PakAlumni Worldwide: The Global Social Network

The Global Social Network

CCP Centennial: The Chinese Economic Miracle

The Chinese Communist Party (CCP) was founded one hundred years ago on July 1, 1921. The party has transformed China from a poor and backward third world country into a vibrant and prosperous industrialized economy. This rapid historic transformation has surprised everyone, including China's friends, but especially its western foes who now see the emergence of the Asian giant as a challenge to centuries-long western domination of the world. It has also earned the CCP high levels of performance legitimacy and popularity among the Chinese people. The CCP's successful response to the COVID crisis has further boosted its legitimacy and popularity in China.

|

| China Surpassed United States in Global Trade |

Chinese Economy:

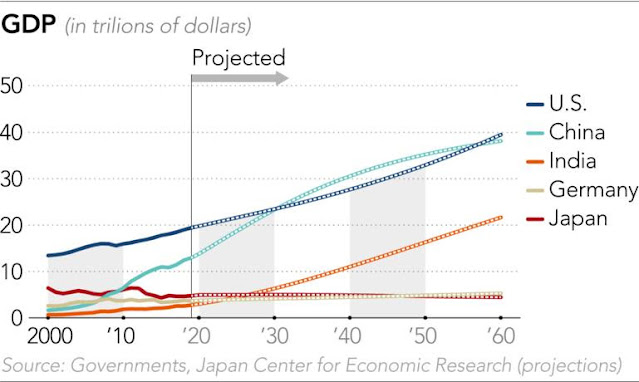

Over the last several decades, China has built a strong manufacturing base to serve as the factory to the world. This efficient industrial base is being used by all major global brand-name multi-national giants to manufacture and supply everything from Barbie dolls to iPhones. It has served as a powerful engine to drive the Chinese economy which now rivals the US economy in size. China's GDP overtook the U.S.'s in 2017 in terms of purchasing power parity, according to Nomura Securities. China has eclipsed the United States as the world's largest trading nation.

|

| Japanese Government Projection of Future GDP Trajectories. Source: ... |

China's Economy Slowing:

There's some evidence that China's economy is slowing after hitting a peak growth in the last decade, according to Forbes magazine. It may sound like wishful thinking but the American magazine argues that "China’s growth has slowed in recent years, partly due to maturity. Extremely poor countries have the potential to grow rapidly. As they approach the level of developed countries, growth is harder and thus slows".

|

| China Economy Slowing. Source: Forbes |

Digital Economy:

The United States is far ahead of China in global digital economy. But the US-China battle for future dominance of this economy is now underway. The winner of this contest will dominate the next phase of global economic competition. It will be determined by achieving mastery of computer chips and software needed to build complex systems.

The United States and its ally Taiwan are far ahead of all other nations in building the most advanced 5 nanometer semiconductor components. But China is gearing up for it. Chinese leader Xi Jinping has appointed Liu He, his most trusted lieutenant, as the "chip czar" to lead this effort as a top national priority.

Technology firms today make up a quarter of the global stock market and the geographic mix has become strikingly lopsided, according to The Economist magazine. America and, increasingly, China are ascendant, accounting for 76 of the world’s 100 most valuable firms. Europe’s tally has fallen from 41 in 2000 to 15 today.

|

|

|

|

| Locations of Global 500 Companies. Source: Fortune Magazine |

Haq's Musings

South Asia Investor Review

China-Pakistan Scientific Cooperation

US-China Battle For Influence in Pakistan

Indian Movie White Tiger on India's Democracy

Musharraf Earned Performance Legitimacy

Has Intel's India-American Techie Jeopardized US Technology Leaders...

Marvel Pays $7.5 Billion For Cavium Co-Founded by Pakistani-American

OPEN Silicon Valley Forum 2017: Pakistani Entrepreneurs Conference

Pakistani-American's Tech Unicorn Files For IPO at $1.6 Billion Val...

