PakAlumni Worldwide: The Global Social Network

The Global Social Network

Goldman Sachs' Jim O'Neill Bullish on Pakistan

In his recently published book "The Growth Map", Goldman Sachs' Jim O'Neill of BRIC fame has reiterated Pakistan's long term growth prospects as part of the Next 11 (N-11) group of nations which includes Bangladesh, Egypt, Indonesia, Iran, Mexico, Nigeria, Pakistan, Philippines, Turkey, South Korea, and Vietnam.

Goldman Sachs has recently launched an N-11 equity fund (GSYAX) to enable investors to take advantage of growth in the Next-11 group of nations.

Answering a reporter's question about the growth prospects of GCC (oil-rich nations of Gulf Cooperation Council) at a recent investment conference in Dubai, he said: "Some GCC countries are well placed to be hubs for the BRIC and N-11-influenced world. I often think of Dubai as a kind of N-11 center, even the capital of the N-11 world, given its business adjacency to Egypt, Pakistan, Iran, Turkey, and, of course, India and Russia."

While the primary criterion used by Goldman Sachs for membership of a developing nation in BRIC and N-11 is the size of its population, the firm also considers what it calls Growth Environment Score (GES) of each nation. The 13 variables which make up growth environment score are inflation, fiscal deficit, external debt, investment rate, openness of the economy, penetration of phones, penetration of personal computers, penetration of internet, average years of secondary education, life expectancy, political stability, rule of law and corruption.

Goldman Sachs has given Pakistan a low GES score which puts the country among the bottom third of Next-11 nations. However, this score is rising, and Goldman forecasts that Pakistan will be among the top 20 world economies by 2025.

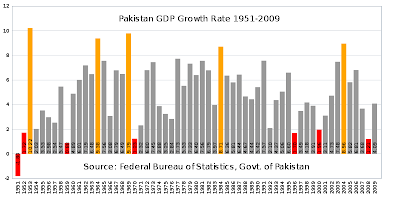

It seems to me that Goldman Sachs' assessment of Pakistan's growth prospects are too heavily influenced by the current crises the country faces. It is too conservative and does not fully reflect its future potential based on the nation's economic history over the last 64 years. For example, Goldman assumes a future growth rate that is less than the average of over 5% a year which Pakistan has seen over the last 64 years.

My view is that Goldman Sachs' forecast should fully reflect the fact that Pakistan's per capita GDP increased by 60% to $3,000 in the last decade. Even if it is assumed that there is no demographic dividend and the country's gdp growth rate will not accelerate, its per-capita income should still rise to nearly $20,000 by 2050, well above the Goldman Sachs' forecast of $15,066.00.

It is unrealistic to assume that Pakistan's economy will not benefit from its very young population. With half of its population below 20 years and 60 per cent below 30 years, Pakistan is well-positioned to reap huge demographic dividend, with its workforce growing at a faster rate than total population. This trend is estimated to accelerate over several decades. The average Pakistanis are now taking education more seriously than ever. Youth literacy is about 70% and growing, and young people are spending more time in schools and colleges to graduate at higher rates than their Indian counterparts in 15+ age group, according to a report on educational achievement by Harvard University researchers Robert Barro and Jong-Wha Lee. Vocational training is also getting increased focus since 2006 under National Vocational Training Commission (NAVTEC) with help from Germany, Japan, South Korea and the Netherlands.

The fact is that equity markets in Pakistan have already produced much higher returns than BRICs' markets have over the last decade.

Pakistan's main stock market ended 2010 with a 28 percent annual gain, driven by foreign buying mainly in the energy sector, despite concerns about the country's macroeconomic indicators after summer floods, according to Reuters. Although it was less than half of the 63% gain recorded in 2009, it is still an impressive rise in KSE-100 index when compared with the performance of Mumbai(+17%) and Shanghai(-14.3%) key indexes. Among other BRICs, Brazil is up just 1% for the year, and the dollar-traded Russian RTS index rose 22% in the year, reaching a 16-month closing high of 1,769.57 on Tuesday, while the ruble-based MICEX is also up 22%.

Pakistan's key share index KSE-100 dropped about 5% in 2011, significantly less than most the emerging markets around the world. Mumbai's Sensex, by contrast, lost about 25% of its value, putting it among the worst performing markets in the world.

Given the historical economic data I have shared in this post, I remain optimistic that Pakistan can and will easily beat Jim O'Neill's current forecast in the coming decades.

Related Links:

Pakistan's 64 Years of Independence

Goldman Sachs & Franlin-Templeton Bullish on Pakistan

Emerging Market Expert Investing in Pakistan

Pakistan's Demographic Dividend

Genomics & Biotech Advances in Pakistan

Pakistan Rolls Out 50Mbps Broadband Service

More Pakistan Students Studying Abroad

-

Comment by Riaz Haq on December 7, 2022 at 8:22am

-

Pakistan projected to be among largest economies in the world by 2075: Goldman Sachs

https://www.dawn.com/news/1725141

Pakistan’s star future status is predicted on the back of its population growth, which along with Egypt and Nigeria, could place it among the largest economies in the world in the next 50 years, according to Goldman Sachs.

