PakAlumni Worldwide: The Global Social Network

The Global Social Network

Digital Pakistan 2022: Broadband Penetration Soars to 90% of 15+ Population

The year 2022 was a very rough year for Pakistan. The nation was hit by devastating floods that badly affected tens of millions of people. Macroeconomic indicators took a nose dive as political instability reached new heights. In the middle of such bad news, Pakistan saw installation of thousands of kilometers of new fiber optic cable, inauguration of a new high bandwidth PEACE submarine cable connecting Karachi with Africa and Europe, and millions of new broadband subscriptions. Broadband penetration among 140 million (59% of 236 million population) Pakistanis in the15-64 years age group reached almost 90%. This new digital infrastructure helped grow technology adoption in the country.

|

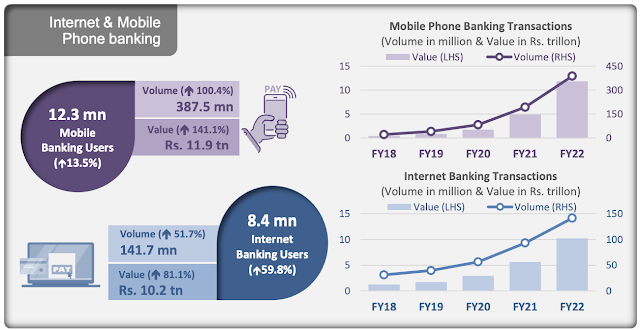

| Internet and Mobile Phone Banking Growth in 2021-22. Source: State ... |

Fintech:

Mobile phone banking and internet banking grew by 141.1% to Rs. 11.9 trillion while Internet banking jumped 81.1% to reach Rs10.2 trillion. E-commerce transactions also accelerated, witnessing similar trends as the volume grew by 107.4% to 45.5 million and the value by 74.9% to Rs106 billion, according to the State Bank of Pakistan.

|

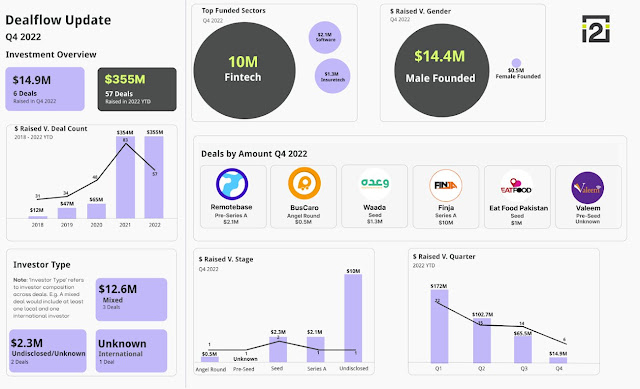

| Pakistan Startup Funding in 2022. Source: i2i Investing |

Fintech startups continued to draw investments in the midst of a slump in venture funding in Pakistan. Fintech took $10 million from a total of $13.5 million raised by tech startups in the fourth quarter of 2022, according to the data of Invest2Innovate (i2i), a startups consultancy firm. In Q3 of 2022, six out of the 14 deals were fintech startups, compared to two deals of e-commerce startups. Fintech startups raised $38 million which is 58% of total funding ($65 million) in Q3 2022, compared to e-commerce startups that raised 19% of total funding. The i2i data shows that in Q3 2022, fintech raised 37.1% higher than what it raised in Q2 2022 ($27.7 million). Similarly, in Q2 2022, the total investment of fintech was 63% higher compared to what it raised in Q1 2022 ($17 million).

|

| E-Commerce in Pakistan. Source: State Bank of Pakistan |

E-Commerce:

E-commerce continued to grow in the country. Transaction volume soared 107.4% to 45.5 million while the value of transactions jumped 75% to Rs. 106 billion over the prior year, according to the State Bank of Pakistan.

|

| Pakistan Among World's Top 10 Smartphone Markets. Source: NewZoo |

PEACE Cable:

