PakAlumni Worldwide: The Global Social Network

The Global Social Network

Fintech to Expand Financial Inclusion in Pakistan

About 100 million Pakistani adults lacked access to formal and regulated financial services as of 2016, according to a World Bank report on financial inclusion. Only 2.9% of adults in Pakistan had a debit card, and only 1% of adults used them to make payments. Just 1.4% of adults used an account to receive wages and 1.8% of adults used it to receive government transfers in 2014. Since then, Pakistan has been leading the way in South Asia in digital finance and branchless banking.

According to the latest State Bank statistics on branchless banking (BB) sector, mobile wallets reached a high of 33 million as of September 2017, up 21% over the prior quarter. About 22 percent of these accounts – 7.4 million – are owned by women, up 29% in July-September 2017 over previous quarter. A McKinsey and Co analysis shows that adoption of financial technology (fintech) can help dramatically increase financial inclusion in Pakistan.

Karandaaz Pakistan , a non-profit organization, set up jointly by UK’s Department for International Development and Bill and Melinda Gates Foundation, is promoting financial technology in the country. Finja and Inov8 are among the better known fintech startups in the country. Chinese e-commerce giant Alibaba's Ant Financial's recent entry in Pakistan is creating a lot of excitement in Pakistan's fintech community.

Financial and Digital Inclusion in Pakistan. Source: Brookings Inst... |

Importance of Financial Inclusion:

Access to regulated financial services for all is essential in today's economy. It allows people and businesses to come out of the shadows and fully participate in the formal economy by saving, borrowing and investing.

Those who lack access to regulated banking services are often forced to resort to work with unscrupulous lenders who trap them in debt at unaffordable rates. Such loans in extreme cases lead to debt bondage in developing countries.

Financial inclusion is good for individuals and small and medium size businesses as well as the national economy. It spurs economic growth and helps document more of the economy to increase transparency.

Status of Financial Inclusion in Pakistan:

About 100 million Pakistani adults lacked access to formal and regulated financial services as of 2016, according to a World Bank report on financial inclusion. Only 2.9% of adults in Pakistan had a debit card, and only 1% of adults used them to make payments. Just 1.4% of adults used an account to receive wages and 1.8% of adults used it to receive government transfers in 2014. Since then, Pakistan has been leading the way in South Asia in digital finance and branchless banking.

M-wallets Growth in Pakistan in millions. Source: Business Recorder |

Mobile wallets, also called m-wallets, are smartphone applications linked to bank accounts that allow users to make payments for transactions such as retail purchases. According to recent State Bank statistics on branchless banking (BB) sector, mobile wallets reached a high of 33 million as of September 2017, up 21% over the prior quarter. About 22 percent of these accounts – 7.4 million – are owned by women, up 29% seen in Jul-Sep 2017 over previous quarter. Share of active m-wallets has also seen significant growth from a low of 35% in June 2015 to 45% in September 2017.

“The benefits of digital payments go well beyond the convenience many people in developed economies associate with the technology,” says Dr. Leora Klapper, Lead Economist at the World Bank Development Research Group. “Digital financial services lower the cost and increase the security of sending, paying and receiving money. The resulting increase in financial inclusion is also vital to women’s empowerment.”

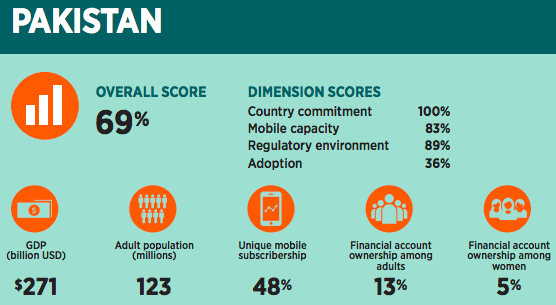

A McKinsey and Co analysis shows that adoption of financial technology (fintech) can help dramatically increase financial inclusion in Pakistan. Pakistan is ranked 16th among 26 nations ranked by Brookings Institution with an overall score of 69% in "The State of Financial and Digital Inclusion Project Report" for 2017. The Internet revolution is enabling rapid growth of financial technology (fintech) for increasing financial inclusion in Pakistan.

A McKinsey Global Institute report titled "Digital Finance For All: Powering Inclusive Growth In Emerging Economies" projects that adoption of financial technology (fintech) in Pakistan will add 93 million bank accounts and $36 billion a year to the country's GDP by 2025. It will also create 4 million new jobs and add $7 billion to the government coffers in this period.

