PakAlumni Worldwide: The Global Social Network

The Global Social Network

Investors Ignore Modi's Threats & Drive Pakistan Shares to New High

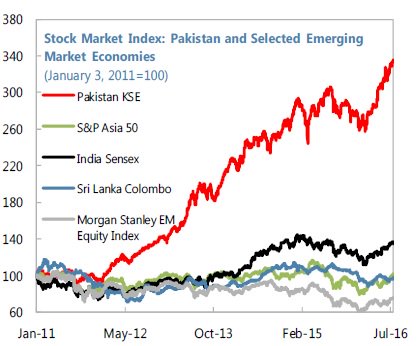

Indian Prime Minister Narendra Modi's threats of war and Pakistan's isolation have failed to deter investors as KSE-100 index made new highs this week. The key index of Pakistani shares closed at an all time high level of 41,412.04 points this week. Pakistan shares index has continued to outperform all regional and emerging market indices over the last 5 years.

Modi's Threats:

First came "boli nahi, goli" (Bullets, not talks). Then came "chappan inch ki chhaati" (56 inch chest, 44 actual according to Modi's tailor) and "Munh tor jawab (Jaw-breaking response) followed by threats of isolating Pakistan and claims of surgical strikes across the line of control in Kashmir.

Investors ignored all of Modi's bluster as just rhetoric and drove Pakistani shares to a new all-time record.

Market Performance:

To add insult to injury, the investment flow maintained Pakistan market as the best performer in the region with KSE-100 outperforming all regional and emerging market indices over the last 5 years.

As of Sept 30, 2016, KSE100 index, the PSX's key stock index, has gained almost 24 percent year to date making Pakistan the best performing market in Asia. Vietnam and Indonesia follow with returns of 18% and 16.8%, respectively, while India’s Sensex Index has gained only 6.7%.

Year-to-date, the Global X MSCI Pakistan ETF (PAK) has gained 21.7%, according to Barron's Asia.

Pakistan's shares are still selling at a big discount in terms of average price-earnings ratio of just 9.7 while other major indices in emerging markets like India are trading at much higher PE ratios of 15 or more.

A total of 576 companies are listed on the PSX, with an aggregate market cap of slightly higher than 8 trillion rupees (US$80 billion), according to Nikkei Asian Review. PSX market cap is just 28% of Pakistan's GDP of $280 billion.

ADB Pakistan Forecast:

The Asian Development Bank (ADB) has recently raised Pakistan's economic growth forecast for fiscal year 2017 (from July 2016 to June 2017) from 4.8% to 5.2%. The Bank also sees brighter outlook for the the entire South Asian region.

Summary:

Pakistan's economic recovery is in full swing with double digit growth in multiple industries, including auto, pharma, chemicals, cement, fertilizers, minerals, etc. It is expected to pick up steam over the next several years with new investments on the back of China-Pakistan Economic Corridor related projects.

Investors have brushed aside Indian Prime Minister Narendra Modi's threats against Pakistan to drive the shares index to a new record high. They have expressed strong confidence in Pakistan's economy to continue to perform well.

Related Links:

ADB Raises Pakistan GDP Growth Forecast

Is Pakistan Ready For War With India?

India's Israel Envy: Surgical Strikes in Pakistan?

Growing Middle Class in Pakistan

-

Comment by Riaz Haq on October 15, 2016 at 9:16am

-

#India Is Making A Mistake By Turning #BRICS Summit Into A #Pakistan Bashing Program. #Modi #Kashmir #China

http://www.huffingtonpost.in/2016/10/15/india-is-making-a-mistake-b...

Much before the BRICS heads of nations meet in Goa today, the western media had already begun writing about its live funeral, if not epitaph. Less than a decade into its existence, this economic grouping of newly industrialised countries--that account for about half of the world population and nearly a quarter of its combined GDP--seems to be losing its relevance other than being a feel-good club.

At its eighth annual meeting in Goa, BRICS is making headlines in India, not for any economic cooperation and growth, but for geopolitics. If the seventh summit at Ufa in Russia last year was about the much celebrated BRICS Bank (New Development Bank) and contingent reserve arrangement, all that we hear about the eight summit in Goa is geopolitics: terrorism, military cooperation with Russia and isolation of Pakistan. And it's India that's mostly talking.

