PakAlumni Worldwide: The Global Social Network

The Global Social Network

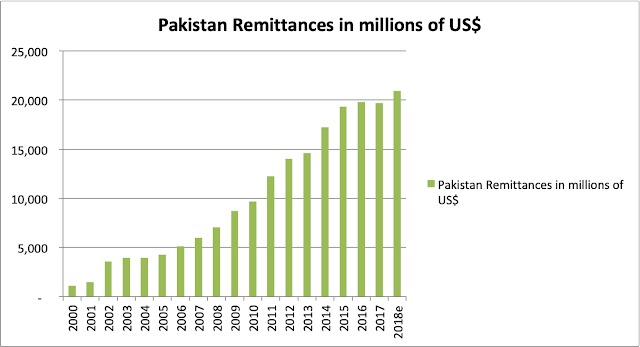

Diaspora Remittances to Pakistan Soar 21X Since Year 2000

Remittance inflows from Pakistani diaspora have jumped 21-fold from about $1 billion in year 2000 to $21 billion in 2018, according to the World Bank. In terms of GDP, these inflows have soared nearly 7X from about 1% in year 2000 to 6.9% of GDP in 2018.

Meanwhile, Pakistan's exports have declined from 13.5% of GDP in year 2000 to 8.24% of GDP in 2017. At the same time, the country's import bill has increased from 14.69% in year 2000 to 17.55% of GDP in 2017. This growing trade imbalance has forced Pakistan to seek IMF bailouts four times since the year 2000. It is further complicated by external debt service cost of over $6 billion (about 2% of GDP) in 2017. Foreign investment in the country has declined from a peak of $5.59 billion (about 4% of GDP) in 2007 to a mere $2.82 billion (less than 1% of GDP) in 2017. While the current account imbalance situation is bad, it would be far worse if Pakistani diaspora did not come to the rescue.

Diaspora Remittances:

Estimated inflows of $20.9 billion make Pakistan the world's 7th largest recipient of remittances for 2018, according data released by the World Bank in its latest "Migration and Remittances" report of December 2018. In South Asia region, Pakistan is the second largest recipient of remittances of $20.9 billion after top-ranked India's $79.5 billion.

Pakistan Remittances in Millions of US Dollars. Source: World Bank |

Remittances from Pakistani diaspora have grown nearly 21-fold since the year 2000. Pakistanis sent home remittances adding up to 6.9% of the country's GDP in 2018, up from 1% back in year 2000.

Pakistan's Trade:

In 2017, Pakistan exported goods and services worth $22 billion while it imports amounted to $57 billion, a trade deficit of $35 billion for the year. This is a dramatic deterioration from about $2 billion trade deficit (2% of GDP) in year 2000 to $35 billion trade deficit (about 12 % of GDP) in year 2017.

Pakistan Trade Deficit in Billions of US$. Source: World Bank |

Pakistan's exports have declined from 13.5% of GDP in year 2000 to 8.24% of GDP in 2017. At the same time, the country's import bill has increased from 14.69% in year 2000 to 17.55% of GDP in 2017.

Foreign Direct Investment:

Foreign direct investment (FDI) in Pakistan was a mere $2.82 billion (less than 1% of GDP) in 2017, down from a peak of $5.59 billion (4% of GDP) in 2007. The lack of foreign investment has contributed to the country's dwindling reserves and balance of payments difficulties requiring it to seek yet another IMF bailout.

Pakistan's External Debt. Source: State Bank of Pakistan via Dr. Is... |

Pakistan's Debt:

Significant growth in remittances from Pakistani diaspora has clearly helped but the external accounts gap is too big for it. This has forced Pakistan to borrow heavily in recent years. It has raised debt service costs and put pressure on Pakistan's reserves.

