PakAlumni Worldwide: The Global Social Network

The Global Social Network

China to Invest in Pakistan's Export-Oriented Industries, Buy More Pakistani Products

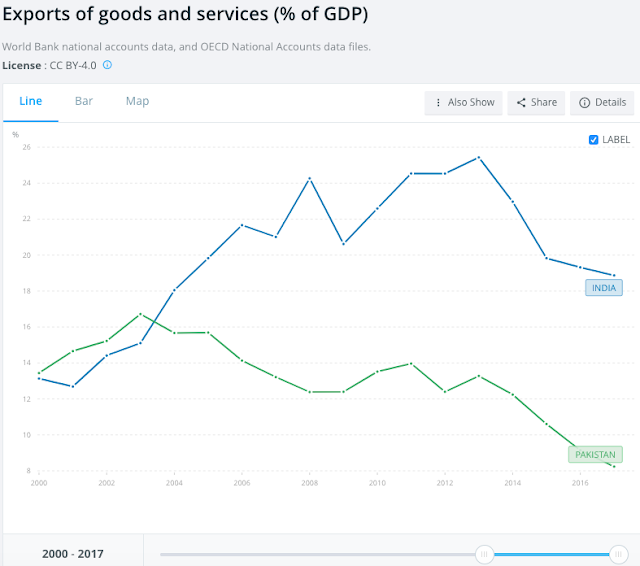

The bulk of Pakistan's exports consist of low value commodities like chadar, chawal and chamra (textiles, rice and leather). These exports have declined from about 15% to about 8% of GDP since 2003. Pakistan's trade deficits are growing at an alarming rate as the imports continue to far outstrip exports. This situation is not sustainable. What must Pakistan do to improve it? What can Pakistan do to avoid recurring balance of payments crises? How can Pakistan diversify and grow its exports to reduce the gaping trade gap? How can Pakistan's closest ally China help? Can China invest in export oriented industries and open up its huge market for exports from Pakistan? Let's explore answers to these question.

East Asia's Experience:

East Asian nations have greatly benefited from major investments made by the United States and Europe in export-oriented industries and increased access to western markets over the last several decades. Asian Tigers started with textiles and then switched to manufacturing higher value added consumer electronics and high tech products. Access to North American and European markets boosted their export earnings and helped them accumulate large foreign exchange reserves that freed them from dependence on the IMF and other international financial institutions. China, too, has been a major beneficiary of these western policies. All have significantly enhanced their living standards.

|

| Pakistan Among World's Top 10 Textile Exporters. Source: Statista |

Chinese Investment and Trade:

Pakistan needs similar investments in export-oriented industries and greater access to major markets. Given the end of the Cold War and changing US alliances, it seems unlikely that the United States would help Pakistan deal with the difficulties it faces today.

China sees Pakistan as a close strategic ally. It is investing heavily in the Belt and Road Initiative (BRI) which includes China-Pakistan Economic Corridor (CPEC). A recent opinion piece by Yao Jing, the Chinese Ambassador in Pakistan, published in the state-owned China Daily, appears to suggest that China is prepared to offer such help. Here are two key excerpts from the opinion piece titled "A community of shared future with Pakistan":

1. China will actively promote investment in Pakistan. The Chinese government will firmly promote industrial cooperation, expand China's direct investment in Pakistan, and encourage Chinese enterprises to actively participate in the construction of special economic zones. Its focus of cooperation will be upgrading Pakistan's manufacturing capacity and expanding export-oriented industries.

2. China will also actively expand its imports from Pakistan. In November, China will hold the first China International Import Expo in Shanghai, where, as one of the "Chief Guest" countries, Pakistan has been invited to send a large delegation of exporters and set up exhibitions at both the national and export levels. It is hoped that Pakistan will make full use of this opportunity to promote its superior products to China. The Chinese side will also promote cooperation between the customs and quarantine authorities of both countries to facilitate the further opening-up of China's agricultural product market to Pakistan. China will, under the framework of free trade cooperation between the two countries, provide a larger market share for Pakistani goods, and strengthen cooperation and facilitate local trade between Gilgit-Baltistan and China's Xinjiang Uygur autonomous region. And China will take further visa facilitation measures to encourage more Pakistani businesspeople to visit China.

