PakAlumni Worldwide: The Global Social Network

The Global Social Network

Construction Boom Resumes in Pakistan

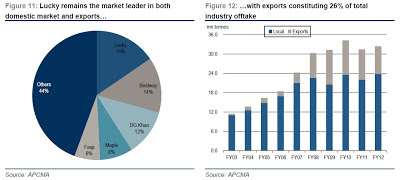

Renewed construction boom in Pakistan has helped the nation's cement producers significantly increase their sales and profits. Year-over-year, income at Lucky Cement, Pakistan's largest producer of building materials, is up 33% while DG Khan Cement, second largest cement company, has quadrupled its profits.

|

| Source: Credit Suisse Report on Pakistan Cement Sector |

Cement production, an important barometer of national economic activity, was up 8% in 2011-12, according to a research report compiled by a Credit Suisse analyst.

CS analyst Farhan Rizvi says in his report that "higher PSDP (Public Sector Development Program) spending has led to a resurgence in domestic cement demand in FY12 (+8%) and with increased PSDP allocation for FY13 (+19%) and General Elections due in Feb-Mar 2013, domestic demand is likely to remain robust over the next six-nine months".

|

| Nagan Chowrangi Interchange in Karachi |

Ongoing public sector projects include new large and small dams, irrigation canals, power plants, highways, flyovers, airports, seaports, etc. Most of these were already in the pipeline when the PPP government assumed control in 2008. Recent pre-election increases in PSDP funding allowed work to resume on these projects in 2011-12.

In addition to public sector infrastructure projects, there is a lot of privately funded real estate development activity visible in all major cities of the country. Big real estate developers like Bahria Town and Habib Construction are developing both commercial and housing projects in Islamabad, Karachi and Lahore. Other cities like Faisalabad, Hyderabad, Larkana, Multan, Mirpur, Peshawar and Quetta are also seeing new housing communities, golf courses, hotels, office complexes, restaurants, shopping malls, etc.

|

| Artist's Rendering of Sheraton Islamabad Golf City Resort |

Credit Suisse is bullish on Pakistan's cement sector in particular and Pakistani shares in general.

CS analyst Farhan Rizvi has initiated coverage with "an OVERWEIGHT stance, as we believe compelling valuations, improving domestic demand outlook, better pricing power and easing cost pressures make the sector an attractive investment proposition. Despite better growth prospects (3-year CAGR of 17% over FY12-15E) and improving margins, the sector trades at an attractive FY13E EV/EBITDA of 3.8x, 49% discount to the historical average multiple of 7.4x. Moreover, FY13E EV/tonne of US$74 is approximately 29% discount to historical average EV/tonne of US$104 and 50% discount to the region".

Another CS analyst Farrukh Khan, based in Credit Suisse’ Asia Pacific

headquarters in Singapore,says in his research report that “liquidity in 2012 has been concentrated in stocks offering positive

earnings surprises (e.g., United Bank, Lucky Cement, DG Khan Cement and

Bank Alfalah), enabling them to be strong outperformers. With further improvements in

liquidity, we expect a broad-based price discovery to take hold in

attractively valued oil and fertilizer stocks as well.”

A string of strong earnings announcements by Karachi Stock Exchange

listed companies and the Central Bank's 1.5% rate cut have already helped the KSE-100 index gain 32% in US dollar terms year to date.

Related Links:

Haq's Musings

Strong Earnings Propel KSE-100 to 4 Year High

Development in Pakistan-Defence.pk

Credit Suisse on Pakistan Cement Sector

Credit Suisse Research Report on Pakistan Equities

Tax Evasion Fosters Aid Dependence

Poll Finds Pakistanis Happier Than Neighbors

Pakistan's Rural Economy Booming

Pakistan Car Sales Up 61%

Resilient Pakistan Defies Doomsayers

Land For Landless Women in Pakistan

-

Comment by Riaz Haq on February 5, 2013 at 2:22pm

-

Here's an ET report on rising cement consumption in first 7 months of FY12-13:

LAHORE:

A recovery in domestic cement consumption in the first seven months of the current fiscal year has saved the day for the industry, which has been constantly losing its export markets. January was another good month for local sales, with things continuing poorly on the export front.

According to a statement issued by the All Pakistan Cement Manufacturers Association, cement sales jumped by 10.10% to 2.135 million tons in the domestic market in January.