Summary:

Remittances from Pakistani diaspora have jumped 21-fold from about $1 billion in year 2000 to $21 billion in 2018, according to the World Bank. In terms of GDP, these inflows have soared nearly 7X from about 1% in year 2000 to 6.9% of GDP in 2018. Meanwhile, Pakistan's exports have declined from 13.5% of GDP in year 2000 to 8.24% of GDP in 2017. Foreign investment in the country has declined from a peak of $5.59 billion (about 4% of GDP) in 2007 to a mere $2.82 billion (less than 1% of GDP) in 2017. At the same time, the country's import bill has increased from 14.69% in year 2000 to 17.55% of GDP in 2017. This growing trade imbalance has forced Pakistan to seek IMF bailouts four times since the year 2000. It is further complicated by external debt service cost of over $6 billion (about 2% of GDP) in 2017. While the current account imbalance situation is bad, it would be far worse if Pakistani diaspora did not come to the rescue.

Related Links:

Can Pakistan Avoid Recurring Balance of Payment Crisis?

Pakistan Economy Hobbled By Underinvestment

Can Indian Economy Survive Without Western Capital Inflows?

Pakistan-China-Russia Vs India-Japan-US

Chinese Yuan to Replace US $ as Reserve Currency?

Remittances From Overseas Pakistanis

-

Comment by Riaz Haq on April 5, 2019 at 8:29am

-

In US, there are 450,000 Pakistanis and 3.2 million Indians... a ratio of about 7:1 http://www.riazhaq.com/2017/08/pakistani-diaspora-thriving-in-ameri...

Most people who haven’t seen the US data have a similar feeling in America as you do about UAE. It’s important to look at the actual data. If you compare remittances from UAE to India vs Pakistan, the ratio is about 6. Read this https://m.khaleejtimes.com/business/banking-finance/Indians-top-the...

-

Comment by Riaz Haq on July 8, 2019 at 6:20pm

-

During the first ten months of 2015, a total of 774,795 migrant workers left Pakistan. That number is presumed to have exceeded 800,000 by end of December 2015, constituting yet a new record.

http://www.oit.org/wcmsp5/groups/public/---asia/---ro-bangkok/---il...

Over the past decade, there has been a substantial increase in the foreign employment of Paki- stanis. There are three modes for migrating overseas: through overseas employment promoters, through the OEC and for workers to directly obtain employment. The data on workers using an overseas employment promoter and managing overseas migration on their own is collected by the BEOE. The OEC maintains its own records. Based on both sets of records, more than 8.7 million Pakistani workers have gone abroad for employment since the 1970s. Most of them were registered with the BEOE, with only a total of 139,354 Pakistani workers using the services of the OEC over the past five decades. According to the BEOE records, the annual placement of Pakistanis increased from 143,329 in 2005 to 431,842 in 2008. After a decline during the following two years, it reached 458,229 migrant workers in 2011 before jumping to 639,601 workers in 2012 and 753,841 workers in 2014 (figure 1). During the first ten months of 2015, a total of 774,795 migrant workers left Pakistan. That number is presumed to have exceeded 800,000 by end of December 2015, constituting yet a new record.

During the economic boom period (2005–08), there was an increasing trend of overseas migration, from 4 per cent in 2005 to 10.5 per cent in 2008. After 2008, the world economies as well as the economies of the Gulf Cooperation Council (GCC) countries (popular destinations for Pakistani workers) were hit hard by the global financial cri- sis. There was then a substantial decline in economic growth across the globe, severely affecting overseas migration. As a result, demand for foreign labour declined in GCC countries and, hence, overseas migration from Pakistan declined. The flow of overseas migration increased at an average growth of 8 per cent instead of 10 per cent during that crisis period. The pace picked up after 2011, returning to a growth rate of more than 10 per cent per annum.

Pakistan is administratively demarcated into four provinces and three regions (the Federally Administered Tribal Areas, Gilgit-Baltistan and Azad Jammu and Kashmir). There are 148 dis- tricts2 in these provinces and regions. The data on the origin of migrants from Pakistan is not evenly distributed across provinces and regions nor across districts; rather, there appears to be a concentration in some districts. Between 1981 and 2015, as shown in Map 1, more than 4.1 million workers from Punjab Province who registered with the BEOE went abroad for employ- ment, followed by more than 2 million workers from Khyber Pakhtunkhwa Province, 757,053 workers from Sindh Province, 404,698 workers from the Federally Administered Tribal Areas and 94,942 from Balochistan.

