PakAlumni Worldwide: The Global Social Network

The Global Social Network

Expensive Fuel Hits Power Sector in India & Pakistan

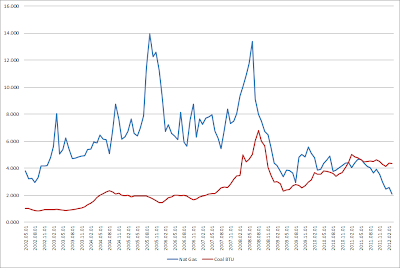

Lack of affordable fuel has forced many power producers in Pakistan to operate at a fraction of their installed capacity since 2008. It has led to widespread load-shedding in the country, seriously hurting its economy. Similar situation now appears to be developing in India as well, although it's not quite as serious as Pakistan's current crisis yet. Current costs of various fuel options vary from $4 per mmBTU for coal to $20 per mmBTU for oil. Recently, the US prices of natural gas have dropped dramatically from $12 per mmBTU a few years ago to less than $2 per mmBTU, about half the price of coal, with the shale gas revolution currently sweeping the United States.

India burns coal to produce 55 percent of its electricity needs. Domestic coal production has increased just 1 percent last year while 11 percent additional power generation capacity has been installed. Some power producers have been importing coal, but that option has become more untenable recently because India’s biggest supplier, Indonesia, has doubled coal prices, according to a report in New York Times.

The gap between demand and supply in India has increased to 10.2 percent last month, from 7.7 percent a year earlier. In some states like Andhra Pradesh and Tamil Nadu, power cuts have become so common that many factories report getting more electricity from diesel generators than they do from the power grid, at much higher cost.

Retail rates for electricity are lower than the cost of producing and delivering it and the difference is made up by Indian state government subsidies running into hundreds of billions of rupees annually.

Unlike India which uses coal, Pakistan relies heavily on natural gas for the bulk of electricity production and other energy needs. Demand for natural gas now exceeds 4.5 billion cubic feet per day or 1.6 trillion cubic feet per year, with a shortfall of nearly 300 million cubic feet per day. According to BMI, gas accounted for 47.5% of Pakistan's primary energy demand (PED) in 2007, followed by oil at 30.7%, hydro-electric energy at 12.9% and coal with a 7.9% share.

The main option Pakistan is pursuing now is Iran-Pakistan pipeline to import gas and reduce the growing gap between supply and demand. However, this option faces serious obstacles with tightening US and international sanctions aimed at isolating Iran because of concerns about Iran's nuclear ambitions. At the same time, Pakistan is also negotiating for LNG imports from Algeria. The wholesale prices of these options are 3 to 4 times more expensive than the the retail rate of $3 to $5 per mmBTU for domestic gas being produced in Pakistan.

In addition to gas imports, Pakistan has other options to meet its energy needs. Some of these are as follows:

1. Developing its shale gas reserves estimated 51 trillion cubic feet near Karachi in southern Sindh province. The US experience has shown that investment in shale gas can increase production quite rapidly and prices brought down from about $12 per mmBTU in 2008 to under $2 per mmBTU recently. Pursuing this option requires US technical expertise and significant foreign investment on an accelerated schedule.

2. Increasing production of gas from nearly 30 trillion cubic feet of remaining conventional gas reserves. This, too, requires significant investment on an accelerated schedule.

3. Converting some of the idle power generation capacity from oil and gas to imported coal to make electricity more available and affordable.

4. Utilizing Pakistan's vast coal reserves in Sindh's Thar desert. The problem here is that the World Bank, Asian Development Bank and other international financial institutions (IFIs) are not lending for coal development because of environmental concerns.And the Chinese who were showing interest in the project have since pulled out.

5. Hydroelectric and other renewables including wind and solar. Several of these projects are funded and underway but it'll take a while to bring them online to make a difference.

In my view, Pakistan should pursue all of the above options with options 1, 2 and 3 as a priority for now. Pakistan's best interest is not in defying Saudis and Americans to buy expensive Iranian gas and end up with crippling sanctions which could be much worse than its current energy crisis. Its best interests will be served by developing its own cheap domestic shale gas on an accelerated schedule with Saudi investment and US tech know-how. If the Americans and the Saudis refuse to help, then Pakistan will have a stronger case to go with the Iran gas option.

