PakAlumni Worldwide: The Global Social Network

The Global Social Network

CCP Centennial: The Chinese Economic Miracle

The Chinese Communist Party (CCP) was founded one hundred years ago on July 1, 1921. The party has transformed China from a poor and backward third world country into a vibrant and prosperous industrialized economy. This rapid historic transformation has surprised everyone, including China's friends, but especially its western foes who now see the emergence of the Asian giant as a challenge to centuries-long western domination of the world. It has also earned the CCP high levels of performance legitimacy and popularity among the Chinese people. The CCP's successful response to the COVID crisis has further boosted its legitimacy and popularity in China.

|

| China Surpassed United States in Global Trade |

Chinese Economy:

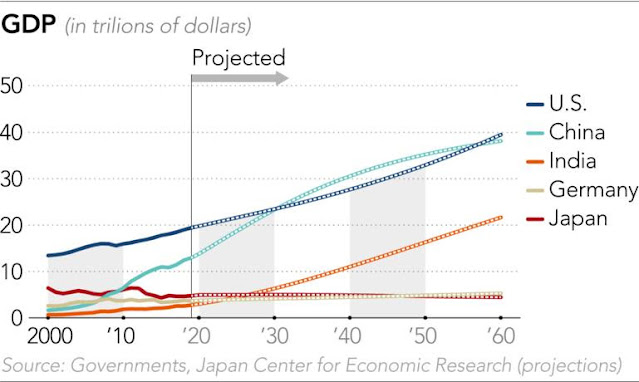

Over the last several decades, China has built a strong manufacturing base to serve as the factory to the world. This efficient industrial base is being used by all major global brand-name multi-national giants to manufacture and supply everything from Barbie dolls to iPhones. It has served as a powerful engine to drive the Chinese economy which now rivals the US economy in size. China's GDP overtook the U.S.'s in 2017 in terms of purchasing power parity, according to Nomura Securities. China has eclipsed the United States as the world's largest trading nation.

|

| Japanese Government Projection of Future GDP Trajectories. Source: ... |

China's Economy Slowing:

There's some evidence that China's economy is slowing after hitting a peak growth in the last decade, according to Forbes magazine. It may sound like wishful thinking but the American magazine argues that "China’s growth has slowed in recent years, partly due to maturity. Extremely poor countries have the potential to grow rapidly. As they approach the level of developed countries, growth is harder and thus slows".

|

| China Economy Slowing. Source: Forbes |

Digital Economy:

The United States is far ahead of China in global digital economy. But the US-China battle for future dominance of this economy is now underway. The winner of this contest will dominate the next phase of global economic competition. It will be determined by achieving mastery of computer chips and software needed to build complex systems.

The United States and its ally Taiwan are far ahead of all other nations in building the most advanced 5 nanometer semiconductor components. But China is gearing up for it. Chinese leader Xi Jinping has appointed Liu He, his most trusted lieutenant, as the "chip czar" to lead this effort as a top national priority.

Technology firms today make up a quarter of the global stock market and the geographic mix has become strikingly lopsided, according to The Economist magazine. America and, increasingly, China are ascendant, accounting for 76 of the world’s 100 most valuable firms. Europe’s tally has fallen from 41 in 2000 to 15 today.

|

|

|

|

| Locations of Global 500 Companies. Source: Fortune Magazine |

Haq's Musings

South Asia Investor Review

China-Pakistan Scientific Cooperation

US-China Battle For Influence in Pakistan

Indian Movie White Tiger on India's Democracy

Musharraf Earned Performance Legitimacy

Has Intel's India-American Techie Jeopardized US Technology Leaders...

Marvel Pays $7.5 Billion For Cavium Co-Founded by Pakistani-American

OPEN Silicon Valley Forum 2017: Pakistani Entrepreneurs Conference

Pakistani-American's Tech Unicorn Files For IPO at $1.6 Billion Val...

Pakistani-American Cofounders Sell Startup to Cisco for $610 million

Pakistani Brothers Spawned $20 Billion Security Software Industry

Pakistani-American Ashar Aziz's Fireeye Goes Public

Pakistani-American Pioneered 3D Technology in Orthodontics

Pakistani-Americans Enabling 2nd Machine Revolution

Pakistani-American Shahid Khan Richest South Asian in America

Two Pakistani-American Silicon Valley Techs Among Top 5 VC Deals

Pakistani-American's Game-Changing Vision

-

Comment by Riaz Haq on May 21, 2022 at 9:07am

-

The Fortune Global 500 is now more Chinese than American

BY ALAN MURRAY AND DAVID MEYERhttps://fortune.com/2020/08/10/fortune-global-500-china-rise-ceo-da...

