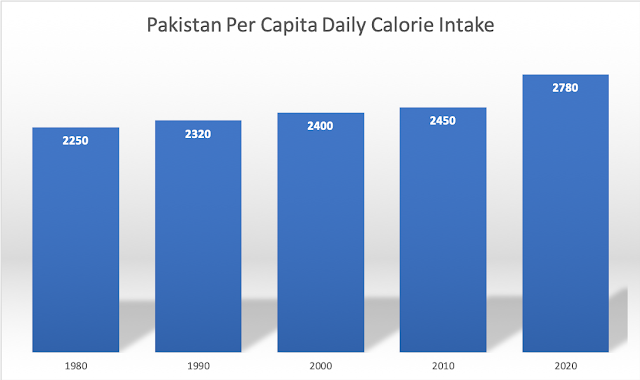

In terms of the impact of economic growth on average Pakistanis, the per capita average daily calorie intake jumped to 2,735 calories in FY 2021-22 from 2,457 calories in 2019-20. The biggest contributor to it is the per capita consumption of fresh fruits and vegetables which soared from 53.6 Kg to 68.3 Kg, less than half of the 144 Kg (400 grams/day) recommended by the World Health Organization. Healthy food helps cut disease burdens and reduces demand on the healthcare system. Under former Prime Minister Imran Khan's leadership, Pakistan succeeded in achieving these nutritional improvements in spite of surging global food prices amid the Covid19 pandemic.

|

| Pakistan Per Capita Daily Calorie Consumption. Source: Economic Surveys of Pakistan |

The trend of higher per capita daily calorie consumption has continued since the 1950s. It has risen from about 2,078 in 1949-50 to 2,400 in 2001-02 and 2735 in 2021-22. The per capita per day protein intake in grams increased from 63 to 67 to about 75 during these years. Health experts recommend that women consume at least 1,200 calories a day, and men consume at least 1,500 calories a day, says Harvard Health Publishing. The global average has increased from 2360 kcal/person/day in the mid-1960s to 2900 kcal/person/day currently, according to the Food and Agricultural Organization (FAO). The USDA (United States Department of Agriculture) estimates that most women need 1,600 to 2,400 calories, while the majority of men need 2,000 to 3,000 calories each day to maintain a healthy weight. Global Hunger Index defines food deprivation, or undernourishment, as consumption of fewer than 1,800 calories per day.

|

| Share of Overweight or Obese Adults. Source: Our World in Data |

The share of overweight or obese adults in Pakistan's population is estimated by the World Health Organization at 28.4%. It is 20% in Bangladesh, 19.7% in India, 32.3% in China, 61.6% in Iran and 68% in the United States.

|

| Major Food Items Consumed in Pakistan. Source: Economic Survey of P... |

The latest edition of the Economic Survey of Pakistan estimates that per capita calories come from the annual per capita consumption of 164.7 Kg of cereals, 7.3 Kg of pulses (daal), 28.3 Kg of sugar, 168.8 liters of milk, 22.5 Kg of meat, 2.9 Kg of fish, 8.1 dozen eggs, 14.5 Kg of ghee (cooking oil) and 68.3 Kg of fruits and vegetables. Pakistan's economy grew 5.97% and agriculture outputs increased a record 4.4% in FY 2021-22, according to the Economic Survey. The 4.4% growth in agriculture has boosted consumption and supported Pakistan's rural economy.

The minimum recommended food basket in Pakistan is made up of basic food items (cereals, pulses, fruits, vegetables, meat, milk, edible oils and sugar) to provide 2150 kcal and 60gram protein/day per capita.

The state of Pakistan's social sector is not as dire as the headlines suggest. There are good reasons for optimism. Key indicators show that nutrition and health in Pakistan are improving but such improvements need to be accelerated.

South Asia Investor Review

Pakistan's Expected Demographic Dividend

Pakistan's Social Sector

World Bank: Pakistan Reduced Poverty, Grew Economy During Covid19 P...