Pakistan's Role:

Pakistan needs to take the Chinese Ambassador Yao Jing's offer to increase Chinese investments and open up China's market for imports from Pakistan. Pakistan's new government led by Prime Minister Imran Khan should take immediate steps to pursue the Chinese offer. Finance Minister Asad Umar needs to form a high-powered team of top bureaucrats and leading businessmen to develop a comprehensive plan to attract investments in export-oriented industries and diversify and grow exports to China and other countries. Pakistan must make full use of its vast network of overseas diplomatic missions to promote investment and trade.

Summary:

Pakistan's exports have declined from about 15% of GDP to about 8% since 2003. The nation's trade deficits are growing at an alarming rate as the imports continue to far outstrip exports. This situation is not sustainable. Chinese Ambassador Yao Jing has offered a helping hand to increase Chinese investment and trade in Pakistan. Pakistan's new government led by Prime Minister Imran Khan should take the Chinese Ambassador's plan seriously. Finance Minister Asad Umar needs to form a high-powered team of top bureaucrats and leading businessmen on a comprehensive plan to attract investments in export-oriented industries and diversify and grow exports to China and other countries.

Related Links:

Can Pakistan Avoid Recurring Balance of Payment Crisis?

Pakistan Economy Hobbled By Underinvestment

Can Indian Economy Survive Without Western Capital Inflows?

Pakistan-China-Russia Vs India-Japan-US

Chinese Yuan to Replace US $ as Reserve Currency?

Remittances From Overseas Pakistanis

-

Comment by Riaz Haq on September 3, 2018 at 1:41pm

-

#Pakistan rules out possible #IMF bailout funds to repay #China. U.S. Secretary of State Mike #Pompeo, who is scheduled to visit Pakistan later this week, has warned that any bailout by the IMF should not include funds to pay off #Chinese #loans. #CPEC https://asia.nikkei.com/Economy/Pakistan-rules-out-possible-IMF-bai...

If the U.S. "vehemently" objects to an IMF bailout, "we are going to convince them that this money will not go to China," said Abdul Qadir Memon, Pakistan's consul general in Hong Kong. "It will go to balance our external accounts so that we are able to sustain our imports for the next year or so," he said in a question-and-answer session following a speech at the Foreign Correspondents' Club.

The country is facing a fiscal crisis and the new government of Prime Minister Imran Khan, who took office last month, is considering a bailout from the international lending agency. U.S. Secretary of State Mike Pompeo, who is scheduled to visit Pakistan later this week, has warned that any bailout by the IMF should not include funds to pay off Chinese loans. The U.S. is the largest contributor to the IMF.

Pakistan has seen its foreign exchange reserves plunge over the past two years due to ballooning international payments, partly reflecting the previous government's massive spending on infrastructure projects supported by China's Belt and Road Initiative. The $62 billion China-Pakistan Economic Corridor, or CPEC, is a flagship project in the initiative and an important investment in Pakistan's economy.

Memon rejected assertions by many that the Belt and Road Initiative was to blame for the country's financial crisis and the belief that Pakistan would go to the IMF to repay Chinese loans. "The balance of payments difficulties for Pakistan is because of high oil prices," he said. Brent crude prices have jumped nearly 50% over the past year. They were trading around $78 a barrel on Monday.

But he cautioned that an IMF bailout would come with "stringent" conditions, which could undermine the government's ability to implement policies if it agrees to the terms. The government "may opt for other resources, and [the] People's Republic of China, Saudi Arabia -- in the past we had this deferred payment imports of oil," he said, adding that the government is examining its options.