The Fortune Global 500 list is out this morning, and you can find it here. Walmart once again tops the list, followed by three Chinese companies—Sinopec, State Grid and China National Petroleum. The big story is this: for the first time, there are more Fortune Global 500 companies based in Mainland China and Hong Kong than in the U.S.–124 vs. 121. Add in Taiwan’s companies, and the Greater China total jumps to 133.

It’s hard to overstate the significance of the change in the global economy that represents. As Fortune Editor-in-Chief Cliff Leaf points out, when the Global 500 list first came out in 1990, there were no Chinese companies on the list. In the intervening three decades, the Chinese economy has skyrocketed, powered by a global trade boom that expanded from 39% of global GDP to 59%.

So now what? That’s the question Geoff Colvin explores in his piece here. The U.S. and Chinese economies are intertwined in so many ways, it’s hard to imagine them ever truly “decoupling.” Yet powerful political forces on both sides seem to be propelling them in that direction.

It’s worth noting that the Global 500 ranking is based on revenues, and many of the Chinese companies on the list—like the three mentioned above—earned their spot not necessarily because of their business dynamism, but because they are state-supported monopolies in the world’s largest market.

And by the way, being on the list is no guarantee of profitability. The five biggest losers on this year’s list—Pemex, Schlumberger, Softbank, the U.S. Postal Service and Nissan—lost $52 billion in 2019. (Sixth and seventh in the money losers’ ranking were Deutsche Bank and General Electric, which together lost another $11 billion.) Saudi Aramco, on the other hand, netted $88 billion in profits and is Fortune Global 500’s most profitable company for the second consecutive year.

-

Comment by Riaz Haq on August 7, 2022 at 12:04pm

-

60% o Fortune Global 500 companies are in 3 countries:

Greater China 145

United States 124

Europe 127

Japan 47

https://fortune.com/2022/08/06/worlds-biggest-companies-global-500-...

This map-and-chart package captures one of the top business stories of the past two decades: China’s rise in the global corporate hierarchy. Greater China (including Taiwan) surpassed the U.S. for the largest number of Global 500 companies for the first time in fiscal 2018; it widened its lead in 2020, when COVID shut down much of the world and China kept humming. One striking subplot in this story is the degree of state involvement in China’s big businesses: 87 of the companies from mainland China on this year’s list are majority or entirely government-owned. (In the U.S., just three fit that description: the Postal Service and real estate finance agencies Fannie Mae and Freddie Mac.) Can state-owned companies act nimbly and stay competitive in a fragmenting global economy? That’s the next chapter.

-

Comment by Riaz Haq on September 1, 2022 at 8:37pm

-

#US Orders #Nvidia to Halt Sales of Top #AI Chips to #China. Nvidea says ban on its A100 & H100 chips designed to speed up machine learning could interfere with completion of developing the H100, its flagship chip it announced this year. #geopolitics

https://www.usnews.com/news/technology/articles/2022-08-31/nvidia-s...

By Stephen Nellis and Jane Lanhee Lee

(Reuters) -Chip designer Nvidia Corp said on Wednesday that U.S. officials told it to stop exporting two top computing chips for artificial intelligence work to China, a move that could cripple Chinese firms' ability to carry out advanced work like image recognition and hamper Nvidia's business in the country.

The announcement signals a major escalation of the U.S. crackdown on China's technological capabilities as tensions bubble over the fate of Taiwan, where chips for Nvidia and almost every other major chip firm are manufactured.

Nvidia shares fell 6.6% after hours. The company said the ban, which affects its A100 and H100 chips designed to speed up machine learning tasks, could interfere with completion of developing the H100, the flagship chip it announced this year.

Shares of rival Advanced Micro Devices Inc fell 3.7% after hours. An AMD spokesman told Reuters it had received new license requirements that will stop its MI250 artificial intelligence chips from being exported to China but it believes its MI100 chips will not be affected. AMD said it does not believe the new rules will have a material impact on its business.

