PakAlumni Worldwide: The Global Social Network

The Global Social Network

CCP Centennial: The Chinese Economic Miracle

The Chinese Communist Party (CCP) was founded one hundred years ago on July 1, 1921. The party has transformed China from a poor and backward third world country into a vibrant and prosperous industrialized economy. This rapid historic transformation has surprised everyone, including China's friends, but especially its western foes who now see the emergence of the Asian giant as a challenge to centuries-long western domination of the world. It has also earned the CCP high levels of performance legitimacy and popularity among the Chinese people. The CCP's successful response to the COVID crisis has further boosted its legitimacy and popularity in China.

|

| China Surpassed United States in Global Trade |

Chinese Economy:

Over the last several decades, China has built a strong manufacturing base to serve as the factory to the world. This efficient industrial base is being used by all major global brand-name multi-national giants to manufacture and supply everything from Barbie dolls to iPhones. It has served as a powerful engine to drive the Chinese economy which now rivals the US economy in size. China's GDP overtook the U.S.'s in 2017 in terms of purchasing power parity, according to Nomura Securities. China has eclipsed the United States as the world's largest trading nation.

|

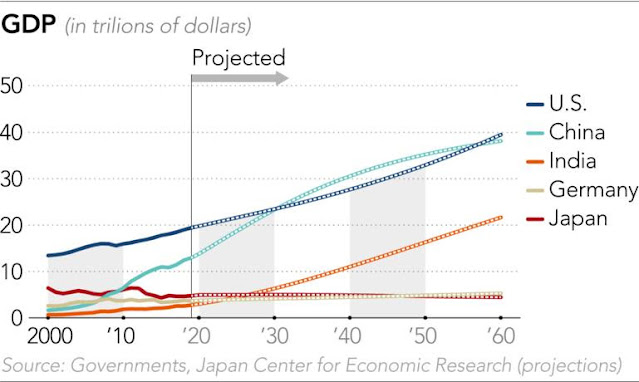

| Japanese Government Projection of Future GDP Trajectories. Source: ... |

China's Economy Slowing:

There's some evidence that China's economy is slowing after hitting a peak growth in the last decade, according to Forbes magazine. It may sound like wishful thinking but the American magazine argues that "China’s growth has slowed in recent years, partly due to maturity. Extremely poor countries have the potential to grow rapidly. As they approach the level of developed countries, growth is harder and thus slows".

|

| China Economy Slowing. Source: Forbes |

Digital Economy:

The United States is far ahead of China in global digital economy. But the US-China battle for future dominance of this economy is now underway. The winner of this contest will dominate the next phase of global economic competition. It will be determined by achieving mastery of computer chips and software needed to build complex systems.

The United States and its ally Taiwan are far ahead of all other nations in building the most advanced 5 nanometer semiconductor components. But China is gearing up for it. Chinese leader Xi Jinping has appointed Liu He, his most trusted lieutenant, as the "chip czar" to lead this effort as a top national priority.

Technology firms today make up a quarter of the global stock market and the geographic mix has become strikingly lopsided, according to The Economist magazine. America and, increasingly, China are ascendant, accounting for 76 of the world’s 100 most valuable firms. Europe’s tally has fallen from 41 in 2000 to 15 today.

|

|

|

|

| Locations of Global 500 Companies. Source: Fortune Magazine |

Haq's Musings

South Asia Investor Review

China-Pakistan Scientific Cooperation

US-China Battle For Influence in Pakistan

Indian Movie White Tiger on India's Democracy

Musharraf Earned Performance Legitimacy

Has Intel's India-American Techie Jeopardized US Technology Leaders...

Marvel Pays $7.5 Billion For Cavium Co-Founded by Pakistani-American

OPEN Silicon Valley Forum 2017: Pakistani Entrepreneurs Conference

Pakistani-American's Tech Unicorn Files For IPO at $1.6 Billion Val...

Pakistani-American Cofounders Sell Startup to Cisco for $610 million

Pakistani Brothers Spawned $20 Billion Security Software Industry

Pakistani-American Ashar Aziz's Fireeye Goes Public

Pakistani-American Pioneered 3D Technology in Orthodontics

Pakistani-Americans Enabling 2nd Machine Revolution

Pakistani-American Shahid Khan Richest South Asian in America

Two Pakistani-American Silicon Valley Techs Among Top 5 VC Deals

Pakistani-American's Game-Changing Vision

-

Comment by Riaz Haq on July 2, 2021 at 11:05am

-

In the movie "White Tiger", lead character Balram sarcastically compares India's democracy with China's sanitation system. “If I were in charge of India, I’d get the sewage pipes first, then the democracy.” Numerous scenes in the film illustrate poor sanitation in India by showing Balram and others squatting and defecating in the open.

https://www.riazhaq.com/2021/02/the-white-tiger-incisive-social.html

-

Comment by Riaz Haq on July 2, 2021 at 12:27pm

-

Marking Party’s #Centennial, Xi Warns That #China Will Not Be Bullied. A century after the Communist Party’s founding, China’s leader said foreign powers would “crack their heads and spill blood” if they tried to stop its rise. #CPC100Years #UnitedStates https://www.nytimes.com/2021/07/01/world/asia/xi-china-communist-pa...

