PakAlumni Worldwide: The Global Social Network

The Global Social Network

Auto Sector in India, Pakistan and China

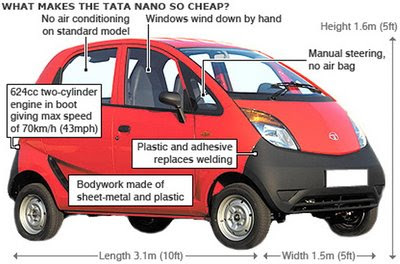

Tata Motors is set to launch its low-cost Nano minicar Monday, March 23, according to media reports from India. With a starting price of about $1,945, which doesn't include dealer markup and other charges that consumers will pay, the Nano will be one of the world's cheapest cars. This product launch comes at a time when the auto industry is facing a severe downturn, attributed to the worldwide consumer credit crunch amidst a serious global financial crisis.

Like other auto makers around the world, Tata Motors is also contending with declining demand, both for its bread-and-butter commercial vehicles in India and its luxury brands, Jaguar and Land Rover. The company reported its first quarterly net loss in seven years in the October-December 2008 quarter, and saw its debt rating cut by ratings firms. More immediately, Tata Motors faces a June deadline to repay $2 billion in loans related to its Jaguar-Land Rover acquisition from Ford Motor Co. last year, according to the Wall Street Journal.

The automobile industry in India—the tenth largest in the world with an annual output of 2 million units last year—is expected to become one of the major global automotive industries in the future. A number of domestic companies produce automobiles in India and the growing presence of multinational investment, too, has led to an increase in overall growth. Following the economic reforms of 1991 the Indian automotive industry has demonstrated sustained growth as a result of increased competitiveness and reduced restrictions. The monthly sales of passenger cars in India exceed 100,000 units, according to a related Wikipedia entry.

In comparison with the rest of the world, the Chinese market for automobiles appears to be relatively robust. Monthly auto sales in China surpassed those in the U.S. for the first time in January, but automakers and industry watchers say the news may tell us more about the troubles in the U.S. than about China's growing car market, says a report published in San Francisco Chronicle.

Data released in February by the China Association of Automobile Manufacturers shows 735,000 new cars were sold in China last month, down 14.4 percent from the record of 860,000 set in January 2008. U.S. sales, meanwhile, fell 37 percent to 656,976 vehicles — a 26-year low.

In Pakistan, Engineering Development Board (EDB) is attempting to increase the GDP contribution of the automotive sector to 5.6%, boost car production capacity to half a million units as well as attract an investment of US$ 3 billion and reach an auto export target of US$ 650 million.

In addition to the growing defense industry, auto industry can become a driving force for the much needed manufacturing industrial base in Pakistan to create significant employment opportunities for its large population. Last year, the auto sector contributed US$ 3.6 billion, only about 2% of the GDP, to the national economy, and employed about 192,000 people.

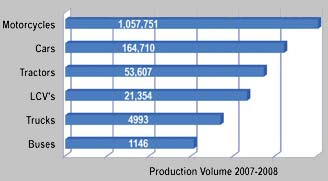

Pakistan's auto parts manufacturing is a billion US dollars a year industry. Sixty percent of its output goes to the motor cycle industry, 22% is for cars, and the rest is consumed by trucks, buses & tractors.

After a significant growth spurt in 2002-2006, the auto sector is feeling the pain of economic slow-down in Pakistan. The industry is continuing in a slump which began in the previous financial year and according to Business Monitor International's recently published Pakistan Automotives Report, the industry’s performance this year will get worse. In FY08, which ended in June 2008, total vehicle sales fell by 6.2%. The downturn carried over into FY09, with sales for the first half of the year (July to December 2008) down by 48% year-on-year to 52,927 units for cars and light commercial vehicles (LCVs), while compared with November, sales for December were down 55%. These results support BMI’s forecast for a drop in sales of cars and LCVs to around 112,000 units in FY09. BMI expects the total auto market in Pakistan to contract by over 32%, with the worst damage done in the car and bus segments, which is forecast to fall by 45% each. Pakistan’s Economic Co-ordination Committee (ECC) is to consider a tax cut of 10% for domestic car manufacturers, which has been proposed by the Ministry of Industries and Production. However, the plan is not without its opposition, as the Federal Board of Revenue is reportedly against supporting individual sectors as this would prompt other industries to seek help. Moreover, with just five carmakers producing locally, the automotive industry is relatively small. On the other hand, the industry is also largely self-sufficient as the majority of its output is sold within Pakistan; this reduces the country’s reliance on imports and raises issues such as the protection of local jobs and the industry’s contribution to the overall economy.