Pakistani-American Cofounders Sell Startup to Cisco for $610 million

Pakistani Brothers Spawned $20 Billion Security Software Industry

Pakistani-American Ashar Aziz's Fireeye Goes Public

Pakistani-American Pioneered 3D Technology in Orthodontics

Pakistani-Americans Enabling 2nd Machine Revolution

Pakistani-American Shahid Khan Richest South Asian in America

Two Pakistani-American Silicon Valley Techs Among Top 5 VC Deals

Pakistani-American's Game-Changing Vision

-

Comment by Riaz Haq on July 17, 2021 at 12:27pm

-

#TSMC eyes expansion in #US & #Japan to meet high chip demand. Expansion plans come amid concern over the concentration of chipmaking capability in #Taiwan. #China does not rule out the use of force for Taiwan's most advanced #semiconductor #technology. https://www.reuters.com/technology/taiwans-tsmc-posts-11-jump-q2-pr...

Taiwan Semiconductor Manufacturing Co Ltd (TSMC) (2330.TW) signalled on Thursday plans to build new factories in the United States and Japan, riding on a pandemic-led surge in demand for chips that power smartphones, laptops and cars.

TSMC, which posted record quarterly sales and forecast higher revenue for the current quarter, said it will expand production capacity in China and does not rule out the possibility of a "second phase" expansion at its $12 billion factory in the U.S. state of Arizona.

The world's largest contract chipmaker and a major Apple Inc (AAPL.O) supplier also said it is currently reviewing a plan to set up a speciality technology wafer fabrication plant, or fab, in Japan.

TSMC's overseas expansion plans come amid concern over the concentration of chipmaking capability in Taiwan, which produces the majority of the world's most advanced chips and is geographically close to political rival China, which does not rule out the use of force to bring the democratic island under its control.

Taiwan and TSMC have also become central in efforts to resolve a pandemic-induced global chip shortage that has forced automakers to cut production and hurt manufacturers of smartphones, laptops and even appliances. read more

"We are expanding our global manufacturing footprint to sustain and enhance our competitive advantages and to better serve our customers in the new geopolitical environment," TSMC chairman Mark Liu told an analyst call.

"While our overseas fabs are not initially able to match the costs of our manufacturing operations in Taiwan, we will work with governments to minimise the cost gap," Liu said.

He did not give details of its plans in America and Japan, adding the company was working to "firm up" wafer prices to reflect cost increases.

Reuters reported in May TSMC was eyeing expansion in Arizona beyond the one currently planned. read more

Liu said TSMC was also planning a capacity expansion in China's Nanjing due to the "urgent need" of clients, using the mature 28 nanometre semiconductor manufacturing technology.

It is scheduled to enter production next year and will eventually reach a production of 40,000 wafers per month by mid-2023, he said.

Revenue for April-June at TSMC , Asia's most valuable manufacturing company, climbed 28% to a record $13.29 billion.

For the quarter ending in September, TSMC forecast revenue of $14.6 billion to $14.9 billion, compared with $12.1 billion in the same period a year earlier.

TSMC said the auto chip shortage will gradually reduce for its customers from this quarter but expects overall semiconductor capacity tightness to extend possibly into next year.

The Taiwanese firm, which also makes chips for Qualcomm Inc (QCOM.O), had previously flagged a $100 billion expansion plan over the next three years, as fifth-generation telecommunications (5G) technology and artificial intelligence applications drive global demand for advanced chips. read more

-

Comment by Riaz Haq on July 18, 2021 at 6:40pm

-

#China emerges as the the biggest global #trading nation, eclipsing the #UnitedStates. How will it affect the #US #currency and #American dominance of the international #financial system? #economy #trade #finance #investment https://www.worldstopexports.com/chinas-top-import-partners/

https://twitter.com/haqsmusings/status/1416932505194680322?s=20

-----------------

China Eclipses U.S. as Biggest Trading Nation

Bloomberg News

February 10, 2013

https://www.bloomberg.com/news/articles/2013-02-09/china-passes-u-s...

