PakAlumni Worldwide: The Global Social Network

The Global Social Network

Comprehensive Energy Plan Crucial to Pakistan's Future

Since the middle of the 18th century, the Industrial Revolution has transformed the world. Energy-hungry machines are now doing more and more of the work at much higher levels of productivity than humans and animals who did it in pre-industrial era. In recent years, the rapid growth in computers and mobile phones spawned by the Information and Communications Technology (ICT) revolution has further increased demand for energy. Currently somewhere between 5-10% of

electrical consumption is for ICT and it's likely to continue to grow rapidly.

Energy Consumption:

Energy consumption in this day and age generally indicates a nation's level of industrialization, productivity and standards of living. Going by this yardstick, Pakistan's 14 million BTUs per capita consumption in 2009 indicates that the country has a long way to go to achieve levels comparable with the world average productivity signified by 71 million BTUs per capita as estimated by US Energy Information Administration for 2009.

Regional Comparison:

Although Pakistan's 14 million BTUs per capita energy use is ahead of Bangladesh's 6 million BTUs and Sri Lanka's 10 million BTUs, it is less than India's 18 million BTUs, and far behind China's 68 million BTUs and Malaysia's 97 million BTUs.

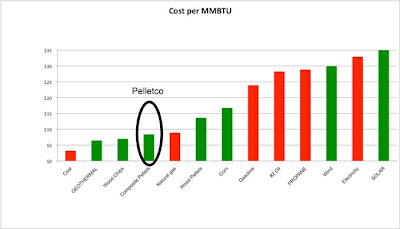

Energy Costs:

Fossil fuels are currently the primary source of the bulk of energy used. Cost of producing energy from various fossil fuels ranges from $2-4 per million BTUs for coal to $19-20 per million BTUs from oil. Costs of energy from natural gas vary widely depending on the source. Cost of shale gas in the United States has plummeted to about $2 per million BTU recently, while Pakistan has signed agreements to purchase gas from Iran and Turkmenistan in the range of $10 to $12 per million BTUs. Cost of production of domestic natural gas is in the range of $2 to $4 per million BTU.

Impact on Economy:

Energy costs have had a huge impact on Pakistan's economy. Its heavy dependence on imported oil has been a big contributor to balance of payments crises in the past. In 2008, for example, the oil prices jumped from less than $50 a barrel to $150 a barrel and forced the country to seek IMF bailout. Pakistan oil import bill has increased from about $7 billion in 2007 to over $12 billion in 2011. Energy shortages have also put a significant dent in Pakistan's GDP growth.

Pakistan's Fuel Options:

If Pakistan could generate all of the 14 million BTUs of energy per capita from coal, the cost would be $28 to $56 for each person. Alternatively, the cost of using oil for the entire production would add up to about $280 per person, a significant chunk of Pakistan's per capita income of $1372 in 2011-12. The costs therefore range from a low of $28 to a high of $280 per Pakistani.

Energy Policy Suggestions:

As the nation develops and the energy demand increases, the policy makers have to try and produce as much of the needed energy at costs closer to the low-end of the range from $2 to $20 per million BTUs. Here are some policy suggestions for Pakistan's energy policy going forward:

1.

Develop Pakistan's shale gas reserves estimated at 51 trillion cubic feet near Karachi in southern Sindh province. The US experience has shown that

investment in shale gas can increase production quite rapidly and prices

brought down from about $12 per mmBTU in 2008 to under $2 per mmBTU

recently. Pursuing this option requires US technical expertise and

significant foreign investment on an accelerated schedule.

2.

Increase production of gas from nearly 30 trillion cubic feet of

remaining conventional gas reserves. This, too, requires significant

investment on an accelerated schedule.

3. Convert

some of the idle power generation capacity from oil and gas to imported

coal to make electricity more available and affordable.

4.

Utilize Pakistan's vast coal reserves in Sindh's Thar desert. The

problem here is that the World Bank, Asian Development Bank and other

international financial institutions (IFIs) are not lending for coal

development because of environmental concerns.And the Chinese who were

showing interest in the project have since pulled out.

5. Invest in hydroelectric and other renewables including wind and solar. Several of

these projects are funded and underway but it'll take a while to bring

them online to make a difference.