|

| Pakistan Tractor Sales. Source: Trading Economics |

Among the automakers, Indus Motors and Pakistan Suzuki reported positive earnings: The two leading car assemblers PSMC and INDUS posted positive earnings for 2008. PSMC reported operating losses of Rs 399 million. However, increase in other income by 77 percent offset their losses helping PSMC post positive earnings of Rs 26 million, according to Daily Times. Honda posted a loss after tax of Rs 190 million for the period July-December 2008 after a decline in net sales by 5 percent and a massive surge in operating expenses over the corresponding period last year.

The poor state of the industry is reflected in BMI’s Business Environment Rating for the automotive industry in Asia Pacific, where Pakistan is in last place on a score of 42.4 out of a possible 100. The market is held back by low production growth potential and an average rating for sales growth. However, as a signatory to the Trade Related Intellectual Property Rights Agreement (TRIPS) under the auspices of the World Trade Organization (WTO), the country’s regulatory environment scores well. A number of free trade agreements also contribute to this criterion, although forming FTAs with non-Asian countries would improve this rating further. Despite low marks for bureaucracy and corruption, the market does score well for its long-term economic risk and policy continuity.

With just a handful of manufacturers, Pakistan’s competitive landscape remains narrow. Japanese car manufacturers control most of the country’s passenger car production and sales. Figures for FY08 show that Suzuki-brand models represented 62% of total Pakistani passenger car production and 51.7% of sales. Toyota is gaining, however, with Corolla becoming the country’s best-selling model in the first half of FY09.

According to Daily Times, as many as 60,000 workers and staffers in Pakistan's auto sector have lost their jobs from July, 2008 to January, 2009 due to falling demand for cars. More jobs cuts are feared with continuing weakness in demand.

Given strong underlying growth dynamics in South Asia, the negative feedback effects of the global financial crisis are expected to be temporary. A relatively rapid rebound is expected in 2010, with a projected revival of GDP growth to 7.2 per cent. The long term prospects for the auto industry in the continent of Asia appear to be quite favorable. As the current financial crisis ebbs, there will be significant pent-up demand for automobiles in Asia, including India, Pakistan and China, that will drive the growth in auto industry.

Related Links:

Pakistan Automobiles Report 2009

Auto Pakistan Expo 2009

Automobile Technology in Pakistan

A Review of Global Road Accident Fatalities

Pakistan Automotive Report

China Surpasses US in Auto Sales

Auto Industry in India

India's Global Shopping Spree

-

Comment by Riaz Haq on January 11, 2016 at 8:58am

-

Although such disruption has yet to come to Pakistan’s auto industry, plenty of auto related services such as classifieds, car brokerage, dealerships and sales are quickly moving online to websites such as Apni Gari, Carmudi, OLX, PakWheels, Sasti Gari and countless others.

Smartphones with internet connectivity are deployed to solve some of the inherent problems related to the conventional auto trade. For example, buying a used car from a dealer meant several visits to find the right car or sifting through hundreds of newspaper classifieds, with limited information and no pictures. With online portals, people can sift through tens of thousands of cars listed for sale across Pakistan, look at pictures and then decide which ones they want to investigate further.

Similarly, sellers faced challenges with the traditional system because they either had to leave their car at the dealer’s for a long period of time or sell it to the dealer instantly at a price lower than the market value. With online services, they can now list their cars and wait until they find a buyer willing to offer the right price.

