PakAlumni Worldwide: The Global Social Network

The Global Social Network

Has Bangladesh Really Left India and Pakistan Behind in Per Capita Income?

Is Bangladesh's officially reported GDP figure credible? Do consumption figures support Bangladesh's claim of higher per capita income than India and Pakistan? Is it the recent rebasing of GDP that boosted Bangladesh's per capita income above India's and Pakistan's? If Bangladesh has higher GDP per capita, why is its per capita consumption of energy, cement and steel so much lower than India's and Pakistan's? Does Pakistan really have a much larger informal economy than Bangladesh or India do? How long has it been since Pakistan rebased its GDP calculations? Is there a lot more currency in circulation in Pakistan than in Bangladesh and India? Let us try and answer these questions!

Rebasing GDP:

Bangladesh just rebased its GDP in 2020-21 to year 2015-16. This has boosted its per capita income by double digits for every year since 2015-16. Bangladesh's per capita income for the 2015-16 fiscal year has now gone up to $1,737 from $1,465 in the old calculation. For the 2019-2020 fiscal, the per capita income has gone up to $2,335 from $2,024. The new GDP estimate covers 21 sectors, up from 15 sectors previously. India last rebased its GDP in 2015, a change that bumped up its per capita GDP by double digits. Nigeria's last rebasing in 2012 increased the size of its economy (GDP) by nearly 90%. Pakistan's current base year is 2005-6. Rebasing which is now long overdue will almost certainly increase Pakistan's per capita income by double digits.

In its 2014 annual report, the State Bank of Pakistan talked about a number of new sectors that are either under-reported or not covered at all: "In terms of LSM growth, a number of sectors that are showing strong performance; (for example, fast moving consumer goods (FMCG) sector; plastic products; buses and trucks; and even textiles), are either under reported, or not even covered. The omission of such important sectors from official data coverage, probably explains the apparent disconnect between overall economic activity in the country and the hard numbers in LSM."

Pakistan's last economic census was done in 2003 and published in 2005, livestock census in 2006 and agriculture census in 2010. The country's economy has changed significantly since then, adding several new economic activities while others may have diminished. The Quantum Index of Large Scale Manufacturing (QIM) with 2005-06 base year gives a weight to textiles of 20.9% (Yarn 13.7 and cloth 7.2). But the textile industry has significantly changed as reflected in its exports. The value added textiles (non-yarn and non-cloth) now make almost 80% of the total textile exports. These changes are not reflected in current GDP calculations.

|

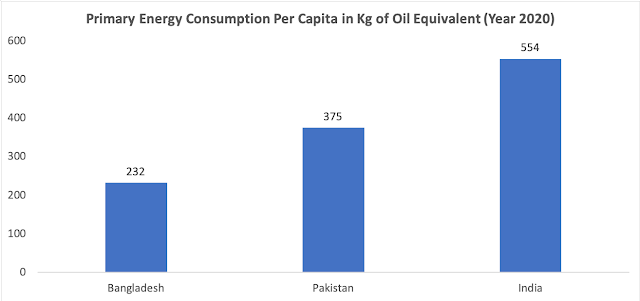

| Primary Energy Consumption Per Capita. Source: British Petroleum St... |

Energy consumption:

Life in modern times is heavily dependent on energy. Per capita energy consumption, a key barometer of economic activity, is significantly lower in Bangladesh than in India and Pakistan. Use of electricity per capita in Bangladesh is significantly less than in India and Pakistan.

|

|

|

Commercial energy use (kg of oil equivalent per capita) above refers to apparent consumption, which is equal to indigenous production plus imports and stock changes, minus exports and fuels supplied to ships and aircraft engaged in international transport. It's only 142 Kg of oil per capita in Bangladesh, much lower than 463 Kg in Pakistan and 494 Kg in India.

A more recent British Petroleum "Statistical Review of World Energy 2021" puts the per capita primary energy consumption at 9.7 Gigajoules (232 kilogram of oil equivalent) for Bangladesh, 15.7 Gj (375 kgoe) for Pakistan and 23.2 Gj (554 kgoe) for India.

