PakAlumni Worldwide: The Global Social Network

The Global Social Network

India's Crony Capitalism: Modi's Pal Adani's Wealth Grows at the Expense of Ordinary Bangladeshis and Indians

Prime Minister Shaikh Hasina has agreed to buy expensive electricity from India in spite of a power glut in Bangladesh, according to a report in the Washington Post. The newspaper quotes B.D. Rahmatullah, a former director general of Bangladesh’s power regulator, as saying, "Hasina cannot afford to anger India, even if the deal appears unfavorable." “She knows what is bad and what is good,” he said. “But she knows, ‘If I satisfy (Gautam) Adani, Modi will be happy.’ Bangladesh now is not even a state of India. It is below that.” The Washington Post report says: "Facing a looming power glut, Bangladesh in 2021 canceled 10 out of 18 planned coal power projects. Mohammad Hossain, a senior power official, told reporters that there was “concern globally” about coal and that renewables were cheaper".

|

| Gautam Adani (L) and Narendra Modi |

|

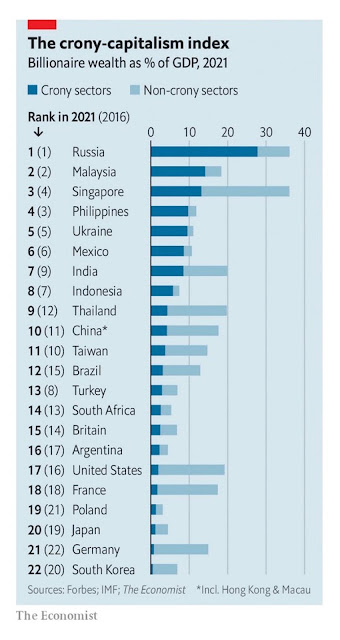

| India Ranks High on Crony Capitalism Index. Source: Economist |

Hasina recently visited New Delhi to seek political and economic assistance from the Indian Prime Minister Narendra Modi. This summit was preceded by Bangladesh Foreign Minister Abdul Momen's trip to India where he said, "I've requested Modi government to do whatever is necessary to sustain Sheikh Hasina's government". Upon her return from India, Sheikh Hasina told the news media in Dhaka, "They (India) have shown much sincerity and I have not returned empty handed". It has long been an open secret that Indian intelligence agency RAW helped install Shaikh Hasina as Prime Minister of Bangladesh, and her Awami League party rely on New Delhi's support to stay in power. Bangladesh Foreign Minister Abdul Momen has described India-Bangladesh as one between husband and wife. In an interview with Indian newspaper 'Ajkal,' he said, "Relation between the both countries is very cordial. It's much like the relationship between husband and wife. Though some differences often arise, these are resolved quickly." Both Bangladeshi and Indian officials have reportedly said that Sheikh Hasina "has built a house of cards".

|

| Shaikh Hasina (L) with Narendra Modi |

The Washington Post reports that the Modi government has changed laws to help Adani’s coal-related businesses and save him at least $1 billion. After a senior Indian official opposed supplying coal at a discount to Adani and other business tycoons, he was removed from his job by the Modi administration, according to the paper. Modi has continued to support Adani's business with discounted coal even after telling the United Nations he would tax coal and ramp up renewable energy. India is the world's third largest carbon emitter.

|

| World's Top 5 Carbon Emitters. Source: Our World in Data |

While the coal prices have declined to the level before the start of the Ukraine War, Adani’s power would still cost Bangladesh 33% more per kilowatt-hour than the publicly disclosed cost of running Bangladesh’s domestic coal-fired plant, according to Tim Buckley, a Sydney-based energy finance analyst.

|

| India's Crony Capitalism: Adani Enterprises Stock Up 56,000% on Modi's Watch |

Gautam Adani has become India's richest and the world's second richest person (after Elon Musk) since the election of Prime Minister Narendra Modi in 2014. Financial Times calls Adani "Modi's Rockefeller". Adani's rise owes itself to India's crony capitalism, according to France's Le Monde. Here's an excerpt of a Le Monde story on Adani:

"Adani has not invented some revolutionary technology or disruptive business model. His meteoric success cannot be attributed to innovation. In each sphere of activity among his conglomerates – airports, ports, mining, aerospace, defense industry – the Indian state plays a significant role, whether in allocating licenses or signing contracts. He is known as a close friend of Indian Prime Minister Narendra Modi, who also hails from Gujarat, a state in western India".