China’s rise is unstoppable, Xi Jinping declared. The country will not be lectured. And those who try to block its ascent will hit a “Great Wall of steel.”

Mr. Xi, the most powerful Chinese leader in generations, delivered the defiant message in a speech in Beijing on Thursday that celebrated 100 years of the Chinese Communist Party.

The speech was laden with symbols intended to show that China and its ruling party would not tolerate foreign obstruction on the country’s path to becoming a superpower. The event’s pageantry symbolized a powerful nation firmly, yet comfortably, in control: A crowd of 70,000 people waved flags, sang and cheered in unison. Troops marched and jets flew overhead in perfect formations. And each time Mr. Xi made a pugnacious comment, the crowd applauded and roared approval.

At times, Mr. Xi’s strident words seemed aimed as much at Washington as at the hundreds of millions of Chinese who watched on their televisions. The biggest applause from the handpicked, Covid-screened audience on Tiananmen Square came when he declared that China would not be pushed around.

“The Chinese people will never allow foreign forces to bully, oppress or enslave us,” he said, clad in a Mao suit. “Whoever nurses delusions of doing that will crack their heads and spill blood on the Great Wall of steel built from the flesh and blood of 1.4 billion Chinese people.”

Mr. Xi’s address was one of the most anticipated of his nearly nine years in power and was all the more significant because he seeks to extend his rule. The celebration was Mr. Xi’s chance to cement a place, at least implicitly, on a dais of era-defining Chinese leaders, above all Mao Zedong and Deng Xiaoping.

Mr. Xi has sought to portray himself as a transformative leader guiding China into a new era of global strength and rejuvenated one-party rule. And the stagecraft was focused on conveying a modern, powerful nation largely at ease while much of the world still struggles with the pandemic.

He trumpeted the party’s success in tamping down Covid-19, reducing poverty and firmly quashing dissent in Hong Kong, the former British colony. With splashes of bellicose rhetoric, he dismissed challenges from abroad, asserting that Beijing had little appetite for what it saw as sanctimonious preaching.

-

Comment by Riaz Haq on July 3, 2021 at 10:12pm

-

Debt, not demographics, will determine the future of China’s economy

https://fortune.com/2021/06/17/china-census-population-change-debt-...

In May, Beijing belatedly released its latest 10-year census data, setting off warnings in China and abroad that the country was facing a demographic crisis. But the world may be misreading the implications of China’s population changes.

How well China responds to its worsening demographics will have more to do with how China’s economy adjusts from its investment-led growth model—and, primarily, how it adjusts its reliance on debt.

This doesn’t mean there won’t be direct demographic consequences. With China’s working population declining by 0.5% to 0.6% a year over the next several years, productivity growth per worker must be higher than it has been over the past two decades to achieve the same amount of GDP growth.

This matters when we project China’s long-term growth rates. Beijing announced last year that it expected to double China’s real GDP in the next 15 years. This requires average real GDP growth of 4.7% a year. Yet a declining working population means that China’s productivity per worker must increase at a faster rate: 5.2% to 5.3%, rather than the 4.5% it would have needed when the working population was still rising.

We can perhaps see these consequences more clearly by focusing on balance sheet implications. One advantage of a growing working population is that the amount of debt that must be supported by each worker automatically declines over time.

The opposite is true with a declining working population. Total debt in China represents at least 280% of China’s GDP, according to government figures. If China’s future GDP growth requires the same level of credit growth as it has in the past, then China’s debt-to-GDP ratio must rise to somewhere between 400% and 500%: an unprecedented level of debt, especially for a developing country.

Adjusting for a declining working population makes the numbers even worse. As the working population declines by 0.5% to 0.6% a year, the amount of debt per worker rises by an additional 2% to 3% of GDP every year.

These are bad numbers, but they do not in themselves represent a crisis. This is because China’s debt trajectory was already unsustainable, and the main impact of China’s adverse demographics will be to accelerate the adjustment. That is why China’s leadership must either resolve its overreliance on debt or—like most countries that have followed a similar growth model—be forced to do so in a way likely to be economically painful.

There are broadly speaking four ways China can “resolve” its rising debt burden.

The first—long promised by government officials—is to transform the economy away from the no-longer-productive infrastructure and property sectors. Although historically hard to execute, in principle redirecting funding into high-tech and other productive sectors allows investment growth to remain high without requiring even faster growth in debt.

The second—promised by China’s more sophisticated economic policymakers—is to replace declining investment with rising consumption to drive GDP growth. This effectively means sharply shrinking the government share of GDP and redirecting it to the household sector so as to allow China to maintain growth targets without the reliance on debt that is necessary to sustain current investment levels.

The third and fourth ways involve a collapse in GDP growth. One way would be for a very sharp—and presumably short-term—contraction in GDP driven by a financial crisis, although this is still unlikely in the case of China’s highly controlled financial system. The other would be a Japanese-style “lost” decade—or more—of very low growth as China slowly rebalances and struggles with its debt.

-

Comment by Riaz Haq on July 4, 2021 at 10:53pm

-

How China became the big winner of the COVID era

US is buying even more goods from China than it did before the pandemic

https://www.freightwaves.com/news/how-china-became-the-biggest-winn...When news first broke of the COVID lockdown in Wuhan, the initial prediction was: The virus will cripple the economy of China, which is the engine of global trade, and that will be terrible for the shipping business.