China surpassed the U.S. to become the world’s biggest trading nation last year as measured by the sum of exports and imports of goods, official figures from both countries show.

U.S. exports and imports of goods last year totaled $3.82 trillion, the U.S. Commerce Department said last week. China’s customs administration reported last month that the country’s trade in goods in 2012 amounted to $3.87 trillion.

China’s growing influence in global commerce threatens to disrupt regional trading blocs as it becomes the most important commercial partner for some countries. Germany may export twice as much to China by the end of the decade as it does to France, estimated Goldman Sachs Group Inc.’s Jim O’Neill.

“For so many countries around the world, China is becoming rapidly the most important bilateral trade partner,” O’Neill, chairman of Goldman Sachs’s asset management division and the economist who bound Brazil to Russia, India and China to form the BRIC investing strategy, said in a telephone interview. “At this kind of pace by the end of the decade many European countries will be doing more individual trade with China than with bilateral partners in Europe.”

U.S. Leadership

When taking into account services, U.S. total trade amounted to $4.93 trillion in 2012, according to the U.S. Bureau of Economic Analysis. The U.S. recorded a surplus in services of $195.3 billion last year and a goods deficit of more than $700 billion, according to BEA figures released Feb. 8. China’s 2012 trade surplus, measured in goods, totaled $231.1 billion.

The U.S. economy is also double the size of China’s, according to the World Bank. In 2011, the U.S. gross domestic product reached $15 trillion while China’s totaled $7.3 trillion. China’s National Bureau of Statistics reported Jan. 18 that the country’s nominal gross domestic product in 2012 totaled 51.93 trillion yuan ($8.3 trillion).

“It is remarkable that an economy that is only a fraction of the size of the U.S. economy has a larger trading volume,” Nicholas Lardy, a senior fellow at the Peterson Institute for International Economics in Washington, said in an e-mail. The increase isn’t all the result of an undervalued yuan fueling an export boom, as Chinese imports have grown more rapidly than exports since 2007, he said.

-

Comment by Riaz Haq on August 8, 2021 at 10:12am

-

Opinion: The United States and China are locked in a Cold Peace

By Fareed Zakaria

https://www.washingtonpost.com/opinions/2021/08/05/us-and-china-are...

The Soviet Union barely existed on the economic map of the free world. It presided over a tightly controlled economic bloc of communist countries that had few connections — in trade or travel — with the rest of the planet. Mostly, its economy was about resources — oil, gas, nickel, copper, etc. China, by contrast, is deeply integrated into the world economy. It is now the world’s leading trading nation in goods. Twenty years ago, the vast majority of countries traded more goods with the United States than with China. Today, it has flipped. Last year, China replaced the United States as the European Union’s largest trading partner in goods.

China needs U.S. consumers for its economic growth. But conversely, many of the United States’ largest companies — from General Motors to Apple to Nike — need the Chinese market. The Walmart effect — the availability of low-priced goods of every kind to Americans — has been closely tied to sourcing from China. Even when you look at something such as the United States’ expanding green economy, you find the shadow of China behind it. Those solar panels you see everywhere have become so affordable and thus ubiquitous because many are made in China. And then there is the roughly $1 trillion worth of American debt that China holds.

The United States will need a strategy that mirrors the complexity of this relationship, one in which China is part competitor, part customer, part adversary. Some of this the Biden administration has done very well, bringing America’s allies together in a more united front against China, such as for its human rights abuses. But Biden is also confronting the reality that the United States’ allies have close economic ties with China. (In Asia, most countries have China as their largest trading partner.) They would like to have both strong trading relations with China and strong geopolitical ties with the United States. Forcing them to choose might create more problems than it solves.

Adding even more nuance, China is strong but it is not taking over the world. It faces substantial challenges ahead. It is graying quickly because of the legacy of Beijing’s one-child policy. It has still not shown that it can avoid the “middle income trap” faced by rising economies that aspire to join the ranks of rich ones. Chinese President Xi Jinping is nurturing the state sector and unleashing regulators on private companies. And China’s new, assertive foreign policy has caused a backlash from its biggest neighbors, from India to Australia to Japan. Last week, the Philippines renewed a defense agreement with the United States that it had long announced it was planning to end.