Pakistan and East Africa Connecting Europe (PEACE) cable, a 96 TBPS (terabits per second), 15,000 km long submarine cable, went live in 2022. It brought to 10 the total number of submarine cables currently connecting or planned to connect Pakistan with the world: TransWorld1, Africa1 (2023), 2Africa (2023), AAE1, PEACE, SeaMeWe3, SeaMeWe4, SeaMeWe5, SeaMeWe6 (2025) and IMEWE. PEACE cable has two landing stations in Pakistan: Karachi and Gwadar. SeaMeWe stands for Southeast Asia Middle East Western Europe, while IMEWE is India Middle East Western Europe and AAE1 Asia Africa Europe 1.

|

| Mobile Data Consumption Growth in Pakistan. Source: ProPakistan |

Fiber Optic Cable:

The first phase of a new high bandwidth long-haul fiber network has been completed jointly by One Network, the largest ICT and Intelligent Traffic and Electronic Tolling System operator in Pakistan, and Cybernet, a leading fiber broadband provider. The joint venture has deployed 1,800 km of fiber network along motorways and road sections linking Karachi to Hyderabad (M-9 Motorway), Multan to Sukkur (M-5 Motorway), Abdul Hakeem to Lahore (M-3 Motorway), Swat Expressway (M-16), Lahore to Islamabad (M-2 Motorway) and separately from Lahore to Sialkot (M-11 Motorway), Gujranwala, Daska and Wazirabad, according to Business Recorder newspaper.

Mobile telecom service operator Jazz and Chinese equipment manufacturer Huawei have commercially deployed FDD (Frequency Division Duplexing) Massive MIMO (Multiple Input and Output) solution based on 5G technology on a large scale in Pakistan. Jazz and Huawei claim it represents a leap into the 4.9G domain to boost bandwidth.

|

| Pakistan Telecom Indicators November 2022. Source: PTA |

|

| Pakistan's RAAST P2P System Taking Off. Source: State Bank of Pakistan |

Broadband Subscriptions:

Pakistan has 124 million broadband subscribers as of November, 2022, according to Pakistan Telecommunications Authority. Broadband penetration among 140 million (59% of 236 million) Pakistanis in 15-64 years age bracket is 89%. Over 20 million mobile phones were locally manufactured/assembled in the country in the first 11 months of the year.

|

| Bank Account Ownership in Pakistan. Source: Karandaaz |

|

| Financial Inclusion Doubled In Pakistan in 5 Years. Source: Karandaaz |

Documenting Pakistan Economy:

Pakistan's unbanked population is huge, estimated at 100 million adults, mostly women. Its undocumented economy is among the world's largest, estimated at 35.6% which represents approximately $542 billion at GDP PPP levels, according to World Economics. The nation's tax to GDP ratio (9.2%) and formal savings rates (12.72%) are among the lowest. The process of digitizing the economy could help reduce the undocumented economy and increase tax collection and formal savings and investment in more productive sectors such as export-oriented manufacturing and services. Higher investment in more productive sectors could lead to faster economic growth and larger export earnings. None of this can be achieved without some semblance of political stability.

Related Links:

-

Comment by Riaz Haq on April 22, 2023 at 7:42pm

-

DigitAll: What happens when women of Pakistan get access to digital and tech tools? A lot!

by Javeria Masood – Head of Solutions Mapping, UNDP Pakistan

https://www.undp.org/pakistan/blog/digitall-what-happens-when-women...

4. Solutions are as good a connector as the communal problem

Take the example of healthcare. During the pandemic, we saw the case of herd immunity. Women in Dera Ghazi Khan are using this approach for other health concerns by self-help. Mujahida Perveen from UC Pega got diagnosed with Thyroid disease. She has found information on YouTube to manage her concerns and is educating others to take their symptoms seriously, get tested and adopt healthy choices.

‘I searched on YouTube about what a thyroid patient should do. I followed the recommended food intake and exercises and see a huge improvement.’

5. Local access does not limit global opportunities

Including women in the workforce has a strategic advantage at both a community and country scale. This perpetuates the flow of money and opportunities. Ayesha Abushakoor from Zawar Wala is a Quran teacher who has students within and outside the country and uses Digital Wallets to receive her fees.

‘My brother informed me that I can use the internet to provide Quran tuition to children. Now I have students here as well as in Dubai and Saudi Arabia.’

6. Future is supportive men

Ramla’s fathers an outlier in the community. He has four daughters whom he plans on educating, so they can get jobs and improve their lives. Unlike other men in the neighbourhood, he believes in equality and does not conform his daughters to discriminatory societal standards. Women in his family have access to mobile phones and the internet for recreation and education. His eldest daughter, Ramla, is in grade four and is passionate about studying.

