PakAlumni Worldwide: The Global Social Network

The Global Social Network

Pakistan At 75: Highlights of Economic and Demographic Progress Since Independence

Pakistan is a young nation with a lot of unrealized potential. As the country turns 75, it is important to recognize that all basic indicators of progress such as income, employment, education, health, nutrition, electricity use, telecommunications and transportation have shown significant improvements over the last seven and a half decades. These improvements can be accelerated if Pakistan can overcome its economic growth constraints from recurring balance of payments crises such as the one it is experiencing now. The only way to do it is through rapid expansion of exports and major reductions in reliance on imports such as fossil fuels and cooking oil.

Income/GDP Growth:

Economic Survey of Pakistan 2021-22 confirms that the nation's GDP grew nearly 6% in fiscal year 2021-22, reaching $1.62 Trillion in terms of purchasing power parity (PPP). It first crossed the trillion dollar mark in 2017. In nominal US$ terms, the size of Pakistan's economy is now $383 billion. The country's per capita income is $1,798 in nominal terms and $7,551 in PPP dollars.

|

| Pakistan GDP, Per Capita Income Growth. Source: 75 Years Economic J... |

Electricity Consumption:

Pakistan's electricity consumption is an important indicator of economic activity and living standards. It has soared from 40 GWH in 1949 (1 KWH per capita) to 136,572 KWH in 2021 (620 KWH per capita). Last year, hydroelectric dams contributed 37,689 GWH of electricity or 27.6% of the total power generated, making hydropower the biggest contributor to power generated in the country. It was followed by coal (20%), LNG (19%) and nuclear (11.4%). Nuclear power plants generated 15,540 GWH of electricity in 2021, a jump of 66% over 2020. Overall, Pakistan's power plants produced 136,572 GWH of power in 2021, an increase of 10.6% over 2020, indicating robust economic recovery amid the COVID19 pandemic.

|

|

|

|

| Installed Power Generation Capacity Growth. Source: Bilal Gilani of... |

Population Growth:

Pakistan's population has grown rapidly over the last 75 years. It is now 227 million, 6.7 times 34 million in 1951. However, the total fertility rate has declined from 6.5 babies in 1950 to 3.3 babies per woman in 2021.

|

|

|

|

| Pakistan Total Fertility Rate Per Woman of Child-Bearing Age. Sourc... |

|

|

|

|

|

|

Unlike Pakistan's, India's labor participation rate (LPR) has been falling significantly in the last decade. It fell to 39.5% in March 2022, as reported by the Center for Monitoring Indian Economy (CMIE). It dropped below the 39.9% participation rate recorded in February. It is also lower than during the second wave of Covid-19 in April-June 2021. The lowest the labor participation rate had fallen to in the second wave was in June 2021 when it fell to 39.6%. The average LPR during April-June 2021 was 40%. March 2022, with no Covid-19 wave and with much lesser restrictions on mobility, has reported a worse LPR of 39.5%.

|

| Labor Participation Rates in India and Pakistan. Source: ILO/World ... |

Youth unemployment for ages 15-24 in India is 24.9%, the highest in the South Asia region. It is 14.8% in Bangladesh and 9.2% in Pakistan, according to the International Labor Organization and the World Bank.

Pakistan has managed to significantly reduce poverty since its inception.

|

|

|

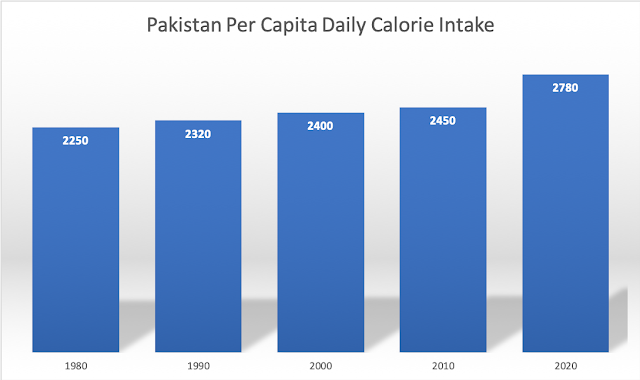

In terms of the impact of economic growth on average Pakistanis, the per capita average daily calorie intake jumped to 2,735 calories in FY 2021-22 from 2,457 calories in 2019-20. It has grown from 2250 calories in 1980 to 2780 calories in 2020.

|

|

|

Agriculture:

