PakAlumni Worldwide: The Global Social Network

The Global Social Network

Gallup Survey Says Pakistan Among Top Nations For Optimism

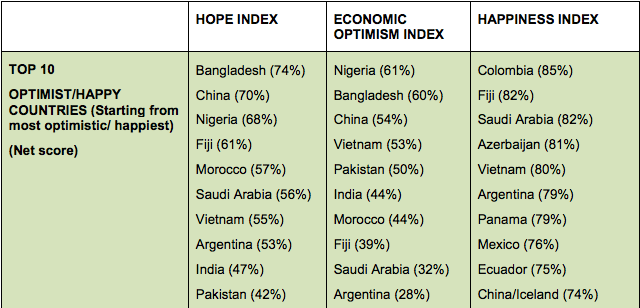

The results of the 2015 WIN/Gallup International survey of 68 countries across the globe show Pakistan ranking 5th on economic optimism and 10th on overall optimism.

The World Bank reporting the tailwinds pushing Pakistan's economic growth seems to support the optimism in Pakistan. Most observers believe that the year 2015 has turned out to be a good year for Pakistan with the return of general optimism among businessmen, investors and consumers. Economic recovery has continued as Pakistan Army's efforts, including its Operation Zarb e Arb and Karachi Operation by Rangers, have started to bear fruit with significant decline in terrorism. There are new signs of a thaw in India-Pakistan ties with Indian Prime Minister Modi's surprise year-end visit to Lahore. Efforts to bring peace in Afghanistan took a new positive turn with the hopeful entry of the Taliban into a quadrilateral process involving Afghanistan, Pakistan, China and the United States.

Overall, 64% of Pakistanis say they happy, slightly below the 66% average for the 68 countries surveyed. Among south Asian nations, 66% of Bangladeshis, 58% of Indians and 42% of Afghans say they are happy, according to WIN/Gallup International Survey for 2015.

Bangladesh (74%), Nigeria (61%) and Columbia (85%) top Hope, Economic Optimism and Happiness Indices respectively. Pakistan scores 42% (rank 10) on hope and 50% (rank 5) on economic optimism indices. India scores 47% (rank 9) on Hope and 44% (rank 6) on Economic Optimism indices.

Jean-Marc Leger, President of WIN/Gallup International Association, said that "2015 has been a tumultuous year for many across the globe, despite that the world remains largely a happy place. 45% of the world is optimistic regarding the economic outlook for 2016, up by 3 per cent compared to last year."

Let's hope the new crises unfolding at the start of the year 2016 such as the China market crash, the Pathankot terrorist attack in India, the new escalation of Iran-Saudi conflict and the claimed hydrogen bomb test claimed by North Korea do not sour the 2015 year-end optimism reported by the WIN/Gallup survey.

Related Links:

Pakistan's Trillion Dollar Economy

China-Pakistan Industrial Corridor (CPEC)

How Can Pakistan Benefit From Low LNG Prices?

Who's Better For Human Development? Politicians or Musharraf?

-

Comment by Riaz Haq on January 11, 2016 at 7:20pm

-

#Pakistan receives remittances of $9.7b in 1st 6 months (Jul-Dec) of FY 2016 from diaspora. Up 6.2% from last year. http://tribune.com.pk/story/1025906/pakistan-receives-remittances-a... …

Overseas Pakistanis sent remittances amounting to $9.7 billion in July-December, which translates into a year-on-year (YoY) increase of 6.2%, according to data released by the State Bank of Pakistan (SBP) on Monday.

Remittances amounted to $9.1 billion in the same six months of the preceding fiscal year. They amounted to almost $1.63 billion in December alone, which is 2.8% higher than the remittances received in the preceding month, SBP data shows.

Pakistanis based in foreign countries sent home $18.4 billion in 2014-15, which translated into a YoY increase of 16.5%. Inflows from Saudi Arabia were the largest source of remittances in Jul-Dec. They amounted to nearly $2.9 billion in the six months, up 9.3% from the corresponding period of the last year.