Eighteen months and 3.9 million deaths later, the pandemic has had the opposite effect. Ships are full and, ironically, the country where the outbreak began has seen the biggest and broadest economic upside.

Chinese exports are now much higher than they were before the outbreak, courtesy of pandemic-induced changes in consumer behavior and COVID-driven fiscal stimulus from the world’s governments.

The only major economy to grow in 2020 was China’s. GDP growth continued in Q1 2021. Business is at an all-time high for Chinese liner operators, shipyards and container-equipment factories.

U.S. demand for Chinese exports is increasingly urgent as sales continue to offset inventory rebuilds. Trade has revved up in the opposite direction, as well: China is buying more American soybeans, crude oil, propane and natural gas.

Pandemic boosts Chinese trade

Nerijus Poskus, vice president of global ocean at Flexport, recently told American Shipper, “Back in 2020, if you’d asked 100 economists what would happen when COVID first hit China, all of them would have probably said that economies will go down, consumption will go down and prices for shipping will fall. Well, all of them would have been wrong.”

Very wrong: China’s export value in January-May averaged $247.5 billion per month, up 29% from January-May 2019, pre-COVID, according to the country’s customs data.

As more goods are going out, supporting container-shipping demand, more raw materials and commodities are coming in, employing tankers, bulkers and gas carriers. China’s import value averaged $206.8 billion per month in January-May, up 25% from the same period in 2019.

Turning trade into even more business

When demand for ocean transport surges, so too does demand for shipbuilding, container manufacturing and global liner operations. The U.S. has virtually no presence in these sectors. China is the world leader in the first two and a major force in the third.

As of Jan. 1, 2020, pre-COVID, Chinese shipyards had commercial orders totaling 29.8 million compensated gross tons (CGT), according to U.K.-based valuation and data provider VesselsValue. At that point, China — which was already the world’s largest shipbuilding nation — accounted for 38.7% of the global orderbook.

The Chinese yards’ orderbook was 26.9 million CGT as of Thursday, according to VesselsValue. While that is down from pre-COVID (orders dropped worldwide in Q1-Q3 2020 and partially rebounded thereafter), China’s share of the global orderbook is now 40.5%, even higher than it was before the pandemic.

China’s dominance is far more extreme in container-equipment manufacturing. Over 96% of all the world’s dry containers and 100% of reefer containers are manufactured in China. Factories produced 2.66 million twenty-foot equivalent units (TEUs) of containers in the first five months of this year, according to data from U.K.-based consultancy Drewry.

“I would be surprised if the 5-million-TEU mark is not exceeded in 2021,” commented John Fossey, Drewry’s head of container equipment and leasing research. The previous record was 4.42 million TEUs in 2018. If 5 million TEUs were produced this year, it would represent a 61% increase compared to last year and a 77% increase versus 2019.

In the liner sector, China’s COSCO Group (including OOCL) is the world’s fourth-largest ..., with a fleet capacity of 3 million TEUs, according to Alphaliner. Like all ocean carriers, COSCO is reaping historic profits from COVID-era consumer demand; the shipping division of COSCO posted a profit of $2.7 billion for Q1 2021, more than it earned in all of last year.

According to data from IHS Markit (NYSE: INFO), the COSCO Group carried more Asian containerized imports to the U.S. in January to April than any other liner owner, accounting for 16.9% of inbound volume, slightly above its trans-Pacific market share in the same period in 2019.

China is now the world’s second-largest shipowning nation overall, behind Japan, according to VesselsValue. During the pandemic, China passed Greece to move up from third to second place.

Containerized imports from China

The ships at anchor waiting to unload at California ports highlight the strength of demand for Chinese goods.

The value of America’s goods imports from China averaged $37.7 billion per month in January-April, up 8% from the same period in 2019, pre-COVID.

To gauge U.S. importer exposure to China, American Shipper analyzed Census Bureau data on five categories of imports from China transported by container: computers and electronic products, electrical equipment and appliances, furniture and fixtures, apparel and accessories, and miscellaneous manufactured commodities.

The combined value of imports in these categories rose 10% in January-April versus the same period in 2019. The computer/electronics segment — the largest of the five categories by value — was up 10%, electrical equipment 17% and miscellaneous manufactured commodities 40%. Furniture was down 11% and apparel was down 29%.

(Chart: American Shipper based on data from U.S. Census Bureau)

Despite all the talk of supply chain diversification over the years, American sourcing remains very China-centric. In January-April, China’s average share of total U.S. import value of furniture was 37%, computers 35%, electrical equipment 33%, miscellaneous manufactured goods 33% and apparel 22%.

(Chart: American Shipper based on data from U.S. Census Bureau)

U.S. importers reliant on Chinese sourcing face a new headache. The recent COVID outbreak hitting operations in the Chinese port of Yantian and surrounding ports in June will have a major impact on trade flows going forward. Yantian and surrounding ports handle about one-quarter of China’s containerized exports to America.

Ocean carrier Maersk told customers that “both the extended duration of the disruption and the sheer number of sailings that had to omit calling Yantian” mean that it will take “weeks if not months to recover.”

