PakAlumni Worldwide: The Global Social Network

The Global Social Network

Pakistan's Fiscal Year 2022 GDP Reaches $1.62 Trillion in Purchasing Power Parity (PPP) Terms

Economic Survey of Pakistan 2021-22 confirms that the nation's GDP grew nearly 6% in the current fiscal year, reaching $1.62 Trillion in terms of purchasing power parity (PPP). It first crossed the trillion dollar mark in 2017. In nominal US$ terms, the size of Pakistan's economy is now $383 billion. In terms of the impact of economic growth on average Pakistanis, the per capita average daily calorie intake jumped to 2,735 calories in FY 2021-22 from 2,457 calories in 2019-20. Pakistan experienced broad-based economic growth across all key sectors in FY 21-22; manufacturing posted 9.8% growth, services 6.2% and agriculture 4.4%. The 4.4% growth in agriculture is particularly welcome; it helps reduce rural poverty. The country's per capita income is $1,798 in nominal terms and $7,551 in PPP dollars. These figures do not yet show up in Google searches. Under former Prime Minister Imran Khan's leadership, Pakistan succeeded in achieving outstanding economic growth and nutritional improvements in spite of surging global food prices amid the Covid19 pandemic. Increasing energy consumption and soaring global energy prices have rapidly depleted Pakistan's forex reserves, forcing the country to seek yet another IMF bailout. History tells us that these bailouts have been forced whenever Pakistan's GDP growth has exceeded 5%. The best way for Pakistan to accelerate its growth beyond 5% in a sustainable manner is to boost its exports by investing in export-oriented industries, and by incentivizing higher savings and investments.

|

| Pakistan Economic Data. Source: IMF April 2022 |

The IMF (International Monetary Fund) has updated its website in April, 2022 with data reported for FY 2020-21. It's not unusual for the IMF data reporting to lag by a year or more. Pakistan's Economic Survey 2021-22 was published in June, 2022.

|

| Sector-wise Economic Growth. Source: Economic Survey of Pakistan 20... |

Pakistan experienced broad-based economic growth across all key sectors in FY 21-22; manufacturing posted 9.8% growth, services 6.2% and agriculture 4.4%. The 4.4% growth in agriculture is particularly welcome; it helps reduce rural poverty.

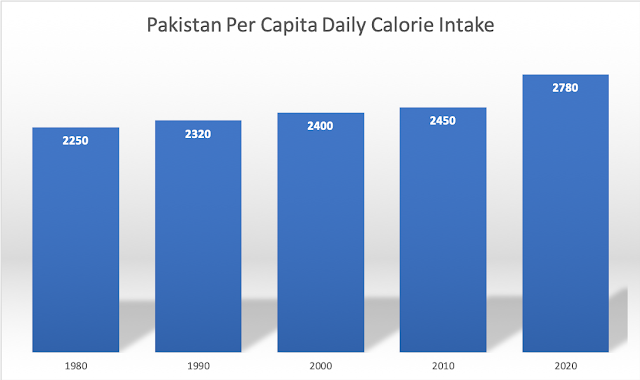

In terms of the impact of economic growth on average Pakistanis, the per capita average daily calorie intake jumped to 2,735 calories in FY 2021-22 from 2,457 calories in 2019-20. The biggest contributor to it is the per capita consumption of fresh fruits and vegetables which soared from 53.6 Kg to 68.3 Kg, less than half of the 144 Kg (400 grams/day) recommended by the World Health Organization. Healthy food helps cut disease burdens and reduces demand on the healthcare system. Under former Prime Minister Imran Khan's leadership, Pakistan succeeded in achieving these nutritional improvements in spite of surging global food prices amid the Covid19 pandemic.

|

| Pakistan Per Capita Daily Calorie Consumption. Source: Economic Surveys of Pakistan |

The trend of higher per capita daily calorie consumption has continued since the 1950s. It has risen from about 2,078 in 1949-50 to 2,400 in 2001-02 and 2735 in 2021-22. The per capita per day protein intake in grams increased from 63 to 67 to about 75 during these years. Health experts recommend that women consume at least 1,200 calories a day, and men consume at least 1,500 calories a day, says Harvard Health Publishing. The global average has increased from 2360 kcal/person/day in the mid-1960s to 2900 kcal/person/day currently, according to the Food and Agricultural Organization (FAO). The USDA (United States Department of Agriculture) estimates that most women need 1,600 to 2,400 calories, while the majority of men need 2,000 to 3,000 calories each day to maintain a healthy weight. Global Hunger Index defines food deprivation, or undernourishment, as consumption of fewer than 1,800 calories per day.