Pakistan is among the world's largest food producers. It experienced broad-based economic growth across all key sectors in FY 21-22; manufacturing posted 9.8% growth, services 6.2% and agriculture 4.4%. The 4.4% growth in agriculture is particularly welcome; it helps reduce rural poverty.

|

| Production of Tractors in Pakistan |

|

| Wheat Production in Pakistan |

|

| Rice Production in Pakistan |

|

| Corn Production in Pakistan |

|

| Sugarcane Production in Pakistan |

|

| Meat Production in Pakistan |

|

| Milk Production in Pakistan |

|

| Cotton Production in Pakistan |

Literacy in Pakistan has increased from just 16.4% in 1950-51 to 62.8% in 2020-21. Male literacy is now at 73.4% but the female literacy lags at only 51.9%. The area of female literacy clearly requires greater attention and focus.

|

| Literacy Rate in Pakistan |

|

| University Enrollment in Pakistan |

|

| Enrollment in Degree Colleges in Pakistan |

Telecommunications:

Telecommunication services and broadband subscriptions in Pakistan have rapidly grown, especially over the last two decades. The number of telephone and mobile users has increased from just 15,200 in 1947 to 194.2 million in 2021.

|

| Phone Users in Pakistan |

Transportation:

Expansion of road infrastructure and increasing vehicle ownership have contributed to the growth of the road transport sector. Number of registered vehicles in Pakistan has soared from 31,892 in 1947 to 32.4 million in 2021. Road length has grown from 26,300 Km in 1947 to 500,000 Km in 2021.

|

| Vehicle Ownership and Road Length in Pakistan |

Pakistan has seen significant improvements in its population's living standards since independence in 1947. Average Pakistani has much higher income and greater access to food, healthcare, education, housing, transport, electricity and communication services.

Acknowledgement: Charts and data in this blog post are sourced from 75 Years Economic Journey of Pakistan published by Pakistan's Ministry of Finance.

South Asia Investor Review

Pakistan's Expected Demographic Dividend

Pakistan's Social Sector

World Bank: Pakistan Reduced Poverty, Grew Economy During Covid19 P...

Pakistan Among World's Largest Food Producers

Pakistan's Balance of Payments Crisis

Panama Leaks in Pakistan

Olive Revolution in Pakistan"

Naya Pakistan Sehat Card: A Giant Step Toward Universal Healthcare

Prime Minister Imran Khan's Effectiveness as Crisis Leader

India in Crisis: Unemployment and Hunger Persists After Waves of Covid

Riaz Haq's Youtube Channel

-

Comment by Riaz Haq on August 30, 2022 at 9:11am

-

#Modi says bhajans (#Hindu religious songs) will cure #malnutrition. Over 35% of #Indian children are stunted, 19.3% wasted & 32.5% underweight.

BJP rule has seen undernourished population increase from 14.9% to 15.5% of population https://science.thewire.in/health/narendra-modi-malnutrition-bhajan/ via @TheWireScience

In the 92nd episode of ‘Mann ki Baat’, Prime Minister Narendra Modi said conducting bhajans can be part of the solutions to reducing malnutrition.

Cultural and traditional practices are not harmful. But it is in bad faith to make them part of habits that sideline tested and approved solutions to crucial welfare issues.

The statement also distracts from the fact that in Modi’s time as prime minister, India has come to account for a quarter of all undernourished people worldwide

There is much evidence in the public domain that says the availability, accessibility and affordability of good-quality food is crucial to improve the nutritional and health status of India’s people. There is nothing, however, about bhajans.

Many scholars and scientists have often criticised Prime Minister Modi for his irrational claims on many occasions. Reminiscent of his “taali, thali and Diwali” campaign as the COVID-19 pandemic was gaining strength, Modi’s comment on bhajans only distracts from the dire importance of effective public health measures – even as the rate of improvement of some important indicators have slid in his time at the helm.

Cultural and traditional practices are not harmful. But it is in bad faith to make them part of habits that sideline tested and approved solutions to crucial welfare issues.

In his monologue, Modi narrated a story of how people of a community in Madhya Pradesh each contribute a small quantity of grains, using which a meal is prepared for everyone one day a week. However, he shifted the focus at this point to devotional music in bhajan–kirtans – organised under the ‘Mera Bachha’ campaign – instead of dwelling on the role of Indigenous food cultures. This is counterproductive.

