PakAlumni Worldwide: The Global Social Network

The Global Social Network

Are Lockdowns Absolutely Necessary to Contain the Coronavirus Pandemic?

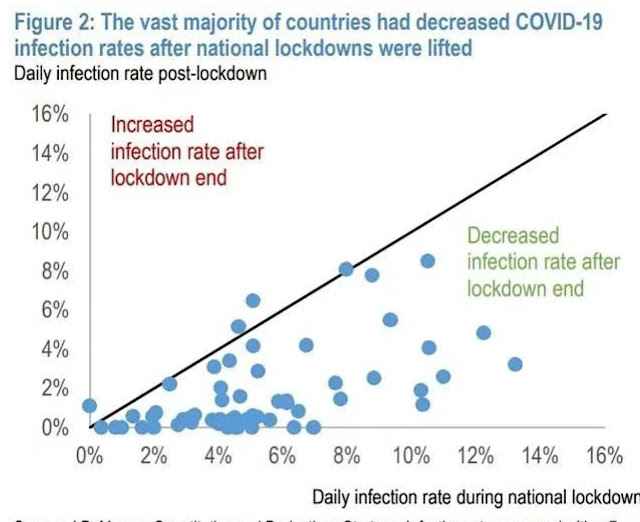

Many countries have imposed strict lockdowns to control the spread of coronavirus. Marko Kolanovic of JP Morgan claims that numbers had declined because the virus "likely has its own dynamics" that are "unrelated to and often inconsistent lockdown measures". He cites as evidence a number of places whose infection rates, or "R" values, have continued to fall despite restrictions being lifted.

Coronavirus Transmission Rates Before & After Lockdown. Sou... |

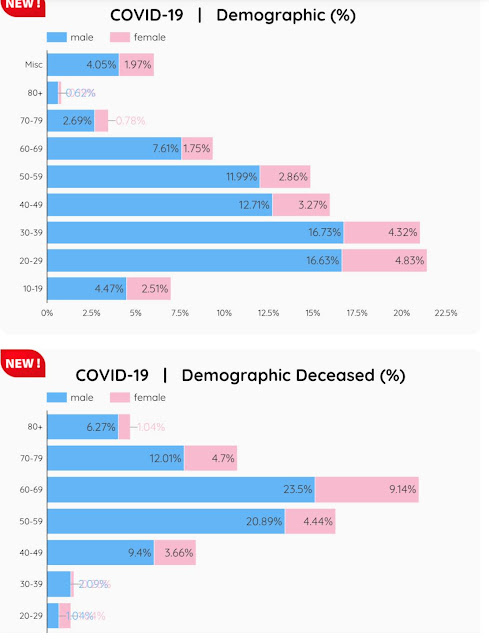

Are these absolutely necessary? What are its costs and benefits in terms of lives and livelihoods, particularly in developing countries like Pakistan with young populations? Over 40% of all coronavirus deaths in Europe and America have occurred among the elderly living in nursing homes. Pakistanis age 60+ account for 19% of cases but 58% of deaths. Like US and Europe, older people are much more likely to die from coronavirus in Pakistan. But average life expectancy in Pakistan is just 67 years and the median age in the country is only 22 years. The explanations offered for low death rates in South Asia include younger populations, more sunshine, higher temperature and humidity, universal BCG vaccinations etc. Yale researchers have argued in a recently published paper to consider universal mask adoption and increased hygiene measures as an alternative to complete lockdown.

Coronavirus Infections and Death Demographics. Source: Pakistan Hea... |

Are there other tools such as compulsory face masks which can preserve both lives and livelihoods? In a recently published paper tiled "The Benefits and Costs of Social Distancing in Rich and PoorCountr..., Yale researchers support universal mask adoption and increased hygiene measures as a alternatives to social distancing and complete lockdown.

What will be the impact of coronavirus lockdown on global economy? European Union foreign policy chief Josep Borell has said "Analysts have long talked about the end of an American-led system and the arrival of an Asian century. This is now happening in front of our eyes," he said. "If the 21st century turns out to be an Asian century, as the 20th was an American one, the pandemic may well be remembered as the turning point of this process."

Does it impinge on civil liberties of the people? Could such lockdowns cause various physical and mental illnesses leading to deaths and high rates of suicides?

Despardes with Faraz Darvesh host discusses these questions with Ali Hasan Cemendtaur, Misbah Azam and Riaz Haq.

Related Links:

Vast Majority of Pakistanis Support Imran Khan's Handling of Covid1...

Pakistani-American Woman Featured in Netflix Documentary "Pandemic"

Can Pakistan Respond Effectively to Coronavirus Pandemic?

Can Pakistan Effectively Respond to Coronavirus Outbreak?

How Grim is Pakistan's Social Sector Progress?

Pakistan Fares Marginally Better Than India On Disease Burdens

Can Imran Khan Lead Pakistan to the Next Level?

Democracy vs Dictatorship in Pakistan

Pakistan Child Health Indicators

Pakistan's Balance of Payments Crisis

Conspiracy Theories About Pakistan Elections"

PTI Triumphs Over Corrupt Dynastic Political Parties

Strikingly Similar Narratives of Donald Trump and Nawaz Sharif

-

Comment by Riaz Haq on June 19, 2020 at 9:31pm

-

#Asian Development Bank (#ADB) projects #Pakistan’s #economy to grow at 2% in the upcoming fiscal year 2020-21. It added #India’s #GDP was forecast to contract by 4.0% in fiscal year 2020, ending on March 31, 2021. #COVID19 #Lockdown #ImranKhan #Modi https://tribune.com.pk/story/2245558/2-pakistan-economy-grow-2-next...