-

Comment by Riaz Haq on July 8, 2019 at 6:21pm

-

United Nations International Migration Report

https://www.un.org/en/development/desa/population/migration/publica...

In 2017, India was the largest country of origin of

international migrants (17 million), followed by

Mexico (13 million). Other countries of origin with

large migrant populations include the Russian

Federation (11 million), China (10 million),

Bangladesh (7 million), Syrian Arab Republic (7

million) and Pakistan and Ukraine (6 million each).

Globally, the twenty largest countries or areas of origin account for almost half (49 per

cent) of all international migrants, while one-third (34 per cent) of all international migrants

originates in only ten countries. India is now the country with the largest number of people

living outside the country’s borders (“diaspora”), followed by Mexico, the Russian

Federation and China. In 2017, 16.6 million persons from India were living in another

country compared to 13.0 million for Mexico (figure 7). Other countries with significant

“diaspora” populations are the Russian Federation (10.6 million), China (10.0 million),

13

International Migration Report 2017: Highlights

Bangladesh (7.5 million), Syrian Arab Republic (6.9 million), Pakistan (6.0 million) and

Ukraine (5.9 million). Of the twenty largest countries or areas of origin of international

migrants, eleven were located in Asia, six in Europe, and one each in Africa, Latin America

and the Caribbean, and Northern America.

-

Comment by Riaz Haq on July 8, 2019 at 6:22pm

-

There has been a major decline in manpower export to Saudi Arabia where only 100,910 emigrants proceeded for employment in the year 2018 as compared to 2017, a drop of 42,453 emigrants.

https://www.thenews.com.pk/print/482725-massive-decline-in-manpower...

According to Economic Survey 2018-19, no doubt Overseas Employment Migration has an important role in respect of employment creation and poverty eradication. International migration creates significant financial and social benefits for migrants, for their families, and for the countries of origin and destination. Pakistan is one of the largest labour exporting countries of the region and since 1971, more than 10.61 million Pakistanis have proceeded abroad for employment.

It unfolds saying that major decline has been observed in manpower export to Saudi Arabia as only 100,910 proceeded for employment in year 2018 as compared to 2017, a drop of 42,453 emigrants.

More importantly, the situation of manpower export to UAE is also not different from the export to Saudi Arabia as manpower export to UAE also decreased in 2018. In recent years, Malaysia emerged as an important destination country for Pakistani workers as in 2018 increase of 38 percent manpower export towards Malaysia was observed as compared to 2017. Due to the present government‘s efforts for enhancing manpower export, an increasing trend has been observed in Qatar, which is a positive sign.

It also tells that the highest number of workers who went abroad was 185,902 from Punjab, followed by Khyber Pakhtunkhwa 88,361. From Northern Areas, the number of registered workers increased from 3,417 in 2017 to 4,185 in 2018.

However, the situation in other provinces is not encouraging which shows that there is a need to understand the changing trends/dynamics of labour importing countries in order to meet the manpower demand in future.

During 2018, there has been a declining trend in all occupational groups except in the highly qualified category. The scope for low skilled workers is declining and competition among expatriates is increasing. The up skilling and certification of workforce is the pressing need of the time to meet the international standards and demand. In this regard, the role of NAVTTC, TEVTAs and Higher Education Commission (HEC) is crucial to produce skilled and qualified workforce. Moreover, efforts are required at government to government (G2G) level to secure employment opportunities for the Pakistani workforce.

---------------------------

Table 12.7: Number of Pakistani Workers Registered Abroad

S. No. Countries 2014 2015 2016 2017 2018

1 UAE 350,522 326,986 295,647 275436 208635

2 Bahrain 9,226 9,029 8,226 7,919 5745

3 Malaysia 20,577 20,216 10,625 7,174 9881

4 Oman 39,793 47,788 45,085 42,362 27202

5 Qatar 10,042 12,741 9,706 11,592 20993

6 Saudi Arabia 312,489 522,750 462,598 143,363 100910

7 UK 250 260 346 340 587

http://finance.gov.pk/survey/chapters_19/Economic_Survey_2018_19.pdf

-

Comment by Riaz Haq on November 17, 2019 at 10:21pm

-

2019 International

Migration and

Displacement Trends

and Policies Report

to the G20

https://www.oecd.org/migration/mig/G20-migration-and-displacement-t...

