PakAlumni Worldwide: The Global Social Network

The Global Social Network

Gallup Survey Says Pakistan Among Top Nations For Optimism

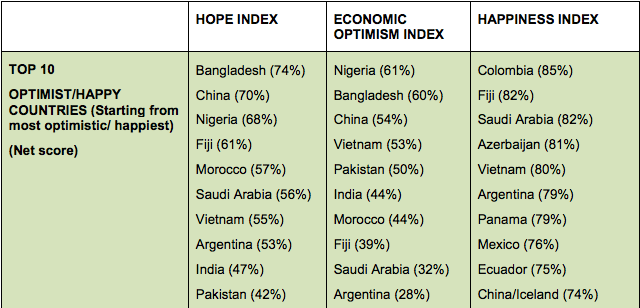

The results of the 2015 WIN/Gallup International survey of 68 countries across the globe show Pakistan ranking 5th on economic optimism and 10th on overall optimism.

The World Bank reporting the tailwinds pushing Pakistan's economic growth seems to support the optimism in Pakistan. Most observers believe that the year 2015 has turned out to be a good year for Pakistan with the return of general optimism among businessmen, investors and consumers. Economic recovery has continued as Pakistan Army's efforts, including its Operation Zarb e Arb and Karachi Operation by Rangers, have started to bear fruit with significant decline in terrorism. There are new signs of a thaw in India-Pakistan ties with Indian Prime Minister Modi's surprise year-end visit to Lahore. Efforts to bring peace in Afghanistan took a new positive turn with the hopeful entry of the Taliban into a quadrilateral process involving Afghanistan, Pakistan, China and the United States.

Overall, 64% of Pakistanis say they happy, slightly below the 66% average for the 68 countries surveyed. Among south Asian nations, 66% of Bangladeshis, 58% of Indians and 42% of Afghans say they are happy, according to WIN/Gallup International Survey for 2015.

Bangladesh (74%), Nigeria (61%) and Columbia (85%) top Hope, Economic Optimism and Happiness Indices respectively. Pakistan scores 42% (rank 10) on hope and 50% (rank 5) on economic optimism indices. India scores 47% (rank 9) on Hope and 44% (rank 6) on Economic Optimism indices.

Jean-Marc Leger, President of WIN/Gallup International Association, said that "2015 has been a tumultuous year for many across the globe, despite that the world remains largely a happy place. 45% of the world is optimistic regarding the economic outlook for 2016, up by 3 per cent compared to last year."

Let's hope the new crises unfolding at the start of the year 2016 such as the China market crash, the Pathankot terrorist attack in India, the new escalation of Iran-Saudi conflict and the claimed hydrogen bomb test claimed by North Korea do not sour the 2015 year-end optimism reported by the WIN/Gallup survey.

Related Links:

Pakistan's Trillion Dollar Economy

China-Pakistan Industrial Corridor (CPEC)

How Can Pakistan Benefit From Low LNG Prices?

Who's Better For Human Development? Politicians or Musharraf?

-

Comment by Riaz Haq on February 26, 2016 at 9:22pm

-

#Pakistan: An Undiscovered Land Of Opportunities For International Investors. #CPEC http://seekingalpha.com/article/3936206-pakistan-undiscovered-land-opportunities?source=tweet … $PAK $NTWK $PKKKY

Summary

Lowest market P/E in the region with the highest return.

Macroeconomic stability.

Upgradation of Moody's rating of the country.

Pakistan is the 26th largest economy according to PPP (Purchasing Power Parity), and the sixth largest populous country in the world with a burgeoning middle class, having 54% of the population below the age of 24 years. In news, Pakistan has been presented as the turbulent nation embroiled in militancy and political violence. However, the landscape of the country has been changing since the past two years, with an improving macroeconomicsituation, steady political outlook and substantial improvement in law and order, and the upgradation of its bond ratings from Caa1 to B3, a stable outlook.

On 9th June 2015, the MSCI stated about a potential reclassification of theMSCI Pakistan Index into Emerging Markets from the current classification of Frontier Markets in its 2016 Annual Market Classification review. This categorization would trigger a large flow of emerging market funds to return to Pakistan as the MSCI Emerging Market Index is tracked by global funds worth $1.7 trillion, according to Bloomberg.

Further, in one of the lectures at the Aga Khan University, the Chief Investment Strategist of Morgan Stanley said that Pakistan's rise is just a matter of time. This was due to the favorable demographics and the lower P/E of the stocks - performing better in terms of return - when compared to the markets of the developed world.

The KSE 100 Index, which tracks the top 100 companies out of the 557 listed on the stock exchange had a five-year US dollar CAGR of 25% (highest among its peers) and net profit margins 60% above the five-year average of the peer group whose margins are 10.2% lower than its five-year average. The Bourse has an average ROE of 19.2% against the peer average of 10.2%.

