PakAlumni Worldwide: The Global Social Network

The Global Social Network

Goldman Sachs Projects Pakistan Economy to Become the World's 6th Largest by 2075

|

| GDP Ranking Changes Till 2075. Source: Goldman Sachs Investment Res... |

|

| Economic Growth Rate Till 2075. Source: Goldman Sachs Investment Re... |

Economic Impact of Slower Population Growth:

Daly and Gedminas argue that slowing population growth in the developed world is causing their economic growth to decelerate. At the same time, the economies of the developing countries are driven by their rising populations. Here are four key points made in the report:

1) Slower global potential growth, led by weaker population growth.

2) EM convergence remains intact, led by Asia’s powerhouses. Although real GDP growth has slowed in both developed and emerging economies, in relative terms EM growth continues to outstrip DM growth.

3) A decade of US exceptionalism that is unlikely to be repeated.

4) Less global inequality, more local inequality.

|

| Goldman Sachs' Revised GDP Projections. Source: The Path to 2075 |

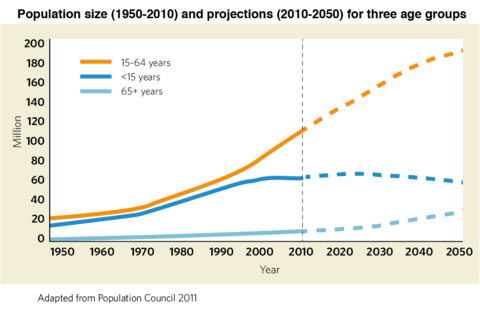

Demographic Dividend:

With rapidly aging populations and declining number of working age people in North America, Europe and East Asia, the demand for workers will increasingly be met by major labor exporting nations like Bangladesh, China, India, Mexico, Pakistan, Russia and Vietnam. Among these nations, Pakistan is the only major labor exporting country where the working age population is still rising faster than the birth rate.

|

| Pakistan Population Youngest Among Major Asian Nations. Source: Nik... |

|

| World Population 2022. Source: Visual Capitalist |

|

| World Population 2050. Source: Visual Capitalist |

Over 10 million Pakistanis are currently working/living overseas, according to the Bureau of Emigration. Before the COVID19 pandemic hit in 2020, more than 600,000 Pakistanis left the country to work overseas in 2019. Nearly 700,000 Pakistanis have already migrated in this calendar year as of October, 2022. The average yearly outflow of Pakistani workers to OECD countries (mainly UK and US) and the Middle East was over half a million in the last decade.

|

| Consumer Markets in 2030. Source: WEF |

World's 7th Largest Consumer Market:

Pakistan's share of the working age population (15-64 years) is growing as the country's birth rate declines, a phenomenon called demographic dividend. With its rising population of this working age group, Pakistan is projected by the World Economic Forum to become the world's 7th largest consumer market by 2030. Nearly 60 million Pakistanis will join the consumer class (consumers spending more than $11 per day) to raise the country's consumer market rank from 15 to 7 by 2030. WEF forecasts the world's top 10 consumer markets of 2030 to be as follows: China, India, the United States, Indonesia, Russia, Brazil, Pakistan, Japan, Egypt and Mexico. Global investors chasing bigger returns will almost certainly shift more of their attention and money to the biggest movers among the top 10 consumer markets, including Pakistan. Already, the year 2021 has been a banner year for investments in Pakistani technology startups.

Haq's Musings

South Asia Investor Review

Pakistan is the 7th Largest Source of Migrants in OECD Nations

Pakistani-Americans: Young, Well-educated and Prosperous

Last Decade Saw 16.5 Million Pakistanis Migrate Overseas

Pakistan Remittance Soar 30X Since Year 2000

Pakistan's Growing Human Capital

Two Million Pakistanis Entering Job Market Every Year

Pakistan Projected to Be 7th Largest Consumer Market By 2030

Hindu Population Growth Rate in Pakistan

Do South Asian Slums Offer Hope?