Mills working in the country’s north sold 1.706 million tons, while those in the south supplied 429,000 tons to the domestic market.

Meanwhile, exports of cement dropped 11.91% – with total exports at 522,584 tons in January. Of this quantity, mills in the north exported 330,016 tons and plants in the south shipped 192,568 tons overseas.

In seven months (July-January) of the current fiscal year, total cement sales rose 4.02% and reached 18.607 million tons – domestic consumption stood at 13.862 million tons, up 7.98% while exports were 4.746 million tons, down 6.05%.

Despite economic challenges like unemployment, unstable law and order conditions and the impact of sporadic natural disasters, domestic demand has been aided by private construction and the government’s infrastructure development programmes in the last 10 years, according to brokerage house Shajar Capital.

In the future, “rising remittances and changing socio-economic indicators like increasing urbanisation are expected to contribute to boosting housing demand in the country,” it said.

Discussing the patterns of consumption, Shajar said Pakistan consumed only 152 kilogrammes per capita of cement, lower than both world and regional averages, leaving room for expansion of demand.

A spokesman for the cement manufacturers association spoke of the energy crisis prevailing in the country, saying half of the cement units in northern areas could not operate at optimum levels in January because of the energy shortage.

Industry experts point out that cement manufacturers are not fully utilising capacity, hampering their ability to service bank loans. They say exports should be increased as the markets of India and Afghanistan can be exploited with the support of the government.

They stress that cement is one of the few commodities readily accepted in India, and it alone could triple Pakistan’s exports to Delhi. The only hurdle is the Indian bureaucracy, which impedes free and fair exports.

They asked the government to settle the issue through talks with the Indian trade officials.

http://tribune.com.pk/story/502722/domestic-cement-sales-rise-8-in-...

-

Comment by Riaz Haq on February 15, 2013 at 8:35am

-

Here's Emirates 24-7 report on a massive property investment deal between Abu Dhabi Group and Malik Riaz:

UAE’s Abu Dhabi Group and Pakistani real estate tycoon Malik Riaz on Friday signed a deal to invest $45 billion (Dh165.15 billion) in Pakistan including building the world’s tallest building in Karachi.

Pakistan’s news channel Geo reported today that $35 billion (Dh165.15 billion) will be pumped in Sindh province while the rest will be invested in Lahore and Islamabad.

Under the deal, Sports City, International City, Media City, Educational and Medical City will be built in Pakistan’s financial capital. The news channel said that world’s Seven Wonders will also be built as part of the project.

The deal is expected to generate over 2.5 million jobs in Pakistan.

The channel, however, didn’t reveal the time for the completion of the project.

http://www.emirates247.com/business/economy-finance/abu-dhabi-group...

-

Comment by Riaz Haq on August 11, 2013 at 8:18am

-

Here's Daily Times on increase in Pakistan's cement exports in 2012-13:

The cement exports from the country witnessed increase of 15.81 percent during fiscal year 2012-13 against the same period of last year.

The cement exports were recorded at $577.878 million whereas during July-June 2011-12, the exports remained $498.844 million. On month on month basis, the cement exports also increased by 2.49 percent and decreased by 4.16 percent in June 2013 when compared with the exports in June 2012 and May 2013.

According to data released by Pakistan Bureau of Statistics (PBS), the exports in June 2013 were recorded at $53.338 million where as in June 2012 and May 2013 the value of exports remained $52.043 and $55.655 million.

http://www.dailytimes.com.pk/default.asp?page=2013%5C08%5C01%5Cstor...

-

Comment by Riaz Haq on November 30, 2013 at 10:34pm

-

Here's World Cement report about cement consumption in Pakistan:

The All Pakistan Cement Manufacturers Association reported a 10.10% increase in domestic cement consumption in January. The country, which has almost 45 million t of cement capacity, has seen exports fall in recent years as expansion programmes increase capacity in Pakistan’s traditional export markets and new exporters have joined the competition. However, domestic demand is on the rise, hitting an all-time high of almost 24 million t in FY11/12.

January saw domestic sales reach 2.135 million t, comprised of 1.706 million t from the north and 429 000 t from the south of the country. Demand has been pushed by private construction as well as government infrastructure projects, a trend set to continue as the per capita cement demand in the country is well below average at 152 kg.