Plenty of auto related services such as classifieds, car brokerage, dealerships and sales are quickly moving online to websites such as Apni Gari, Carmudi, OLX, PakWheels, Sasti Gari and countless others.

According to World Bank data, there are three million cars on the road in Pakistan today. This number is increasing rapidly as more than 170,000 new cars are sold every year and about 35,000 to 40,000 cars are imported every year as well. Yet these numbers pale in comparison to other developing countries, given that the car ownership per capita in Pakistan is very low.

There is already a trade of about 750,000 used cars taking place every year in Pakistan and more than 50% of this used car inventory has already come online through auto buying/selling portals. Given that trade is moving online, used car dealerships have realised the power of the internet and according to the All Pakistan Motor Dealers Association (APDMA), 4,500 dealerships in Pakistan are putting all of their inventory online on auto sites and other mediums like their own websites, social media, etc.

Not only has the car trade moved online, so has the research part, whereby people decide what to buy. Rather than relying on an auto expert, a relative or a friend, anyone can go online, find out the pros and cons of the different makes and decide what to buy. In a study conducted by Nielsen, Pakistanis spend about three weeks deciding on what their next car will be and the majority of this time is spent online thanks to the abundance of information.

Services such as car financing and maintenance have also moved online. With over 10 banks offering car financing, the internet is an excellent means for people to compare rates and terms and conditions. In terms of maintenance, services such as AutoGenie allow people to book an appointment with an experienced mechanic who will come to their home and make the necessary repairs. Similarly, Insta Lube, a service launched by Total this April, enables people to call a helpline to have their automobile’s oil changed at their home.

While all the above feels like disruption in the traditional way of doing things, in my view we are only just getting started in Pakistan and all the businesses that are disrupting today will be disrupted in turn unless they innovate. In more mature markets like the US, used car sales are even more disrupted and are almost like buying diapers on Amazon.

---

So imagine being driven around in driverless cars owned by Uber! Disrupt or be disrupted!

http://aurora.dawn.com/news/1141310

-

Comment by Riaz Haq on March 12, 2016 at 8:45am

-

#Honda to double production capacity at #motorcycle plant in #Pakistan to 1.35 million units | ET Auto http://auto.economictimes.indiatimes.com/news/two-wheelers/motorcycles/honda-to-double-production-capacity-at-motorcycle-plant-in-pakistan/49641931 …

Two wheeler manufacturer Honda has announced plans to double the production capacity of its existing motorcycle plant at Sheikhupura in Pakistan, the company informed in a statement.

From current 6,00,000 units, the company will increase the capacity to 1.2 million units during the next three years to accommodate the expected expansion of the motorcycle market in Pakistan.

Honda is also planning to invest approximately $ 50 million in this three-year capacity expansion, which also will add approximately 1,800 new associates.

After this expansion, Honda's overall annual production capacity will be increased to 1.35 million units.

For this capacity expansion, Honda will first add another production line to the Sheikhupura Plant with the plan to begin production on this new line in October 2016. It then will further expand the overall capacity in stages.

Honda is currently producing motorcycles at two plants - the Karachi plant in the southern part of the country and the Sheikhupura plant in the northeastern part of the country, with annual production capacity of 1,50,000 units and 6,00,000 units, respectively.

The Sheikhupura plant manufactures Honda CD70, CD Dream, Pridor, CG125, CG Dream and Deluxe.

-

Comment by Riaz Haq on March 18, 2016 at 10:22pm

-

#Pakistan announces new #auto industry policy to encourage greenfield investments in #manufacturing http://tribune.com.pk/story/1068402/long-awaited-auto-policy-approv... …

In the hope of attracting a European carmaker, the government on Friday approved a new automobile policy, which offers tax incentives to new entrants to help them establish manufacturing units and compete effectively with the three well-entrenched assemblers.

After a hiatus of almost two and a half years, the Economic Coordination Committee (ECC) of the cabinet gave the go-ahead to the Automotive Development Policy 2016-21, according to an announcement made by the Ministry of Finance.

