PakAlumni Worldwide: The Global Social Network

The Global Social Network

Confident Consumers Push Pakistan Eid Sales Up by Double Digits

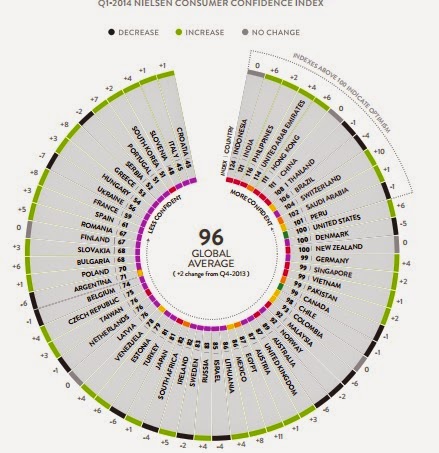

Nielsen, a global provider of data on consumers, reports that Pakistan consumer confidence has held steady at 99 for two consecutive quarters. This compares favorably with consumer confidence figures which declined over the previous quarter in the overall Middle East/Africa region. Among the region, UAE led the way for Middle East/Africa consumer confidence with an index of 109, a decline of five points from first-quarter 2014. Egypt (81) reported a drop of six points compared to the first quarter. South Africa posted the only regional confidence increase, climbing three points to 85, and confidence held steady in Saudi Arabia (102).

|

| Global Consumer Confidence Index Report. Source: Nielsen |

More than half (56%) of Middle East/ Africa respondents in Nielsen consumer surveys viewed their personal finances in a positive light which held steady from the first quarter. In Pakistan, 59 percent of the respondents believed the state of their finances was good or excellent, up from 57 percent in the first quarter of this year.

“Pakistani consumers are generally optimistic as seen by mostly high consumer confidence scores over the last three years. However, a score of 99 in the first as well as the second quarter of this year, is the highest we’ve seen since the second quarter of 2011,” said Mustafa Moosajee, Managing Director, Nielsen Pakistan. “This reflects the overall mood in the country, especially relating to economic conditions. The economy is showing signs of recovery but macro challenges remain.”

Pakistan's Nielsen consumer confidence index of 99 is just below 100, a level that indicates optimism. Countries at or above 100 are: China (111), India (121), Indonesia (124), UAE (114), Philippines (111), Thailand (108), Brazil (106), Switzerland (104), Saudi Arabia (102), Peru (101), United States (100), Denmark (100) and New Zealand (100).

Consumer spending in Pakistan has increased at a 26 percent average pace the past three years, compared with 7.7 percent for Asia, according to data compiled by Euromonitor International, a consumer research firm. Pakistan's rising middle class consumers in major cities like Karachi, Lahore and Islamabad are driving sales of international brand name products and services. Real estate developers and retailers are responding to it by opening new mega shopping malls such as Dolmen in Karachi and Centaurus in Islamabad.

|

| Dolmen City, Clifton, Karachi |

http://edition.cnn.com/video/#/video/world/2013/04/01/mohsin-bristi...

Pakistan has continued to offer much greater upward economic and social mobility

to its citizens than neighboring India over the last two decades. Since 1990, Pakistan's middle

class had expanded by 36.5% and India's by only 12.8%, according to an ADB report titled "Asia's Emerging Middle Class: Past, Present And ...

.

Dolmen Mall Clifton Featured on CNN from DHAToday on Vimeo.

Rising consumer is good but not sufficient to boost economic growth to meet the needs of growing population. What Pakistan requires badly now is significant new investments, both foreign and domestic, to overcome the ongoing energy crisis and rejuvenate the manufacturing sector.

Related Links:

Haq's Musings

Upwardly Mobile Pakistan

Educational Attainment in Pakistan

Foreign Visitors to Pakistan Pleasantly Surprised

Pakistan's Infrastructure and M2 Motorway

India Pakistan Comparison 2011

Resilient Pakistan Defies Doomsayers

Branchless Banking Responds to Pakistan Floods

Pakistan's Rural Economy Recovering

Pakistan's Growing Middle Class

Pakistan is Too Big to Fail

FMCG Consumption Boom in Rural Pakistan

Pakistan Visits Open Indian Eyes

Twitter Feed

Live Traffic Feed

Sponsored Links

South Asia Investor Review

Investor Information Blog

Haq's Musings

Riaz Haq's Current Affairs Blog

Please Bookmark This Page!

Blog Posts

Trump Leads America into an Unpopular War in the Middle East!

President Donald Trump joined Israel in yet another war of choice in the Middle East last week. Polls conducted in the United States immediately after the start of the Iran war show that the majority of Americans do not support it. A YouGov snap poll fielded Saturday — the day of the strikes — found 34% of Americans approve of the U.S. attacks on Iran, with 44%…

ContinuePosted by Riaz Haq on March 3, 2026 at 10:00am — 2 Comments

India-Israel Axis Threatens Peace in South Asia

The bonhomie between Israeli Prime Minister Netanyahu, an indicted war criminal, and Indian Prime Minister Narendra Modi, accused of killing thousands of Muslims, was on full display this week in Israel. Both leaders committed to supporting the Afghan Taliban regime which is accused of facilitating cross-border terrorist attacks by the TTP in Pakistan. Mr. Modi was warmly welcomed by…

ContinuePosted by Riaz Haq on February 27, 2026 at 10:45am — 2 Comments

© 2026 Created by Riaz Haq.

Powered by

![]()

You need to be a member of PakAlumni Worldwide: The Global Social Network to add comments!

Join PakAlumni Worldwide: The Global Social Network