PakAlumni Worldwide: The Global Social Network

The Global Social Network

Construction and Manufacturing Driving Double-Digit Growth in Pakistan Cement and Steel Production

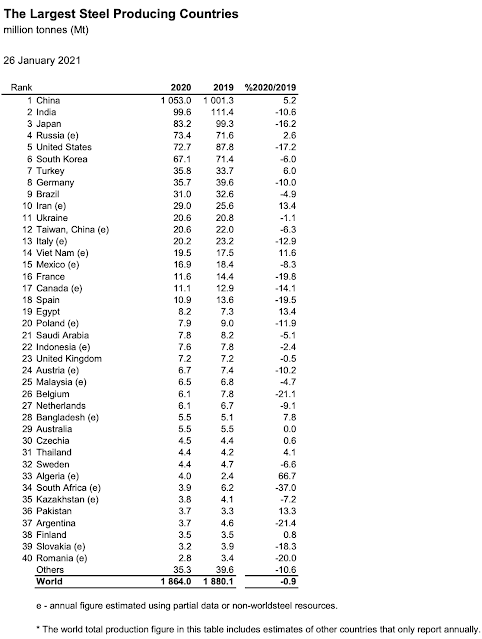

Pakistan steel production grew by 13.3% in 2020, the second fastest among the top 40 steel producing countries, according to data published by the World Steel Association. At the same time, Pakistan Bureau of Statistics revealed that the nation's steel imports rose by 18% year-over-year. The demand for steel was driven by construction and manufacturing sectors which are leading Pakistan's economic recovery.

|

| World Steel Production. Source: World Steel Association |

Pakistan steel-makers produced 3.7 million tons of steel in 2020, up 13.2% from 3.2 million tons in 2019. Neighboring India saw 10.6% decline in steel production in the same period. Global steel production declined 0.9% in 2020. Pakistan also imported $2.1 billion worth of iron, steel and scrap in the first 7 months (July 2020- January 2021) of the current fiscal year. It's a jump of 18% from the same period in prior fiscal year. Pakistan steel industry reached peak production of 5 million tons in 2017 before declining to 4.7 million tons in 2018 and 3.3 million tons in 2019.

Construction boom helped Pakistan grow its domestic cement consumption by 17% in the first 7 months (July 2020-January 2021) of the current fiscal year. Domestic cement sales rose to 27.65 million tons in this period, while exports grew by 10.23% to 5.71million tons from 5.186 million tons in the same period last year. The total cement sales (local and exports) were 33.36 million tons, up 15.77% over the corresponding period of the last fiscal year.

Related Links:

Pakistan to Become World's 6th Largest Cement Producer By 2030

Pakistan's Response to COVID19 Pandemic

Pakistan Digital Economy Surged 69% Amid Covid19 Pandemic

Soaring Food Prices Hurting Pakistanis

Najam Sethi on Desperation in PDM Ranks

India's Firehose of Falsehoods Against Pakistan

-

Comment by Riaz Haq on April 14, 2021 at 10:13am

-

#Pakistan’s LSM (#manufacturing) sector grows 7.45% in first 8 months (July20-Feb21) of current fiscal year. Robust growth #automobile & #cement sectors in March 21 & and robust inflows of workers’ remittances, export earnings & revenue collection on taxes https://tribune.com.pk/story/2294563/pakistans-lsm-sector-grows-745

The large-scale manufacturing (LSM) sector has grown 7.45% in the first eight-month (Jul-Feb) of current fiscal year 2021 amid third wave of the Covid-19 pandemic in Pakistan, according to the Pakistan Bureau of Statistics (PBS).

The LSM growth would largely offset impact of poor cotton production in agriculture sector and extend the much-needed support to the overall economic growth in the year.

Out of total 15 sectors in LSM, eight have posted growth. These include textile, automobiles, fertilisers, pharmaceuticals, food, beverages and tobacco, coke and petroleum products, chemicals and non-metallic mineral products.

However, output of seven sub-sectors contracted, which were including iron and steel products, electronics, leather products, paper and board, engineering products, rubber products and wood products.