6. Curb widespread power theft, improve collection of electricity dues from consumers, and resolve spiraling circular debt to make Pakistan's energy sector attractive to domestic and foreign investors.

Energy Conservation:

In addition to significantly increasing energy production, Pakistan needs to take prudent steps to conserve by promoting the use of energy-saving electric bulbs and machines. Concerns about the environment have propelled many developed nations to cut energy consumption in recent years. For example, serious conservation efforts have reduced Japan's 172 million BTUs per capita in 2009 down from 178 in 2005, Germany is at 163 million BTUs in 2009 down from 175 in 2005, and the United States is down to 308 million BTUs in 2009 from 340 million BTUs per person per year in 2005.

Summary:

Instead of addressing different pieces of the energy puzzle in an ad hoc fashion under multiple ministries and bureaucracies fighting turf battles, Pakistani policy makers need to look at the big picture for the sake of the nation's future. Nothing short of a holistic approach with a comprehensive energy policy formulated and implemented under a competent and powerful energy czar will do.

Related Links:

Haq's Musings

US EIA International Data on Per Capita Energy Consumption

Affordable Fuel for Pakistan's Electricity

Pakistan Needs Shale Gas Revolution

US Census Bureau's International Stats

Pakistan's Vast Shale Gas Reserves

US AID Overview of Pakistan's Power Sector

US Can Help Pakistan Overcome Energy Crisis

Abundant and Cheap Coal Electricity

US Dept of Energy Report on Shale Gas

Pakistan's Twin Energy Crises

Pakistan's Electricity Crisis

Pakistan's Gas Pipeline and Distribution Network

Pakistan's Energy Statistics

US Department of Energy Data

Electrification Rates By Country

CO2 Emissions, Birth, Death Rates By Country

China Signs Power Plant Deals in Pakistan

Pakistan Pursues Hydroelectric Projects

Pakistan Energy Industry Overview

Energy from Thorium

Comparing US and Pakistani Tax Evasion

Pakistan's Oil and Gas Report 2010

Circular Electricity Debt Problem

International CNG Vehicles Association

Rare Earths at Reko Diq?

Lessons From IPP Experience in Pakistan

Correlation Between Human Development and Energy Consumption

-

Comment by Riaz Haq on June 12, 2012 at 6:44pm

-

Here's a BR story on latest energy consumption figures in Pakistan:

The primary energy supply in the country has witnessed 2.3 per cent increase during current fiscal year as compared to last year.

The availability of energy per capita remained 0.372 TOE (14.76 million BTUs using conversion factor of 39.68 million BTUs equals 1 TOE) during the year as compared to 0.371 TOE in 2010, posting a positive growth rate of 0.16 percent.

An official source on Tuesday said due to population growth rate of almost two per cent, the balance between energy supply and emerging needs was outset.

He said analysis of composition of final energy supplies in the country suggests that the supply of coal during last ten years grew at an average rate of 7.5 per cent per annum followed by gas, electricity, petroleum products and crude oil with average growth rates of 5.7 per cent, 3.4 per cent, 2.1

http://www.brecorder.com/pakistan/industries-a-sectors/61840-primar...

http://www.businessdictionary.com/definition/tonne-of-oil-equivalen...

-

Comment by Riaz Haq on June 16, 2012 at 8:22am

-

Here's World Bank economist's assessment of Pak competitiveness, according to The News:

Pakistan needs to improve its competitiveness for rapid industrialisation, which offers it a range of potential benefits, including more jobs creation, tax revenues and economic growth, said Dan Biller, World Bank’s lead economist on South Asia Region for Sustainable Development.

Addressing businessmen in Lahore, he said that the GDP growth of Pakistan in 2011 was only 24 percent, while China grew at 9.2 percent, India 7.8 percent, Sri Lanka at eight percent, Indonesia 6.4 percent and Malaysia 5.2 percent.

Among all these countries, Pakistan has the largest agricultural share of GDP and smallest industrial share, he said.

Biller said that lower industrialisation in Pakistan against other regional countries is due to its lower competitiveness, adding that Pakistan ranks poorly on the Global Competitive Index of the World Economic Forum. Pakistan’s institutions are weak, scoring 3.4 points out of 10, he said, adding that Malaysia score 5.2 points, China 4.3 points, India 3.8 points, Indonesia 3.8 points and Sri Lanka scored 4.2 points on quality of institutions.