‘My father has promised me that he will support me in getting a Master’s degree. During Covid-19, I took pictures of the syllabus made by my teacher and studied it on my father’s phone. He also makes the best biryani (Pakistan’s favourite rice dish)!’

What happens when the society stops putting barriers on women and provides them with access to technology and digital tools? They thrive.

They educate, empower, and enable themselves to empower others. All the women, who shared their stories, had one thing in common. They all thought of financial empowerment as a mechanism to upscale not just themselves, and their immediate families but the whole community. Their thinking and conversations are about long-term societal change.

Innovation and technology do not have a gender and it should not be gender biased in availability. We need to develop infrastructure, policies, and a climate toward an equitable digital future for all.

-

Comment by Riaz Haq on April 28, 2023 at 10:19am

-

Pakistan’s UBL Fund Managers taps Codebase for digital onboarding solution

https://www.fintechfutures.com/2023/04/ubl-fund-managers-taps-codeb...

One of Pakistan’s largest mutual fund operators, UBL Fund Managers, has partnered with Codebase to develop and launch a digital onboarding service for its business.

The omnichannel mobile and web application integrates with UBL Fund’s existing infrastructure, allowing customers to open mutual fund accounts “quickly and securely”.

The onboarding solution, which is one of only a few that complies with Security and Exchange Commission of Pakistan (SECP) and the State Bank of Pakistan’s (SBP) requirements, has been built using Codebase’s Digibanc platform.

The fintech platform comprises a number of features including external and internal API integration, full API integration with UBL Funds’ existing app, video call scheduling and back-office management workflows.

Billed as the first-of-its-kind in Pakistan, the portal offers access to investments for more than 220 million Pakistani nationals both within and outside the country.

UBL Fund Managers CEO Yaser Qadri says fintech solutions are “outpacing” traditional finance and in order to maintain market leadership, “financial institutions must harness technology to provide customers with seamless onboarding and ease of use”.

The partnership reflects Pakistan’s shift towards digitalisation within investments and mutuals funds.

Until recently, those looking to invest in mutual funds had to meet a company representative or visit an office or branch before filling out forms. The solution developed by Codebase and UBL means customers can complete the process remotely.

Customers can digitally onboard for UBL Funds’ JhatPat E-Account, including both the Sahulat Account (basic, with transaction limits) and the Sarmayakari Account (unlimited, subject to KYC).

-

Comment by Riaz Haq on May 13, 2023 at 12:39pm

-

‘Digital Pakistan’ in a coma: What is the cost of the broadband shut down?

https://profit.pakistantoday.com.pk/2023/05/11/digital-pakistan-in-...

One of the immediate groups that were affected were gig workers. These are daily workers that earn their money on platforms such as Careem, Foodpanda, and Indrive. These people require stable internet access through mobile phone data to do their jobs. Over these days, Foodpanda and services such as Careem were out of service because their captains and riders had no way of accepting rides/orders or of following maps. To put things in context, there are over 13000 foodpanda and Bykea riders, 30,000 Uber and Careem captains, and around 12,000 Foodpanda home chefs whose daily wages are dependent on broadband data.

Similarly, the shut down also had a serious impact on freelancers. A large number of Pakistanis work for foreign clients remotely on platforms such as Fivver and Upwork providing services ranging from coding to content writing and search engine optimization.

The gig-economy is an emerging sector in Pakistan. Freelancers in the country earned around $400 million in both 2021 and in 2022 which accounts for about 15% of Pakistan’s total $2.6 billion ICT (information-communication-technology) exports.

Almost immediately after the shutdown, both platforms put up signs next to the profiles of Pakistani users saying that the service providers belonged to a country that was experiencing internet outages which could delay their projects. The warning sign was not an exaggeration. A lot of these freelancers depend on broadband data to get their work done. On top of this, the freelancing world is brutal. Clients are very picky and small interruptions can very quickly sour client relationships that take years to build sometimes.

