PakAlumni Worldwide: The Global Social Network

The Global Social Network

Chinese FDI Soars as CPEC Projects Begin in Pakistan

Pakistan is seeing soaring foreign direct investment (FDI) with improving security and the start of several major energy and infrastructure projects as part of China-Pakistan Economic Corridor (CPEC), according to the UK's Financial Times business newspaper.

A New High in FDI:

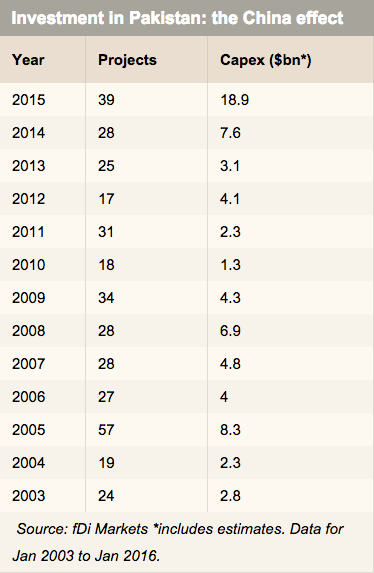

The year 2015 was a bumper year for foreign investment pouring into Pakistan, says the Financial Times. The country saw 39 greenfield investments adding up to an estimated $18.9 billion last year, according to fDi Markets, an FT data service. This is a big jump from 28 projects for $7.6 billion started in 2014, and marks a new high for greenfield capital investment into the country since fDi began collecting data in 2003.

The number of projects in 2015 is the largest since Pakistan attracted 57 greenfield projects back in 2005 on President Musharraf's watch. China is now the top source country for investment into the country, surpassing the second-ranked United Arab Emirates, primarily due to its investments in power.

|

| Top 10 Destinations of Chinese FDI 2012-14. Source: UNESCAP |

Major CPEC Projects:

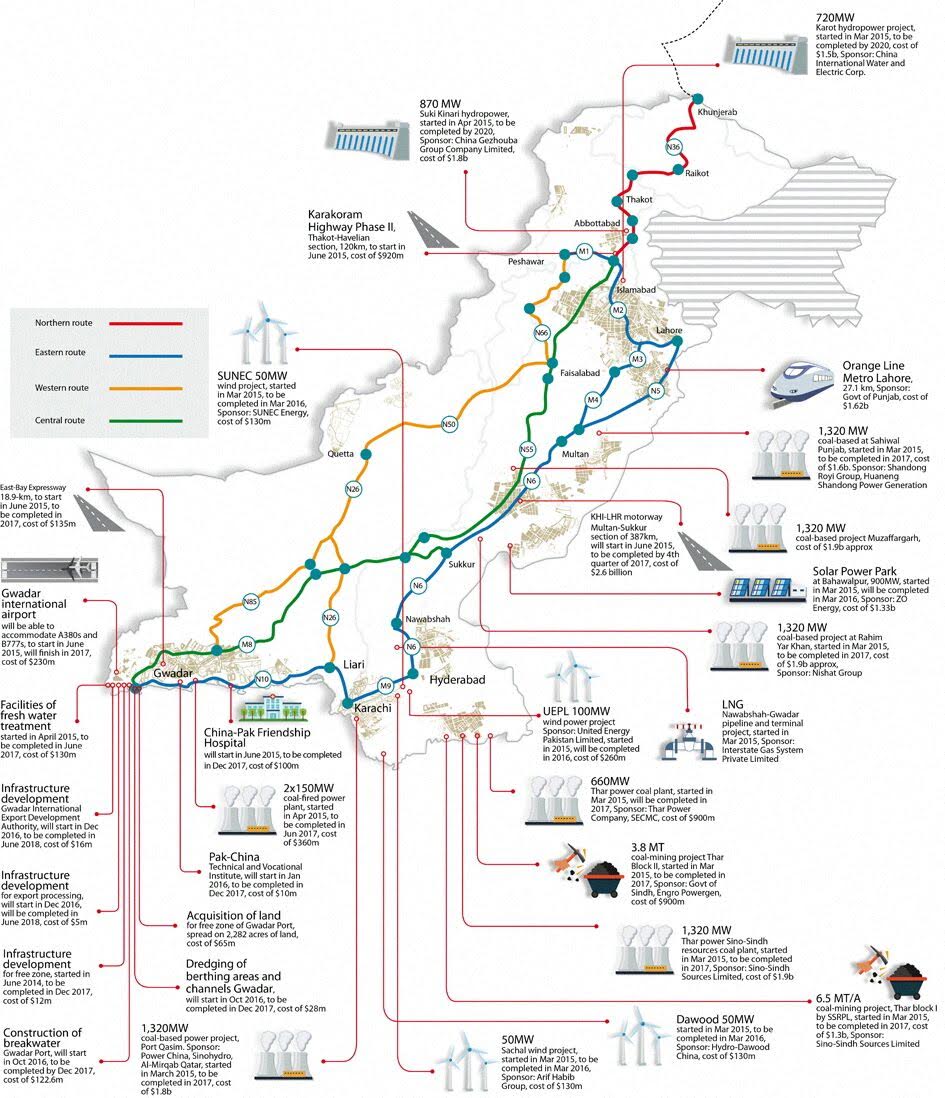

China's Shanghai Electric, a power generation and electrical equipment manufacturing company, announced plans last year to establish a 1,320 megawatt coal-based power project in Thar desert using domestic coal, scheduled to launch in 2017 or 2018. Traditional energy and power projects made up two-thirds of last year’s total greenfield investment into Pakistan at $12.9 billion with alternative energy bringing in a further $1.8 billion.

CPEC Projects |

Among the more notable projects, UAE-based Metal Investment Holding Corporation announced plans to partner with Power China E & M International to invest $5 billion to build three coal-fired plants at Karachi’s Port Qasim. In addition, the transportation sector is also showing promise, with 12 projects totaling $3 billion being announced or initiated last year.

Special Economic Zones:

Beyond the initial phase of power and road projects, there are plans to establish special economic zones in the Corridor where Chinese companies will locate factories. Extensive manufacturing collaboration between the two neighbors will include a wide range of products from cheap toys and textiles to consumer electronics and supersonic fighter planes.

The basic idea of an industrial corridor is to develop a sound industrial base, served by competitive infrastructure as a prerequisite for attracting investments into export oriented industries and manufacturing. Such industries have helped a succession of countries like Indonesia, Japan, Hong Kong, Malaysia, South Korea, Taiwan, China and now even Vietnam rise from low-cost manufacturing base to more advanced, high-end exports. As a country's labour gets too expensive to be used to produce low-value products, some poorer country takes over and starts the climb to prosperity.

Once completed, the Pak-China industrial corridor with a sound industrial base and competitive infrastructure combined with low labor costs is expected to draw growing FDI from manufacturers in many other countries looking for a low-cost location to build products for exports to rich OECD nations.

Key Challenges:

While the commitment is there on both sides to make the corridor a reality, there are many challenges that need to be overcome. The key ones are maintaining security and political stability, ensuring transparency, good governance and quality of execution. These challenges are not unsurmountable but overcoming them does require serious effort on the part of both sides but particularly on the Pakistani side. Let's hope Pakistani leaders are up to these challenges.

Summary:

Pak-China economic corridor is a very ambitious effort by the two countries that will lead to greater investment and rapid industrialization of Pakistan. Successful implementation of it will be a game-changer for the people of Pakistan in terms of new economic opportunities leading to higher incomes and significant improvements in the living standards for ordinary Pakistanis. It will be in the best interest of all of them to set their differences aside and work for its successful implementation.

Related Links:

Chinese to Set New FDI Record For Pakistan

Pak Army Completes Half of CPEC Western Route

IPPs Enjoy Record Profits While Pakistan Suffers

Can Pakistan Say No to US Aid?

Pak-China Defense Industry Collaboration Irks West

President Musharraf Accelerated Human & Financial Capital G...

China's Investment and Trade in South Asia

China Signs Power Plant Deals with Pakistan

Soaring Imports from China Worry India

Yuan to Replace Dollar in World Trade?

-

Comment by Riaz Haq on May 30, 2016 at 10:15pm

-

A newer and increasingly common option in conventional power projects involving Chinese contractors is a project finance structure

such as a BOT (build-operate-transfer). Under a BOT, developers set up and arrange loans to a special purpose vehicle (SPV) in the host country. Some 70-80% of the capital costs of construction will come from these loans, and the remainder will be provided by the developers through equity and / or other loans.

The SPV then enters into all the contracts needed for the project, including an engineering procurement construction (EPC) contract with the contractor. If the funding is from China, this EPC contract will almost always be with a Chinese contractor.