Related Links:

Haq's Musings

Pakistan Needs Shale Gas Revolution

US Census Bureau's International Stats

Pakistan's Vast Shale Gas Reserves

US AID Overview of Pakistan's Power Sector

US Can Help Pakistan Overcome Energy Crisis

Abundant and Cheap Coal Electricity

US Dept of Energy Report on Shale Gas

Pakistan's Twin Energy Crises

Pakistan's Electricity Crisis

Pakistan's Gas Pipeline and Distribution Network

Pakistan's Energy Statistics

US Department of Energy Data

Electrification Rates By Country

CO2 Emissions, Birth, Death Rates By Country

China Signs Power Plant Deals in Pakistan

Pakistan Pursues Hydroelectric Projects

Pakistan Energy Industry Overview

Water Scarcity in Pakistan

Energy from Thorium

Comparing US and Pakistani Tax Evasion

Zardari Corruption Probe

Pakistan's Oil and Gas Report 2010

Circular Electricity Debt Problem

International CNG Vehicles Association

Rare Earths at Reko Diq?

Lessons From IPP Experience in Pakistan

Correlation Between Human Development and Energy Consumption

BMI Energy Forecast Pakistan

-

Comment by Riaz Haq on May 3, 2013 at 11:17am

-

Here's a Dawn report on the cost of fuel for thermal power in Pakistan:

ISLAMABAD: The government disclosed in the Supreme Court on Thursday that about Rs2 billion was being spent daily (Rs749bn a year) on purchase of furnace oil for thermal power generation.

“This Rs749bn is in addition to Rs250bn which the government has to incur in terms of subsidised electricity provided to certain consumers,” Managing Director of the Pakistan Electric Power Company (Pepco) Zarghoon Ishaq Khan informed a three-judge bench headed by Chief Justice Iftikhar Mohammad Chaudhry which had taken notice of the rising electricity loadshedding.

The court regretted that despite spending a huge amount on thermal power generation people continued to endure huge power cuts.

The total electricity shortfall currently stands at about 4,000MW against a demand of 13,800MW. The generating units at present are collectively producing about 9,200MW.

The court directed Pepco, National Transmission and Dispatch Company, generation companies, Indus River System Authority and Alternative Energy Development Board to come up with actual reasons for loadshedding, bottlenecks and difficulties in providing the required electricity to consumers.

http://dawn.com/2013/05/03/rs2bn-being-spent-daily-on-thermal-power/

-

Comment by Riaz Haq on June 23, 2013 at 8:40am

-

Here's a GlobalPost report on coal conversion of gas-oil-fired power plants in Pakistan:

Pakistan has asked the Manila-based Asian Development Bank to help finance two coal-fired power units at the Jamshoro thermal power station in Sindh, a senior official of Pakistan's Water and Power Development Authority told Kyodo News this week.

Zafar Umar Farooqi, chief engineer at the authority, said Pakistan had initially sought a $433 million ADB loan for one 600-megawatt unit but the bank has now been asked to consider a loan for two units.

He said the size of ADB loan will be decided after consultations with the bank, but he indicated the total cost of Jamshoro project would be around $1.5 billion.

The government-owned WAPDA operates an 850-MW oil-gas fired thermal power plant at Jamshoro at less than 40 percent of its capacity because of a shortage of fuel oil and gas.

The ADB loan will be used to convert the existing plant to coal and set up an additional coal-fired plant at the site, increasing installed capacity at Jamshoro to 2,050 MW.

The government has already invited expressions of interest from consultants to oversee construction at Jamshoro, which is about 150 kilometers northeast of Karachi and uses water from the Indus River for cooling.

Pakistan has long examined setting up coal-fired power plants to use its own lignite coal, but efforts have been unsuccessful because of the high ash content in the coal.

Ismail Khan, senior external relations officer for the ADB for Pakistan, said the new units at Jamshoro would be designed to use mixed local and imported coal, most probably from Indonesia.