Biller said that Pakistan’s score in infrastructure was dismal 2.8 points, while Malaysia scored 5.5, China 4.3, India 3.6, Indonesia 3.8 and Sri Lanka scored 4.1 points.

Similarly, he said, Pakistan’s score was the lowest among these countries in macroeconomic stability, health and primary education, higher education and training, goods market efficiency and labour market efficiency. Only in the market size, Pakistan had a better score than Sri Lanka, he added.

He also said that Pakistan has the most expensive and least-efficient port systems in the region, adding that the handling charges at the Karachi Port Trust are $110 per ton. India charges $80 per ton, Sri Lanka $150 per ton and Hong Kong charged $140 per ton. Ship charges of 2,800 tons are $30,000 at KPT, $5,500 in Sri Lanka, $6,000 in Hong Kong and $25,000 in the Indian port.

He said Pakistan handles 55 containers per hour, Sri Lanka 70 per hour, Hong Kong 100 per hour and India 65 per hour. The Customs authorities in Pakistan examine 10 percent containers physically; Sri Lanka and Hong Kong less than five percent, while physical examination of containers in India is also high, but less than 100 percent, he said, adding that Pakistani ports lack water depth, which is 10.5 feet at KPT, 13 feet in Sri Lanka, 14 feet in Hong Kong and 12 feet in Indian ports.

The World Bank economist said that Pakistan provides relatively low access to services that impeded foreign investment. Pakistan has two fixed telephone lines per 100 people against 22 in China, 2.9 in India, 17.2 in Sri Lanka, 15.8 in Indonesia and 16.1 in Malaysia.

Around 99.4 percent of the population in China has access to electricity; it is 66.3 percent in India, 76.6 percent in Sri Lanka, 62.4 percent in Pakistan, 64.5 percent in Indonesia and 99.4 percent in Malaysia, he added.

The roads and power generation are number one infrastructure concern for the businesses worldwide, Biller said, and advised Pakistan to reduce the transport cost that is critical to competitiveness.

In addition, the state should ensure safe mobility and enhance regional connectivity. Pakistan’s foreign market access potential is at least 4.5 times higher than the United States, he said, adding that its current market access is only 4-9 percent of the United States.

Pakistan’s market share in total global exports is less than half percent and remained stagnant since 2000. India, on the other hand, increased its global export share from 0.6 percent in 2000 to 1.5 percent in 2010, he added.

http://www.thenews.com.pk/Todays-News-3-114426-Pakistan-needs-to-im...

-

Comment by Riaz Haq on June 26, 2012 at 9:15pm

-

Here's a Business Recorder story on energy generation in Pakistan:

Till the introduction of Power Policy 2002, there were 13 IPPs operating in the country with an installed capacity of 4,340 MW. These include Hub Power 1,292 MW, AES Lalpir (now Pakgen Power) 362 MW, AES Pak-Gen (now Pakgen Power) 365 MW, Altern Energy 29 MW, Fauji Kabirwala 157 MW, Gul Ahmed 136 MW, Habibullah Coastal 140 MW, Japan Power 120 MW, Kohinoor Energy 131 MW, Liberty Power 235 MW, Rousch Pakistan 412 MW, Saba Power 114 MW, SEPCO 135 MW, Tapal Energy 126 MW and Uch Power 586 MW. In subsequent years, another 12 IPPs of total installed capacity of 2,468 MW were commissioned, whereas WAPDA-owned KAPCO of 1,638 MW also emerged as an IPP. Power plants commissioned after implementation of the Power Policy 2002 are Attock Gen 165 MW, Atlas Power 225 MW, Engro Energy 227 MW, Foundation Power (Daharki) 110 MW, Halmore Power 225 MW, Hub Power Narowal 225 MW, Liberty Power Tech 202 MW, Nishat Power 202 MW, Nishat Chunian 202 MW, Orient Power 225 MW, Saif Power 225 MW and Sapphire Electric 235 MW. A number of small IPPs, or SPPs, generate electricity with a total capacity of over 700 MW, of which mostly are in-house or captive power plants.