“What should not be understated is the sheer magnitude of the task ahead as peak season volumes continue to ramp up,” warned Maersk.

US commodity exports to China recover

Amid the trade turmoil initiated by the Trump administration, China retaliated by curtailing purchases of American agricultural goods and energy commodities such as propane, liquefied natural gas (LNG) and crude oil.

The good news is that China is buying more American exports again.

Soybeans — China’s most important role as a buyer is in the soybean market. U.S. soybean exports to China collapsed in 2018 due to trade politics and the African Swine Flu’s impact on China’s pig population (soybeans are used to feed pigs).

Data from the U.S. Department of Agriculture shows that Chinese buying recovered by 2020, when 54% of U.S. soybean exports went to China. Total U.S. exports jumped to a record 64.1 million metric tons last year. Chinese buying continues this year, with the country taking 47% of Q1 2021 U.S. export volumes.

(Chart: American Shipper based on data from U.S. Department of Agriculture)

U.S. soybean exports to China have recently helped propel rates for dry bulk ships in the Panamax....

Propane — In the tanker markets, China is an important destination for American propane. The propane is transported aboard large 84,000-cubic-meter liquefied petroleum gas tankers and is used by China for residential consumption and as a feedstock for plastics manufacturing.

U.S. propane sales to China evaporated in 2019 during trade hostilities. But in full-year 2020 and Q1 2021, China came back to the market, taking 10% of U.S. seaborne propane exports, according to Energy Information Administration (EIA) data.

Seaborne exports approximated by excluding exports to Canada and Mexico due to land-based transport to those countries (Chart: American Shipper based on data from EIA)

LNG — China overtook Japan last year to become the world’s largest importer of LNG. China stopped buying U.S. LNG in 2019 amid trade tensions, but accounted for 9% of America’s LNG exports last year. In Q1 2021, 8% of U.S. exports went to China, according to EIA data.

(Chart: American Shipper based on data from EIA)

Crude oil — Chinese imports from America play a key role in demand for ships called very large crude carriers (VLCCs, tankers that carry 2 million barrels of oil). VLCC demand is measured in ton-miles: volume multiplied by distance. The sailing distance from the U.S. Gulf to China is more than double the distance from the Middle East to China. Thus, the more China imports from the U.S. instead of from the Middle East, the better for VLCC rates.

China accounted for just 5% of U.S. export volume deliveries in 2019, at the height of the trade war. Its share bounced back to 17% in 2020 and 13% in Q1 2021, according to EIA data.

Seaborne exports approximated by excluding exports to Canada due to land-based transport to those countries (Chart: American Shipper based on data from EIA)

Trade balance no better than pre-trade war

Overall, U.S. goods exports to China averaged $11.6 billion per month in January-April, up 38% from the same period in 2019.

The U.S.-China goods trade balance (exports minus imports) averaged minus $26.1 billion in the first four months of this year — slightly better than in January-April 2019, pre-COVID, due to the higher U.S. exports.

(Chart: American Shipper based on data from U.S. Census Bureau)

As for the effectiveness of the Trump administration’s tariffs, which have not been reversed by President Joe Biden, the average goods trade balance was minus $25.5 billion in January-April 2016, before Donald Trump’s election.

In the same period this year, the balance was 2% higher, in favor of Chinese exports to America.

-

Comment by Riaz Haq on July 5, 2021 at 10:21am

-

Fareed Zakaria: "America has been the comeback nation of the last decade. I think this is still not fully appreciated and understood by many people, the fact that America's share in the global economy, contrary to all the pessimism that existed exactly a decade ago, has ended up going significantly higher over the last decade"

http://transcripts.cnn.com/TRANSCRIPTS/2107/04/fzgps.01.html

Joining me now is Ruchir Sharma. He is the chief global strategist at Morgan Stanley Investment Management and the author of "The 10 Rules of Successful Nations." So, Ruchir, let me start by asking you, is it fair for people to look at the -- the American economy, post-pandemic, and say, you know, it is now booming, or the boom that -- that existed pre-pandemic, you know, we're back to that -- to that? Is that really what's going on, in long historical context?

RUCHIR SHARMA, CHIEF GLOBAL STRATEGIST, MORGAN STANLEY INVESTMENT MANAGEMENT: Yeah, hi, Fareed. I think so. Because we went through the last decade, for the first time in American history, without a recession in the U.S. We had the pandemic-induced recession, which was, in many ways, artificial, and now we are back to where we were, where we left off, the only difference being that we have spent a lot of bullets in fighting this pandemic, from an economic standpoint, in terms of the deficits we are running and the debt we have been forced to tack on to (inaudible) with this pandemic.

But the main point here is this, that America has been the comeback nation of the last decade. I think this is still not fully appreciated and understood by many people, the fact that America's share in the global economy, contrary to all the pessimism that existed exactly a decade ago, has ended up going significantly higher over the last decade.

ZAKARIA: So when you think about, you know, sort of, the -- this decade, what you're saying is that, after the global financial crisis, America, sort of, got its act together, or whatever, and has basically been on a kind of long boom that has really -- you know, it's striking. Most people thought we would decline as a percentage of GDP. We've actually increased over the last 10 years.