“The LSM Index output increased by 4.85% for (the single month of) February 2021 compared to February 2020,” PBS reported. “The LSMI decreased by 4.15 % compared to January 2021.”

Pak-Kuwait Investment Company (PKIC) Head of Research Samiullah Tariq said the LSM output declined in February compared to January due to imposition of partial lockdown in some areas nationwide amid third wave of the pandemic in the country and lesser number of days in February.

“The robust latest production numbers reported by automobile and cement sectors for March…and robust inflows of workers’ remittances, export earnings and revenue collection on taxes in the month suggest that slowdown in LSM in February is a temporary phenomenon and it would revert in March,” he added.

The government fully supports housing and construction sector with the aim of reviving industrial production amid Covid-19 pandemic. It provided different tax incentives and awarded subsidiary on housing and construction loans, as it is of the view that the strategy would enable construction and allied industries to grow and extend much-needed support to gross domestic product (GDP).

The government has targeted to achieve GDP growth of 2.1% in the ongoing fiscal year 2021. The central bank remains confident the country would achieve an economic growth of 3% despite the third wave of the pandemic in the country. The Ministry of Finance anticipated the growth at 2.6% to 2.8%.

However, the International Monetary Fund (IMF) forecasted economic growth at 1.5% recently, which is half of what the State Bank of Pakistan (SBP) has projected. The World Bank’s outlook stands at 1.3% in FY21. The central bank said the economic indicators stood strong even as the number of coronavirus infections in the country soared.

The government has decided to impose smart lockdown in areas where the rate of infection is at 15%. Special Assistant to the Prime Minister (SAPM) on Health Dr Faisal Sultan said the other day that the coronavirus disease has severely affected the country’s healthcare system and “the situation is worse than that in June last year”.

A worsening situation is ringing an alarming bell, as it carries the potential to partially impact industrial out as well. The PBS reported that the textile sector grew 2.69% in the July-February period of the ongoing fiscal year compared to 0.33% in the same period of last year. Automobile sector surged 14.66% in the period compared to contraction of 35.93% in the corresponding period of last year. Food, beverage and tobacco sector increased 15.75% compared to contraction of 1.87%. Non-metallic mineral products surged 20.77% compared to 4.35%. Fertiliser sector jumped 5.66% in July-February period of FY21 compared to 5.99% in the same period of last year.

-

Comment by Riaz Haq on April 14, 2021 at 10:14am

-

#Pakistan #car sales record triple-digit growth in March 2021. #Automobile sales in the first nine months (Jul-Mar) of the ongoing fiscal year jumped 37%. #lsm #manufacturing #economy #covid19 #pandemic

https://tribune.com.pk/story/2294568/car-sales-record-triple-digit-...

Automobile sales in Pakistan recorded a steep growth of 198% in March 2021 compared to the same period of last year primarily due to a lockdown in March 2020.

In addition, the dispatches of vehicles having engine capacity of 1,000cc and below skyrocketed 437% on a year-on-year basis.

According to data released by the Pakistan Automotive Manufacturers Association (PAMA) on Tuesday, car companies sold 20,801 units in March 2021 against 6,986 units dispatched in March 2020.

“The triple-digit growth in sales volume can be attributable to a low base effect amid a countrywide lockdown imposed by the government in March last year, which restricted economic activity,” said Arif Habib Limited analyst Arsalan Hanif in a report.

“Moreover, rebound in the economy after the easing of lockdown and a drop in the policy rate aided the rise in car sales.”

On a month-on-month basis, auto sales surged 27% due to extra working days in March compared to February.

He added that sales of cars of 1,000cc and below engine capacity soared on the back of a massive surge in demand for Suzuki Alto.

A report of Topline Securities added that the month-on-month growth in vehicle sales would be 20% if Lucky Motor Corporation (KIA, non-member of PAMA) was included.

It said that Indus Motor Company recorded the highest increase of 53% in monthly sales in March at 6,695 because the company had witnessed supply issues in February.

“Sales growth of Indus Motor Company was primarily driven by Hilux sales, which were up 103% month-on-month,” the report said.

