PakAlumni Worldwide: The Global Social Network

The Global Social Network

Pakistan Agribusiness Investments in Dairy & Livestock

US venture investor Tim Draper, Swiss food giant Nestle, and American beverage titan Coca Cola are investing heavily in Pakistan's agribusiness.

Silicon Valley private equity investor Tim Draper, a well-known international venture capitalist, is quietly investing in Pakistan's agribusiness, the largest provider of food commodities in the Middle East, according to San Francisco Examiner.

The share of livestock in Pakistan's agriculture output nearly doubled from 25.3 percent in 1996 to 49.6 percent in 2006, according to FAO. As part of the continuing livestock revolution, Nestle is investing $334 million to double its dairy output in Pakistan, according to Businessweek. Reuters is reporting that the company has already installed 3,200 industrial-size milk refrigerators

at collection points across the country to start the

kind of cold storage chain essential for a modern dairy industry, and

give farmers a steady market for their milk. In another development on the infrastructure front, Express Tribune has reported that Pakistan Horti Fresh Processing (Pvt)

Limited has invested in the world's largest hot treatment plant to process 15 tons of mangoes per hour for exports. Hot water treatment will also help reduce waste of fruits and vegetables by increasing shelf-life for domestic consumption.

The Coca-Cola Company is planning to invest another US$280 million by 2013 in

Pakistan, according to BMI's Q3 2012 Food & Beverage Report for Pakistan. Coke plans to channel the bulk of its

capital expenditures towards increasing the production of its existing

brands as well as expanding its overall beverages portfolio. Coca-Cola

plans to introduce more juices and mineral water in the Pakistani market

over the coming years. This strategy could diversify Coca- Cola’s

presence beyond the carbonates sector and help it secure early footholds

in the higher-value bottled water and fruit juice segments, which boast

tremendous long-term promise.

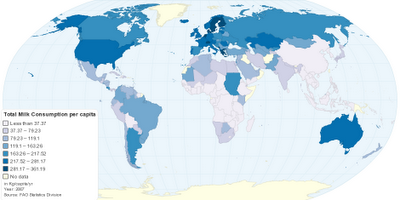

In addition to foreign investors, big name Pakistani companies like Dawood Group's Engro, billionaire industrialist Mian Mansha's Nishat Group and former minister Jahangir Khan Tareen's JK Dairies are placing big bets on food and beverage market in the country. Annual milk consumption in Pakistan reached 230 kg per capita in 2005, more than twice India's per capita consumption, according to FAO.

Business Monitor International expects "Pakistani agriculture sector to reap record harvests for key crops

such as rice, sugar and cotton owing to favorable weather in 2011 and the year-on-year increase in

crop area following floods in 2010". "We expect the dairy, poultry and

wheat industries to be the biggest beneficiaries of increased investment in the agriculture sector", adds BMI's report.

Pakistan is world’s eighth

largest consumer of food and food is

the second biggest industry in the country, providing 16 per cent

employment in production, according to report published in Express Tribune. In addition to rising domestic demand, growth in agribusiness is supplemented by

increased exports as Pakistan expands trade with new partners. BMI expects basmati rice to take

up a greater share of the trade as production increases. Cotton production to 2015/16: 45.5% to 12.8 million bales. Increased demand from Europe and

emerging markets will drive output. BMI also expect an increase in domestic farmers switching

from rice and sugar to cotton cultivation. Sugar production to 2015/16: 22.1% to 4.8 million tons. Large-scale consumers such as

confectioners, candy makers and soft drink manufacturers account for about 60% of the total

sugar demand and will be the main drivers of growth.

Pakistan witnessed a livestock revolution follow Green Revolution. Here's how International Livestock Research Institute puts the dramatic changes in Pakistan's agriculture sector since the mid 1960s:

Since the mid 1960s, investment in Green Revolution technologies – high-yielding varieties of cereals, chemical fertilizers, pesticides, irrigation and mechanization of farm operations – significantly increased cereal crop productivity and output. Success in the crop sector created a platform for diversification of farm and non-farm activities in the rural areas including the livestock sector, especially the dairy sector. Some of the Green Revolution technologies had a direct impact on the dairy sector while others had an indirect impact. Increased cereal productivity and output helped to reduce prices of cereals relative to other commodities in both rural and urban areas. This, along with increased income from high crop-sector growth, created demand for better-quality foods including livestock products. This created market opportunities and incentives for crop producers to diversify into higher-value products, such as milk, meat, vegetables and fruits.