|

| Share of Overweight or Obese Adults. Source: Our World in Data |

The share of overweight or obese adults in Pakistan's population is estimated by the World Health Organization at 28.4%. It is 20% in Bangladesh, 19.7% in India, 32.3% in China, 61.6% in Iran and 68% in the United States.

|

| Major Food Items Consumed in Pakistan. Source: Economic Survey of P... |

The latest edition of the Economic Survey of Pakistan estimates that per capita calories come from the annual per capita consumption of 164.7 Kg of cereals, 7.3 Kg of pulses (daal), 28.3 Kg of sugar, 168.8 liters of milk, 22.5 Kg of meat, 2.9 Kg of fish, 8.1 dozen eggs, 14.5 Kg of ghee (cooking oil) and 68.3 Kg of fruits and vegetables. Pakistan's economy grew 5.97% and agriculture outputs increased a record 4.4% in FY 2021-22, according to the Economic Survey. The 4.4% growth in agriculture has boosted consumption and supported Pakistan's rural economy.

The minimum recommended food basket in Pakistan is made up of basic food items (cereals, pulses, fruits, vegetables, meat, milk, edible oils and sugar) to provide 2150 kcal and 60gram protein/day per capita.

The state of Pakistan's social sector is not as dire as the headlines suggest. There are good reasons for optimism. Key indicators show that nutrition and health in Pakistan are improving but such improvements need to be accelerated.

South Asia Investor Review

Pakistan's Expected Demographic Dividend

Pakistan's Social Sector

World Bank: Pakistan Reduced Poverty, Grew Economy During Covid19 P...

Surging Global Food Prices Amid Covid Pandemic

Pakistan's Balance of Payments Crisis

Panama Leaks in Pakistan

Olive Revolution in Pakistan"

Nay Pakistan Sehat Card: A Giant Step Toward Universal Healthcare

Prime Minister Imran Khan's Effectiveness as Crisis Leader

India in Crisis: Unemployment and Hunger Persists After Waves of Covid

Riaz Haq's Youtube Channel

-

Comment by Riaz Haq on August 27, 2022 at 3:46pm

-

In the 2021 GHI, Pakistan ranks 92nd out of 116 countries with sufficient data to calculate GHI scores. With a score of 24,7 Pakistan has a level of hunger that is serious. Since 2000, the GHI score of Pakistan has decreased by 12, which represent a percentage decreased of 23.7%. Pakistan’s GHI score trend shows that, while the decline in the score is steady, it has decreased at a faster rate since 2012, meaning that progress in the fight against hunger is accelerating.

https://www.pakistantoday.com.pk/2022/08/17/welthungerhilfe-present...

-

Comment by Riaz Haq on August 27, 2022 at 4:03pm

-

Although GHI scores show that global hunger has been on the decline since 2000, progress is slowing. While the GHI score for the world fell 4.7 points, from 25.1 to 20.4, between 2006 and 2012, it has fallen just 2.5 points since 2012. After decades of decline, the global prevalence of undernourishment—one of the four indicators used to calculate GHI scores—is increasing.

https://reliefweb.int/report/world/2021-global-hunger-index-hunger-....

-------The average minimum dietary energy requirement varies by country—from about 1,660 to more than 2,050 kilocalories (commonly, albeit incorrectly, referred to as calories) per person per day for all countries with available data in 2020 (FAO 2021). For previous GHI calculations, see von Grebmer et al.

https://www.globalhungerindex.org/about.html#:~:text=The%20average%....

-

Comment by Riaz Haq on August 27, 2022 at 4:14pm

-

GHI scores are calculated using a three-step process that draws on available data from various sources to capture the multidimensional nature of hunger (Figure A.1).

First, for each country, values are determined for four indicators:

UNDERNOURISHMENT: the share of the population that is undernourished (that is, whose caloric intake is insufficient);

CHILD WASTING: the share of children under the age of five who are wasted (that is, who have low weight for their height, reflecting acute undernutrition);

CHILD STUNTING: the share of children under the age of five who are stunted (that is, who have low height for their age, reflecting chronic undernutrition); and

CHILD MORTALITY: the mortality rate of children under the age of five (in part, a reflection of the fatal mix of inadequate nutrition and unhealthy environments).

