PakAlumni Worldwide: The Global Social Network

The Global Social Network

Economic History of India Since 1 AD

When the British arrived in Mughal India, the country's share of the world GDP was 25%, about the same as the US share of the world GDP today. By 1947, undivided India's share of world GDP ($4 trillion in in 1990 Geary-Khamis dollars) had shrunk to about 6% (India: $216 billion, Pakistan: $24 billion). Since independence, India's contribution to world GDP has shrunk further to about 4%, according to British Economist Angus Maddison who died in 2010.

The colonization of India and many other nations in Asia and Africa began with the advent of the Industrial Revolution in Europe which resulted in a major power shift from East to West over the time-span of just a few decades. Prior to the Industrial Revolution, the world depended mainly on agriculture based on human and animal muscle power. Countries with large populations and farmlands had large share of the world GDP. The per capita productivity differences among nations and regions were relatively small. The machine age changed it all. Those who used machines became much more productive and significantly richer than the rest.

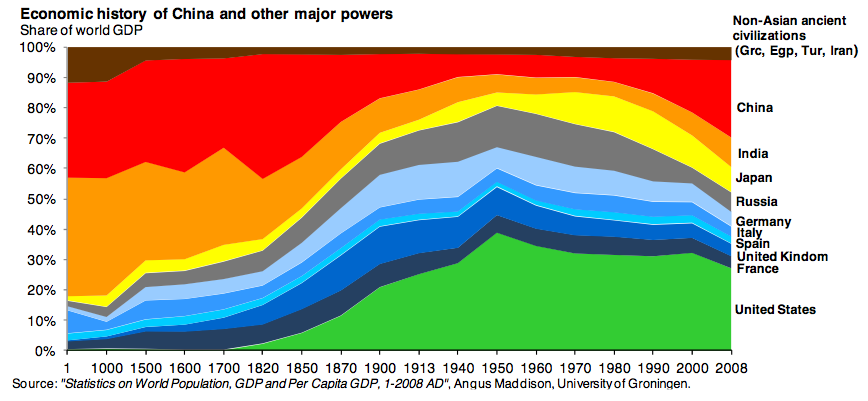

In 1000 AD, according to British Economist Angus Maddison, China and India together accounted for more than half of the world GDP (calculated in 1990 dollars in terms of purchasing power parity). By 1600, that share was 51.4%, with China accounting for 29% and India 22.4% of world GDP. A hundred years later, China’s GDP had fallen but India’s went up to 24.4% of world output. By 1820, however, India’s share had fallen to 16.1%. By 1870, it went down to 12.2%. International Monetary Fund (IMF) projections indicate that India’s share of world GDP would be 6.1% in 2015.

While it is a fact that India's total GDP was at one point the highest in the world, does it mean that the average Indian was richer than his or her counterparts elsewhere in the world? To answer this question, let's look at Maddison's figures for per capita GDP in various parts of the world.

In 1 AD, India’s GDP per capita was $450, the same as China’s. But Italy under the Roman Empire had a per capita income of $809. In 1000 AD, India’s per capita income was $450 and China’s $466. But the average of the Islamic Caliphate in Baghdad which ruled West Asia (Turkey, Syria, Iran and Iraq) was much higher at $621. An average citizen of the Abbasid Caliphate was richer than an average Indian or Chinese. In fact, the per capita income in the Abbasid Caliphate was the highest in the world in 1000 AD.

As the European Renaissance began, new centers of prosperity emerged. Italy topped the table in 1500 AD, with per capita income of $1,100, the Netherlands following with a per capita income of $761. The UK was not far behind, with a per capita income of $714. All of these nations were richer than India and China which had per capita incomes of $550 and $600 respectively.

|

| India Health-Wealth Indicators Source: Gapminder.com |

While India today has the world's largest population of poor, it is still richer than it has ever been in terms of per capita incomes. Indians are also living longer than ever in the country's history; average life expectancy in India has risen from just 23 years in 1800 to 65.5 years now. However, India continues to significantly lag the rest of the world on both economic and social indicators.

Related Links:

Haq's Musings

Power Shift Since Industrial Revolution

Can Superpoor India Become a Superpower?

India: World's Largest Population of Poor, Hungry and Illiterates

Sri Lanka Leads South Asia in Economic and Social Indicators

Upwardly Mobile Pakistan

Brief History of Pakistan Economy

India Ranks Last on PISA, TIMSS

-

Comment by Umair Feroze Awan on March 6, 2014 at 9:51am

-

sir interesting read . I think there are 2 flaws : 1 : the life expectancy in india at 23 years seems unbelievable either there was havoc of infant mortality or widespread wars killing people. 2. the per capita income today when compared to those historically has much lesser purchase power however that is not drawn as a conclusion here. Happy to learn more.

-

Comment by Riaz Haq on March 6, 2014 at 9:58am

-

Average life expectancy was very short in the world for most of human history until the advent of modern medicine. The per capita income figures for all nations are normalized to 1990 US dollar purchasing power parity.

-

Comment by Riaz Haq on July 28, 2023 at 2:23pm

-

How India's Economy Will Overtake the U.S.'s

https://time.com/6297539/how-india-economy-will-surpass-us/

BY ARVIND PANAGARIYA

Arvind Panagariya is a Professor of Economics at Columbia University in New York City.

The brilliant and late economic historian Angus Maddison estimated that India was the world's largest economy for a staggering one and a half millennia. China surpassed India by 1820 but they remained the world’s two largest economies until 1870, when the twin effects of the Industrial Revolution in the West and European colonization were more fully felt. Britain then emerged as the world’s foremost economic power; that economic title passed to the U.S. by 1900. Yet amid increasing talk of Asia’s rise, is the world economy now poised to return to its old normal?

