PakAlumni Worldwide: The Global Social Network

The Global Social Network

Massive Oil Discovery in Pakistan: Hype vs Reality

Prime Minister Imran Khan has recently raised Pakistanis' hopes of ExxonMobil and ENI being on the verge of a massive discovery of offshore oil and gas reserves in Pakistan. Is this real? Or mostly hype? What is the size of these reserves? Will it be more than sufficient to meet Pakistan's current needs of over 200 million barrels of oil per year? Will Pakistan become a net exporter of oil and gas like major OPEC nations?

Top 3 Offshore Drilling Sites in Asia-Pacific. Source: Bloomberg |

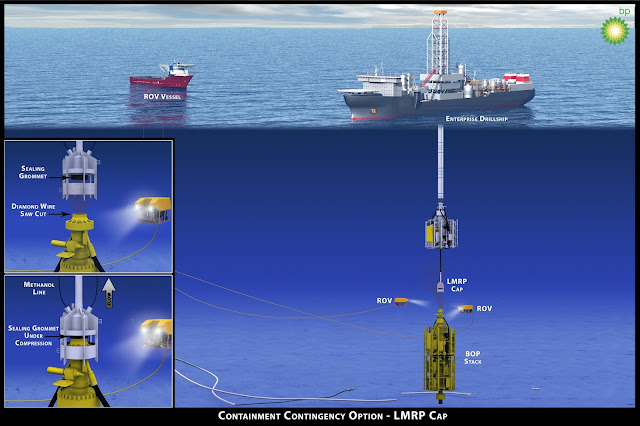

Why is it taking so long to get confirmation from the companies involved? What are the technical issues in getting confirmation of these huge reserves? Why is there such a big concern about blow-out? Is it because the 1.5 billion barrels pre-drill estimate of Kekra-1 well in block G of the Indus basin off the Karachi coast? Could such a large reserve cause a major blow-out accident like the one British Petroleum had in Gulf of Mexico near Louisiana in the United States? How long will it take to fix the blow-out preventer (BOP) and complete drilling of the remaining 600-800 meters of the total depth of over 5,500 meters deep in the Arabian Sea?

Offshore Blowout Preventer Stack. Courtesy: British Petroleum |

Azad Labon Kay Sath host Faraz Darvesh discusses these questions with Misbah Azam and Riaz Haq (www.riazhaq.com)

Related Links:

Pakistan's Insatiable Appetite For Energy

US EIA Estimates of Oil and Gas in Pakistan

Can Pakistan Avoid Recurring IMF Bailouts?

Pakistan is the 3rd Fastest Growing Trillion Dollar Economy

CPEC Financing: Is China Ripping Off Pakistan?

Information Tech Jobs Moving From India to Pakistan

Methane Hydrate Release After Balochistan Quake

-

Comment by Riaz Haq on September 17, 2024 at 9:36am

-

USGS: Pakistan Mining Industry 2019

https://pubs.usgs.gov/myb/vol3/2019/myb3-2019-pakistan.pdf

------

2018. In fiscal year 2019 (July 1, 2018, through

June 30, 2019), the mining and quarrying sector contributed

2.6% of the GDP and the growth rate of the mining and

quarrying sector was negative 1.96% compared with 7.72% in

fiscal year 2018 (International Monetary Fund, 2020; State Bank

of Pakistan, 2020a, p. 18–19; 2020b, p. 8; 2020d, p. 3).

The total import value in fiscal year 2019 was $54.8 billion

compared with $60.8 billion in fiscal year 2018. The import

value of mineral fuels, oils, and their distillation products was

$16.0 billion; iron and steel, $3.38 billion; articles of iron or

steel, $840 million; and aluminum and articles of aluminum,

$349 million. The total export value in fiscal year 2019 was

$23.0 billion compared with $23.2 billion in fiscal year 2018.

The export value of mineral fuels, oils, and their distillation

products was $477 million; salt, sulfur, lime, and stone,

$463 million; and copper and articles of copper, $269 million

(State Bank of Pakistan, 2020c, p. 123–124).

---------

In 2019, the production of lignite was estimated to have

increased by 180%; lead (mine, Pb content), by 68%; feldspar,

by 61%; chromium (mine, Cr2

O3

content), by 46%; zinc (mine,

Zn content), by 39%; talc, by 38%; lead (secondary, refinery),

by 33% (reported); soda ash, by 27%; bentonite, by 24%;

kaolin, by 17%; and sand and gravel (industrial, silica), by 12%.

In contrast, the production of fuller’s earth was estimated to

have decreased by 85%; dolomite, by 57%; bauxite, by 49%;

iron oxide pigment, by 47%; magnesite, by 39%; sulfur (native),

by 38%; pumice, by 33%; raw steel, by 30% (reported);

limestone, by 22%; iron (mine, Fe content) and phosphate rock

(gross weight), by 20% each; barite, by 15%; sand and gravel

(industrial, unspecified), by 13%; rock salt, by 12%; and quartz,

--------

Copper and Gold.—In 2019, Metallurgical Corporation

of China Ltd. (MCC) applied for an extension of its mining

license for the Saindak copper-gold mine, which was set to

expire in 2022. MCC operated the Saindak Mine through a

50%-owned subsidiary, Saindak Metals Ltd. The company

produced 13,049 metric tons (t) of copper (mine, Cu content)

in 2019, which was an increase of 4.1% from the 12,538 t

produced in 2018. MCC mined mainly the south and north ore

bodies using open pit mining; the deposits were expected to be

depleted of minable resources after 2021. The east ore body of

the mine was estimated to have 278 million metric tons (Mt)

of ore and an expected mine life of 19 years. The exports of

copper and articles thereof from Pakistan to China increased to

$550 million in 2019 from $106 million in 2016

----------

Natural Gas.—Pakistan was in the process of building five

liquefied natural gas (LNG) terminals that were expected to

start operation in 2021 or 2022. The new terminals would triple

Pakistan’s LNG imports and help lessen the gas shortage in

the country. Pakistan had been subject to shortages of natural

gas for power generation, fertilizer production, and household

usages owing to the country’s inability to supply enough gas

from domestic resources, its aged distribution network, and the

difficulty in sourcing LNG cargoes (Nickel, 2019; Abbasi, 2020;

Mohanty and others, 2021).