Adani has lent his personal airplanes to Modi for BJP's election campaigns. Adani has also recently taken over NDTV, the only Indian major TV channel known for its independence from the BJP government. This takeover has forced Prannoy and Radhika Roythe, the channel's founding couple, to step down. It has also forced out Ravish Kumar, a harsh critic of the Modi regime who hosted a number of popular shows like Hum Log, Ravish ki Report, Des Ki Baat, and Prime Time.

|

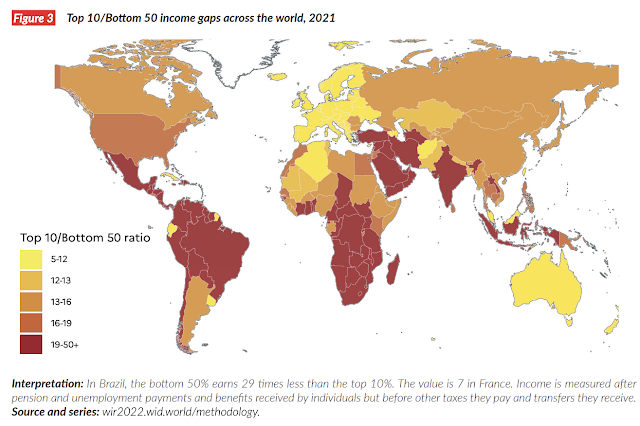

| Income Inequality Map. Source: World Inequality Report 2022 |

India is one of the most unequal countries in the world, according to the World Inequality Report 2022. There is rising poverty and hunger. Nearly 230 million middle class Indians have slipped below the poverty line, constituting a 15 to 20% increase in poverty. India ranks 94th among 107 nations ranked by World Hunger Index in 2020. Other South Asians have fared better: Pakistan (88), Nepal (73), Bangladesh (75), Sri Lanka (64) and Myanmar (78) – and only Afghanistan has fared worse at 99th place. Meanwhile, the wealth of Indian billionaires jumped by 35% during the pandemic.

Related Links:

Haq's Musings

South Asia Investor Review

India Among World's Most Unequal Countries

Shaikh Hasina Seeks Modi's Help to Survive

Food in Pakistan 2nd Cheapest in the World

Indian Economy Grew Just 0.2% Annually in Last Two Years

Pakistan to Become World's 6th Largest Cement Producer by 2030

India: World's Biggest Oligarchy?

Pakistan's Computer Services Exports Jump 26% Amid COVID19 Lockdown

Coronavirus, Lives and Livelihoods in Pakistan

Vast Majority of Pakistanis Support Imran Khan's Handling of Covid1...

Pakistani-American Woman Featured in Netflix Documentary "Pandemic"

Incomes of Poorest Pakistanis Growing Faster Than Their Richest Cou...

How Grim is Pakistan's Social Sector Progress?

Pakistan's Sehat Card Health Insurance Program

Trump Picks Muslim-American to Lead Vaccine Effort

COVID Lockdown Decimates India's Middle Class

COP27: Pakistan Demands "Loss and Damage" Compensation

Pakistan's Balance of Payments Crisis

How Has India Built Large Forex Reserves Despite Perennial Trade De...

India's Unemployment and Hunger Crises"

PTI Triumphs Over Corrupt Dynastic Political Parties

Strikingly Similar Narratives of Donald Trump and Nawaz Sharif

Nawaz Sharif's Report Card

Riaz Haq's Youtube Channel

-

Comment by Riaz Haq on January 30, 2023 at 10:17am

-

Heard on the Street: #Adani Group saga is a credibility test for #India’s markets and institutions. How #NewDelhi reacts will greatly affect foreign #investors’ perception of the country’s attractiveness. #Modi #CronyCapitalism #economy

https://www.wsj.com/articles/adani-group-saga-is-credibility-test-f... via @WSJ

The sprawling conglomerate built by Gautam Adani is under attack by short seller Hindenburg Research, which successfully deflated electric-vehicle maker Nikola Motors in 2020. At stake is both Mr. Adani’s empire and, potentially, India’s own ambitions to position itself as a credible alternative to China—as a manufacturing giant and a must-have part of an emerging-markets portfolio.