Second, each of the four component indicators is given a standardized score on a 100-point scale based on the highest observed level for the indicator on a global scale in recent decades.

Third, standardized scores are aggregated to calculate the GHI score for each country, with each of the three dimensions (inadequate food supply; child mortality; and child undernutrition, which is composed equally of child stunting and child wasting) given equal weight (the formula for calculating GHI scores is provided in Appendix B).

This three-step process results in GHI scores on a 100-point GHI Severity Scale, where 0 is the best score (no hunger) and 100 is the worst. In practice, neither of these extremes is reached. A value of 0 would mean that a country had no undernourished people in the population, no children younger than five who were wasted or stunted, and no children who died before their fifth birthday. A value of 100 would signify that a country’s undernourishment, child wasting, child stunting, and child mortality levels were each at approximately the highest levels observed worldwide in recent decades. The GHI Severity Scale shows the severity of hunger—from low to extremely alarming—associated with the range of possible GHI scores.

BOX 1.1

WHAT IS MEANT BY “HUNGER”?

The problem of hunger is complex, and different terms are used to describe its various forms.

Hunger is usually understood to refer to the distress associated with a lack of sufficient calories. The Food and Agriculture Organization of the United Nations (FAO) defines food deprivation, or undernourishment, as the consumption of too few calories to provide the minimum amount of dietary energy that each individual requires to live a healthy and productive life, given that person’s sex, age, stature, and physical activity level.

Undernutrition goes beyond calories and signifies deficiencies in any or all of the following: energy, protein, and/ or essential vitamins and minerals. Undernutrition is the result of inadequate intake of food in terms of either quantity or quality, poor utilization of nutrients due to infections or other illnesses, or a combination of these factors. These, in turn, are caused by a range of factors, including household food insecurity; inadequate maternal health or childcare practices; or inadequate access to health services, safe water, and sanitation.

Malnutrition refers more broadly to both undernutrition (problems caused by deficiencies) and overnutrition (problems caused by unbalanced diets, such as consuming too many calories in relation to requirements with or without low intake of micronutrient-rich foods).

In this report, “hunger” refers to the index based on four component indicators. Taken together, the component indicators reflect deficiencies in calories as well as in micronutrients.

https://www.globalhungerindex.org/about.html#:~:text=The%20average%....

-

Comment by Riaz Haq on August 27, 2022 at 5:54pm

-

India Hunger Index Controversy:

Noted columnists in India have also commented on how a faulty metric, which is based on four measures or indicators (none of which actually measure hunger) is creating a flawed narrative against India9,10. Prominent researchers have commented that the GHI exaggerates the measure of hunger, lacks statistical vigour10, has a problem of multiple counts11,12, and gives higher representation to under-five children. The measurement of hunger is complex and should not be oversimplified, as in the GHI13. Therefore, the use of alternative approaches should be considered to evaluate hunger14,15. In view of these issues, the Indian Council of Medical Research (ICMR), Department of Health Research of the Ministry of Health and Family Welfare, Government of India, constituted in 2019 an Expert Committee to review the indicators used in the GHI. The deliberations of this Committee are presented here, and it is argued that the four indicators used in the GHI, [undernourishment, stunting, wasting and child mortality (CM)] do not measure hunger per se, as these are not the manifestations of hunger alone.Go to:

About the GHI

The GHI is a weighted average derived from four indicators1. These are (i) the PUN, or proportion of the population that is undernourished, calculated as the proportion of the population that has an energy intake less than the FAO Minimum Dietary Energy Requirement (MDER) of 1800 calories/capita/day1; (ii) CWA, or the prevalence of wasting in children under five years old, estimated as the percentage of children aged 0-59 months, whose weight for height is below minus two standard deviations (-2SD) from the median of the WHO Child Growth Standards1; (iii) CST, or the prevalence of stunting in children under five years old, estimated as the percentage of children, aged 0-59 months, whose height for age is below -2SD from the median of the WHO Child Growth Standards; and (iv) CM, or the proportion of children dying before the age of five, estimated as the proportion of child deaths between birth and five years of age, generally expressed per 1000 live births. As per the justification mentioned in the GHI report1 for using these indicators, the PUN indicator captures the nutrition situation of the entire population while the other indicators are specific to under-five children (CWA, CST and CM) in which the adverse effects assume greater importance. The inclusion of both wasting and stunting (CWA and CST) is intended to allow the GHI to consider both acute and chronic undernutrition.