Concerns that Pakistan is falling into a debt trap with China have also extended to Sri Lanka. Last year, China wrote off more than $1 billion in debt in exchange for a long-term lease on a deep-water port in the Indian Ocean nation. Sri Lanka again is working with China's central bank for an injection of cash.

Memon said that China has shown flexibility in its negotiations with Pakistan on terms and conditions of loans. "The payback period is longer," he noted. "Pakistan has no history of default."

The consul general also addressed the news over the weekend that the U.S. had suspended $300 million in military-related funds for Pakistan, with the Department of Defense citing what it said was Islamabad's "failure to take action against terrorists," according to National Public Radio.

Memon criticized the decision, saying it was not aid for Pakistan but a payment the U.S. "owes" the country. "This is the money the United States has committed to Pakistan for providing support for the coalition logistics and air support so that the United States can fight its war on terror inside Afghanistan," he said, adding that "in our books, this is a receivable."

He called Washington's move a pressure tactic and cited the "ups and downs" of the two countries' relationship. "There has been suspicion, acrimony and, at times, hostility displayed by the U.S. leadership, but we are willing to work with them based on mutual respect, mutual trust."

-

Comment by Riaz Haq on September 3, 2018 at 5:49pm

-

Biggest #India bond inflow in 7 months fails to rescue rupee. Higher #oil prices and fears of #fiscal slippage before a general election next year have combined to make #Indian #rupee Asia’s worst performer in 2018. #Modi #BJP #economy https://www.bloomberg.com/news/articles/2018-09-03/biggest-india-bo... via @markets

Global investors in August bought the most Indian bonds in seven months, showing signs of returning to a market they’d abandoned for the better part of 2018. The inflow brought no joy for currency traders as the rupee hit multiple new lows in the past two weeks.

Funds plowed $403 million into rupee-denominated bonds after $105 million in July, amid optimism the worst of the yearlong rout that sent the local benchmark yield to its highest since 2014 is over. The streak needs to extend to chip away at this year’s outflow of $5.6 billion that has contributed to the currency weakness.

A rout in emerging-market currencies, elevated oil prices and fears of fiscal slippage before a general election next year have combined to make the rupee Asia’s worst performer in 2018. The currency capped its biggest monthly retreat in three years in August, falling past an unprecedented 71 per dollar on Friday.

Local traders polled by Bloomberg last month expect the headwinds, most notably from the price of oil, to persist.“Yields are attractive but the overall negative sentiment around emerging markets will put pressure on Indian bonds,” said Manu George, Singapore-based director of fixed income at Schroder Investment Management Ltd., which oversees $582 billion in assets. “We’re less bullish on bonds now” after recently increasing exposure to India, he said.

-

Comment by Riaz Haq on September 4, 2018 at 7:38am

-

#Indian #rupee is in a free-fall. On Sep 3, #INR closed below Rs71 per dollar mark for the first time ever. It came a mere 18 days after it ended below the key Rs70 threshold. Since January, #India's #currency has already depreciated by 10%. https://qz.com/india/1377219/ via @qzindia

Asia’s worst-performing currency is simply unable to break its fall.

On Sept. 03 the rupee closed below the Rs71 per dollar mark for the first time ever. This came a mere 18 days after it ended below the key Rs70 threshold. Since January, the Indian currency has already depreciated by 10%.

The news that the Indian economy grew at a sprightly 8.2% in the April-June period, the highest in nine quarters, provided some cushion, but only so much. “…with the environment we are in right now, the rupee is more likely to track global cues,” IFA Global, a forex advisory firm, said in a report.

Crude prices: In the past many weeks, international crude oil price, which had stabilised in the April-June quarter, has been on the rise again. In the last fortnight alone, it gained $7 per barrel and the crude oil futures were trading above $75 per barrel on Sept. 03. Considering that India imports nearly 80% of its fuel needs, rising oil prices leads to a higher dollar bill which, in turn, weakens the rupee.

