PakAlumni Worldwide: The Global Social Network

The Global Social Network

Can Pakistan Avoid Recurring BoP Crises Requiring IMF Bailouts?

Every country needs US dollars to import products because the US dollar is the international trade and reserve currency. Only the United States can print dollars; all others must acquire them through exports and capital inflows like investments, remittances and loans. Pakistan has had serious problems in acquiring sufficient amount of dollars for its needs through trade and investments over the last several decades. It has been forced to seek IMF bailouts repeatedly.

China, India and East Asia:

China and other East Asian nations have built up large dollar reserves by running massive trade surpluses mainly through exporting lots of products and services to the rest of the world.

Others, such as India, have built up significant US dollar reserves in spite of running large trade deficits. India relies mainly on foreign investments, remittances from non-resident Indians and foreign debt for its dollar reserves.

India is consistently ranked among the top recipients of foreign direct and portfolio investments as percentage of its GDP.

Pakistan's Foreign Investment and Trade:

Like India, Pakistan also runs large trade deficits. It also depends on foreign investments, remittances from overseas Pakistanis and foreign debt for its dollar reserves. So why does Pakistan have serious recurring balance of payments crises?

Unlike India, Pakistan ranks very low among recipients of foreign direct and portfolio investments as percentage of its GDP. . Part of it is the perception of insecurity since 911. The real security situation has dramatically improved in the last few years but the perception continues to lag.

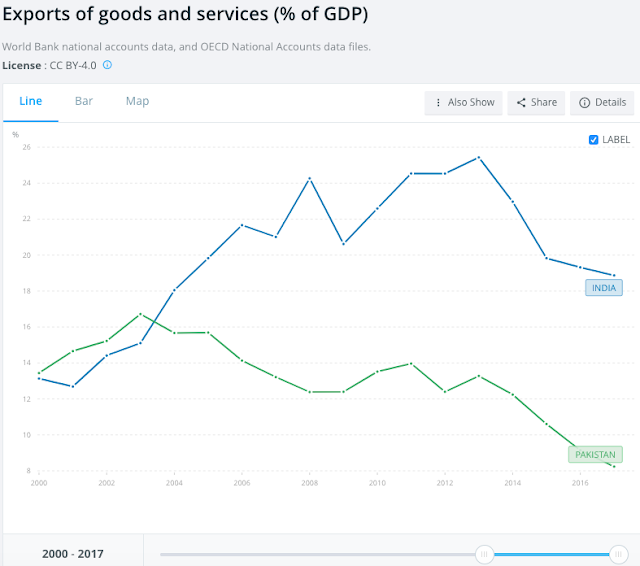

Pakistan's exports have also lagged behind India's as percentage of gross domestic product (GDP). In fact, Pakistan's exports have halved from about 16% of GDP in 2003 to 8% of GDP in 2017. India's exports have increased from 15% to 19% of GDP in the same period, according to the World Bank.

Export-Orientation of Industries:

Pakistan has a fairly diverse industrial sector which caters to its domestic market. People running these businesses and industries have little or no knowledge of the customer needs and regulatory requirements of foreign markets where their products or services could be sold to boost Pakistan's exports and dollar earnings.

Pakistan's economic attaches posted at the nation's embassies need to focus on all export opportunities in international markets and help educate Pakistani businesses on the best way to take advantage of them. This needs to be a concerted effort involving various government ministries and departments working closely with industry groups.

Illicit Capital Flows:

Pakistan's new government led by the Pakistan Tehreek e Insaf Chief Imran Khan needs to urgently crack down on illicit outflow of dollars. One of the ways large amounts of money moves across international borders is through trade misinvoicing.

Global Financial Integrity (GFI) defines trade misinvoicing as "fraudulently manipulating the price, quantity, or quality of a good or service on an invoice submitted to customs" to quickly move substantial sums of money across international borders.

How does trade miscinvoicing work? Here's an example:

Let's say an exporter in Pakistan exports goods worth $1 million to a foreign country and invoices it at $500,000 through an offshore middleman. The middleman invoices and collects $1 million from the end customer, sends $500,000 to Pakistan and deposits $500,000 in an offshore account. The result: Pakistan is deprived of the $500,000 in foreign exchange.