SHARMA: Exactly. And I think that there is a further point here, that, as an economic power, America's share in the global economy has now been roughly similar for the last three to four decades. But as a financial superpower, America has never been this powerful as it is now. That is the big distinction. As a financial superpower, America's power today is unrivaled and unparalleled.

The problem with this -- and I think that this is what I'm coming to now -- that this may be as good as it gets, that a lot of people are getting very excited and optimistic about America now, but that -- the time to have been really optimistic and really excited was when everybody was pessimistic a decade ago, or much -- through that period.

But now, amidst this giddiness, I would just point to the fact that American assets today, if you look at the stock market, you look at the bond market, you look at American housing, you put it all together, America has never looked this expansive compared to the rest of the world. And -- when it's come to looking this expansive over the last 100 years, generally it has done more poorly compared to the rest of the world.

-

Comment by Riaz Haq on July 5, 2021 at 10:21am

-

Riaz Haq has left a new comment on your post "CCP Centennial: The Chinese Economic Miracle":

ZAKARIA: Louis Menand is perhaps the foremost historian of America's cultural and intellectual landscape. His last book, "The Metaphysical Club," won the Pulitzer Prize. His new one, "The Free World," has received even more rave reviews.

He teaches at Harvard University and writes for The New Yorker.

http://transcripts.cnn.com/TRANSCRIPTS/2107/04/fzgps.01.html

ZAKARIA: Let me ask you, when you look at American culture today, what does it look like, you know, compared to the period you've just written so much about? MENAND: Well, the period I wrote about is the period right after the

Second World War, from about 1945 to 1965, the early Cold War years. So, comparing that period to today, I think we would say that today cultured America is doing extremely well.

I mean, we have to bracket the pandemic period, when cultural industry struggled a bit, but on the whole there's just an enormous amount of product out there. People are creating it. People are consuming it. People go to museums. They buy books. They download music. They stream everything.

And all those things are infinitely more accessible than they were 50 years ago. And I think they're more central to people's lives -- plus the bar to entry for creators of culture and consumers of culture is just very low. Anybody, pretty much, can record a song and post it on Spotify or YouTube, and almost anybody can listen to it there.

And, remember, video games are culture. TikTok is culture. Music videos are culture. And all these products now circulate worldwide.

I would even say that criticism is in great shape because the Web is filled with criticism. A lot of it's very learned and sophisticated, and it's all very easily accessible. So I would say, by that measure, I would say culture today is very strong.

ZAKARIA: What about -- the big difference that strikes me is -- between culture today and the period you were writing about in this book, which is -- and you alluded to it at the start -- which is it's totally decentralized now. There are no gatekeepers. You don't need to go through a certain set of established avenues or things like that, whereas culture in the 1950s, '60s was still very hierarchical.

Is that a good thing, that it's become so completely democratized, or does it mean, sort of, anything goes and standards have gone down?

MENAND: How could it not be a good thing?

You know, when I started out writing for magazines in the 1970s and 1980s, it was all print, and there were relatively few publications where, you wrote a review or wrote an essay, people would pay attention to it. So the gate was very narrow to become part of the critical conversation in a public way. Just very few people could get into those -- those journals and those venues.

Today is completely different. Anybody can write a review on Amazon. Believe me, they do.

-

Comment by Riaz Haq on July 5, 2021 at 12:18pm

-

The White House released a report on Tuesday that offers a solemn assessment of American companies prioritizing profits over national security and long-term sustainability. “A focus on maximizing short-term capital returns has led to the private sector’s underinvestment in long-term resilience,” the 250-page report states. The United States has a competitive advantage over China in the production of semiconductor manufacturing equipment (SME), which provides a chokepoint that can limit “advanced semiconductor capabilities in countries of concern.”

https://www.forbes.com/sites/roslynlayton/2021/06/10/white-house-re...

The report details the findings and recommendations of the Administration’s 100-day supply chain review required by President Biden’s executive order from February that directed the review of four key industries: semiconductors, large capacity batteries, critical minerals and pharmaceuticals. The report states that the Chinese government’s “massive subsidy campaign [as much as $200 billion over the past eight years] to develop its domestic semiconductor capability” has exploited “gray areas” in international trade rules and avoided World Trade Organization (WTO) oversight. The Chinese government has propped up key tech industries, including semiconductors manufacturing and SME production, through a “novel subsidy strategy” meant to avoid “transparency requirements of the WTO subsidy regime.” Essentially, government subsidies are booked as “investments” to avoid WTO disclosure rules.

This one of many “innovation mercantilist” tactics that Chinese state has practiced for years, according to a recent report and event by the Information Technology & Innovation Foundation which details China’s deleterious impact on competitive international ecosystems for semiconductors, telecommunications equipment, biopharmaceuticals, solar photovoltaics, and high-speed rail. Co-author Stephen Ezell estimates that the US loses out on some 5000 semiconductors patents annually because of this predation.

The Chinese Communist Party has made a concerted effort to dominate the semiconductor market. The Made in China 2025 plan aims to produce 70 percent of China’s chip demand indigenously and pledges as much as $1.4 trillion of investment into China’s semiconductor industries.