As compared to other financial flows, remittance volumes to developing countries are large and have risen

steadily over the last 3 decades from USD 126 billion (1990) to USD 528 billion (2018) (Figure 12). In

2018, remittance flows rose in all regions, most notably in Europe and Central Asia (20 percent) and South

Asia (13.5 percent). These remittance flows are over 3 times the size of ODA flows and higher than FDI

flows (excluding China), thereby forming an important source of development finance. For example, in

Africa, remittances have been the largest and most stable source of international financial flows since 2010.

Remittances are therefore significant contributors to GDP, form a valuable source of foreign exchange for

governments and play a role in stabilizing the external sector. Globally the top 5 remittance receiving

countries are India, China, Philippines, Mexico, Pakistan and the top 5 Remittance source countries are the

United States, Saudi Arabia, Switzerland, China and Russia.

Immigrants from the main countries of origin tend to be concentrated in either OECD or non-OECD G20

countries. Nearly all of the immigrants from Mexico, Poland, Romania, Morocco and the Russian Federation

lived in G20 countries in 2015/16. In contrast, most immigrants from Bangladesh, Ukraine, Pakistan and

Kazakhstan resided in non-OECD countries.

The demographic profile of immigrants in G20 countries varies by origin and destination. Overall, half of

the foreign born in 2015/16 were women, but this share varied among the top 15 origin countries from a low

of 40% for Pakistan to a high of 60% for the Philippines. More than half of the top 15 countries had emigrant

populations with majorities of women (Ukraine, China, Philippines, Poland, Kazakhstan, Germany, Romania

and the Russian Federation). Almost 52% of immigrants in OECD countries were women, while this share

was 43% for non-OECD countries. Only 11% of immigrants were between 15 and 24 years old, ranging from

20 only 5% of Italian immigrants to 17% of Chinese immigrants. A slightly higher share of immigrants in nonOECD countries (14%) were between 15 and 24 years old.

-

Comment by Riaz Haq on April 22, 2020 at 8:10am

-

Global #remittance flows expected to plunge by more than $100 billion, hitting #India, #Pakistan, #Egypt, #Nigeria, and the #Philippines where remittances are crucial source of external financing. #COVID19 #lockdown #OilPrice #economy https://www.ft.com/content/471cb6b2-f354-4fe0-b36f-3078a506a2d8 via @financialtimes

Remittance flows around the world are expected to plummet by more than $100bn this year, depleting a vital source of financing for low and middle-income nations as they struggle with the economic chaos triggered by the coronavirus pandemic, according to the World Bank.

In a report released on Wednesday, the bank said the impact of lockdowns that have closed economies across the globe and the resulting job losses would cause a 20 per cent decline in remittance flows to low and middle income countries compared with last year, from a record $554bn to $445bn.

It would be the largest fall in recent history, and those most vulnerable to the decline include fragile states such as Somalia, Haiti and South Sudan, and small island nations such as Tonga, with remittances accounting for more than a third of gross domestic product in some. Larger countries including India, Pakistan, Egypt, Nigeria, and the Philippines will also be hit as remittances have become a crucial source of external financing for them.

Dilip Ratha, the World Bank’s lead economist for migration and remittances, told the Financial Times that the fall would be a “major financial shock” to countries that depend on remittances.

“If we are expecting a fall of 20 per cent it’s going to be a huge shock, it’s going to cause a lot of hardship for countries in terms of macroeconomic management and balance of payments difficulties,” Mr Ratha said. “But more important is the human story . . . The number of people who are going to be impacted — both for the migrants in host countries and families back home it’s going to be huge.”

Last year, remittances overtook foreign direct investment to become the biggest source of capital inflows to low and middle-income countries for the first time; they accounted for about 8.9 per cent of GDP in poorer countries in 2019.

The World Bank estimates that in 2019 there were 272m international migrants — including 26m refugees — and more than 700m internal migrants around the world providing financial support to dependants elsewhere. But foreign workers are often the first to lose their jobs in times of crisis.