Pakistani stocks are cheaper when compared to their regional peers. Consider the following graph for further details:

As the above graph illustrates, Pakistani stocks have a lower P/E, P/B and higher dividend yield relative to its peers.

As the above graph illustrates, Pakistani stocks have a lower P/E, P/B and higher dividend yield relative to its peers.

-

Comment by Riaz Haq on March 7, 2016 at 8:11am

-

#Pakistan Stock Exchange breaches 33k-point barrier. #PSE #Karachi | Shanghai Daily: http://www.shanghaidaily.com/article/article_xinhua.aspx?id=322481#... …

The Pakistan Stock Exchange (PSX) broke the psychological barrier of 33,000 points on Monday for the first time since January 7, 2016 as investors took keen interest in oil stocks in the wake of rising international oil prices.

The Pakistan Stock Exchange's (PSX) benchmark KSE 100-Index skyrocketed by 1.79 percent or 580.86 points to 33,022.60 points on Monday when compared with 32,441.74 points reported on Friday. During the nine-day bullish rally, the main index has piled on 2,458.10 points from 30,564.50 on Feb. 23 to 33,022.60 points on March 7.

The KSE All Share Index jumped by 1.62 percent or 361.08 points to 22,628.04 points, the KSE 30-Index augmented by 2.24 percent or 429.92 points to 19,600.42 points, the KMI 30-Index elevated by 2.16 percent or 1,216.13 points to 57,514 points, whereas the Islamic All Share Index gained 1.69 percent or 256.60 points to 15,479.22 points on Monday.

During Monday's trading session, the main index moved in a broad range of 588.55 points as it scaled an intraday high of 33,030.29 points as against an intraday low of 32,441.74 points.

Investors gained confidence with international oil price rising which resulted in a buying spree in other sectors including cement. Continuous foreign inflows in cement sector helped Maple Leaf Cement (MLCF), Dera Ghazi Khan Cement (DGKC), and Fauji Cement Limited (FCCL) to close up 3.5 percent, 1.64 percent, and 1.93 percent, respectively.

Oil prices continued to rise internationally which led gain in Pakistan Oilfields Limited (POL), Pakistan Petroleum Limited (PPL) and Oil and Gas Development Company (OGDC) by 2.31 percent, 3.62 percent, and 3.25 percent, respectively.

Market volumes surged by 35.09 percent or 52.763 million shares to 203.118 million shares on Monday when compared with 150.354 million shares recorded on Friday.

Market capitalization increased by 1.78 percent or 120.809 billion rupees (1.184 billion U.S. dollars) to 6.916 trillion rupees (67.812 billion dollars) whereas trade value swelled by 39.32 percent or 3.381 billion rupees (33.151 million dollars) to 11.98 billion rupees (117.458 million dollars).

Among 364 active scrips on Monday, prices of 250 issues advanced, 82 declined, whereas values of 32 other companies stayed unchanged at previous week's level.

Jahangir Siddiqui Company Limited, TRG Pakistan Limited, and Pakistan Telecommunication Company Limited were the top traded companies with turnovers of 14.761 million shares, 14.568 million shares, and 10.735 million shares, respectively.

Nestle Pakistan was the top price gainer with increment of 95 rupees (93.14 cents) to 6,800 rupees (66.66 dollars) while on the flip side Wyeth Pakistan Limited led the major price shedders with decrement of 60 rupees (58.82 cents) to 1,750 rupees (17.15 dollars).

Comment

- ‹ Previous

- 1

- 2

- Next ›

Twitter Feed

Live Traffic Feed

Sponsored Links

South Asia Investor Review

Investor Information Blog

Haq's Musings

Riaz Haq's Current Affairs Blog

Please Bookmark This Page!

Blog Posts

EU-India Trade Deal: "Uncapped" Mass Migration of Indians?

The European Union (EU) and India have recently agreed to a trade deal which includes an MOU to allow “an uncapped mobility for Indian students”, according to officials, allowing Indians greater ease to travel, study and work across EU states. India's largest and most valuable export to the world is its people who last year sent $135 billion in remittances to their home country. Going by the numbers, the Indian economy is a tiny fraction of the European Union economy. Indians make up 17.8%…

ContinuePosted by Riaz Haq on January 28, 2026 at 11:00am — 8 Comments

Independent Economists Expose Modi's Fake GDP

Ruling politicians in New Delhi continue to hype their country's economic growth even as the Indian currency hits new lows against the US dollar, corporate profits fall, electrical power demand slows, domestic savings and investment rates decline and foreign capital flees Indian markets. The International Monetary Fund (IMF) has questioned India's GDP and independent economists…

ContinuePosted by Riaz Haq on January 25, 2026 at 4:30pm — 10 Comments

© 2026 Created by Riaz Haq.

Powered by

![]()

You need to be a member of PakAlumni Worldwide: The Global Social Network to add comments!

Join PakAlumni Worldwide: The Global Social Network