Surging Global Food Prices Amid Covid Pandemic

Pakistan's Balance of Payments Crisis

Panama Leaks in Pakistan

Olive Revolution in Pakistan"

Nay Pakistan Sehat Card: A Giant Step Toward Universal Healthcare

Prime Minister Imran Khan's Effectiveness as Crisis Leader

India in Crisis: Unemployment and Hunger Persists After Waves of Covid

Riaz Haq's Youtube Channel

-

Comment by Riaz Haq on August 10, 2022 at 8:00am

-

Pakistan’s finance minister says the country has avoided a Sri Lanka-like default crisis

https://www.cnbc.com/2022/08/10/pakistans-finance-minister-says-cou...

Pakistan’s finance minister (Miftah Ismail) said the government has taken steps that will put the country on the right track and help the South Asian nation avoid an economic collapse. But that will cause pain for its people, he added.

“There were serious worries about Pakistan heading Sri Lanka’s way. Pakistan getting into a default-like situation, but thankfully, we’ve made some significant changes. We’ve brought in significant austerity, black belt tightening, and I think we’ve averted that situation,” Miftah Ismail told CNBC’s “Street Signs Asia” on Tuesday.

The country is desperately fighting for its survival as the recent rise in commodity and energy prices have exacerbated its debt problems.

“There were serious worries about Pakistan heading Sri Lanka’s way, Pakistan getting into a default-like situation, but thankfully, we’ve made some significant changes. We’ve brought in significant austerity, black belt tightening. And I think we’ve averted that situation,” Miftah Ismail told CNBC’s “Street Signs Asia” on Tuesday.

“We are now in an IMF program. We have reached the staff-level agreement. We expect to get a board approval later this month. We’ve taken off subsidies from fuel, from power ... We’ve raised taxes. So, I think we’re headed in the right direction.”

Nevertheless, Ismail acknowledged that recent measures taken by the government will be difficult for Pakistan and would mean a lot of pain for the people.

“But look at the alternative. If we had gone the Sri Lankan way this would have been much worse,” the minister said.

-

Comment by Riaz Haq on August 13, 2022 at 8:21am

-

75 Years

Economic Journey of Pakistan

Toward a Vibrant Pakistan

https://www.finance.gov.pk/75_Years_Economic_Journey_of_Pakistan.pdf

Government of Pakistan

Ministry of Finance

August 13, 2022

-

Comment by Riaz Haq on August 15, 2022 at 1:31pm

-

#SriLanka Collapsed First, but It Won’t Be the Last. 60% of low-income & 30% of middle-income nations are in #debt distress. #Pakistan, #Bangladesh, Tunisia, Ghana, #SouthAfrica, #Brazil, Argentina, Sudan — the list of those in trouble is growing rapidly. https://www.nytimes.com/2022/08/15/opinion/international-world/sri-...

By Indrajit Samarajiva

Mr. Samarajiva is a Sri Lankan writer who publishes at his blog Indi.ca.

"We simply import too much, export too little and cover the difference with debt. This unsustainable economy was always going to collapse"

As a Sri Lankan, watching international news coverage of my country’s economic and political implosion is like showing up at your own funeral, with everybody speculating on how you died.

The Western media accuses China of luring us into a debt trap. Tucker Carlson says environmental, social and corporate governance programs killed us. Everybody blames the Rajapaksas, the corrupt political dynasty that ruled us until massive protests by angry Sri Lankans chased them out last month.

But from where I’m standing, ultimate blame lies with the Western-dominated neoliberal system that keeps developing countries in a form of debt-fueled colonization. The system is in crisis, its shaky foundations exposed by the tumbling dominoes of the Ukraine war, resulting in food and fuel scarcity, the pandemic, and looming insolvency and hunger rippling across the world.

Sri Lanka is Exhibit A. We were once an economic hope, with an educated population and a median income among the highest in South Asia. But it was an illusion. After 450 years of colonialism, 40 years of neoliberalism, and four years of total failure by our politicians, Sri Lanka and its people have been beggared.

Former President Gotabaya Rajapaksa deepened our debt problems, but the economy has been structurally unsound across administrations. We simply import too much, export too little and cover the difference with debt. This unsustainable economy was always going to collapse.