U.S.-based Hindenburg Research, which last week said it held short positions in Adani Group through its U.S.-traded debt and offshore derivatives, has accused the conglomerate of accounting fraud and stock manipulation through opaque offshore entities. Adani Group denies the allegations and says the short seller is trying to smear its reputation and derail a public stock offering. Shares of the group’s companies have plunged since Hindenburg’s report, wiping out nearly $64 billion in market value. Hindenburg’s report comes amid a $2.5 billion secondary share sale by Adani Enterprises 512599 4.21%increase; green up pointing triangle that closes on Tuesday.

The Indian government now faces a stark choice.

Reuters reports that India’s markets regulator is already looking into Hindenburg’s allegations as an extension of its own, previously stalled investigation. Foreign investors, who hold a large chunk of the conglomerate’s sizable debt, may be reluctant to keep financing it until they are confident that the regulator has thoroughly assessed Hindenburg’s claims. Yields on the group’s dollar bonds have leapt: an Adani Ports & Special Economic Zone Ltd. 532921 -0.29%decrease; red down pointing triangle dollar bond maturing in 2027 was yielding 12% on Monday, according to FactSet, up from less than 7% in mid-January. Yields on an Adani Green Energy Ltd. ADANIGREEN -20.00%decrease; red down pointing triangle bond maturing in 2024 have risen to 15%.

On the other hand, if a government investigation were to unearth real financial problems, India’s public-sector banks and insurers might end up holding the bag: Brokerage CLSA estimates, for example, that state-controlled banks have lent Adani Group companies the equivalent of about 6% of their fiscal year 2024 net worth. And Adani Group is a major part of the effort to upgrade India’s chronically poor infrastructure and thus its competitiveness.

Infrastructure is a capital-intensive business, so it is little surprise that Adani Group has a heavy debt load. Still, the group’s debt has risen precipitously in recent years. Net debt sits at 1.6 trillion Indian rupees, equivalent to $19.63 billion, while consolidated gross debt is 1.9 trillion Indian rupees, or $23.31 billion, according to Jefferies. Total debt at five major Adani companies rose about 76% from fiscal year 2019 to fiscal year 2022, according to data from CLSA, while earnings before interest, taxes, depreciation and amortization is up 120%. Flagship firm Adani Enterprises’ ratio of net debt to trailing Ebitda is 5.8, according to FactSet. That is much higher than peer Reliance Industries, which stands at 1.5. And Adani Enterprises shares fetch 112 times prospective earnings.

Foreign investors have also played an increasing role in financing Adani Group’s expansion in recent years, leaving it vulnerable to a change in sentiment. CLSA calculates that 29% of total debt at five major group companies—Adani Power 533096 -5.00%decrease; red down pointing triangle, Adani Green, Adani Ports, Adani Enterprises and Adani Transmission—is in foreign-currency bonds. But the brokerage estimates that 49% of the debt increase from fiscal year 2019 to fiscal year 2022 came from foreign-currency bonds.

-------------

The stakes could hardly be higher for both India and Adani Group.

-

Comment by Riaz Haq on January 30, 2023 at 7:10pm

-

#Adani Rout Hits $68 Billion as Fight With #Hindenburg Intensifies. Most Adani stocks declined again on Monday, flagship gained. The conglomerate’s dollar bonds also extended a plunge. #India #stocks #Modi #StockMarketindia https://www.bloomberg.com/news/articles/2023-01-30/most-adani-stock...

-

Comment by Riaz Haq on January 31, 2023 at 10:03am

-

2022 CORRUPTION PERCEPTION INDEX REVEALS NEGLECT OF ANTI-CORRUPTION EFFORTS IN ASIA PACIFIC

Nearly 90 per cent of countries have made no significant progress since 2017

https://www.transparency.org/en/press/2022-corruption-perceptions-i...

ASIA PACIFIC HIGHLIGHTS

The CPI ranks 180 countries and territories by their perceived levels of public sector corruption on a scale of zero (highly corrupt) to 100 (very clean).

The Asia Pacific average holds at 45 for the fourth consecutive year, and over 70 per cent of countries rank below 50.

New Zealand (87), Singapore (83), Hong Kong (76) and Australia (75) lead the region.

Afghanistan (24), Cambodia (24), Myanmar (23) and North Korea (17) are the lowest in the region.

Singapore (83) and Mongolia (33) are at historic lows this year.

While many countries have stagnated, countries in Asia Pacific made up nearly half of the world’s significant improvers on the CPI since 2017.

The significant improvers are: South Korea (63), Vietnam (42) and the Maldives (40).