-

Comment by Riaz Haq on August 28, 2022 at 7:23am

-

Riaz Haq has left a new comment on your post "Have Deadly Monsoon Floods Replenished Groundwater to End Long Drought in Pakistan? ":

Saeed Shah

@SaeedShah

China, Saudi Arabia, UAE + Qatar led the $37bn package, expected to be agreed by IMF board on Monday. But the floods are dealing a new financial blow, causing economic damage of at least $10 billion, estimates

@MiftahIsmail

. Over 1,000 people killed.

https://twitter.com/SaeedShah/status/1563885236198449155?s=20&t...

----------

Pakistan’s government in recent weeks has tied up at least $37 billion in international loans and investments, officials said, pulling the country away from the kind of financial collapse seen in Sri Lanka.

https://www.wsj.com/articles/pakistan-says-it-has-secured-financing...

The board of the International Monetary Fund is scheduled to meet Monday to consider a bailout deal worked out between IMF staff and Islamabad, under which the lender will provide $4 billion over the remainder of the current fiscal year, which began July 1.

The IMF required the country to first arrange additional funds to cover the rest of its external funding shortfall for the fiscal year. The full package is now in place, according to the Pakistani government.

Despite that vital step, Pakistan’s economic stability is far from assured. Opposition leader Imran Khan continues a fierce campaign against the government to press for fresh elections, while catastrophic flooding from the summer’s monsoon rain will cost the economy billions of dollars.

Among allies, China led the way, providing more than $10 billion, mostly by rolling over existing loans, Pakistani officials said.

Saudi Arabia, meanwhile, is rolling over a $3 billion loan and providing at least $1.2 billion worth of oil on a deferred-payment basis, the officials said. Riyadh announced last week it also would invest $1 billion in Pakistan. The United Arab Emirates will invest a similar amount in Pakistan’s commercial sector, and it is rolling over a $2.5 billion loan.

Last week, the remaining money was secured, with a dash to Qatar by Prime Minister Shehbaz Sharif and Finance Minister Miftah Ismail. Doha announced it would invest $3 billion in Pakistan.

“It’s not been easy,” Mr. Ismail said in an interview. “I think Pakistan right now is not in danger of default. But our viability depends on the IMF program.”

As the IMF and allies disburse funds, the balance of payments crisis should ease. But the scale of the flooding from heavier-than-usual monsoon rains means that the country will need more financing than it had planned for, warned the Pakistan Business Council, which represents larger companies.

Mr. Ismail, the finance minister, estimated that the economic impact of the floods would be at least $10 billion. That would amount to around 3% of gross domestic product. Some 30 million people have been affected by the flooding and more than 1,000 killed since mid-June, officials say.

When a new government came to power in April, it had warned that the country was at risk of defaulting on its foreign debt payments. The situation was made worse by the price shock from the Ukraine war, which pushed up the cost of fuel and other imports.

Pakistan is due to make loan repayments of nearly $21 billion in the current financial year. In addition, it needs to cover its current-account deficit, which is officially forecast at $9.2 billion.

The rest of the new funding is aimed at building up foreign currency reserves—now only enough to cover about six weeks of imports—by the end of the fiscal year, officials say.

The IMF didn’t respond to a request for comment.

-

Comment by Riaz Haq on August 28, 2022 at 7:23am

-

Pakistan’s government in recent weeks has tied up at least $37 billion in international loans and investments, officials said, pulling the country away from the kind of financial collapse seen in Sri Lanka.

https://www.wsj.com/articles/pakistan-says-it-has-secured-financing...

Tahir Abbas, head of research at Arif Habib, a Pakistani stockbroker, said that the country’s debt challenge didn’t become as acute as Sri Lanka’s, because its borrowings were owed mostly to other countries or multilateral agencies, which can be more easily renegotiated. Colombo, which defaulted on its sovereign debt in May, had also borrowed heavily from private-sector bondholders.

“We are in a good position. The IMF deal is secured, friendly countries have helped, and global commodity prices are coming down,” Mr. Abbas said.

However, the confrontation between the government and the leader it replaced in April has expanded to the IMF deal in recent days. Mr. Khan’s political party, which runs the governments of two of Pakistan’s four provinces, threatened to undermine the terms of the IMF agreement by not providing funds due from the provinces to the central government.

The opposition is hitting back after the government charged Mr. Khan with terrorism over a recent speech. He also faces a hearing over a contempt of court charge this week. Mr. Khan risks arrest, and being barred from politics, from the cases.