Conventional power projects are seen as particularly 'bankable' BOT projects, because the technology is usually tried and tested and there is a high likelihood that performance requirements will be met. These projects also do not generally require significant land acquisitions, or need extensive underground works, reducing the risk of delays and unforeseen problems. Many jurisdictions, in fact, now have standard form power purchase agreements and implementation agreements that offer to allocate project risks between the offtaker, the government and the developers in a split that is attractive to many lenders.

It has taken Chinese contractors some time to get used to EPC contracts under project financed structures, as these tend to be tough on the contractor. Rates of delay and performance liquidated damages, and the caps on these, are generally much higher, and the contractor's rights to additional time and cost are limited. Many of these rights have to match the power purchase agreement that the SPV has negotiated with the offtaker. However, the upside for the contractor is that the developers are often willing to pay a higher contract price in return for the contractor taking on these additional risks.

Where the finance for the project is coming from Chinese banks, the Chinese contractor may enjoy stronger bargaining power, although that is not always the case. There are plenty of Chinese contractors with the skills needed to build these power stations, and developers will often use the threat of switching negotiations to a competing contractor to get their way in negotiations.

Evolution to investment

Even before the launch of OBOR, the larger and more experienced Chinese contractors had begun the transition from a traditional contractor business model to a 'contractor plus investment' model. Now, the signs are that a significant proportion of OBOR projects will involve Chinese contractors making investments in the projects that they are engaged to construct, and conventional power projects have been among the first to use this structure.

The China Pakistan Economic Corridor (CPEC) has been among the first to see innovative project structures. The Thar Coal Block II project involves the development of an open pit coal mine and 660MW mine mouth power station through two SPVs set up by a consortium of Pakistani and Chinese investors, including a major Chinese contractor who will act as both EPC contractor and SPV equity participant. Project finance loans, including conventional RMB and Rupee Islamic tranches, are provided by syndicates of Pakistani and Chinese lenders including Habib Bank, United Bank, China Development Bank, Industrial and Commercial Bank of China and Construction Bank of China.

- See more at: http://www.conventuslaw.com/report/chinas-one-belt-one-road-policy-...

-

Comment by Riaz Haq on June 3, 2016 at 7:51am

-

#Pakistan Budget Seeks Decade-High #GDP Growth as #IMF Loan Nears End http://bloom.bg/1sr7q1R via @business

Pakistan is targeting the fastest growth in more than a decade, proposing cutting taxes to boost exports and support farmers in its spending plan as it wraps up a three-year, $6.6 billion International Monetary Fund loan program.

Pakistan proposed a zero-rated sales tax regime for five export industries, including textiles, leather, surgical instruments, sports goods and carpets, Finance Minister Ishaq Dar said Friday while presenting the government’s 4.89 trillion rupee ($46.7 billion) budget for the fiscal year starting July 1. The fiscal deficit is estimated to decrease to 3.8 percent next year from an estimated 4.3 percent, he said. The spending plan will probably be approved by Parliament this month.

“In three years we have achieved stability, now we will go for growth,” Dar said in Parliament in Islamabad. “We need to increase growth and jobs opportunities.”

Gross domestic product is forecast to expand 5.7 percent in the year starting July 1 on higher infrastructure spending, Prime Minister Nawaz Sharif said this week ahead of the budget presentation.

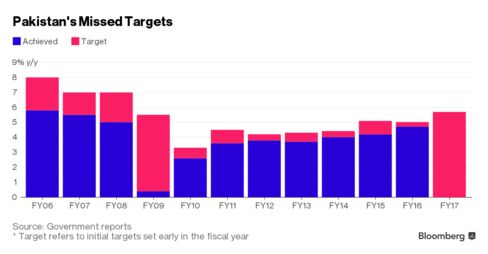

If Sharif is successful, it will be the first time in at least a decade that any Pakistani government has hit a growth target. Nonetheless, the economy’s accelerating expansion since he took office in 2013 has put Pakistan’s stocks and currency among Asia’s best performers during that time.

For the coming year, Sharif aims to spend 1.68 trillion rupees to build roads, dams and ports, a 14 percent increase. The nation is also looking to add power plants to end electricity shortages in two years, while also maintaining a fight against militants who have killed 60,000 people since 2001.