Remittances received in Jul-Dec from the United Arab Emirates (UAE) increased 9.4% to $2.1 billion on a YoY basis. Inflows from the UAE had registered the largest increase (26.1%) from any major remittance-sending country in 2014-15, SBP data shows.

In the first six months of the current fiscal year, remittances from Dubai have surged 42% YoY. But the figure for overall inflows from the UAE so far has remained subdued because of a 27.2% annual decline in remittances from Abu Dhabi over the same period.

Remittances from the United States and the United Kingdom remained $1.3 billion and $1.2 billion, respectively, in Jul-Dec. The YoY change in remittances from the US and the UK has been -4.4% and 3.2%, respectively.

Decline in US

According to a separate SBP report issued last month, it believes that US workers of Pakistani origin are holding on to their savings within the United States instead of remitting them back home. They are withholding that portion of their savings that they would otherwise send their families for “investment purposes,” the SBP believes.

In the presence of a wide gap between the rates of investment returns in the United States and Pakistan, US workers of Pakistani origin would prefer investing their savings in Pakistan until recently – something that resulted in healthy annual growth in worker remittances from the United States for many years.

But with interest rates going up in the United States and coming down in Pakistan, the difference in the average investment returns is narrowing.

Remittances from Gulf Cooperation Council (GCC) countries, excluding Saudi Arabia and the UAE, clocked up at $1.1 billion in Jul-Dec, which is 11.7% higher than the remittances received from these countries in the same months of the preceding fiscal year.

Remittances from Kuwait in Jul-Dec equalled $365.6 million while those from Oman, Bahrain and Qatar amounted to $391.4 million, $236.5 million and $180.2 million, respectively.

This means the overall share of the oil-rich GCC countries in Pakistan’s remittances is over 64%. Many analysts fear remittances from these countries may dwindle going forward, as their governments begin to scale back infrastructure spending in the wake of a sharp fall in global oil prices.

Remittances received from Norway, Switzerland, Australia, Canada, Japan and ‘other countries’ last month amounted to $136 million as opposed to $102.9 million received in December 2014.

-

Comment by Riaz Haq on January 14, 2016 at 9:00am

-

#Pakistan car sales jump 66% to reach 111,720 units in first 6 months of Fiscal Year 2015-16 #CPEC

http://www.pakistantoday.com.pk/2016/01/12/business/car-sales-up-66... …

The sales of the locally assembled cars have gone up by 66 per cent to reach 111,720 units in the first half of the current fiscal year (2015-16) against only 67,426 units in the same period last year, the data released by the Pakistan Automotive Manufacturers Association (PAMA) said on Monday.

However, the sales of locally assembled cars and tractors (including LCVs) declined by 5 per cent to 18,150 units in December 2015 due to seasonal slowdown as buyers tend to defer car purchases until next year.

“The main reason behind the rising sales of cars is said to be declining interest rates of the banking channels especially for the auto financing as well as overall improvement in the economic situation of the country,” said Topline Brokerage House analyst Muhammad Tahir Saeed.

In a recent development, Pak Suzuki (PSMC), Indus Motors and Honda increased the prices of all of their models by 1 per cent in December 2015 following the government decision of increasing one per cent custom duty on the import of all accessories of the vehicles. Car assemblers were able to pass on the cost hike to the customers due to strong demand in the country.

The government has not yet announced the Auto policy for the next five years but Engineering Development Board (EDB) has submitted the final draft policy to the Ministry of Industries in December 2015. In the policy, the EDB has recommended to give incentives to the newcomers in the auto sector and asked the government to force the companies to deliver the vehicles on time and in case of non-delivery in 60 days, the company will pay back interest on the total amount paid by the customers at the time of the booking.

The analyst forecast that local car sales will grow at 15 per cent in the rest of the fiscal year 2015-16 to reach 206,777 units. This lower growth is due to completion of taxi scheme in February 2016 and decline in Honda Civic volumes in anticipation of new model, which is expected to hit the market in July 2016.

Amongst individual companies, PSMC sales increased by 97 per cent year on year to 70,482 units in the first half 2015-16 primarily due to Punjab government’s taxi scheme.

