PakAlumni Worldwide: The Global Social Network

The Global Social Network

Chinese FDI Soars as CPEC Projects Begin in Pakistan

Pakistan is seeing soaring foreign direct investment (FDI) with improving security and the start of several major energy and infrastructure projects as part of China-Pakistan Economic Corridor (CPEC), according to the UK's Financial Times business newspaper.

A New High in FDI:

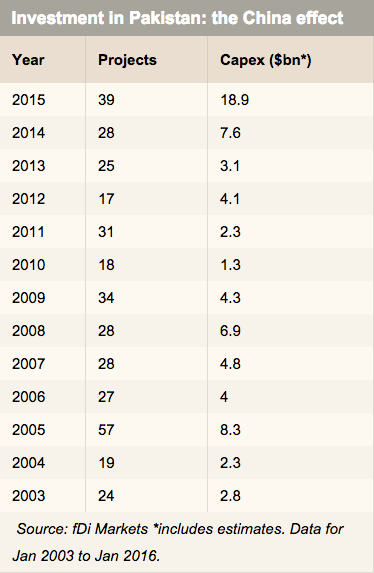

The year 2015 was a bumper year for foreign investment pouring into Pakistan, says the Financial Times. The country saw 39 greenfield investments adding up to an estimated $18.9 billion last year, according to fDi Markets, an FT data service. This is a big jump from 28 projects for $7.6 billion started in 2014, and marks a new high for greenfield capital investment into the country since fDi began collecting data in 2003.

The number of projects in 2015 is the largest since Pakistan attracted 57 greenfield projects back in 2005 on President Musharraf's watch. China is now the top source country for investment into the country, surpassing the second-ranked United Arab Emirates, primarily due to its investments in power.

|

| Top 10 Destinations of Chinese FDI 2012-14. Source: UNESCAP |

Major CPEC Projects:

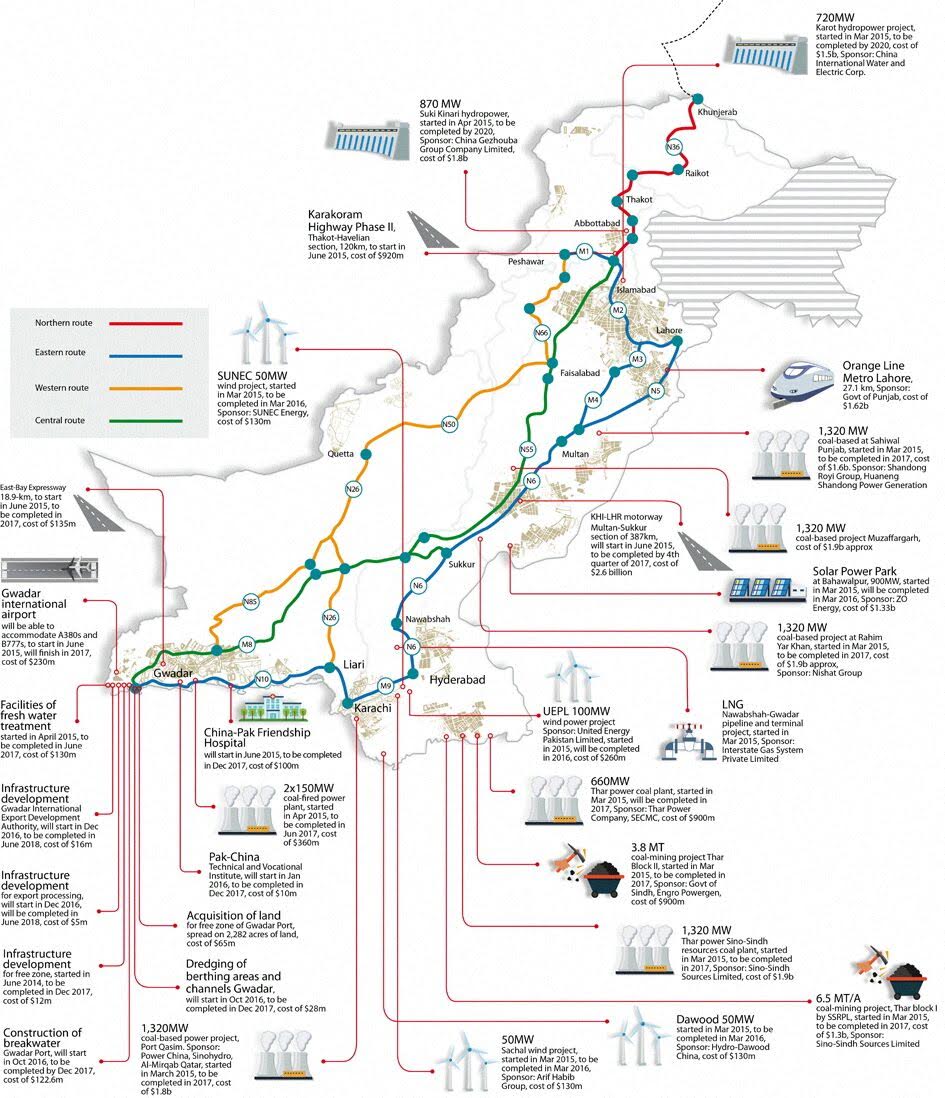

China's Shanghai Electric, a power generation and electrical equipment manufacturing company, announced plans last year to establish a 1,320 megawatt coal-based power project in Thar desert using domestic coal, scheduled to launch in 2017 or 2018. Traditional energy and power projects made up two-thirds of last year’s total greenfield investment into Pakistan at $12.9 billion with alternative energy bringing in a further $1.8 billion.

CPEC Projects |

Among the more notable projects, UAE-based Metal Investment Holding Corporation announced plans to partner with Power China E & M International to invest $5 billion to build three coal-fired plants at Karachi’s Port Qasim. In addition, the transportation sector is also showing promise, with 12 projects totaling $3 billion being announced or initiated last year.

Special Economic Zones:

Beyond the initial phase of power and road projects, there are plans to establish special economic zones in the Corridor where Chinese companies will locate factories. Extensive manufacturing collaboration between the two neighbors will include a wide range of products from cheap toys and textiles to consumer electronics and supersonic fighter planes.

The basic idea of an industrial corridor is to develop a sound industrial base, served by competitive infrastructure as a prerequisite for attracting investments into export oriented industries and manufacturing. Such industries have helped a succession of countries like Indonesia, Japan, Hong Kong, Malaysia, South Korea, Taiwan, China and now even Vietnam rise from low-cost manufacturing base to more advanced, high-end exports. As a country's labour gets too expensive to be used to produce low-value products, some poorer country takes over and starts the climb to prosperity.

Once completed, the Pak-China industrial corridor with a sound industrial base and competitive infrastructure combined with low labor costs is expected to draw growing FDI from manufacturers in many other countries looking for a low-cost location to build products for exports to rich OECD nations.

Key Challenges:

While the commitment is there on both sides to make the corridor a reality, there are many challenges that need to be overcome. The key ones are maintaining security and political stability, ensuring transparency, good governance and quality of execution. These challenges are not unsurmountable but overcoming them does require serious effort on the part of both sides but particularly on the Pakistani side. Let's hope Pakistani leaders are up to these challenges.

Summary:

Pak-China economic corridor is a very ambitious effort by the two countries that will lead to greater investment and rapid industrialization of Pakistan. Successful implementation of it will be a game-changer for the people of Pakistan in terms of new economic opportunities leading to higher incomes and significant improvements in the living standards for ordinary Pakistanis. It will be in the best interest of all of them to set their differences aside and work for its successful implementation.

Related Links:

Chinese to Set New FDI Record For Pakistan

Pak Army Completes Half of CPEC Western Route

IPPs Enjoy Record Profits While Pakistan Suffers

Can Pakistan Say No to US Aid?

Pak-China Defense Industry Collaboration Irks West

President Musharraf Accelerated Human & Financial Capital G...

China's Investment and Trade in South Asia

China Signs Power Plant Deals with Pakistan

Soaring Imports from China Worry India

Yuan to Replace Dollar in World Trade?

-

Comment by Riaz Haq on May 18, 2017 at 7:25am

-

Indian media on Bunji and Bhasha dams in Gilgit Baltistan:

China To Invest $27 Billion In Construction Of Two Mega Dams In Pakistan-Occupied Gilgit-Baltistan

https://swarajyamag.com/insta/china-pakistan-plan-for-construction-...

China and Pakistan have inked a memorandum of understanding (MoU) for the construction of two mega dams in Gilgit-Baltistan, a part of India’s Jammu and Kashmir state that remains under latter’s illegal occupation. The MoU was signed during the visit of Pakistan’s Prime Minister Nawaz Sharif to Beijing for participation in the recently concluded Belt and Road Initiative.

The two dams, called Bunji and Diamer-Bhasha hydroelectricity projects, will have the capacity of generating 7,100MW and 4,500MW of electricity respectively. China will fund the construction of the two dams, investing $27 billion in the process, a report authored by Brahma Chellaney in the Times of India has noted.