But we are just the canary in the coal mine. The entire world is plugged into this failing system and the pain will be widespread.

Here’s how the past few months have felt.

I have a car, which has now turned into a giant paperweight. Sri Lanka literally ran out of gas, so my kids asked if they could play inside it. That’s all it is good for. Getting fuel required waiting for days in spirit-crushing queues. I gave up. I got around by bus or bicycle. Most of the economy stopped moving at all. Now fuel has been rationed, but irrationally. Rich people get enough fuel for gas-guzzling S.U.V.s while working taxis don’t get enough and owners of tractors struggle to get anything at all.

The rupee has lost almost half its value since March and many goods are out of stock. You learn to react at the first sign of trouble: When power cuts started a few months ago my wife and I bought an expensive rechargeable fan; days later, they were sold out. When fuel cuts became dire we immediately bought bicycles, and the next day their price went up. Staples like rice, vegetables, fish and chicken have soared in price.

Many Sri Lankans are going on one meal a day; some are starving. Every week brings to my door a new class of people reduced to begging to survive.

I earn in dollars as a writer online so when the rupee depreciated and was devalued, I effectively got a raise. We can afford solar and battery backups to keep the power on. But many others are at the mercy of blackouts. People couldn’t work as factories and other workplaces shut down and children couldn’t sleep in the heat. The first major protests kicked off in March after a full night of this, when it seemed that the entire country was sleep-deprived and furious.

-

Comment by Riaz Haq on August 15, 2022 at 1:31pm

-

Last month, protesters breached the presidential residence and prime minister’s office, and it was the one thing that felt good. Along with thousands of ordinary Sri Lankans, I got to see inside these colonial-era fortresses for the first time. It was spontaneous, safe and respectful. Couples went on dates there; parents brought their kids. I saw people singing in the president’s house, a mother dancing with her toddler, people swimming in the pool. I walked around a hall lined with plaques bearing the names of British colonizers, which seamlessly became the names of our own presidents.

At the prime minister’s office, someone played the piano and a shirtless man draped in a Sri Lankan flag slept on a couch. Four guys had set up a game of carrom and were flicking the discs around. A child joyfully cartwheeled across the lawn outside, and a community kitchen served rice to anyone that was hungry. It was a beautiful sight in a space where elites had nibbled on canapes before, surrounded by armed guards. It felt hopeful.

But what had briefly felt like true democracy didn’t last. Parliament merely replaced President Rajapaksa with one of his cronies, Ranil Wickremesinghe, who has been prime minister a handful of times but lost his parliamentary seat in 2020. He has turned the military on demonstrators and arrested protesters and trade unionists. It’s all been “constitutional,” eroding faith in the whole liberal democratic system.

Sri Lanka — like so many other countries struggling for solvency — remains a colony with administration outsourced to the International Monetary Fund. We still export cheap labor and resources, and import expensive finished goods — the basic colonial model. The country is still divided and conquered by local elites, while real economic control is held abroad. The I.M.F. has extended loans to Sri Lanka 16 times, always with stringent conditions. They just keep restructuring us for further exploitation by creditors.

And as much as the West blames Chinese predatory lending, only around 10 to 20 percent of Sri Lanka’s foreign debt is owed to China. The majority is owed to U.S. and European financial institutions, or Western allies like Japan. We died in a largely Western debt trap.

Other countries face the same peril. Around 60 percent of low-income nations and 30 percent of middle-income ones are in debt distress or at high risk of it. Pakistan, Bangladesh, Tunisia, Ghana, South Africa, Brazil, Argentina, Sudan — the list of those in trouble is growing rapidly. An estimated 60 percent of the world’s workforce has lower real incomes than before the pandemic, and the rich countries offer little to no help.

But big economies are suffering too. Europe faces energy uncertainty, Americans are struggling to fill their tanks, the United States may already be in recession, its asset bubble threatens to pop, and British families face food worries.