Energy shortage threatens production

However, a new threat is energy shortages, which the APCMA says hampered production in northern areas last month. The Islamabad High Court recently removed the Rs.50/mmbty Gas Development Infrastructure Cess (GIDC), declaring it illegal. Though this will bring down input costs for cement producers in the south, it is reported that it will have no benefit for the more numerous northern producers, who ‘have now been given least priority for gas supply’ (The Nation, 3 February). Some plants are looking into alternative energy supplies – DG Khan Cement, for example, is set to be one of the first applications for Kalina cycle technology in the cement industry.

Lucky Cement prospers

Meanwhile, Lucky Cement Limited has recorded a 42.15% y/y increase in half yearly profit for 2012/13. As of the end of December, the company reported profits of Rs.4.29 billion and improved net sales of Rs.17.511 billion, up 13.9% y/y. The company reportedly plans to upgrade its existing mills and packing machines to reduce operational costs. More information about the company can be found in the February issue of World Cement in the article ‘Pakistan: Cementing its Position’ from Lucky Cement. Subscribers can download the issue by signing in.

Lafarge appoints new country CEO

Finally, Lafarge Pakistan Cement has appointed Amr Reda as the new country CEO of Lafarge Pakistan. Reda had previously been the regional business controller of Lafarge Middle East and Pakistan and has been on the board of directors of Lafarge Pakistan since January 2007.

http://www.worldcement.com/news/cement/articles/Pakistan_domestic_c...

-

Comment by Riaz Haq on December 15, 2013 at 10:03pm

-

Here's an AFP story on gated communities construction boom in Pakistan:

Rawalpindi: On the edge of Rawalpindi, Islamabad’s scruffy, congested twin city, a grand arched gateway opens to a rather different Pakistan, one of tidy lawns, golf courses and constant, reliable electricity.

Welcome to Bahria Town, where Pakistan’s new middle class takes refuge from the Taliban attacks and endless power cuts that plague the rest of the country.

Cars glide softly over the smooth tarmac carpeting the gentle hills of Pakistan’s largest gated community, past immaculate green verges dotted with statues of cattle — which, unlike their real counterparts elsewhere in the country, pose no threat to traffic.

There’s a horse riding centre, a golf course, a posh cinema, an immaculately air-conditioned café and a mini zoo with “the only black panther in Pakistan”, whose growling excites young couples taking a walk.Elsewhere 20 metre models of the Eiffel Tower and Nelson’s Column — complete with lions — watch over this vision of suburbia which seems a world away from the rest of Pakistan’s seething, traffic-choked and crumbling cities.

For Riaz, an employee of a multinational firm, it is heaven compared to the sprawling, violent metropolis of Karachi that he left a few months ago.

An unprecedented wave of murders and kidnappings gripping the port city, Pakistan’s economic capital, forced him to quit for the quiet comfort of Bahria Town.

“Here we have peace, though it’s a bit lacking in life and cafés,” Riaz told AFP as he walked through the zoo with his young son.From jungle to gardens

Popularised in the United States in the 1990s, gated communities have spread across the world.

They have grown in popularity in Pakistan in the last decade as Islamist violence and crime have spiralled and a crippling energy crisis has left people without electricity for hours at a time in the blistering summer.

Pakistan now has at least two dozen gated communities, according to Shaista Zulfiqar of real estate brokerage, zameen.com.

Bahria Town has expanded to three cities — Islamabad, Lahore and Karachi — housing some 100,000 people in total.

When work started on Bahria Town Islamabad in the early 2000s, the area was nothing but “jungle”, said 28-year-old Arif Ali, one of the first residents.

For the residents of Bahria Town and the dozens of other closed communities like it around the unstable country of 180 million people, life passes calmly.

Cameras watch over the enclave 24 hours a day, on top of the guards patrolling to kick out interlopers.

The power cuts that plague life in the rest of Pakistan are a distant memory thanks to enormous generators guzzling to run the residents’ air-conditioners and HD TVs.Boom town

Bahria Town is also a town without a mayor. The development company, owned by billionaire Malik Riaz, sells the land, builds the houses, hospitals, schools, and runs the security, electricity, water, sewage, all in return for a local “tax”.

Bahria Town and its rivals like Gulberg Greens and Khudadad City offer a corner of walled-in paradise for those who can afford it...http://gulfnews.com/news/world/pakistan/happiness-for-some-in-pakis...