However, the government did not change its policy for used car imports, leaving consumers with a narrow range of choice until new brands of good quality are produced in the domestic market.

The Federal Board of Revenue had proposed that import of up to five-year-old used cars should be allowed compared to the current three-year ceiling. It also called for opening imports for commercial purposes.

The automotive policy will be formally launched on Monday. Industries and Production Minister Ghulam Murtaza Jatoi did not attend the ECC meeting.

“The existing three car manufacturers will not be entitled to the benefits that are being offered to the new investors,” said Miftah Ismail, Chairman of the Board of Investment, while talking to The Express Tribune.

The policy was aimed at enhancing consumer welfare and boosting competition besides attracting new players, he added.

Ismail said greater localisation of auto parts had been ensured in the policy and in case the new entrants were unable to achieve the targets, they would be penalised.

The government has allowed one-off duty-free import of plant and machinery for setting up an assembly and manufacturing facility. It has also permitted import of 100 vehicles of the same variants in the form of completely built units (CBUs) at 50% of the prevailing duty for test marketing after the groundbreaking of the project.

A major incentive for the new investors is the reduced 10% customs duty on non-localised parts for five years against the prevailing 32.5%. For existing investors, the duty will be slashed by 2.5% to 30% from the new fiscal year 2016-17.

Similarly, localised parts can be imported by the new entrants at 25% duty compared to the current 50% for five years. For existing players, the duty on import of localised parts will be brought down to 45% from the new fiscal year, beginning July.

In the CBU category, customs duty on cars up to 1,800cc engine capacity has been reduced by 10% for two years – 2017-18 and 2018-19. This will be applicable to the existing players as well and will encourage reduction in car prices.

A single duty rate will be applied to the localised and non-localised parts after five years of the new policy. The present duty structure will continue for seven years for the new investors.

The Board of Investment will provide a single point of contact for all new investors. They will be required to submit a detailed business plan and relevant documents to the Engineering Development Board (EDB) for assessment.

-

Comment by Riaz Haq on November 8, 2016 at 7:41am

-

The first #ElectricVehicle #charging station of #Pakistan inaugurated in #Lahore http://bit.ly/2fBh0ZC via @techjuicepk

The MENAP (Middle East, North Africa, Afghanistan, and Pakistan)’s very first ChargeNow electric charging station for hybrid cars is being inaugurated today in Pakistan. BMW ChargeNow station now available at Emporium Mall in Lahore.Powered by Dewan Motors, the BMW importers in Pakistan, the inaugural ceremony of a electric car charging station is being held at a dedicated event here in Lahore. The Charging station is going to be the first of its kind in Pakistan, or for that matter, in the whole Middle East and Pakistan region.

The station is being launched within the ChargeNow network. The ChargeNow network is a service from BMW which is making BMW collaborate with the charge point operators from around the globe to form a network.

There are three different charging systems in the world. The CHAdeMO standard bears Asian origin. The SuperCharger standard of Tesla and the Combined Charging Standard (CCS) which is preffered by the manufacturers of US and German origin. Although it is still unclear that what system would this dock adhere to, we can anticipate that it could be a CCS system as BMW supports it. ChargeNow DC Fast charging is offered by BMW in cooperation with EVgo. Globally, BMW is also reportedly working on developing wireless inductive charging system.

For quite some time, Pakistanis are also witnessing an increasing number of electric cars. Although not fully Electric, but many hybrid fueled Prius from the Japan based manufacturer Toyota can be seen running on the Pakistani roads. BMW also offers many electric cars, driven by the BMW eDrive technology including the BMW i8.

The concept of Electric cars is relatively a new phenomenon. Although these cars have invaded developed markets and countries in huge numbers, Pakistan hasn’t seen a revolutionizing influx. As the energy crisis and the pollution levels have rose, the awareness on eco-savvy fuels have also seen a rise. Manufacturers from all over the world are putting their heads together to bring out electric cars which serve these purposes well.