More malnourished children

India’s National Family Health Surveys (NFHS) and Comprehensive National Nutrition Surveys have documented the high prevalence of malnutrition and micronutrient deficiency among India’s children, adolescents and women. The recently published NFHS-5 results reported a high prevalence of stunting, wasting and underweightedness among children younger than five years and that they have declined only marginally in the last five years.

--------

A public-health approach to malnutrition requires us to pay attention to a large variety of socioeconomic conditions. In this regard, while many of Prime Minister Modi’s other comments in his monologue are well-taken, especially about public participation, neither the need for context-specific interventions nor for evidence-based policies are served by misplaced allusions to bhajans and kirtans.

-

Comment by Riaz Haq on September 6, 2022 at 5:05pm

-

Tractor assembling increases 16.22pc during last fiscal year

https://pakobserver.net/tractor-assembling-increases-16-22pc-during...

Local tractor assembling witnessed about 16.22 percent growth during last fiscal year (2021-22) as compared the corresponding period of last year.

During the period from July-June, 2021-22, about 58,922 tractors were locally assembled as against the assembling of 50,700 tractors of same period last year, according the data of Large Scale Manufacturing Industries.

During last fiscal year, the upsurge of tractor assembling was mainly attributed to the government’s incentives for the farming communities to mechanization local agriculture sector by reducing tax on locally manufacturing tractors.—APP

-

Comment by Riaz Haq on September 15, 2022 at 4:16pm

-

Surge in services demand helps steady India’s economy in August | Mint

https://www.livemint.com/news/india/surge-in-services-demand-helps-...

Electricity consumption, a widely used proxy to gauge demand in industrial and manufacturing sectors, showed activity is picking up. Numbers from India’s power ministry showed peak demand met in August jumped to 185 gigawatt from 167 gigawatt a month ago. However, rising unemployment numbers tempered the overall optimism, with data from the Centre for Monitoring Indian Economy Pvt. showing the jobless rate climbed to 8.3 percent -- the highest level in a year. That shows the current pace of expansion isn’t enough to create jobs for the million plus people joining the workforce every month.

------------

https://www.reuters.com/article/us-pakistan-energy-climate-change-f...

When electricity projects now in the pipeline are completed in the next few years, Pakistan will have about 38,000 MW of capacity, Gauhar said. But its current summertime peak demand is 25,000 MW, with electricity use falling to 12,000 MW in the winter, he said.

-

Comment by Riaz Haq on September 15, 2022 at 6:10pm

-

Pakistan's power production hits record high at 24,284MW in 2021

https://tribune.com.pk/story/2309291/pakistans-power-production-hit...

----------------------

Economic Survey 2021-22: Pakistan installed capacity 41,557 MW in 2022

https://www.finance.gov.pk/survey/chapter_22/PES14-ENERGY.pdf

Pakistan's Electricity Generation Capacity

The total electricity generation capacity during July-April 2022 has increased by 11.5 percent and it reached 41,557 MW from 37261 MW during the same period last fiscal

-

Comment by Riaz Haq on September 17, 2022 at 10:21am

-

Arif Habib Limited

@ArifHabibLtd

Power Generation Aug’22

Power Generation

Aug’22: 14,053 GWh (18,888 MW), -12.6% YoY | -0.7% MoM

2MFY23: 28,203 GWh (18,954 MW), -11.2% YoY

Fuel Cost

Aug’22: PKR 10.06/KWh, +57% YoY | -6% MoM

2MFY23: PKR 10.39/KWh, +61% YoY

https://twitter.com/ArifHabibLtd/status/1571073410486407169?s=20&am...

-

Comment by Riaz Haq on September 18, 2022 at 7:53am

-

Pakistan and China trumpeted their "all weather" friendship after their leaders met on the sidelines of the Shanghai Cooperation Organization summit on Friday, but analysts warn that Islamabad's scramble to extricate itself from an economic crisis could stoke tensions.

https://asia.nikkei.com/Politics/International-relations/Pakistan-a...

Both sides' readouts of the summit between Chinese President Xi Jinping and Pakistani Prime Minister Shehbaz Sharif were filled with flowery language. Sharif's office said he emphasized that the nations' "iron brotherhood had withstood the test of time" and reaffirmed "his personal resolve to take their bilateral relations to greater heights."