Similarly, imports of goods worth $1 million to Pakistan are overinvoiced at $1.5 million through an offshore middleman and the difference is kept in an overseas account. The result: Pakistan loses another $500,000 in foreign exchange. Meanwhile, the Pakistani traders and the officials facilitating misinvoicing together pocket $1 million or 50% on the two trades. Pakistan's trade and current account deficits grow and the foreign exchange reserves are depleted, forcing Pakistan to go back to the International Monetary Fund (IMF) for yet another bailout with tough conditions.

Terror and Drug Financing:

It is not just greedy politicians, unscrupulous businessmen and corrupt officials in developing countries who rely on fraudulent manipulation of trade invoices; all kinds of drug traders, terrorists and criminals also use what is called TBML (trade-based money laundering).

John A. Cassara, former US intelligence official with expertise in money laundering, submitted written testimony for a US Congressional hearing on “Trading with the Enemy: Trade-Based Money Laundering is the Growth Industry in Terror Finance” to the Task Force to Investigate Terrorism Financing Of the House Financial Services Committee February 3, 2016. Here's an except from it:

"Not long after the September 11 attacks, I had a conversation with a Pakistani entrepreneur. This businessman could charitably be described as being involved in international grey markets and illicit finance. We discussed many of the subjects addressed in this hearing including trade-based money laundering, terror finance, value transfer, hawala, fictitious invoicing, and counter-valuation. At the end of the discussion, he looked at me and said, “Mr. John, don’t you know that your adversaries are transferring money and value right under your noses? But the West doesn’t see it. Your enemies are laughing at you.”"

Summary:

Pakistan needs to find a way to build up and manage significant dollar reserves to avoid recurring IMF bailouts. The best way to do it is to focus on increasing the country's exports that have remained essentially flat in per capita terms. Pakistan's economic attaches posted at the nation's embassies need to focus on all export opportunities in international markets and help educate Pakistani businesses on the best way to take advantage of them. This needs to be concerted effort involving various government ministries and departments working closely with industry groups. At the same time, the new government needs to crack down on illicit outflow of dollars from the country.

Azad Labon Ke Sath host Faraz Darvesh discusses Imran Khan's challenges with Misbah Azam and Riaz Haq (www.riazhaq.com)

Related Links:

Money Laundering Through Trade Misinvoicing

Pakistan Economy Hobbled By Underinvestment

Raymond Baker on Corruption in Pakistan

Can Indian Economy Survive Without Western Capital Inflows?

Culture of Corruption in Pakistan

Chinese Yuan to Replace US $ as Reserve Currency?

Remittances From Overseas Pakistanis

-

Comment by Riaz Haq on August 9, 2018 at 10:08am

-

#Pakistan lines up $4 billion #loan from #SaudiArabia-backed bank the #Islamic #Development Bank. Official involved says Saudi government wants to "play a part in rescuing Pakistan from its present crisis”. #IMF #Bailout #China https://www.ft.com/content/6feaef1a-9bcf-11e8-9702-5946bae86e6d via @financialtimes

Pakistan plans to borrow more than $4bn from the Saudi-backed Islamic Development Bank as part of its attempts to restore dangerously low stocks of foreign currency.

Two officials have told the Financial Times that the Jeddah-based bank has agreed to make a formal offer to lend Islamabad the money when Imran Khan takes over as prime minister. They added that they expect Asad Umar, Mr Khan’s proposed finance minister, to accept.

“The paperwork is all in place,” said one senior adviser in Islamabad. “The IDB is waiting for the elected government to take charge before giving their approval.”

The person added that the loan would not cover Pakistan’s expected financing gap of at least $25bn during this financial year but was “an important contribution”.

Mr Khan, Pakistan’s former cricket captain, is expected to take over as prime minister in the coming days after his Pakistan Tehreek-e-Insaf party won the most seats in last month’s election — though it fell short of an outright majority.

One of his first jobs will be to repair the country’s balance of payments problem, with high imports and stagnant exports having bled the country of much of its foreign exchange reserves.