Can Washington embrace the complexity of this challenge? It is facing an economic powerhouse that, unlike Germany and Japan, is not dependent on the United States for its security. It faces a new great power that is not a democracy and has different values and beliefs, and yet has not occupied and controlled countries as Stalin’s Russia did during the 1940s (which is what triggered the Cold War).

And this is all happening in a world in which international trade has rebounded to pre-pandemic levels. It’s not a new Cold War but something much more complicated: a Cold Peace.

-

Comment by Riaz Haq on August 8, 2021 at 1:05pm

-

Here’s some bad news for military analysts who do not tire of cheering America’s ‘defeat’ in Afghanistan: the US has left Afghanistan; it retains its position as a hegemon by Ejaz Haider

https://www.thefridaytimes.com/afghanistan-tragedy-vs-victory/

To sum up the above, the US military remains the most powerful armed force in the world, singly and in tandem with its allies. It can win wars but not conflicts, especially in areas where it is operating among foreign populations. The latter is also true of other militaries; two, use of force has many frameworks and success and failure would depend on how force is being applied, against whom and to what end. For instance, Iran uses proxies across the greater Middle East to neutralise its asymmetrical disadvantages and its relative military weaknesses against its adversaries. Israel uses a mix of strategies to retain its dominance. The IDF, one of the most formidable armed forces, had a hard time dealing with Hezbollah in the 2006 Lebanon War. But it remains the dominant military force in operations which do not require getting bogged down on the ground against elusive adversaries.

----------------

In case the argument is still unclear, let me assume a scenario for further clarification: in the event the Taliban take control of Kabul and with that a large part of Afghanistan, and in the event that they embark on a policy that the US considers inimical to its interests, the US has the capabilities to destroy Taliban forces. How? One, as noted earlier, the US can win a war against most adversaries very easily; two, the Taliban forces and assets — elusive as an insurgent force — will be over-the-ground as an established government. It’s difficult to operate against elusive forces; it’s easy to destroy concentrated targets.

Let me now come to another issue with reference to victory and defeat, which I flagged above. The US, a western hemisphere superpower, came to these shores to achieve its geopolitical objectives. It could achieve them both in ‘victory’ and ‘defeat’. What do I mean by that? In victory, i.e., in the event it could stabilise Afghanistan and Iraq, it would have two new allies; Iraqi stabilisation could also yield positive results for it in the Middle East. That did not happen and yet it now reaps the dividends of what many consider its ‘defeat’. How? It has cut its losses and gotten out, leaving regional countries to deal with Afghanistan’s likely spillover. Two of those countries are also its geopolitical competitors: China and Russia. Russia is already doing military drills with Uzbek forces as part of CSTO (Collective Security Treaty Organisation); China is bracing up for any spillover effects in Xinjiang.

In the Middle East, if Iraq, Syria and Libya cannot be stable US allies along the lines, for instance, of the Southeast Asian states, the US and Israel can reap the benefits of continuing instability in the region. A fractured region is the second-best option if you can’t get a stable, peaceful, US-friendly region.

So, here’s some bad news for military analysts who do not tire of cheering America’s ‘defeat’ in Afghanistan: the US has left Afghanistan; it retains its position as a hegemon; it remains a nearly USD 23 trillion economy. Meanwhile, in this hour of ‘great victory’, Afghans are killing Afghans and by the looks of it, that’s not going to end anytime soon.

Hamid Dabashi, the celebrated Iranian-American author and academic recently wrote an article, “Why the US war in Afghanistan was a resounding success.” While I do not agree with many of his observations, he is spot-on when he says, “There is nothing sillier than the cliched assumption of Afghanistan as the “graveyard of empires”. The US empire did not die in Afghanistan, nor did Russian imperial designs before it. Quite the contrary: both the US and Russia are robust military and imperial machines at work from Central Asia to the Indian Ocean and beyond.”