China's Foreign Ministry said Xi stressed that "the two countries have all along stood with each other through thick and thin. No matter how the international situation evolves, China and Pakistan are always each other's trustworthy strategic partners."

But hinting at concerns over recent attacks on Chinese interests in Pakistan and worries over payments to Chinese companies, Beijing's readout added: "China hopes that Pakistan will provide solid protection for the security of Chinese citizens and institutions in Pakistan as well as the lawful rights and interests of Chinese businesses."

Looming over the meeting were expectations that Pakistan will seek concessions on dues owed to Chinese power producers operating in the country under the $50 billion China-Pakistan Economic Corridor (CPEC) -- part of Xi's Belt and Road Initiative.

Cash-strapped Islamabad needs to do this to satisfy the International Monetary Fund and unlock more funding, as it rushes to reduce the risk of a debt default.

The government assured the IMF in July that it would strive to reduce capacity payments to Chinese independent power producers (IPPs) either by renegotiating purchase agreements or rescheduling bank loans. Capacity payments are fixed payments made to power plants for generating a minimum amount of electricity to ensure that demand is met. These companies produce costly electricity using imported fuel, and are said to be on the brink of default.

"The IMF anticipated that pressure would come from the Chinese IPPs that the entire loan installment be used to pay them," Nadeem Hussain, a Boston-based author and economic policy analyst, told Nikkei Asia. "Hence, the IMF extended the current program on the condition that it would not go to the Chinese IPPs."

The Washington-based lender released a long-pending tranche of $1.17 billion two weeks ago after Pakistan undertook a series of politically unpopular economic measures toward fiscal discipline. The bailout program, which began in 2019 but stalled, was also extended until next June, with additional funding set to bring the total value to about $6.5 billion, the IMF said in a statement.

But Pakistan owes $1.1 billion to Chinese IPPs for power purchases, contributing to the massive 2.6 trillion-rupee ($11 billion) debt stock in the country's power sector. The IMF has long maintained that Chinese loans threaten Pakistan's debt sustainability.

Xi, in the Chinese Foreign Minister readout of his meeting with Sharif, "stressed that the two sides must continue to firmly support each other, foster stronger synergy between their development strategies, and harness ... the China-Pakistan Economic Corridor to ensure smooth construction and operation of major projects."

Observers say Pakistan's handling of the electricity issue is likely to irk China, noting that Sharif's government committed to the IMF to reopen power contracts without taking the Chinese companies into confidence. Pakistan has also reneged on a promise to set up an escrow account to ensure smooth payments to Chinese IPPs.

-

Comment by Riaz Haq on September 18, 2022 at 7:54am

-

Pakistan and China trumpeted their "all weather" friendship after their leaders met on the sidelines of the Shanghai Cooperation Organization summit on Friday, but analysts warn that Islamabad's scramble to extricate itself from an economic crisis could stoke tensions.

https://asia.nikkei.com/Politics/International-relations/Pakistan-a...

"The Chinese [companies] have been absolutely upset for a very long time," said Haroon Sharif, a former minister of state who spearheaded industrial cooperation with China under the previous government of Prime Minister Imran Khan. "The Chinese stance is that it's a commercial agreement. No IPP is obliged to listen to the [Pakistani] government because the agreements were drawn under the law," he said, referring to a system that predated the Khan government and paved the way for Chinese players to invest in the country's power sector, setting the terms.

Resentment has been building for some time. CPEC projects were stalled for months after Khan took power in 2018, mainly due to graft allegations regarding the previous government's dealings. There were also allegations that the arrangements unfairly benefited Beijing.

"The IPP framework is deeply flawed," Haroon Sharif said. "The [Chinese] IPPs are averse to taking risks because the state guarantees a return on investment in dollar terms whether they are selling [electricity] or not."

As a confidence-building measure, Islamabad did announce the release of 50 billion rupees to the companies by next week and assured the Chinese suppliers that all outstanding dues will be cleared by June next year. The announcement came ahead of Prime Minister Sharif's meeting with Xi at the SCO and a planned visit to China in November, when he might raise concerns about the power deals.

The release of the funds may serve only as a Band-Aid.

The IMF is demanding that Pakistan rationalize payments to the Chinese IPPs in line with earlier concessions extracted from local private power producers, Haroon Sharif explained. Former Prime Minister Khan persuaded local IPPs to accept lower interest rates on outstanding bills before releasing staggered reimbursements in the form of debt instruments, like government bonds.