-

Comment by Riaz Haq on December 24, 2022 at 7:05pm

-

Indian economy grew 8.7% in last fiscal year to surpass pre-Covid levels, IMF says

Growth expected to moderate to 6.8% in current year amid tighter financial conditions

https://www.thenationalnews.com/business/economy/2022/12/23/indian-...

India’s real gross domestic product grew by 8.7 per cent in the 2021-2022 fiscal year, boosting its total output above pre-coronavirus levels despite global macroeconomic headwinds, the International Monetary Fund has said.

India, Asia's third-largest economy and the world's fifth largest, rebounded from the deep pandemic-induced downturn on the back of fiscal measures to address high prices and monetary policy tightening to address elevated inflation, the Washington-based lender said in a report on Friday.

“Economic headwinds include inflation pressures, tighter global financial conditions, the fallout from the war in Ukraine and associated sanctions on Russia, and significantly slower growth in China and advanced economies,” the fund said.

“Growth has continued this fiscal year, supported by a recovery in the labour market and increasing credit to the private sector.”

In October, the IMF cut its global economic growth forecast for next year, amid the Ukraine conflict, broadening inflation pressures and a slowdown in China, the world’s second-largest economy.

The fund maintained its global economic estimate for this year at 3.2 per cent but downgraded next year's forecast to 2.7 per cent — 0.2 percentage points lower than its July forecast.

There is a 25 per cent probability that growth could fall below 2 per cent next year, the IMF said in its World Economic Outlook report at the time.

Global economic growth in 2023 is expected to be as weak as in 2009 during the financial crisis as a result of the Ukraine conflict and its impact on the world economy, according to the Institute of International Finance.

Economic growth in India is expected to moderate, reflecting the less favourable outlook and tighter financial conditions, the IMF said.

Real GDP is projected to grow at 6.8 per cent for the current financial year to the end of March, and by 6.1 per cent in 2023-2024 fiscal year, according to the fund's estimates.

Reflecting broad-based price pressures, inflation in India is forecast at 6.9 per cent in the 2022-2023 fiscal year and expected to moderate only gradually over the next year.

Rising inflation can further dampen domestic demand and affect vulnerable groups, according to the fund.

India’s current account deficit is expected to increase to 3.5 per cent of GDP in the 2022-2023 fiscal year as a result of both higher commodity prices and strengthening import demand, the lender said.

“A sharp global growth slowdown in the near term would affect India through trade and financial channels,” it said.

“Intensifying spillovers from the war in Ukraine can cause disruptions in the global food and energy markets, with significant impact on India. Over the medium term, reduced international co-operation can further disrupt trade and increase financial markets’ volatility.”

However, the successful introduction of wide-ranging reforms or greater-than-expected dividends from the advances in digitalisation could increase India’s medium-term growth potential, the IMF said.

Additional monetary tightening should be carefully calibrated and communicated, it said.

“The exchange rate should act as the main shock absorber, with intervention limited to address disorderly market conditions,” the report said.

The IMF also recommended that India’s financial sector policies should continue to support the exit of non-viable companies and encourage banks to build capital buffers and recognise problem loans.

Reforms to strengthen governance and reduce the government’s footprint are needed to support strong medium-term growth, it said.

The lender also highlighted the need for structural reforms to promote resilient, green and inclusive growth.

-

Comment by Riaz Haq on December 24, 2022 at 8:28pm

-

Arvind Panagariya cautions against cutting trade ties with China

https://www.thehindu.com/business/arvind-panagariya-cautions-agains...

“Engaging China in a trade war at this juncture will mean sacrificing a considerable part of our potential growth... purely on economic grounds, it will be unwise to take any action in response to it (transgressions on the border),” the eminent economist told PTI.

Amid demands for snapping trade ties with China for its transgressions on the border, former NITI Aayog Vice-Chairman Arvind Panagariya has opined that cutting trade ties with Beijing at this juncture would amount to sacrificing India's potential economic growth.