Memory chips are the “most mature” of these efforts. Yangtze Memory Technologies (YMTC), which has received $24 billion in state subsidies, has emerged as a “national champion memory chip producer.” A report by James Mulvenon this year identifies ties between YMTC and the People’s Liberation Army.

“It’s not just YMTC,” cautioned Emily de La Bruyère, senior fellow at the Foundation for the Defense of Democracies, during a China Tech Threat roundtable forum this week. “Changxin Memory Technologies [CXMT] is equally propped up and potentially equally connected to the [People’s Liberation Army].” The roundtable titled "Let the Chips Fall?" explored the theme of how the next Undersecretary for the Department of Commerce’s Bureau of Industry and Security (BIS) should address semiconductor policy.

The White House report appears to be a de facto roadmap for the next BIS chief and is notable for naming leading Chinese fabs with military connections which have yet to be designated as Military End Users or on the Entity List. In no uncertain words, the bipartisan United State China Commission issued a report earlier this month, Unfinished Business: Export Control and Foreign Investment Reforms which critiqued BIS for failing to issue the lists of foundational and emerging technologies as required by the 2018 Export Reform and Control Act. Such a publication would likely trigger action against the Chinese fabs.

“While the United States no longer leads the world in semiconductor manufacturing capabilities,” it has a competitive advantage over China in semiconductor manufacturing equipment (SME), the White House report adds.

-

Comment by Riaz Haq on July 6, 2021 at 8:15am

-

Countering QUAD: Is There A China-Russia-Pakistan Strategic Nexus In The Making?

By Rushali Saha,Research Associate at the Centre for Airpower Studies, New Delhi, India

https://eurasiantimes.com/countering-quad-is-there-a-china-russia-p...

Amid India-US bonhomie over QUAD, it’s interesting to watch how China is maintaining its “all-weather” friendship with Pakistan and an “unbreakable” bond with Russia.

Although it is too soon to prove the existence of a Russia-China-Pakistan ‘axis’, the growing strategic convergence between the three is a significant geopolitical development, especially given the possible formation of power blocs given the growing strategic competition between the US and China.

This convergence will most likely play out in the Indo-Pacific—the epicenter of US-China competition. The rechristening of Asia-Pacific as Indo-Pacific is largely a result of growing convergence among the four QUAD countries — India, the United States, Japan, and Australia.

China’s Opposition To QUAD

China has been vocal about its opposition to this “four-side mechanism” as it adheres to the “Cold War mentality.” Both Russia and Pakistan have displayed their ‘pro-China’ tilt on the QUAD, albeit the Russian vision for the region as a whole is more complex.

Russian foreign minister, Sergey Lavrov’s remarks at the Raisina Dialogue held in New Delhi outlined how despite supporting India’s inclusive Indo-Pacific vision, Moscow is hostile towards QUAD, essentially parroting Chinese concerns about containment.

For Pakistan, America’s growing defense relations and professed commitment to bolster India’s capabilities to counter China, have further strained relations between Islamabad and Washington.

Viewing America’s ‘Free and Open Indo-Pacific’ as a threat, Pakistan is seeking deeper security cooperation with Russia and China through joint naval exercises in the Indian Ocean, exchanging naval officials, and deepening military cooperation.

Pakistan’s PNS Zulfikar frigate is all ready to participate in the Arabian Monsoon exercise with Russian ships in the Arabian Sea after the two navies participated in the Pakistan-hosted biannual maritime multinational naval exercise Aman-2021, which included China and 45 other countries.

Beyond symbolism, these strategic moves deserve greater attention as they come at a time when Pakistan and Russia are being pushed closer together over a negotiated political settlement over Afghanistan, while cracks in the Russia-India-China strategic triangle are solidifying.

Russia-Pakistan-China Convergence

Beyond their shared criticism of QUAD, there are other areas where the strategic objectives of the three countries converge. Despite the Chinese projection of the China-Pakistan Economic Corridor (CPEC) as a purely ‘economic’ project, few would deny the strong geopolitical implications it would have—particularly in the Indian Ocean.

Gwadar Port, in Pakistan’s Balochistan province, handed over to the Chinese in 2013 for 40 years provides Beijing direct access to the Indian Ocean through the Arabian Sea. This would extend Chinese power projection well into the Western Indian Ocean, effectively counterbalancing US and Indian naval capabilities.

According to an article published by a leading Russian think tank, the “only explanation” for Russia deferring participation in CPEC is “respect for India’s sensitivities” given New Delhi’s sovereignty concerns over the nature of the project.

However, in view of the growing ties between Islamabad and Kremlin exemplified in Sergei Lavrov’s visit to Pakistan— the first by a Russian foreign minister in 9 years—has raised apprehensions about whether India can continue to deter Russian participation in the project.

Russia and China’s increasing presence in the resource-rich Western Indian Ocean can be a game-changer in the ongoing geopolitical contest in the region.

Despite being a late entrant, Russia has significantly stepped up its presence in the region, striking a 25-year agreement with Sudan to establish a naval base in the country which will station four Russian ships and up to 300 personnel, although reports suggest Sudan is currently reviewing the deal.

China, which has already penetrated deep into the Indian Ocean through strengthening maritime ties with East African countries, is independently strengthening maritime cooperation with both Russia and Pakistan.