Nvidia said U.S. officials told it the new rule "will address the risk that products may be used in, or diverted to, a 'military end use' or 'military end user' in China."

The U.S. Department of Commerce would not say what new criteria it has laid out for AI chips that can no longer be shipped to China but said it is reviewing its China-related policies and practices to "keep advanced technologies out of the wrong hands.

"While we are not in a position to outline specific policy changes at this time, we are taking a comprehensive approach to implement additional actions necessary related to technologies, end-uses, and end-users to protect U.S. national security and foreign policy interests," a spokesperson told Reuters.

The Chinese foreign ministry responded on Thursday by accusing the United States of attempting to impose a "tech blockade" on China, while its commerce ministry said such actions would undermine the stability of global supply chains.

"The U.S. continues to abuse export control measures to restrict exports of semiconductor-related items to China, which China firmly opposes," commerce ministry spokesperson Shu Jieting said at a news conference.

This is not the first time the U.S. has moved to choke off Chinese firms' supply of chips. In 2020, former president Donald Trump's administration banned suppliers from selling chips made using U.S. technology to tech giant Huawei without a special license.

Without American chips from companies like Nvidia and AMD, Chinese organizations will be unable to cost-effectively carry out the kind of advanced computing used for image and speech recognition, among many other tasks.

Image recognition and natural language processing are common in consumer applications like smartphones that can answer queries and tag photos. They also have military uses such as scouring satellite imagery for weapons or bases and filtering digital communications for intelligence-gathering purposes.

Nvidia said it had booked $400 million in sales of the affected chips this quarter to China that could be lost if firms decide not to buy alternative Nvidia products. It said it plans to apply for exemptions to the rule.

Stacy Rasgon, a financial analyst with Bernstein, said the disclosure signaled that about 10% of Nvidia's data center sales were coming from China and that the hit to sales was likely "manageable" for Nvidia.

-

Comment by Riaz Haq on September 1, 2022 at 8:53pm

-

India’s high-stakes bid to join the global semiconductor race

Chipmaking could be fantastically lucrative but precision engineering has not been a traditional national strength

https://www.ft.com/content/cbd50844-853e-4435-8028-f581d536a89a

The complexity of semiconductor production and supply chains means that manufacturers in a handful of east Asian countries, led by China, Taiwan and South Korea, have been responsible for much of global supply.

That is now changing. In July, the US passed the Chips and Science Act that includes $52bn of grants to support chipmaking and research and development. Meanwhile the EU is looking to build semiconductor resilience with its own €43bn Chips Act.

While India does not yet make microchips commercially, it does contribute to the design of semiconductors because of its strong software base, says Mahinthan Joseph Mariasingham, a statistician and researcher with the Asian Development Bank.

“When it comes to manufacturing, India has lagged behind many of the other countries, partly because of its lack of facilitating infrastructure,” he says. “It was easy for them to get into the software market because it doesn’t require elaborate physical infrastructure.”

-------

The factories outside Chennai, in India’s southern state of Tamil Nadu, are home to an array of global corporate names that lend credibility to Prime Minister Narendra Modi’s “Make in India” campaign, which aims to turn Asia’s third-largest economy into a workshop to the world.

The state’s industrial parks host international investors such as Renault-Nissan and Hyundai, which have large car factories; Dell makes computers there and Samsung produces TVs, washing machines and fridges. There are enough suppliers to Apple (including Taiwan’s Foxconn and Pegatron, and the Finnish contract manufacturer Salcomp) that people in Tamil Nadu’s business community commonly refer to the American tech group, which does not discuss its suppliers, as “the fruit company”.

Now India wants to take a step up the manufacturing value chain, with a high-stakes bid to begin making semiconductors. The Modi government has put $10bn of incentives on the table to tempt manufacturers to set up new “fabs” (semiconductor fabrication plants) and encourage investment in related sectors such as display glass. One plant is being planned in Tamil Nadu.

India’s ambition to enter the chipmaking business comes at a time of growing trade and geopolitical tension as western economies have pushed to decouple their supply chains from China, which has invested heavily to become a leader in the semiconductor industry.

The Covid-19 pandemic and Beijing’s draconian lockdowns have disrupted global chip supply and sent companies and governments on a hunt for alternative sources of production. India, which has cracked down on Chinese social media apps and phone producers against the backdrop of a long-running geopolitical dispute, is offering itself as a democratic alternative tech hub to China.