Afghanistan is only the graveyard of Afghans. That’s called deep tragedy, not victory.

-

Comment by Riaz Haq on September 10, 2021 at 7:55pm

-

ASEAN needs more Belt and Road money, say ministers - Nikkei Asia

https://asia.nikkei.com/Spotlight/Belt-and-Road/ASEAN-needs-more-Be...

Meeting online at a Belt and Road Summit, ASEAN ministers said the region has benefited from the infrastructure and digital connectivity already brought about by BRI, but new initiatives are needed to create opportunities amid pandemic-induced uncertainties.

"I am of the view that there are many tangible aspects that could be derived from the multinational partnership and cooperation under the BRI," said Sansern Samalap, Thailand's vice minister for commerce.

Sansern gave the example of the BRI flagship $5.75 billion China-Thailand high-speed railway project that will promote investments in the Greater Mekong Subregion, which includes Cambodia and Laos as part of the China-Indochina economic corridor.

Finally signed last October after numerous delays over terms and conditions, the initial 253 km line will connect Bangkok to Nakhon Ratchasima, the gateway to northeastern Thailand. Phase one of construction has already begun, and is slated for completion in late 2026. The final 873 km line will carry on up to Vientiane, the Laotian capital, and from there continue north to Kunming in China's Yunnan Province.

"Investors can grab this business opportunity and use Thailand as the gateway into the subregion and ASEAN," said Sansern.

Top Chinese officials participated in the summit, including Gao Yunlong, vice chairman of the national committee of the Chinese People's Political Consultative Conference, and Commerce Minister Wang Wentao.

The BRI was unveiled by President Xi Jinping in 2013. In 2020, China signed BRI cooperation agreements with nearly 140 countries to promote connectivity between Asia, Europe and Africa, mainly through infrastructure projects.

Tan See Leng, Singapore's minister for manpower, told the summit that accelerating ASEAN development plans has become more important if countries are to overcome the current economic slowdown,

"In such times, the BRI plays an even more important role in strengthening regional and multilateral cooperation by promoting connectivity in infrastructure, in finance and in trade," said Tan.

The Asian Development Bank recently downgraded its growth forecast for Asia to 7.2% from the 7.3% projected in April, citing the recent rapid spread of COVID-19 and low vaccination levels in Asian countries.

Tan said Singapore will partner China on some investments in BRI projects. Companies from the two countries are collaborating in various sectors, including logistics, e-commerce, infrastructure, finance and legal services.

Jerry Sambuaga, Indonesia's vice minister for trade, said BRI projects have boosted connectivity and created business opportunities.

"We must maintain this mutually beneficial partnership amidst uncertain global challenges," Sambuaga said. He called for more collaboration on Indonesian tourism projects that benefit local communities, and for the BRI to complement the Regional Comprehensive Economic Cooperation agreement.

RCEP, a 15-country multilateral free trade deal signed in 2020 by ASEAN along with Australia, China, Japan, New Zealand and South Korea, is due to take effect on Jan. 1, 2022. Some analysts expect a delay, however, as not all governments have ratified the agreement in their national legislatures.

Singapore's Tan said today that the city state expected the "timely" implementation of RCEP on schedule.

"We look forward to the implementation of the RCEP in order to realize the benefit to businesses [and] to people while contributing to Asia's economy recovery and strengthening of confidence in the longer-term economic prospects of Asia," he said.

-

Comment by Riaz Haq on February 20, 2022 at 10:18am

-

#China celebrates record #Winter #Olympics #medals haul, beating #US. Traditionally much stronger in the Summer Games, China earned an unprecedented nine gold medals during its home-hosted winter edition after the state ploughed resources into training.

https://www.france24.com/en/live-news/20220220-china-celebrates-rec...

China celebrated a record gold medal haul as the Beijing Winter Olympics concluded Sunday, narrowly beating out chief geopolitical rival the United States to rank third in the medal count.