Speaking to reporters in Islamabad this week, Mr Umar, who served as the PTI’s shadow finance minister while in opposition, warned: “The situation is dire. We’ve got $10bn dollars of central bank reserves, we’ve got somewhere between $8bn and $9bn in short-term liabilities, and therefore your net reserves are close to nothing.”

Officials have already drawn up plans to borrow up to $12bn from the International Monetary Fund — though such a bailout is likely to come with strings attached, such as a demand to see the details behind billions of dollars’ worth of Chinese loans.

Mr Umar is therefore exploring what other options remain open to him, of which the IDB loan is one. Officials said the loan would be used mainly to pay for oil imports, with higher crude prices having contributed to Pakistan’s problems.

One official at the Pakistani central bank who has been involved in negotiations with the IDB said the loan had the backing of the Saudi government, “which wants to play a part in rescuing Pakistan from its present crisis”.

Islamabad and Riyadh have moved closer in recent months after Pakistan agreed to send an undeclared number of troops to “train and advise” security forces there. The Pakistan government insists that the soldiers will not be used to fight in Yemen however, something the Saudis had previously requested.

Despite the promise of money from the IDB, economists warn that Mr Khan’s new government will still have to enact potentially unpopular spending cuts and tax rises to help repair the government’s balance sheet.

“The budget deficit shot up to about 7 per cent of gross domestic product during the last financial year,” said Waqar Masood Khan, a former finance ministry official. “Bringing that down to the target of 4 per cent is not going to be easy.”

-

Comment by Riaz Haq on August 14, 2018 at 10:07am

-

#India's monthly #trade deficit of $18 billion in July worst in 5 years

https://www.bloomberg.com/news/articles/2018-08-14/india-posts-bigg...

The trade deficit -- gap between exports and imports -- was $18 billion in July, fanned by a higher oil import bill, data released by India’s commerce ministry showed on Tuesday. That compares with the $15.7 billion median estimate in a Bloomberg survey of 24 economists and $16.6 billion in June.

While a weaker rupee is positive for exports, it poses an inflation risk for a nation that imports more than 80 percent of its crude-oil needs and adds to the stress on the current-account balance. The rupee dropped to as low as 70.08 per dollar on Tuesday, keeping intact its position as Asia’s worst-performing currency this year.

Every rupee change in the exchange rate against the U.S. dollar impacts India’s crude-oil import bill by 108.8 billion rupees ($1.58 billion), according to the oil ministry.

Inbound shipments of oil in July were at $12.4 billion, up 57.4 percent from a year ago, while gold imports surged 41 percent to $2.96 billion and electronics goods by 26 percent to $5.12 billion. Overall imports rose 29 percent to $43.8 billion, while exports grew at 14 percent to $25.8 billion.

The last time trade deficit was wider was in May 2013 at $19.1 billion, according to data compiled by Bloomberg.

“Broader emerging-market currency movement, dollar strength, and the trend in crude-oil prices will drive the outlook for the rupee in the immediate term, which will have an impact on the landed cost of imports,” said Aditi Nayar, principal economist at ICRA Ltd. in Gurugram, near New Delhi. That will also have a bearing on various commodity prices and transmit into wholesale price inflation, she said.

Gains in wholesale prices eased for the first time in five months, Commerce Ministry data showed on Tuesday. Government data on Monday showed retail inflation quickened 4.17 percent in July from a year earlier, slower than the 4.5 percent median estimate in a Bloomberg survey of economists.

The monetary policy committee led by Governor Urjit Patel has increased interest rates twice since June to curb price pressures, while the central bank used foreign reserves to check currency volatility. The rupee reversed losses to close 0.1 percent higher at 69.8963 on Tuesday in Mumbai, with traders saying state-run banks sold dollars, probably on behalf of the RBI.

The current level of reserves at about $402 billion will provide import cover of less than a year. The nation’s current-account gap has come under pressure and is expected to widen to 2.4 percent of gross domestic product in the financial year to March 2019, from 1.9 percent in the October-December period.