The long list includes ICI Pakistan 26 MW, Sapphire Power 26 MW, Crescent Power 11 MW, Ellicott Spinning 22 MW, Gulistan Power 40 MW, Kohinoor Mills 25 MW, Monno Energy 5 MW, Mahmood Textile 40 MW, DS Power 2 MW, Sitara Energy 78 MW, Bhanero Energy 17 MW, Quetta Textile 31 MW, Ideal Energy 12 MW, Ghazi Power 21 MW, Genertech 28 MW, Nimir Industries 18 MW, Zeeshan Energy 7 MW, Ibrahim Fibers 32 MW, Crescent Bahuman Energy 23 MW and Kohinoor Power 15 MW. In addition, DHA CoGen of 94 MW and Pakistan Steel Mills power plant of 110 MW have in-house power generation facilities. The role of the captive power plants is, nonetheless, significant as these have eased-out the demand on national grid. The SPPs and many captive power units provide their surplus electricity to the network--up to 182 MW to PEPCO-NTDC and 40 MW to the KESC. Textile sector, having an installed captive power plants to achieving dependable and uninterrupted power supply for hi-tech machinery, is the main contributor to NTDC system.

In the power system, a balance between electricity generation and consumption has to be continuously maintained. It was planned to make available a committed net power generation to the level of 23,726 MW (compared to existing 18,580 MW) by June 2012 but the target could not be achieved. A total of 3,400 MW installed generation capacity has been added to the national grid instead since 2008. To overcome power shortages in short term, an investment of RS 32.5 billion was envisaged through the 2011-12 national budget, whereas 14 on-going power projects of cumulative capacity of about 3,000 MW were scheduled for completion during October 2011-June 2012.

-

Comment by Riaz Haq on June 28, 2012 at 7:04am

-

Here's an ET story on Russian interest in energy projects in Pakistan:

Pakistan has agreed to award contracts without bidding for multi-billion-dollar Iran-Pakistan (IP) and Turkmenistan-Afghanistan-Pakistan-India (TAPI) gas pipeline projects to Russia, which will also extend financial assistance.

However, in an understanding reached with Russia, Pakistan made it clear that it would award the contracts on government-to-government basis only. Private Russian firms will not be entertained.

“Pakistan’s government will ask the cabinet to waive public procurement rules for award of pipeline contracts to Russia,” a participant of the meeting of Pak-Russia Joint Working Group on Energy told The Express Tribune.

A 15-strong delegation of Russia, led by the deputy minister for energy, participated in the meeting held in Islamabad on Wednesday.

The two sides would sign a memorandum of understanding (MoU) in next two to three months to move ahead with the projects, he said. Third meeting of the joint working group will be held in Moscow in 2013.

The government has already floated tenders, inviting bids for giving contracts for construction and pipeline procurement for the IP project, costing $1.5 billion.

“Russian energy giant Gazprom may also participate in bidding for the engineering, procurement and construction (EPC) contract, which gives an edge to the company that will pledge financing as well,” a government official said, adding Moscow also agreed to finance the rehabilitation of Guddu and Muzaffargarh power plants.

According to sources, Pakistan will submit a draft of agreement for financial and technical assistance for the IP pipeline in 15 days. Though the Russian side assured financial assistance for the pipelines, they did not indicate the amount.

In a preliminary meeting held in Islamabad on Tuesday, the Russian authorities offered cooperation in gas import through pipelines and the Central Asia South Asia (CASA) electricity import project, which would bring electricity from Central Asian states.

Besides Russia, Iran is also willing to provide $250 million on government-to-government basis for constructing the IP pipeline. Pakistan wants $500 million for the pipeline.

Iran has also come up with a plan to lay Pakistan’s portion of the pipeline based on a mechanism called ‘supplier’s credit’, which Pakistan will repay after two years.

Pakistan is also seeking China’s help for the IP pipeline. In a recent visit to Beijing, President Asif Ali Zardari and Adviser to Prime Minister on Petroleum Dr Asim Hussain succeeded in convincing the Chinese leadership to take part in bidding for the construction of the pipeline.

Electricity import

In addition to supporting the gas pipelines, Russia has also expressed its willingness to cooperate in import of 1,000 megawatts of electricity from Central Asia. Leading financial institutions including the World Bank and Islamic Development Bank have committed financial support for the power import project.