-----

“From a geopolitics point of view, India is attractive . . . We are increasingly one of the largest consumers of semiconductors outside of the US and traditional markets,” says Rajeev Chandrasekhar, India’s minister of state for electronics and information technology.

Manufacturers are now lining up to take up the $10bn offer. Singaporean group IGSS Ventures has signed a memorandum of understanding with the Tamil Nadu state government for what its founder and chief executive Raj Kumar says will “very likely” be a wafer factory it wants to build within three years. The Israeli group ISMC, a joint venture between Israel’s Tower Semiconductor and Abu Dhabi-based Next Orbit Ventures, has signed a letter of intent with the state of Karnataka, home of India’s tech capital, Bangalore, to build a $3bn semiconductor chipmaking plant. And Foxconn has teamed up with Indian group Vedanta to build a semiconductor plant, surveying sites in the western Indian states of Gujarat and Maharashtra.

-

Comment by Riaz Haq on September 7, 2022 at 9:52am

-

#Intel says it has no current plans to start #manufacturing #semiconductor #chips in #India. The comments came after India's transport minister said earlier in the day that the #chipmaker will set up a #semiconductor manufacturing plant in the country.

https://www.reuters.com/technology/intel-says-it-has-no-current-pla...

-

Comment by Riaz Haq on September 12, 2022 at 11:01am

-

China's dominance of manufacturing is growing, not shrinking

Country gaining market share in both low- and high-tech sectors

https://asia.nikkei.com/Opinion/China-s-dominance-of-manufacturing-...

William Bratton is author of "China's Rise, Asia's Decline." He was previously head of Asia-Pacific equity research at HSBC.

When it comes to discussions about China's manufacturing capabilities, there is an all-too-frequent disconnect between rhetoric and reality.

On the one hand, it is widely understood that Chinese producers are losing relative competitiveness. Higher labor costs, bitter trade frictions, rising geopolitical tensions and the domestic pursuit of zero-COVID are all encouraging exporters to leave the country.

China, it is thus argued, has passed "peak manufacturing" and its status as the world's manufacturer stands to be superseded by other countries in the region. By extension, this will materially impact China's economic trajectory and the region's evolving geopolitical balances.

On the other hand, there has been a lack of substantive evidence offered to support the above argument. Although anecdotes abound about certain companies relocating production out of China, the data suggests that such moves are not at the scale necessary to reverse the upward momentum of the country's manufacturing base, nor its international competitiveness.

The most obvious evidence of this is in trade flows.

It is not just that Chinese exports have remained remarkably robust despite COVID-related lockdowns. More than that, the latest numbers from the U.N. Conference on Trade and Development imply that Chinese producers have become more competitive in recent years, not less.

China's manufactured exports, for example, have been growing significantly faster than those of Germany, the U.S., Japan or South Korea. As a result, its share of global manufactured exports by value surged to a new high of 21% last year, compared to just 17% in 2017. The country is now a more important international supplier than Germany, the U.S. and Japan combined.

Furthermore, contrary to the view that supply chains are reducing their exposure to China, Chinese manufacturers have consolidated their primacy across the vast majority of sectors over recent years. In fact, what is particularly remarkable about China's evolving trade structure is that it has been able to simultaneously gain export share in both low- and high-technology industries, including those as eclectic as leather products, truck trailers and optical instruments.

Such gains are hardly indicative of an industrial base under stress. They instead highlight the hyper-competitiveness of China's producers, who increasingly dominate the East and Southeast Asian manufacturing landscape.

For all the chatter about companies leaving China and the changing geographies of supply chains, the reality is that it generated nearly half of the region's manufactured exports in 2021, compared to less than a third 15 years ago.

This competitiveness is derived from the complex and self-reinforcing interaction of multiple factors, many of which are a function of China's size. This allows the country to support far higher levels of domestic competition, innovation and specialization than its neighbors, and results in greater efficiencies and lower production costs, which regional rivals will always struggle to replicate. These scale benefits are subsequently magnified through aggressive industrial development policies that have no obvious precedent in terms of scope or ambition.

So China's manufacturing advantages must be viewed holistically, especially as it can be highly misleading, however tempting, to draw conclusions based on the trends of any specific factor.