It was followed by Honda Atlas Cars with a 30% expansion in sales to 3,153 units in March 2021.

Pak Suzuki Motor Company recorded a month-on-month growth of 14% last month as its sales stood at 10,161 units.

“Among new entrants in the industry, Hyundai Nishat sold 723 units in March 2021 with the inclusion of Hyundai Elantra, while Lucky Motor Corporation sold 2,000 units as per our channel checks,” it stated.

Read more: Car sales rise 15% in December

Nine-month figures

Car sales in the first nine months (Jul-Mar) of the ongoing fiscal year registered a rise of 37%. Automobile sales during the nine-month period came in at 134,522 units against 98,425 units in the corresponding period of last year.

Indus Motor Company managed to outperform during the Jul-Mar period of fiscal year 2020-21 with a 69% growth in sales. The company sold 42,670 units in the nine-month period compared to 25,300 units in the same period of last year.

It was followed by Honda Atlas Cars with a 54% growth at 21,698 units.

Pak Suzuki Motor Company’s sales expanded 13% during the nine-month period as the company sold 66,013 cars compared to 58,303 units in the same period of last year.

-

Comment by Riaz Haq on May 11, 2021 at 7:29am

-

Pakistan’s cement production capacity to increase to 99Mt/yr

https://www.globalcement.com/news/item/12381-pakistan-s-cement-prod...

The All Pakistan Cement Manufacturers Association (APCMA) says that the country’s installed cement production capacity will reach 99Mt/yr within the next few years, with most of the planned work to be completed by mid-2023. The Dawn newspaper has reported that producers are launching new cement plant projects and expanding existing plants with a total new capacity of 18Mt/yr. Upon completion, the current projects will increase domestic cement production capacity by 43% to 99Mt/yr from 69Mt/yr. 94Mt/yr of the new capacity is situated in Northern Pakistan and 5.0Mt/yr in Southern Pakistan.

APCMA says that the reason behind the new expansion cycle is estimated annual sales growth of 10 – 15% from 2021.

-----------

Cement makers to expand production capacity by 40pc

https://www.dawn.com/news/1622795

Pakistan’s cement producers plan to expand their capacity by more than 40 per cent from nearly 69 million tonnes to nearly 99m tonnes over the next several years in anticipation of 10-15pc growth in their sales every year, claims an All Pakistan Cement Manufacturers Association (APCMA) official.

Speaking with Dawn, the APCMA official, who requested anonymity, said almost every cement manufacturer had planned to increase their production capacity through greenfield and brownfield projects. Many projects, especially the brownfield ones, are expected to come on line in the next two years, adding nearly 18m tonnes to the existing capacity.

“Almost 95pc of the new capacity is being planned in the north – mostly in Punjab – where the most growth in demand is coming,” he said.

According to him, the industry was of the view that cement sales will spike as construction activity picks up further going forward on the back of a generous housing package announced last year by the prime minister to help the economy to recover from the Covid-19 pandemic impact. The announcement of mega infrastructure schemes and resumption of work on CPEC related projects and dams too are driving the industry sentiment.

The massive reduction of 625bps in the central bank’s policy rate from 13.25pc to 7pc during March and June last year to offset the impact of the Covid-19 pandemic as well as the availability of cheaper long-term financing for new and old projects under the Temporary Economic Refinance Facility (TERF) initiative, which has diluted the borrowing cost of the industry across different sectors, have also contributed to the cement producers’ decision to undertake expansions.

Most cement makers have already disclosed their expansion plans through bourse filings over the last few months.

The new investments represent the fourth expansion cycle by the cement industry.

Cement dispatches have consistently been rising since the resumption of economic activities last summer ever since the Covid-19 curbs on the construction industry, and other businesses, were lifted. Total cement dispatches – domestic and exports both – jumped 19pc to 48.3m tonnes during the period between July and April from 40.5m tonnes a year ago. Domestic sales are up by almost 19pc to 40.2m tonnes and exports by about 20pc to 8m tonnes.