Per capita consumption of primary energy in Bangladesh has grown by 59% (6.1 Gj to 9.7 Gj) since 2010, much faster than 25% (18.2 Gj to 23.2 Gj) in India and just 6% (14.8 Gj to 15.7 Gj) in Pakistan, according to the British Petroleum's "Statistical Review of World Energy 2021". This indicates much faster economic growth in Bangladesh than India or Pakistan in the last decade.

Cement Consumption:

Use of cement is another important indicator of economic and development activities, particularly in the infrastructure and housing construction sector. China and the United States, the world's biggest economies, also have the highest consumption of cement.

|

| Cement Consumption. Source: International Cement Review |

Steel Consumption:

Per capita steel consumption is another important indicator of economic activity in both construction and manufacturing sectors. It goes into building housing and infrastructure as well manufacturing vehicles and home appliances. The United States and China, the world's biggest economies, are the largest consumers of steel.

|

| Per Capita Steel Consumption. Source: National Steel Advisory Council |

Bangladesh is among the lowest consumers of steel products in the world. Per capita consumption of finished steel in Bangladesh (41 Kg) is lower than the regional peer Myanmar (40.5), India (75.3), Pakistan (45.7), Sri Lanka (53.5), according to the World Steel Association (WSA).

Pakistan's Informal Economy:

One way to estimate the size of the informal economy in any country is by looking at the amount of currency in circulation relative to overall money supply. This data is published regularly by all central banks in South Asia and elsewhere. Pakistan's currency in circulation to M2 ratio (about 30%) is more than double the ratios in Bangladesh (13%) and India (15%), indicating that the informal economy in Pakistan is much bigger.

Dr. Lalarukh Ejaz, an assistant professor at the Institute of Business Administration in Karachi, has estimated the size of Pakistan’s informal economy at 56% of the country’s GDP (as of 2019). This means that it’s worth around $180 billion a year, and that is a massive amount by any yardstick.

Vehicles and home appliance ownership data analyzed by Dr. Jawaid Abdul Ghani of Karachi School of Business Leadership suggests that the officially reported GDP significantly understates Pakistan's actual GDP. Indeed, many economists believe that Pakistan’s economy is at least double the size that is officially reported in the government's Economic Surveys.

Back in 2014, the State Bank of Pakistan stated in its Annual Report as follows: "In terms of LSM growth, a number of sectors that are showing strong performance; (for example, fast moving consumer goods (FMCG) sector; plastic products; buses and trucks; and even textiles), are either under reported, or not even covered. The omission of such important sectors from official data coverage, probably explains the apparent disconnect between overall economic activity in the country and the hard numbers in LSM." Pakistan's GDP has not been rebased in more than a decade. It was last rebased in 2005-6 while India’s was rebased in 2011. The recent rebasing of Bangladesh GDP to year 2015 has boosted its per capita income of Bangladesh for year 2016-16 and all subsequent years . The per capita income for the 2015-16 fiscal year has now gone up to $1737 from $1465 in the old calculation For the 2019-2020 fiscal, the per capita income has gone up to $2335 from $2024. Just rebasing the Pakistani economy will result in double digit increases in GDP for the last several years.

|

| Estimates of Informal Economies in Asia in 2012. Source: IMF A research paper by economists Ali Kemal and Ahmad Waqar Qasim of PIDE (Pakistan Institute of Development Economics) estimated in 2012 that the Pakistani economy’s size then was around $400 billion. All they did was look at the consumption data to reach their conclusion. They used the data reported in regular PSLM (Pakistan Social and Living Standard Measurements) surveys on actual living standards. They found that a huge chunk of the country's economy is undocumented.

|

|

| Currency in Circulation to M2 Ratio Trends. Source: Business Recorder |

Pakistan's Service Sector:

Pakistan's service sector which contributes more than 50% of the country's GDP is mostly cash-based and least documented. Compared to Bangladesh and India, there is a lot more currency in circulation as a percentage of overall money supply in Pakistan. According to the State Bank of Pakistan (SBP), the currency in circulation has increased to Rs. 7.4 trillion by the end of the financial year 2020-21, up from Rs 6.7 trillion in the last financial year, a double-digit growth of 10.4% year-on-year. Currency in circulation (CIC), as percent of M2 money supply and currency-to-deposit ratio, has been increasing over the last few years. The CIC/M2 ratio is now close to 30%, according to the State Bank of Pakistan. The average CIC/M2 ratio in FY18-21 was measured at 28%, up from 22% in FY10-15. This 1.2 trillion rupee increase could have generated undocumented GDP of Rs 3.1 trillion at the historic velocity of 2.6, according to a report in The Business Recorder. In comparison to Bangladesh (CIC/M2 at 13%), Pakistan’s cash economy is double the size. Even a casual observer can see that the living standards in Pakistan are higher than those in Bangladesh and India.

|

| Exports as Percentage of GDP in South Asia. Source: World Bank |

Exports:

Pakistan has performed poorly in exports growth relative to Bangladesh and India since about 2007. This has been the key source of its balance of payments crises and its repeated need for IMF bailouts. Pakistan's economic growth has essentially been constrained by its recurring balance of payment (BOP) crises as explained by Thirlwall's Law.

Summary:

Bangladesh just rebased its GDP in 2020-21 to year 2015-16. This has boosted its per capita income by double digits for every year since 2015-16, raising it above India's and Pakistan's. Based on published data on energy, cement and steel consumption, Bangladesh's claim of having a per capita GDP higher than India's and Pakistan's does not seem credible. In this age of growing energy-intensive industrialization, it does not make sense to have significantly lower use of key inputs like energy to produce higher gross domestic product. For Pakistan, it is important for policymakers to promote ways of documenting more of the economy. It's also important for finance officials to rebase the country's GDP to a more recent year than the year 2006 when it was last done.

Related Links:

Haq's Musings

South Asia Investor Review

Pakistan Among World's Largest Food Producers

Food in Pakistan 2nd Cheapest in the World

Indian Economy Grew Just 0.2% Annually in Last Two Years

Pakistan to Become World's 6th Largest Cement Producer by 2030

Pakistan's 2012 GDP Estimated at $401 Billion

Pakistan's Computer Services Exports Jump 26% Amid COVID19 Lockdown

Coronavirus, Lives and Livelihoods in Pakistan

Vast Majority of Pakistanis Support Imran Khan's Handling of Covid1...

Pakistani-American Woman Featured in Netflix Documentary "Pandemic"

Incomes of Poorest Pakistanis Growing Faster Than Their Richest Cou...

Can Pakistan Effectively Respond to Coronavirus Outbreak?

How Grim is Pakistan's Social Sector Progress?

Pakistan's Insatiable Appetite For Energy

Trump Picks Muslim-American to Lead Vaccine Effort

COVID Lockdown Decimates India's Middle Class

Pakistan to be World's 7th Largest Consumer Market by 2030

Pakistan's Balance of Payments Crisis

How Has India Built Large Forex Reserves Despite Perennial Trade De...

Conspiracy Theories About Pakistan Elections"

PTI Triumphs Over Corrupt Dynastic Political Parties

Strikingly Similar Narratives of Donald Trump and Nawaz Sharif

Nawaz Sharif's Report Card

Riaz Haq's Youtube Channel

-

Comment by Riaz Haq on September 17, 2022 at 10:23am

-

Arif Habib Limited

@ArifHabibLtd

Power Generation Aug’22

Power Generation

Aug’22: 14,053 GWh (18,888 MW), -12.6% YoY | -0.7% MoM

2MFY23: 28,203 GWh (18,954 MW), -11.2% YoY

Fuel Cost

Aug’22: PKR 10.06/KWh, +57% YoY | -6% MoM

2MFY23: PKR 10.39/KWh, +61% YoY

https://twitter.com/ArifHabibLtd/status/1571073410486407169?s=20&am...

-

Comment by Riaz Haq on September 17, 2022 at 6:46pm

-

The ground under Sheikh Hasina’s feet is shifting

By Avinash Paliwal

https://www.hindustantimes.com/opinion/the-ground-under-sheikh-hasi...