Instead, Mr. Panagariya suggested that India should try to enter into free trade agreements (FTA) with countries such as the U.K. and the European Union to expand its trade.

------

Mr. Panagariya, currently a professor of economics at Columbia University, said both countries can play the trade sanctions game but the ability of a $17 trillion economy (China) to inflict injury on a $3 trillion economy (India) is far greater than the reverse.

"Now, there are some who want trade sanctions on China to 'punish' it for its transgressions on the border... if we try to punish China, it will not sit back, as amply illustrated by its response to sanctions by even the mighty United States," he observed.

----------

Mr. Panagariya pointed out that even a large economy such as the U.S. has not been very successful with its sanctions either against China or even Russia.

"Its close ally, EU, has had to pay a very high price of the sanctions against Russia. So, this is a very slippery slope," he observed.

The trade deficit, the difference between imports and exports, between India and China touched $51.5 billionduring April-October this fiscal. The deficit during 2021-22 had jumped to $73.31 billion as compared to $44.03 billion in 2020-21, according to the latest government data According to the data, imports during April-October this fiscal stood at $60.27 billion, while exports aggregated at $8.77 billion.

-

Comment by Riaz Haq on December 25, 2022 at 7:36pm

-

Pakistan: Top Performing Sectors And Scrips Of 2022 – OpEd

https://www.eurasiareview.com/26122022-pakistan-top-performing-sect...

Let me and you accept the harsh reality that 2022 was a bad year for Pakistan’s capital market. Market value (market capitalization) of companies listed at Pakistan Stock Exchange (PSX) declined 17% to RKR6.4 trillion. In US$ terms it plummeted 35% to US$28 billion. Still there are some islands of excellence.

Real Estate Investment Trust (REIT), Synthetic & Rayon, and Sugar were the top performing sectors in 2022 as their market cap increased by 12%, 6% and 5% respectively, despite bad market conditions.

Technology sector was up 2% and outperformed the market despite fall in global listed technology stocks.

As against these, Engineering, Automobile Parts, and Miscellaneous sectors remained the worst performing sectors posting decline of 45%, 41% and 34% respectively.

REIT sector that has only one listed company gained in 2022 due to stable dividend yield coupled with changes in regulations on REITs investment for banks. To recall, State Bank of Pakistan (SBP) recently allowed banks to count their investments in shares issued by REIT towards achievement of housing and construction finance targets.

Synthetic & Rayon also posted strong performance led by rally in Ibrahim Fiber Limited (IBFL).

Sugar sector performance was led by JDW Sugar Mills (JDWS) that announced buy back.

Engineering sector (mainly steel related companies) was badly impacted due to economic slowdown and subdued construction activity.

Automobile parts sector also remained amongst worst performing sectors primarily due to import restrictions, high financing rates and lackluster demand.

For its analysis, Pakistan’s leading brokerage house, Topline Securities assumed sectors with minimum market capitalization of US$100 million adjusted for new listings including Adamjee Insurance (AICL), and Telecard Limited (GEMSNL).

Lotte Chemical (LOTCHEM) doubled while Airlink was down substantially in 2022. LOTCHEM was the top performing stock of the market in 2022 where the scrip gained more than 100%. Investors were excited over potential sell off by Lotte Chemical Corporation South Korea (parent company of LOTCHEM) and subsequent public offer for minority shareholders.

LOTCEHM was followed by Faysal Bank (FABL) and Unilever Pakistan Foods (UPFL). The strong stock performance by FABL is on announcement to convert into an Islamic Bank followed by a special dividend.

Similarly, UPFL stock was up 34% as the company posted strong profitability growth of 33%YoY in 9M2022.

Systems Limited (SYS), Pakistan’s largest listed IT firm remained amongst the top performing stocks for the third consecutive year as the company continued to post strong profitability growth in spite of economic challenges.

Air Link Communication (AIRLINK) declined 54% due to low profits led by lower volumetric sales.

Gul Ahmed Textile Mills (GATM) also reported decline by 52% amid slowdown in textile exports.