If this were not enough, the dream of a Digital Pakistan took another blow in the form of the Point-of-Sale machines also being out of service. A lot of the terminals you see at stores that are used to accept card payments come with in-built sims that connect them to the internet. As a result, Pakistan’s retail and grocery sector was operating entirely on cash. Even the country’s Federal Board of Revenue uses the data from these machines for tax calculation purposes.

Point of Sale (POS) machines, often known as debit/credit card machines, use sims to establish a network connection and make digital payments. The severance of mobile internet signals has rendered these machines temporarily obsolete, limiting everyone to cash payments only.

Reuters reported that Pakistan’s main digital payment systems fell by around 50% the day after former Prime Minister Imran Khan’s arrest. Data shared with Reuters by 1LINK on POS through its platform showed international payment card transactions were down on Wednesday by 45% in volume, from a daily average of 127,000 during the week of May 1 to 7 to approximately 68,000 on May 10. Ali Habib, spokesperson at HBL, Pakistan’s largest bank, said that it had seen a decline of 60% in the throughput of the POS machines.

-

Comment by Riaz Haq on May 13, 2023 at 4:05pm

-

Pakistan shut down the internet - but that didn't stop the protests

https://www.bbc.com/news/world-asia-65541769

The battle between Imran Khan's supporters and the powerful Pakistani military has this week been raging on two fronts - on the streets and on social media. And on one battlefield, the former prime minister seems to have the upper hand.

Within hours of Imran Khan's arrest on Tuesday, Pakistan's government had clamped down on the country's internet, in a move to quell resistance.

---------

Trust that mainstream outlets will adequately inform the public has broken down so much that people go online to find out "what is truly going on", says Uzair Younus, a Pakistani politics expert with The Atlantic Council, a US-based think tank.

"People say 'OK, it's not worth really watching television, because the military is governing what can and cannot be said,'" says Mr Younus.

So when it comes to breaking news like Khan's arrest, people flock online, to reputable journalists and YouTube channels as well as social media.

"I was glued to my screen at work, watching Geo News, one of the country's largest broadcasters," says Mr Younus. "But then I was getting a whole lot more information about protests - who had been shot, where tear gas was being shared - on WhatsApp and on Twitter. Geo was not covering any of that."

Of course, there are all the usual issues that come with relying on social media news - in Pakistan's bitterly complicated political scene, misinformation, disinformation, and conspiracy theories are all rampant, and often peddled by the political actors themselves.

No matter what kind of information people are consuming, limiting online access is a gross violation of fundamental rights, says Ms Dad, who runs the Digital Rights Foundation in Lahore.

"When you shut down the Internet, people have no choice in accessing information," she says.

She argues the authorities' blanket ban violates freedom of speech, access to information and the right to assembly - which are all enshrined in Pakistan's constitution. Internet access is a human right recognised by the United Nations.

Most severe censorship yet

But for Pakistanis, internet censorship days have become increasingly common since Mr Khan was voted out by parliament last April.

The charismatic politician has been on the comeback trail ever since, charging around the country on a convoy, loudly claiming his removal was illegitimate and the charges against him are false. He has spurred thousands to attend his rallies.

Netblocks, a UK-based internet monitor, has counted at least three major internet disruptions linked to Khan's rallies before his arrest - but this week's was the worst yet.

"This is possibly the most severe censorship that we've tracked for Pakistan in recent times," Netblocks researcher Alp Toker told the BBC.

"The scale of it and the fact it involves multiple forms of disruption - both the mobile networks and the social platforms - show a concerted effort to control the narrative."

Netblocks identified that the mobile networks affected had gone down in areas in Punjab - a Khan stronghold and Pakistan's most populous province. The telecoms authority later confirmed it had sent around the kill order following a directive from the interior ministry.

For Pakistan's current rulers, shutting down the internet is a significant move and one not taken lightly. It cuts off public access to healthcare, emergency and financial services.

It has been a big hit to an already failing economy, affecting businesses across the country. Tens of millions of Pakistanis - from delivery drivers to the tech community - rely on the Internet to earn a living.

-

Comment by Riaz Haq on May 13, 2023 at 6:11pm

-

Point-of-sale (POS) transactions routed through Pakistan’s main digital payment systems fell by around 50 per cent the day after former prime minister Imran Khan’s arrest ignited countrywide protests and prompted authorities to shut down mobile internet services, data showed on Thursday.

https://www.dawn.com/news/1752340

The reason for the slump was primarily the mobile broadband suspension, in addition to lower footfall at the limited number of stores opened due to the political turmoil, the two largest payments system operators, 1LINK and Habib Bank Limited (HBL), told Reuters.