McKinsey report says that "Pakistan has solid digital infrastructure and financial regulation in place and has even had some success in digital domestic-remittance payments".

Fintech Players in Pakistan:

There are a number of companies, including some startups, offering fintech applications for smartphones that are linked to bank accounts. EasyPaisa operated by Telenor Microfinance is already well established. Among some of the better known startups working to disrupt the financial services sector in Pakistan are Finja and Inov8.

China's e-commerce giant Alibaba runs a major global e-payments platform Alipay. It also owns Ant Financial which has recently announced the purchase of 45% stake in Pakistan-based Telenor Microfinance Bank.

Telenor Pakistan runs its own e-payments platform EasyPay which will likely link up with Alipay global payments platform after the close of the Ant Financial deal. Bloomberg is also reporting that Alibaba is in serious talks to buy Daraz.pk, an online retailer in Pakistan. These developments are creating a lot of excitement in Pakistan's fintech and e-commerce communities.

Alibaba and Alipay and other similar platforms are expected to stimulate both domestic and international trade by empowering small and medium size Pakistani entrepreneurial businesses and large established enterprises.

Karandaaz Fintech Promotion:

A key player promoting financial inclusion is Karandaaz Pakistan , a non-profit organization, set up jointly by UK’s Department for International Development and Bill and Melinda Gates Foundation. It is providing grants for a number of local initiatives to develop and promote financial technology solutions in Pakistan.

Karandaaz Pakistan is promoting Fintech startups in 5 areas of focus:

1) Access to Financial services

Credit Scoring Models, Formalize savings through need based products, Digital lending services, and Insurance

2) Payments

Retail payments solutions through QR code, Supply / Value Chain Digitization, Ideas around digitization of online payments and merchant payments

3) E-Commerce

Smoothening of on-boarding process, Enabling Escrow Accounts for a retail merchant, Alternate payment modes other than COD

4) Interoperability

Innovative ideas to address the lack of interoperability among m-wallets

5) Early stage ideas related to:

M-Wallet Use cases, Education of Financial Services through technology, Customer Engagement / Experience, Micro Credit, Digital Savings

Summary:

About 100 million Pakistani adults lacked access to formal and regulated financial services as of 2016, according to a World Bank report on financial inclusion. Only 2.9% of adults in Pakistan have a debit card, and only 1% of adults use them to make payments. Just 1.4% of adults use an account to receive wages and 1.8% of adults use it to receive government transfers in 2014. At the same time, Pakistan is leading the way in South Asia in digital finance and branchless banking.

According to the latest State Bank statistics on branchless banking (BB) sector, m-wallets reached a high of 33 million as of September 2017, up 21% over the prior quarter. About 22 percent of these accounts – 7.4 million – are owned by women, up 29% seen in Jul-Sep 2017 over previous quarter. A McKinsey and Co analysis shows that adoption of financial technology (fintech) can help dramatically increase financial inclusion in Pakistan.

Karandaaz Pakistan , a non-profit organization, set up by UK’s Department for International Development and Bill and Melinda Gates Foundation, is promoting financial technology in the country. Chinese e-commerce giant Alibaba's Ant Financial's recent entry in Pakistan is creating a lot of excitement in the country's fintech community.

Related Links:

Fintech Revolution in Pakistan

The Other 99% of the Pakistan Story

Pakistan's Financial Services Sector

-

Comment by Riaz Haq on April 27, 2018 at 8:47am

-

Pakistan Adopting Advance Technologies Rapidly: Anusha Rehman

Daniyal Sohail

https://www.urdupoint.com/en/technology/pakistan-adopting-advance-t...

Minister for Information Technology and Telecommunication Anusha Rehman Friday said, Pakistan was one of those countries that had been adopting the advance technology most rapidly to counter challenges of modern, digital era.

While addressing the concluding ceremony of five-day "Huawei mobile Pakistan Congress 2018" the minister said, the technology advancements were coming in Pakistan adding "we also hope that we can have huawei made in Pakistan as soon as possible." Anusha said, Ministry of IT had started projects for Baluchistan worth Rs 26 billion to provide 3g service to the people there.