Searle Company Limited (SEARLE) was down 52% due to lower profits led by falling gross margins driven by significant jump in raw material cost and company’s inability to immediately pass full impact on to consumers.

-

Comment by Riaz Haq on December 29, 2022 at 10:27am

-

Unlocking Pakistan’s digital potential: The economic opportunities of digital transformation and Google’s contribution

https://alphabeta.com/our-research/unlocking-pakistans-pkr97-trilli...

Pakistan’s vibrant technology sector has grown significantly in recent years and is well-positioned for further growth. The country produces over 20,000 Information Technology (IT) graduates each year, has nurtured over 700 tech start-ups since 2010, and has the fourth highest earning IT workforce in the world. Pakistan’s technology sector also has a large export element, with annual revenue from exports of IT and IT-enabled Services (ITeS) accounting for USD1.4 billion in 2020 – having grown at 10.8 percent per year since 2010. Furthermore, the government has identified the creation of a holistic digital ecosystem – most prominently in its “Digital Pakistan Policy” – as one of the key levers of economic growth.

Despite these significant achievements, the country can go further in its digital transformation journey. Pakistan’s online population has grown rapidly at 68 percent per annum from 2016 to 2019, and the Internet penetration rate reached 35 percent in January 2020. However, the country faces several hurdles to full digital transformation. For example, the World Economic Forum’s “Global Competitiveness Index 2019” ranked Pakistan as 73rd out of 141 countries on the ability of the active working population to possess and use digital skills. Digital transformation will also be important to boost its economic recovery efforts and enhance the long-term resilience of businesses in adapting to future “black swan” events in the post-pandemic era.

There is a significant economic prize attached to accelerating Pakistan’s digital transformation. AlphaBeta’s study (commissioned by Google) finds that digital technologies can unlock PKR9.7 trillion (USD59.7 billion) worth of annual economic value in Pakistan by 2030.

Key messages from the research include:

There is a significant economic prize attached to accelerating Pakistan’s digital transformation. If fully leveraged by 2030, digital technologies could create up to PKR9.7 trillion (USD59.7 billion) in economic value. This is equivalent to about 19 percent of the country’s GDP in 2020. The sectors projected to be the largest beneficiaries are agriculture and food; consumer, retail and hospitality; and education and training. For example, machine learning algorithms have shown to be beneficial for the agricultural and food sector, where AI-powered technologies can monitor ecological conditions to determine whether crops need irrigation or not, reducing water use.

There are three areas of action required for Pakistan to fully capture its digital opportunity: i) develop infrastructure to support the local tech ecosystem; ii) create a conducive environment for IT exports, and iii) promote innovation and digital skills. A range of policies by the Pakistani government has already been introduced to accelerate digital transformation such as “Right of Way” policy, which expedites the expansion of telecom infrastructure, and the “Brand Pakistan” campaign, which promotes the country’s exports via digital platforms. However, there is further scope of actions for Pakistan to consider such as increasing Internet availability through infrastructure investments, especially in rural areas (e.g., Thailand’s “Net Pracharat” programme to expand the national broadband network), creating an accommodative tax framework and ease restrictive data policies, and forging close public-private partnerships to improve the relevance of skills trainings (e.g., “Philippines Talent Mapping Initiative” which involved Philippines’ Department of Labour and Employment consulting with employers to create a framework to analyse the competencies of Filipinos).

-

Comment by Riaz Haq on January 3, 2023 at 5:30pm

-

The year 2023 marks a historic turning point for Asia's demography: For the first time in the modern era, India is projected to surpass China as the most populous country.

https://asia.nikkei.com/Spotlight/Asia-Insight/Old-Japan-young-Indi...

Besides China (1.426 billion) and India (1.417 billion), five other Asian countries had over 100 million people as of 2022, the U.N. figures show. Indonesia had 276 million, Pakistan's population was at 236 million, Bangladesh counted 171 million, Japan had 124 million and the Philippines had 116 million. Vietnam, with 98 million, is expected to join the club soon.