-

Comment by Riaz Haq on September 12, 2022 at 11:02am

-

China's dominance of manufacturing is growing, not shrinking

Country gaining market share in both low- and high-tech sectors

https://asia.nikkei.com/Opinion/China-s-dominance-of-manufacturing-...

William Bratton is author of "China's Rise, Asia's Decline." He was previously head of Asia-Pacific equity research at HSBC.

The country's rapidly rising wages, for example, attract much attention. But it would be a mistake to assume that this signals the loss of competitiveness in more labor-intensive industries.

Rather, it reflects dramatic improvements in productivity and a broader structural shift into higher technology sectors. Furthermore, the use of national averages masks the diversity of China's labor force, with a substantial pool still on relatively low wages.

This is seen in the irrefutable fact that the country's manufacturers are still gaining export share across low-technology and labor-intensive industries, including textiles. In other words, their innate advantages are so substantial and so overwhelming that higher labor costs by themselves have no material impact on their competitiveness.

As such, despite all the frequently cited anecdotes, there is no real evidence that the factors underpinning China's competitiveness are being reversed. Rather, Asia's manufacturing industries will continue to concentrate in China, further entrenching its status as the core of the region's economic system.

This is the challenge for the rest of the region. No matter how hard they try, few countries, if any, will be able to replicate or match China's natural advantages. And this will have profound longer-term economic and geopolitical consequences.

Against the onslaught of highly competitive Chinese products, emerging economies will struggle to develop the manufacturing sectors they need to achieve and sustain productivity-led growth over the long-term.

But even more advanced nations are not immune from the pressures created by China, with the hollowing-out of their industrial structures a very real danger. The displacement of Japanese and South Korean manufacturers from the global telecommunications equipment and shipbuilding markets demonstrates just how quickly China can engage with its neighbors at their own games -- and win.

So for all the suggestions that China's grip on manufacturing is weakening, the reality could not be more different. It is not the Chinese producers that are losing influence, but their rivals across the region.

In fact, the natural forces driving the country's competitive advantages are now both so substantial and entrenched that the rest of Asia is seemingly engaged in an unfair trade fight -- and one it is unlikely to win. The region's slide toward a clearly defined economic core-periphery structure -- with China dominating and the rest being disadvantaged -- now looks inevitable.

In turn, this is creating dependencies which will prove evermore difficult to disentangle, no matter how strong the apparent political commitment in some countries to do so.

This is seen in how recent attempts to diversify imports away from Chinese producers have been constrained by the lack of credible alternative suppliers. It is noticeable that Australia and India, countries positioning themselves as regional rivals to China, have increased -- not reduced -- their reliance on Chinese manufactured imports over the last three years.

It is true that this manufacturing mastery may not have been developed as a deliberate geopolitical tool. But in the same way the U.S. was able to use its post-World War II industrial leadership to advance its own interests, the reliance on Chinese products will naturally give Beijing unrivaled power and influence within Asia. As such, China's future economic and political dominance of the Asian regional economy is set to be underpinned by its vibrant, dynamic and hypercompetitive manufacturing industries, whatever the country's doomsayers may claim.

-

Comment by Riaz Haq on September 14, 2022 at 11:24am

-

#Apple to use #TSMC’s next 3-nm #semiconductor chip #technology in iPhones, Macs next year. There is a cost increase of at least 40% for the same area of silicon when moving to 3-nm chips from the 5-nm family, which includes 4-nm chips. #computers #phones https://asia.nikkei.com/Business/Tech/Semiconductors/Apple-to-use-T...

TAIPEI -- Apple aims to be the first company to use an updated version of Taiwan Semiconductor Manufacturing Co.'s latest chipmaking technology next year, with plans to adopt it for some of its iPhones and Mac computers, sources briefed on the matter told Nikkei Asia.

The A17 mobile processor currently under development will be mass-produced using TSMC's N3E chipmaking tech, expected to be available in the second half of next year, according to three people familiar with the matter. The A17 will be used in the premium entry in the iPhone lineup slated for release in 2023, they said.

N3E is an upgraded version of TSMC's current 3-nanometer production tech, which is only starting to go into use this year. The next generation of Apple's M3 chip for its Mac offerings is also set to use the upgraded 3-nm tech, two sources added.

Nanometer size refers to the width between transistors on a chip. The smaller the number, the more transistors can be squeezed onto a chip, making them more powerful but also more challenging and costly to produce.