-

Comment by Riaz Haq on August 20, 2018 at 4:58pm

-

China offers Pakistan to trade in yuan, help decrease trade deficit

Sources quoting the Chinese ambassador said Beijing was contemplating to invite new Prime Minister Imran Khan as a guest of honour for China Import Fair set to be held in November 2018

https://profit.pakistantoday.com.pk/2018/08/20/china-offers-pakista...

To rein in Pakistan’s rising trade deficit, China is said to have offered Islamabad the option of commencing trading in Renminbi (Yuan) in which regard meeting has been held with the State Bank of Pakistan (SBP).

According to sources privy of the development, the recommendation was put forth by the Chinese Ambassador to Pakistan Yao Jing in a meeting with ex-interim Minister for Commerce, Mian Misbah-ur-Rehman, reports Business Recorder.

In the meeting, several issues of economic cooperation and bilateral between the two countries were brought forth.

Also, China is mulling announcing unilateral trade concessions to Pakistan which will increase its exports to Beijing and hence decrease trade deficit.

The China-Pakistan free trade agreement (CPFTA) part 1 favoured China since their exports to Pakistan were valued over $15 billion compared to Pakistan’s exports of a meagre $1.5 billion in FY18.

And the last round of CPFTA talks held in Islamabad were unsuccessful as both countries were unable to reach an agreement on the second phase.

Also, a high-level meeting presided under the chairman of ex-prime minister Shahid Khaqan Abbasi had taken the decision of not finalizing CPFTA part 2 till the industry was taken aboard.

Furthermore, sources quoting the Chinese ambassador said Beijing was contemplating to invite new Prime Minister Imran Khan as a guest of honour for China Import Fair set to be held in November 2018.

To ensure this visit more purposeful, the Chinese ambassador stated a team led by the Commerce Minister or the Secretary Commerce could visit China before the visit of new PM to find out areas of cooperation and firm up the aim of his visit.

In reply to the interim commerce minister’s worry on granting concessions to India and Bangladesh, the ambassador said those had been proclaimed under the framework of Asia-Pacific Trade Agreement (Bangkok Agreement).

The Chinese ambassador added China-Pakistan Economic Corridor (CPEC) was aimed more on energy and infrastructure linked projects, but Beijing recognized new areas of cooperation and support to Pakistan’s government via trade promotion, foreign direct investment (FDI) and social sector support.

For this, a delegation of Chinese Customs and Quarantine department would come to Pakistan shortly to address concerns over market access and quarantine issue which were impeding trade between both countries.

While talking about FDI, Mr Jing stated Beijing would begin measures to enhance joint venture and investment in special economic zones (SEZs). He advised Shanghai Import Fair would provide a good chance for Pakistan to exhibit its investment potential.

On the topic of social sector cooperation, Mr Jing said regional governments of Xinjiang province and Gilgit-Baltistan (GB) were working in tandem to enhance infrastructure facilities at border posts to resolve customs and quarantine related problems.

-

Comment by Riaz Haq on August 22, 2018 at 8:15am

-

China asks state-owned companies to invest, transfer tech to Pakistan under CPEC

https://www.thenews.com.pk/print/358333-china-asks-state-owned-comp...

Dr Li Jing Feng, director, Regional Studies and Strategic Research Centre, Sichuan Academy of Social Sciences, Beijing, China, has said that China asked its state-owned companies to invest in Pakistan and transfer technology to Pakistan under CPEC.

Dr Li was answering questions at a roundtable on “BCIM-EC & CPEC within China’s Belt-and-Road-Initiatives” organised by Institute of Regional Studies here Monday. Dr Rukhsana Qamber, president of IRS, conducted the proceedings.

Dr Li said that we also train local workers here to start from ground zero in the journey to value added products. Answering another question, Gawadar is more important than Chabahar port as it is a deep sea port and bigger ships cannot dock in the Iranian port.