------------

Even though economists expect India's gross domestic product to grow around 7% in 2023 -- the highest among major economies -- and although the worst of the COVID-19 pandemic appears to be over, India continues to face high unemployment rates of around 8%, according to the Center for Monitoring Indian Economy, a local private researcher. That shows the country is not creating enough jobs to support the growing population.

---------

Kumagai also said that India's growing demand for food could be felt beyond its borders.

"The challenge for India concerning food is that the production of agricultural products is easily affected by the weather," he said. "On the other hand, domestic demand is increasing rapidly. As such, when production is low, domestic supply is prioritized, which eventually may lead to restrictions on exports, just as India restricted wheat exports in 2022, which could cause food problems in other countries as well."

--------

While the South Asian nation's growing and youthful population spells opportunities for development, it also creates layers of challenges, from poverty reduction to education. Experts say soaring demand for food could affect India's trade with other countries, while the World Bank recently estimated that India will need to invest $840 billion into urban infrastructure over the next 15 years to support its swelling citizenry.

"This is likely to put additional pressure on the already stretched urban infrastructure and services of Indian cities -- with more demand for clean drinking water, reliable power supply, efficient and safe road transport amongst others," the bank's report said.

India's dilemmas are only part of a complex and diverging Asian population picture -- split between young, growing countries and aging, declining ones. Humanity's latest milestone turns a spotlight on this gap and the problems on both sides of it.

---

Reaching a world of 8 billion people signals significant improvements in public health that have increased life expectancy, the U.N. said. But it also pointed out, "The world is more demographically diverse than ever before, with countries facing starkly different population trends ranging from growth to decline."

Nowhere is this more apparent than in Asia. The region has young countries with a median age in the 20s, such as India (27.9 years old), Pakistan (20.4) and the Philippines (24.7), as well as old economies with median ages in the 40s, including Japan (48.7) and South Korea (43.9). The gap between the young and the old has gradually widened over the past decades.

While India faces a lack of jobs and infrastructure to support its growing population, Japan faces a serious reduction in births, accelerated by the COVID-19 pandemic, which its government says is a "critical situation." Either way, the population trends are increasingly impacting economies and societies.

Even though economists expect India's gross domestic product to grow around 7% in 2023 -- the highest among major economies -- and although the worst of the COVID-19 pandemic appears to be over, India continues to face high unemployment rates of around 8%, according to the Center for Monitoring Indian Economy, a local private researcher. That shows the country is not creating enough jobs to support the growing population.

-

Comment by Riaz Haq on January 7, 2023 at 10:27am

-

Sadanand Dhume

@dhume

Contrary to all the hype, India’s market for consumer goods remains very small. The Chinese buy about 8X more iPhones and nearly 100X more BMWs than Indians. Starbucks has 20X as many outlets in China as in India. [My take] v

@WSJopinionhttps://www.wsj.com/articles/india-middle-class-free-trade-modi-tar...

https://twitter.com/dhume/status/1611155691540217858?s=20&t=FIh...

Sadanand Dhume

@dhume

This column has set off a mini firestorm here, so let me quickly respond to some of the objections. First, people point out that obviously China is a larger market than India. After all, it’s a larger economy. Chinese GDP in 2021: $17.73T. Indian GDP: $3.18T. 1/nhttps://twitter.com/dhume/status/1611369521146732553?s=20&t=FIh...