-

Comment by Riaz Haq on June 30, 2021 at 4:53pm

-

Pakistan’s electricity demand rises up to 20%

Minister claims growth of circular debt has been reduced by Rs200b this year

https://tribune.com.pk/story/2306561/pakistans-electricity-demand-r...

Federal Minister for Energy Muhammad Hammad Azhar has said up to 20% growth in demand for electricity has been witnessed this year, of which industrial demand has remained above 12-13%.

During a meeting with US Embassy Chargé d’affaires Lesslie Viguerie, Azhar said that the increase in demand was a positive sign not only for the overall economy, but also for the energy sector as it boosted the confidence of investors.

Azhar told the US envoy that due to the prudent policies and effective measures undertaken by the government, the growth of circular debt had been reduced by Rs200 billion this year as compared to the previous year.

The federal minister also spoke about the approximate $800 million investment that Pakistan had made in the expansion and improvement of transmission and distribution system in two and a half years, which led to the record transmission of more than 4,000 megawatts this year.

“Another $117 million has been earmarked for the next financial year for the improvement of transmission and distribution system,” he said. Azhar invited US-based companies to explore possibilities of investment in Pakistan’s energy market. He highlighted that Pakistan and the United States had excellent working relationship in the energy sector, which would get a further boost from the new investor-friendly policies of the present government.

Shedding light on the close partnership between the Power Division and the United States Agency for International Development (USAID), the minister pointed out that yet another milestone in long-term energy planning had been achieved with their assistance in the Indicative Generation Capacity Expansion Plan (IGCEP), which was bound to address the issues related to planning and demand assessment.

-

Comment by Riaz Haq on July 1, 2021 at 7:17am

-

Two new #REITs launched in #Pakistan after unveiling of #ImranKhan's #NayaPakistan #construction program. One REIT is focused on building villas and the other on building apartments in #Karachi. Dividend payment tax on REITs cut to 15% from 25%. #economy https://www.bloomberg.com/news/articles/2021-07-01/pakistan-to-see-...

Pakistan is set for its first real estate investment trust in more than six years as Prime Minister Imran Khan seeks to stimulate the economy through a construction boom.

Arif Habib Dolmen REIT Management Pvt. plans to raise 8 billion rupees ($51 million) via private placements in two REITs for a housing project in Karachi, Muhammad Ejaz, the firm’s chief executive officer, said in an interview Tuesday. It plans to purchase the land in about two months, partly from Silkbank Ltd., he said.

Arif Habib Dolmen had created Pakistan’s only REITin 2015 and the industry, which had gone silent since then, is reviving now on Khan’s incentives and regulatory changes. Pakistan is willing to forgive tax evaders if they invest in construction projects, while banks have been asked to increase their outstanding mortgages by at least 5% by December.

One of the new REITs will focus on villas and the other on apartment buildings and commercial developments. This is a developmental REIT with an expected internal rate of return of more than 30%, according to Ejaz. The older REIT, which holds rental assets including Karachi’s most prominent mall and an office tower, offers a dividend yield of around 12% a year, he said.

Pakistan has been revising rules to make REITs more attractive for investors and developers. Finance Minister Shaukat Tarin in his budget this month lowered the dividend payment tax on REITs to 15% from 25%.

“The government has chosen the right sector for growth,” Ejaz said.

Silk Islamic Development REIT is scheduled to be launched next week for the commercial and apartment building section. Its five equal shareholders are Yunus Brothers Group that owns Lucky Cement Ltd., Fatima Group, Arif Habib Corp., Liberty Group and Arif Habib Dolmen. The second Silk World Development REIT includes real estate developer World Group, which will develop the villas.

-

Comment by Riaz Haq on July 5, 2021 at 4:36pm

-

#Pakistan #cement consumption grows by 13% in June to 5.211 million tons from 4.623Mt in June 2020. Cement sales jumped 20% to 48.119Mt in 11MFY21 from 39.96Mt from 11MFY20. #ImranKhan's #NayaPakistan Housing & PSDP allocation boosted #construction.

https://www.cemnet.com/News/story/171040/pakistan-cement-dispatches...