Three countries declined over this time: Malaysia (47), Mongolia (33) and Pakistan (27).

For each country’s individual score and changes over time, as well as analysis for each region, see the region’s 2022 CPI page.

CORRUPTION PERVASIVE IN ASIA PACIFIC

Across Asia Pacific, governments have claimed they would tackle corruption, but few have taken concrete action. Pervasive corruption and crackdowns on civic space leave the situation dire.

Malaysia (47) has been declining for years as it struggles with grand corruption in the wake of the monumental 1MDB and other scandals implicating multiple prime ministers and high-level officials. The current prime minister has promised to clean up but still appointed a deputy prime minister with serious corruption allegations as part of efforts to stabilise his unity government.

In India (40), considered the largest democracy in the world, the government continues to consolidate power and limit the public’s ability to demand accountability. They detain more and more human rights defenders and journalists under the Unlawful Activities Prevention Act (UAPA).

Massive protests erupted in Sri Lanka (36) as the government’s financial mismanagement resulted in an economic meltdown in the country. Noting the link between pervasive corruption among the country’s leadership and the crisis, Sri Lankans demanded anti-corruption reforms and refused to leave the streets despite brutal police crackdowns.

After years of decline, Australia (75) is showing positive signs this year. Most notably, the government elected last year fulfilled its promise to pass historic legislation for a new National Anti-Corruption Commission. Yet there is still more work that needs to be done, including more comprehensive whistleblower protection laws, and caps and real time disclosure on political donations. Greater transparency and longer cooling off periods to reduce the 'revolving doors' of lobbying must also be prioritised.

In parts of the Pacific, governments have interfered in elections, denying the public the opportunity to have their voices heard. Even with its history of electoral strife, Papua New Guinea’s (30) August election was called its worst ever amid numerous irregularities, stollen ballot boxes and even bouts of violence. In the Solomon Islands (42), frustration with reported collusion between politicians and foreign companies boiled over into violent civil unrest late last year. Now, the government has delayed elections scheduled for until 2024 raising further concerns over the abuse of executive power.

Transparency International calls on governments to prioritise anti-corruption commitments, reinforcing checks and balances, upholding rights to information and limiting private influence to finally rid the world of corruption – and the instability it brings.

-

Comment by Riaz Haq on February 1, 2023 at 7:55am

-

India Bubble Bursts:

Adani Stock Crash at $92 Billion as Collateral Worries Grow

Flagship’s shares tumble 28% in their worst day on record

Stock rout intensifies despite completion of key share sale

https://www.bloomberg.com/news/articles/2023-02-01/adani-flagship-f...

The crisis of confidence plaguing Gautam Adani has taken a sudden turn for the worse, with a record 28% plunge in his flagship company’s stock raising questions over the extra collateral he needs to cover loans.

Adani Enterprises Ltd. plummeted in afternoon trading in Mumbai after Bloomberg reported Credit Suisse Group AG has stopped accepting bonds of Adani Group’s firms as collateral for margin loans to its private banking clients. Banks including Barclays Plc had earlier asked for more shares to cover a $1 billion loan.

With the rout in the group’s stocks triggered by short seller Hindenburg Research’s fraud allegations reaching $92 billion on Wednesday, the risk is that more financial institutions start to scrutinize their exposure to the indebted conglomerate. Without a dramatic upturn, investors who bought into a recently completed $2.5 billion stock sale by Adani Enterprises may be staring at deep losses.

“The problem now is that the dynamics are becoming a self-reinforcing negative feedback loop and investors are now just dumping the shares and asking questions later,” said Peter Garnry, head of equity strategy at Saxo Bank A/S.

Credit Suisse’s private banking arm has assigned a zero lending value for notes sold by Adani Ports and Special Economic Zone Ltd., Adani Green Energy and Adani Electricity Mumbai Ltd., according to people familiar with the matter. It had previously offered a lending value of about 75% for the Adani Ports notes, one of the people said.

When a private bank cuts lending value to zero, clients typically have to top up with cash or another form of collateral and if they fail to do so, their securities can be liquidated.

Loan Collateral

On Friday, Adani added about $300 million worth of shares for the $1 billion loan made by a group of banks, according to people familiar with the matter.

“The Adani family might need to pledge more shares given the drop in share prices, though they could still maintain a healthy headroom with the portion pledged at no more than 40%, based on our calculation,” Sharon Chen, credit analyst at Bloomberg Intelligence, wrote in a note.