Sadanand Dhume

@dhume

But this doesn’t refute my central point—that contrary to popular belief India’s market is small by global standards. We should ask how China pulled so far ahead. In 1990 Chinese GDP ($360b) was similar to Indian GDP ($321b). Now China’s economy is 5.6X larger than India’s. 2/n

Sadanand Dhume

@dhume

Over the past decade, the gap between China and India has not shrunk. It has grown. In 2012, the Chinese economy was 4.7X larger than India’s. 3/nSadanand Dhume

@dhume

Moreover, as I show in my piece, mere GDP figures are misleading. For many consumer goods, the gap between the Chinese market and the Indian market is LARGER than the gap between Chinese and Indian GDP. 4/n

Sadanand Dhume

@dhume

Now to the second major objection: “Don’t talk about Starbucks, iPhones and Netflix subscriptions. These are luxury goods.” My response: The fact that they are luxury goods in India proves my point. If Indians had more disposable income they would not be seen as luxury goods. 5/n

Sadanand Dhume

@dhume

Or take cars, a middle class good in much of the world. In 2021, the Chinese bought 26.3m cars. Indians bought 3.7m cars. The Chairman of Maruti Suzuki recently pointed out that it could take 40 years for the Indian car market to catch up with China’s. 6/nIndia will take 40 yrs to draw level with China's car penetration: Bhargava

As a result, the small car market has been shrinking as two-wheeler customers shelve or delay plans to upgrade to a four-wheeled drivehttps://www.business-standard.com/article/companies/india-to-take-1...

-

Comment by Riaz Haq on January 9, 2023 at 8:39am

-

India's nominal GDP growth is likely to fall in 2023-24, hurting tax collections and putting pressure on the federal government to reduce the budget gap by cutting expenses ahead of national elections in 2024.

https://www.reuters.com/world/india/fall-india-nominal-gdp-growth-f...

Nominal GDP growth, which includes inflation, is the benchmark used to estimate tax collections in the upcoming budget to be presented on Feb. 1. It is estimated to be around 15.4% for the current financial year.

At least four leading economists expect nominal GDP growth to come in between 8% and 11% as inflation slows and real GDP growth eases from an estimated 7% this year, when pandemic-related distortions and pent-up demand pushed up growth rates.

A lower tax revenue will limit the government's ability to spend and support the economy as the country heads to national elections in 2024. It will also strain efforts to bring down the fiscal deficit towards the medium-term target of 4.5% of GDP by 2025/26.

-

Comment by Riaz Haq on January 10, 2023 at 8:57pm

-

Saudi Arabia is considering providing up to $11 billion to #Pakistan, a potential lifeline to a country facing default. #Qatar and #UAE are likely to join #SaudiArabia for up to $22 billion package of #loans and #investments for the country.

https://www.wsj.com/articles/saudi-arabia-signals-it-could-provide-...

ISLAMABAD, Pakistan—Saudi Arabia said Tuesday that it was considering providing up to $11 billion to Pakistan, a potential lifeline to a country facing default.

The United Arab Emirates and Qatar in recent months have said they might also offer help to Pakistan, with potential loans and investments from Gulf nations now totaling at least $22 billion after the latest announcement from Riyadh. Gulf countries have said they could extend a similar level of support to Egypt, which is also struggling economically.

The support from Saudi Arabia could strengthen Pakistan’s hand in negotiating a restart to a stalled bailout from the International Monetary Fund. Islamabad has so far been unwilling to agree to the IMF’s terms for a deal, which include raising electricity and gasoline prices and increasing taxes.

The country’s foreign-currency reserves are fast running out, with financial markets hoping that the IMF program can be put back on track within days.

Pakistan has only around $4.5 billion in official foreign-currency reserves, financial analysts estimate. In January and February this year it is due to repay debt of $6.4 billion, according to figures from the central bank. By December, it must repay a further $12.8 billion, according to the central bank.

Saudi Arabia said Tuesday that it would study increasing its investment plans for Pakistan to $10 billion from $1 billion and would also study raising its loan deposit with Pakistan’s central bank to $5 billion from the current $3 billion, “confirming the Kingdom’s position supportive to the economy of the Islamic Republic of Pakistan and its sisterly people.”

The news followed a visit by Pakistan’s new army chief, Gen. Asim Munir, to Saudi Arabia, where he met Crown Prince Mohammad bin Salman. In the meeting, “they reviewed bilateral relations and the ways of enhancing them,” Riyadh said Monday.

Pakistan is a close partner to Saudi Arabia, including providing soldiers for guarding sites and training Saudi troops. Millions of Pakistanis work in Saudi Arabia.