Contrary to historical trend of December, volumes increased by 3 per cent month on month in December 2015 primarily due to the taxi scheme. Historically, it has been observed that customers defer their buying in December due to year-end phenomenon as they usually prefer to purchase and register their vehicles in the first month of the new year.

INDU sold 30,481 units in first half 2015-16 up from 22,883 units in the same period last year.

In Dec 2015, INDU sales stood at 4,738 units, up 16 per cent YoY. On MoM basis, sales declined by 14 per cent YoY due to year-end phenomenon.

Honda sold 10,610 units in the first half 2015-16 compared to 8,578 units during the same period last year. In December 2015, HCAR sold 1,028 units, up 49 per cent YoY (down 33 per cent MoM).

“Volumes of Honda Civic are expected to dry out in the coming months in anticipation of new model launch in July 2016,” the analyst said.

DELAY IN SUBSIDY AFFECTS TRACTOR SALES:

Pakistan’s tractor segment posted a decline of 41 per cent YoY during the first half 2015-16 to reach 12,375 units. This decline is because of the delay in the launch of provincial tractor subsidy schemes. Punjab and Sindh governments announced in the 2015-16 budget that a subsidy of 25,000/29,000 would be offered on each tractor.

Millat Tractors (MTL) and Al-Ghazi Tractors (AGTL) both witnessed a decline in their volumes during first half of 2015-16.

---

Trucks and buses segment of Pakistan’s automobile sector posted an increase of 40 per cent YoY to reach 2,645 units during first half 2015-16. This surge was due to rising demand because of the China Pakistan Economic Corridor (CPEC) project and improving law and order situation in the country.

-

Comment by Riaz Haq on January 14, 2016 at 10:20am

-

Seeking Alpha on Asian markets:

- Vietnam is our favorite market for equities in our universe in 2016.

- Pakistan should benefit from CPEC "China Pakistan Economic Corridor".

- Consumer and pharmaceutical sectors are AFC's preferred sectors in Bangladesh.

Though it is a new year, there has not been a significant change in the concerns which are in investors' minds. The main worries in 2016 will continue to be the rise in US interest rates, the economic slowdown in China, and geopolitics in the Middle East.

Rising US interest rates have been an issue since the summer of 2013. Though many market participants expected the US Fed to raise rates in December 2015, fears over the impact of further rate hikes remain and this continues to dampen investor sentiment. Clearly, rising US rates would be negative for corporates and governments which hold USD debt. Having said that, amongst the fund's universe, not many or hardly any of the corporates have USD debt and if they do it is a small proportion of their overall debt levels. Further, of the fund's Top 30 holdings which account for 66% of the portfolio, only a few of the holdings are leveraged and not heavily. Regarding government debt in USD, the countries which could be impacted are Pakistan and Sri Lanka, as their foreign debt as % of GDP is ~21% and ~30% respectively. However, most of these USD debts are long term in nature and are also provided by multi-lateral agencies such as the IMF/ADB. Further, as mentioned previously, soft commodity prices are a big positive which can help negate the impact of rising USD interest payments.

Regarding the slowdown of the growth rate in China, as it was the case in 2015, the economies which depend heavily on exports to China could continue to see their economies being impacted. From the fund universe, Mongolia is heavily dependent on China as it accounts for 80-85% of Mongolia's total exports with most exports to China being resource related. The fund's exposure to Mongolian resource stocks is not large and it is currently 3.2% of the fund with the overall exposure to Mongolia being 8.4% of the fund.

http://seekingalpha.com/article/3810526-asia-frontier-capital-2016-...

-

Comment by Riaz Haq on January 16, 2016 at 9:08pm

-

500 sq yds to 1000 sq yds DHA #Karachi homes selling for half a million to a million us dollars average. #Pakistan

http://tribune.com.pk/story/982816/karachi-popular-lahore-and-islam... …

The real estate market entered the fourth quarter smoothly, banking on the success of several popular property markets.

This followed a continuous rise in prices of real estate in major cities – Lahore, Karachi and Islamabad – in the third (July-September) quarter of 2015.