Adani Debts Enter Spotlight as Dollar Bond Deadlines Loom

Adani Power and Adani Ports had the highest portion of shares pledged as of December, according to Bloomberg Intelligence. Adani Power slid 5% on Wednesday. The port unit sank 19%, the most on record.

The equity selloff comes after Adani Enterprises pulled off a successful share sale, which was India’s largest follow-on offering. At least two of India’s biggest business families, including Sajjan Jindal and Sunil Mittal, participated, according to people familiar with the matter, in a sign of solidarity with the billionaire.

Adani Enterprises shares sank to as low as 1,941.20 rupees on Wednesday, 38% below the lower end of the offer price range of 3,112 to 3,276 rupees. The firm is expected to announce the final price for its offering later today.

“The important thing to watch now post allotment is what level of holding period the investors are willing to have on these shares,” said Sameer Kalra, founder of Target Investing in Mumbai. “Having a few investors getting most of the allotment, there is a risk of some portion being sold immediately.”

-

Comment by Riaz Haq on February 1, 2023 at 7:56am

-

India Bubble Bursts:

Adani Stock Crash at $92 Billion as Collateral Worries Grow

Flagship’s shares tumble 28% in their worst day on record

Stock rout intensifies despite completion of key share sale

https://www.bloomberg.com/news/articles/2023-02-01/adani-flagship-f...

“The important thing to watch now post allotment is what level of holding period the investors are willing to have on these shares,” said Sameer Kalra, founder of Target Investing in Mumbai. “Having a few investors getting most of the allotment, there is a risk of some portion being sold immediately.”

Adani Stock Sale Scrapes Through With Less Demand Than Peers

Personal Wealth

Adani has now lost the title as Asia’s richest person to rival billionaire Mukesh Ambani, according to the Bloomberg Billionaires Index. In just one week, his eye-popping wealth gains from last year, some $44 billion, have evaporated.

The storm engulfing Adani has become a test case for India as well, with Hindenburg’s allegations raising questions over the country’s corporate governance, while Adani himself has called the report an attack on India itself.

Market watchers see the fight between Adani and Hindenburg continuing, after the two traded barbs earlier in the week. The Indian conglomerate has called Hindenburg’s report “bogus,” threatened legal action and said it was “a calculated securities fraud” in its 413-page rebuttal, which the short seller said ignored all its key allegations and was “obfuscated by nationalism.”

“Cash generation at Adani companies remains poor while they have traded at extremely high multiples. So, their servicing capability of debt can be impaired if things do not go as per the plan,” said Amit Kumar Gupta, CIO of New Delhi-based Fintrekk Capital. “Now the issue is if stock prices don’t go up, this leverage is detrimental to the group.”

-

Comment by Riaz Haq on February 1, 2023 at 9:57am

-

#Adani calls off $2.5 billion share sale in major blow to #Indian tycoon. Adani Group is “returning the FPO proceeds and withdraws the completed transaction” #scam #fraud #Modi #India #stockmarket #economy

https://sg.finance.yahoo.com/news/indias-adani-enterprises-calls-of...

By Aditya Kalra

NEW DELHI (Reuters) -India's Adani Enterprises called off its $2.5 billion share sale on Wednesday, citing market conditions, amid an ongoing rout in the wider Adani Group's stocks which was sparked by a U.S. short-seller's critical report.

"Given the unprecedented situation and the current market volatility the Company aims to protect the interest of its investing community by returning the FPO proceeds and withdraws the completed transaction," the company said in a statement.

Shares in Indian billionaire Gautam Adani's conglomerate plunged, driving the value of his companies $86 billion lower, with the tycoon also losing his crown as Asia's richest person.

"Today the market has been unprecedented, and our stock price has fluctuated over the course of the day. Given these extraordinary circumstances, the Company’s board felt that going ahead with the issue will not be morally correct," Adani said.

"The interest of the investors is paramount and hence to insulate them from any potential financial losses, the Board has decided not to go ahead with the FPO," he added in a statement.

The withdrawal marks a stunning setback for Adani, the school dropout-turned-billionaire whose fortunes rose rapidly in recent years in line with stock values of his businesses.

Adani, whose business interests span ports, airports, mining, cement and power, is battling to stabilise his companies and defend his reputation.