N3E will offer better performance and energy efficiency than the first version of the tech, TSMC said in a recent technology symposium in Hsinchu. Industry sources said the upgraded production tech is also designed to be more cost-effective than its predecessor.

As TSMC's largest customer and the biggest driver for new semiconductor technologies, Apple is still its most loyal partner when it comes to adopting the latest chip technology. The U.S. tech giant will be the first to use TSMC's first generation of 3-nm technology, using it for some of its upcoming iPads, Nikkei Asia reported earlier.

Previously, Intel told TSMC that it would like to secure 3-nm production by this year or early next year to be among the first wave of adopters like Apple, but it has since delayed its orders to at least 2024, three people told Nikkei Asia.

However, 2023 could mark the second year in a row that Apple uses TSMC's most advanced chipmaking technology for only a part of its iPhone lineup. In 2022, only the premium iPhone 14 Pro range has adopted the latest A16 core processor, which is produced by TSMC's 4-nm process technologies, the most advanced currently available. The standard iPhone 14 range uses the older A15, which was used in the iPhone 13 and iPhone 13 Pro models released in the second half of 2021.

Meanwhile, the race is on among chipmakers to roll out ever more advanced production tech. TSMC and Samsung each hopes to be the first to put 3-nm tech into mass production this year. This technology is suitable for all types of central and graphics processors for smartphones, computers and servers, as well as those used in artificial intelligence computing.

Apple, meanwhile, is likely to use the different levels of production tech to introduce greater differences between its premium and nonpremium models, according to Dylan Patel, chief analyst with Semianalysis. Previously the biggest differences have been in screens and cameras, but this could be expanded to include processors and memory chips, he said.

According to the analyst's estimate, there is a cost increase of at least 40% for the same area of silicon when moving to 3-nm chips from the 5-nm family, which includes 4-nm chips.

TSMC, Intel and Apple declined to comment.

-

Comment by Riaz Haq on September 14, 2022 at 2:10pm

-

Foxconn and Vedanta to build $19bn India chip factory

https://www.bbc.com/news/62873520

Foxconn and Vedanta have announced $19.5bn (£16.9) to build one of the first chipmaking factories in India.

The Taiwanese firm and the Indian mining giant are tying up as the government pushes to boost chip manufacturing in the country.

Prime Minister Narendra Modi's government announced a $10bn package last year to attract investors.

The facility, which will be built in Mr Modi's home state of Gujarat, has been promised incentives.

Vedanta's chairman Anil Agarwal said they were still on the lookout for a site - about 400 acres of land - close to Gujarat's capital, Ahmedabad.

But both Indian and foreign firms have struggled in the past to acquire large tracts of land for projects. And experts say that despite Mr Modi's signature 'Make in India' policy - designed to attract global manufacturers - challenges remain when it comes to navigating the country's red tape.

Gujarat Chief Minister Bhupendrabhai Patel, however, said the project "will be met with red carpet... instead of any red tapism".

The project is expected to create 100,000 jobs in the state, which is headed for elections in December, where the BJP is facing stiff competition from oppositions parties.

According to the Memorandum of Understanding, the facility is expected to start manufacturing chips within two years.

"India's own Silicon Valley is a step closer now," Mr Agarwal said in a tweet.

India has vowed to spend $30bn to overhaul its tech industry. The government said it will also expand incentives beyond the initial $10 billion for chipmakers in order to become less reliant on chip producers in places like Taiwan, the US and China.

"Gujarat has been recognized for its industrial development, green energy, and smart cities. The improving infrastructure and the government's active and strong support increases confidence in setting up a semiconductor factory," according to Brian Ho, a vice president of Foxconn Semiconductor Group.

Foxconn is the technical partner. Vedanta is financing the project as it looks to diversify its investments into the tech sector.

Vedanta is the third company to announce plans to build a chip plant in India. A partnership between ISMC and Singapore-based IGSS Ventures also said it had signed deals to build semiconductor plants in the country over the next five years.

-

Comment by Riaz Haq on March 5, 2023 at 11:09am

-

Opinion The Checkup With Dr. Wen: What does it mean to hold China ‘accountable’ for covid?

By Leana S. Wen

https://www.washingtonpost.com/opinions/2023/03/02/china-covid-pand...

whether it (COVID) is caused by laboratory accidents or animal-to-human spillover. ...