It’s going to get worse: The I.M.F. just warned that the likelihood of a global recession is mounting. As economies collapse, Western loans simply won’t get repaid and poor nations will crash out of the dollar system that props up Western lifestyles. Then, even Americans won’t be able to money-print their way out of trouble. It’s already begun. Sri Lanka has started settling loans in Indian rupees while India is buying Russian oil in rubles. China may buy Saudi oil with yuan.

The Sri Lankan uprising that threw out our leaders is called the Aragalaya. It means “struggle.” It’s going to be a long one, and it’s spreading across the world.

-

Comment by Riaz Haq on August 16, 2022 at 5:27pm

-

#Pakistan’s #rupee, #bonds & #stocks are rallying as #investors bet the nation will win a #bailout from the #IMF this month & avoid #debt #default. Pakistan has also secured $4 billion from friendly countries. #economy #currency #SriLanka #Dollar #Euro

https://www.bloomberg.com/news/articles/2022-08-16/pakistan-assets-...

Dollar bonds due in December were indicated at about 95 cents on the dollar on Tuesday from a low of 85 cents in July, as investors turn more confident the debt will be repaid. The rupee surged 11% this month to 213.87 per dollar as of Monday, the biggest gainer in the world. The benchmark stock index climbed 9%, the top performer in Asia after Sri Lanka.

Pakistan has adopted austerity measures to win approval from the IMF to resume its stalled bailout package as frontier nations from Egypt to El Salvador battle the threat of a default. Fitch Ratings and Moody’s Investor Service said in late July they expect the nation to secure $1.2 billion from the IMF, while Saudi Arabia is said to renew its $3 billion deposit in assistance, easing financing pressure on Pakistan.

“After completing a slew of difficult prior actions, Pakistan finally received staff-level approval to resume and extend its IMF program, which should pave the way for board approval barring any policy mistakes,” said Patrick Curran, a senior economist at London-based research firm Tellimer Ltd. “With the program back on track, Pakistan will be given additional runway to avoid a crisis.”

Pakistan will sign the IMF’s letter of intent on Monday. The IMF board meeting is expected on Aug. 29 for the loan approval.

“The strength of the rupee reflects the strength of the economy,” Finance Minister Miftah Ismail said. “The currency movement is not cosmetic. The government’s decision to curb imports is helping the rupee to gain against the US dollar.”

Pakistan has secured $4 billion from friendly countries, a condition set by the IMF, according to Finance Minister Miftah Ismail. The IMF is set to decide on the loan on August 29, The News reported Saturday, citing Ismail.

“The IMF loan has been partially priced-in but there are a couple of other triggers going forward,” said Mohammed Sohail, chief executive of Topline Securities in Karachi. “Falling oil prices will continue to help, and once the IMF is approved, bilateral money will flow in.”

-

Comment by Riaz Haq on August 16, 2022 at 7:07pm

-

Arif Habib Limited

@ArifHabibLtd

Large Scale Manufacturing Industries (LSMI) output witnessed an increase of 11.5% YoY during Jun’22 (+0.2% MoM). Moreover, latest data suggests that during FY22, LSMI output increased by 11.7% YoY.https://twitter.com/ArifHabibLtd/status/1559506139917828098?s=20&am...

-

Comment by Riaz Haq on August 24, 2022 at 8:08am

-

Qatar Wealth Fund Plans $3 Billion Investment in Pakistan

https://www.bloomberg.com/news/articles/2022-08-24/qatar-wealth-fun...

QIA may invest in South Asian nation’s airports, hospitality

Pakistan is trying to shore up its finances to avoid a default

Qatar’s sovereign wealth fund plans to invest $3 billion in key sectors of Pakistan’s economy as the gas-rich Gulf state extends its support to the cash-strapped South Asian nation.

The $445 billion Qatar Investment Authority is evaluating strategic investments in the country’s main airports in Islamabad and Karachi, as well as in the renewable energy, power and hospitality sectors, according to people familiar with the matter.

The investments from the QIA may partly overlap with the $2 billion in bilateral support Qatar has already planned for Pakistan, one of the people said, asking not to be identified because the information is private. The fund may end up investing more or less than $3 billion depending on the asset valuations and opportunities, the people said, without sharing a time frame.