Farooqi said separate tenders will be invited for conversion of existing Jamshoro plant from oil-gas to coal.

Pakistan has an acute power shortage and the new government of Pakistan Muslim League (N) has given top priority to increasing power generation.

http://www.globalpost.com/dispatch/news/kyodo-news-international/13...

-

Comment by Riaz Haq on December 9, 2013 at 10:01am

-

APP reports that Asian Development Bank has agreed to finance coal-fired power generation plant in Pakistan in spite of strong opposition from the environmental lobby:

The Asian Development Bank (ADB) is providing a $900 million loan for a new supercritical coal power generation unit in Pakistan that will deliver reliable and cost effective electricity to hundreds of thousands of energy-starved households and businesses.

The coal-fired generation unit, the first in the country to use supercritical boiler technology, will be built at an existing power plant in the town of Jamshoro in Sindh province, about 150 kilometres east of the provincial capital, Karachi.

It will employ state-of-the-art emission control equipment resulting in cleaner emissions than the existing heavy fuel oil-fired generators and subcritical boiler technology, which is more commonly used, according to ADB statement issued on Monday.

Pakistan only has 19 percent of the global average for carbon dioxide emissions per person and has only one coal-fired power plant in operation generating 0.7 percent of the generation mix.

Recycling ash from the plant will also save about 115,000 tons of carbon dioxide equivalents per year, the statement said adding the electricity generated from the plant will alleviate some of the power shortages and replace generation from small individual oil and diesel generators which is expected to save a further 503,000 tons of carbon dioxide per year.

The new plant will generate electricity at a lower cost saving about $535 million per year on its fuel import bill compared with oil fired generation.

The new unit is a part of broader government efforts to decrease electricity tariff.

Coal-fired power plants, using cleaner technology, provide an environmentally sound and cost-effective medium-term energy solution at a time when the country's natural gas reserves are dwindling.

Resolving the energy crisis is a priority for the country and the government is pursuing all options including large hydropower plants, renewable energy, energy efficiency, increasing domestic gas production, and importing electricity and natural gas.

Pakistan has substantial potential for large hydropower which will be developed to meet long-term energy needs because of the longer construction period involved.

Small and medium sized hydropower will be developed to meet medium-term needs, it said adding the stable base-load power provided by this project will enable the fluctuating power from solar and wind power to be used without disruption to the grid.

ADB's assistance, which includes $870 million from ordinary capital resources and $30 million from its concessional Asian Development Fund, will be complemented by cofinancing of $150 million from the Islamic Development Bank and counterpart funds of $450 million from the government.

The project is expected to be completed by December 2018. ADB's assistance will also provide 5 years of operation and maintenance support after its completion.http://www.brecorder.com/top-news/1-front-top-news/147932-adb-provi...$900mn-to-support-pakistan-end-energy-crisis.html

http://www.businessweek.com/news/2013-12-09/adb-to-lend-900-million...

http://www.huffingtonpost.com/jake-schmidt/important-test-of-the-ov...

-

Comment by Riaz Haq on March 28, 2015 at 8:32am

-

The first shipment of LNG is scheduled to arrive in Pakistan on 26 March 2015, according to local reports.

Sources suggest that Qatargas has sold the LNG to Pakistan at approximately US$8 – 9/million Btu.

The government of Pakistan is keen to secure supplies of LNG from Qatar to help ease the energy crisis that is currently plaguing the country. Last year, Engro Corp.’s subsidiary, Elengy Terminal Pakistan Limited (ETPL), won the contract to develop Pakistan’s first LNG import infrastructure within a 335-day deadline.

Engro Corp. prepared an exclusive article discussing the regasification project for the March 2015 issue of LNG Industry. In the article, Engro explained the extent of the energy crisis in Pakistan:

Pakistan’s demand for gas [is] expected to double in the next 10 years and current gas production at 4 billion ft3/d was less than the required 6 billion ft3/d. At the current rate of growth, the demand could touch 13 billion ft3/d by 2020.