Not everyone agrees. House Foreign Affairs Committee Chair Michael McCaul (R-Tex.) told CNN on Monday that “some people need to be held accountable, whether that be in a civil context or criminal liability context.” He mentioned the possibility of sanctions against China as well as reparations “for killing millions of people across the world.”

These comments suggest an intentionality behind the spread of covid-19 that neither scientists nor intelligence experts have found any evidence for. To the contrary, as much as U.S. intelligence agencies disagree about the coronavirus’s origins, they agree on one aspect: This was not intentional. It was not an act of bioterrorism. No one intended to weaponize a virus to cause a global pandemic.

This fact bears repeating, and I hope McCaul and others who have been calling for “accountability” will be clear with Americans to distinguish between an intentional act and their preferred theory of a laboratory accident.

And they should be reminded that such a mishap could have happened in the United States, too.

In 2014, when the Food and Drug Administration conducted an office cleanup to move to a new location, it found hundreds of vials of virus samples in an unsecured storage room. Six of them turned out to be vials of the deadly smallpox virus. Astonishingly, no one knew they were there. It’s possible the vials had been there since the 1950s but were forgotten in subsequent inventories.

Also in 2014, some 75 staff members at the Centers for Disease Control and Prevention were exposed to anthrax after scientists failed to inactivate the anthrax bacterium before sending it to three labs that weren’t prepared to handle it. In a separate incident, the CDC inadvertently sent what it thought were harmless strains of flu but actually was the H5N1 avian flu.

More recently, in November 2022, poliovirus was found in the wastewater of a lab in the Netherlands that conducted research on polio. One lab employee was infected as a result of this mishap, which was described in the Eurosurveillance journal as an “unnoticed breach of containment at the facility.”

None of these incidents resulted in mass outbreaks. But they could have. If they did, what would accountability have looked like?

Certainly, mistakes should be identified and systems put into place to prevent them, as was done in the occurrences above. But if an outbreak spread beyond our shores as a result of human error, should other countries impose sanctions or require reparations? Should they go so far as to demand civil and criminal penalties for lab workers?

And what about diseases that don’t originate in the lab but could be attributed to farming practices, deforestation, climate change and other activities that bring animals — and animal pathogens — closer to humans? Should the Democratic Republic of Congo and South Sudan, where the first two outbreaks of Ebola occurred, be on the hook for costs borne to other countries from Ebola? Should the United States, where Lyme disease was first identified, be held responsible to the world for its effects?

Such blame games are not conducive to the goal of preventing pandemics. They could deter researchers from engaging in scientific investigations crucial to the development of vaccines and treatments. They could also give fodder to conspiracy theories and fuel violence against people of certain ethnic origins, as we have already seen in the rise in anti-Asian attacks. And if countries are worried about liability and retribution, it could further disincentivize global health cooperation.

---

But it’s not going to make the world safer to threaten punishment.

Comment

- ‹ Previous

- 1

- 2

- 3

- 4

- Next ›

Twitter Feed

Live Traffic Feed

Sponsored Links

South Asia Investor Review

Investor Information Blog

Haq's Musings

Riaz Haq's Current Affairs Blog

Please Bookmark This Page!

Blog Posts

EU-India Trade Deal: "Uncapped" Mass Migration of Indians?

The European Union (EU) and India have recently agreed to a trade deal which includes an MOU to allow “an uncapped mobility for Indian students”, according to officials, allowing Indians greater ease to travel, study and work across EU states. India's largest and most valuable export to the world is its people who last year sent $135 billion in remittances to their home country. Going by the numbers, the Indian economy is a tiny fraction of the European Union economy. Indians make up 17.8%…

ContinuePosted by Riaz Haq on January 28, 2026 at 11:00am — 8 Comments

Independent Economists Expose Modi's Fake GDP

Ruling politicians in New Delhi continue to hype their country's economic growth even as the Indian currency hits new lows against the US dollar, corporate profits fall, electrical power demand slows, domestic savings and investment rates decline and foreign capital flees Indian markets. The International Monetary Fund (IMF) has questioned India's GDP and independent economists…

ContinuePosted by Riaz Haq on January 25, 2026 at 4:30pm — 9 Comments

© 2026 Created by Riaz Haq.

Powered by

![]()

You need to be a member of PakAlumni Worldwide: The Global Social Network to add comments!

Join PakAlumni Worldwide: The Global Social Network