--------

India using SAARC for ridiculing Pakistan or even undermining its convening rights is the swat, BRICS is the sledgehammer. Instead of development planners and finance ministry bureaucrats, it's going to be an Ajit Doval show. At least that's what Indian media reports indicate. Apparently he and his officials will push for "a strongly worded counterterrorism statement and a declaration that will highlight isolating countries that provide shelter to terror groups and help in arming these groups". The summary of this statement is two words: isolate Pakistan. Is that what BRICS means to India?

And how does it even matter? Will Russia and China, the only BRICS countries that are of consequence to the south Asian geopolitics, will ever do anything? Certainly not. Pakistan is China's strategic asset and Russia, a self-interested voluntary ally against American strategy of using India as its Asian pivot. Brazil and South Africa are so far away and don't even have enough money or political resources for themselves.

Therefore, making BRICS a proxy opportunity to bash Pakistan is a little excessive. If India has been clever and strategic, it should have used it for strengthening the idea of BRICS, when the whole world is justifiably sceptical. Isolation of Pakistan should have been just the incidental message that India would have anyway conveyed by inviting BIMSTEK (Bay of Bengal Initiative for Multi-Sectoral Technical and Economic Cooperation), that Pakistan is not a part of.

-------

Showing off on the BRICS platform, at least for the time being, doesn't mean much because the global media have almost written it off with disappointing growth projections for Brazil, South Africa and Russia and competing interest by China.

India could have done by less theatre and more substance. Repetition of lines to keep people in perpetual anticipation, national pride and false-hopes, not just in dealing with Pakistan, but also in improving their lives, seems to have become a habit. And it has started showing everywhere as a standard, Indira-era Indian imprint.

-

Comment by Riaz Haq on October 20, 2016 at 7:20am

-

What next 4 #Pakistan, #Asia's best-performing stock market? It's already up 27% year-to-date #Karachi http://bloom.bg/2eJBggc via @markets

Pakistan has plowed an independent trajectory this year, outperforming both its fellow frontier markets and members of the emerging-market grouping that it is slated to join in 2017.

The country's benchmark KSE100 Index has rallied 27 percent year-to-date to become Asia’s best-performing equity market in 2016, according to a basket of 26 peers tracked by Bloomberg. The market received a boost in June when MSCI Inc. announced that it would reclassify Pakistan as part of its benchmark emerging-market index from May 2017 — a show of confidence that it declined to extend to China.

It was a long time coming for South Asia's second-largest economy. The Pakistan Stock Exchange, previously known as the Karachi Stock Exchange, was downgraded to frontier-market status in 2009 after it introduced curbs against sell orders to stem an investor exodus in late 2008.

After registering gains over seven of the eight years since, investors are betting it still has further to climb.

"The benchmark index can easily reach 60,000 before the general election in 2018," said Vasseh Ahmed, who's chief investment officer of Karachi-based Faysal Asset Management Ltd., in an interview. That represents almost a 50-percent increase from present levels. "Now that the IMF program is over, the government will be giving incentives that will positively impact the market and business sentiment. The boost from the upgrade and Chinese investment is also there.".

The KSE100 Index reached its all-time peak of 41,464.31 last Friday, and by 2:23 p.m. in Karachi was heading toward a new record. Last month Pakistan completed a three-year $6.6 billion International Monetary Fund loan program. Thanks to the aid, Prime Minister Nawaz Sharif was able to avert a balance-of-payments crisis and boost foreign-exchange reserves to a new high.

"Textile is already seeing the push, and the government may further boost the agriculture sector. The banking sector will also rebound given interest rates have bottomed, while the oil and gas sectors are rallying following a recovery in energy prices and infrastructure development," added Ahmed. The country's central bank has held its benchmark interest rate at 5.75 percent since cutting by 25 basis points in May.

For Federico Parenti, Milan-based fund manager of Base Sicav Emerging and Frontier Markets Equity Fund, Pakistan is on top of his wish-list.

"My fund is currently waiting to get access to such a beautiful and nice market," Parenti said by e-mail. "At the moment Pakistan access is delayed due to fear of political and religious risks, but I think staying just in Europe for investment and thinking other places won't change for the better is a bigger risk."

-------

For Parenti, the improvements that are predicted by EFG Hermes to lure around $475 million of inflows by the middle of next year do, in themselves, carry risks.