If this happens, the energy conundrum in the country could well become an energy catastrophe. Towns and rural areas will be in perpetual darkness, and a majority of the industrial units will be forced to shut down or remain uncompetitive. Consequently, unemployment will increase, a greater majority of Pakistanis will fall below the poverty line, food inflation will become rampant, and social indicators will be well below that of sub-Saharan countries.

By this time, Pakistan will only be able to meet 41% of its energy requirements and will have an energy import bill of US$52 billion. With no end in sight, the repercussions of Pakistan’s ongoing energy crisis are severe and go well beyond threats to the country’s economic well-being and stability.

Hence, it is imperative to look for an alternative source of gas in Pakistan. Importing LNG will enable the government to save significant foreign exchange through import substitution of oil, and will alleviate the energy crisis plaguing the country.

http://www.lngindustry.com/regasification/23032015/Pakistan-set-for...

-

Comment by Riaz Haq on December 21, 2015 at 7:57pm

-

#China consortium to help finance $2 billion #Engro #Thar coal-mining & power generation project in #Sindh #Pakistan http://www.chinadaily.com.cn/business/2015-12/22/content_22771350.htm …

A consortium led by China Machinery Engineering Corp is set to finance a coal-based power plant and a mining project being developed by Engro Corp, a Pakistani firm.

The first phase of the $2 billion project will consist of a coal-based power plant with two 330-megawatt units in Thar Block II in the Sindh province of Pakistan and a coal mining project for power generation.

The project is also part of the cooperation along the China-Pakistan Economic Corridor, which runs about 3,000 kilometers from Gwadar to the northwestern Chinese city of Kashgar, Xinjiang Uygur autonomous region, a part of the ancient Silk Road linking Eurasia and Africa, CMEC said in a statement.

Zhang Chun, president of CMEC, said that it is the first integration project of coal mining and coal-based power plant among the projects in the China-Pakistan Economic Corridor, which is expected to push forward the economic development in Pakistan.

"I think we have opened a new chapter in the overseas market with this project," Zhang said.

"Since our strength lies in foreign engineering project contracting, it will become a model project in Pakistan."

The deal follows President Xi Jinping's state visit to Pakistan in April, when the two sides agreed to set up an economic corridor to bolster China's new trade initiatives-the Silk Road Economic Belt and the 21st Century Maritime Silk Road.

Wang Shida, an expert on Afghanistan at the Beijing-based China Institute of Contemporary International Relations, said that the project will help bolster Pakistan's energy supplies, something that has hindered local economic development.

He said Pakistan relies heavily on imported crude oil, diesel and natural gas, with less than 0.1 percent of energy coming from coal-fired power stations, leaving much potential for growth in coal-based power projects.

"The cost is very high due to the reliance on imports. Construction of more coal-powered plants will ease the demand-supply gap in Pakistan," he said.

China has already invested more than $40 billion for development of the China-Pakistan Economic Corridor with energy projects being a major focus including hydropower plants, coal-fired stations and wind farms, experts said.

The signing ceremony also involved financial groups like China Development Bank and Habib Bank Ltd in Pakistan.

-

Comment by Riaz Haq on October 4, 2016 at 6:46pm

-

Circular #debt in #Pakistan #power sector declining: #IMF | SAMAA TV

http://www.samaa.tv/economy/2016/10/circular-debt-in-pakistan-power...

The annual increase in circular debt of Pakistan’s power sector has come down from Rs 222 billion to just Rs 8 billion in the fiscal year 2015-16.

It was revealed in the data graphics released by the International Monetary Fund (IMF) about the circular debt of Pakistan’s Power sector.

According to the data, power sector losses paid out of the federal budget in Pakistan have come down from Rs 342 billion in fiscal year2012-13 and Rs 138 billion in fiscal year 2013-14 to zero since past two years fiscal years 2014-15 and 2015-16.

-

Comment by Riaz Haq on December 21, 2018 at 8:43am

-

PTI Government unhappy, but Pakistan to stay with coal

https://www.eco-business.com/news/government-unhappy-but-pakistan-t...

Out of the 21 energy projects to be completed on a fast track (by 2019) with a cumulative capacity of 10,400 MW, nine are coal power plants, seven wind power plants, three hydropower, and two are HVDC transmission line projects.