Adani Group had on Tuesday mustered enough support from investors for the share sale for Adani Enterprises to proceed, in what some saw as a stamp of investor confidence.

But after a brief respite the selloff in Adani Group stocks and bonds resumed on Wednesday, with shares in Adani Enterprises plunging 28% and Adani Ports and Special Economic Zone dropping 19%, the worst day on record for both.

(Reporting by Aditya Kalra and Jahnavi Nidumolu in Bengaluru; Editing by Anil D'Silva, Kirsten Donovan and Alexander Smith)

-

Comment by Riaz Haq on February 1, 2023 at 8:23pm

-

Citigroup Wealth Unit Halts Margin Loans on Adani Securities

https://www.bloomberg.com/news/articles/2023-02-02/citigroup-s-weal...

Private bank unit removes lending value with immediate effect

Move comes after Credit Suisse stopped accepting some bonds

Citigroup Inc.’s wealth arm has stopped accepting securities of Gautam Adani’s group of firms as collateral for margin loans as banks ramp up scrutiny of the Indian tycoon’s finances following allegations of fraud by short seller Hindenburg Research.

The US lender’s move to restrict lending comes after a similar change at Credit Suisse Group AG, as Adani’s beleaguered empire becomes further engulfed in crisis.

-

Comment by Riaz Haq on February 2, 2023 at 7:34am

-

#Adani market losses stretch to $100bn after #FPO share sale abandoned. #Indian group has now lost almost half its $223 billion market value since Jan. 25, when #Hindenburg Research said in a report that it had taken short positions in Adani. #Fraud #Scam https://asia.nikkei.com/Business/Companies/Adani-Group/Adani-market...

BENGALURU -- Adani Group stocks plummeted on Thursday after its flagship company scrapped a fully subscribed share sale the day before, deepening losses in the Indian conglomerate's market value to over $100 billion in the wake of scathing short-seller allegations.

The secondary share issue, which was expected to be India's largest-ever follow-on public offering, was seen as critical for the conglomerate and its abandonment has stoked swirling concerns over the group's outlook.

Shares in the flagship Adani Enterprises plunged 26.5% on Thursday, while those of Adani Green Energy, Adani Transmission and Adani Total Gas all fell 10%; India's benchmark stock index rose 0.38%.

Gautam Adani, the group's billionaire chairman, said in a recorded message on Thursday morning that the company had withdrawn the secondary sale to "insulate investors from potential losses."

The conglomerate had said in a statement to the stock exchange late on Wednesday that the company's board "felt that going ahead with the [share] issue will not be morally correct." Adani Enterprises stock had closed trading on Wednesday 30% below the floor price of the $2.5 billion share sale.

The conglomerate has now lost almost half its $223 billion market value since Jan. 25, when Hindenburg Research said in a report that it had taken short positions in Adani companies through U.S.-traded bonds and "non-Indian-traded derivative instruments." The report also made a host of accusations against the conglomerate, including "brazen stock manipulation and accounting fraud."

India's opposition parties on Thursday demanded an investigation into the Hindenburg allegations, upending a parliamentary session that had been set to focus on the country's newly unveiled budget.

The sprawling conglomerate, which has emerged as a central player in India's push to develop world-class infrastructure, has denied the allegations, calling them "baseless" and "a calculated attack on India."

But lenders Credit Suisse and Citigroup have stopped accepting bonds from various Adani Group companies as collateral for margin loans, Bloomberg has reported, citing sources. Both banks declined to comment when approached by Nikkei Asia.

In a rebuttal to Hindenburg last week, the conglomerate had touted "deep bank relationships" with a range of financial institutions, including Citi and Credit Suisse.

"The biggest threat of the [Adani] dispute will be on what impact it has on foreign investor confidence," Charu Chanana, a Singapore-based market strategist at Saxo Markets, wrote in a report this week. "The sentiment has turned slightly bearish on India in general, given the risks of political influence and lack of transparency. While these risks are inherent to the Indian markets and well aware to investors, the risk-reward for the Indian markets has just taken another turn for the worse."

Foreign investors have been jumpy about Indian equities, turning net sellers immediately after the Hindenburg report came out. Their net outflow from Jan. 25 to Feb. 1 stood at 168.5 billion rupees ($2.1 billion), including 61.3 billion rupees on Jan. 30, the highest single-day outflow by foreign investors since mid-June, according to stock exchange data. However, they turned net buyers of Indian equities on Thursday, with net inflows of 25.42 billion rupees.