Pakistan has made significant progress in agriculture and livestock sectors showing that it has the potential to feed its people well and produce huge surpluses to fuel exports boom. The continuation of this progress will depend largely on success in making needed public and private investments in energy and water infrastructure and education and health care.

Related Links:

Haq's Musings

FMCG Consumption Boom in Pakistan

Music Drives Coke Sales in Pakistan

World Bank Report on Pakistan Agribusiness

Pakistan's Sugar Crisis

FAO Livestock Sector Brief 2002

Recurring Floods and Droughts

Poll Finds Pakistanis Happier Than Neighbors

Pakistan's Rural Economy Booming

Pakistan Car Sales Up 61%

Resilient Pakistan Defies Doomsayers

Land For Landless Women in Pakistan

Growing Water Scarcity in Pakistan

Political Patronage in Pakistan

Corrupt and Incompetent Politicians

Pakistan's Energy Crisis

Culture of Tax Evasion and Aid Dependence

Climate Change in South Asia

US Senate Report on Avoiding Water Wars in Central and South Asia

-

Comment by Riaz Haq on December 25, 2020 at 10:09am

-

Cargill acquires minority stake in FAP’s terminal at Port Qasim

https://www.thenews.com.pk/print/755755-cargill-acquires-minority-s...

Global commodities trader Cargill Inc had bought a minority stake in Fauji Akbar Portia Marine Terminal Limited (FAP), Pakistan’s one of the largest bulk terminal, which handles agricultural supplies in the country, a statement said on Tuesday.

The deal is privately held US-based Cargill’s first investment into Pakistan, after the strategic intent announced in last January.

With this investment, Cargill will handle grains, cereals, rice, oilseeds and fertilizers at Port Qasim.

Waqar Malik, chairman Fauji Foundation said this transaction is a signal and validation of the Pakistan opportunity seen by the world’s leading player in agriculture commodities.

“With its global port experience, Cargill will help drive greater operational efficiencies for the port to reach its potential of handling agri-cargo safely and efficiently,” Malik said.

He added that Cargill, with its global port experience, will help drive greater operational efficiencies for the port to reach its potential of handling agri-cargo safely and efficiently.

“Going forward, both partners aim to build a safety culture that will create a world class, safe and sustainable environment for FAP’s employees and customers.”

Imran Nasrullah, country president, Cargill Pakistan said the investment would further adds to the company’s global port operation’s footprint and strengthens its agricultural trading and supply chain operations in the region.

“In future we will also look at opening doors for other sectors where we can add value, besides exploring business synergies with our existing partners,” Nasrullah said.

He said the investment also demonstrate Cargill “commitment to partner in the economic growth of Pakistan by bringing in our global expertise and investment”.

FAP is a joint venture between Fauji Foundation, Akbar Group of Companies and National Bank of Pakistan. FAP started operations in 2010 and provides complete supply chain management solutions for ship berthing, unloading, storage and bagging of all types of grains, cereals, oilseeds and fertilizers. The terminal operates with international standards and has helped build efficiencies in dry cargo handling in Pakistan.

The statement said Fauji Foundation, through this partnership with the world’s leading agriculture company, will transform FAP’s supply chain to enhance overall value for all stakeholders including suppliers, customers, employees and shareholders.

-

Comment by Riaz Haq on January 3, 2021 at 6:50pm

-

Dysfunctional Horticulture Value Chains and

the Need for Modern Marketing Infrastructure:

The Case of Pakistan

https://www.adb.org/sites/default/files/publication/534716/dysfunct...

Total cereal production in the country increased to 38.34 million

MT in 2016 from 25.99 million MT in 2001, registering a growth of

47.52%. More than 70% of this growth was contributed by growth

in yield, while the rest was contributed by growth in cultivated land.

The country produced 6.64 MT vegetables and 5.89 MT of fruits in

2001, which increased to 9.77 MT and 6.8 MT, respectively, in 2015.