The violent protests that followed Imran’s arrest on Tuesday by the country’s anti-graft agency have hit commercial activity in Pakistan hard.

Mobile data services have remained shut since Tuesday night on the orders of the interior ministry — the longest such continuous shutdown in a country that often suspends communications as a tool to quell unrest.

Many major roads and businesses have also remained shut, mainly in Lahore, the country’s second-largest city.

Data shared with Reuters by 1LINK on POS through its platform showed international payment card transactions were down on Wednesday by 45pc in volume, from a daily average of 127,000 during the week of May 1 to 7 to approximately 68,000 on May 10.

The daily value of transactions using international payment cards was down 46pc, from Rs606 million to Rs330m on May 10.

1LINK is Pakistan’s major facilitator of POS digital payment transactions for international platforms such as Visa and Mastercard.

Transactions on Pakistan’s only domestic payment scheme, PayPak, were down 52pc in volume to 18,000 transactions on Wednesday, and 56pc down in value to roughly Rs62m.

Ali Habib, spokesperson at HBL, Pakistan’s largest bank, said that it had seen a decline of 60pc in the throughput of the POS machines.

“HBL processes over 30pc of the entire throughput of the POS machines in Pakistan. This is the largest share in the market,” he added.

The State Bank of Pakistan did not immediately respond to questions sent by Reuters.

Cash transactions still dominate Pakistan’s commercial dealings, with much of the market undocumented, but digital payments have been growing fast in the country of 220 million. Many retailers and industrialists across Pakistan have also said their activities had ground to a halt since the protests started on Tuesday.

More than 1,600 people have been arrested while at least five have been killed and hundreds injured in riots, including more than 160 policemen.

On Tuesday, the Pakistan Telecommunication Authority (PTA) suspended mobile broadband services across the country.

Social media platforms such as Facebook, Youtube and Twitter were also down, resulting in demand for virtual private networks to surged by 1,329pc on Wednesday compared with the average, according to Simon Migliano, Head of Research at Top10VPN.

Migliano calculates that the suspension of mobile broadband and social media platforms has cost nearly $100m so far.

-

Comment by Riaz Haq on May 15, 2023 at 4:21pm

-

Pakistan Telecom Authority and NADRA to work together on multi-finger biometrics

https://www.biometricupdate.com/202303/pakistan-telecom-authority-a...

A memorandum of understanding between the Pakistan Telecommunication Authority (PTA) and the National Database and Registration Authority (NADRA) has established a collaboration on digital ID and biometrics as the country works towards achieving the UN’s Sustainable Development Goals and its own ‘Vision 2025’ policy.

The collaboration will cover work on digital identity, a multi-finger biometric verification system, and fraud detection and prevention capabilities, according to an announcement from the PTA.

The MoU states that the organizations will work together to build a coordination mechanism to align their work, as well as knowledge sharing and joint training sessions on relevant issues and technologies.

NADRA Chairman Tariq Malik underlined the importance of the collaboration during a signing event at PTA Headquarters in Islamabad.

Telecoms in Pakistan began using the multi-finger biometric verification system for SIM registration last November, with the system randomly requesting two of the registrant’s fingers for biometric verification to thwart spoofing.

-

Comment by Riaz Haq on May 16, 2023 at 1:06pm

-

Importance of e-commerce for Pakistan’s growth

Sector may continue growing, driven by internet penetration, middle classhttps://tribune.com.pk/story/2404587/importance-of-e-commerce-for-p...

KARACHI:

The e-commerce sector in Pakistan has achieved significant growth over the past few years, thanks to the increasing internet and smartphone penetration.According to a report of eMarketer, Pakistan’s e-commerce sales are projected to reach $2.1 billion by 2023, up from $1.2 billion in 2018. This article will explore the state of e-commerce sector, its challenges and opportunities, and how it is expected to evolve in the future.

E-commerce in Pakistan is still in its nascent stages, but it is growing rapidly. A report of the State Bank of Pakistan says the number of registered e-commerce merchants increased from 571 in 2015 to 1,516 in 2019. Similarly, the number of e-commerce transactions increased from 3.4 million in 2015 to 29.7 million in 2019.