-

Comment by Riaz Haq on May 31, 2017 at 4:57pm

-

#China's company plans #bus manufacturing plant in #Pakistan. #CPEC #MassTransit

https://tribune.com.pk/story/1423281/chinese-company-plans-bus-manu...

KARACHI: The China-Pakistan Economic Corridor (CPEC) has indeed opened several avenues for business ventures that were previously unexplored between Pakistan and China.

In one such development, a renowned Chinese company – Yutong Bus – has expressed interest in investing in inter-city and intra-city bus services in Sindh.

Pakistan ramps up coal power with Chinese-backed plants

An 11-member delegation of Yutong Bus, led by General Manager Shi Cun Tu, expressed the interest while talking to Sindh Board of Investment (SBI) Chairperson Naheed Memon at her office on Tuesday.

They discussed various aspects of investment in plying inter-city and intra-city buses in Sindh, including Karachi.

The delegation told the SBI chairperson that their company was keen to pour money into running buses on different routes in Karachi and is also interested in setting up a manufacturing plant for the purpose.

Memon welcomed their offer and noted that there were many opportunities of investment in the transport sector in Sindh and the provincial government would continue to encourage public-private partnership projects.

The SBI chairperson asked the delegation to come up with suggestions on the basis of their priorities so that the Sindh government could take further steps.

Mass transit

The Sindh government is set to allocate Rs3.19 billion for the transport and mass transit system in the budget for fiscal year 2017-18, a source in the Sindh Finance Department said.

The allocation includes Rs2.29 billion for 11 new schemes for inter-city and intra-city transport services in the province. The provincial government is considering initiating multiple road transportation projects like the Green Line project launched by the federal government in Karachi.

The projects eyed by the Sindh government include Bus Rapid Transport Service (BRTS) Red Line, BRTS Blue Line and BRTS Yellow Line. All the three projects are for Karachi, the business hub of Pakistan.

Other transportation schemes include expansion in road and circular railway networks within and among cities including Karachi, Jacobabad and Khairpur, the source said.

China-Pakistan Economic Corridor: ‘Long-term plan’ to be inked soon

Apart from these, the 11 new schemes comprise construction of a bus terminal in Garhi Khairo, Jacobabad; construction of integrated Intelligent Transportation System for Karachi and upgrading of traffic signals (second phase) in multiple cities including Karachi.

The provincial government is scheduled to announce the budget on June 5, 2017.

-

Comment by Riaz Haq on May 7, 2018 at 7:33am

-

#Mercedes-Benz trucks now to be Made-in-#Pakistan: Daimler AG and NLC sign MoU https://www.financialexpress.com/auto/car-news/mercedes-benz-trucks... … via @FinancialXpress

Pakistan's National Logistics Cell has signed a MoU with Daimler AG to assemble Mercedes-Benz Trucks in the country. With the upcoming China-Pakistan Economic Corridor (CPEC) and a new network that links Pakistan's seaports in Gwadar and Karachi with Northern Pakistan, this new plant will boost Commercial Vehicle sales in Pakistan.

German Automaker, Daimler AG has signed a memorandum of understanding (MoU) with The National Logistics Cell (NLC), Pakistan to set up a manufacturing unit of Mercedes‐Benz trucks in Pakistan. In a statement released by NLC, the company confirms that Daimler AG will locally assemble Mercedes-Benz Trucks in Pakistan and marks a major shift in the logistics and transportation industry’s preference towards European manufacturers.

News report further confirms that Major General Mushtaq Faisal, the director general, and Zia Ahmed, Chief Executive Officer of Pak NLC Motors signed the MoU on behalf of NLC. On behalf of Mercedes-Benz Trucks, Klaus Fischinger, head of the executive committee, and Dr Ralf Forcher, head of sales, were present to sign the MoU.