"Because of the MSCI upgrade, the ratio of foreigners holding onto Pakistani stocks is set to increase," the fund manager said. "But they will also add volatility since most of the money is 'disloyal,' meaning that they can easily pull their money out of the country whenever they want."

Still, he said he plans to allocate 10 percent of his funds to Pakistan once regulators give the go-ahead, with these challenges failing to overwhelm to the country's enticing demographics. "The prospect is bright with the growing young population and the rising middle class. I want a piece of your economy — a piece of your frozen food, a piece of your cement, and a piece of your hospitals," he wrote.

-

Comment by Riaz Haq on November 4, 2016 at 4:04pm

-

Chinese cos consortium to invest $3b in infrastructure, industries in #Pakistan. #China #CPEC http://www.pakistantoday.com.pk/2016/11/04/business/chinese-compani... … via @epakistantoday

A consortium of Chinese investment companies met Prime Minister Nawaz Sharif on Friday and announced to bring $3 billion in investment funds to Pakistan.

Representatives of a consortium of Chinese investment companies comprising China Huarong International Holdings Limited, China Innovative Finance Group Limited, Hong Kong Tian Group, Chandong Hi-Speed Group and China Road & Bridge Group called on Prime Minister Nawaz Sharif at the PM House.

Warmly welcoming the delegation, the prime minister appreciated the Chinese delegation’s fruitful interaction with ministries of Finance, Petroleum & Natural Resources, Water & Power and Capital Development Authority. The PM expressed hope that members of the Chinese delegation would have a productive visit in the backdrop of briefing by various ministries about immense potential for investment in Pakistan’s infrastructure development, energy and communication sectors.

The prime minister expressed his gratitude to the leadership and brotherly people of the People’s Republic of China for their all-weather support that was getting stronger with each passing day. The CPEC was a game changer that was going to transform the lives of the billions of people of the region, the PM added.

He said that the economic outlook of Pakistan has altogether changed in the last three years, which was being acknowledged globally. Standard & Poor’s (S&P) has also upgraded Pakistan’s ranking to B from B-; Pakistan is among this year’s global top 10 improvers in Doing Business 2017. Inflation was continuously on downward trend; reduction in petroleum prices also helped in decreasing inflation, further added the PM. The Foreign Exchange Reserves have now increased to over $ 24 billion, the prime minister apprised the delegation.

Our Investment Policy has been designed to provide a comprehensive framework for creating a conducive business environment for the attraction of FDI, he said. Pakistan’s policy trends have been consistent, with liberalization, de-regulation, privatization, and facilitation being its foremost cornerstone, stated the prime minister. The Law of Special Economic Zones (SEZ) has been made to meet the global challenges of competitiveness to attract Foreign Director Investment (FDI).

Members of the visiting delegation lauded the vision of the prime minister for economic revival and putting the country on development path. The members of the delegation said that Pakistan was fully ready as well as capable of absorbing and capitalising the Foreign Direct Investment. The delegation apprised the prime minister that they were bringing $ 3 billion investment fund to Pakistan because of the vision of the prime minister that focussed on infrastructure development and energy sectors. The Chinese delegation also expressed its intent to explore possibility of starting a new airline in Pakistan after the permission from the Government of Pakistan. The Chinese side said that it was actively pursuing its investments in infrastructure, power, aviation and tourism sectors of Pakistan.

‘We fully appreciate the vision of Prime Minister Nawaz Sharif which enunciates that economic prosperity is an offshoot of infrastructure connectivity and self sufficiency in the energy sector’, the members of the delegation stated. They said that the present government under the visionary leadership of Nawaz Sharif has done enormous work in infrastructure development and achieving energy self sufficiency. The present government has very liberal investment regime that offers an ideal and investor friendly environment for which the leadership role of Prime Minister Muhammad Nawaz Sharif is highly appreciated, said the members of the delegation.

-

Comment by Riaz Haq on November 8, 2016 at 9:29pm

-

International business enterprises eager to get involved with #CPEC in #Pakistan - Global Times #China

http://www.globaltimes.cn/content/1016354.shtml

As the first Chinese truck containers entered a Pakistani dry port in the north last week and the first major size vessel last month docked at the Gwadar port, the ending point of the China-Pakistan Economic Corridor (CPEC), CPEC, a multi-billion-US dollar project, has become a visible "game changer" for Pakistan and the entire region.