-

Comment by Riaz Haq on February 2, 2023 at 8:43pm

-

#Adani Rout Wipes Out Half of Group Value Since #Hindenburg Report as brutal stock rout in Adani’s companies continued Friday. The billionaire needs to do more to restore confidence in his conglomerate’s financial health. #India #Modi #Scam https://www.bloomberg.com/news/articles/2023-02-03/adani-stock-rout... via @markets

Adani said to be in seeking prepayment of shares-backed loans

Goldman and JPMorgan tout value in Adani’s beaten-down bonds

The brutal stock rout in Gautam Adani’s companies continued Friday, an indication that the billionaire needs to do more to restore confidence in his conglomerate’s financial health after accusations of fraud by a short-seller erased half of the group’s market value.

The group’s 10 stocks all fell in early Mumbai trading. Flagship Adani Enterprises Ltd. dropped as much as 10%, adding to a nearly 50% plunge in the last two sessions. The losses for the Adani group companies since the short-seller report have extended to $118 billion, one of the worst in India’s history.

-

Comment by Riaz Haq on February 4, 2023 at 10:53am

-

#Adani’s Rise Was Intertwined With #India’s. Now It’s Unraveling. Adani has responded by invoking nationalism, calling #HindenburgReport “a calculated attack on India” #Hindenburg retorted "fraud can't be obfuscated by nationalism" #Modi #scam #fraud https://www.nytimes.com/2023/02/04/business/adani-modi-india.html

The tycoon often said the Adani Group’s goals were in lock step with India’s needs. Now, the company’s fortunes are crashing, a collapse whose pain will be felt across the country.

Gautam Adani began the year as one of the richest men who ever lived, an upstart billionaire whose conglomerate, one of India’s largest, had surged in value by 2,500 percent in five years.

That rise, as he portrayed it, wasn’t his alone: It was inseparable from the “growth story” of India itself. His companies’ goals were in lock step with the country’s needs, he often said. Relying on his longstanding partnership with India’s powerful leader, Narendra Modi, he brought his private companies — spanning power, ports, food and more — into alignment with one politician more closely than any business titan before him.

Now, in spectacular fashion, the fortunes of his Adani Group are crashing down even faster than they had shot up — a collapse whose pain will be felt across the country, rippling through its economic and political spheres.

More than $110 billion in market value — roughly half of the Adani Group’s worth — has vanished in just over a week, like air from a burst balloon. The pinprick was a report by a small New York investment firm, Hindenburg Research, whose description of “brazen accounting fraud” and stock manipulation sent investors fleeing, just as the Adani Group was beginning a sale of new shares to investors, India’s biggest-ever secondary share offering.

Adani wrapped itself in nationalism as a defense, calling the report “a calculated attack on India” and on “the independence, integrity and quality of Indian institutions.” Hindenburg retorted that Adani was waving the flag to obfuscate shady dealings, like the use of offshore shell companies to exaggerate its stocks’ valuations in order to paper over its excessively debt-fueled ascent.

Twitter Feed

Live Traffic Feed

Sponsored Links

South Asia Investor Review

Investor Information Blog

Haq's Musings

Riaz Haq's Current Affairs Blog

Please Bookmark This Page!

Blog Posts

Pakistani International Students Flocking to European Universities

Recent data shows that there are nearly 10,000 Pakistani students attending colleges and universities in Germany. This figure is second only to the United Kingdom which issued over 35,000 student visas to Pakistanis in 2024. The second most popular destination for Pakistani students is Australia which is hosting nearly 24,000 students from Pakistan as of 2023, according to the ICEF…

ContinuePosted by Riaz Haq on July 15, 2025 at 9:00am

Pakistani Prosthetics Startup Aiding Gaza's Child Amputees

While the Israeli weapons supplied by the "civilized" West are destroying the lives and limbs of thousands of Gaza's innocent children, a Pakistani startup is trying to provide them with free custom-made prostheses, according to media reports. The Karachi-based startup Bioniks was founded in 2016 and has sold prosthetics that use AI and 3D scanning for custom designs. …

ContinuePosted by Riaz Haq on July 8, 2025 at 9:30pm

© 2025 Created by Riaz Haq.

Powered by

![]()

You need to be a member of PakAlumni Worldwide: The Global Social Network to add comments!

Join PakAlumni Worldwide: The Global Social Network