The Asian Development Bank (ADB) has projected Pakistan’s economy would regain some pace and grow at 2% in the upcoming fiscal year 2020-21, after contracting by 0.4% in the outgoing fiscal year 2019-20 in the wake of Covid-19 pandemic.

The ADB said in a regular supplement to its annual flagship economic publication, the Asian Development Outlook (ADO) 2020 that inflation rate in Pakistan would remain at 11% as against the earlier projection of 11.5% in current fiscal year ending on June 30.

“Pakistan’s economy was on the path to recovery before Covid-19, and once the Covid-19 impact subsides, Pakistan will resume its efforts to address macroeconomic imbalances and initiate structural reform, likely holding economic growth to a projected 2.0% in FY2021,” the bank said.

“Inflation rate in Pakistan would remain at 11% as against the earlier projection of 11.5% in current fiscal year,” it said, adding that in next fiscal year, the inflation rate would remain 8% against the earlier projection of 8.3%.

The supplement said that South Asia’s economy, which had been hit hard by Covid-19, was forecast to contract by 3.0% in 2020, compared to 4.1% growth predicted in April. It added India’s was forecast to contract by 4.0% in fiscal year 2020, ending on March 31, 2021, before growing 5.0% in 2021.

The ADB said that the developing Asia overall would barely grow in 2020 as containment measures to address the coronavirus pandemic hampered economic activity and weakened external demand. It forecast growth of 0.1% for the region in 2020 – down from the 2.2% forecast in April.

The growth of 0.1% would be the slowest for the region since 1961. Excluding the newly-industrialised economies of Hong Kong, China; Republic of Korea; Singapore; and Taipei, China, developing Asia is forecast to grow 6.6% in 2021,” the supplement said.

“Economies in Asia and the Pacific will continue to feel the blow of the Covid-19 pandemic this year even as lockdowns are slowly eased and select economic activities restart in a ‘new normal’ scenario,” ADB Chief Economist Yasuyuki Sawada said in a statement.

“While we see a higher growth outlook for the region in 2021, this is mainly due to weak numbers this year, and this will not be a V-shaped recovery. Governments should undertake policy measures to reduce the negative impact of Covid-19 and ensure that no further waves of outbreaks occur.”

-

Comment by Riaz Haq on July 18, 2020 at 1:34pm

-

#Pakistan #FDI jumps 88% to $2.561 billion in FY20. Top sectors: #power ($764.3m) & #communications ($663.9m). #China top source with net FDI of $844.1 million, followed by #Norway $402 million and #HongKong $190.7 million. https://www.thenews.com.pk/print/688274-fdi-jumps-88pc-to-2-561bln-...

Foreign direct investment (FDI) in Pakistan jumped 88 percent in the fiscal year of 2019/20, with most of the inflows going into power and communications sectors, led by China, numbers released by State Bank of Pakistan (SBP) showed on Friday.

Pakistan attracted $2.561 billion FDI in July to June FY2020, compared with $1.362 billion in the previous fiscal year.

The direct investment, however, was lower than the government’s target of $4.34 billion set for FY2020. This was due to the COVID-19 pandemic’s negative impact on investments that were felt strongly.

The FDI was up 70.53 percent year-on-year to $174.8 million in June. It stood at $102.5 million during the same month of last fiscal year.

The SBP data showed that China remained the largest investor with a net FDI of $844.1 million in FY2020, followed by Norway (402 million) and Hong Kong ($190.7 million).

FDI in the power sector attracted $764.3 million foreign capital in July-June FY2020. However, investors pulled out $323.9 million from this sector in FY2019. The increase in the FDI in energy companies is attributed to an ongoing work on the CEPC-related projects especially in the thermal and coal-fired projects. Eight energy projects have been completed and nine are currently under construction.

Communications sector inflows in the FY2020 stood at $663.9 million, while the communications businesses saw an outflow of $55.7 million a year earlier.

Foreign funds managers pulled $241.3 million from the government securities such as treasury bills and Pakistan Investment Bonds in FY2020. That compared with $1 billion outflows in FY2019. Outflows from the stock market stood at $281.7 million, compared with $415.2 million in previous year.

Total foreign investment amounted to $2.038 billion in FY2020 against the outflows of $54.8 million in FY2019.

Comment

- ‹ Previous

- 1

- 2

- Next ›

Twitter Feed

Live Traffic Feed

Sponsored Links

South Asia Investor Review

Investor Information Blog

Haq's Musings

Riaz Haq's Current Affairs Blog

Please Bookmark This Page!

Blog Posts

EU-India Trade Deal: "Uncapped" Mass Migration of Indians?

The European Union (EU) and India have recently agreed to a trade deal which includes an MOU to allow “an uncapped mobility for Indian students”, according to officials, allowing Indians greater ease to travel, study and work across EU states. India's largest and most valuable export to the world is its people who last year sent $135 billion in remittances to their home country. Going by the numbers, the Indian economy is a tiny fraction of the European Union economy. Indians make up 17.8%…

ContinuePosted by Riaz Haq on January 28, 2026 at 11:00am — 8 Comments

Independent Economists Expose Modi's Fake GDP

Ruling politicians in New Delhi continue to hype their country's economic growth even as the Indian currency hits new lows against the US dollar, corporate profits fall, electrical power demand slows, domestic savings and investment rates decline and foreign capital flees Indian markets. The International Monetary Fund (IMF) has questioned India's GDP and independent economists…

ContinuePosted by Riaz Haq on January 25, 2026 at 4:30pm — 10 Comments

© 2026 Created by Riaz Haq.

Powered by

![]()

You need to be a member of PakAlumni Worldwide: The Global Social Network to add comments!

Join PakAlumni Worldwide: The Global Social Network