Mr. Ismail also faces calls to renegotiate the program from influential voices within his own party, upset about the austerity measures imposed as part of the program. Gasoline and electricity prices have been raised sharply and government spending reined in. Inflation hit 45% in a weekly official index released on Aug. 25.

The flooding is likely to add to inflation, with 2 million acres of crops affected, as well as hit exports.

The immediate relief effort could cost the authorities at least $1 billion, the finance minister said. Pakistan has appealed for international aid to help cope with the floods, with $500 million promised so far.

-

Comment by Riaz Haq on September 18, 2022 at 2:15pm

-

Strong #US #Dollar Spells Trouble for World #Economy. Its rise being felt in #fuel and #food shortages in #SriLanka, in #Europe’s record #inflation, in #Japan’s exploding #trade deficit, #Pakistan's #IMF bailout and #Bangladesh seeking IMF help https://www.wsj.com/articles/dollars-rise-spells-trouble-for-global... via @WSJ

For the U.S., a stronger dollar means cheaper imports, a tailwind for efforts to contain inflation, and record relative purchasing power for Americans. But the rest of the world is straining under the dollar’s rise.

“I think it’s early days yet,” said Raghuram Rajan, a finance professor at the University of Chicago’s Booth School of Business. When he served as governor of the Reserve Bank of India last decade, he complained loudly about how Fed policy and a strong dollar hit the rest of the world. “We’re going to be in a high-rates regime for some time. The fragilities will build up.”

-------------

The U.S. dollar is experiencing a once-in-a-generation rally, a surge that threatens to exacerbate a slowdown in growth and amplify inflation headaches for global central banks.

The dollar’s role as the primary currency used in global trade and finance means its fluctuations have widespread impacts. The currency’s strength is being felt in the fuel and food shortages in Sri Lanka, in Europe’s record inflation and in Japan’s exploding trade deficit.

This week, investors are closely watching the outcome of the Federal Reserve’s policy meeting for clues about the dollar’s trajectory. The U.S. central bank is expected Wednesday to raise interest rates by at least 0.75 percentage point as it fights inflation—likely fueling further gains in the greenback.

In a worrying sign, attempts from policy makers in China, Japan and Europe to defend their currencies are largely failing in the face of the dollar’s unrelenting rise.

Last week, the dollar steamrolled through a key level against the Chinese yuan, with one dollar buying more than 7 yuan for the first time since 2020. Japanese officials, who had previously stood aside as the yen lost one-fifth of its value this year, began to fret publicly that markets were going too far.

The ICE U.S. Dollar Index, which measures the currency against a basket of its biggest trading partners, has risen more than 14% in 2022, on track for its best year since the index’s launch in 1985. The euro, Japanese yen and British pound have fallen to multidecade lows against the greenback. Emerging-market currencies have been battered: The Egyptian pound has fallen 18%, the Hungarian forint is down 20% and the South African rand has lost 9.4%.

The dollar’s rise this year is being fueled by the Fed’s aggressive interest-rate increases, which have encouraged global investors to pull money out of other markets to invest in higher-yielding U.S. assets. Recent economic data suggest that U.S. inflation remains stubbornly high, strengthening the case for more Fed rate increases and an even stronger dollar.

Dismal economic prospects for the rest of the world are also boosting the greenback. Europe is on the front lines of an economic war with Russia. China is facing its biggest slowdown in years as a multidecade property boom unravels.

-

Comment by Riaz Haq on September 18, 2022 at 2:17pm

-

Strong #US #Dollar Spells Trouble for World #Economy. Its rise being felt in #fuel and #food shortages in #SriLanka, in #Europe’s record #inflation, in #Japan’s exploding #trade deficit, #Pakistan's #IMF bailout and #Bangladesh seeking IMF help https://www.wsj.com/articles/dollars-rise-spells-trouble-for-global... via @WSJ

For the U.S., a stronger dollar means cheaper imports, a tailwind for efforts to contain inflation, and record relative purchasing power for Americans. But the rest of the world is straining under the dollar’s rise.

“I think it’s early days yet,” said Raghuram Rajan, a finance professor at the University of Chicago’s Booth School of Business. When he served as governor of the Reserve Bank of India last decade, he complained loudly about how Fed policy and a strong dollar hit the rest of the world. “We’re going to be in a high-rates regime for some time. The fragilities will build up.”

-------------

-------

On Thursday, the World Bank warned that the global economy was heading toward recession and “a string of financial crises in emerging market and developing economies that would do them lasting harm.”