Investments from China are also set to rise. The $45 billion China Pakistan Economic Corridor is getting under way and will contribute to growth, Sharif said last month.

“Chinese investment will start kicking in that will help end the energy crisis and there is a possibility of a rebound in agriculture,” said Yawar uz Zaman, head of research at Karachi-based Shajar Capital Pakistan Pvt. Even so, the government may struggle to reach its target, he said.

As always in Pakistan, risks are ever present. Sharif’s efforts to privatize entities like Pakistan International Airlines Corp. have also met resistance. A recent tax amnesty to boost government revenues flopped, and an interest-rate cut by the State Bank of Pakistan last month as inflation quickened caught investors by surprise.

‘Looks Difficult’

“There is a disconnect between the State Bank’s narrative and the cut,” said Sakib Sherani, chief executive officer at Islamabad-based research company Macroeconomic Insights Ltd., referring to looser monetary policy at a time when price pressures are seen rising. “There will be growth but a major breakthrough -- as they wish to achieve near 6 percent -- that looks difficult.”

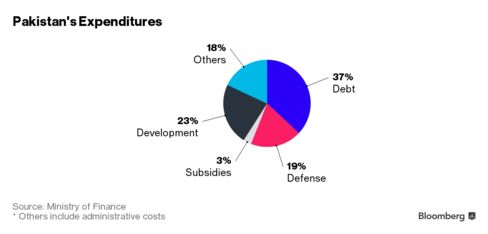

The military also eats up about a fifth of total spending. The defense budget has been increased 11 percent to 860 billion rupees and a separate 100 billion rupees is allocated for a military offensive against militants and to support people displaced by the operations, Dar said.

Even so, analysts see Sharif sticking broadly to the IMF targets as the program concludes. All end-March 2016 quantitative performance criteria, including the budget deficit target and the floor on the central bank’s net international reserves, have been met, the IMF said May 12.

“They will remain disciplined,” said Raza Jafri, director, research and development, at Intermarket Securities Ltd. “The IMF program will be ending but you are still getting a lot of money from Asian Development Bank and World Bank.”

-

Comment by Riaz Haq on June 3, 2016 at 9:10am

-

#Pakistan budget targets #tax revenue rise to $37.8b, hold deficit at 3.8% of #GDP, down from 4.3% now. http://reut.rs/25Eymg8 via @Reuters

Pakistan is targeting a 16 percent rise in tax revenues in the year ending June 2017, Finance Minister Ishaq Dar said on Friday as he unveiled a budget aimed at shoring up the South Asian country's finances.

Dar said Pakistan would target a fiscal deficit of 3.8 percent of gross domestic product for the coming financial year, down from the 4.3 percent envisaged for this year.

He told parliament that the aim was to push Pakistan's persistently low tax-to-GDP ratio to above 10 percent and raise revenues from taxation to 3.95 trillion rupees ($37.8 billion)from 3.42 trillion this year. Pakistan's financial year runs from July to June.

Pakistan's economy grew at an estimated 4.7 percent in the year to June 2016 - short of the government's 5.5 percent target but the highest rate for eight years - after a slide in oil prices and growth in industry and services boosted demand.

Investor confidence has slowly returned to a country that was battered by the global financial crisis.

But the economy remains structurally weak, hamstrung by poor infrastructure, the threat of militant violence and narrow tax base.

Successive governments have promised to rein in tax evaders and boost revenues but face fierce resistance to change, including from the many politicians and businessmen believed to be among those dodging their taxes. ($1 = 104.6000 Pakistani rupees)

-

Comment by Riaz Haq on September 17, 2016 at 10:22am

-

#Kuwait wins approval for setting up #oil refinery in #Balochistan #Pakistan #FDI

http://tribune.com.pk/story/1179648/kuwait-wins-approval-setting-oi...Economic managers of Pakistan have given the go-ahead to Kuwait Petroleum Corporation for setting up an oil refinery in the coastal area of Balochistan – a welcome investment initiative for the largely under-developed province, which will reduce the need for import of refined petroleum products in the country.

The Economic Coordination Committee (ECC), the highest economic decision-making body, took the decision in a meeting held on September 7 in response to Kuwait Petroleum’s interest in pouring capital into setting up a refinery in Balochistan, said an official aware of developments.