In the history of IT of Pakistan, this was the biggest investment for Balochistan, which aimed to target hundreds of villages to connect these remote areas with 3G service, she added. She said,a population of about 196,177, covering 269 mauzas and an area of 39,434 sq kms would get modern broadband facilities through this project.

The project would cover Awaran, Jhal Jao and Mashkai tehsils/sub-tehsils of Awaran district and Bela, Lakhra, Liari, Uthal, Dureji, Hub, Sonmiani and Kanraj of Lasbel district, she added. The Minister said, after launching 3G services in Baluchistan, other services like careem would be start in in the province which would be a great achievement of Ministry of Information Technology.

She emphasized the importance of technological advancement and virtual assistance for the generations to come to bring this nation on path of Technology evolution and prosperity. "Government is making all out efforts to introduce 5G technology in Pakistan by 2020 to bring it at par with Developed economies in term of technology advancements." She emphasized that women's economic empowerment was at the heart of the sustainable development and essential to achieve gender equality, poverty eradication and inclusive economic growth.

She shared initiatives steered by IT ministry in this regard, particularly ICT for Girls program. She said, achievements of Pakistan in the arena of ICT and future plans for continued growth in this sector would enable transformation into "Digital Pakistan".

Anusha described the DigiSkills program as an important part of Information Technology initiative of the government that would create online employment opportunities to enable youth to earn 200 to 300 dollars per month and with the help of this program, youth from across the country would provide services across the globe.

She appreciated the Huawei Technology role in setting such precedent to promote emerging technologies in Pakistan by involving Industry players and engaging the Government to make it reality. The Minister hoped that people of Pakistan were going to use the opportunities that were created by Huawei, the technology giant.

-

Comment by Riaz Haq on May 22, 2018 at 10:52am

-

Ant Financial is about to upend the entire Pakistani retail banking sector

‘There is ZERO realization of what is coming and how big this sea change will be

http://www.atimes.com/article/ant-financial-is-about-to-upend-the-e...

anking in Pakistan has not, to put it diplomatically, reached its full potential. It is so inefficient, according to one industry insider, that more than 35 banks provide services to only about 12% of the population. But Omer Salimullah, a fintech specialist with Karachi-based JS Bank, wrote in a post last week that the days are numbered for this sorry state of affairs, and China’s Ant Financial will be the catalyst.

The Alibaba subsidiary took the plunge into the Pakistani financial services market with an acquisition earlier this month, looking to tap into the potential of around 100 million un-banked individuals. Ant Financial’s acquisition of Telenor Microfinance Bank for the sum of US$185 million is “a VERY big deal,” Salimulla emphasized. “As a comparison, 100% of RBS Pakistan was sold to Faysal Bank for US$ 50 million. Please note that Ant has not valued a Pakistani micro finance bank at US$ 410 million. What they have valued is the almost complete takeover of the retail financial services market from incumbent banks,” he said.

Ant’s partnership with Telenor’s mobile banking brand, Easypaisa, is going to transform banking services in the country, and synergy with a possible acquisition of Pakistan’s largest e-commerce player Daraz, will expand the ecosystem even further. The Chinese fintech giant stands to swallow up a huge chunk of the youth an un-banked market, according to Salimulla, and many small to mid-sized banks will not survive the next several years.

“There is too much old-world thinking in corridors of powers in banks. There is ZERO realization of what is coming and how big this sea change will be,” he warned.

-

Comment by Riaz Haq on May 22, 2018 at 10:52am

-

How Ant Financial Will Completely Change the Pakistani Retail Banking Landscape

https://www.linkedin.com/pulse/how-ant-financial-completely-change-...

Banking in Pakistan is an extremely in-efficient industry where 35+ banks have only been able to bank 25 million Pakistanis in the last 70 odd years. This means that as an industry, banks are providing their services to only 12% of the population. The branchless banking industry has not fared much better either with only 35 million wallets out of which 50% are inactive (no activity in the past 3 months). This is a sorry state of affairs by any yardstick. In the new world, wherever there has been inefficiency in an industry, it has been disrupted – big time! Uber, Didichuxing, Careem, Grab have decimated the taxi industry worldwide. AirBnB has dented the hotel industry significantly to the extent that Airbnb is now bigger than the world's top five hotel brands put together. PayTM in India (Ant owns more than 50% of Paytm and has injected close to US$ 1 billion into this company) has now become the biggest financial firm in India, in less than five years. and plans to become the world's largest digital bank with 500 million account holders. With all the inefficiencies found in it's midst, the retail banking industry in Pakistan is a prime candidate for this type of massive disruption.