Several factors are driving the growth of e-commerce. Firstly, the increasing use of smartphones and internet has made it easier for people to shop online.

We Are Social says in its report Pakistan has 97 million internet users, representing 38.7% of the population. Similarly, the number of mobile phone users in the country is expected to reach 161 million by 2025, up from 113.6 million in 2020, according to a report of GSMA.

Secondly, the Covid-19 pandemic has accelerated the growth of e-commerce, as people are opting for online shopping to avoid physical contact. Pakistan Telecommunication Authority says there was a 35% increase in e-commerce sales during the first wave of the pandemic.

Thirdly, the government of Pakistan has been taking steps to promote e-commerce. In 2019, the government launched the E-commerce Policy Framework, which is aimed at creating an enabling environment for the growth of e-commerce.

The policy includes measures such as simplifying the tax system, improving the logistics infrastructure and providing training and support to e-commerce entrepreneurs.

Despite its rapid growth, the e-commerce sector faces several challenges. One of the biggest challenges is the lack of trust among consumers.

According to a report of the Pakistan Software Export Board, only 18% of Pakistanis have ever made an online purchase, citing concerns of fraud and security as the main reason.

Another challenge is the lack of a robust logistics infrastructure. World Bank says in its report logistics cost accounts for around 18% of the value of goods in Pakistan, compared to 8-10% in developed countries. This is due to factors such as poor road infrastructure, a lack of standardised packaging, and inefficient customs procedures.

Payment infrastructure is also a major challenge. While digital payment solutions such as JazzCash and easypaisa have gained popularity, many people still prefer cash-on-delivery as a payment method. This poses a challenge to e-commerce businesses, as they have to deal with the risk of fraud and non-payment.

Despite the challenges, there are several opportunities. One of the biggest opportunities is the large and growing population of Pakistan. According to the United Nations, Pakistan is the world’s fifth-most populous country, with a population of over 220 million. This represents a huge potential market for e-commerce businesses.

Another opportunity is the growing middle class. McKinsey & Company says Pakistan’s middle class is expected to double by 2030, reaching 100 million people. This presents an opportunity for e-commerce businesses to target a growing market of consumers who have the purchasing power to buy online.

Moreover, the rise of social media presents another opportunity. Social media platforms such as Facebook, Instagram and TikTok are widely used in Pakistan, and many businesses have leveraged these platforms to reach potential customers.

E-commerce businesses can also use social media platforms to market their products and services and reach a wider audience.

-

Comment by Riaz Haq on May 16, 2023 at 1:06pm

-

Importance of e-commerce for Pakistan’s growth

Sector may continue growing, driven by internet penetration, middle class

https://tribune.com.pk/story/2404587/importance-of-e-commerce-for-p...

Pakistan’s e-commerce sector is expected to continue growing in the coming years, driven by factors such as increasing internet penetration, a growing middle class, and government support. However, the sector also faces several challenges that need to be addressed to ensure its continued growth.

One area that needs improvement is the logistics infrastructure. The government and private sector need to invest in improving the road infrastructure, standardising packaging, and streamlining customs procedures to reduce logistics cost and improve efficiency of the supply chain.

Another area that needs improvement is the payment infrastructure. While digital payment solutions have gained popularity, more needs to be done to increase the adoption of these solutions and reduce reliance on cash-on-delivery.

This includes improving awareness of digital payment solutions, enhancing security measures, and providing incentives to consumers to use digital payments.

-

Comment by Riaz Haq on May 21, 2023 at 3:52pm

-

For four days last week, Pakistan’s tech industry lost between $3 million and $4 million a day as internet services across the world’s fifth-most populous nation were shut down amid political turmoil.

https://restofworld.org/2023/south-asia-newsletter-political-turmoi...

On May 9, Pakistan’s former prime minister and popular politician Imran Khan was arrested in Islamabad on charges of corruption. This led to widespread protests across the country, and the government imposed an “indefinite” internet shutdown in several regions. On May 12, the Supreme Court ruled Khan’s arrest illegal, and he was subsequently released. Internet services in Pakistan have now been restored, but the damage has already been done.