Why Lahore is better than Karachi today

Even though some projects of prominent developers did face a few impediments, this was not a reason enough to raise major concerns, according to a report released by zameen.com, an online property portal.

According to the report, Karachi’s realty market performed brilliantly. There was just one exception – Bahria Town Karachi – which posted unfavourable numbers as prices of 250 square yard plots fell 5.39%. Similarly, a drop of 3.85% was recorded in 500 square yard plots in the third quarter.

DHA Karachi and DHA City Karachi, on the other hand, did not disappoint and gave investors encouraging returns. DHA Karachi recorded a sharp 8.27% price gain for 500 square yard plots and an even sharper rise of 12.35% for 250 square yard plots.

DHA City Karachi registered increases of 16.60% and 11.65% in prices of the two categories respectively.

Five reasons why Karachi is better than Dubai

DHA Karachi once again emerged as the most expensive locality, where the average sale price of a 500-square-yard house stood at Rs60 million and that of a 250-square-yard home was Rs41 million.

Lahore market

The property market of Lahore saw a humble upward movement. Although many major localities continued to excite investors by registering good levels of growth, DHA Lahore remained merely stable in the one-kanal category with prices dropping a negligible 0.69%.

However in the 10-marla category, a sharp drop of 6.61% was registered in the third quarter, said the report.

There could be a variety of reasons behind this, including the imposition of withholding tax on banking transactions, a rise in taxes and the income source disclosure notices sent to investors. Most significantly, the take-off of DHA projects in Bahawalpur, Multan and Peshawar may have shifted investor focus.

10 reasons why we love Karachi

In contrast, Bahria Town and LDA Avenue-I performed well despite multiple pending litigations. Bahria Town depicted a sharp price rise of 14.57% for one-kanal plots and a 5.32% increase for 10-marla plots. LDA Avenue-I posted a 5.04% rise in the one-kanal category and 7.63% gain in the 10-marla category.

Islamabad market

The real estate market of Islamabad showed a mixed picture. Sector E-11 registered price increases of 3.33% and 1.69% and F-11 recorded rises of 2.22% and 3.73% for one-kanal and 10-marla categories respectively.

Bahria Town experienced a sharp 5.66% rise for one-kanal plots whereas prices of 10-marla plots remained stable, with a negligible drop of 0.76%. Activity in DHA Islamabad seemed listless this time around. The one-kanal category saw a 1.57% drop, while 10-marla plots recorded a 4.30% drop.

The status of DHA Valley and the intended development of Dadocha dam on its site remained controversial. Needless to say, investor confidence has taken a hit.

Karachi population to increase by 50% in 15 years

However, DHA Islamabad has recently announced plans to allot alternative plots to those affected by the DHA Valley problems, so things could start to look better soon.

Predictably, Sector F-11 remained one of the most expensive localities, where the average price of a one-kanal house stood around Rs69 million and that of a 10-marla house was around Rs36 million.

http://www.zameen.com/Homes/Karachi_DHA_Defence-213-2.html#reference

-

Comment by Riaz Haq on January 17, 2016 at 6:53pm

-

#China's #CPEC investment in #Pakistan, largest ever in a foreign country, could grow even larger in 2016 and beyond

http://www.eurasiareview.com/17012016-china-pakistan-relations-fore... …

It appears that the recently announced China-Pakistan Economic Corridor (CPEC) will remain at the centre of Sino-Pakistan ties during 2016, and even beyond. The CPEC, signed in 2013, got a boost in April 2015 during Chinese President Xi Jinping’s Pakistan visit, where he announced the allocation of US$46 billion for its completion. This is the largest investment China has committed to another country, and the largest Pakistan has ever received.

According to some informed quarters, China may add to this volume if the implementation of the CPEC moves forward smoothly on the Pakistani side. The corridor intends to connect China’s western region with Pakistan’s Gwadar Port via a network of roads, rail and fiber optics.