It is against this backdrop that Iran, Russia, and China held their first-ever joint naval exercise in the Northern Indian Ocean in 2019, where Iran reportedly also invited the Pakistani Navy.

Growing Military Ties

Meanwhile, the latest iteration of bilateral naval exercise between China and Pakistan—Sea Guardians 2020—reflects the growing complexity and expanding the scope of their bilateral maritime partnership.

With Pakistan and Russia committing to increasing the frequency of their joint military drills and maritime exercises to fight terrorism and piracy, the possibility of a Russia-China-Pakistan naval exercise, may not be so remote anymore.

Arguably the strongest glue holding the three countries together is a common aversion to the ‘western construct’ of a ‘rules-based order.’

Against the ‘rules-based order’, China and Russia have been parallelly pushing the narrative on ‘global governance’—premised on the centrality of United Nations—as reflected in the Lavrov-Wang joint statement following the Russian foreign minister’s visit to China earlier this year.

Meanwhile, China and Pakistan have strengthened cooperation in multilateral forums such as the United Nations, evident from the recently released joint statement where the two countries pledged to back each other’s “core interests” and “firmly safeguard multilateralism.”

In October last year, Pakistan—on behalf of 55 countries, which included Russia—made a joint statement at the UN “opposing interference in China’s internal affairs under the pretext of Hong Kong.”

The leaders of the US, Japan, India, and Australia during the first-ever QUAD summit in March this year. (via Twitter)

In the context of the evolving geo-strategic construct of Indo-Pacific and rapidly fluctuating power relations, each country will act in a manner that maximizes its national interest.

The QUAD countries are working together to defend a regional order which was largely constructed by the United States, from rivals, namely China.

China’s careful critique of Western intentions in the Indo-Pacific and representation of QUAD as an “Indo-Pacific NATO” gels well with Russian interests.

The emerging disconnect in US-Pakistan relations has paralleled closer Indo-American ties which have effectively pushed Pakistan closer to China and Russia, binding the three together by shared criticism of what they see as ‘Western hegemony.’

In the current era of strategic uncertainty, the deepening relations between Russia, Pakistan, and China is a major challenge for the QUAD countries, although they are gaining recognition for their agenda from regional and extra-regional actors.

Going forward, one of the first steps QUAD must take is to convince actors, especially Southeast Asian countries, that QUAD is indeed not an ‘Asian NATO.’ To do this, it must begin by robustly defining what it means by a ‘rules-based order’ and clarify that it is not at variance with multilateralism or ASEAN centrality.

-

Comment by Riaz Haq on July 9, 2021 at 5:09pm

-

Destiny of CPEC depends on regional peace, while potential Afghan civil war serves US interests

By Aasma Wadud

Published: Jul 09, 2021 03:12 PM

https://www.globaltimes.cn/page/202107/1228255.shtml

War is not an event. It is an economy. Countries like the US have reaped fortunes from it, leaving both destruction and devastation behind. With US troops leaving Afghanistan, the future of the country remains uncertain. It symbolizes that Afghanistan will be abandoned and left alone to an inevitable defeat at the hands of the Taliban. Critics are forecasting a civil war, but there is another perspective that many fail to recognize: The US failed to link its evacuation of troops to sustainable peace, but was it circumstantial or intentional?

With China emerging as an economic superpower, the war economy is now obsolete. China's Belt and Road Initiative (BRI) has given the world generally and the region precisely a new dimension where growth, development, stability, and peace are inevitable for every nation. Afghanistan has been burning like fuel for decades with the past's war economy. Sometimes directly and sometimes through proxies, the past's superpowers have manipulated its geopolitical location, culture, political and social dynamics. Sadly, in the past, war was a commodity that was bought and sold conveniently; Afghan war complemented the needs of those nations with power. With the situation still unfolding, is Afghanistan on the verge of another civil war, or will things change for the better this time?

The last G7 meeting in June 2021 aimed to develop strategies to counter China's BRI, which signifies its importance. The US has invested in India to counter China's influence in the region. But to America's surprise, India has failed to deliver what it was expected to achieve. Because of this, the US needed to find another more spontaneous and swift solution to the loss of its hegemony. With rapid US troop evacuation, Afghan civil war seems to be the apparent outcome, especially for war-dependent economies like the US and its allies. A civil war can serve the US multiple purposes, including some form of instability in the region to counter the BRI. It could sabotage the CPEC and maximize pressure on Pakistan's economy, which is essential to potentially winning the country's most-needed cooperation. Moreover, it could offer the US' struggling economy new support. In the past, time and again, Afghanistan has fallen prey to war economy ventures, but times have changed. With US troops leaving Afghanistan, Indian investment in the country is going to fall off. It has limited alternatives to defending its strategic interests in Afghanistan. Additionally, it fears a new wave of terrorism, and is concerned about the Taliban's growing presence. Finally, as the region stabilizes, Kashmir will see more prominence and limelight.

With the BRI and CPEC, peace has become the hottest commodity in the region. In many ways, the world's future economic growth depends on peace in Afghanistan. It is a fact that Afghanistan's internal dynamics remain the same, where domestic warlords are still significant. The Taliban has evolved from the roadside fighting group to a more flexible and accepting political entity. They are more diverse, with Afghan, Tajik and Uzbek representation. Furthermore, geopolitical transformation will have an impact on the whole situation. In the past, stakeholders were manipulated for war; but this time, "peace" will be the product offered and bought.