Chinese power producers, however, have fiercely opposed similar propositions in the past. In March, Chinese IPPs closed down operations due to unpaid dues, insisting they did not have money to import fuel. The government disbursed another installment of 50 billion rupees to get them to resume operations.

The IMF now wants Pakistan to negotiate an increase in the duration of bank loans from 10 years to 20 years, or to reduce the markup on arrears owed to Chinese IPPs from 4.5% to 2%, the ex-minister said.

He added that there is a lesson in this for China. "Chinese companies should deeply study macroeconomic fundamentals [before making any investments], and not blindly follow state guarantees,'' Sharif argued. At the same time, he said, this will have a far-reaching impact on Pakistan's future investment climate.

-

Comment by Riaz Haq on September 18, 2022 at 1:51pm

-

Strong #US #Dollar Spells Trouble for World #Economy. Its rise being felt in #fuel and #food shortages in #SriLanka, in #Europe’s record #inflation, in #Japan’s exploding #trade deficit, #Pakistan's #IMF bailout and #Bangladesh seeking IMF help https://www.wsj.com/articles/dollars-rise-spells-trouble-for-global... via @WSJ

For the U.S., a stronger dollar means cheaper imports, a tailwind for efforts to contain inflation, and record relative purchasing power for Americans. But the rest of the world is straining under the dollar’s rise.

“I think it’s early days yet,” said Raghuram Rajan, a finance professor at the University of Chicago’s Booth School of Business. When he served as governor of the Reserve Bank of India last decade, he complained loudly about how Fed policy and a strong dollar hit the rest of the world. “We’re going to be in a high-rates regime for some time. The fragilities will build up.”

-------------

The U.S. dollar is experiencing a once-in-a-generation rally, a surge that threatens to exacerbate a slowdown in growth and amplify inflation headaches for global central banks.

The dollar’s role as the primary currency used in global trade and finance means its fluctuations have widespread impacts. The currency’s strength is being felt in the fuel and food shortages in Sri Lanka, in Europe’s record inflation and in Japan’s exploding trade deficit.

This week, investors are closely watching the outcome of the Federal Reserve’s policy meeting for clues about the dollar’s trajectory. The U.S. central bank is expected Wednesday to raise interest rates by at least 0.75 percentage point as it fights inflation—likely fueling further gains in the greenback.

In a worrying sign, attempts from policy makers in China, Japan and Europe to defend their currencies are largely failing in the face of the dollar’s unrelenting rise.

Last week, the dollar steamrolled through a key level against the Chinese yuan, with one dollar buying more than 7 yuan for the first time since 2020. Japanese officials, who had previously stood aside as the yen lost one-fifth of its value this year, began to fret publicly that markets were going too far.

The ICE U.S. Dollar Index, which measures the currency against a basket of its biggest trading partners, has risen more than 14% in 2022, on track for its best year since the index’s launch in 1985. The euro, Japanese yen and British pound have fallen to multidecade lows against the greenback. Emerging-market currencies have been battered: The Egyptian pound has fallen 18%, the Hungarian forint is down 20% and the South African rand has lost 9.4%.

The dollar’s rise this year is being fueled by the Fed’s aggressive interest-rate increases, which have encouraged global investors to pull money out of other markets to invest in higher-yielding U.S. assets. Recent economic data suggest that U.S. inflation remains stubbornly high, strengthening the case for more Fed rate increases and an even stronger dollar.

Dismal economic prospects for the rest of the world are also boosting the greenback. Europe is on the front lines of an economic war with Russia. China is facing its biggest slowdown in years as a multidecade property boom unravels.

-

Comment by Riaz Haq on September 18, 2022 at 1:51pm

-

Strong #US #Dollar Spells Trouble for World #Economy. Its rise being felt in #fuel and #food shortages in #SriLanka, in #Europe’s record #inflation, in #Japan’s exploding #trade deficit, #Pakistan's #IMF bailout and #Bangladesh seeking IMF help https://www.wsj.com/articles/dollars-rise-spells-trouble-for-global... via @WSJ

For the U.S., a stronger dollar means cheaper imports, a tailwind for efforts to contain inflation, and record relative purchasing power for Americans. But the rest of the world is straining under the dollar’s rise.

“I think it’s early days yet,” said Raghuram Rajan, a finance professor at the University of Chicago’s Booth School of Business. When he served as governor of the Reserve Bank of India last decade, he complained loudly about how Fed policy and a strong dollar hit the rest of the world. “We’re going to be in a high-rates regime for some time. The fragilities will build up.”