Chinese company keen to set up oil refinery

The ECC also decided to seek an extension in the timeframe for oil import credit facility from three to four months in an effort to ease pressure on the country’s foreign currency reserves. It directed Pakistan State Oil (PSO), the state oil marketing giant, to try and persuade Kuwait Petroleum to extend the existing credit facility from 90 to 120 days or even more.

In another decision, the ECC permitted import of furnace oil and jet fuel from Kuwait without resorting to competitive bidding. At present, PSO imports diesel from the Gulf Arab state on 90-day deferred payment.

A representative of the Ministry of Petroleum and Natural Resources, who was present in the ECC huddle, said before the year 2000, Pakistan purchased diesel from Kuwait under a long-term contract with the Gulf state’s government.

However, in the wake of market deregulation, Pakistan government in 2001-02 asked PSO to enter into a fuel supply contract with Kuwait Petroleum. Immediately after that, the two sides inked an agreement for the sale and purchase of high-speed diesel only with payment guarantees from the government of Pakistan. Now, this agreement has been in place for the last around 15 years.

Earlier, Kuwait Petroleum had expressed interest in exporting furnace oil and jet fuel as part of the existing arrangement and was looking to install an oil refinery in the coastal area of Balochistan with storage facilities.

‘Pakistan has received Rs1.6tr as investment in oil and gas sector’

“Pakistan and Kuwait have an old bilateral relationship in terms of oil trade and Kuwait Petroleum is a time-tested supplier, well-reputed for the most economical supplies, product quality and supply security,” an official told the ECC meeting.

The Ministry of Petroleum and PSO suggested that furnace oil and jet fuel could be included in the existing sale and purchase contract by making an addition to it.

This could be done by invoking rule-5 of the Public Procurement Regulatory Authority (PPRA) Rules 2004, which provides for waiving mandatory public procurement procedures in case of an international or inter-governmental commitment of the federal government.

The ministry took up the matter with the PPRA and Law and Justice Division for legal advice.

Later, the PPRA endorsed the proposal. The Law Division, on its part, pointed out that the contract was linked with the agreement between Pakistan government and Kuwait Petroleum and new products could be added. Therefore, it would be treated and read as an integral part of the existing contract.

After examining the proposal from legal point of view, the Law Division cleared it subject to meeting all formalities.

-

Comment by Riaz Haq on January 17, 2017 at 8:00am

-

Foreign Direct #Investment #FDI in #Pakistan Crosses $1 Billion in first 6 months of Fiscal Year 2016-17. #CPEC

http://dunyanews.tv/en/Business/370802-Foreign-Direct-Investment-in...

Foreign investment in the country flourished after a long pause and a growth of 10 percent to $1.080 billion was recorded in the six months of the current fiscal year, the State Bank of Pakistan data showed.

The economic measures according to an analyst started paying some dividends as after a long gap in the first six months the barrier of $1 billion has been crossed. However, the stock market was on the losing side as the foreign fund managers repatriated their investment during July to December period. Outflow from the Pakistan Stock Exchange stood around $254 million as against $236 million of the same period last year or 2015.

There has been general tendency among the foreign fund houses to pull out from the emerging markets as they felt that with the rising interest rates and hope of further rise in the US in 2017, the best option to park their funds would be the US treasury or bonds.

Another analyst said that foreign direct investment recorded increase because of one time arrival of payment received from the Netherland as they bought majority of stakes of Engro Foods amounting to $464 million. Another factor which increased the net foreign investment climbing by 52.5 percent to $1.804 billion was the issuance of the Euro Bonds by the government during the period.

The government and economists mostly bet on China Pakistan Economic Corridor (CPEC) as the project would yield around $5 billion dollars year in the coming years.

-

Comment by Riaz Haq on February 28, 2017 at 2:24pm

-

Chinese investors are contemplating to build a chemical and automobile city in Gwadar under the umbrella of #CPEC

https://tribune.com.pk/story/1341071/gwadar-china-build-automobile-...

Chinese investors are contemplating to build a chemical and automobile city in Gwadar under the umbrella of the China-Pakistan Economic Corridor (CPEC).

According to a private news channel, sources linked to CPEC project stated that the Chinese authorities have already initiated paperwork on said projects, which reflects their seriousness.

Analysts have advised owners of local automobile industry to start joint ventures with Chinese as this would help in transfer of technology as well as boost the local industry. Earlier, China announced to set up a steel factory under CPEC apart from various other projects.