In this backdrop comes the Ant Financial Services Group (“Ant Financial”), established by Alibaba Group and its founder Jack Ma acquisition of 45% of Telenor Microfinance Bank (TMB) for US$ 185 million at a total post money valuation of US$ 410 million. Make no bones about it - this is a VERY big deal. As a comparison, 100% of RBS Pakistan was sold to Faysal Bank for US$ 50 million. Please note that Ant has not valued a Pakistani micro finance bank at US$ 410 million. What they have valued is the almost complete takeover of the retail financial services market from incumbent banks. They realize that Pakistan is one of the most in-efficient banking markets in the world and it will be simple to take every last morsel of the retail banking pie from banks. The market potential of some 100 million un-banked individuals is a mouth-watering prospect for Ant.

How Will “Ant Paisa Bank” Take Over Retail Banking in Pakistan?

Go big on QR: Ant will introduce Alipay (or a local variant) here in Pakistan. This will be their big play to capture a huge chunk of retails payments which are currently happening in cash. QR uptake has been slow in Pakistan where only small players like FonePay are pushing it. With the financial & marketing muscle that Ant brings, they will make QR payments common with incentives on both the merchant and customer side.

- Digital Lending: This will be the secret sauce which finally tips the scale for digitization payments in Pakistan. Consumer lending via Ant has reached $95 billion in China and Paytm in India launched Paytm Score in February which they will use to lend to users of their platform. Our biggest hurdle in digitizing cash payments has been the reluctance of users (especially merchants) to document their cash flow fearing tax implications. In a country where less than 1% of the population pays tax, this has always been the biggest impediment in digitizing payments. However, once the conversation switches to these merchants receiving funding/loans from Ant based on their throughput via Ant channels (i.e. giving loans to small businesses for purchasing goods from Ali Baba), they will be more than happy to roll the transaction through digital channels.

-

-

Comment by Riaz Haq on May 22, 2018 at 10:53am

-

How Ant Financial Will Completely Change the Pakistani Retail Banking Landscape

https://www.linkedin.com/pulse/how-ant-financial-completely-change-...

Technology Stack: In a recent interview post the Ant investment, Shahid Mustafa, CEO of Telenor Bank said “….there’s a sunset date for the current technology and that’s when we will look to upgrade the back-end technology”. With all the financial clout that Ant will bring, the thing that will break the proverbial camel’s back (the camel being the Pakistani financial industry) will be the tech prowess that Ant will introduce in Pakistan. MIT Tech Review published an article with the headline “Meet the Chinese Finance Giant That’s Secretly an AI Company” referring to Ant’s AI, computer vision and natural language processing capabilities. This is how important AI is to Ant. Last year the company acquired EyeVerify, a U.S. company that makes eye recognition software. Ant will bring AI powered payments, lending, insurance, and anti-fraud capabilities to Pakistan and completely transform the way financial services are delivered. Think Instant and Frictionless.

- Amazing User Experiences: The news of Ant buying Daraz, the largest e-commerce player in Pakistan, has been doing the round for quite some time. If this deal goes through, Ant will bring it’s world class e-commerce expertise via Ali Baba to Pakistan. Digital payments has always been a challenge for e-commerce in Pakistan. Having both the payment and e-comm side under its control, Ant can make a huge dent into both these fledgling areas. Imagine being offered an AI-powered personalized & instant loan on shopping done on Daraz. Imagine being able to file an insurance claim for a car accident where all you need to do is take a picture of the accident and Ant’s AI image processing engine will finalize the findings in seconds. Imagine bots talking to Pakistanis in any regional language to handle customer service or conduct transactions (voice will remove the last block in making digitization widespread in Pakistan where lack of education prevents reading and writing based solutions to gain traction)

Why Does This Matter to Existing Banks?

With the marketing and tech muscle that Ant will bring into Pakistan, the next 24 months are going to be critical for small to mid-sized banks. Easypaisa is a brand that resonates both with the un-banked and the youth. These markets are major growth areas for banks going forward and if these are taken away by Easypaisa due to providing delightful user experiences, the oxygen will be sucked out of this industry. Expect to see a LOT of mergers among the incumbent banks. The big-5 may survive due to their corporate and treasury business but the mid to small sized banks will go under water due to the coming tsunami. It may seem that I may be overstating the threat but this is not the case. There is a high level of digital illiteracy on the management boards of Pakistani banks and the average age of C-level suites in banks is 50+. There is too much old-world thinking in corridors of powers in banks. There is ZERO realization of what is coming and how big this sea change will be.