Pakistan has also drawn in recent months on its other close allies, in the Gulf and China, as it struggles to repay loans taken out over the last decade.

Pakistani Prime Minister Shehbaz Sharif will visit the U.A.E. later this week, and Islamabad hopes his hosts will roll over a $2 billion loan due to mature shortly and provide additional financing. The U.A.E. pledged last year to invest around $2 billion in Pakistan. Qatar has said it would invest $3 billion in Pakistan.

None of the Gulf nations’ investment plans, mostly likely to involve the purchase of state-owned enterprises, have so far materialized. Saudi Arabia has also floated the idea of building a large oil refinery in Pakistan.

China has provided a $4 billion loan deposit with Pakistan’s central bank. Around a third of Pakistan’s debt is held by Beijing. In recent years, Beijing has carried out a multibillion-dollar infrastructure-building program in the country, a showcase for its global Belt and Road Initiative, which seeks to spread Chinese influence through large construction projects.

There are few ready investment opportunities in Pakistan for Gulf nations, while its cash needs are immediate, said Samiullah Tariq, head of research at Pakistan Kuwait Investment Company, a local financing group. Despite the Saudi announcement, Pakistan still needs the IMF, he said.

“There is a liquidity crunch,” said Mr. Tariq. “We need the money right away.”

-

Comment by Riaz Haq on January 11, 2023 at 12:21pm

-

World Bank Cuts 2023 Global Growth Projection as Inflation Persists

China and Ukraine inject uncertainty into world economy

https://www.wsj.com/articles/world-bank-cuts-2023-global-growth-pro...

The forecast growth rate only narrowly keeps the global economy out of recession territory. The international development organization cited a coalescence of high inflation, rising interest rates, lower investment and Russia’s invasion of Ukraine as threats to growth, along with pandemic-related disruptions in China and stress in its real-estate sector.

“Global growth has slowed to the extent that the global economy is perilously close to falling into recession,” the World Bank said in its latest report on global economic prospects. World Bank President David Malpass told reporters Tuesday he is “deeply concerned that the slowdown may persist.”

----

“Inflation won’t quite go down the way people expected,” Mr. Dimon said. “But it will definitely be coming down a bit.”

Some economists have projected that both the U.S. and parts of Europe could slip into a recession for a portion of 2023. A global recession, defined as a contraction in annual global per capita income, is more rare because China and emerging markets often grow faster than more developed economies. Essentially the world economy is considered to be in recession if economic growth falls behind population growth.

For all of 2023, the World Bank forecasts U.S. gross domestic product will increase 0.5% from the prior year, and expects no growth for the eurozone. The bank predicts China’s GDP will increase 4.3% in 2023 from the prior year, an uptick from an estimate of 2.7% growth last year. Emerging market and developing economies are projected to expand 3.4%, a steady rate of growth from 2022’s expansion.

Russian GDP is forecast to contract 3.3% after falling 3.5% in 2022, as sanctions continue to weigh on spending and investment, the bank said.

Elevated inflation is keeping pressure on global central banks to tighten monetary policy, which subsequently slows investment and the broader economy.

The World Bank called on global central banks to remain alert to the risk that aggressively tightening monetary policy to fight inflation could spill across borders. The new report called for discussions between central bankers to “help mitigate risks associated with financial stability and avoid an excessive global economic slowdown in the pursuit of inflation objectives.”

Federal Reserve Chairman Jerome Powell, speaking in Stockholm Tuesday, reiterated the central bank’s commitment to bringing down inflation, even though he said interest-rate increases could fuel political blowback.

“Price stability is the bedrock of a healthy economy and provides the public with immeasurable benefits over time,” Mr. Powell said. “But restoring price stability when inflation is high can require measures that are not popular in the short term as we raise interest rates to slow the economy.”