The CPEC is a part of Xi’s grand strategic concept of “One Belt One Road” (OBOR) to connect with over 60 countries and regions. Under OBOR, besides CPEC, China has initiated other projects such as the Bangladesh, China, India, and Myanmar (BCIM) Corridor; Silk Route in Central Asia; and the 21st Century Maritime Silk Route. But the CPEC is regarded as the ‘flagship’ project among them due to various reasons.

It is the only corridor that involves just one other country, Pakistan, and with whom China has a ‘trust’-based relationship. Other corridors consist of different countries with varying degrees of relations with China. Moreover, the CPEC can provide China an access to the Indian Ocean by reducing both time and distance. This route is not only shorter in distance but avoids the Malacca Strait and the vast Indian Ocean dominated by rival Indian and US navies.

For Pakistan, the CPEC can bring large-scale investments in the energy sector, infrastructure building, and industry, giving a boost to its moribund economy. Once Pakistan is prepared, China may also move some of its industry and bring Pakistan into its chain of production. Above all, the CPEC will increase China’s stakes in Pakistan which will leverage Islamabad in regional affairs. It is this backdrop that demonstrates the centrality of the CPEC in future Sino-Pak relations.

From the construction point of view, the corridor has been divided into short, mid and long-term projects. In 2016, progress or completion of some projects for infrastructure development and energy are expected. Actually, it is the top priority of the incumbent government to finish some projects at the earliest to show its performance to the public.

According to the understanding that exists between the two countries, Chinese state companies will build several CPEC-related projects. 2016 will thus witness a number of Chinese engineers, technicians and workers coming to Pakistan. There are already over 120 companies and 1,20,00 technicians engaged in different projects in Pakistan. This increased number of Chinese nationals in Pakistan will add to two-way exchanges. At the same time, however, it will also raise the question of their safety and security. Pakistan has established a special force of 1,20,00 men under the army to provide security to Chinese expatriates and guard their construction work. But given the law and order situation in the country, these measures appear insufficient. Lack of sufficient security may restrict the free moment of Chinese workers and tourists.

-

Comment by Riaz Haq on January 23, 2016 at 3:57pm

-

DAVOS, Switzerland: Prime Minister Muhammad Nawaz Sharif Friday invited Swiss and international investors to Pakistan’s energy, telecom, infrastructure, urban development, agro-industry and textiles sectors that offer exciting opportunities for investment.

“I invite you to be our partners in realizing our vision for Pakistan. Our vision is of a Pakistan which is business friendly; a Pakistan where foreign investors feel safe and secure; and a Pakistan which is modern, progressive and forward-looking,” he told a group of investors here at a breakfast meeting.

“I assure you that my business-friendly government will extend all possible assistance to you in your business endeavours in Pakistan,” the Prime Minister said as he shared with the gathering, country’s greatly improved internal security situation, and robust economic indicators.

He was speaking at a Breakfast Meeting, hosted by Ikram Sehgal, Chairman of the Pathfinder Group on “Pakistan – A land of Business Opportunities.”

Finance Minister Ishaq Dar, Commerce Minister Engineer Khurram Dastgir, Special Assistant to Prime Minister on Foreign Affairs Tariq Fatemi and Miftah Ismail attended the meeting along with around a hundred participants of the World Economic Forum.

The Prime Minister said investment incentives in Pakistan were diverse and business friendly.

“Our primary objective is to create an environment conducive for investment inflows. We offer a liberal investment policy, which includes 100 percent equity ownership, full repatriation of capital, tax-breaks, and customs duty concessions on import of machinery and raw materials,” Nawaz Sharif told the investors.

“We offer prospects of co-production, joint ventures with local partners and joint marketing arrangements. The taxation regime is one of the lowest in the region and its collection is undertaken through a dedicated Large Taxpayers Unit. A multiplicity of tax concessions is available along with provisions of tax exemptions to specific businesses,” he said.

Prime Minister Nawaz Sharif told the investors gathered in the Swiss town for the 46th World Economic Forum that Pakistan’s economic upturn was now being acknowledged and appreciated worldwide.

“Leading international publications, funds managers and rating agencies have made positive assessments of our economic turnaround,” he added.