China is developing the Gwadar port as a strategic and commercial hub under its ‘One-Belt One-Road’ initiative that promises shared regional prosperity. CPEC is one of many arteries of the ‘One-Belt One-Road’

In 2013, Pakistan handed over the Gwadar port to the Chinese company by annulling a deal with a Singapore company that could not develop the port after taking over in 2007. The ECC further approved amendments in the Gwadar Port Concession Agreement for operating and developing the Gwadar port and free zone.

On October 31, hundreds of Chinese trucks loaded with goods rolled into the Sost dry port in Gilgit-Baltistan as a multibillion-dollar project between Pakistan and China formally became operational.

The corridor is about 3,000-kilometre long consisting of highways, railways and pipelines that will connect China’s Xinjiang province to the rest of the world through Gwadar port.

-

Comment by Riaz Haq on May 15, 2017 at 4:50pm

-

Exclusive: CPEC master plan revealed

https://www.dawn.com/news/1333101

In any plan, the question of financial resources is always crucial. The long term plan drawn up by the China Development Bank is at its sharpest when discussing Pakistan’s financial sector, government debt market, depth of commercial banking and the overall health of the financial system. It is at its most unsentimental when drawing up the risks faced by long term investments in Pakistan’s economy.

The chief risk the plan identifies is politics and security. “There are various factors affecting Pakistani politics, such as competing parties, religion, tribes, terrorists, and Western intervention” the authors write. “The security situation is the worst in recent years”. The next big risk, surprisingly, is inflation, which the plan says has averaged 11.6 per cent over the past 6 years. “A high inflation rate means a rise of project-related costs and a decline in profits.”

Efforts will be made, says the plan, to furnish “free and low interest loans to Pakistan” once the costs of the corridor begin to come in. But this is no free ride, it emphasizes. “Pakistan’s federal and involved local governments should also bear part of the responsibility for financing through issuing sovereign guarantee bonds, meanwhile protecting and improving the proportion and scale of the government funds invested in corridor construction in the financial budget.”

It asks for financial guarantees “to provide credit enhancement support for the financing of major infrastructure projects, enhance the financing capacity, and protect the interests of creditors.” Relying on the assessments of the IMF, World Bank and the ADB, it notes that Pakistan’s economy cannot absorb FDI much above $2 billion per year without giving rise to stresses in its economy. “It is recommended that China’s maximum annual direct investment in Pakistan should be around US$1 billion.” Likewise, it concludes that Pakistan’s ceiling for preferential loans should be $1 billion, and for non preferential loans no more than $1.5 billion per year.

It advises its own enterprises to take precautions to protect their own investments. “International business cooperation with Pakistan should be conducted mainly with the government as a support, the banks as intermediary agents and enterprises as the mainstay.” Nor is the growing engagement some sort of brotherly involvement. “The cooperation with Pakistan in the monetary and financial areas aims to serve China’s diplomatic strategy.”

The other big risk the plan refers to is exchange rate risk, after noting the severe weakness in Pakistan’s ability to earn foreign exchange. To mitigate this, the plan proposes tripling the size of the swap mechanism between the RMB and the Pakistani rupee to 30 billion Yuan, diversifying power purchase payments beyond the dollar into RMB and rupee basket, tapping the Hong Kong market for RMB bonds, and diversifying enterprise loans from a wide array of sources. The growing role of the RMB in Pakistan’s economy is a clearly stated objective of the measures proposed.