Traditionally much stronger in the Summer Games, China earned an unprecedented nine gold medals during its home-hosted winter edition after the state ploughed resources into training.

By Sunday afternoon, at least four trending hashtags related to China's best haul had received almost 200 million views on the Twitter-like platform Weibo.

Much of that commentary was as pleased about beating the United States by one place as it was China's best winter finish.

"Last year the US surpassed China by one gold medal in the Summer Olympics, this year China surpassed the US by one medal," read one comment liked more than 2,800 times.

The Chinese team won 15 medals in total -- nine golds, four silvers and two bronzes.

Figure skating duo Han Cong and Sui Wenjing secured the country's last Olympic gold -- and broke a previous world record -- in an emotional pairs event on Saturday evening.

Winter powerhouse Norway was in first place with 16 gold medals and a total of 37. Runner-up Germany received 12 golds and 27 medals in total.

Beijing sees the Winter Games as a propaganda showpiece with which to burnish its international image and project soft power abroad.

But the event has been clouded by political controversies.

The United States led a diplomatic boycott of the Games over China's human rights record, which was joined by multiple Western countries.

The Games also saw a doping scandal involving a teenage Russian athlete and growing fears of a Russian invasion of Ukraine.

However, Chinese medal-winners have been lionised as national heroes by state media, while Chinese social media has been flooded with patriotic comments.

"I am so proud of the Chinese team's achievements," 32-year-old tech worker Min Rui told AFP on Sunday as she shopped with two girlfriends near an Olympic countdown clock in one of Beijing's central districts.

"The winter sports industry is still in its infancy and many athletes were chosen from other sporting disciplines. So coming third in the medal tally, ahead of countries like the US and Canada, is a real achievement."

Beijing's investment in developing winter sports has nurtured a new generation of breakout stars.

Among them are teenage snowboarding champion Su Yiming and Chinese-American skier Eileen Gu, who is the most decorated Chinese athlete with two golds and one silver medal.

Gu switched to compete for China over the United States in 2019.

China won one gold and a total of nine medals at the 2018 Pyeongchang Winter Olympics.

It had never won more than three gold medals in Winter Games history.

-

Comment by Riaz Haq on March 19, 2022 at 6:30pm

-

How the West Can Win a Global Power Struggle

In an economic Cold War pitting China and Russia against the U.S. and its allies, one side holds most of the advantages. It just has to use them.

https://www.wsj.com/articles/how-the-west-can-win-a-global-power-st...

Of course the East plays a central role in the global economy. As recent market turmoil illustrates, Russia is a key supplier of not just oil and gas but metals such as palladium, used in catalytic converters, and nickel. China dominates manufacturing of countless goods whose value became abundantly clear during the pandemic, when demand for some, such as protective personal equipment, skyrocketed.

To a great extent these strengths reflect Russia’s comparative advantage in geology and China’s in factory labor. The West’s comparative advantage is in knowledge. That’s why Russia and China court Western investment. For example, to develop a complex liquefied natural gas (LNG) project in the Arctic, Russia relied on Norwegian, French and Italian contractors for essential expertise, research firm Rystad Energy notes.

Catching up with the West is no easy task, as semiconductors illustrate. Western companies dominate all the key steps in this critical and highly complex industry, from chip design (led by U.S.-based Nvidia, Intel, Qualcomm and AMD and Britain’s ARM) to the fabrication of advanced chips (led by Intel, Taiwan’s TSMC and South Korea’s Samsung ) and the sophisticated machines that etch chip designs onto wafers (produced by Applied Materials and Lam Research in the U.S., the Netherlands’ ASML Holding and Japan’s Tokyo Electron ).