Current account deficit: Rising oil prices and a weakening rupee mean that India’s current account deficit may widen to 2.8% of the GDP this financial year, up from 1.9% last year, according to a report by Nomura Research. This year, the deficit has already jumped to a nearly five-year high of $18 billion. This only adds further pressure on the rupee.

International developments: The situation in Turkey is taking a toll on currencies of the emerging markets. The Turkish lira has already lost over 40% of its value this year. Last month, the US imposed higher tariffs on imports of steel, aluminium, and other commodities from Turkey which has set off turbulence in the latter’s economy.

Besides the US-Turkey confrontation, there is also the bigger US-China trade war brewing. The two countries have also been increasing duties on each other’s goods. Some observers view this as the beginning of a new Cold War.

None of this augurs well for the Indian currency.

Passive RBI: Typically, when the rupee weakens, the central bank sells dollars from its reserves to rescue it. So far, though, the Reserve Bank of India (RBI) has not intervened aggressively to shore up the domestic currency.

“The intensity of RBI’s intervention has dissipated,” said Abheek Barua, chief economist at HDFC Bank, India’s biggest private lender. “While there is complete lack of communication from the RBI, comments from officials from the government and quasi-government agencies appear to give the impression that they support this fall in the rupee’s value in the interests of competitiveness.”

US economy: The dollar is having a good run this year due to an uptick in the US’s GDP numbers. That country’s economy grew 4.1% in the second quarter of this year, the fastest since late 2014. It has also been adding more jobs, while average wages have picked up, too.

By all indications, most of these global cues are unlikely to change much in the immediate future. So businesses and individuals in India need to brace themselves.

-

Comment by Riaz Haq on September 4, 2018 at 9:56pm

-

Manufacturing value added per capita and manufactured exports per capitaSource: United Nations Industrial Development Organization (UNIDO)

Pakistan MVA per capita 2010 $134 2015 $146

Pakistan Manufactured Exports per capita 2010 $102 2015 $94Bangladesh MVA per capita 2010 $122 2015 $182Bangladesh Manufactured Exports per capita 2010 $121 2015 $152India MVA per capita 2010 $228 2015 $298India Manufactured Exports per capita 2010 $152 2015 $186China MVA per capita 2010 $1,432 2015 $2,048China Manufactured Exports per capita 2010 $1,132 2015 $1,601

-

Comment by Riaz Haq on September 6, 2018 at 8:20am

-

Opinion: New government in Pakistan and future of CPEC

Zamir Ahmed Awan

https://news.cgtn.com/news/3d3d674d3345444d7a457a6333566d54/share_p...

It has been announced that the Chinese foreign minister, Wang Yi, will visit Pakistan from September 7-9 at the invitation of his counterpart Shah Mehmood Qureshi. Wang Yi's visit will be very important as this will be his first trip to Pakistan since the general election there on July 25.

---------------

Imran Khan constituted a nine-member high powered cabinet committee for the CPEC to be headed by the Minister of Planning, Development and Reforms Makhdoom Khusro Bakhtiar.

The members of the committee are Foreign Minister Shah Mehmood Qureshi, Minister for Law and Justice Naseem, Minister for Finance Asad Umar, Minister for Petroleum Division Ghulam Sarwar, Minister for Railway Sheikh Rashid and the PM's advisers on commerce, textiles, industry, production and investment.

The committee will focus on the CPEC and its related issues. It is a very high level and powerful committee which will focus on the progress of the projects in various areas of energy, infrastructure and industrialization.

More emphasis will be given to special economic zones (SEZs). The prime minister also has constituted several other committees on various areas like energy and privatization and an economic council.

The new government is aware of national issues and priorities. Economic development is at the top of the agenda. The CPEC is the mode of economic development in Pakistan. The government is giving China a very high priority and committed to turning CPEC into a more beneficial and fruitful endeavor for both countries.