Pakistan’s cement sector posted a robust YoY growth of 12.73 per cent in June 2021, as total dispatches rose to 5.211Mt against 4.623Mt in June 2020. Cement dispatches rose by 20.40 per cent to 48.119Mt in 11MFY21 from 39.96Mt during the eleven months of the last financial year 2019-20, according to data released by the All Pakistan Cement Manufacturers Association (APCMA).

The rise is attributed to construction activities under the Naya Pakistan Housing Scheme (NPHS), vital government initiatives, and in anticipation of higher Public Sector Development Program (PSDP) allocation for the year 2021-22.

Intermarket Securities Ltd also supported the same growth sentiment and argued that the construction sector will remain in the limelight as cement dispatches continue to grow on the back of a normalisation of construction activities. This has been led by the relief package announced by the government coupled with progress on the NPHS.

An APCMA spokesman said that FY20-21 had been a good year for cement, as demand has grown considerably. The cement industry is expanding its capacity from 70Mt to around 100Mt. The expectation is that the market will increase by 15 per cent annually for the next three years due to an increase in projects funded by the PSDP and China-Pakistan Economic Corridor (CPEC), as well as expanding housing and industrial demand.

Export

According to APCMA, exports also increased from 7.847Mt during the financial year 2019-20 to 9.314Mt during the outgoing financial year 2020-21, showing a growth of 18.69 per cent. Pakistan usually exports cement overland to Afghanistan and by sea to the Middle East, Africa, and South and Central Asia.

-

Comment by Riaz Haq on July 5, 2021 at 5:51pm

-

According to the figures of Pakistan Bureau of Statistics (PSB), total iron and steel scrap imports in 11MFY21 rose 4.429m tonnes, valuing $1.7bn versus 3.6m tonnes at a cost of $1.4bn in the same period in FY20.

https://www.dawn.com/news/1631301

Steel bar makers on Thursday gave the first post-budget shock to consumers by raising prices by Rs5,000 per tonne to Rs150,500-151,500 per tonne citing unexpected surge in international scrap prices.

Before the Budget 2021-22, manufacturers had increased the prices by Rs3,000 to Rs146,500 per tonne. Steel bar makers had informed the construction sector that rising steel scrap prices in world market had affected their cost of production.

Keeping in view steel bar price of Rs110,000-113,000 per tonne prevailing in November 2020, the total price jump to date is Rs38,000-40,000 per tonne.

However, the average per tonne import price of iron and steel scrap has dropped to $386 per tonne in 11MFY21 from $389 per tonne in the same period in FY20.

According to the figures of Pakistan Bureau of Statistics (PSB), total iron and steel scrap imports in 11MFY21 rose 4.429m tonnes, valuing $1.7bn versus 3.6m tonnes at a cost of $1.4bn in the same period in FY20.

Former chairman Association of Builders and Developers of Pakistan (ABAD) Hassan Bakhshi feared that the Prime Minister Imran Khan’s dream of providing low-cost housing to the masses under the Naya Pakistan Housing Scheme is unlikely to materialise in view of persistent and unchecked increase in prices of steel bars and cement. He urged the government to allow import of steel bars at reduced duties and taxes to break the cartel of steel bar manufacturers.

Mr Bakshi said the cost of construction on a high-rise project has increased by 10-15 per cent keeping in view a jump of 50pc in steel bar prices in the last one-and-a-half years when steel bar price was Rs100,000 per tonne. Steel bars hold 40-45pc share in total construction cost of a high-rise project.

-

Comment by Riaz Haq on July 5, 2021 at 8:35pm

-

Installed power capacity grows 3.6pc

Mushtaq Ghumman 11 Jun 2021

https://www.brecorder.com/news/40099412

The country’s installed capacity of electricity has posted a growth 3.6 percent to 37,261 MW till April 2021, as compared to 35, 972 MW during the same period in 2019-20, but no significant change is witnessed in its consumption pattern.