Yields of fruits and vegetables remain low. For example, yield

of potato (in tons per hectare) in Pakistan is significantly lower

compared to European countries like Belgium, the Netherlands,

Spain, and Turkey; and the United States (US) (Figure 2). Overall,

growth of yield played a small role in the growth of production of

fruits of vegetables during 1990–2016.3

Total production of potato, onion, and tomato was about 6.23 MT

in 2015, which accounted for about 64% of quantity and about 70%

of value of all vegetables produced in Pakistan. Punjab, Sindh, Khyber

Pakhtunkhwa, and Balochistan provinces accounted for 83%, 1%,

9%, and 7%, respectively, of total potato production. Shares of these

provinces in total tomato production were 9%, 10%, 45%, and 26%,

respectively. Sindh (40%) and Balochistan (28%) led in total onion

production, followed by Punjab (21%) and Khyber Pakhtunkhwa (11%).

Pakistan exports different types of fruits and vegetables. The value

of the country’s export of fruits and vegetables in 2016–2017 was

about $568 million. Per capita consumption of fruits and vegetables

in Pakistan is low compared to Europe and America, and roughly at

par with South Asian comparators like Afghanistan and Bangladesh.

In 2013, per capita consumption of fruits was only about 29

kilograms (kg) in Pakistan compared to 95 kg in Europe and 105 kg in

the US. Per capita consumption of vegetables was 26 kg in Pakistan

compared to 115 kg in the European Union and 114 kg in the US in

the same year.4

Current Horticulture Value Chain

Several players are involved in different segments of the horticulture

value chain in Pakistan.

Collection and Shipment

Majority of the farmers sell their produce at wholesale markets. Most

farmers contract out fruit orchards during the flowering stage to the

middlemen, commission agent, and/or wholesalers who provide

loans to the farmers over the course of production. Vegetables and

fruits are transported by the same cart or truck from farms to the main

markets in the absence of specialized vehicles for specific products.

The same vehicle is used for many other purposes including animal

transportation. Recently however, reefer trucks have been introduced

on a limited scale in some parts of Pakistan. In the absence of direct

access of carrier vehicles to the farms, farmers gather their products

in a convenient spot along the roadside for pickup. When middlemen

or contractors are involved, it is their responsibility to collect and

transport the produce. The unsold or unauctioned produce in one

market is sent to other markets in the same locality.

Fruits and vegetables are packaged using local materials before

shipment. In most cases such packaging fails to preserve the

freshness and quality of the products. Another problem is absence of

cooling and packaging centers, and inadequate cold storage facilities

to preserve the produce at or near the wholesale markets. More than

555 cold storage units have been identified in Pakistan with about

0.9 million MT storage capacity, against more than 15 million MT of

production of fruits and vegetables. There are no available cooling

and packaging houses, and cold storage facilities close to the farms

that can be used by the producers.

-

Comment by Riaz Haq on January 3, 2021 at 6:50pm

-

Pakistan’s cash crops — vegetable production

https://dailytimes.com.pk/603906/pakistans-cash-crops-vegetable-pro...

Vegetables constitute an integral component of our cropping pattern but the increasing pressure on food and cash crops has limited the area under vegetables to about 3.1% of the total cropped area. Because they have a shorter maturity period vegetables fit well in most farming systems. Vegetables provide proteins, minerals and vitamins required for human nutrition. In Pakistan though, the daily per capita intake is low, being about 100 grams compared to the recommended consumption of about 285 grams. Vegetables are very important due to their higher yield potential, higher return and high nutritional value while being suitable for small land holding farmers. Most Pakistanis prefer cooked vegetables over raw vegetables, use plenty of fat during cooking and like to stir-fry their vegetables but high heat kills many of the beneficial nutrients and vitamins, and the excessive fat intake encourages obesity and high cholesterol.

However, according to the Asian Development Bank until today Pakistan remains a low level producer of vegetables basically for the domestic market only. In some instances, Pakistan has to import vegetables. One such example is pulses. Pulses are the most important source of vegetable protein in Pakistan. The demand for pulses is increasing because of the population growth and the fact that dal is cheap staple food for the poor. There is a need to develop varieties with higher yield potential that respond to improved management practices so as to meet the increasing demand of pulses and for import substitution. Pakistan Agricultural Research Council has started a program in order to develop varieties of chickpea, lentil, mung bean and black gram through breeding, molecular techniques and selection. The new varieties should be responsive to high inputs like irrigation, fertilizers and inoculation and be resistant to disease, drought and cold. Last year a four-person U.S. pulse industry team visited Karachi during April 29-May 1 to attend the first U.S. pulses seminar, hold industry meetings, visit a processing facility, see a traditional grain market and tour a hypermarket. But instead of helping Pakistani agro-industry the visit resulted in Pakistani buyers contracting for import of American pulses for the coming year. Overall, Pakistan is spending Rs. 102 billion annually on import of pulses. Among the reasons for that is that pulses were grown in marginalized land which has low productivity due to lack of water.