The new government is in the stage of planning and consultation. The federal cabinet may be expanded and the induction of professionals and advisers in various positions in government are ongoing, as only a strong team can take the nation out of the crisis.

The new Minister of Planning, Development and Reform, Makhdoom Khusro Bakhtiar, held an important meeting with the Chinese Ambassador to Pakistan, Yao Jing, to discuss Pakistan-China relations and the future of CPEC.

The minister stressed the importance of creating more and more employment opportunities for the local population which he wished to tap through CPEC. They discussed how to implement China’s development model in Pakistan.

Tourism, industrialization and agriculture were identified as priority areas. Development of SEZs is in the planning stage and close consultation is going on with the Chinese to learn from their experience.

The Chinese ambassador assured the minister that he will request his government to bring Chinese investors to Pakistan to aid Pakistan's economy.

In fact, the new Government is more serious on CPEC and giving it very high importance. The Chinese side has been requested to extend its best possible cooperation to the new government and make the best use of new incentives and policies for the benefit of both countries.

A stronger and prosperous Pakistan, with Chinese assistance, may be more proud of China too. Let the two “Iron Brothers” enhance cooperation and set up an example of international friendship and cooperation for the rest of the world.

-

Comment by Riaz Haq on September 6, 2018 at 5:34pm

-

CPEC spurs Pakistan’s industrial growth, up by 5.4% in FY18

https://dailytimes.com.pk/286581/cpec-spurs-pakistans-industrial-gr...

The country’s large scale manufacturing (LSM) sector has witnessed growth of 5.38 percent during the fiscal year 2017-18 (FY18) compared to the corresponding period of last year, but, below the government’s FY18 target of 6.3 percent.

LSM grew 3.13 percent in 2015-16, 3.38 percent in 2014-15, 5.39 percent in 2013-14, 4.28 percent in 2012-13 and 5.6 percent in 2016-17.

The factors, according to the central bank, which facilitated LSM growth mainly included increased capacity utilization due to ease in energy supplies; high credit off-take owing to low interest rates; output stimulus in associated industries due to widespread construction activities; and an improved business environment on the back of CPEC related projects and favorable law and order situation.

Construction allied and consumer durable industries registered a notable growth. However, sugar industry was not able to capitalize on record sugarcane production; in stark contrast to last year, when it was the main driver of LSM growth.

The Quantum Index Numbers (QIM) of large scale manufacturing industries was recorded at 147.07 points during July-June 2017-18 against 139.55 points during same period of last year, according to latest data of Pakistan Bureau of Statistics (PBS).

The State Bank of Pakistan (SBP) said industrial production has witnessed the highest growth in the current fiscal year since FY08. The performance can be traced to noteworthy contributions from construction and manufacturing activities. Public sector development program (PSDP) and CPEC related expenditure have had a spillover impact on manufacturing sub-sectors such as steel, cement and automobiles. However, the industry could not achieve the growth target set for FY18 on account of a lower increase in gross value addition (GVA) by electricity generation and gas distribution.

The highest growth of 13.24 percent was witnessed in the indices monitored by Oil Companies Advisory Committee (OCAC) followed by Ministry of Industries with 5.04 percent and the indices of Provincial Bureaus of Statistics (PBOS) with 4.4800 percent.

On month-on-month basis, the industrial output increased by 0.51 percent in June 2018 compared to June 2017 while it decreased by 8.30 per cent if compared to May 2018.

Meanwhile, the major sectors that showed growth during the said fiscal compared to same period of the previous year, included textile (0.38 percent), food beverages & tobacco (2.78 percent), coke and petroleum products (13.24 percent), pharmaceuticals (2.94 percent), non metallic mineral products (11.04 percent), automobiles (17.78 percent), iron and steel products (21.78 percent), electronics (32.43 per cent), paper and board (9.38 percent), engineering products (7.58 per cent), and rubber products (6.21 percent).