-

Comment by Riaz Haq on February 3, 2014 at 1:07pm

-

Here's Express Tribune on Bahria Town projects in Karachi and Rawalpindi:

RAWALPINDI: Pakistan’s largest real estate company, Bahria Town (BT) on Sunday started the booking process for its residential plots in Karachi and Rawalpindi.

Under the project, the real estate giant will allot plots to more than 0.5 million people. On the first day of booking, more than 50 thousand people received the form against a fee of Rs1,000.

The demand was such that some people reportedly resold their forms at a profit.

People from all walks of life showed great interest in the BT project and long queues of citizens were seen at the booking offices till late at night.

Talking to Express News, people said even the VIPs were found standing in queues, and the credit for this went to the founder and chairman of Bahria Town, Malik Riaz Hussain.

The BT representative said Sunday was reserved for the distribution of forms for residential plots. “The booking forms for commercial plots will to be offered on Monday (today),” he added.http://tribune.com.pk/story/663864/bahria-town-project-over-50000-r...

-

Comment by Riaz Haq on February 15, 2014 at 10:17pm

-

Here's UAE's National newspaper story on real estate sector in Pakistan:

The government spends more than US$5 billion on construction from its annual development budget. The housing sector, however, gets less than half of the amount allocated for construction each year. The burgeoning population and rapid urbanisation calls for more housing schemes in the country. Private real estate developers have a crucial role to meet housing.

In view of the security concerns, private developers have resorted to building gated communities in major cities. Pakistan’s Bahria Town is Asia’s largest real estate developer and private housing society, which has practically implemented the idea of foolproof safety. Bahria’s ongoing projects, such as the JV D&B Valley, Golf City, Garden City, Bahria Icon, cover more than 1 billion square feet that will accommodate more than 1 million residents. Bahria’s 25,000 employees are delivering US$5 billion of iconic developments.

Administered by the Pakistan army, Defence Housing Authority (DHA) is a real estate organisationthat mainly develops housing for current and retired military officers. DHA has establishments in all the major cities including Karachi, Lahore and Islamabad. DHA City, one of the largest state-of-the-art residential-cum-commercial projects, is under construction in Karachi. DHA has also built gated communities. And the prices of residential and commercial property in DHA housing schemes have been on the rise.

Launched in 2008, DHA Valley is a joint venture of DHA, Bahria Town and Habib Rafiq Private. The project aims at developing a secure community with essential amenities. DHA Valley offers 1,125 sq ft and 1,800 sq ft residential plots for 650,000 Pakistan rupees (Dh22,749) and 880,000 rupees respectively, with a quarterly instalment plan for Pakistani residents. It also offers1,800 sq ft residential plots for US$12,900 for overseas Pakistani residents.

The winner of five awards from the Asia Pacific International Property Awards, Bahria Town is actually fuelling the growth of real estate sector in the country.

Bahria’s projects in Rawalpindi and Islamabad and the development of a gated community worth $6 billion in the twin cities is the great property success story. The amenities offered by Bahria Town attracted residents and allured real estate investors. It ensures a 24-hour supply of electricity, fool-proof security and other amenities. The value of real estate in the Bahria towns in Lahore, Islamabad and Rawalpindi has increased manifold in the past five years. The price of a 1,800 sq ft residential plot at Bahria towns in Lahore and Rawalpindi has increased up to 5 million rupees from 1.5m rupees in just three to four years.

Karachi, the country commercial capital, has endured stagnancy or a fall in property prices because of deteriorating law and order over the past five years. Bahria Town has come forward as the answer to many of the problems confronting the real estate investors. Bahria town Karachi is currently the focus of speculative trade in real estate. Frenzied investors are ready to offer triple the price for plot files. What is really a commendable the properties are financially accessible to the middle class. For example in the newly launched Bahria Town scheme in Karachi, the price for a 1,125 sq ft residential plot is 2.6 million rupees, while the price of a 2,160 sq ft plot is more than 5m rupees. Similarly, the price a two bed apartment is 2.6m rupees, while the price of four-bed apartment is 8.2m rupees. These properties can be purchased through instalments under a five-year plan.

http://www.thenational.ae/business/industry-insights/property/prope...

-

Comment by Riaz Haq on March 3, 2014 at 8:27am

-

Here's an Express Tribune story on real estate sector in Pakistan:

After passing through a correction phase of nearly five months, the real estate market in Lahore is once again on the path of growth. However, there are a number of reasons why the extent of the growth may not meet investors’ expectations.