Major General Faisal further said that this is a historic moment for Pakistan’s commercial vehicle industry. A report on Tribune further quotes him saying “The local assembly of Mercedes‐Benz trucks would prove as a strategic opportunity that would leverage the modernisation of Pakistan’s logistics industry,” said the official. Pakistan government has promised to give more incentives in its Auto Development Policy 2016-21 and these locally-assembled Mercedes-Benz trucks would be sold at competitive prices.

This is also a huge move for Pakistan with the China-Pakistan Economic Corridor (CPEC) coming up, Daimler seems to have invested at the right time to make the most of Pakistan's logistics movement to China.

In an IANS report, Dr Ralf Forcher, head of sales at Mercedes‐Benz Special Trucks was quoted saying "Pakistan’s infrastructure and construction sectors have registered significant growth in recent years, giving a boost to the logistics industry that, in turn, means increased demand for commercial vehicles."

The demand for Commercial vehicles in Pakistan is set to go up with CPEC and a new network that links Pakistan's seaports in Gwadar and Karachi with Northern Pakistan.

-

Comment by Riaz Haq on May 15, 2019 at 4:27pm

-

#India’s stalling #car market sparks wider concerns. Last month, passenger vehicle sales were 17.7% lower, two-wheelers (#motorcycles) down 16% and commercial vehicles declined 6% than a year before #manufacturing #auto #industry #Modi https://www.ft.com/content/b3b92502-7650-11e9-be7d-6d846537acab via @financialtimes

As India overtook China to become the world’s fastest-growing major economy, its buoyant car market was a conspicuous sign of its momentum.

Driven by growing urban disposable income, the car sector enjoyed robust growth as sales surged, with global giants such as Hyundai vying for market share with dominant incumbent Maruti Suzuki.

Its rapid expansion between 2015 and the first half of last year prompted predictions that India would soon overtake Japan and Germany to become the world’s third-biggest motor market.

But figures released this week showed a sudden reversal of that upbeat narrative. Last month, passenger vehicle sales were 17.7 per cent lower than a year before, according to the Society of Indian Automobile Manufacturers.

The pain was severe across all vehicle categories, which are closely watched as economic indicators. “Two-wheeler” sales, an important sign of rural economic health, fell by 16 per cent, while commercial vehicle sales declined 6 per cent.

For some foreign carmakers, the Indian market has been a tough nut to crack despite the success of Hyundai, Honda and Toyota, which have built up a significant presence in the country. Some big western groups have struggled to compete in the market, where Maruti Suzuki last year held a share of 51 per cent.

General Motors stopped sales in India in 2017 as part of a retreat from its less successful national ventures, and media speculation has been swirling about Ford ceding control of its Indian operation to local peer Mahindra & Mahindra.

The latest data add to concerns about flagging economic momentum in India, reflecting weak job growth and the impact of a squeeze in the credit market.

Unfortunately for Narendra Modi, prime minister, these worries have arisen in the middle of a general election where he has presented the government as an architect of growth.

“It reflects a broader lack of confidence in the economy — the entire consumption sector is slowing down,” said Prabodh Agrawal, chief financial officer at IIFL, a financial institution. “Liquidity is tight and confidence is low.”

Industry observers now fear that the car sector has become one of the most prominent victims of a debt market crunch that began last September, when defaults by infrastructure and finance group IL&FS triggered sharp outflows from mutual funds.

That drained money from the commercial paper market, a major source of funding for the nonbank financial companies that had driven the growth of loans as they took market share from the ailing state-controlled banks. The so-called NBFCs were particularly active in areas such as vehicle loans and lending to small businesses.

“In smaller towns and cities, NBFCs really control the [vehicle financing] game,” said Puneet Gupta, a car analyst at IHS Markit.

The motor industry had already been flagging after a strong first half of 2018, but sentiment darkened more seriously as the credit squeeze fed through.

“For everyone I speak to in the market, November was a turning point — there was a ripple effect from the NBFC crisis,” said Anant Goenka, managing director of Ceat, the country’s biggest tyre producer.