As can be seen there are multiple factors constraining not only the production of pulses but of all vegetables. One important factor apart from seeds quality, diseases and others is the human factor. The majority of the population in Pakistan lives in rural areas where poverty is deep and widespread. People are not only poor but mostly uneducated. Whatever knowledge farmers have is from their fathers and grandfathers. Not or insufficiently able to read and write is another major constraint. New seeds and how to handle them, use of new fertilizers are incomprehensible to them. Moreover, many of them are landless or small farmers with holdings too small to be profitable. And the number of such people is increasing with the passage of time. Has there ever been an attempt to bring small landowners in a cooperative together? That would solve the problem of too small holdings, access to credits, training-on the job and others.

-

Comment by Riaz Haq on January 3, 2021 at 7:09pm

-

Dysfunctional Horticulture Value Chains and

the Need for Modern Marketing Infrastructure:

The Case of Pakistan

https://www.adb.org/sites/default/files/publication/534716/dysfunct...

Negative Impacts of the Current Value Chain The negative impacts of the current value chain can be assessed in terms of the low share of farmers in consumer prices . Usually producers get 15% to 20% of the retail price. Production of perishables like potato, onion and tomato suffers from a major setback every 3–4 years. Usually two or three good harvests are followed by a bad harvest. Besides, natural factors like unfavorable weather also negatively affect production. Producers do not get price dividends when production is low, shooting the retail price. Benefits of high retail prices are disproportionately expropriated by the middlemen. When there is a market glut where perishables and their prices fall, producers suffer as their share in retail prices also falls significantly. Sometimes producers throw away their perishable produce to protest their low prices. It emerged from discussions with the traders in Badami Bagh Ravi Link wholesale market that producers’ share in retail prices is inversely related with the perishability of the crop. Both seasonal and spatial price fluctuations of fruits and vegetables are high in Pakistan. For instance, in 2017, the price of 100 kg of tomato in Lahore fluctuated between 1,450 Pakistan rupees (PRs) to PRs13,150, or more than 800%. In the same year, price fluctuation for fresh potato was between PRs1,550 to PRs4,300 for 100 kg, or 177%. The annual cost of price fluctuations of fruits and vegetables is estimated to be about $825 million. Postharvest losses in fruits and vegetables due to mishandling of the perishable product, poor transportation, and inadequate storage facilities and market infrastructure account for about 30%–40% of total production. The annual value of postharvest losses of potato, tomato, peas, cauliflowers, carrots, turnip, radish, brinjal, squash, okra, onion, grapes, and mango in Balochistan, Khyber Pakhtunkhwa, Punjab, and Sindh, valued at the respective 2016 provincial wholesale prices, is about $700 million to $934 million. An alternative estimate suggests that a reduction of around 75% of the current postharvest loss, when valued at export premium prices, would be equivalent to an annual saving of approximately $1.13 billion.

Due to low economies of scale, lack of synergies and collaboration among traders, high loading and unloading time, and hightransportation cost, overall marketing cost is very high. A reduction of marketing cost by $0.025 per kilogram would save about $55 million annually in the Ravi Link wholesale market in Lahore. It is difficult to comply with food safety, sanitary, and phytosanitary standards with the current value chain. The income and corporate tax revenues foregone due to the current value chain and marketing structure are also potentially high. Current Situation of the Main Wholesale Markets in Lahore The situation of four wholesale markets located in Lahore were analyzed, namely, (i) Badami Bagh Ravi Link, (ii) Akbari Mandi, (iii) a fish market at Urdu bazaar, and (iv) a flower market in Sughian Pul Shekhopura Road. The key findings are as follows. Physical Limitations The main problem is inadequate space for activities, forcing the commission agents and wholesalers to operate in open spaces with consequent spoilage. The average size of stalls is about 16 square meters only, which makes sorting, grading, and display of products difficult. Most of the corridors and offices in the premises have little active ventilation as required by international standards.