Nearly USD 35 billion of the USD 60 billion worth of loans for producing energy from the China Pakistan Economic Corridor (CPEC) will be used to build new power stations, mainly coal-fired.

The projects completed include two mega coal power plants of 1,320 MW each, one in Punjab’s Sahiwal (commercially operating since May 2017) and the other in Karachi’s Port Qasim (Commercially operating since April 2018) using imported bituminous coal with modern supercritical coal-fired units. According to news reports, the country’s National Accountability Bureau has initiated an alleged corruption probe into both the costly projects.

Another one under completion is in the Thar desert in Sindh, about 400 kilometres from the port city of Karachi. It includes mining and setting up two 330 MW power plants at a cost of USD 2 billion. Once completed, it will be the first large power generation project using local coal.

The Sindh Engro Coal Mining Company has finally reached the coal seam in the desert. According to the company’s chief executive officer, Shamsuddin Shaikh, by October the company would have dug down to 162 metres to be able to dig up “useful” lignite coal. At the same time work at the first of the two power plants is 85 per cent complete and commissioning will begin by November-December this year when it will start supplying power to the national grid on an experimental basis. Once the first plant is fired, it will gobble up 3.8 million tons of coal each year.

Other projects in the pipeline include three 1,320 MW coal power plants. The ones at Rahim Yar Khan (in Punjab), and Hub (in Balochistan) to be completed between December 2018 and August 2019 respectively, will use imported coal. The third one, at Thar Block VI (in Sindh), will use indigenous lignite coal.

That does not mean that Pakistan is going to be completely coal-driven. Vaqar Zakaria, managing director of environmental consultancy firm Hagler Bailly Pakistan, put the figure to “just about 10 per cent of current power generation” which is from imported coal. However, he pointed out that coal-based power generation will increase to about 30 per cent of the country’s capacity requirement in the next three years once plants on Thar coal come online, and those at Hub and Jamshoro expand on imported coal.

Zakaria pointed out that the main argument in favour of Thar coal was the “lower reliance on imported fuel”, and to meet the “demand particularly when hydropower drops in winter” although the capital cost was high as the mines also have to be developed. However, he predicted the country will “see a slowdown in capacity addition in Thar in future”.

But projects relying on imported coal were questionable, especially those that are being carried out now, said Zakaria. “The earlier ones were justified [by the government] on the basis of load shedding and early induction of power to fill the demand-supply gap like the one at Port Qasim and Sahiwal plants that are already online; but the ones at Hub and Jamshoro cannot be justified on that basis. It is hard to understand why a project on imported coal was added so late in the game,” he said.

Comment

- ‹ Previous

- 1

- 2

- Next ›

Twitter Feed

Live Traffic Feed

Sponsored Links

South Asia Investor Review

Investor Information Blog

Haq's Musings

Riaz Haq's Current Affairs Blog

Please Bookmark This Page!

Blog Posts

India-Israel Axis Threatens Peace in South Asia

The bonhomie between Israeli Prime Minister Netanyahu, an indicted war criminal, and Indian Prime Minister Narendra Modi, accused of killing thousands of Muslims, was on full display this week in Israel. Both leaders committed to supporting the Afghan Taliban regime which is accused of facilitating cross-border terrorist attacks by the TTP in Pakistan. Mr. Modi was warmly welcomed by…

ContinuePosted by Riaz Haq on February 27, 2026 at 10:45am

Modi's AI Spectacle: Chaos and Deception in New Delhi

The India AI Impact Summit 2026, held at Bharat Mandapam in New Delhi, has been marred by chaos, confusion and deception. The events on the ground have produced unintended media headlines for India's Prime Minister Narendra Modi who wants to be seen as the "vishwaguru" (teacher of the world) in the field of artificial intelligence as well. First, there was massive chaos on the opening day, with long…

ContinuePosted by Riaz Haq on February 19, 2026 at 12:00pm — 13 Comments

© 2026 Created by Riaz Haq.

Powered by

![]()

You need to be a member of PakAlumni Worldwide: The Global Social Network to add comments!

Join PakAlumni Worldwide: The Global Social Network