According to the Economic Survey 2020-21, Pakistan is dependent on energy imports because there is a lack of investment in indigenous resources of hydro, natural gas and lignite. The government has decided to stop building new coal-fired power plants because of environmental issues. Due to significant increase in electricity demand, both state-owned companies and IPPs are actively engaged in producing electricity. However, fiscal sustainability has become a challenge due to increase in energy payments. This energy deficiency began from a fuel mix transformation which was initiated two decades ago, when power generation used to rely more on imported furnace oil than hydropower.

Till April, FY2021, installed capacity of electricity reached 37,261 MW, as compared to 35, 972 MW during the same period of 2019-20, posting a growth of 3.6 percent. The hydro share in total electricity generation has declined in FY2021 as compared to its share in FY2020. Currently, thermal has the largest share in electricity generation. Moreover, its percentage share in FY2021 has increased as compared to FY2020. Significant growth of RLNG usage in energy mix has helped improve supply to various power plants. RLNG is also supplied to fertilizer plants.

There is little change in the consumption pattern of electricity. During July- April FY2021, the share of agriculture in electricity consumption remained constant. However, the share of industry in electricity consumption has increased which shows revival of economic activities.

Commenting on history of energy crisis, the Economic Survey says that current energy crisis began to manifest itself by late 2007. The problem has evolved over the years from one of chronic power supply deficit to one where there is excess installed capacity but not enough cash flow in the system to run it. The latter created ‘circular debt’ issue. Specifically, the ‘circular debt’ in Pakistan’s energy supply chain refers to the cash flow shortfall incurred in the power sector from the delayed/non-payment of obligations by consumers, Discos and the government. It has continued to grow in size over the years, rising from 1.6 percent of GDP (Rs161billion) in 2008, to 5.2 percent of GDP (Rs 2,150 billion) in June 2020. The present government has given prime importance to resolve this issue and is working on various options to reduce circular debt.

In terms of energy-mix, Pakistan’s reliance on thermal which includes imported coal, local coal, RLNG and natural gas has been decreasing over the last few years. Pakistan’s dependence on natural gas in the overall energy mix is on the decline and the reduction of its share in the energy mix is due to declining natural gas reserves and introduction of LNG. The share of renewable energy has steadily increased over the years. The government is also taking measures to increase the shares of hydel and nuclear in energy-mix.

In Pakistan, special measures have been taken to use these innovations for domestic usage of energy, such as Electrical Vehicle Policy 2020-25.

The hydro share in total electricity generation has declined in FY2021 as compared to its share in FY2020. Currently, thermal has the largest share in electricity generation. Moreover, its percentage share in FY2021 has increased as compared to FY2020. Significant growth of RLNG usage in energy mix has helped improve supply to various power plants. RLNG is also supplied to fertilizer plants, industrial and transport sectors.

-

Comment by Riaz Haq on July 8, 2021 at 8:35pm

-

Rebar prices in Pakistan lower compared to China, Turkey

https://www.thenews.com.pk/print/861483-rebar-prices-in-pakistan-lo...

The steel manufacturers of Pakistan are selling rebars at a lower price as compared to international market prices by absorbing the constantly increasing cost of inputs.

In the recent past, the prices of scrap have skyrocketed. The average monthly price of steel scrap as per London Metal Exchange (LME) in June was $260 and now the latest price in the month of July 2021 has crossed $540 per ton.

Similarly, prices of steel rebar in international markets as per LME last year July was $420 in 2020 and in July 2021 the average rebar prices – assuming zero duty – are $831 in Turkey and $845 in China whereas, in Pakistan the rebar prices without duty and landing charges on scrap is $794.

“If we compare the prevailing international prices with our local markets, the prices in Pakistan are still at approximately 6 to 4 percent cheaper than China and Turkey respectively, which are among the largest steel producing countries,” PALSP said in a statement.

“All of this current market situation is beyond the control of manufacturers for the reason that the domestic steel industry is largely dependent on imported raw material and prices of steel are directly related to international prices of scrap/raw material.

Pakistan’s steel industry is selling bars at less price by constantly reducing their margins which is evident from the fact that their gross margins which were 19% plus in the period from 2015 to 2018 to 12 percent currently.”