-

Comment by Riaz Haq on June 25, 2021 at 5:30pm

-

Speaking at a Karachi Chamber of Commerce and Industry webinar in December, Adviser to the Prime Minister on Institutional Reforms Dr Ishrat Husain stressed the importance of looking beyond the textile sector and diversifying Pakistan’s exports. Otherwise, he warned, we will remain “stuck” at 25 to 30 billion dollars in exports per year.

https://www.dawn.com/news/1611075

“If we can capture just one percent of the Chinese market by providing components, raw materials [and] intermediate goods to the Chinese supply chain,” he had said, “we can get 23 billion dollars in exports to China, which is very favourably inclined towards Pakistan...”

From the looks of it, others were on the same page as Husain. Last month, it was reported by China Economic Net (CEN) that China will import dairy products from Pakistan. The Commercial Counsellor at the Pakistan Embassy in Beijing, Badar uz Zaman, told CEN that Pakistan got this opportunity due to its high quality dairy products, available at a low price.

Pakistan is the fourth largest milk producer globally, Zaman pointed out.

Indeed, the country’s dairy industry has great potential and can prove to be ‘white gold’ for Pakistan. Unfortunately, the sector is currently struggling due to various reasons but, if its export potential is realised, it can transform not only the sector itself but Pakistan’s economy as well.

According to the Food and Agriculture Organisation at the United Nations, in the last three decades, global milk production has increased by more than 59 percent, from 530 million tonnes in 1998 to 843 million tonnes in 2018.

This rise in global milk consumption is an opportunity for countries such as Pakistan to earn foreign exchange by exporting milk and dairy products to countries which have insufficient milk production. According to a Pakistan Dairy Association estimate, with support from the government, Pakistan can earn up to 30 billion dollars from exports of only dairy products and milk.

Unfortunately, this potential is being wasted. As per statistics provided by the Pakistan Dairy Association, livestock and dairy currently make up approximately only 3.1 percent of Pakistan’s total exports; which would mean about a mere 0.68 billion dollars in FY2020.

-

Comment by Riaz Haq on February 15, 2022 at 5:48pm

-

Dastaangoi

0uFetSbtr32u8ary1s 1600, 2202d1 ·

Pakistani Beverages (1/3)

Pakola was the creation of seven brothers from the Teli family of Dhoraji in India who migrated to Pakistan in 1947. The idea of Pakola came from its founder Haji Ali Mohammad, who dreamed of developing a drink that portrayed the true reflection and taste of Pakistan. In order to pursue his dream, Haji Ali Mohammad opened a small factory with only two machines at Lawrence Road in Karachi, Pakistan with Pakola Ice-cream Soda being the initial product.

The drink was launched at Pakistan Air Force base on the anniversary of Pakistan’s Independence, 14 August 1950, in the presence of the first Prime Minister, Liaquat Ali Khan.

Later when Pakistan Beverages (PB) came into existence at SITE (Karachi), the brand Pakola was produced there. In 1979, when Pakistan Beverages location was announced as a production facility for Pepsi, Mehran Bottlers came into existence and continued to produce the drink along with other products such as Apple Sidra and Bubble Up.

Pakola is now available in America, Africa, Australia, Canada, Middle East, New Zealand and the United Kingdom. It is the only carbonated beverage manufactured in Pakistan that is exported globally.

-

Comment by Riaz Haq on February 15, 2022 at 5:59pm

-

PABC raises Rs4.6b through IPO

Can maker secures maximum allowed price of Rs49 per sharehttps://tribune.com.pk/story/2306898/pabc-raises-rs46b-through-ipo

Pakistan Aluminium Beverage Cans (PABC) raised Rs4.6 billion by selling one-fourth of the stake in the company to institutional, individual and retail investors at the Pakistan Stock Exchange (PSX) on Wednesday.

The company secured the maximum allowed price of Rs49 per share, which it determined by holding the Dutch auction (book building process) on Tuesday and Wednesday. It kick-started the auction at the minimum (floor) price of Rs35 per share.

Rules in place allowed the company to sell shares at 40% higher price against its floor price of Rs35 per share. The company sold a total of 93.88 million (26%) shares in the auction at the PSX.