On the other hand, the industries that witnessed negative growth include f, chemicals (0.23 percent), fertilizers (9.88 percent), leather products (0.19 percent), and wood products (37.75 percent).

The provisional QIM is being computed on the basis of the latest production data of 112 items received from sources including Oil Companies Advisory Committee (OCAC), Ministry of Industries and Production (MoIP) and Provincial Bureaus of Statistics (PBoS). OCAC provides data of 11 items, MoIP of 36 items while PBoS proved data of remaining 65 items.

-

Comment by Riaz Haq on September 6, 2018 at 5:39pm

-

50 Auto Factories' Production Improved With JICA Support

https://www.urdupoint.com/en/business/50-auto-factories-production-...

Small and Medium Enterprises Development Authority (SMEDA) has improved production systems of 50 Auto Factories with the support of Japan International Cooperation Agency (JICA).

Small and Medium Enterprises Development Authority (SMEDA) has improved production systems of 50 Auto Factories with the support of Japan International Cooperation Agency (JICA).

SMEDA Chief Executive Officer Sher Ayub disclosed this here Wednesday while commenting on second term of SMEDA-JICA joint project being run for technical support of auto parts manufacturing industry in Pakistan.

The project, he said, was being conducted in coordination with Pakistan Association of Automotive Parts and Accessories Manufacturers (PAAPAM).

He acknowledged services of the Provincial Chief SMEDA-Sindh Mukesh Kumar to make this project successful in close coordination with PAAPAM.

He said that Auto sector was one of the rapidly growing sectors in Pakistan. Its contribution towards the national economy in the form of technology transfer, employment and revenue generation is visible, he said and pointed out that the sector had a significant room to further improve quality, bring innovation and flexibility of manufacturing system which is being addressed with the support of JICA. He observed that Japan's technical support had helped the local auto parts manufacturers to get prepared for export market by improving quality and productivity of their products, as per world's requirements.

Earlier, at a ceremony held at PAAPAM Office, the SMEDA (Sindh) Provincial Chief Mukesh Kumar gave a briefing on the activities to be conducted under second term of SMEDA-JICA joint project for technical support of Auto sector in the country.

Yoshihisa Onoe - senior representative of JICA Pakistan Office, Hiroshi KANEKI - Chief of JICA Technical Team, Hiroshi SASAKI-Deputy Chief of JICA Team, Ikuta, Ishitaki, Sato (JICA Experts) and Muhammad Ashraf Sheikh, Senior Vice Chairman PAAPAM also spoke on this occasion.

Yoshihisa Onoe-the Senior Representative of JICA, in his address, assured to continue the technical support for Pakistan's industry to compete in the world market in terms of technical know-how and the modern manufacturing techniques.

He acknowledged that JICA's collaboration with SMEDA and PAAPAM had proved to be very useful for the local auto parts' manufacturing industry in Pakistan.

He was glad to note that productivity of the sector had increased to an optimal level, whereas, the rejection rates to be witnessed in the manufacturing processes had reduced to the lowest possible level. He said that the SMEs, engaged in auto parts manufacturing, had a great potential to compete the world market and assured to extend fullest technical support of JICA to impart the best practices being exercised in auto sector of the developed world.

Muhammad Ashraf Sheikh, Senior Vice Chairman (PAAPAM) appreciated SMEDA initiatives to get JICA's technical cooperation for auto parts industry.

He said that PAAPAM members had greatly availed of the assistance to increase their productivity and reduce rejection rates in their manufacturing processes. He urged SMEDA and JICA to continue the program even after completion of the set period.