With an improved security situation in the south Asian country, Pakistan's macroeconomy has been stabilizing and enjoying momentum over the past years. Recently, the country has been upgraded to an emerging economy from a frontier economy on the Morgan Stanley MSCI index.

"The CPEC itself for Pakistan could at least offer a significant opportunity for the country to address its supply side constraints such as weak foreign capital inflow," said Bilal Khan, senior economist at Standard Chartered Bank (Pakistan) Ltd., adding that against the backdrop of rebounding oil prices in the near future, which means Pakistan's oil import bills will swell, the CPEC will attract foreign direct investment from both private and public sectors to help keep a balanced current account in Pakistan.

Due to the enhanced infrastructure such as roads and railways brought by the CPEC, "we forecast that the gross domestic product (GDP) growth should increase from around 4.7 percent last year to around 6 percent by 2019, and stay around the same level for 2020," the economist told Xinhua in a recent interview in Karachi, the financial center of Pakistan.

With such a robust economic outlook, many foreign companies that have already been investing here for years are tending to re-invest in the country by seeking more opportunities under the CPEC, according to Pakistan's Overseas Investors Chamber of Commerce and Industry (OICCI).

Abdul Aleem, chief executive and secretary general of the OICCI, told Xinhua that members of the chamber, who economically contributed to about 18 percent of GDP and some 33 percent of total tax collected in Pakistan, have seen the potentials in the market here and they re-invested about half of their profit in Pakistan rather than taking their money back.

He said that his members and many local companies are eager to talk with Chinese companies that have projects under the CPEC so that they could make clear exactly what the opportunities are and how to access them.

As a member of the OICCI, the Standard Chartered Bank (Pakistan) Ltd. believes that the CPEC is a unique opportunity for it to play a "pivotal role" in ensuring that the bank could help make the huge project a real success in the south Asian country, according to the chief executive officer (CEO) of the bank.

---

He said that the bank is also promoting the internationalization of the Chinese currency renminbi in order to facilitate settlements by companies involved in China or CPEC related business.

Identifying the myriad lucrative opportunities offered by the CPEC, also a pilot project under the China-proposed Belt and Road initiative, Standard Chartered also formed a "Belt & Road" Strategy Execution team to help facilitate its business in countries covered by the initiative.

"More than 60 percent of Standard Chartered's global markets across Africa, Asia and the Middle East stand to benefit from China's 'Belt & Road' initiative," said a recent press release by the bank in Karachi.

-

Comment by Riaz Haq on November 19, 2016 at 8:31am

-

#Modi's #demonetization : #India's GDP growth rate will crash to just 0.5% in 2nd half of FY17 via @forbes

http://www.forbes.com/sites/timworstall/2016/11/19/effects-of-demon...

Ambit Capital, a respected Mumbai-based equity research firm, has officially estimated that the demonetisation-driven cash crunch will result in GDP growth crashing to 0.5% in the second half of financial year 2016-17. This means the GDP growth for six months, from October 2016 to March 2017, could decelerate to 0.5%, down from 6.4% in the previous six months.

Further, Ambit Capital estimates that during the October to December quarter that we are currently in, the GDP growth may contract, thus showing negative growth. However, Ambit is hopeful that a strong formalisation of the informal economy will ensue through 2017 until 2019 and this disruption could also crimp GDP growth in 2017-18 to 5.8 % from their earlier estimate of 7.3%.

-----------

“The demonetisation-driven cash crunch that is playing out in India will paralyse economic activity in the short term. We expect a strong ‘formalisation effect’ to play out as nearly half of the non-tax paying businesses in the informal sector (40% share in GDP) will become unviable and cede market share to their organised sector counterparts. We expect this dynamic to crimp GDP growth in India in FY18 as well and hence we have cut our FY18 GDP growth estimate to 5.8 per cent YoY (from 7.3 per cent),” Ambit economists Ritika Mankar Mukherjee, Sumit Shekhar and Prashant Mittal said in a note.