Petroleum.—Eni Pakistan Ltd. (owned by Eni S.p.A. of Italy,

as operator), Exploration and Production Pakistan BV, Oil and

Gas Development Co., and Pakistan Petroleum Ltd. each held a

25% interest in the Kekra-1 well of the Indus Block G. In 2019,

the consortium ended exploration at the Kekra-1 well after

no reserves of petroleum were found (Hassan, 2019; Rarrick,

2019).

-

Comment by Riaz Haq on April 26, 2025 at 8:24pm

-

Kuwait joins Pakistan offshore bids

https://tribune.com.pk/story/2541890/kuwait-joins-pakistan-offshore...

ISLAMABAD:

Kuwait Foreign Petroleum Exploration Company (Kufpec) has decided to participate in Pakistan's offshore bidding round. Already, the company has been in Pakistan since 1987 and has invested $1.5 billion cumulatively.

A high-level meeting was held between Federal Minister for Petroleum Ali Pervaiz Malik and Ali Taha Al-Temimi, Country Manager of Kufpec and Chairman of the Pakistan Petroleum Exploration & Production Companies Association (PPEPCA). The meeting focused on strengthening collaboration in Pakistan's oil and gas sector, enhancing exploration activities, and addressing key challenges to enhance exploration activities.

———-

Ali Taha Al-Temimi, representing Kufpec – a leading international exploration company and a subsidiary of Kuwait Petroleum Corporation – appreciated the government's efforts and shared insights on optimising hydrocarbon exploration to meet Pakistan's growing energy demand. He apprised that Kufpec is aiming to participate in the offshore bidding round of Pakistan. Moreover, he briefed on the ongoing activities of the company in the country. Since 1987, Kufpec has invested $1.5 billion cumulatively.

-

Comment by Riaz Haq on July 30, 2025 at 4:17pm

-

Trump Truth Social Posts On X

@TrumpTruthOnX

We are very busy in the White House today working on Trade Deals. I have spoken to the Leaders of many Countries, all of whom want to make the United States “extremely happy.” I will be meeting with the South Korean Trade Delegation this afternoon. South Korea is right now at a 25% Tariff, but they have an offer to buy down those Tariffs. I will be interested in hearing what that offer is.

We have just concluded a Deal with the Country of Pakistan, whereby Pakistan and the United States will work together on developing their massive Oil Reserves. We are in the process of choosing the Oil Company that will lead this Partnership. Who knows, maybe they’ll be selling Oil to India some day!

Likewise, other Countries are making offers for a Tariff reduction. All of this will help reduce our Trade Deficit in a very major way. A full report will be released at the appropriate time. Thank you for your attention to this matter. MAKE AMERICA GREAT AGAIN!

https://x.com/TrumpTruthOnX/status/1950654905804279830

------------

Trump Says Pakistan Deal Done, South Korea Is Close

https://www.wsj.com/livecoverage/fed-meeting-interest-rate-decision...

The U.S. and Pakistan have concluded a trade pact, President Trump said Wednesday, adding that a deal could be close with South Korea.

Trump said on Truth Social that the U.S. has “concluded a Deal with the Country of Pakistan, whereby Pakistan and the United States will work together on developing their massive Oil Reserves,” and is in the process of choosing a company to lead the partnership.

Trump also said he would meet with a South Korean delegation on Wednesday afternoon, who would bring an offer to “buy down” the 25% tariffs Trump has threatened to impose Aug. 1. Trump has previously pressed others to commit funds to build infrastructure and energy projects in the U.S., including the European Union and Japan.

Trump provided no further detail, but said "a full report" would be released "at the appropriate time."

Comment

- ‹ Previous

- 1

- 2

- Next ›

Twitter Feed

Live Traffic Feed

Sponsored Links

South Asia Investor Review

Investor Information Blog

Haq's Musings

Riaz Haq's Current Affairs Blog

Please Bookmark This Page!

Blog Posts

EU-India Trade Deal: "Uncapped" Mass Migration of Indians?

The European Union (EU) and India have recently agreed to a trade deal which includes an MOU to allow “an uncapped mobility for Indian students”, according to officials, allowing Indians greater ease to travel, study and work across EU states. India's largest and most valuable export to the world is its people who last year sent $135 billion in remittances to their home country. Going by the numbers, the Indian economy is a tiny fraction of the European Union economy. Indians make up 17.8%…

ContinuePosted by Riaz Haq on January 28, 2026 at 11:00am — 6 Comments

Independent Economists Expose Modi's Fake GDP

Ruling politicians in New Delhi continue to hype their country's economic growth even as the Indian currency hits new lows against the US dollar, corporate profits fall, electrical power demand slows, domestic savings and investment rates decline and foreign capital flees Indian markets. The International Monetary Fund (IMF) has questioned India's GDP and independent economists…

ContinuePosted by Riaz Haq on January 25, 2026 at 4:30pm — 8 Comments

© 2026 Created by Riaz Haq.

Powered by

![]()

You need to be a member of PakAlumni Worldwide: The Global Social Network to add comments!

Join PakAlumni Worldwide: The Global Social Network