The tighter credit market has been reflected in India’s economic growth figures: gross domestic product grew at 6.6 per cent in the last quarter of 2018, the slowest pace for five quarters.\

-

Comment by Riaz Haq on August 11, 2021 at 12:37pm

-

#China's Great Wall Motor to shift some #India investment to #Brazil after approval delays. It is reallocating to Brazil a portion of its $1-billion investment in India. Great Wall is acquiring Daimler's plant in Brazil to build #SUVs. #automobile

https://www.reuters.com/business/autos-transportation/exclusive-gre...

In 2020, Great Wall unveiled plans to invest $1 bln in India

Part of the $1 bln being re-allocated to Brazil -sources

Firm close to buying plant in Brazil amid global push -sources

Great Wall committed to India but cautious over delays -sources

NEW DELHI/BEIJING, Aug 11 (Reuters) - Great Wall Motor (601633.SS) has decided to re-allocate to Brazil a portion of its $1-billion investment in India, as the Chinese automaker has been unnerved by a year-long delay in winning government approvals, three sources told Reuters.

The re-allocation, which could range up to $300 million, comes as the sources said the maker of popular sport-utility vehicles (SUVs) and pick-ups was close to acquiring a former Daimler (DAIGn.DE) plant in Brazil to build cars.

Great Wall has also tasked James Yang, its India president since last year, with the responsibility of assisting with operations in the Latin American nation, said the sources, who have direct knowledge of the matter.

"Brazil is almost a done deal and it did not make sense to keep the funds blocked for India," said one of the sources, explaining the rationale for the change of focus.

Great Wall's move is a fallout of India's decision in April 2020 to more closely scrutinise investments from China, the sources said, as part of a crackdown that followed a border clash between the two Asian giants.

Just two months before, amid the fanfare of India's biennial car show, Great Wall had said it would invest $1 billion to build cars there, by buying a former General Motors (GM) (GM.N) factory, as well as making batteries and car parts.

Two of the sources said the re-allocated funds, budgeted by Great Wall for India since 2020, would mainly have been used to buy GM's factory, a cost that sources had earlier put at about $300 million.

Great Wall declined to comment. The Indian government did not immediately reply to an email seeking comment.

The step highlights growing nervousness and impatience among Chinese investors, who have seen roughly 150 investment proposals worth more than $2 billion held up by India's slow approvals process, according to industry estimates.

The delays are forcing Great Wall, which was expected to begin selling its India-made Haval brand of SUVs in the country this year, to look at taking a more measured approach.

It may even consider entering the market with a fully-built imported vehicle before starting domestic production, one of the sources said.

"When approvals in India come through, Great Wall will be ready with the money, but it may not be a straight decision anymore," said the source.

Report ad

"The company will judge the situation before moving forward. What if future approvals get stuck?"

Earlier this year, India had been set to clear about 45 of the investment proposals from China, mainly in manufacturing, but it was not immediately clear how many had been approved. read more

Indian officials say the situation cannot return to business as usual until de-escalation at the border is complete, however. read more

The Chinese automaker will also wait for ties between the two nations to improve and for the COVID-19 pandemic to ease in India before speeding up its plans for the market, said a second source.

Great Wall still wants to make cars in India and is now building its supply chain, the source added.

The firm saw India as a key market when it kicked off its global expansion, envisioning its plant in the subcontinent to be its biggest outside China.

Great Wall now makes cars in Russia and Thailand, where it acquired a plant at the time it announced its India plans.

-

Comment by Riaz Haq on August 6, 2023 at 8:00am

-

Fingers ‘turned to powder’: maimed workers of #India’s #automobile hub in #Haryana. Poor training, shoddy equipment leave thousands of auto workers injured. 52% of accidents happen on power press machine, 47% of workers had low-quality safety gear. #MakeInIndia #safety https://www.aljazeera.com/economy/2023/8/4/crushed-fingers-hands-ma...

At the break of dawn, thousands of workers walk out from dusty and congested maze-like alleys to work at nearby factories in Manesar, one of India’s leading automobile hubs, about 50km (31 miles) south of the capital.