He said Pakistan was home to the 6th largest population in the world with 180 million people. He said Pakistan has 26th largest economy by purchasing power parity, 44th largest economy by real Gross Domestic Product and the 10th largest country in the world, according to the size of its labour force.

“With a thriving democracy, sound economic policies, a youthful population, abundant natural resources and its strategic location, Pakistan is poised to emerge as an economic powerhouse in the region. We are promoting accountable, responsible and transparent governance, bolstered by a free media, independent judiciary and a vibrant civil society.”

http://www.dnd.com.pk/pm-nawaz-invites-intl-investors-to-pakistans-...

-

Comment by Riaz Haq on January 25, 2016 at 7:21am

-

‘#Pakistan to receive up to $500 million (portfolio investment) post #MSCI re-classification’ to emerging market

http://tribune.com.pk/story/1033420/from-frontier-to-emerging-pakis... … …

Pakistan is expected to receive an inflow of up to $500 million in foreign portfolio investment should the MSCI reclassify it as an emerging market in its upcoming annual review in May, says Next Capital CEO Najam Ali.

MSCI is a leading provider of international investment decision support tools. Assets of more than $9.5 trillion are estimated to be benchmarked to MSCI indices worldwide.

Investment portfolio: FDI shrinks to $803.2m in 11MFY15

Speaking to The Express Tribune last week, Ali said his conversations with foreign fund managers show Pakistan should expect “significantly better” investments after MSCI upgrades its status from Frontier Market (FM) to Emerging Market (EM).

Global institutional investors use different MSCI indices – such as frontier, emerging, China and US markets – to create balanced portfolios to generate maximum returns while keeping in view their overall risk appetite.

Ali’s comments follow several bouts of volatility on the Pakistan Stock Exchange (PSX) that were triggered by an unrelenting foreign sell-off.

In fact, foreign selling was one of the main reasons for the flat performance of the PSX in 2015, as the net outflow of foreign investment amounted to $317.3 million. In contrast, there was a net inflow of $382.5 million in 2014, resulting in a 33% rise in the benchmark index. Investors’ confidence in the stock market remains shaky, as most blue-chip shares continue to take a battering.

Three Pakistan companies upgraded on investors’ radar

Pakistan was part of MSCI EM between 1994 and 2008. However, the temporary closure of the Karachi Stock Exchange in 2008 led MSCI to remove it from EM and classify it as a “standalone country index”. MSCI made Pakistan a part of FM in May 2009 and it has remained as such since then.

Currently, six Pakistani companies – Engro Corp, MCB Bank, Habib Bank, United Bank, OGDC and Fauji Fertilizers – meet the size and liquidity criteria of MSCI for EM. A company must have market capitalisation of $1.3 billion to be part of EM as opposed to $670 million for FM. Similarly, the EM requirement for minimum free float is $670 million as opposed to $52 million for FM.

Pakistan’s weight in the MSCI FM Index is 8.9%. Its weight in the MSCI EM Index will be approximately 0.17%. “Most FM funds will continue their investment in Pakistan as long as the improving macro theme is intact,” Ali said, adding that EM funds will also start investing in Pakistan post-reclassification. “If Pakistan’s macro story improves further, we can expect a significantly higher level of inflows.”

Qatar and UAE underwent an MSCI upgrade recently. Both markets witnessed “dramatically positive impacts” when their reclassification to MSCI EM was announced in May 2013, Ali said. “UAE saw a 40% re-rating in the price-to-earnings multiples between May 2013 and May 2014 while the re-rating in Qatar over the same period was 45%,” he added.

Currently 15 companies on the PSX have a market capitalisation of more than $1 billion. More companies will qualify for MSCI EM with better liquidity and free float, he added.

365 days, 685 points

Time to buy

Ali said nothing in the Pakistani market should worry international investors. “Foreign funds are receiving redemption requests, which means they have to offload investments locally as well. But foreigners are selling only a handful of Pakistani stocks. Why should the rest of the market fall? It is time for locals to buy.”