For the past few years, developers, after failing to find a suitable place in Lahore, have tended to focus on neglected but other populous cities of Punjab including Multan, Faisalabad, Gujranwala and Sialkot.

Hashu Group is one of them, Bahria town, city housing schemes (once a part of Bahria town) are the others. The latest name is the Defence Housing Authority (DHA). Since DHA is the most trusted name for any investor – in Pakistan and overseas – people find a reasonable alternate to invest.

Gujranwala, Multan and Bahawalpur are three cities where DHA has planned to establish housing societies, among which the sale and purchase for DHA Gujranwala has already kicked off. Such developments are observed as a positive for the long-term growth of the real estate sector.

“This spread out is good for the market in general,” said Mian Talat, chief executive officer at Talat Enterprisers, a real estate firm. “People now have more choices to invest and live according to their convenience.

The correction in the Karachi Stock Exchange is also a factor behind the recovery of the real estate market recovery.

Common investors of both markets believe that the KSE may crash any time. Given the situation, investors tend to switch to the real estate market. When stock index starts declining, many investors switch over to the real estate market and this is what is happening exactly now”, Talat added.

Few years back, Lahore, Karachi and Islamabad/Rawalpindi were the only places where investors found some room to put their money in for some profits. However, these cities are now pushing their limits — Lahore’s boundaries are now merging with some of its districts due to various factors.

Property prices in Lahore, despite almost a 20% correction in these five months, are quite abnormal. It is hard to find a piece of one kanal of land in a decent housing scheme below Rs10 million. If the same amount of land is located in a prime location inside a housing schemes then the price exceeds Rs20 million.

“Since Lahore is one of the major beneficiaries of the real estate boom, it is unlikely that real estate activities are stalled in the future. This is due to developments of housing schemes in other cities”, said Waseem Tariq, Chief Executive Officer of F-1 Properties. “The price fluctuation mechanism for real estate, as per our expectations, will be solid now.”http://tribune.com.pk/story/675018/real-estate-market-hits-growth-t...

-

Comment by Riaz Haq on March 12, 2014 at 9:45am

-

Dubai close second to London for foreign buyers. Here's a report on Dubai real estate in 2014:

Dubai, 18 February 2014 - Renewed demand from domestic and overseas buyers seeking Dubai property assets is a sign of increasing interest in Dubai's improving real estate market, according to leading international real estate consultancy Cluttons.

Strong interest in Emaar's newly launched Lila and Yasmin properties at Arabian Ranches, Bahrain-based Ravi Pillai Group's plans to invest USD$1.5 billion into two real estate projects in Business Bay and Downtown, and the USD$1.9 million investment by Chow Tai Food Endowment Industry Investment Development (Group) Ltd in serviced apartments, high-end residences and two five-star hotels at Dubai Pearl, illustrate the growing appetite for real estate investment from intuitional investors who have been largely absent since the market rebounded.Faisal Durrani, Associate - residential and international research at Cluttons comments on the depth of buyer demand in Dubai: "The launch of Yasmin demonstrates the domestic interest in established communities like Arabian Ranches, which feature completed infrastructure that are expanding in areas south of Dubai. Villa communities tend to be limited to a few hundred villas in order to create a sense of exclusivity and deliver on the promise of 'gated communities'. We expect to see more such 'bolt-on' schemes launched, as developers expand prominent communities and focus on areas that are well established."

The recent report on buyer activity released by the Dubai Land Department highlights the appetite for real estate assets in Dubai that extends well beyond the UAE, with 162 nationalities committing to Dubai's bricks and mortar during 2013.

Durrani continued: "Unsurprisingly, Indian nationals topped the list of the city's most active buyers, with Dubai often viewed in the same league as London by this group. The relative geographic proximity to India and the large non-resident Indian population in the region are two further critical drivers for those looking to park their Rupees in Dubai's real estate market. And now we're seeing the demand base broadening from individuals to institutional players. Britons and Pakistani nationals rounded off the top three nationalities that purchased property in Dubai last year."This is further evidenced in Cluttons International Private Capital Survey 2013/14 which was released late last year. The survey found that within the region, Dubai ranks ahead of other global real estate investment destinations.

Cluttons surveyed nine global locations across the Middle East and Asia-Pacific region and although London ranked as the go-to investment destination by the world's wealthy, Dubai came in a close second, up from seventh place a year earlier....http://www.zawya.com/story/Overseas_and_domestic_buyers_target_Duba...