-

Comment by Riaz Haq on September 9, 2018 at 4:15pm

-

#Pakistan's #PTI government led by #ImranKhan plans to review or renegotiate #CPEC agreements with #China. #Chinese FM Wang Yi visiting #Islamabad indicates #Beijing open renegotiating its 2006 trade deal with Pakistan. https://www.ft.com/content/d4a3e7f8-b282-11e8-99ca-68cf89602132

Pakistani ministers and advisers say the country’s new government will review BRI investments and renegotiate a trade agreement signed more than a decade ago that it says unfairly benefits Chinese companies.

The projects concerned are part of the $62bn China-Pakistan Economic Corridor plan — by far the largest and most ambitious part of the BRI, which seeks to connect Asia and Europe along the ancient silk road.

They include a huge expansion of the Gwadar port on Pakistan’s south coast, as well as road and rail links and $30bn worth of power plants.

“The previous government did a bad job negotiating with China on CPEC — they didn’t do their homework correctly and didn’t negotiate correctly so they gave away a lot,” Abdul Razak Dawood, the Pakistani member of cabinet responsible for commerce, textiles, industry and investment, told the Financial Times.

“Chinese companies received tax breaks, many breaks and have an undue advantage in Pakistan; this is one of the things we’re looking at because it’s not fair that Pakistan companies should be disadvantaged,” he said.

Wang Yi, Chinese foreign minister, who visited Islamabad at the weekend, indicated that Beijing could be open to renegotiating its 2006 trade deal with Pakistan. “CPEC has not inflicted a debt burden on Pakistan,” he told reporters. “When these projects get completed and enter into operation, they will unleash huge economic benefits.”

But Islamabad's second thoughts follow other recent setbacks for BRI, which is seen by many as a bid by China’s President Xi Jinping to extend Beijing’s influence throughout the world. Governments in Malaysia, Sri Lanka, Myanmar and elsewhere have already expressed reservations over the onerous terms of Chinese BRI lending and investment.

Imran Khan, the former cricket star who was elected Pakistan’s prime minister last month, has established a nine-member committee to evaluate CPEC projects. It is scheduled to meet for the first time this week and will “think through CPEC — all of the benefits and the liabilities”, said Mr Dawood, who sits on the new committee.

“I think we should put everything on hold for a year so we can get our act together,” he added. “Perhaps we can stretch CPEC out over another five years or so.”

Several other officials and advisers to the Khan government concurred that extending the terms of CPEC loans and spreading projects out over a longer timeframe was the preferred option, rather than outright cancellation.

Pakistan is in the middle of a financial crisis and must decide in the coming weeks whether to turn to the IMF for its 13th bailout in three decades, as pressure on the Pakistani rupee makes the burden of servicing foreign currency debt more onerous.

Asad Umar, Pakistan’s new finance minister, told the FT he was evaluating a plan that would allow Islamabad to avoid an IMF programme, which several people close to the government say would i nvolve new loans from China and perhaps also from Saudi Arabia.

Mr Umar and Mr Dawood both said Pakistan would be careful not to offend Beijing even as it takes a closer look at CPEC agreements signed over the past five years. Mr Khan was elected on a platform of anti-corruption and transparency and has pledged to publish details of existing CPEC contracts.

“We don’t intend to handle this process like Mahathir,” Mr Umar said, referring to the newly elected nonagenarian Malaysian prime minister who has warned about the risk of Chinese “neo-colonialism” Malaysia has cancelled three China-backed pipeline projects and put a showpiece BRI rail link under review.

-

Comment by Riaz Haq on September 14, 2018 at 8:27am

-

#Chinese buying mission to visit #Pakistan. #Chinese Ambassador in #Islamabad: “Such buying missions will be of great importance for #Pakistani #exporters and the overall export growth of the country.” #CPEC #exports #trade #China https://tribune.com.pk/story/1803428/2-chinese-buying-mission-visit...

Adviser to Prime Minister on Textile, Commerce, Industry and Production Abdul Razak Dawood has underlined the need for enhancing exports from Pakistan to China as well as to the global market.

“It will require better access to the Chinese market,” he said while talking to Chinese Ambassador Yao Jing who called on the minister on Friday.