The stark message adds to concerns that financial pressures are widening for emerging markets outside of well-known weak links such as Sri Lanka and Pakistan that have already sought help from the International Monetary Fund. Serbia became the latest to open talks with the IMF last week.

“Many countries have not been through a cycle of much higher interest rates since the 1990s. There’s a lot of debt out there augmented by the borrowing in the pandemic,” said Mr. Rajan. Stress in emerging markets will widen, he added. “It’s not going to be contained.”

A stronger dollar makes the debts that emerging-market governments and companies have taken out in U.S. dollars more expensive to pay back. Emerging-market governments have $83 billion in U.S. dollar debt coming due by the end of next year, according to data from the Institute of International Finance that covers 32 countries.

-

Comment by Riaz Haq on November 25, 2022 at 7:31pm

-

Pakistan's central bank unexpectedly raised its key policy rate by 100 basis points to 16% on Friday to ensure high inflation does not get entrenched.

The move brings the State Bank of Pakistan's (SBP) 2022 hikes to 625 basis points. It kept the rate unchanged at its last two meetings in October and September.

https://www.reuters.com/markets/asia/pakistan-cenbank-raises-key-ra...

Analysts at the post-policy briefing told Reuters that SBP Deputy Governor Murtaza Syed said the bank responded as inflation had moved beyond a transient shock in food and energy prices to show up in core inflation.

Syed also said the bank did not want high inflation expectations to become entrenched, and aimed to get ahead of broader pressures on the economy, they added.

"Looks like SBP is more concerned with rising inflation. Moreover IMF talks for next tranche is under way and is delayed, that may have also compelled the committee to take this step to fight inflation," Topline Securities' Chief Executive Mohammed Sohail said.

Pakistan's timely finalisation of a recovery plan from the floods is essential to support discussions and continued financial support from multilateral and bilateral partners, the International Monetary Fund (IMF) said on Wednesday.

"Too much emphasis on current inflation," Fahad Rauf, head of research at Ismail Iqbal Securities, told Reuters. "On a forward looking basis, inflation is going to head downwards."

He estimated a drop in November CPI to 24% from 26.6% in October. Economic activity indicators signal a sharp slowdown and another rate hike will do more harm than good by increasing the government's debt burden, hurting the private sector and causing higher unemployment, he added.

The SBP affirmed a Gross Domestic Product estimate of about 2% for fiscal 2023 and a current account deficit forecast of about 3% of GDP. However, it now expects higher food prices and core inflation to push average inflation to 21-23% instead the previous estimate of 18-20%.

-

Comment by Riaz Haq on January 5, 2023 at 7:31am

-

2023 PPP GDPs, according to IMF

Pakistan $1.62 trillion

Bangladesh $1.48 trillion

Egypt $1.8 trillion

https://www.imf.org/external/datamapper/PPPGDP@WEO/PAK/BGD/EGY

Twitter Feed

Live Traffic Feed

Sponsored Links

South Asia Investor Review

Investor Information Blog

Haq's Musings

Riaz Haq's Current Affairs Blog

Please Bookmark This Page!

Blog Posts

Pakistani Prosthetics Startup Aiding Gaza's Child Amputees

While the Israeli weapons supplied by the "civilized" West are destroying the lives and limbs of thousands of Gaza's innocent children, a Pakistani startup is trying to provide them with free custom-made prostheses, according to media reports. The Karachi-based startup Bioniks was founded in 2016 and has sold prosthetics that use AI and 3D scanning for custom designs. …

ContinuePosted by Riaz Haq on July 8, 2025 at 9:30pm

Indian Military Begins to Accept Its Losses in "Operation Sindoor" Against Pakistan

The Indian military leadership is finally beginning to slowly accept its losses in its unprovoked attack on Pakistan that it called "Operation Sindoor". It began with the May 31 Bloomberg interview of the Indian Chief of Defense Staff General Anil Chauhan in Singapore where he admitted losing Indian fighter aircraft to Pakistan in an aerial battle on May 7, 2025. General Chauhan further revealed that the Indian Air Force was grounded for two days after this loss. …

ContinuePosted by Riaz Haq on July 5, 2025 at 10:30am — 6 Comments

© 2025 Created by Riaz Haq.

Powered by

![]()

You need to be a member of PakAlumni Worldwide: The Global Social Network to add comments!

Join PakAlumni Worldwide: The Global Social Network