As global travel has been frozen, many are now in limbo, neither able to work nor to return to their home countries.

Some governments have introduced measures to support business to ensure they continue paying workers. But the World Bank said: “So far, government policy responses to the Covid-19 crisis have largely excluded migrants and their families back home.”

There have also been allegations that some Gulf states, including Saudi Arabia and Qatar, have deported migrants during the crisis. Saudi officials deny they have forcibly repatriated workers and said Riyadh was co-operating with governments if migrants wanted to return. Doha said those it deported were involved in “illegal activities” and insisted it was adhering to international standards in its treatment of workers.

Lockdowns have also made it harder for migrants to send money back to their families as money-transfer offices have been forced to close; many poorer migrants do not have bank accounts and are not able to conduct online money transfers.

-

Comment by Riaz Haq on September 18, 2020 at 9:25am

-

In the outgoing FY (2019-20), Pakistani expatriates remitted a record of $23.12 billion with more than 6% year-on-year (YoY) growth compared to $21.74 of FY 2018-19.

http://tribune.com.pk/article/97174/the-curious-case-of-pakistans-s...The momentum has not only persisted but amplified in on-going FY 21 with a whopping $2.77 billion remittance in July, followed by an inflow of $2.095 billion in August. This unprecedented surge is bemusing, and what has baffled many is the fact that this escalation has occurred during the pandemic. So, what could the potential triggers to this mammoth inflow be?

The extraordinary leap can be primarily due to the tightening of informal money markets, which has augmented the inflow through formal banking channels. In the budget for FY 2020-21, the incumbents allocated Rs25 billion to formalise foreign remittances, which would aid in stockpiling foreign exchange reserves to service colossal national debt obligations.

Pakistanis typically used to carry cash in their luggage physically. But due to flight reduction and sparse international travels, they would have been compelled to access official banking channels for money transfers. Also, remittances might have incremented on account of significant job losses in the Gulf region due to the Covid-related recession. Hence the spiral may demonstrate high one-time repatriation of money back to Pakistan.

On the other hand, the State Bank of Pakistan (SBP) has emphasised an orderly ‘market-based’ exchange rate management and sound policymaking under the Pakistan Remittance Initiative. The SBP sheds the spotlight on the reduction of the threshold for eligible transactions from $200 to $100 under the Reimbursement of Telegraphic Transfer (TT) Charges Scheme. It also stressed on adoption of digital channels and targeted marketing campaigns to promote formal routes. Similarly, IT-related freelance services’ payment limits have increased from $5,000 to $25,000 per individual per month. The SBP believes that it has facilitated to enhance home remittances through formal banking channels in Pakistan.

The crux of the matter is remittances will upslope further in the future due to effectuated compliance of formal banking channels. Still, the recent abnormal increment will ease down in the coming months when the western economies recuperate from the ramifications of the Covid-related slump.

-

Comment by Riaz Haq on September 19, 2020 at 6:30pm

-

Fitch has warned of decline in remittances amid the #Coronavirus shock. But #remittances have been robust in #Pakistan and Bangladesh. ADB says 14% of households in #Bangladesh, 8% in #Philippines, 4% in Pakistan and 2% in #India receive remittance income. https://www.fitchratings.com/research/sovereigns/apac-remittances-t...

Fitch Ratings-Hong Kong-08 September 2020: The coronavirus pandemic and subsequent impact on the oil market are having a considerable effect on migrant workers and are likely to supress remittance flows in the APAC region, Fitch Ratings says in a special report. We expect flows to weaken in the coming quarters, even though recent amounts have been surprisingly robust in some countries due to temporary factors. Declining remittances in economies that are dependent on them may affect sovereign ratings through pressures on external finances and economic growth.

Demand for migrant labour has provided an important and stable source of foreign-currency remittance flows for a number of APAC sovereigns, including Bangladesh (6.0% of GDP), Pakistan (7.9%), Sri Lanka (8.0%) and the Philippines (8.4%). India is the largest recipient of remittances globally but they account for a small share of GDP at 2.9%. Remittance flows have helped keep current account deficits contained by offsetting large trade deficits. Indeed, without remittances the Philippines, Pakistan, Sri Lanka, and Bangladesh would all have large current account deficits of between 7%-10% of GDP.