Prospects for such an outcome can hardly be overestimated. With its economy already 70% of the U.S. and growing at more than twice the latter's rate, China is poised to become the world’s largest economy between 2035 and 2040. But the next debate is over whether the Indian economy will also surpass the U.S.’s—and when.

The good news for India is that during the 15 years preceding COVID-19, the country sustained a real GDP growth rate of 8% compared with less than 2% for the U.S. If India can keep this up for the next two decades and grow 5% a year thereafter while the U.S. maintains its growth rate of 2%—two scenarios that are possible, if not likely—it would overtake the latter by 2073.

There are several factors working in India’s favor. To begin with, the country’s GDP per capita is less than 20% of China's and 5% of the U.S.'s. This yawning gap in productivity per person offers India vast opportunities to catch up. As the country accumulates capital and imparts skills to its workforce, it can achieve large productivity increases just by deploying the superior existing technologies.

India also enjoys the twin advantages of a young and large population. Keeping the population size aside momentarily, a young population offers three advantages. First, it potentially translates into a relatively larger workforce and, consequently, higher output per capita. Second, given that the young tend to save for old age while the old spend more than they save, a younger population also translates into higher savings and therefore higher investment. The higher investment directly adds to output and indirectly facilitates the adoption of superior technology. Finally, a younger population brings greater energy and vibrancy to a nation, leading to more innovation.

But to take full advantage of its young population, India must do more to raise its labor participation rate, particularly among women. Less than one-quarter of women 15 and up participate in India's workforce, compared with three-fifths in China and the U.S. And better education at all levels will play an essential role in that endeavor.

-

Comment by Riaz Haq on July 28, 2023 at 2:24pm

-

How India's Economy Will Overtake the U.S.'s

https://time.com/6297539/how-india-economy-will-surpass-us/

As for population size, India likely surpassed China this year to become the world’s most populous country, and the gap will only widen in the near future. That confers additional benefits through economies of scale in the provision of public goods. Take, for example, India’s digital payments infrastructure built on the biometric identity system known as Aadhaar and the United Payments Interface (UPI) platform, which serves as host to hundreds of banks. Using Aadhaar to verify identity, UPI clears transactions between bank-account holders in real-time. The larger the number of users, the lower the per-capita cost of building the infrastructure for it.

This same argument also applies to other sectors. Once an expressway has been built, for example, the larger the population in the communities residing around it, the lower the per-capita cost of connecting them to it. The same goes for railway and air connectivity, electricity, and piped water. Once these amenities have been brought to one village, the extra cost of extending them to other nearby villages is small.

Size also brings benefits when it comes to creating supply chains. A larger population means greater scope for agglomeration and cost efficiencies. Today, with the risks of investing and operating in China multiplying, multinationals are switching to the so-called "China+1" strategy, looking for an additional, less risky but cost-effective location for their investments. India has a distinct advantage in becoming that "+1" country because it constitutes the largest single market among potential competitors. Components produced in different locations can move freely without having to face a customs border. A large internal labor market also makes for better prospects for a closer match between the skills needed and those available.

But first, India needs to reduce its trade protectionism, which remains relatively high. No country has sustained growth rates of at least 8%, as India needs to do to overtake the U.S. economy, without embracing globalization. The country should roll back tariffs, strike more free trade deals with major economies and trade blocs, and cut back on the use of anti-dumping.

There are additional areas where India cannot afford to be complacent. The country must swiftly privatize a number of public sector enterprises, particularly banks, that have a long history of low or negative returns. Tax reform should also be high on the government's agenda; a constant complaint of businesses, especially small- and medium-sized ones, has been overzealous tax authorities and a convoluted and opaque system.

In essence, India needs to remember the spirit of its economic reforms in 1991—which centered around liberalization, privatization, and globalization—that have gone some distance toward accelerating growth. If the country wants to return to being one of the world's top two economies in the next 50 years, it must deepen and widen the reforms it began three decades ago.

Comment

Twitter Feed

Live Traffic Feed

Sponsored Links

South Asia Investor Review

Investor Information Blog

Haq's Musings

Riaz Haq's Current Affairs Blog

Please Bookmark This Page!

Blog Posts

Modi's AI Spectacle: Chaos and Deception in New Delhi

The India AI Impact Summit 2026, held at Bharat Mandapam in New Delhi, has been marred by chaos, confusion and deception. The events on the ground have produced unintended media headlines for India's Prime Minister Narendra Modi who wants to be seen as the "vishwaguru" (teacher of the world) in the field of artificial intelligence as well. First, there was massive chaos on the opening day, with long…

ContinuePosted by Riaz Haq on February 19, 2026 at 12:00pm — 13 Comments

India-Pakistan Cricket Match: The Biggest Single Event in the World of Sports

Why did Pakistan's decision to boycott the India-Pakistan match in solidarity with Bangladesh in this year's T20 World Cup send shockwaves around the world? And why did it trigger the International Cricket Council's and other cricket boards' urgent efforts to persuade Pakistan to return to the match? The reason has a lot to do with its massive financial impact, estimated to be as much as …

ContinuePosted by Riaz Haq on February 11, 2026 at 4:00pm — 2 Comments

© 2026 Created by Riaz Haq.

Powered by

![]()

You need to be a member of PakAlumni Worldwide: The Global Social Network to add comments!

Join PakAlumni Worldwide: The Global Social Network