What Can Existing Banks Do?

Are we looking to help banks that charge customers an average of PKR 50 for an Interbank Fund Transfer (IBFT) transaction (some are charging more than PKR 150) while giving out free checkbooks? Most banks think they’ve become digital because they’ve rolled out a mobile app. All the other important areas like account opening, lending, payments continue the way they were implemented in the mid-90s. This is not digital. And no Head of Digital Transformation or a Head of Innovation can convert a dinosaur into an agile cheetah. Transforming an organisation is next to impossible due to legacy systems and legacy mindsets (Nokia and Kodak couldn't do it).

-

Comment by Riaz Haq on August 12, 2018 at 4:47pm

-

#Technology firms Avanza Group & Premier Systems announce investment of $5 million in the #payment #gateway to connect individuals with merchants and banks via joint venture as Avanza Premier Payment Services (APPS) in #Pakistan #mobilepayments #ecommerce https://www.techjuice.pk/two-technology-firms-to-establish-online-p...

Two technology groups in Pakistan have collaborated to develop a local online payment gateway system to take a share in the growing e-commerce market of Pakistan.

Avanza Group and Premier Systems announced to invest over $5 million in the gateway which is aimed to connect individuals with merchants and banks. According to sources, the two companies will set up the joint venture as Avanza Premier Payment Services (APPS).

Mahmood Kapurwala, CEO of Avanza Group said, “the size of Pakistan’s e-commerce market is estimated to be $1 billion, which should be $30-$40 billion in a country with a population of 207 million.’ He also partnered with NCR, Avaya, Microsoft, and IBM. He added, “We are looking at this gap as an opportunity.”APPS claims to be the first Financial Technology (fintech) in the country to obtain payment system provider (PSP) and payment system operator (PSO) licenses from the State Bank of Pakistan (SBP). According to McKinsey and Company, a worldwide management consulting firm, Fintech will add about 4 million jobs, 93 million bank accounts and $36 billion annually to the gross national product (GNP), and $7 billion to the government’s net revenue by 2025.

The newly-founded company plans to incentivize brick and mortar businesses with free online services, like building websites and digital marketing. It will only take a certain share in the profit that comes through online businesses. Adnan Ali, CEO, APPS said: “It will move Pakistan towards digitizing major institutions, such as merchants, schools, billing industries, mutual funds and other corporate entities by providing a digital gateway.”

Avanza Group CEO said, Increase in e-commerce acceptance will also help grow the overall retail market when people will have the choice to buy products present in other cities, He said, “If everything remains on track, earning a revenue of Rs400 million will not be a big deal.”

-

Comment by Riaz Haq on August 14, 2018 at 7:29pm

-

#Pakistan #digital #banking growth accelerates. Fiscal 2017-18 saw 3.4 million #ecommerce transactions worth Rs18.7 billion, representing year over year growth of 183.3% and 98.9%. #fintech https://www.globalvillagespace.com/pakistan-banking-sector-witnesse... via @GVS_News

The State Bank of Pakistan (SBP) in its ‘Payment Systems Review’ for the financial year 2017-2018 has provided a statistical snapshot of the payment systems in the country, showing growth in various traditional and modern payment systems.

During the financial year 2018, the country’s core payment systems infrastructure remained operationally resilient. All the channels of payment systems showed significant growth compared to the previous year. The large-value payment system i.e. Pakistan Real Time Interbank Settlement Mechanism (PRISM) processed 1.7 million transactions amounting Rs361 trillion.

There were 1,094 locally registered e-Commerce Merchants having their merchant accounts in 8 banks as of the end of June 2018 showing limited boarding of e-Commerce merchants in the country

These transactions showed significant growth of 54.5 percent and 29.2 percent in both volume and value of transactions compared to the previous financial year. In these transactions, the transactions with regards to third-party customers’ transfers have the highest share of 1.3 million transactions (i.e. 79 percent of the overall recorded transactions) whereas Government securities settlement transactions have the highest share of Rs256 trillion in a value of transactions.