The IPO was oversubscribed by 2.5 times at 233.23 million shares against the offer to sell 93.88 million shares.

It was the second largest initial public offering (IPO) in the private sector in terms of size of raised funds at Rs4.6 billion.

Funds gathered through the listing would go to UK-based asset management firm Ashmore that plans to break away from the company. It held a total of 51% stake in the company, out of which it sold almost half (26%) through the auction at the PSX.

Ashmore has also entered into agreements to sell rest of its holding in the company at a price of Rs30.80-31.85 to two major investors including Hamida Salim Mukaty (part of Liberty Group) and Soorty Enterprises (Private) Limited in private deals. PABC has shared plans to enhance its annual capacity from 700 million cans to 950 million cans. It aims to complete the expansion by July 2022.

The expansion is being financed through the State Bank of Pakistan’s (SBP) Long Term Financing Facility (LTFF) at an attractive rate of 3% (inclusive of bank margin of 1%). The company has established relationship with key beverage bottlers in Pakistan and Afghanistan such as PepsiCo, Coca Cola, Mehran Bottlers (Pakola) and Zalal Mowafaq, Afghanistan.

In addition to this, the company also supplies aluminium beverage cans to Nestle Pakistan, Murree Brewery, King Beverages, Super Cola Beverages, Sufi Group of Companies, Six B, Daani International, Master Beverages and Foods and Afghan Red Pomegranate.

As per company estimates, the can penetration in the beverage packaging market is roughly 3-4%.

The off-trade consumption in soft drinks market of Pakistan stood at 3.13 billion litres in 2020 and it is expected to hit 4.34 billion litres by 2025, registering a five-year CAGR of 6.7% on volume basis, as per Euromonitor International.

-

Comment by Riaz Haq on July 6, 2023 at 5:07pm

-

Land Information And Management System: Step Towards Pakistan’s Modern Agriculture Revolution – OpEd

https://www.eurasiareview.com/05072023-land-information-and-managem...

By Sarah Saeed

Land is an essential resource and one of the primary elements of statehood which ensures the survival of a nation-state.Administrative inefficiencies, corruption, and lack of transparency that afflict conventional land management practices can lead to land conflicts and poor management. The cumulative impact of past negligence has made economic revival, a question of survival for Pakistan.

Looking back, Pakistan’s First Green Revolution was launched in the mid-sixties. Through the use of innovative technologies, timely application of high-yielding varieties (HYV) seeds, chemical fertilizers, and irrigation water, the output of food grains increased by three times. At that time, Pakistan scored far better than other South Asian nations, where the production of wheat surged by 79%, from 3.7 MMT to 6.8 MMT.

As of now, population-production gap is widening while area under cultivation is declining, and agriculture-related imports are now estimating at $10 billion,creating economic stress. Simply put, Pakistan’s productivity is currently below average. According to the World Food Program, 18.3% of Pakistanis—36.9% of the population—are experiencing acute food crises. With the entire wheat demand exceeding 30.8 MMT, the wheat shortage problem is becoming worse. There is now a shortage of about 4 MM as output is just 26.4 MMT. Over the past ten years, cotton output has decreased by 40%, from 14.8 million bales to 5 million bales.

With all these challenges in view, there is a dire need to take a promising initiative, aimed at enhancing Modern Agro Farming utilizing over 9 million hectares of uncultivated waste state land. In this regard Land Information and Management System – Center of Excellence has been established under Director General Strategic Projects by Adjutant General Branch, GHQ. LIMS is a digital platform to manage land related data with the mission to ensure Food Security and Optimize Agricultural Production inPakistan through innovative technologies and sustainable precision-guided agricultural practices based on agro-ecological potential of land, while ensuring well being of rural communities and preservation of environment.

LIMS is keen to contribute significantly in Agriculture sector and has recently initiated Modern Agriculture farming projects, starting from Punjab. In coordination with all provinces, thus far total land identified is almost 4.4 million acres in which Punjab and Sindh both separately have 1.3 million acres of land, whereas Khyber Pakhtunkhwa has 1.1 million acres of land and Balochistan contains 0.7 million acres of land. The project is well expected to deliver a paradigm change in terms of land management and agricultural growth, triggering a system revolutionization. System revolutionization refers to the use of real-time data on land, crops, weather, and pest management under one roof to guide agricultural progress.