He observed that Chinese being killed in Pakistan are of extreme concern for China.Earlier, in his talk, Dr Li focused his discussion on BCIM economic corridor and compared it with CPEC. He said that due to Indian reservations, the Bangladesh China India Myanmar Economic Corridor (BCIM-EC) would not be successful although both Bangladesh and Myanmar were in favour of it. On the other hand, CPEC would be successful for a number of reasons, the main one being the strong understanding and mutual trust that exists between Pakistan and China, he said adding that Gawadar is developing and would ultimately become a developed city. He was also aware of the negative feelings on CPEC that have been aired in various fora.

Mr Annice Mahmood formerly from Pakistan Institute of Development Economics said that like China, Pakistan should export its surplus produce to rectify its balance of payment deficit. He said that remittances to Pakistan are from unskilled workers but still we are getting something. He said Russia tried to help us stand on our feet but we did not respond. India responded and got the dividend. He said instead of getting profit and paying back but not much was done to create self-reliance and promote self- sustained growth within the country.

-

Comment by Riaz Haq on August 27, 2018 at 8:57pm

-

#China will increase #FDI in #Pakistan, build special economic zones and upgrade #Pakistan's #manufacturing capacity and expand #export-oriented industries. China will also actively expand its #imports from Pakistan. #CPEC

http://usa.chinadaily.com.cn/a/201808/28/WS5b8487b1a310add14f3880c5...

Developing China-Pakistan relations has always been a priority of China's neighborhood diplomacy. China is looking forward to strengthening cooperation with the new Pakistani government, bringing more dividends of the CPEC to the grassroots and the general public in Pakistan, making it a model project for the benefits of both peoples.

China will actively promote investment in Pakistan. The Chinese government will firmly promote industrial cooperation, expand China's direct investment in Pakistan, and encourage Chinese enterprises to actively participate in the construction of special economic zones. Its focus of cooperation will be upgrading Pakistan's manufacturing capacity and expanding export-oriented industries.

We will continue to organize delegations from the private sector in China to visit Pakistan and set up various platforms for business-to-business cooperation. We will also continue to promote the transfer of high-quality and advanced industrial technologies from China to Pakistan, establish more joint ventures, and strengthen the brand of "Made in Pakistan".

China will also actively expand its imports from Pakistan. In November, China will hold the first China International Import Expo in Shanghai, where, as one of the "Chief Guest" countries, Pakistan has been invited to send a large delegation of exporters and set up exhibitions at both the national and export levels. It is hoped that Pakistan will make full use of this opportunity to promote its superior products to China.

The Chinese side will also promote cooperation between the customs and quarantine authorities of both countries to facilitate the further opening-up of China's agricultural product market to Pakistan. China will, under the framework of free trade cooperation between the two countries, provide a larger market share for Pakistani goods, and strengthen cooperation and facilitate local trade between Gilgit-Baltistan and China's Xinjiang Uygur autonomous region. And China will take further visa facilitation measures to encourage more Pakistani businesspeople to visit China.

Improving Pakistani people's livelihoods

Besides, China will focus more on helping Pakistani people improve their livelihoods. It will actively promote cooperation between the two countries' universities, establish more vocational and technical training centers in Pakistan, provide aid for building 50 schools in the tribal districts of Khyber Pakhtunkhwa province (that is, in the former Federally Administered Tribal Areas), expand the primary school in Gwadar "donated" by China. The purpose of this is to help Pakistan improve the quality of its human resources, especially of the youth.

Besides, China will consider setting up an agricultural technology demonstration center in Pakistan to improve local agricultural technology, production efficiency and value-added agricultural industry. It also will strengthen scientific and technological cooperation with Pakistan, establish a China-Pakistan Joint Research Center on Earth Science, strengthen scientific research on disaster reduction and prevention, promote ecological and environmental protection, and help develop green and sustainable growth in Pakistan.

Moreover, Beijing will encourage Chinese companies to fulfill their social responsibilities and play a more active role in sponsoring livelihood projects. We will also explore more pragmatic cooperation with Pakistan in such areas as poverty alleviation and healthcare.

-

Comment by Riaz Haq on September 11, 2018 at 7:54am

-

#Pompeo said #UnitedStates won't block #Pakistan if it seeks #IMF bailout: Pakistani minister http://po.st/aR0gJl via @ChannelNewsAsia

U.S. Secretary of State Mike Pompeo assured Pakistan last week Washington would not try to block any request for a bailout from the International Monetary Fund (IMF), Pakistani Information Minister Fawad Chaudhry said on Tuesday.