-

Comment by Riaz Haq on December 6, 2016 at 10:08am

-

#Pakistan shares index #KSE100 hits all time record to close at 44,199. Up 35.13% in 2016 YTD. #Karachi #CPEC https://www.bloomberg.com/quote/KSE100:IND …

KARACHI: Bulls dominated the Pakistan Stock Exchange on Tuesday as the market crossed another psychological landmark. The main index jumped past the 44,000 level after having crossed the 43,000 on November 14, 2016.

The market traded neutral to developments of the Panama case. The benchmark KSE 100 index rallied up to record a new highest high of 44,236.89 with appreciation of 496.92 points. The index ended at 44,231.10, up by 491.13points, levels not touched ever before. The KMI 30 index ballooned higher by 1115.77 points to 74,785.76. The KSE All Share index also surged 309.55 points to close the session at 30,522.54. The advancer to decliner ratio stood at 217 to 175.

The market volumes edged up from previous session’s 345.47 million to 372.59 million. K-Electric Limited (KEL +1.84%) turned out to be volume leader, volume of 22.80 million, for the day after the Competition Commission of Pakistan (CCP) gave clearance to its acquisition.

Many cement stocks featured in the list of top traded scripts but the commercial bank sector again reported top cumulative volume of 59.85 million. The cement sector followed with total of 56.94 million shares traded.

The cement sector was star performer for the day after All Pakistan Cement Manufacturers Association (APCMA) released data for the month of November 2016. The industry achieved its highest capacity utilization of 98.61% and recorded sales of 3.749 million tonnes against 3.377 million tonnes in the same month last year. Local demand expanded from 2.843 million tonnes to 3.270 million tonnes in the same month last year while exports continued to contract, down 10.39%.

According to spokesperson of APCMA, exports are expected to remain under pressure as Afghan market is penetrated by Iran and export by sea is on the decline whereas exports to India have a positive trend. However, he was confident that growth in local demand would nullify this impact.

Eleven of seventeen scripts traded gained around 5%, including Attock Cement (Pakistan) Limited (ACPL +4.97%), D G Khan Cement Company Limited (DGKC +4.89%), Maple Leaf Cement Factory Limited (MLCF +4.99%) and Fauji Cement Company Limited (FCCL +4.98%).

http://dailytimes.com.pk/business/06-Dec-16/psx-continues-to-break-...

-

Comment by Riaz Haq on December 30, 2016 at 8:44am

-

From Wall Street Journal Dec 30, 2016: Pakistan’s benchmark KSE 100-stock index was on track to become the biggest gainer this year, with a 45.3% surge after its inclusion in the MSCI Emerging Markets Index in June. http://www.wsj.com/articles/asia-shares-finish-2016-higher-1483093479 Asia’s equity markets ended 2016 slightly higher, despite a number of unexpected global events that had threatened to throw markets into disarray. With China the main exception, major Asian stock markets rose for the year. Australia’s S&P/ASX 200 rose 7%, while both Japan’s Nikkei Stock Average and Hong Kong’s Hang Seng Index added 0.4%. Singapore’s Straits Times Index rose 0.2% for the year. Among smaller markets, particularly those in Southeast Asia, performance was more mixed, with benchmark indexes in Malaysia, Vietnam and the Philippines ending the year in the red. Thailand’s benchmark SET 50 index was an outperformer, with the index on track to gain 18.6% for the year, even as investor buying interest paused after the death of the country’s long-reigning monarch in October. “We are seeing a Goldilocks scenario in global markets,” said Khiem Do, head of Asian multiasset investments at Baring Asset Management. Corporate earnings have been picking up, prompting investments, he said. In addition, Mr. Do said that toward the second half of the year, investments in fixed-income assets started moving to equities, helping global markets. Still, there were a number of global surprises that affected Asia’s equity markets, including the Brexit vote in June and Donald Trump’s victory in the U.S. presidential election in November. Even more surprising, analysts say, was the stock-market rally that followed Mr. Trump’s win. That was opposite earlier expectations of what would happen in the event of a Trump win, said Andrew Sullivan, managing director of sales trading at Haitong International Securities. “People have become more cautious and acting on fact rather than rumor,” Mr. Sullivan said Meanwhile, the Shanghai Composite Index tanked 12.3% for the year, as regulators there cracked down on leveraged purchases of stocks by insurance companies and as the yuan fell about 6.5% against the U.S. dollar for the year. To be sure, China’s declines could have been much steeper. In January, the Shanghai index plunged as much as 25%, as a circuit-breaker mechanism for the stock market, introduced to reduce volatility, set off a global market panic, forcing authorities to shelve the system. Malaysia’s Bursa index ended down 3.7% for the year, suffering from the controversy surrounding the Malaysian state investment fund known as 1MDB. Though not considered one of Asia’s main markets, Pakistan’s benchmark KSE 100-stock index was on track to become the biggest gainer this year, with a 45.3% surge after its inclusion in the MSCI Emerging Markets Index in June. However, on Friday, the last trading session of 2016, a weaker dollar early in the day sent local currencies higher, hurting the competitiveness of exports in the region. The greenback later recovered to trade 0.4% higher compared with the yen. But that wasn’t enough to stave off the decline in export stocks such as Honda Motor, which dropped 0.8%; Nissan, which ended down 0.4%; and Sony, which fell 0.7%. Toshiba, however, gained 9.4%, after analysts pointed out that the stock was oversold on worries of rising expenses at its U.S. nuclear-power unit. Overnight in the U.S., crude-oil prices fell after crude stockpiles there rose unexpectedly. In Asian trade, prices recovered slightly to trade at $57.08 a barrel. Among energy stocks in the region on Friday, Japan Petroleum lost 1.6%, and Inpex Corp. fell 0.8%. In Australia, Woodside Petroleum dropped 1.8%, contributing to the 0.6% decline in the benchmark S&P/ASX 200. In currencies, the euro briefly jumped on Friday against the U.S. dollar in thin Asian trade. The currency pair rose above $1.0700, its highest level in two weeks, from around $1.0490 in a matter of moments.