Russia and China have made efforts to reduce this dependence. Russia developed locally designed microprocessors called Elbrus and Baikal to run data centers, cybersecurity operations and other applications. Though neither has achieved significant market share, they “represent the pinnacle of local design capability,” said Kostas Tigkos, principal at Jane’s, a defense intelligence provider. Russia hoped that they would eventually displace chips made by Intel and AMD, he said. “This would not only have been the foundation for diversifying their installed base, but a stepping stone for exports of those processors to other friendly nations.” But without manufacturers like TSMC to make the chips, Russia is facing “the complete disintegration of their aspirations to develop their own industry.”

China has a much bigger semiconductor industry than Russia, and its partly state-owned national champion, Semiconductor Manufacturing International Co. (SMIC), could in theory make Russia’s chips, but that would take at least a year, Mr. Tigkos said. Moreover, its efforts to catch up to its Taiwanese competitor have been set back by sanctions. In 2020 the U.S. required companies using American technology to obtain a license to sell to SMIC. This effectively limited its ability to acquire advanced equipment from Netherlands’ ASML, which is critical for “any country that wants to have a competitive semiconductor industry,” Mr. Tigkos said.

Why does all this matter to the outcome of the geopolitical contest? Over time economic weight, strength and vitality are what allow countries to sustain military capability, achieve and maintain technological superiority, and remain attractive partners for other countries.

Yet GDP does not automatically equate to strategic influence. To win a Cold War, it’s not enough for the West to hold the best economic cards, it has to know how to play them. Economic statecraft, as this is called, does not come naturally to the West: Its institutions are built on the assumption that companies are private enterprises, not instruments of the state. They do business wherever it’s profitable, regardless of their home countries’ strategic interests.

-

Comment by Riaz Haq on May 1, 2022 at 4:59pm

-

Chip consortium ISMC (joint venture between #AbuDhabi-based Next Orbit Ventures and #Israel's Tower Semiconductor) to set up $3 billion plant in India's Karnataka. It will be #India's first #Semiconductor #fabrication plant. #technology https://finance.yahoo.com/news/chip-consortium-ismc-plans-3-0802377... via @Yahoo

ISMC and Indian conglomerate Vedanta Ltd have applied for Prime Minister Narendra Modi's $10 billion incentive plan to push companies to set up semiconductor and display operations in India, the government's next big bet on electronics manufacturing.

-----------

BENGALURU (Reuters) - International semiconductor consortium ISMC will invest $3 billion in India's southern Karnataka state to set up a chip-making plant, the state government said on Sunday.

ISMC is a joint venture between Abu Dhabi-based Next Orbit Ventures and Israel's Tower Semiconductor. U.S. chip giant Intel Corp has announced plans to acquire Tower.

India’s first semiconductor fabrication unit is expected to generate more than 1,500 direct jobs and 10,000 indirect jobs, the state's investment promotion division said in a tweet.

ISMC and Indian conglomerate Vedanta Ltd have applied for Prime Minister Narendra Modi's $10 billion incentive plan to push companies to set up semiconductor and display operations in India, the government's next big bet on electronics manufacturing.

Munsif Vengattil

Sun, May 1, 2022, 1:02 AM·1 min read

A silicone semiconductor is seen at the offices of Tower Semiconductor in northern Israel

By Munsif Vengattil

BENGALURU (Reuters) - International semiconductor consortium ISMC will invest $3 billion in India's southern Karnataka state to set up a chip-making plant, the state government said on Sunday.

ISMC is a joint venture between Abu Dhabi-based Next Orbit Ventures and Israel's Tower Semiconductor. U.S. chip giant Intel Corp has announced plans to acquire Tower.

India’s first semiconductor fabrication unit is expected to generate more than 1,500 direct jobs and 10,000 indirect jobs, the state's investment promotion division said in a tweet.

ISMC and Indian conglomerate Vedanta Ltd have applied for Prime Minister Narendra Modi's $10 billion incentive plan to push companies to set up semiconductor and display operations in India, the government's next big bet on electronics manufacturing.

- ADVERTISEMENT -

Vedanta told Reuters on Saturday it was in "advanced talks" with Gujarat and Maharashtra in west India and Telangana in the south to choose a site by mid-May. It has a planned investment outlay of $20 billion for its semiconductor and display push.