-

Comment by Riaz Haq on March 20, 2014 at 7:50pm

-

Here's a Wall Street Journal story on multi-screen theaters construction boom in Pakistan:

KARACHI, Pakistan—At the brand-new Nue Multiplex here, chauffeured cars drop families at the door. Excited squeals of children reverberate from the games arcade. Hollywood and Bollywood movies play on five screens.

"We wanted to have something of international standard," said Tariq Baig, executive director of the $100 million multiplex that opened in August, replete with a Canadian sound system, Danish carpeting, and chairs and screens imported from the U.K. "We didn't go for anything local."

Nue is part of a wave of Western-style cinemas that are opening across Pakistan, aiming to serve the entertainment-starved middle classes in a country where movie houses were traditionally dilapidated, seedy, and shunned by families.

The blossoming of Western cinema in Pakistan is something of a phenomenon, taking place even as Islamist militants—who view all cinema as sinful— increasingly target the country's moviegoers.

There are just 104 movie screens in all of Pakistan, a country of 180 million people. Still, that is a jump from 20 screens in 2005, according to various distributors and cinema owners. There are another 100 screens under construction, they say.

Pakistan's cinema renaissance began in 2006, when the then military dictator, Pervez Musharraf, loosened a law dating back to the 1965 war between India and Pakistan that banned the import of Bollywood films. Though imports of Indian movies are still restricted, Mr. Musharraf's ruling allowed them to be granted a "No Objection Certificate" by the government in special cases. The ordinance also created a loophole in the law that allowed Indian films to be imported via another country.

"Everyone wants to go to the cinema," says Nadia Jamil, a popular TV and film actress based in Lahore. "It's the Indian films that have created the market that everyone wants to rush to."

----------

Cinema construction has been on a tear over the past few years in a number of developing countries where growing middle classes are flocking to theaters. China last year added 5,077 new film screens, boosting its total to 18,200, according to the official Xinhua news agency.

---------

Peshawar's cinemas are a far cry from the multiplexes of Lahore, Islamabad and Karachi. The only defense against the intense summer heat are ancient fans. In the winter patrons come with their own blankets. The audiences are exclusively male, and many of the theaters show porn, crudely dubbed into Pashto, the local language. Audiences are small and profits are slim. Tickets cost around 50 rupees (50 cents), depending on how popular the film is.Habib ur Rehman, the manager of the Picture House cinema, the first theater to be attacked by the Taliban, said in conservative Peshawar being in the cinema business isn't something you boast about. He said the modern multiplexes springing up in other parts of the country would never come to the city. "They will not succeed here. The people don't like Hindi and English films. They want Musarrat Shaheen, " he said, referring to a famous Pashto actress.

Despite the Taliban threats, Rehan Shah, who works at the Shama Cinema, the second Peshawar theater attacked, said people are eager for these cinemas to reopen.

"People are already asking, 'Why are you not open? We want entertainment,' " he said.

http://online.wsj.com/news/articles/SB10001424052702303546204579439...

Twitter Feed

Live Traffic Feed

Sponsored Links

South Asia Investor Review

Investor Information Blog

Haq's Musings

Riaz Haq's Current Affairs Blog

Please Bookmark This Page!

Blog Posts

Pakistanis' Insatiable Appetite For Smartphones

Samsung is seeing strong demand for its locally assembled Galaxy S24 smartphones and tablets in Pakistan, according to Bloomberg. The company said it is struggling to meet demand. Pakistan’s mobile phone industry produced 21 million handsets while its smartphone imports surged over 100% in the last fiscal year, according to …

ContinuePosted by Riaz Haq on April 26, 2024 at 7:09pm

Pakistani Student Enrollment in US Universities Hits All Time High

Pakistani student enrollment in America's institutions of higher learning rose 16% last year, outpacing the record 12% growth in the number of international students hosted by the country. This puts Pakistan among eight sources in the top 20 countries with the largest increases in US enrollment. India saw the biggest increase at 35%, followed by Ghana 32%, Bangladesh and…

ContinuePosted by Riaz Haq on April 1, 2024 at 5:00pm

© 2024 Created by Riaz Haq.

Powered by

![]()

You need to be a member of PakAlumni Worldwide: The Global Social Network to add comments!

Join PakAlumni Worldwide: The Global Social Network