As planned, Research & Development in Seeds, Fertilizers, and Artificial Intelligence-based solutions through public/private collaborations and agreements with foreign and domestic partners will improve effectiveness, productivity, and sustainability by ensuring food security through large-scale farming, including livestock. Precision farming, biotechnology (genetic engineering, seed coating, and seed inoculation), irrigation management, pest management, agro-forestry, and aquaculture are some of the contemporary farming practices introduced by LIMS. These practices will further increase production yield, decrease input costs, minimize environmental impact, and support research and development.

-

Comment by Riaz Haq on July 6, 2023 at 5:08pm

-

Land Information And Management System: Step Towards Pakistan’s Modern Agriculture Revolution – OpEd

https://www.eurasiareview.com/05072023-land-information-and-managem...

By Sarah Saeed

The world is currently using 80 % hybrid seed while Pakistan is using only 8% of the same. Pakistan’s seed requirement is 1.77 million tons, whereas seed availability is only 0.77 million tons. LIMS efforts are in hand to use certified hybrid seeds with concurrent development of seed involving Japan Vegetables (JVs) with Multi-National companies, which can pay rich dividends.

By leveraging the expertise, resources, and technology of various entities coupled with modern irrigation systems, Pakistan is in desperate need to revolutionize its agricultural sector horizontally and vertically as well as ensure food security for its rapidly growing population. As an immediate and well calibrated project which promises introduction of transparency, efficiency, and equality to the system, LIMS has the potential to revolutionize land management in Pakistan.

Planned under LIMS, real-time data gathering, processing, and reporting will be useful for identifying problems and putting into place prompt solutions for increased output. In turn, this will not only solve the constantly lingering threat of food security but also make it possible for the country to ecplo export possibilities and support the expansion of economy. Additionally, by allowing Modern Agro Farming access to state property, it will help in drawing investment, foster innovation, and provide job possibilities.

-

Comment by Riaz Haq on August 17, 2023 at 8:46pm

-

Annual milk production during 2021/2022 was estimated approximately 65.7 million tonnes, giving Pakistan a place in the list of world's top 5 milk producing countries. Dairy farming in Pakistan is fragmented and practiced on various scales both in rural and peri-urban areas mainly by private sector.

https://sdgs.un.org/sites/default/files/2023-05/B65%20-%20Tariq%20-...

Dairy sector in Pakistan plays a pivotal role in the national economy and its value is more than the

combined value of major cash-crops i.e. wheat and cotton. Annual milk production during 2021/2022 was

estimated approximately 65.7 million tonnes, giving Pakistan a place in the list of world’s top 5 milk

producing countries. Dairy farming in Pakistan is fragmented and practiced on various scales both in rural

and peri-urban areas mainly by private sector. However, this industry is facing challenges (nutrition,

healthcare, breeding, government support and public health) that threaten its sustainability and

livelihoods of millions of people involved in the sector

Twitter Feed

Live Traffic Feed

Sponsored Links

South Asia Investor Review

Investor Information Blog

Haq's Musings

Riaz Haq's Current Affairs Blog

Please Bookmark This Page!

Blog Posts

EU-India Trade Deal: "Uncapped" Mass Migration of Indians?

The European Union (EU) and India have recently agreed to a trade deal which includes an MOU to allow “an uncapped mobility for Indian students”, according to officials, allowing Indians greater ease to travel, study and work across EU states. India's largest and most valuable export to the world is its people who last year sent $135 billion in remittances to their home country. Going by the numbers, the Indian economy is a tiny fraction of the European Union economy. Indians make up 17.8%…

ContinuePosted by Riaz Haq on January 28, 2026 at 11:00am — 7 Comments

Independent Economists Expose Modi's Fake GDP

Ruling politicians in New Delhi continue to hype their country's economic growth even as the Indian currency hits new lows against the US dollar, corporate profits fall, electrical power demand slows, domestic savings and investment rates decline and foreign capital flees Indian markets. The International Monetary Fund (IMF) has questioned India's GDP and independent economists…

ContinuePosted by Riaz Haq on January 25, 2026 at 4:30pm — 9 Comments

© 2026 Created by Riaz Haq.

Powered by

![]()

You need to be a member of PakAlumni Worldwide: The Global Social Network to add comments!

Join PakAlumni Worldwide: The Global Social Network