Modi and his IT ministers outlined plans on Friday for investment incentives in the sector, saying they want India to become a key player in a global chip market dominated by manufacturers in Taiwan and a few other countries.

India's semiconductor market is forecast to grow to $63 billion by 2026 from $15 billion in 2020, the government says.

(Reporting by Munsif Vengattil and Aditya Kalra in New Delhi; Editing by Clarence Fernandez and William Mallard)

-

Comment by Riaz Haq on May 1, 2022 at 8:24pm

-

Semiconductor Fabrication by country:

USA 44%

South Korea 24%

Japan 9%

EU 9%

Taiwan 6%

China 5%

In 2018, about 44 percent of U.S.-headquartered firms’ front-end semiconductor wafer capacity was located in the United States. Other

leading locations for U.S. headquartered front-end semiconductor wafer fab capacity were Singapore, Taiwan, Europe, and Japan.

https://www.semiconductors.org/wp-content/uploads/2019/05/2019-SIA-...

-

Comment by Riaz Haq on May 21, 2022 at 8:57am

-

A total of 143 Chinese companies (vs 122 US companies) have made it to the list of world's top 500 enterprises measured by business revenue, making China top the ranking for a second consecutive year, according to the Fortune Global 500 list for 2021 released on Monday.

https://news.cgtn.com/news/2021-08-03/China-tops-Fortune-Global-500...

China's Xiaomi Group, JD.com, Alibaba Group and Tencent Holdings are among the seven internet-related companies on the list this year, while the other three are from the U.S., namely Amazon, Alphabet and Facebook.

Among the seven internet giants, Xiaomi saw the largest increase in the rankings, rising by 84 places, the list shows.

China had 133 companies on the list last year, surpassing the United States for the first time.

There are 122 U.S. companies on the list this year, up by one from last year, while Japan holds steady with 53.

Total revenue for the world's largest companies dropped by 4.8 percent to $31.7 trillion in 2021, the first decline in five years.

Due to the COVID-19 impact, cumulative sales in energy and automotive sectors fell by over 10 percent, while all six airlines on last year's list failed to make the cut this year.

-------------

Hua Chunying 华春莹

@SpokespersonCHN

China government official

In 1989, only one Chinese company made it into the #Global500.

In 2021, the number reached 143, ranking first in the world.

https://twitter.com/SpokespersonCHN/status/1527662503849000960?s=20...

Comment

- ‹ Previous

- 1

- 2

- 3

- 4

- Next ›

Twitter Feed

Live Traffic Feed

Sponsored Links

South Asia Investor Review

Investor Information Blog

Haq's Musings

Riaz Haq's Current Affairs Blog

Please Bookmark This Page!

Blog Posts

Modi's AI Spectacle: Chaos and Deception in New Delhi

The India AI Impact Summit 2026, held at Bharat Mandapam in New Delhi, has been marred by chaos, confusion and deception. The events on the ground have produced unintended media headlines for India's Prime Minister Narendra Modi who wants to be seen as the "vishwaguru" (teacher of the world) in the field of artificial intelligence as well. First, there was massive chaos on the opening day, with long…

ContinuePosted by Riaz Haq on February 19, 2026 at 12:00pm — 4 Comments

India-Pakistan Cricket Match: The Biggest Single Event in the World of Sports

Why did Pakistan's decision to boycott the India-Pakistan match in solidarity with Bangladesh in this year's T20 World Cup send shockwaves around the world? And why did it trigger the International Cricket Council's and other cricket boards' urgent efforts to persuade Pakistan to return to the match? The reason has a lot to do with its massive financial impact, estimated to be as much as …

ContinuePosted by Riaz Haq on February 11, 2026 at 4:00pm — 2 Comments

© 2026 Created by Riaz Haq.

Powered by

![]()

You need to be a member of PakAlumni Worldwide: The Global Social Network to add comments!

Join PakAlumni Worldwide: The Global Social Network