The shutdown was a “massive setback” for the country’s IT industry, the Pakistan Software Houses Association (P@SHA) said in a tweet on May 11. “This is an alarming situation, and action needs to be taken urgently to address this issue,” it said in another tweet. “P@SHA demands immediate action to resolve the problem.”

Careem, inDrive, Foodpanda, and Bykea were among the companies that took the worst hit from the internet suspension, reported independent news platform ProPakistani.

Pakistan’s telecomms industry also lost $5.4 million in revenue due to the shutdown, a source told Al Jazeera on May 12. “The devastating effect on the economy is quantifiable but the inconvenience to people is incalculable,” tweeted Aamir Hafeez Ibrahim, CEO of mobile network operator Jazz.

In a letter to the government last week, Pakistan-focused venture capital association VCAP said such “restrictions have an immediate and adverse impact on Pakistan’s startups, which are reliant on such platforms for new user acquisition and growth. The suspension of mobile broadband also greatly impacts Pakistani citizens, who are mobile-first, and use these digital solutions for financial services, mobility, food, commerce, and more.”

Meanwhile, freelance workers in the country also lost access to the outside world during the shutdown. Pakistan is the third-largest global supplier of freelance work, and IT services make up a large chunk of it. Employers seeking Pakistani workers on freelance marketplace Fiverr were met with a note that read: “This freelancer is in a location currently experiencing internet disruptions. As a result, they may not be able to fulfill orders as quickly as usual.”

The crisis could not have come at a worse time for Pakistan’s tech workers, and the industry as a whole. The country has been dealing with a massive economic crisis, with dwindling forex reserves. It is currently waiting on a $1.1 billion loan from the International Monetary Fund. Pakistan’s foreign direct investment (FDI) plunged 44% in the first seven months of the 2023 financial year.

Calling it “absolutely nonsense from the international point of view,” Wille Eerola, chairman of the Finland Pakistan Business Council, said the internet shutdown is “only harming — or even destroying — the image of Pakistan as a country for international business and FDI.”

-

Comment by Riaz Haq on May 22, 2023 at 10:24am

-

Importance of e-commerce for Pakistan’s growth

Sector may continue growing, driven by internet penetration, middle class

https://tribune.com.pk/story/2404587/importance-of-e-commerce-for-p...

Pakistan’s e-commerce sector is expected to continue growing in the coming years, driven by factors such as increasing internet penetration, a growing middle class, and government support. However, the sector also faces several challenges that need to be addressed to ensure its continued growth.

One area that needs improvement is the logistics infrastructure. The government and private sector need to invest in improving the road infrastructure, standardising packaging, and streamlining customs procedures to reduce logistics cost and improve efficiency of the supply chain.

Another area that needs improvement is the payment infrastructure. While digital payment solutions have gained popularity, more needs to be done to increase the adoption of these solutions and reduce reliance on cash-on-delivery.

This includes improving awareness of digital payment solutions, enhancing security measures, and providing incentives to consumers to use digital payments.

Twitter Feed

Live Traffic Feed

Sponsored Links

South Asia Investor Review

Investor Information Blog

Haq's Musings

Riaz Haq's Current Affairs Blog

Please Bookmark This Page!

Blog Posts

Pakistanis' Insatiable Appetite For Smartphones

Samsung is seeing strong demand for its locally assembled Galaxy S24 smartphones and tablets in Pakistan, according to Bloomberg. The company said it is struggling to meet demand. Pakistan’s mobile phone industry produced 21 million handsets while its smartphone imports surged over 100% in the last fiscal year, according to …

ContinuePosted by Riaz Haq on April 26, 2024 at 7:09pm

Pakistani Student Enrollment in US Universities Hits All Time High

Pakistani student enrollment in America's institutions of higher learning rose 16% last year, outpacing the record 12% growth in the number of international students hosted by the country. This puts Pakistan among eight sources in the top 20 countries with the largest increases in US enrollment. India saw the biggest increase at 35%, followed by Ghana 32%, Bangladesh and…

ContinuePosted by Riaz Haq on April 1, 2024 at 5:00pm

© 2024 Created by Riaz Haq.

Powered by

![]()

You need to be a member of PakAlumni Worldwide: The Global Social Network to add comments!

Join PakAlumni Worldwide: The Global Social Network