He suggested that the finance minister should set up a market stability fund of Rs20 billion under the state-owned asset management company with the sole objective of absorbing any foreign selling. “It will restore investors’ confidence in the market. The economy is doing well, so should the stock market,” he said.

-

Comment by Riaz Haq on January 28, 2016 at 8:27pm

-

The Rise Of #Pakistan: Analyst "extremely bullish on Pakistan's future" #CPEC

http://seekingalpha.com/article/3843276-rise-pakistan-industry-appr... … $PAK

By Dylan Waller

I am extremely bullish on Pakistan's economic future, and focus on buy opportunities for listed equity in Pakistan.

ETFs are often not the best reflection of a country's value, and there are some relevant concerns I have with this ETF.

Pakistan trades at a strong discount to emerging Asia, and will be reclassified for eligibility as an emerging market this year.

The China Pakistan Economic Corridor will serve as a catalyst for Pakistan's economy, and primarily benefit the cement industry.

Pakistan is an incredibly relegated frontier market, with strong upside potential, driven both by the strong levels of growth ahead for the country, and Pakistan's discount to emerging Asia. The newly launched Global X MSCI Pakistan ETF (NYSEARCA:PAK) offers U.S. investors exposure to Pakistan's economy, by investing in a diverse portfolio of approximately 32 securities. I have noticed, along with other SA contributors, that ETFs are often not a pure representation of a country's economic potential, and have also personally observed that actively managed funds offer a superior alternative to outperform a stock market index/ETFs.

An extreme case of a poor performing ETF in a strong performing market is the Market Vectors Vietnam ETF (NYSEARCA:VNM), which curiously declined amid the VN Index gain for a wide number of reasons, mainly due to its industry approach and valuation. Investing in strategic, high-growth industries, while selecting stocks with lower valuation and higher dividend yields, is one of the clear cut ways to outperform the index and be successful in frontier and emerging markets. I have previously outlined a bull case for Pakistan in this article, and would like to follow through with an analysis of which industries in Pakistan should be sought after and avoided, and whether the Global X MSCI Pakistan ETF is an appropriate vehicle for this promising, frontier market.

-

Comment by Riaz Haq on February 3, 2016 at 8:31pm

-

Farewell speech: #Pakistan is on a positive trajectory, says departing #UK High Commissioner Barton

http://tribune.com.pk/story/1039748/farewell-speech-pakistan-is-on-... …

“I will leave Pakistan next week at the end of my tenure as high commissioner after my two years here, but I am more optimistic than ever about the future of the country, and I believe that the country is now on a positive trajectory in four crucial areas including democracy, security, economy and regional relationships,” Barton said, adding that he first time visited the country over 20 years ago.

“We are of course linked by history, and I am very confident about the future relationship between the UK and Pakistan,” the High Commissioner said and maintained that he visited the Regimental Museum of the Punjab Regiment – which was his grandfather’s regiment – in Mardan and to be shown three documents that he had signed in the 1920s.

“But it is the people-to-people links that represent the present and the future. That’s why the partnership between the UK and Pakistan is long term.”

He outlined the positive role the UK had in Pakistan in the past and the partnership is likely to continue in the future.

He said around 1.3 million Pakistanis who have had microfinance loans through UK Aid and the work of the Department for International Development and UK helped 270,000 women to get CNIC cards supporting their citizenship rights. He said 5.2 million of the poorest families in Pakistan were being supported by the Benazir Income Support Programme, which is partly-funded by the UK. This programme is also providing incentives to over 1 million children to attend and stay in school, through its conditional education transfers.

He said 6.3 million Pakistani primary school children had benefited from direct UK support and the British Council will train 1 million teachers of English by 2018, to help improve the way English is taught in schools maintaining that every year, the British Council enabled 220,000 people to take nearly half a million UK examinations here in Pakistan.

“We have helped 118 Pakistani universities develop partnerships with over 90 universities in the UK, we have the Chevening scholarship programme for people pursuing fully-funded masters’ degrees at top UK universities…and there are some 1,300 Pakistani Chevening alumni now,” he said.