-

Comment by Riaz Haq on May 15, 2017 at 10:45pm

-

#China and #Pakistan sign US$50 billion MoU for #Indus River Cascade. #Bhasha #Dasu #Patan #Thakot Dams. #CPEC http://www.hydroworld.com/articles/2017/05/china-and-pakistan-sign-... China and Pakistan signed a US$50 billion memorandum of understanding (MoU) on May 13 to develop and complete the Indus River Cascade, according to information from the China-Pakistan Economic Corridor (CPEC). The MoU was one of several signed related to improving and developing Pakistan’s infrastructure.Yousuf Naseem Khokhar, Pakistan’s Water and Power Development Authority (WAPDA) secretary for Water and Power, and Chinese Ambassador in Pakistan, Sun Weidong, signed the MoU under the CPEC agreement during the Diamer-Bhasha Project Conference hosted by China’s National Energy Administration (NEA) in Beijing, China.Under the MoU, China’s NEA would oversee building and funding the five hydropower projects that have an estimated total installed generation capacity of 22,320 MW and according to WAPDA, the Indus River has a potential of producing 40,000 MW.The Indus River Cascade begins from Skardu in Gilgit-Baltistan and runs through Khyber Pakhtunkhwa, both located in the northwestern portion of Pakistan. Overall, Pakistan has identified a potential of 60,000 MW from hydropower projects.The planned cascade includes the 4,500-MW Diamer-Basha project, which is already being constructed and four additional projects being developed: 2,400-MW Patan; 4,000-MW Thakot; 7,100-MW Bunji; and 4,320-MW Dasu.In April, WAPDA awarded a pair of contracts to perform resettlement works associated with construction of the two-stage Dasu hydropower project to China's Zhongmei Engineering Group, worth about $18.56 million combined. The work includes the resettlement of Barseen, Kaigah, Khoshe, Logro, Nasirabad and Uchar.WAPDA said the resettlement package includes utilities, roads and other amenities including schools, livestock accommodations and recreational areas.In February, WAPDA announced it finalized the main contracts for civil works for stage-1 of the Dasu project, which is 2,160 MW. The Dasu hydropower stage-I project is estimated to cost about $4.2 billion and is located on the Indus River in the Kohsitan district of Khyber Pakhtunkhwa. Its location is about 240 km upstream of the 3,480-MW Tarbela hydropower complex and 74 km downstream from the Diamer-Basha site.According to CPEC information, funding the Indus River Cascade represents China’s second-largest investment in Pakistan following $57 billion already committed to several infrastructure improvements under the CPEC.

-

Comment by Riaz Haq on May 17, 2017 at 7:56am

-

Behind China’s $1 Trillion Plan to Shake Up the Economic Order

https://www.nytimes.com/2017/05/13/business/china-railway-one-belt-...

VANG VIENG, Laos — Along the jungle-covered mountains of Laos, squads of Chinese engineers are drilling hundreds of tunnels and bridges to support a 260-mile railway, a $6 billion project that will eventually connect eight Asian countries.

Chinese money is building power plants in Pakistan to address chronic electricity shortages, part of an expected $46 billion worth of investment.

Chinese planners are mapping out train lines from Budapest to Belgrade, Serbia, providing another artery for Chinese goods flowing into Europe through a Chinese-owned port in Greece.

The massive infrastructure projects, along with hundreds of others across Asia, Africa and Europe, form the backbone of China’s ambitious economic and geopolitical agenda. President Xi Jinping of China is literally and figuratively forging ties, creating new markets for the country’s construction companies and exporting its model of state-led development in a quest to create deep economic connections and strong diplomatic relationships.

------------

China is moving so fast and thinking so big that it is willing to make short-term missteps for what it calculates to be long-term gains. Even financially dubious projects in corruption-ridden countries like Pakistan and Kenya make sense for military and diplomatic reasons.

The United States and many of its major European and Asian allies have taken a cautious approach to the project, leery of bending to China’s strategic goals. Some, like Australia, have rebuffed Beijing’s requests to sign up for the plan. Despite projects on its turf, India is uneasy because Chinese-built roads will run through disputed territory in Pakistan-occupied Kashmir.

-----------

The power plants in Pakistan, as well as upgrades to a major highway and a $1 billion port expansion, are a political bulwark. By prompting growth in Pakistan, China wants to blunt the spread of Pakistan’s terrorists across the border into the Xinjiang region, where a restive Muslim population of Uighurs resides. It has military benefits, providing China’s navy future access to a remote port at Gwadar managed by a state-backed Chinese company with a 40-year contract.

Many countries in the program have serious needs. The Asian Development Bank estimated that emerging Asian economies need $1.7 trillion per year in infrastructure to maintain growth, tackle poverty and respond to climate change.

-

Comment by Riaz Haq on May 17, 2017 at 10:43pm

-

China takes ‘project of the century’ to Pakistan

As part of its ‘One Belt, One Road’ project Beijing is pumping $55bn into its neighbour amid doubts over who really benefits

https://www.ft.com/content/05979e18-2fe4-11e7-9555-23ef563ecf9a

The leak of China’s original proposals for the CPEC agreement in the Pakistan newspaper Dawn this week heightened fears. The terms prioritise the industrial ambitions of the Xinjiang Production and Construction Corps, a quasi-

military organisation vital to Beijing’s oil and security policies which also dominates the agricultural economy of the frontier region of Xinjiang.