The Qatari ruler’s office confirmed the plan to invest in Pakistan in a statement posted on its website. The decision came during a meeting between ruler Sheikh Tamim Bin Hamad Al Thani and Pakistan Prime Minister Shehbaz Sharif.

Default Risk

Qatar is pledging its support for Pakistan to help ease the country’s funding crunch and the consequent risk of a default. Prime Minister Sharif has been visiting Qatar ahead of an IMF board meeting next week that could lead to the release of $1.2 billion in financing. Arab nations committed to supporting the country only after it secured a program from the Washington-based lender.

IMF Is Said to Seek Assurance on Saudi Funding to Pakistan

During the meeting, officials also discussed the progress Qatar -- the world’s top supplier of liquefied natural gas -- has made on investing in Pakistan’s next import terminal, according to people with knowledge of the discussions. While progress has been made, some steps remain, they said.

Shares in state-controlled Pakistan International Airlines rose as much as 10% following the news of Qatar’s interest in the hospitality sector. The carrier owns the Roosevelt Hotel in New York and has previously tried to sell the iconic property.

The South Asian nation will also get $1 billion in oil financing from Saudi Arabia and a similar amount in investments from the United Arab Emirates. Gulf states often provide a mix of deposits and investment pledges when they provide aid to states.

The Pakistan rupee is the best performer globally this month and has gained about 9% since dropping to a record low last month as worries over a possible default fade, according to data tracked by Bloomberg.

-

Comment by Riaz Haq on August 25, 2022 at 10:14am

-

Saudi Arabia to invest $1 billion in Pakistan

https://english.alarabiya.net/amp/News/gulf/2022/08/25/Saudi-Arabia...

Saudi Arabia will invest $1 billion in Pakistan to support the country’s economy, the official Saudi Press Agency (SPA) reported on Thursday.

“King Salman bin Abdulaziz ordered investing $1 billion in the brotherly [country] of Pakistan [in line with] the Kingdom’s stance in support of the country’s economy and its people,” SPA reported.

It added that Saudi Arabia’s Foreign Minister Prince Faisal bin Farhan informed his Pakistani counterpart, Bilawal Bhutto-Zardari, of the decision during a phone call.

The foreign ministers also discussed bilateral ties and means to improve them as well as regional and international affairs of mutual interest.

Pakistan is in economic turmoil and faces a balance of payments crisis, with foreign reserves having dropped as low as $7.8 billion, barely enough for more than a month of imports.

It is also contending with a widening current account deficit, depreciation of the rupee against the US dollar and inflation that hit more than 24 percent in July.

-

Comment by Riaz Haq on August 25, 2022 at 10:14am

-

Oman offer to build Gwadar railway conjures Pakistan port's past - Nikkei Asia

https://asia.nikkei.com/Spotlight/Belt-and-Road/Oman-offer-to-build...

ISLAMABAD -- A company from Oman is looking to invest in a train line that would link the Pakistani port town of Gwadar -- envisioned as a key stop on China's Belt and Road infrastructure network -- with Pakistan's main railway system.

The proposed multibillion-dollar project could go a long way toward resolving the seafront city's lack of rail connectivity. It also conjures up the past of Gwadar, which was part of Oman for 175 years. But at the same time, Pakistan's turbulent political situation is casting doubt on the prospects for pushing the plan forward and realizing the port's potential.

Earlier this month, officials from Anvwar Asian Investments, an Omani project financing firm, met with officials of Pakistan's Board of Investment and expressed interest in building a 1,087-kilometer railway between Gwadar and Jacobabad in central Pakistan. The investment would be worth $2.3 billion, and the Omani side says it is ready to provide an immediate tranche of $500 million as initial financing, according to the BOI.

Many see the plan as fitting, given the history that binds Gwadar with Oman -- about 450 km away, across the mouth of the Gulf of Oman.

In 1783, the ruler of what was then Kalat State -- now Balochistan -- gifted Gwadar to Oman's Taimur Sultan, a defeated prince on the run, who later mounted a comeback and reigned as sultan in Muscat. Gwadar remained part of Oman until roughly a decade after Pakistan's inception, when Islamabad purchased it in 1958 with British help.