The association said the government dropped a bomb shell on the long steel sector by giving FED exemption to erstwhile FATA/PATA hence giving competitive advantage to the steel industry of that area of Rs 25,000 per ton which is likely to throw the documented

-

Comment by Riaz Haq on July 17, 2021 at 10:29am

-

#imrankhanPTI's #NayaPakistan #Construction Bet Boosts Investment. #Pakistan’s cement production capacity to grow by 31% to 91 million tons a year after announced expansions are completed. Pak home mortgage grew by 18% to a record Rs. 97.8 billion in May https://www.bloomberg.com/news/articles/2021-07-13/khan-s-construct...

https://twitter.com/haqsmusings/status/1416448327764221952?s=20

#imrankhanPTI's #NayaPakistan #Construction Bet Sees #Cement Firms Boosting #Investment. #Pakistan’s cement production capacity will increase by 31% to 91 million tons a year after the announced expansions are completed. #economy https://www.bloomberg.com/news/articles/2021-07-13/khan-s-construct...

A group of 19 cement manufacturers have seen their shares rise 67% in the past year, compared with the KSE-100 Index’s 30% gain. About 1,000 projects have registered under the government initiative with the boom just about to start on the ground, according to Mohammed Hassan Bakshi, a member of Khan’s Naya Pakistan Housing Program.

----------

Pakistani cement companies are investing to expand capacity a year after Prime Minister Imran Khan chose the construction sector to stimulate the economy.

Lucky Cement Ltd., Bestway Cement Ltd., and D.G. Khan Cement Co. are among more than half-a-dozen firms to announce plans in recent months. Pakistan’s cement production capacity will increase by 31% to 91 million tons after the announced expansions are completed, according to Insight Securities Pvt.

Khan’s government last year said it will subsidize low-cost housing and forgive tax evaders if they invest in construction projects. Banks have also been asked to increase their outstanding mortgages by at least 5% by December. Cement stocks have outpaced the nation’s benchmark index.

“Construction-related activities have a very, very big multiplier effect in emerging economies,” said Waleed Saigol, director at Maple Leaf Cement Factory Ltd. “The government has realized that the private sector has to play a leading role in getting the wheels turning again.”

-------------------

The construction boom is also having other effects. Pakistan’s consumer home finance, which is one of the lowest in South Asia, has increased by 18% to a record 97.8 billion rupees in May, according to Foundation Securities Pvt. The country has also seen its first real estate investment trust in more than six years.

The nation’s economic growth is “supported by a continued strengthening of domestic consumption and resilient manufacturing and construction activity,” Fitch Ratings Ltd. said in May. However, a fresh wave of Covid-19 cases “could disrupt the positive momentum.”

Comment

- ‹ Previous

- 1

- 2

- 3

- 4

- Next ›

Twitter Feed

Live Traffic Feed

Sponsored Links

South Asia Investor Review

Investor Information Blog

Haq's Musings

Riaz Haq's Current Affairs Blog

Please Bookmark This Page!

Blog Posts

Trump Leads America into an Unpopular War in the Middle East!

President Donald Trump joined Israel in yet another war of choice in the Middle East last week. Polls conducted in the United States immediately after the start of the Iran war show that the majority of Americans do not support it. A YouGov snap poll fielded Saturday — the day of the strikes — found 34% of Americans approve of the U.S. attacks on Iran, with 44%…

ContinuePosted by Riaz Haq on March 3, 2026 at 10:00am — 3 Comments

India-Israel Axis Threatens Peace in South Asia

The bonhomie between Israeli Prime Minister Netanyahu, an indicted war criminal, and Indian Prime Minister Narendra Modi, accused of killing thousands of Muslims, was on full display this week in Israel. Both leaders committed to supporting the Afghan Taliban regime which is accused of facilitating cross-border terrorist attacks by the TTP in Pakistan. Mr. Modi was warmly welcomed by…

ContinuePosted by Riaz Haq on February 27, 2026 at 10:45am — 2 Comments

© 2026 Created by Riaz Haq.

Powered by

![]()

You need to be a member of PakAlumni Worldwide: The Global Social Network to add comments!

Join PakAlumni Worldwide: The Global Social Network