Comparing it with the trading organisation that paved the way for British rule in India, the head of a large investment company in Pakistan says: “We have to be careful if we don’t want this to turn into a repeat of the East India Company. If we squander it, it will.”

China wants to complete four main tasks via CPEC: expand the Gwadar port on Pakistan’s south coast, which it financed, built and owns, build a fleet of power plants, construct road and rail links and set up special economic zones where companies can enjoy tax breaks and other business incentives.

-----------

In building infrastructure, Beijing is doing for Pakistan what Islamabad has been unable to do for itself, especially as far as power generation is concerned. Peak electricity demand in Pakistan is 6 gigawatts greater than it can generate — equivalent to about 12 medium-sized coal power plants. Blackouts in many parts of the country last for several hours a day.

To meet this shortfall China is expected to spend more than $35bn — about two-thirds of the entire CPEC budget — building or helping to construct 21 power plants, which will be mainly fuelled by coal. The combined 16GW of capacity that they could provide would repair Pakistan’s supply gap twice over.

The building work associated with CPEC has already boosted heavy industry in the country. Arif Habib, one of the country’s biggest business conglomerates, says it is trebling its cement production in anticipation of CPEC.

“China will expand the [economic] pie,” says Ahsan Iqbal, Pakistan’s planning minister. “This project will create new [domestic] demand.”

------

------

“The risk is that down the line China will call the shots and that we will pay the price later,” says Syed Murad Ali Shah, the chief minister of Sindh, the province in which Karachi is located. “It is up to us.”

The Chinese plan, revealed by Dawn newspaper to have been delivered in December 2015, has only added to those concerns. It talks about thousands of acres of agricultural land leased out to Chinese enterprises to develop seed varieties and irrigation technology. It would install a full system of monitoring and surveillance in cities from Peshawar to Karachi, with 24-hour video recordings on roads. It would build a national network of fibre-optic cables to boost internet access.

Key to this is the XPCC. Under the plan the Han Chinese economic and paramilitary organisation is mandated to invest in Pakistan as a springboard for economic development around Kashgar, the heartland of 11m Turkic-speaking Muslims known as Uighurs.

Ministers in Islamabad say the document contains proposals originally drawn up by Beijing, but will not say how far the draft agreements, which are still being negotiated, differ from it.

----------------

Whatever the concerns in Pakistan that Islamabad is ceding too much power to China, many in the business and political communities argue that the benefits from the infrastructure projects are well worth it.

“Pakistan requires money and money has no colour,” Kimihide Ando, head of Mitsubishi Corp in Pakistan, says.

Others argue that, following the problems with the free-trade agreement, Pakistan’s ministers will be more savvy this time. “The Chinese have taken us for a ride [before] but we have let them,” says Ehsan Malik, chief executive of the Pakistan Business Council. “Given we have made huge mistakes before, hopefully we will learn this time.”

Comment

- ‹ Previous

- 1

- 2

- 3

- 4

- Next ›

Twitter Feed

Live Traffic Feed

Sponsored Links

South Asia Investor Review

Investor Information Blog

Haq's Musings

Riaz Haq's Current Affairs Blog

Please Bookmark This Page!

Blog Posts

Pakistanis' Insatiable Appetite For Smartphones

Samsung is seeing strong demand for its locally assembled Galaxy S24 smartphones and tablets in Pakistan, according to Bloomberg. The company said it is struggling to meet demand. Pakistan’s mobile phone industry produced 21 million handsets while its smartphone imports surged over 100% in the last fiscal year, according to …

ContinuePosted by Riaz Haq on April 26, 2024 at 7:09pm

Pakistani Student Enrollment in US Universities Hits All Time High

Pakistani student enrollment in America's institutions of higher learning rose 16% last year, outpacing the record 12% growth in the number of international students hosted by the country. This puts Pakistan among eight sources in the top 20 countries with the largest increases in US enrollment. India saw the biggest increase at 35%, followed by Ghana 32%, Bangladesh and…

ContinuePosted by Riaz Haq on April 1, 2024 at 5:00pm

© 2024 Created by Riaz Haq.

Powered by

![]()

You need to be a member of PakAlumni Worldwide: The Global Social Network to add comments!

Join PakAlumni Worldwide: The Global Social Network