According to Chellaney, India does not have a single dam measuring even one-third of Bunji in power generation capacity. The total installed hydropower capacity in India’s part of the state does not equal even Diamer-Bhasha, the smaller of the two dams.

The two dams are part of Pakistan’s North Indus River Cascade, which involves construction of five big water reservoirs with an estimated cost of $50 billion. These dams, together, will have the potential of generating approximately 40,000MW of hydroelectricity. Under the MoU, China’s National Energy Administration would oversee the financing and funding of these projects.

-

Comment by Riaz Haq on March 21, 2018 at 7:22am

-

#Pakistan #FDI surging. Expected to reach $3.7 billion in fiscal year 2017-18 ending in June 2018. #CPEC #China #Investment

https://www.reuters.com/article/us-pakistan-economy-investment/paki...

Pakistan expects net foreign direct investment (FDI) to jump about 60 percent in 2017/2018, the chairman of Pakistan’s Board of Investment said, but some Western investors appear to be put off by China’s growing influence in the South Asian nation.

Chinese companies are building roads, power stations and a deep-water port in Pakistan after Beijing offered more than $50 billion in funding for Pakistani infrastructure as part of China’s vast Belt and Road initiative.

Chinese investment has helped spur Pakistan’s economic growth to more than 5 percent, its highest in a decade, while also increasing Beijing’s clout in Pakistan at a time when Islamabad’s relations with the United States, an historic ally, are fraying over Pakistan’s handling of Islamist militants and the conflict in Afghanistan.

Naeem Zamindar, a state minister responsible for promoting foreign investment in Pakistan, said some Western investors appeared reticent because of an incorrect perception that Chinese companies would get “exclusive advantages” and concessions that would not allow for an even playing field.

“A perception was created that the Chinese are taking over. The fact of the matter is that this is not true,” Zamindar told Reuters in his office in Islamabad.

“Pakistan’s government is very clear about it: we want investors of all hues to come in and participate in building this economy - whether American, English or Japanese.”

Zamindar said some Chinese companies building power stations had obtained soft loans but that was because the money was provided by Beijing, which made such terms a condition of its financing for projects that were part of the China-Pakistan Economic Corridor (CPEC), a key leg of the Belt and Road infrastructure network.

But for the second phase of CPEC, in which a series of Special Economic Zones (SEZs) will be set up to boost Pakistan’s industries, Chinese companies will not receive preferential treatment, Zamindar added.

“That is completely non-discriminatory,” he said, adding that Pakistan’s Special Economic Zones Act stipulates no country or company will get preferential treatment within the SEZs.

“The (SEZ) concessions are published and are on the website, open to all.”

Zamindar said net FDI for the financial year 2017/2018 (July-June) is expect to reach about $3.7 billion, with Chinese companies providing up to 70 percent of the new investment.

Net FDI has been gradually rising since 2014/2015, when it plummeted to less than $1 billion. It rose to $2.3 billion last year, according to central bank data.

Foreign direct investment is separate from the China-Pakistan Economic Corridor investments. More than 20 CPEC projects worth nearly $27 billion are currently being implemented, a senior government official told Reuters, meaning either work has begun on the projects or financing deals have been completed.

Zamindar said militant attacks were sharply down in recent years and security was much improved, but some investors are unaware of this and had an outdated “negative image” of Pakistan.

Yet overall interest in Pakistan had jumped, Zaminder said, and he would tour Britain, the United States, France and Saudi Arabia in coming weeks to promote the opportunities available in the country of 208 million people and a fast-expanding middle class.

“We are open for business.”

Comment

- ‹ Previous

- 1

- 2

- 3

- 4

- Next ›

Twitter Feed

Live Traffic Feed

Sponsored Links

South Asia Investor Review

Investor Information Blog

Haq's Musings

Riaz Haq's Current Affairs Blog

Please Bookmark This Page!

Blog Posts

Will India Grow Old Before it Gets Rich?

India's population has aged faster than expected while its economic growth has slowed over the last decade. This raises the obvious question: Will India get old before it gets rich? Is India getting poorer relative to its peers in the emerging markets? …

|

Posted by Riaz Haq on October 29, 2024 at 12:30pm

India: A Rogue State Ruled By Gangsters?

The United States and Canadian governments are alleging that Indian government agents plotted assassinations of Sikh dissidents on their soils. Their investigations paint a shocking picture of how recklessly Prime Minister Narendra Modi’s government operates. …

|

Posted by Riaz Haq on October 19, 2024 at 4:43pm — 7 Comments

© 2024 Created by Riaz Haq.

Powered by

![]()

You need to be a member of PakAlumni Worldwide: The Global Social Network to add comments!

Join PakAlumni Worldwide: The Global Social Network