Bangladesh's foreign minister

AK Abdul Momen arrived in

India last month to fight polit-

ical fires. But he found himself

dealing with massive floods

that hit Sylhet and Assam.

Nature has its ways to convey

that not all is well in India's

near-east. Far from the glitz

about Bangladesh's economic

success, on display during the

recent inauguration of the

Padma Bridge, clampdown on

Islamists, and shrewd man-

agement of big power rivalries,

is a parallel potent reality of

Prime Minister Sheikh Has-

ina's authoritarianism,

heightened polarisation, and

economic distress. As an

Indian official mentioned to

me, and a Bangladeshi official

echoed. Hasina "has built a

house of cards"

The economic, social, and

political ground under Has-

ina's feet is shifting in real

time. It is slow enough to be

dismissed as non-urgent, but

sure enough to become press-

ing, if not dealt with urgently.

With general elections due in

2023, and external debt repay-

ment schedules kicking in

from 2024, it is a matter of

time for the veneer of (forced)

stability to lose its sheen. The

risk of dislocation, if not col-

lapse, of this so-called house

of cards has increased in

recent years, and it could

undermine whatever is left of

India's connectivity aspira-

tions in its near east.

Domestically, the Hasina gov-

ernment has exacerbated two

contradictions in a tradition-

ally polarised polity. One, she

is in power, but with little to

no electoral legitimacy. The

Awami League's (AL) manipu-

lation of the 2014 and 20118

elections (a practice not just

reserved for national elections

and against opponents),

unceasing harassment of its

key opponent, the Bangladesh

Nationalist Party (BNP), gag-

ging of media, social media

monitoring using advanced

digital surveillance, and a

forced tilt towards the conser-

vative Islamic Right as a bal-

ancing move after targeting

these formations using force,

has created wide pockets of

intense frustration.

Unlike her father, Sheikh

Mujibur Rahman, who created

a one-party State, but failed to

contain a famine in 1974, Has-

ina has placed her bets on eco-

nomic development. The argu-

ment runs that good economic

performance coupled with lib

eral use of force will make a

one-party State under Has-

ina's leadership sustainable.

But this is where the second

contradiction kicks in.

Bangladesh's external debt to

Gross Domestic Product ratio

has increased to 21.8%, import

spending has shot up by nearly

44%, forex reserves of $42

billion are falling and can

cover about five months'

worth of imports, and the rev-

enue from readymade gar-

ments export and remittances

is not keeping pace with the

fast rising costs to the

exchequer.

Couple this with the global

inflation created by the Rus-

sia-ukraine war and United

Statesled sanctions, and it

becomes clear why Momen is

asking India to remove anti-

dumping duties on Banglade-

shi jute exports. Further com-

plicating this situation is

Dhaka's propensity to accept

external loans for infrastruc-

tural projects at highly inflated

costs, making repayment dif-

ficult. One of the cases in point

is the 2015 Rooppur Nuclear

Power Plant deal with Russia

for which Dhaka is to repay

$13.5 billion. India paid $3 bil-

lion for a similar plant in

Kudankulam.

Why does Dhaka accept such

deals? Because external fin-

ance fuels (limited) infra-

structural growth, chronic

corruption, and keeps the

political illusion of economic

development alive. To be clear

and fair, Bangladesh's eco-

nomic journey has been more

than commendable. But to

expect an economic miracle,

which is bound to dwindle due

to internal or external shocks,

to sustain a corrupt system

pretending to be a democracy

is a tall ask. Herein, Hasina has

ensured that neither the

Islamists nor the BNP

which enjovs public sympathy,

even if it may not get a fair

election - pose a serious

challenge to her.

-

Comment by Riaz Haq on September 19, 2022 at 4:52pm

-

Prime Minister Sheikh Hasina said on Wednesday that her recent visit to India benefitted Bangladesh and she has not returned "empty handed" and emphasised that her trip has opened up a new horizon in the relationship between the two friendly neighbouring countries.

https://www.business-standard.com/article/current-affairs/i-have-no...

During Hasina's visit, India and Bangladesh signed seven agreements, including one on sharing of waters of Kushiyara river which is expected to benefit the regions of southern Assam and Bangladesh's Sylhet region.