The High Commissioner also argued that people in Pakistan now have more space to think about the longer term future, including challenges around demography, the environment and the economy.

-

Comment by Riaz Haq on February 14, 2016 at 5:33pm

-

Debt Markets worry over #Pakistan default on $50 billion debt coming due as Credit Default Swaps surge http://bloom.bg/1oCaZR1 via @business

Bets are rising that Pakistan will default on its debt just as it starts to revive investor interest with a reduction in terrorist attacks.

Credit default swaps protecting the nation’s debt against non-payment for five years surged 56 basis points over the past week amid the global market sell-off, the steepest jump after Greece, Venezuela and Portugal among more than 50 sovereigns tracked by Bloomberg. About 42 percent of Pakistan’s outstanding debt is due to mature in 2016 -- roughly $50 billion, equivalent to the size of Slovenia’s economy.

Prime Minister Nawaz Sharif has worked to make Pakistan more investor-friendly since winning a $6.6 billion International Monetary Fund loan in 2013 to avert an external payments crisis. The economy is forecast to grow 4.5 percent, an eight-year high, as a crackdown on militant strongholds helps reduce deaths from terrorist attacks.

"Pakistan’s high level of public debt, with a large portion financed through short-term instruments, does make the sovereign’s ability to meet their financing needs more sensitive to market conditions," Mervyn Tang, lead analyst for Pakistan at Fitch Ratings Ltd., said by e-mail.

Since Sharif took the loan, Pakistan’s debt due by end-2016 has jumped about 79 percent. He’s also facing resistance in meeting IMF demands to privatize state-owned companies, leading to a strike this month at national carrier Pakistan International Airlines Corp.

The bulk of this year’s debt, some $30 billion, is due between July and September, and repayments will get tougher if borrowing costs rise more. The spread between Pakistan’s 10-year sovereign bond and similar-maturity U.S. Treasuries touched a one-year high on Thursday.

If Pakistan’s debt servicing costs rise, Sharif doesn’t have much room to maneuver. Already about 77 percent of the country’s 13 trillion rupees ($124 billion) budget for the year through June 30 is earmarked for interest and principal repayment on loans.

------

Another worry, as ever in Pakistan, is political stability. The military has ruled the country for most of the time since independence in 1947, and General Raheel Sharif -- no relation to the prime minister -- has boosted the army’s image with a campaign to root out terrorists who massacred 134 children in 2014.

While Raheel Sharif has said he plans to retire when his term ends in November, the risk of political upheaval is ever present. Pakistan has the 10th highest political risk score among more than 120 countries in the Economist Intelligence Unit ranking, worse than Egypt and Iran.

Twitter Feed

Live Traffic Feed

Sponsored Links

South Asia Investor Review

Investor Information Blog

Haq's Musings

Riaz Haq's Current Affairs Blog

Please Bookmark This Page!

Blog Posts

Modi's AI Spectacle: Chaos and Deception in New Delhi

The India AI Impact Summit 2026, held at Bharat Mandapam in New Delhi, has been marred by chaos, confusion and deception. The events on the ground have produced unintended media headlines for India's Prime Minister Narendra Modi who wants to be seen as the "vishwaguru" (teacher of the world) in the field of artificial intelligence as well. First, there was massive chaos on the opening day, with long…

ContinuePosted by Riaz Haq on February 19, 2026 at 12:00pm — 10 Comments

India-Pakistan Cricket Match: The Biggest Single Event in the World of Sports

Why did Pakistan's decision to boycott the India-Pakistan match in solidarity with Bangladesh in this year's T20 World Cup send shockwaves around the world? And why did it trigger the International Cricket Council's and other cricket boards' urgent efforts to persuade Pakistan to return to the match? The reason has a lot to do with its massive financial impact, estimated to be as much as …

ContinuePosted by Riaz Haq on February 11, 2026 at 4:00pm — 2 Comments

© 2026 Created by Riaz Haq.

Powered by

![]()

You need to be a member of PakAlumni Worldwide: The Global Social Network to add comments!

Join PakAlumni Worldwide: The Global Social Network