There were 1,094 locally registered e-Commerce Merchants having their merchant accounts in 8 banks as of the end of June 2018 showing limited boarding of e-Commerce merchants in the country. Consumers carried out 3.4 million online transactions of worth Rs18.7 billion on these locally registered e-Commerce Merchants during the year FY18.

These transactions showed a significant YoY growth of 183.3 percent and 98.9 percent compared to the previous year. In addition to the above, domestically issued Debit, Credit and Pre-paid cards processed 6.8 million transactions of Rs. 39.7 billion on local and International e-Commerce merchants. In these e-Commerce transactions, Credit Cards has the highest share both in volume and value of transactions.

While no specific information has been provided on the number of users of these cards, the number of transactions processed through these cards has increased by 37.3 percent with total transactions, as on June 2018, having been reported at 34.4 million, at a value of Rs201.5 billion during the fiscal year 2018.

Agriculture loans in 2017/18 were 38.1 percent higher than the previous year’s disbursements of Rs704.5 billion, the State Bank of Pakistan (SBP)

Having grown at a pace of 21.8 percent and 23.4 percent in the volume and value of transactions respectively, during the year under review, debit cards processed a total of 441.1 million transactions worth Rs5.1 trillion, far greater than the size and value of transactions conducted using credit cards.

However, the bulk of this usage has been on transactions concerning ATM withdrawals whereas the share of transactions with respect to Point of Sale usage has been merely 8.6 percent in volume and 2.9 percent in the value of transactions.

Credit cards, on the other hand, has been the predominant medium for Point of Sale usage, with the 87.2 percent of the total volume of credit card transactions being made on Point of Sale payments and 10.2 percent in e-Commerce transactions.

Meanwhile, Banks disbursed agriculture credit of Rs972.6 billion during the last fiscal year of 2017/18, falling short of Rs1 trillion target set by the Agriculture Credit Advisory Committee (ACAC), the central bank said on Thursday.

-

Comment by Riaz Haq on September 4, 2018 at 9:39am

-

SBP to increase financial inclusion of SMEs to 17pc

https://pakobserver.net/sbp-to-increase-financial-inclusion-of-smes...

Assistant Chief Manager, SBP’s Banking Services Corporation, Ms. Rabia Yaqoob Khan gave a detailed presentation to the business community on financing schemes of SBP for SMEs.

Rabia Yaqoob Khan said that only six percent SMEs were currently availing loans from banks despite the fact that 40 percent of them have relationship with banks. She said that SBP has set target of increasing financial inclusion of SMEs from current 6 to 8 percent to 17 percent by 2020 so that these businesses could achieve better growth and development.

Assistant Chief Manager, SBP’s Banking Services Corporation said that SBP has launched 9 financing schemes for SMEs at 6 percent markup to facilitate them expansion and growth. She said that for this purpose, regulatory framework and taxation system would be simplified for SMEs.

She said that the incumbent government was taking keen interest in promoting SMEs and hoped that maximum SMEs should avail these schemes for fast growth and development.

In his welcome address, Senior Vice President ICCI, Muhammad Naveed Malik said that SMEs were the backbone of our economy as they constituted over 90 percent of total business enterprises in Pakistan. He said SMEs contributed 30 percent to GDP, 25 percent to exports and 78 percent to industrial employment that showed their important role in the economic development of the country.

The SVP ICCI said the tough collateral conditions of banks were the major hurdle for SMEs growth and urged that SBP should ask banks to offer soft term credit facility to SMEs that would help them to grow fast and play effective role in strengthening the economy.

Vice President ICCI Nisar Mirza said that strengthening SMEs would yield multiple benefits for the economy as it would promote trade and industrial activities, enhance exports, encourage investment, create more jobs and increase tax revenue of the government. He emphasized that government should pay special attention to promoting SMEs that would pave way for sustainable development of the economy.

Sardar Tahir, President, Islamabad Estate Agents Association, Zahid Rafiq General Secretary, Ch. Nadeem, Khalid Chaudhry, Dildar Abbasi, Muhammad Faheem Khan and others were present at the occasion.—INP

-

Comment by Riaz Haq on November 22, 2018 at 7:57pm

-

Fintech Factory, Pakistan’s first and only financial technology focused accelerator program in collaboration with TPS, Sybrid, Rapidcompute, JS Bank & Takaful Pakistan, is progressing towards Karandaaz’s 3rd Fintech Disrupt Challenge finale. Karandaaz, Pakistan’s leading promoter of financial inclusion and associated technology, partnered with Fintech Factory to induct selected applicants for FDC III (2018) into the accelerator program and help them reach a market-tested scalable MVP for the challenge.