Central banks rapidly raised interest rates last year to combat high inflation, and are expected to fine-tune their approach this year as rates reach levels that are likely to weigh on economic growth. In the U.S., the labor market remained strong through 2022’s end, suggesting the Federal Reserve rapid rate rises haven’t yet significantly cooled demand.

---------

The World Bank has previously said that developing countries have amassed high levels of debt that could be difficult to repay as the global economy slows and interest rates rise.

“Further adverse shocks could push the global economy into yet another recession,” the report said, adding that “small states are especially vulnerable to such shocks because of the reliance on external trade and financing, limited economic diversification, elevated debt, and susceptibility to natural disasters.”

-

Comment by Riaz Haq on January 13, 2023 at 8:20am

-

UAE pledges $3bn loan to help cash-strapped ally Pakistan

The existing loan of $2bn will be topped with an additional loan of $1bn

https://www.aljazeera.com/news/2023/1/12/uae-extends-existing-loan-...

The United Arab Emirates is pledging a $1bn loan to cash-strapped Pakistan and also agreed to roll over an existing loan of $2bn in a boost to the South Asian nation grappling with an economic crisis, according to Pakistan prime minister’s office.

The announcement came after Pakistani Prime Minister Shehbaz Sharif held talks with UAE President Sheikh Mohamed bin Zayed Al Nahyan in the capital Abu Dhabi on Thursday on his third visit to the Gulf country after taking office last April.

The two leaders “agreed to deepen the investment cooperation, stimulate partnerships and enable investment integration opportunities between the two countries,” a PMO statement said.

Sharif has been struggling to put the economy on track since taking office, with his first finance minister Miftah Ismail resigning abruptly last September.

Islamabad is seeking financial aid from its close allies such as Saudi Arabia and China, besides the UAE as it negotiates for the next tranche of loans from the International Monetary Fund (IMF).

Ismail told Al Jazeera that the decision to roll over the fund is “great news to Pakistan”, and the announcement was seen by some analysts as a much-needed relief to the country which has seen its central bank’s foreign reserves deplete to less than $4.5bn, covering less than a month of imports.

Ammar Habib Khan, an Islamabad-based economist, said that the additional funding would provide timely support to Pakistan’s precarious economy.

On Wednesday, the World Bank slashed the gross domestic product (GDP) growth projections to 2 percent. The dire economic situation has forced the government to resort to extreme steps, such as closing malls and restaurants early.

“This funding will provide some support to Pakistan to manage its imports. However, to get out of the crisis, it does need more injection of dollars, necessitating continuation of the International Monetary Fund programme,” he told Al Jazeera.

Pakistan has struggled to convince the IMF to release the next tranche of $1.1bn loans, which has been pending since September on account of deadlock between the two parties.

Twitter Feed

Live Traffic Feed

Sponsored Links

South Asia Investor Review

Investor Information Blog

Haq's Musings

Riaz Haq's Current Affairs Blog

Please Bookmark This Page!

Blog Posts

Pakistani International Students Flocking to European Universities

Recent data shows that there are nearly 10,000 Pakistani students attending colleges and universities in Germany. This figure is second only to the United Kingdom which issued over 35,000 student visas to Pakistanis in 2024. The second most popular destination for Pakistani students in Australia which is hosting nearly 24,000 students from Pakistan as of 2023, according to the ICEF…

ContinuePosted by Riaz Haq on July 15, 2025 at 9:00am

Pakistani Prosthetics Startup Aiding Gaza's Child Amputees

While the Israeli weapons supplied by the "civilized" West are destroying the lives and limbs of thousands of Gaza's innocent children, a Pakistani startup is trying to provide them with free custom-made prostheses, according to media reports. The Karachi-based startup Bioniks was founded in 2016 and has sold prosthetics that use AI and 3D scanning for custom designs. …

ContinuePosted by Riaz Haq on July 8, 2025 at 9:30pm

© 2025 Created by Riaz Haq.

Powered by

![]()

You need to be a member of PakAlumni Worldwide: The Global Social Network to add comments!

Join PakAlumni Worldwide: The Global Social Network