The destiny of the BRI and CPEC depend on peace in Afghanistan. China is known for positively contributing to other countries' economies, development, and growth. China will go the extra mile to ensure peace in the region, and will look to ensure a new chapter of growth and prosperity is achieved in Afghanistan.

-

Comment by Riaz Haq on July 17, 2021 at 12:12pm

-

#China wants to buy advanced #chip machine from #Netherlands. #US says NO. It's an ASML machine called an extreme ultraviolet (EUV) lithography system that is essential to making advanced #semiconductor #microprocessors. #silicon #technology https://www.wsj.com/articles/china-wants-a-chip-machine-from-the-du... via @WSJ

Beijing has been pressuring the Dutch government to allow its companies to buy ASML Holding ASML -2.35% NV’s marquee product: a machine called an extreme ultraviolet lithography system that is essential to making advanced microprocessors.

The one-of-a-kind, 180-ton machines are used by companies including Intel Corp. INTC -1.51% , South Korea’s Samsung Electronics Co. and leading Apple Inc. supplier Taiwan Semiconductor Manufacturing Co. TSM -1.52% to make the chips in everything from cutting-edge smartphones and 5G cellular equipment to computers used for artificial intelligence.

China wants the $150-million machines for domestic chip makers, so smartphone giant Huawei Technologies Co. and other Chinese tech companies can be less reliant on foreign suppliers. But ASML hasn’t sent a single one because the Netherlands—under pressure from the U.S.—is withholding an export license to China.

The Biden administration has asked the government to restrict sales because of national-security concerns, according to U.S. officials. The stance is a holdover from the Trump White House, which first identified the strategic value of the machine and reached out to Dutch officials.

Washington has taken direct aim at Chinese companies like Huawei and has also tried to convince foreign allies to restrict the use of Huawei gear, over spying concerns that Huawei says are unfounded. The pressure aimed at ASML and the Netherlands is different, representing a form of collateral damage in a broader U.S.-China tech Cold War.

ASML Chief Executive Peter Wennink has said that export restrictions could backfire.

“When it comes to targeted, specific, national security issues, export controls are a valid tool,” he said in a statement. “However, as part of a broader national strategy on semiconductor leadership, governments need to think through how these tools, if overused, could slow down innovation in the medium term by reducing R&D.” He said in the short to medium term, it is possible that widespread use of export controls “could reduce the amount of global chip manufacturing capacity, exacerbating supply chain issues.”

---

That currently isn’t on the table inside the Biden White House, people familiar with the matter say. The U.S. is trying to put together alliances of Western countries to work jointly on export controls, people familiar with the matter said. The move could also have ramifications beyond ASML, further roiling semiconductor supply lines already under strain around the world.

ASML spun out of Dutch conglomerate Royal Philips NV in the 1990s. It is based in bucolic Veldhoven, near the Belgian border. It specializes in photolithography, the process of using light to print on photosensitive surfaces.

Photolithography is key to chip makers, which use light to draw a checkerboard of lines on a silicon wafer. Then they etch away those lines, like a knife carving into wood, but with chemicals. The remaining silicon squares become transistors.

The more transistors on a piece of silicon, the more powerful the chip. One of the best ways to pack more transistors into silicon is to draw thinner lines. That is ASML’s specialty: Its machines print the world’s thinnest lines.

The machines, which require three Boeing 747s to ship, use a laser and mirrors to draw lines five nanometers wide. Within a few years, that is expected to shrink to less than a nanometer wide. By comparison, a strand of human hair is 75,000 nanometers wide.

Twitter Feed

Live Traffic Feed

Sponsored Links

South Asia Investor Review

Investor Information Blog

Haq's Musings

Riaz Haq's Current Affairs Blog

Please Bookmark This Page!

Blog Posts

Modi's AI Spectacle: Chaos and Deception in New Delhi

The India AI Impact Summit 2026, held at Bharat Mandapam in New Delhi, has been marred by chaos, confusion and deception. The events on the ground have produced unintended media headlines for India's Prime Minister Narendra Modi who wants to be seen as the "vishwaguru" (teacher of the world) in the field of artificial intelligence as well. First, there was massive chaos on the opening day, with long…

ContinuePosted by Riaz Haq on February 19, 2026 at 12:00pm — 4 Comments

India-Pakistan Cricket Match: The Biggest Single Event in the World of Sports

Why did Pakistan's decision to boycott the India-Pakistan match in solidarity with Bangladesh in this year's T20 World Cup send shockwaves around the world? And why did it trigger the International Cricket Council's and other cricket boards' urgent efforts to persuade Pakistan to return to the match? The reason has a lot to do with its massive financial impact, estimated to be as much as …

ContinuePosted by Riaz Haq on February 11, 2026 at 4:00pm — 2 Comments

© 2026 Created by Riaz Haq.

Powered by

![]()

You need to be a member of PakAlumni Worldwide: The Global Social Network to add comments!

Join PakAlumni Worldwide: The Global Social Network