Remittances in APAC also provide economic benefits to recipient countries. First, they support domestic consumption by providing an additional income source to households. According to the Asian Development Bank, about 14% of households in Bangladesh receive remittance income, 8% in the Philippines, 4% in Pakistan and 2% in India. Second, job opportunities for migrant workers relieve slack in domestic job markets.

Remittance flows in APAC were surprisingly mixed in the second quarter of 2020. Monthly data show a considerable and broad decline in remittances during April and May, as Fitch expected, but a recovery in June and July. The rebound in flows was particularly robust in Pakistan and Bangladesh, where flows broke records in both June and July. Sri Lanka and the Philippines also saw an improvement in remittance flows in June, but much more modest.

Anecdotal evidence points to temporary factors for the increase in recorded remittances in the recent period. These include migrant workers transferring their savings in preparation to return home, the impact of lockdown restrictions on transferring funds and a shift to formal remittance channels, which are picked up in the official data.

Fitch forecasts a 12% decline across the region in the second half of the year as the temporary support factors fade.

The deterioration in remittance inflows is likely to widen current account deficits, contributing to higher external financing needs. For countries with fragile external finances, such as Pakistan and Sri Lanka, the shock to remittances could exacerbate existing challenges. Lower oil prices and subdued import demand, however, are likely to soften the aggregate impact on external balances.

Remittances typically provide a countercyclical buffer for economic activity and vulnerable households. In domestic economic shocks, family members working abroad can increase remittances to help mitigate the impact of sluggish domestic activity. The pandemic, however, represents a much more synchronised global economic shock than previous downturns. This limits the potential support of the remittance channel.

Lower remittance flows could affect public finances through two channels: lower revenue collection from weaker consumption and higher social spending to support remittance-dependent households as well as returning migrant workers. Many countries in the region already have limited fiscal space to address the current coronavirus shock and the decline in remittances could exacerbate current challenges.

-

Comment by Riaz Haq on September 22, 2020 at 11:27am

-

Migrant workers from Asia’s developing countries have managed to send home record amounts of money in recent months, defying pandemic expectations and propping up home economies at a critical time.

Remittance doomsayers see something else in the bigger-than-usual transfers: a coming crash, triggered by a bleak job market, particularly in the Middle East. As they see opportunity drying up along with demand for oil, workers are sending money home in advance of their own return.Unlike Latin American countries, which continue to benefit from a tentative U.S. recovery, Asian countries are vulnerable to economic austerity in Saudi Arabia and elsewhere in the Middle East. More than 60% of remittances to India, Bangladesh and Pakistan come from Gulf Cooperation Council countries, said Khurram Schehzad, chief executive officer at Karachi-based advisory Alpha Beta Core Solutions Pvt. The region is also the top destination for workers from the Philippines, lone of the world’s largest suppliers of overseas labor.

Saudi Arabia has already raised taxes and import fees to make up for falling oil revenue. Job cuts in the kingdom appear to target foreigners first, with Riyadh-based Jadwa Investment estimating more than a million foreign workers will leave the labor market this year.

After eight years of sending money to family in Karachi, Abdul Hanan Abro is one of the workers who will follow his money home. He was laid off from his acc ..He was laid off from his accounting job in Dubai in May and hasn’t found a new gig -- and he’s not the only one. “No one is getting anything,” said Abro. “Two to three of my friends have already moved back to Lahore. People are selling their cars and stuff, doing their final settlements.”

For Abro, coming home means starting over. He wants to use the savings he accumulated overseas to start a business. “It’s high time to just focus on what I was planning for two to three years now,” Abr ..coming home means starting over. He wants to use the savings he accumulated overseas to start a business. “It’s high time to just focus on what I was planning for two to three years now,” Abro said. “It’s better than wasting more time in finding a job in this market.”