-

Comment by Riaz Haq on December 30, 2016 at 10:25am

-

Q1 Report from State Bank of #Pakistan expects FY17 #GDP growth between 5% and 6%, Budget deficit to rise to 5% http://www.pakistantoday.com.pk/2016/12/30/sbp-releases-first-quart... …

The State Bank of Pakistan (SBP) on Friday released its first quarterly report on the economy of Pakistan.

According to the report, SBP has projected growth in the manufacturing sector in the remaining part of the fiscal year due to supporting policies and encouraging outlook.

A good response is expected from the automobile, sugar, pharmaceuticals and construction sectors.

The report states that fiscal deficit rose because of lower than expected tax collection in the first quarter. SBP expects fiscal deficit to rise to 5 per cent of GDP in FY17 as against the target of 3.8 per cent.

SBP is also expecting export targets for FY17 to be missed by $2.2 billion from the target of $24.7 billion.

The GDP growth rate is projected to be between 5 to 6 per cent in FY17 against the target of 5.7 per cent.

Remittances will also remain stagnant in FY17 around last year’s level of $20.5 billion.

According to SBP, inflation will range between 4.5 per cent to 5.5 per cent in FY17 against the target of 6 per cent.

Comment

Twitter Feed

Live Traffic Feed

Sponsored Links

South Asia Investor Review

Investor Information Blog

Haq's Musings

Riaz Haq's Current Affairs Blog

Please Bookmark This Page!

Blog Posts

India-Israel Axis Threatens Peace in South Asia

The bonhomie between Israeli Prime Minister Netanyahu, an indicted war criminal, and Indian Prime Minister Narendra Modi, accused of killing thousands of Muslims, was on full display this week in Israel. Both leaders committed to supporting the Afghan Taliban regime which is accused of facilitating cross-border terrorist attacks by the TTP in Pakistan. Mr. Modi was warmly welcomed by…

ContinuePosted by Riaz Haq on February 27, 2026 at 10:45am — 2 Comments

Modi's AI Spectacle: Chaos and Deception in New Delhi

The India AI Impact Summit 2026, held at Bharat Mandapam in New Delhi, has been marred by chaos, confusion and deception. The events on the ground have produced unintended media headlines for India's Prime Minister Narendra Modi who wants to be seen as the "vishwaguru" (teacher of the world) in the field of artificial intelligence as well. First, there was massive chaos on the opening day, with long…

ContinuePosted by Riaz Haq on February 19, 2026 at 12:00pm — 14 Comments

© 2026 Created by Riaz Haq.

Powered by

![]()

You need to be a member of PakAlumni Worldwide: The Global Social Network to add comments!

Join PakAlumni Worldwide: The Global Social Network