The adviser emphasised that in addition to strong political affinity, Pakistan and China enjoyed excellent trade and commercial relations bonded further by the signing of the China-Pakistan Free Trade Agreement in 2006.

He added that agreement on the China-Pakistan Economic Corridor (CPEC) opened another dimension to the ever-growing trade and economic relations between the two countries.

Jing announced that a Chinese buying mission would visit Pakistan. “Such buying missions will be of great importance for Pakistani exporters and the overall export growth of the country,” he stressed.

Dawood appreciated China for organising the China International Import Expo, which would be held in November 2018 in Shanghai, and expressed gratitude for declaring Pakistan as the “Guest of Honour” during the event.

Both sides agreed to work more closely to build a brighter and prosperous future for the region

-

Comment by Riaz Haq on October 25, 2018 at 4:44pm

-

Joint venture: #Pakistan, #China firms to build $200m glass #manufacturing complex for production of premium, #export-quality #glass products in special economic zone. https://tribune.com.pk/story/1834085/2-joint-venture-pakistan-china...

Deli China and JW SEZ Group have joined hands for establishing a $200 million modern glass manufacturing complex in Pakistan for the production of premium, export-quality glass products.

In this regard, the groundbreaking ceremony was held at the Prime Minister’s Office where prominent businessmen, government officials and a Chinese delegation were present.

Commenting on the initiative, Prime Minister Imran Khan said initiatives like ‘Make in Pakistan’ were immensely important for the economic development of the country.

“We need to promote such initiatives and the government will fully support such projects which are aimed at producing jobs and boosting the economy,” he said. “This investment is an indication of foreign investors’ confidence in the market of Pakistan.”Pakistan, China may sign deal for investment in agriculture

The two sides have established Deli-JW Glassware Company Limited for the project. Pak-China Investment Company is facilitating Chinese investment in Pakistan and is also assisting in financing the project.

The project will utilise natural resources in Pakistan and use latest technology to convert into glassware, float glass and other kinds of glass products.

The project will be set up in the Industrial City M-3, Faisalabad whereas the unit for the processing of key raw material will be set up in Risalpur, Khyber-Pakhtunkhwa.

Pakistan needs to improve competitiveness to attract FDI

The main glass manufacturing complex will comprise glassware manufacturing units, float glass units and other value-added glass products. The groundbreaking for phase-I of the project was held on Thursday and it will start production by the end of 2019.

Twitter Feed

Live Traffic Feed

Sponsored Links

South Asia Investor Review

Investor Information Blog

Haq's Musings

Riaz Haq's Current Affairs Blog

Please Bookmark This Page!

Blog Posts

Modi's AI Spectacle: Chaos and Deception in New Delhi

The India AI Impact Summit 2026, held at Bharat Mandapam in New Delhi, has been marred by chaos, confusion and deception. The events on the ground have produced unintended media headlines for India's Prime Minister Narendra Modi who wants to be seen as the "vishwaguru" (teacher of the world) in the field of artificial intelligence as well. First, there was massive chaos on the opening day, with long…

ContinuePosted by Riaz Haq on February 19, 2026 at 12:00pm — 9 Comments

India-Pakistan Cricket Match: The Biggest Single Event in the World of Sports

Why did Pakistan's decision to boycott the India-Pakistan match in solidarity with Bangladesh in this year's T20 World Cup send shockwaves around the world? And why did it trigger the International Cricket Council's and other cricket boards' urgent efforts to persuade Pakistan to return to the match? The reason has a lot to do with its massive financial impact, estimated to be as much as …

ContinuePosted by Riaz Haq on February 11, 2026 at 4:00pm — 2 Comments

© 2026 Created by Riaz Haq.

Powered by

![]()

You need to be a member of PakAlumni Worldwide: The Global Social Network to add comments!

Join PakAlumni Worldwide: The Global Social Network