Construction of a cross-border transmission line is being considered for creating a dedicated link aimed at supplying surplus hydropower during summer months from Kyrgyzstan and Tajikistan to Pakistan.

http://tribune.com.pk/story/400262/breakthrough-pakistan-to-award-g...

-

Comment by Riaz Haq on June 28, 2012 at 10:06pm

-

Here's an interesting Friday Times story on reliable power supply in may parts of Karachi where people pay their bills:

e have not had loadshedding for more than 10 months as far as I can remember," said Umar Ansari, a resident of Gulshan-e-Iqbal Karachi. "We have no loadshedding. Just the usual breakdowns once in a while," says Yasir Khan, who lives in PECHS. That might be unbelievable for people living in other parts of Pakistan, but some residents of Karachi have found new respect for the once-loathed Karachi Electric Supply Company.

"We have devised a new mechanism for loadshedding," says Muhammad Haroon, a KESC official. "If the recovery rate in an area is up to a certain mark, we exempt that area from loadshedding. It is very simple. If you pay your bills, you get electricity, if you don't, then you're not on the priority list."

The situation in interior Sindh is somewhat different. "Despite the falling recovery rates, average load shedding is 2 to 4 hours a day in most parts of Sindh and Balochistan," says Yaqoob Chandio, an official working at the HUB Power Company. Punjab has said the uneven distribution of power is unfair.

Raja Pervez Ashraf, the newly elected prime minister, promised during his recent visit to Karachi that he would improve power supply in Karachi and the rest of Pakistan. "I will do my best," he said. "One of the first meetings I called after becoming prime minister was to discuss the power crisis. Inshallahh we will resolve this issue."

The shortfall of electricity in the country is about 7,000 megawatts, according to Saeed Muhammad, a PEPCO official. Experts say the problem is not of generation capacity, but of circular debts, recovery and theft.

According to WAPDA and PEPCO figures, Pakistan Railway alone owes Rs422 million to various electricity distribution companies. The ISI owes more Rs8.2 million, Pakistan Rangers Rs120 million, the Senate Rs49 million.

The total billing in May 2012 was Rs87.4 billion, but only Rs35,9 billion were recovered. In April, the total bills amounted to Rs79.4 billion but the distribution companies collected only Rs30.2 billion. In March, only 31.3 billion were collected in bills, instead of Rs51.8 billion. In January this year, the collection was Rs29.3 billion of the total bills of Rs77 billion.

According to information provided by the Finance Department, the ratio of recovery from consumers of electricity was only 51 percent. That means 49 percent of electricity bills in Pakistan were not paid. The highest number of defaulters are in Balochistan and Sindh.

"If the KESC owes PEPCO for power purchases, the finance ministry owes KESC for tariff differential claims. KESC therefore holds payments until the finance minister delivers, and if pressed, offers to adjust its receivables against its payables," says Khurram Hussain, an energy policy expert.

The other key factor in the power crisis is line losses - stolen electricity for which no one is billed. Officials in various departments in Sindh say line losses in Sindh are over four times than those in Punjab. That means an average consumer in Punjab pays for the consumer who is stealing electricity in Sindh.

----------

Karachi Chamber of Commerce and

"The solution is very simple," according to policy expert Muhammad Yahya. "Enough with the free rides. The government and the consumers must pay for the electricity they consume."...http://www.thefridaytimes.com/beta3/tft/article.php?issue=20120629&...

-

Comment by Riaz Haq on June 28, 2012 at 10:10pm

-

Here's a Daily Times report on Punjab's plans to deal with power crisis:

The Punjab government has finalised plans to install coal energy plants in industrial estates across the province through public-private partnership, Chief Minister Shahbaz Sharif said on Thursday.

Presiding over a meeting at his Minar-e-Pakistan tent office to review the pace of development of energy-related projects in the province, the CM said that provision of relief to the people, who are undergoing agonising load shedding, poverty and inflation, was of utmost importance.