The remarks, which Chaudhry said Pompeo made during his visit to Pakistan on Wednesday, come in stark contrast to Pompeo's warnings in July that the United States had serious reservations about the IMF giving money to Pakistan due to concerns Islamabad would use the cash to pay off Chinese loans.

Those comments rattled Islamabad, which is facing a currency crisis and may have no option but to turn again to the IMF for a rescue if staunch allies China and Saudi Arabia do not offer more loans to prop up its foreign currency reserves.

Chaudhry told Reuters that relations between United States and Pakistan were "broken" before Pompeo's trip to Islamabad but the visit had "set many things straight" and re-invigorated ties.

"He assured Pakistan that...if Pakistan opted to go to IMF for any financial help, the USA will not oppose it," Chaudhry said in the capital, Islamabad.

The U.S. embassy in Islamabad did not have any immediate comment.

The new government of Prime Minister Imran Khan, who took office in August, is trying to avert a currency crisis caused by a shortage of dollars in an economy hit by a ballooning current account deficit and dwindling foreign currency reserves.

Pakistani officials say they are discussing taking drastic measures to avert seeking a bailout from the IMF, which has come to Pakistan's rescue 14 times since 1980, including most recently in 2013.

Pakistan's relations with the United States have soured in recent years over the war in Afghanistan and Islamabad's alleged support for Islamist militants. Ties dropped to a new low when President Donald Trump in January accused Pakistan of lies and deceit by playing a double game on fighting terrorism.

Islamabad denies aiding insurgents in Afghanistan and lashed out against Trump's remarks, which were followed up by Washington suspending U.S. military aid.

At the United States' urging, a group of Western countries in February convinced a global body to put Pakistan on a terrorism financing watch list, a move that triggered concerns the United States may also seek to block Islamabad in other forums.

In July, Pompeo said there was "no rationale" for the IMF to bail out Pakistan. Pompeo's worries that Islamabad would use the IMF money to pay off Chinese loans echoes concerns by other U.S. officials that China is saddling many emerging market countries with too much debt. Beijing staunchly denies such claims.

"There's no rationale for IMF tax dollars, and associated with that American dollars that are part of the IMF funding, for those to go to bail out Chinese bondholders or China itself," Pompeo said in July, referring to a possible Pakistan bailout.

But during last week's visit Pompeo said he was hopeful of "a reset of relations" long strained over the war in Afghanistan.

Read more at https://www.channelnewsasia.com/news/asia/pompeo-said-us-won-t-bloc...

Comment

Twitter Feed

Live Traffic Feed

Sponsored Links

South Asia Investor Review

Investor Information Blog

Haq's Musings

Riaz Haq's Current Affairs Blog

Please Bookmark This Page!

Blog Posts

Modi's AI Spectacle: Chaos and Deception in New Delhi

The India AI Impact Summit 2026, held at Bharat Mandapam in New Delhi, has been marred by chaos, confusion and deception. The events on the ground have produced unintended media headlines for India's Prime Minister Narendra Modi who wants to be seen as the "vishwaguru" (teacher of the world) in the field of artificial intelligence as well. First, there was massive chaos on the opening day, with long…

ContinuePosted by Riaz Haq on February 19, 2026 at 12:00pm — 9 Comments

India-Pakistan Cricket Match: The Biggest Single Event in the World of Sports

Why did Pakistan's decision to boycott the India-Pakistan match in solidarity with Bangladesh in this year's T20 World Cup send shockwaves around the world? And why did it trigger the International Cricket Council's and other cricket boards' urgent efforts to persuade Pakistan to return to the match? The reason has a lot to do with its massive financial impact, estimated to be as much as …

ContinuePosted by Riaz Haq on February 11, 2026 at 4:00pm — 2 Comments

© 2026 Created by Riaz Haq.

Powered by

![]()

You need to be a member of PakAlumni Worldwide: The Global Social Network to add comments!

Join PakAlumni Worldwide: The Global Social Network