"They (India) have shown much sincerity and I have not returned empty handed," Hasina told reporters here, nearly after a week she returned home following a four-day visit to India from September 5 to 8.

"I think that my visit, after a long break of three years due to the Covid pandemic, has opened a new horizon in Bangladesh-India relations, she said, adding that the people of both sides would be benefited from the cooperation in all the areas identified during her India visit and the decisions taken to solve the existing bilateral problems.

Her comments came as leaders of the main opposition outside parliament BNP alleged that Bangladesh gained nothing from her India visit while its secretary general Mirza Fakhrul Islam Alamgir said, "Hasina is unable to deal with India".

Hasina said a MoU on the cross-border Kushiyara river was one of the major achievements of her tour as it was expected to protect over 5,820,000 hectares of land in Bangladesh's northeastern Sylhet region from sudden and protracted flooding.

She said that as per the MoU, Bangladesh would receive 153 cusecs of water under the Surma-Kushiyara project from the common river Kushiyara and as a result, 5,000 hectares of land would get irrigation facilities through Rahimpur Link Canal.

She said the water sharing issue of major Teesta also featured during her talks with Indian counterpart Narendra Modi while BNP chairperson and former prime minister Khaleda Zia even forgot to raise the long pending Ganges water issue during her New Delhi tour."

Bangladesh and India had signed the Ganges Treaty in 1996 during Hasina's ruling Awami League government.

She said the two countries reached an agreement on cooperation in the fields of environment, climate change, cyber security, space technology, and green economy, cultural and people-to-people communication.

"We agreed to complete the construction work of the second gate proposed by India at the Petrapol-Benapole border as soon as possible to expand trade. A delegation from Bangladesh will soon visit India to participate in the start-up fair," Hasina added.

Hasina said New Delhi agreed not to halt export of products like sugar, onion, garlic and ginger to Bangladesh without informing Dhaka in advance so Bangladesh could find alternative sources for those essentials.

She said that cessation of border killings, trade expansion, withdrawal of anti-dumping duty on Bangladesh jute products, repatriation of the Rohingyas, import of electricity from Nepal and Bhutan via India, were also discussed.

"After all, in the changed world situation, this visit would accelerate both the countries to move forward together in a new way, Hasina said.

She added that similarities of language and culture deepened the historic relations with our closest neighbour and friendly country, India.

"Apart from this, the support during the Liberation War and cooperation after the independence has reached this friendship at a special level, she added.

(Only the headline and picture of this report may have been reworked by the Business Standard staff; the rest of the content is auto-generated from a syndicated feed.)

-

Comment by Riaz Haq on December 29, 2022 at 7:58pm

-

Informal Savings in Pakistan

https://www.dawn.com/news/1725956

According to research by Oraan, around 41pc Pakistanis saved via committees (or Rosca), whereas Karandaaz puts that figure at 34pc. Assuming the informal economy accounts for roughly 30pc, as suggested by research from the Pakistan Institute of Developing Economics, it translates into annual committees of Rs4 trillion at base prices, using conservative inputs.

While this back-of-the-envelope calculation is far from scientific, it helps contextualise how big the informal savings market really is. Everyone from a widow looking to save up for her children’s education to young adults trying to save up for their marriage, committees are what they turn to.

This phenomenon is not exclusive to Pakistan. According to a note by Middle East Venture Partners (one of the investors in Bykea), “the global market is largely untapped and ripe for disruption with 2.4 billion people using money circles through traditional channels.”

They recently participated in the Egyptian digital committees’ startup MoneyFellows’ $31m Series B.

Apart from the traditional financial institutions’ general apathy towards the customer, committees appeal to an average Pakistani for several reasons: they are a community-based instrument with some level of flexibility and there is no interest involved.

Most importantly, it helps them manage cash flow better due to habitual change. For women, the product enjoys particular popularity since the former financial services are largely inaccessible.

However, since committees are primarily cash-based with virtually no money trail involved, it poses massive risks, as we saw recently when a girl, Sidra Humaid, who ran a network of committees through social media, defaulted on Rs420m of payments.