He said that the government had chalked out a plan to provide solar panels to poor families and biogas units to small farmers for running their tube wells. He said that the programme of providing solar panels to poor families would be initiated from south Punjab. “The solar panel will run one fan and two electric bulbs,” he said, adding that

Shahbaz said that the present energy crisis had adversely affected all sectors, and had deprived citizens of their sleep and peace. “Therefore, under these circumstances, provision of immediate relief to the people has become essential,” he said.

The CM said that provision of solar panels to the poor would be made through transparent balloting, and similar method would be adopted for distribution of biogas units among small farmers.

He directed the officials concerned to evolve a methodology for distribution of solar panels and biogas units so that the programme could be implemented at the earliest.

He also told them to hold negotiations with reliable and best companies for the purchase of solar panels. He disclosed that the quota of south Punjab with regard to provision of biogas units to small farmers would be 10 percent higher and, initially, 1000 biogas units would be distributed.

Shahbaz said that a programme had also been evolved to set up coal-energy plants of 50MW in the industrial estates with public-private partnership.

Earlier, Energy Secretary Jehanzeb Khan informed the meeting about the progress on coal-related energy projects. The investors present in the meeting also showed interest in make investment in the energy sector.

http://www.dailytimes.com.pk/default.asp?page=2012%5C06%5C29%5Cstor...

-

Comment by Riaz Haq on July 2, 2012 at 10:42am

-

Here are excerpts of a Wall Street Journal story on energy crisis in India:

India is facing an energy crisis that is slowing economic growth in the world's largest democracy.

At stake is India's ability to bring electricity to 400 million rural residents—a third of the population—as well as keep the lights on at corporate office towers and provide enough fuel for 1.5 million new vehicles added to the roads each month.

-----------

Vast tracts of rural India lack electricity. Even in such business hubs as Delhi's suburb of Gurgaon, companies employ backup generators because of regular outages. Factories are forced to curtail production. And vaccines that require refrigeration go bad because of spotty service.

----------

Energy imports will be costly for India's already shaky public finances, economists say, and the government will have to pass on higher costs to consumers and businesses. That won't be easy. Residents depend on government subsidies to lower prices for electricity, auto fuels and cooking gas.Last month, Standard & Poor's cited India's yawning 5.8% budget deficit and inability to reform fuel subsidies as reasons it was considering downgrading the country's debt from investment-grade to junk status. Fitch, another ratings firm, later joined S&P in cutting its outlook on India's sovereign debt from "stable" to "negative."

"India has a very distorted system of subsidies," Jaipal Reddy, minister for petroleum and natural gas, said. "But how, in a vibrant democracy like in India, do you change the system suddenly?"

The country's energy crunch can be overcome, he said: "We'll have to pay for more, that's about all. It does not weaken the long-term growth story."

-----------

India's efforts in April to strike a long-term gas supply deal with Qatar faltered over price, about $20 per million British thermal units, or more than triple the cost of Indian domestic gas.Exploration for gas and oil discoveries isn't going well. Since 1998, the government has issued 87 exploration blocks to companies through competitive bidding. Only three blocks have gone into production.

Interest in India is waning among the global oil companies that dominate exploration: Eight of the 37 companies that bid in the last round of auctions were foreign companies, down from 21 in 2008.

Mr. Reddy, the oil and gas minister, said he was considering allowing firms to sell what they produce at higher prices to attract more investment. Companies complain that government price caps are too low.

Policy makers are resigned to costly imports for now. "In all probability the import dependence in primary energy is going to increase," said Mr. Ahluwalia of the Planning Commission. "The real issue is, 'Can we pay for that energy?' "

http://online.wsj.com/article/SB10001424052702304331204577352232515...

-

Comment by Riaz Haq on July 2, 2012 at 5:20pm

-

Here a News story on KESC exempting low-loss areas from load-shedding:

The Karachi Electric Supply Company (KESC) has denied allegations that the power utility has “ulterior motives”, and it is resorting to 12 to 14 hours of loadshedding, saying only three to 7½ hours of loadshedding is being carried out for the last six months in high-loss areas.

“Low-loss areas in Karachi are still exempted from loadshedding while loadshedding is only being resorted up to 7½ hours only in high-loss areas despite the fact that electricity demand has soared to 2,500 megawatts,” a KESC spokesman said on Thursday.