Many of Gwadar's older residents still have Omani nationality as well.

Nasir Sohrabi, president of the Rural Community Development Council in Gwadar, said Oman has been the primary overseas destination for the people of Gwadar, even after the town became part of Pakistan. "Plenty of people from Gwadar live in Oman and do business or work as employees in many sectors, including the army," he told Nikkei Asia.

Oman is well-regarded among many locals. Sohrabi added that when Gwadar suffered severe power shortages in 2001, Oman's then-ruler, Sultan Qaboos, gave the city 45 power generators.

"This is one instance of the people of Gwadar having a special bond with Oman," Sohrabi said.

The railway investment offer, if it comes to fruition, would significantly ease access to Gwadar and its Chinese-built and operated port, part of the $50 billion China-Pakistan Economic Corridor.

Despite being in the middle of BRI activity in Pakistan, no train lines run to Gwadar, and uncertainty shrouds plans for other railway upgrades under CPEC. Plans call for improving tracks between Peshawar and Karachi, the latter of which is about 600 km from Gwadar. But this project, known as Main Line-1 or ML-1, appears at risk of being shelved due to a disagreement on costs between Islamabad and Beijing, according to local reports in April.

"China wanted ML-1 to have a price tag of $9 billion, which Pakistan reduced to $6.8 billion," an official who deals with the planning of federal projects in Pakistan told Nikkei Asia on condition of anonymity, as he is not authorized to talk to the media.

The official added that Islamabad wants loans at a lower rate than what Beijing is prepared to offer.

Sohrabi stressed that Gwadar can never be a successful major port without a strong railway network.

"Currently, the cargo which is unloaded at Gwadar Port is transported by road to Karachi [and] from there it's shipped to other parts of the country via rail," he said. "If this is the case, then it makes more sense to unload cargo directly at Karachi Port instead of Gwadar."

-

Comment by Riaz Haq on August 27, 2022 at 3:46pm

-

In the 2021 GHI, Pakistan ranks 92nd out of 116 countries with sufficient data to calculate GHI scores. With a score of 24,7 Pakistan has a level of hunger that is serious. Since 2000, the GHI score of Pakistan has decreased by 12, which represent a percentage decreased of 23.7%. Pakistan’s GHI score trend shows that, while the decline in the score is steady, it has decreased at a faster rate since 2012, meaning that progress in the fight against hunger is accelerating.

https://www.pakistantoday.com.pk/2022/08/17/welthungerhilfe-present...

Twitter Feed

Live Traffic Feed

Sponsored Links

South Asia Investor Review

Investor Information Blog

Haq's Musings

Riaz Haq's Current Affairs Blog

Please Bookmark This Page!

Blog Posts

Trump Administration Seeks Pakistan's Help For Promoting “Durable Peace Between Israel and Iran”

US Secretary of State Marco Rubio called Pakistan Prime Minister Shehbaz Sharif to discuss promoting “a durable peace between Israel and Iran,” the State Department said in a statement, according to Reuters. Both leaders "agreed to continue working together to strengthen Pakistan-US relations, particularly to increase trade", said a statement released by the Pakistan government.…

ContinuePosted by Riaz Haq on June 27, 2025 at 8:30pm — 3 Comments

Clean Energy Revolution: Soaring Solar Energy Battery Storage in Pakistan

Pakistan imported an estimated 1.25 gigawatt-hours (GWh) of lithium-ion battery packs in 2024 and another 400 megawatt-hours (MWh) in the first two months of 2025, according to a research report by the Institute of Energy Economics and Financial Analysis (IEEFA). The report projects these imports to reach 8.75 gigawatt-hours (GWh) by 2030. Using …

ContinuePosted by Riaz Haq on June 14, 2025 at 10:30am — 3 Comments

© 2025 Created by Riaz Haq.

Powered by

![]()

You need to be a member of PakAlumni Worldwide: The Global Social Network to add comments!

Join PakAlumni Worldwide: The Global Social Network