----

Even beyond this, committees have flaws by design, only amplified by Pakistan’s macros. For instance, the person receiving the first lump sum amount will always be at an advantage since their instalments in the subsequent months would be worth less due to both inflation and rupee depreciation. The recipient of the last payment would see the amount’s purchasing power eroded substantially by the time they get it.

Moreover, due to the community-based nature of the product, the risk of network defaulting is higher as people of usually similar risk profiles would be pooling in their money.

For example, if employees from an organisation have running office committees, delayed salaries or layoffs within the organisation would lead to a bad equilibrium, creating losses for the rest of the group, often resulting in default.

However, there are ways to address some of those challenges. First of all, to (partially) protect your lump sum from depreciation or devaluation, you can enter a committee with a duration of up to 10 months. Given Pakistan’s macros of late, you’d still lose money in real terms but to be fair, that’d most likely be the case in any other instrument as well, including the risk-free government papers.

In fact, contrary to popular perception, there are certain ways to further alleviate the inflation problem. Digital committees have an option of gamifying the experience by rewarding good payment behaviour through loyalty programs and/or brand partnerships to provide discounts on utilities-based services and products.

Secondly, digital committees help create a trail of money which, coupled with a centralised authority (the platform itself), brings in accountability and recourse in the event of a default. The receipt and/or ledger helps with basic accounting in committees creating transparency for people within the group.

The third benefit of digital committees is the security factor. The participant has to go through a know-your-customer and credit check process to make sure there is no fraudulent behaviour that could negatively impact the group, along with the participant’s ability and willingness to pay to create an overall environment for responsible finance.

-

Comment by Riaz Haq on January 24, 2025 at 10:21am

-

Muhammad Yunus Criticism of Sheikh Hasina | High growth under Hasina was ‘fake’

https://www.thedailystar.net/news/bangladesh/news/high-growth-under...

Chief Adviser Professor Muhammad Yunus yesterday said Bangladesh's high growth under ousted prime minister Sheikh Hasina was "fake" and faulted the world for not questioning for her "corruption".

Yunus, 84, an economist and the 2006 Nobel Peace Prize winner, took charge of the South Asian country's interim government in August after Hasina was forced to flee to neighbouring India following weeks of violent protests.

Hasina has been credited with turning around the economy and the country's massive garments industry during her 15 years in power, although critics have accused her of human rights violations and suppressing free speech and dissent.

Hasina, who had ruled Bangladesh since 2009, is being investigated there on suspicion of crimes against humanity, genocide, murder, corruption and money laundering and Dhaka has asked New Delhi to extradite her.

Comment

- ‹ Previous

- 1

- 2

- 3

- 4

- Next ›

Twitter Feed

Live Traffic Feed

Sponsored Links

South Asia Investor Review

Investor Information Blog

Haq's Musings

Riaz Haq's Current Affairs Blog

Please Bookmark This Page!

Blog Posts

EU-India Trade Deal: "Uncapped" Mass Migration of Indians?

The European Union (EU) and India have recently agreed to a trade deal which includes an MOU to allow “an uncapped mobility for Indian students”, according to officials, allowing Indians greater ease to travel, study and work across EU states. India's largest and most valuable export to the world is its people who last year sent $135 billion in remittances to their home country. Going by the numbers, the Indian economy is a tiny fraction of the European Union economy. Indians make up 17.8%…

ContinuePosted by Riaz Haq on January 28, 2026 at 11:00am — 6 Comments

Independent Economists Expose Modi's Fake GDP

Ruling politicians in New Delhi continue to hype their country's economic growth even as the Indian currency hits new lows against the US dollar, corporate profits fall, electrical power demand slows, domestic savings and investment rates decline and foreign capital flees Indian markets. The International Monetary Fund (IMF) has questioned India's GDP and independent economists…

ContinuePosted by Riaz Haq on January 25, 2026 at 4:30pm — 8 Comments

© 2026 Created by Riaz Haq.

Powered by

![]()

You need to be a member of PakAlumni Worldwide: The Global Social Network to add comments!

Join PakAlumni Worldwide: The Global Social Network