Commenting on the allegations levelled by an MQM MPA in the Sindh Assembly on Thursday, he insisted that the KESC was a public utility and acting as a utility service provider, otherwise it could have disconnected power to several defaulters who were not ready to pay their electricity dues.

“The KWSB is the biggest defaulter, but the KESC is still providing power to it as any action against the water utility can create an extreme water shortage in the city. Corporate organisations do not give such relaxations to their clients,” he claimed.

Commenting on the provision of 50 billion rupees in subsidy to the KESC, the spokesman said public representatives should know that subsidies were provided to consumers, not to the power producing companies.

“Subsidy is being given to the consumers so that the entire cost of power production is not passed on to the consumers, otherwise each unit of electricity would be costlier than the rates applicable now,” he maintained.

On the occasion, the KESC spokesman urged the public representatives to assist the power utility in curbing electricity theft and recovering dues from the defaulting consumers, and said that by doing this, the KESC would be able to minimise loadshedding and breakdowns and provide quality service to its consumers.

Meanwhile, the KESC strongly condemned the rising streak of violence at its area offices by defaulting consumers, trying to pressure the company into restoring the power supply without wanting to clear their dues.

A KESC’s Garden area office came under attack recently by agitating defaulters, who get electricity from Malbari Lines and Ambajivilljee PMTs, where power theft is in the region of 60 percent and outstanding bills are close to Rs10 million.

Often in such cases, the PMTs are rendered faulty due to the unauthorised connected load put by illegal power users.

In the case of the Garden area’s PMTs, the KESC issued the defaulting consumers with several notices for th clearance of bills, warning them to refrain from illegally using electricity and asking if they wanted the utility to replace the non-functioning PMTs.

They, however, refused to cooperate and instead shifted their illegal load through unauthorised hook connections onto another PMT, eventually overloading it to the point of breaking down.

Consequently, the KESC officials held several meetings with the local MPA and area notables and sought their support for the clearance of dues and curbing the menace of power theft....

http://www.thenews.com.pk/Todays-News-4-114462-KESC-denies-allegati...

-

Comment by Riaz Haq on July 12, 2012 at 9:48am

-

Here's an AP report on US gas and electricity rates:

A plunge in the price of natural gas has made it cheaper for utilities to produce electricity. But the savings aren't translating to lower rates for customers. Instead, U.S. electricity prices are going up.

Electricity prices are forecast to rise slightly this summer. But any increase is noteworthy because natural gas, which is used to produce nearly a third of the country's power, is 43 percent cheaper than a year ago. A long-term downward trend in power prices could be starting to reverse, analysts say. Pacific Gas & Electric, for instance, is asking to raise gas and electric rates by $144 a year for the typical customer in 2014.

"It's caused us to scratch our heads," says Tyler Hodge, an analyst at the Energy Department who studies electricity prices.

The recent heat wave that gripped much of the country increased demand for power as families cranked up their air conditioners. And that may boost some June utility bills. But the nationwide rise in electricity prices is attributable to other factors, analysts say:

In many states, retail electricity rates are set by regulators every few years. As a result, lower power costs haven't yet made their way to customers.

Utilities often lock in their costs for natural gas and other fuels years in advance. That helps protect customers when fuel prices spike, but it prevents customers from reaping the benefits of a price drop.

The cost of actually delivering electricity, which accounts for 40 percent of a customer's bill on average, has been rising fast. That has eaten up any potential savings from the production of electricity.

Utilities are building transmission lines, installing new equipment and fixing up power plants after what analysts say has been years of under-investment.

This may reverse what has been a gradual decline in retail electricity prices. Adjusted for inflation, the average retail electricity price has been drifting mostly lower since 1984, when it was 16.7 cents per kilowatt-hour.

"The ratepayer is going to have to foot the bill," says David Wright, vice chairman of the South Carolina Public Service Commission and president of the National Association of Regulatory Commissioners.

PG&E is seeking permission to raise gas and electric rates by $1.25 billion in 2014, $1.75 billion in 2015 and $2.25 billion in 2016, arguing it needs the money to upgrade its distribution network and hire an additional 2,200 employees. If approved by state regulators, the average residential customer would see their combined gas and electric bill rise in the first year by $12 a month, or $144 a year.