By that time, the research projects Pakistan’s Real GDP to have grown to $12.7 trillion and its GDP per capita to $27,100.

These numbers, however, are projected to be less than a third of the size of China, India and the US. India’s Real GDP in 2075 is projected at $52.5 trillion and per capita GDP at $31,300.

Among key risks to their projections, the economists particularly highlight “environmental catastrophe” and “populist nationalism”.

Unless a path to sustainable growth is ensured through a globally coordinated response, climate change could heavily skew these projections, particularly for countries like Pakistan, with geographies that are especially vulnerable.

With populist nationalists coming to power in many countries, the report says it might lead to increased protectionism that could potentially result in the reversal of globalisation, thereby increasing income inequality across countries.

Other key projections

Global growth on a declining path

The paper notes that global growth has slowed from an average of 3.6 per cent per year in the past 10 years to 3.2pc, and the slowdown has been relatively broad-based.

They project global growth will average 2.8pc between 2024 and 2029 and will be on a gradually declining path.

The rise of emerging markets

While global growth is dipping, emerging economies are growing faster than developed markets and will continue to converge with them.

“The weight of global GDP will shift (even) more towards Asia over the next 30 years nations as China, the US, India, Indonesia and Germany top the league table of largest economies when measured in dollars. Nigeria, Pakistan and Egypt could also be among the biggest.”

Declining global population

The decline in global growth will be driven by the decline in population growth, which UN projections imply will fall to close to zero by 2075. The paper says this is a “good problem to have” as it mitigates damages to the environment but could pose economic problems arising from high healthcare costs and an ageing population.

US won’t repeat exceptional growth

The US won’t be able to repeat its strong performance from the last decade, with potential growth remaining “significantly lower” than that of large developing economies.

The US dollar is also projected to lose strength in the next 10 years.

Less global inequality, more local inequality

Emerging markets’ convergence has led to falling income inequality between economies but income inequality within most economies has risen. This poses a major challenge to the future of globalisation.

-

Comment by Riaz Haq on July 12, 2023 at 7:05am

-

20 Largest Economies in the World by 2050: The Rising Giants

https://www.southwestjournal.com/largest-economies-in-the-world/

Complete List

Country Projected GDP at PPP (in trillion)

Vietnam $3.18

Philippines $3.34

South Korea $3.54

Iran $3.90

Pakistan $4.24

Egypt $4.33

Nigeria $4.35

Saudi Arabia $4.69

France $4.71

Turkey $5.18

United Kingdom $5.37

Germany $6.14

Japan $6.78

Mexico $6.86

Russia $7.13

Brazil $7.54

Indonesia $10.5

United States $34.1

India $44.1

China $58.5

---------

In our exploration of the future, we’ve delved into the fascinating realm of global economic dynamics, forecasting the 20 largest economies by the year 2050. But if you’re eager to cut to the chase, feel free to jump straight to our top 5 predictions.

Our journey begins in the heart of London, at the headquarters of our own professional services network.

We’re proud to stand among the world’s leading accountancy firms, and in 2017, we embarked on a bold project: The World in 2050. This report was our attempt to gaze into the crystal ball of the world’s economic future, three decades down the line.

Our projections suggest a seismic shift in the global economic landscape. We anticipate the global economy will surge by 130% by 2050, with China commanding a 20% share of the world’s GDP in purchasing power parity.

------------

Pakistan Forecasted GDP at PPP: $4.24 trillion

Pakistan, the world’s fifth most populous nation, is expected to be among the 20 largest economies in the world by 2050, driven by its youthful population. A Goldman Sachs report from December 2022 even tipped Pakistan to be the sixth largest economy by 2075.

Comment

- ‹ Previous

- 1

- 2

- Next ›

Twitter Feed

Live Traffic Feed

Sponsored Links

South Asia Investor Review

Investor Information Blog

Haq's Musings

Riaz Haq's Current Affairs Blog

Please Bookmark This Page!

Blog Posts

EU-India Trade Deal: "Uncapped" Mass Migration of Indians?

The European Union (EU) and India have recently agreed to a trade deal which includes an MOU to allow “an uncapped mobility for Indian students”, according to officials, allowing Indians greater ease to travel, study and work across EU states. India's largest and most valuable export to the world is its people who last year sent $135 billion in remittances to their home country. Going by the numbers, the Indian economy is a tiny fraction of the European Union economy. Indians make up 17.8%…

ContinuePosted by Riaz Haq on January 28, 2026 at 11:00am — 8 Comments

Independent Economists Expose Modi's Fake GDP

Ruling politicians in New Delhi continue to hype their country's economic growth even as the Indian currency hits new lows against the US dollar, corporate profits fall, electrical power demand slows, domestic savings and investment rates decline and foreign capital flees Indian markets. The International Monetary Fund (IMF) has questioned India's GDP and independent economists…

ContinuePosted by Riaz Haq on January 25, 2026 at 4:30pm — 10 Comments

© 2026 Created by Riaz Haq.

Powered by

![]()

You need to be a member of PakAlumni Worldwide: The Global Social Network to add comments!

Join PakAlumni Worldwide: The Global Social Network