In April, the World Bank predicted overseas workers would send home 20% less this year, the biggest drop since at least 1980. The lender hasn’t updated its forecast to reflect the recent resilience, but a decline is still ..“People are returning home,” said Thomas Isaac, the finance minister for Kerala, which accounts for the country’s largest share of remittances. “Therefore, they bring back all their savings.” India is the world’s top recipient of transfers and a leading supplier of labor to the gulf; it took in $83 billion last year, exceeding the $51 billion it took in as foreign direct investment.

Overall, remittances to the Asia-Pacific region will drop 12% in the second half of 2020 compared with th ..Kerala’s proud record for near-total literacy gave its citizens a leg-up over other Indians — not to mention Pakistanis, Bangladeshis and others — seeking jobs in the Gulf. Despite their better education, the overwhelming majority of Keralites did jobs that indeed required being “roasted in the desert sun,” as Dad put it. In the classic migration pattern, young men endured great physical hardship and forewent luxuries to save up, remit money home and bring over friends and relatives. The steady ..

-

Comment by Riaz Haq on November 12, 2020 at 4:21pm

-

October #remittances to #Pakistan grow 14% to $2.3 billion, the 5th consecutive month above $2 billion. Remittances up 26.5% to $9.4 billion during the first 4 months of FY21, compared with July-Oct FY20. #economy #ImranKhan #PTI- Profit by Pakistan Today https://profit.pakistantoday.com.pk/2020/11/12/october-remittances-...

Workers’ remittances amounted to $2.3 billion during October 2020, showing an increase of 14.1 per cent when compared with October 2019.

This is for the fifth consecutive month that workers’ remittances remained above $2 billion, according to latest figures released by the State Bank of Pakistan (SBP) on Thursday.

A large part of the year-on-year (YoY) increase in October this year, 30pc, was sourced from Saudi Arabia, 16pc from the United States of America and 14.6pc from the United Kingdom (UK).

“Improvements in Pakistan’s FX market structure and its dynamics, efforts under the Pakistan Remittances Initiative (PRI) to formalise the flows and limited cross-border travelling contributed to the growth in remittances,” the SBP stated.

Meanwhile, on a cumulative basis, workers’ remittances rose 26.5pc to $9.4bn during the first four months of FY21, when compared with July-Oct FY20.

“These numbers were expected. The whole South Asia region is getting above-average inward remittances due to lockdown and reduction in flights and movement of unofficial funds,” said Muhammad Sohail of Topline Securities.

“In the short-run, this [the increase in remittances] will support local currency,” he added.

Earlier, a World Bank report had projected that remittances to Pakistan to grow at about 9pc in 2020, totalling about $24bn.

The World Bank attributed this increase to the diversion of remittances from informal to formal channels due to the difficulty of carrying money by hand under travel restrictions.

Comment

- ‹ Previous

- 1

- 2

- 3

- Next ›

Twitter Feed

Live Traffic Feed

Sponsored Links

South Asia Investor Review

Investor Information Blog

Haq's Musings

Riaz Haq's Current Affairs Blog

Please Bookmark This Page!

Blog Posts

India-Israel Axis Threatens Peace in South Asia

The bonhomie between Israeli Prime Minister Netanyahu, an indicted war criminal, and Indian Prime Minister Narendra Modi, accused of killing thousands of Muslims, was on full display this week in Israel. Both leaders committed to supporting the Afghan Taliban regime which is accused of facilitating cross-border terrorist attacks by the TTP in Pakistan. Mr. Modi was warmly welcomed by…

ContinuePosted by Riaz Haq on February 27, 2026 at 10:45am

Modi's AI Spectacle: Chaos and Deception in New Delhi

The India AI Impact Summit 2026, held at Bharat Mandapam in New Delhi, has been marred by chaos, confusion and deception. The events on the ground have produced unintended media headlines for India's Prime Minister Narendra Modi who wants to be seen as the "vishwaguru" (teacher of the world) in the field of artificial intelligence as well. First, there was massive chaos on the opening day, with long…

ContinuePosted by Riaz Haq on February 19, 2026 at 12:00pm — 13 Comments

© 2026 Created by Riaz Haq.

Powered by

![]()

You need to be a member of PakAlumni Worldwide: The Global Social Network to add comments!

Join PakAlumni Worldwide: The Global Social Network