The average U.S. residential electricity price is expected to be 12.4 cents per kilowatt hour for the June-to-August period, up 2.4 percent from the same time last year. For the full year, electricity prices are expected to rise 2 percent. PG&E's average residential price is 16.1 cents per kilowatt hour.

In a typical summer month, that would mean an extra $3 on a residential bill, which includes the cost of generating the power and delivering it to a home, plus local taxes and fees. ...

http://www.mercurynews.com/pge/ci_21053334/electricity-is-cheaper-m...

-

Comment by Riaz Haq on July 12, 2012 at 5:05pm

-

Here's an ET story on Iran-Pakistan electricity deal:

Iran has linked the price for export of 1,000 megawatts of electricity with international crude prices and the rate will fluctuate in the range of 7 to 11 cents per unit.

Pakistan and Iran have already signed a memorandum of understanding (MoU) for electricity supply. According to a government official, the two sides have also agreed on the price which will be in the range of 7 to 11 cents per unit.

An official of the Ministry of Water and Power said gas prices in Iran were linked with global oil rates, therefore, it based the power price on crude oil prices in the international market.

According to the price formula, Pakistan will be paying a maximum rate of 11 cents per unit of electricity if crude prices reach $110 per barrel and the price range will be reviewed after five years.

“The electricity price has been capped by the time oil rates do not cross the $145 per barrel mark. However, if crude prices rise above that level, the two countries will be bound to review the electricity rate before the end of five-year period,” the ministry official said.

Under the proposed project, Iran will build a powerhouse in Zahedan province bordering Pakistan to generate electricity for export and has also expressed its willingness to provide $800 to $900 million for the project. A 700km transmission line of 500 kilovolts will also be laid from the Pak-Iran border to Quetta.

Some officials suggest that the government should ask Iran to install the power plant in Pakistan in order to avoid expenditure on laying the distribution and transmission line.

Besides the 1,000MW for which an MoU has been signed, Iran has also offered to export a huge quantity of 10,000MW to Pakistan.

However, the ministry official pointed out that Iran, at present, had no power plants to export such a huge quantity. “So the best way is to press Tehran to establish power plants in Pakistan,” the official said, adding Iran had already shown interest in setting up a 200MW plant in Balochistan near the border.

To push ahead with talks on electricity supply, a four-member delegation of Iran’s Mapna group of companies, headed by Abbas Ali Abadi, held a meeting with Federal Water and Power Minister Chaudhry Ahmed Mukhtar at the ministry on Monday.

The delegation expressed great interest in the power sector and discussed the setting up of plants of 1,000MW capacity immediately. The Iranians were also keen on installing smaller plants of 25MW on the ground as well as on barges to help Pakistan overcome the prevailing power crisis.

http://tribune.com.pk/story/406416/electricity-supply-iran-links-po...

Twitter Feed

Live Traffic Feed

Sponsored Links

South Asia Investor Review

Investor Information Blog

Haq's Musings

Riaz Haq's Current Affairs Blog

Please Bookmark This Page!

Blog Posts

India-Israel Axis Threatens Peace in South Asia

The bonhomie between Israeli Prime Minister Netanyahu, an indicted war criminal, and Indian Prime Minister Narendra Modi, accused of killing thousands of Muslims, was on full display this week in Israel. Both leaders committed to supporting the Afghan Taliban regime which is accused of facilitating cross-border terrorist attacks by the TTP in Pakistan. Mr. Modi was warmly welcomed by…

ContinuePosted by Riaz Haq on February 27, 2026 at 10:45am

Modi's AI Spectacle: Chaos and Deception in New Delhi

The India AI Impact Summit 2026, held at Bharat Mandapam in New Delhi, has been marred by chaos, confusion and deception. The events on the ground have produced unintended media headlines for India's Prime Minister Narendra Modi who wants to be seen as the "vishwaguru" (teacher of the world) in the field of artificial intelligence as well. First, there was massive chaos on the opening day, with long…

ContinuePosted by Riaz Haq on February 19, 2026 at 12:00pm — 13 Comments

© 2026 Created by Riaz Haq.

Powered by

![]()

You need to be a member of PakAlumni Worldwide: The Global Social Network to add comments!

Join PakAlumni Worldwide: The Global Social Network