Fintech Factory’s unique financial technology accelerator program takes startups with market validation and offers them access to state-of-the-art workspace, industry-leading mentors, skillset development through personalized training, and networking opportunities. The program aims to develop the ecosystem in a self-sustaining manner to catalyze innovation in the fintech space to reduce the digital divide and improve the lives of Pakistanis.

https://www.techjuice.pk/7-trainees-from-pakistans-first-fintech-ac...

-

Comment by Riaz Haq on December 4, 2018 at 9:21am

-

#Legacy #banks #payment platform fights back. #Swift takes on #fintechs with new faster, more efficient system. SWIFT platform is now owned by 2,500 banks and is used to move more than $200 billion around the world daily. #blockchain https://www.ft.com/content/05d41660-f7c8-11e8-af46-2022a0b02a6c via @financialtimes

Legacy payments platform Swift is piloting a new system to speed up banks’ cross-border transfers and reduce errors, firing a shot across the bow of a blockchain-based project that claims to do the same thing and payments fintechs that offer cheaper, faster services.

Founded in 1973, Swift was banks’ original answer to the question of how to move money around the world more quickly and easily. The platform is now owned by 2,500 banks and is used to shift more than $200bn around the world daily.

Inefficiencies, however, have left the platform ripe for competition from payments start-ups such as Revolut and TransferWise, as well as the Interbank Information Network (IIN). More than 130 banks, led by JPMorgan Chase, have signed on to the blockchain-based IIN project, which shares information between banks on a mutual distributed ledger. That allows them to quickly resolve errors and compliance issues that can delay payments by weeks.

In a testament to how banks are hedging their bets on the future of payments, several of those banks are now part of a pilot for Swift’s own fix for lengthy payment delays — — a new “prevalidation” system in which banks use an application programming interface (API) to access each other’s data to check things such as the validity of bank account numbers when a payment is initiated.

Under the blockchain-based system information is shared on a mutually distributed ledger hosted on the cloud that can be accessed and edited by all participants in real time. The API system, by contrast, allows banks to access each other’s data on a bilateral basis, ensuring the recipient’s account information is correct before it is sent in an effort to reduce delays.

“We know that there are still some payments which are badly formatted and missing some information,” said Luc Meurant, chief marketing officer of Swift. “Instead of correcting that later in the chain and delaying payment, we are trying to anticipate as many of those issues as possible (with prevalidation) so payments can be processed faster.”

Swift estimated that around 10 per cent of all payments on its platform were held up because of errors. Manish Kohli, global head of payments and receivables at Citi, said the new system would “considerably reduce” the costs banks incur to resolve problematic payments and would improve customer experiences. That would “absolutely” allow banks to cut pricing and compete more effectively with fintechs, he added.

Mr Meurant said that while the solution was going after “exactly the same kind of issues” as IIN, Swift’s fix was superior because its angle is “one of scale and industrialisation” and the solution could be rolled out to Swift’s 10,000-plus members relatively quickly.

JPMorgan Chase has been the leading voice on the IIN, but is also one of the 15 banks taking part in the Swift pilot. A spokesman declined to comment on the relative merits of the two projects and JPMorgan’s decision to back both.

Mr Kohli said his bank, which has not joined the IIN, believed the Swift solution was more viable because APIs were already widely used within banks in applications such as sharing customer data to give people an aggregate view of their accounts in one place.

“We felt this would be faster to scale,” said Mr Kohli, adding that payments solutions only really work if they are ubiquitous.

He pointed to Swift’s success in introducing its global payments innovation (GPI) as evidence that it can achieve quick adoption. GPI, which allowed payments to be tracked end to end and introduced transparency on fees, was introduced more than a year ago and is being used in more than 50 per cent of Swift’s payments. It will be used exclusively by 2020 by users of the Swift network.

-

Comment by Riaz Haq on December 25, 2018 at 7:51am

-

#Alibaba's #Alipay's entry to tap great potential of #Pakistan #ecommerce market. US$184 million investment to expedite mass adoption of digital #payments in Pakistan. #Internet penetration rising with estimated 60 million subscribers of 3G and 4G. https://on.china.cn/2EO9fAc

Alipay, a subsidiary of Hangzhou-based Ant Financial, has been cleared by the Competition Commission of Pakistan (CCP) to acquire a 45 percent stake in Pakistan's Telenor Microfinance Bank.