In India, the automobile industry employs around 3.7 million people and contributes 7.1 percent to the gross domestic product (GDP). Just in Manesar and the next-door city of Gurugram, both in Haryana state, approximately 80,000 workers are employed in different automobile units of Hero MotoCorp, Maruti Suzuki, Yamaha, and other global companies.

Waiting restlessly outside a government dispensary for his turn, Manish Kumar, 20, a worker at one such factory in Manesar, quickly covers his bandaged hand with a piece of cloth as a group of workers walk past him. In February, Manish lost two fingers when a power press machine, used in the manufacturing of car windows, came crashing down on his hand.

“I came to Manesar like thousands of other workers to support my family and for a better future. But little did I know, instead, this place would make me dependent on someone for the rest of my life,” Manish told Al Jazeera.

“The incident is fresh in my mind and I get traumatised when someone asks me what happened to your hand, and that’s why I try to hide it most of the time,” he said.

Before the outbreak of the COVID-19 pandemic, Manish worked as a casual labour in his central Indian state, Madhya Pradesh. To meet his daily ends and support his ailing parents, he boarded a bus to Manesar, like hundreds of others from his village, in search of a better job opportunity. Soon at the recommendation of a friend, he landed a job that would earn him 13,500 rupees ($163) per month in a small factory manufacturing parts for auto major Maruti Suzuki.

“The factory owners don’t care about our safety; their main agenda is production should not stop at any cost … The machine I was working on malfunctioned for a week, and still I was made to work on it instead of getting it repaired. The machine crushed my two fingers due to their negligence, turning them into powder.”

“It has been over a month, and still, I don’t know whether I will ever be able to work again,” said Manish while struggling to clear drops of sweat dripping from his face. He said he is yet to receive any compensation for his injury.

Like Manish, thousands of others have been injured while working in this sector in India. “Crushed”, a report published by Safe in India Foundation (SII) revealed that, on average, 20 workers lose their hands and/or fingers daily while working in automobile factories spread in the Manesar and Gurgaon areas. Around 65 percent of injured workers are under the age of 30.

The automobile manufacturing sector in India recorded 3,882 incidents of injuries including 1,050 deaths in 2020, according to data from the Directorate General Factory Advice Service and Labour Institutes (DGFASLI). That year, the state of Haryana reported 50-60 nonfatal accidents, it said. However, SII says that figure is far from reality as each year it helps at least 4,000 workers suffering from a range of injuries in the state’s auto sector.

Comment

- ‹ Previous

- 1

- 2

- Next ›

Twitter Feed

Live Traffic Feed

Sponsored Links

South Asia Investor Review

Investor Information Blog

Haq's Musings

Riaz Haq's Current Affairs Blog

Please Bookmark This Page!

Blog Posts

Trump Administration Seeks Pakistan's Help For Promoting “Durable Peace Between Israel and Iran”

US Secretary of State Marco Rubio called Pakistan Prime Minister Shehbaz Sharif to discuss promoting “a durable peace between Israel and Iran,” the State Department said in a statement, according to Reuters. Both leaders "agreed to continue working together to strengthen Pakistan-US relations, particularly to increase trade", said a statement released by the Pakistan government.…

ContinuePosted by Riaz Haq on June 27, 2025 at 8:30pm — 4 Comments

Clean Energy Revolution: Soaring Solar Energy Battery Storage in Pakistan

Pakistan imported an estimated 1.25 gigawatt-hours (GWh) of lithium-ion battery packs in 2024 and another 400 megawatt-hours (MWh) in the first two months of 2025, according to a research report by the Institute of Energy Economics and Financial Analysis (IEEFA). The report projects these imports to reach 8.75 gigawatt-hours (GWh) by 2030. Using …

ContinuePosted by Riaz Haq on June 14, 2025 at 10:30am — 3 Comments

© 2025 Created by Riaz Haq.

Powered by

![]()

You need to be a member of PakAlumni Worldwide: The Global Social Network to add comments!

Join PakAlumni Worldwide: The Global Social Network