The investment of over US$184 million will expedite widespread adoption of digital payments in Pakistan. With internet penetration continuously on the rise, there are an estimated 60 million subscribers of 3G and 4G in the country that can become potential users of the service.

Several mobile payment services are presently operating in Pakistan. Primarily, these have been offered by telecom operators with a large number of cellular subscribers. However, limited international application has kept the penetration rate of the payment portals relatively low. Entry of Alipay, the world's largest mobile payment platform, will intensify competition higher, improve the quality of service and reinvigorate the entire landscape of the industry.

Pakistan's growing young population makes it suitable for embracing cashless payments on a large scale. People under the age of 30 form 64 percent of the population who are always the most likely to take up any new technology. On top of that, high cellular phone use will be a facilitative factor, since the mobile-first strategy for internet-based businesses is very valid in Pakistan.

Commencement of Alipay's operations in Pakistan will also provide a major push to e-commerce. eBay CEO Devin Wenig recently identified emerging economies like Pakistan as the fastest growing e-commerce hubs of the world. The trend is spreading like wildfire across the country with new online shops emerging constantly. A reliable e-payment gateway with worldwide collaborators is all that Pakistanis need to streamline their online transactions.

Alibaba had already acquired Pakistan's leading e-commerce platform Daraz. Utilizing the reach of Alibaba, Pakistani sellers will now be able to connect with global buyer.

The digital payment boom will be most beneficial for small and medium-sized enterprises that form the backbone of the national economy. Many of these businesses face difficulties in financial transactions due to being located in rural areas. Alipay might prefer to focus on them as the Pakistani government wants to reduce their business costs and difficulties.

Across the border in China, a new policy is on the cards to increase e-commerce purchases from overseas. Around 63 additional categories are being added to a product list of what can be imported duty-free through online platforms. Moreover, 22 cities, such as Beijing, Nanjing and Shenyang, are also being included in e-commerce pilot zones.

With several food items in the revised e-commerce import list, there is much potential for Pakistani farm produce. Fruits like mango and the mandarin hybrid kinnow can gain extended reach in the Chinese food market and the recent push to increase meat and poultry production could further boost Pakistan's exports.

The targeted online shoppers in China are increasingly focusing on foreign brands. Large businesses and premium brands from Pakistan can reach out to these buyers through Tmall Global – another Alibaba operated e-commerce platform allowing Chinese consumers to purchase products from abroad. Pakistan's small to medium businesses might not have the logistic prerequisites for this platform, but international-standard large companies certainly can.

Ant Financial is coming to Pakistan at a time when trade between Pakistan and China is touching new heights through the flagship project of Belt and Road Initiative (BRI) known as China Pakistan Economic Corridor (CPEC).

Twitter Feed

Live Traffic Feed

Sponsored Links

South Asia Investor Review

Investor Information Blog

Haq's Musings

Riaz Haq's Current Affairs Blog

Please Bookmark This Page!

Blog Posts

Modi's AI Spectacle: Chaos and Deception in New Delhi

The India AI Impact Summit 2026, held at Bharat Mandapam in New Delhi, has been marred by chaos, confusion and deception. The events on the ground have produced unintended media headlines for India's Prime Minister Narendra Modi who wants to be seen as the "vishwaguru" (teacher of the world) in the field of artificial intelligence as well. First, there was massive chaos on the opening day, with long…

ContinuePosted by Riaz Haq on February 19, 2026 at 12:00pm — 9 Comments

India-Pakistan Cricket Match: The Biggest Single Event in the World of Sports

Why did Pakistan's decision to boycott the India-Pakistan match in solidarity with Bangladesh in this year's T20 World Cup send shockwaves around the world? And why did it trigger the International Cricket Council's and other cricket boards' urgent efforts to persuade Pakistan to return to the match? The reason has a lot to do with its massive financial impact, estimated to be as much as …

ContinuePosted by Riaz Haq on February 11, 2026 at 4:00pm — 2 Comments

© 2026 Created by Riaz Haq.

Powered by

![]()

You need to be a member of PakAlumni Worldwide: The Global Social Network to add comments!

Join PakAlumni Worldwide: The Global Social Network