-------------

-------

On Thursday, the World Bank warned that the global economy was heading toward recession and “a string of financial crises in emerging market and developing economies that would do them lasting harm.”

The stark message adds to concerns that financial pressures are widening for emerging markets outside of well-known weak links such as Sri Lanka and Pakistan that have already sought help from the International Monetary Fund. Serbia became the latest to open talks with the IMF last week.

“Many countries have not been through a cycle of much higher interest rates since the 1990s. There’s a lot of debt out there augmented by the borrowing in the pandemic,” said Mr. Rajan. Stress in emerging markets will widen, he added. “It’s not going to be contained.”

A stronger dollar makes the debts that emerging-market governments and companies have taken out in U.S. dollars more expensive to pay back. Emerging-market governments have $83 billion in U.S. dollar debt coming due by the end of next year, according to data from the Institute of International Finance that covers 32 countries.

-

Comment by Riaz Haq on September 20, 2022 at 10:56am

-

India’s economy has outpaced Pakistan’s handily since Partition in 1947 – politics explains why.

By Surupa Gupta

Professor of Political Science and International Affairs, University of Mary Washington

https://theconversation.com/indias-economy-has-outpaced-pakistans-h...

Pakistan's economy grew at a faster pace than India's from the 1960s through 1980s thanks in large part to generous outside aid and cheap loans, as well as more foreign trade...... The growth script flipped in the 1990s, with India growing at a 6% rate over the next 30 years, outpacing Pakistan’s 4%.

-------------

What explains the role reversal (starting in 1990s)? Economics and politics both played a part.

Pakistan has long relied on external sources of funding more than India has, receiving $73 billion in foreign aid from 1960 to 2002. And even today, it frequently relies on institutions such as the International Monetary Fund for crisis lending and on foreign governments like China for aid and infrastructure development.

The aid has allowed Pakistan to postpone much-needed but painful reforms, such as expanding the tax base and addressing energy and infrastructure problems, while the loans have saddled the country with a large debt. Such reforms, in my view, would have put Pakistan on a more sustainable growth path and encouraged more foreign investment.

While India also got a fair amount of support from international aid groups and a few countries such as the U.S. earlier in its existence, it never depended upon it – and has relied less on it in recent decades. In addition, in 1991, India liberalized trade, lowered tariffs, made it easier for domestic companies to operate and grow, and opened the door to more foreign investment.

These reforms paid off: By integrating India’s economy to the rest of the world, the reforms created market opportunities for Indian companies, made them more competitive, and that, in turn, led to higher growth rates for the overall economy.

Another way to measure the different paths is in gross domestic product per person. In 1990, India and Pakistan had almost identical per-capita GDPs, a little under $370 per person. But by 2021, India’s had surged to $2,277, about 50% higher than Pakistan’s.

The reasons for their different choices have a lot to do with politics.

Pakistan has suffered from near-constant political instability. From 1988 to 1998 alone, it had seven different governments as it alternated between civilian and military governments following coups. This discouraged foreign investment and made it much harder to make reforms and follow through on them. Through all these changes, Pakistan’s military spending as a share of its GDP remained higher than India’s during the entire post-independence period.

India, on the other hand, has managed to maintain a steady democracy. Though it’s far from perfect, it has kept leaders more accountable to the people and led to more inclusive growth and less reliance on foreign institutions or governments. In one decade alone, India lifted over 270 million people out of poverty.

At a time when democracy is under threat in so many parts of the world, this history, in my view, reminds us of the value of democratic institutions.

Twitter Feed

Live Traffic Feed

Sponsored Links

South Asia Investor Review

Investor Information Blog

Haq's Musings

Riaz Haq's Current Affairs Blog

Please Bookmark This Page!

Blog Posts

Can Pakistan's JF-17 Become Developing World's Most Widely Deployed Fighter Jet?

Worldwide demand for the JF-17 fighter jet, jointly developed by Pakistan Aeronautical Complex (PAC) and China’s Chengdu Aircraft Industry Group (CAIG), is surging. It is attracting buyers in Africa, Asia and the Middle East. At just $40 million a piece, it is a combat-proven flying machine with no western political strings attached. It has enormous potential as the lowest-cost 4.5…

ContinuePosted by Riaz Haq on February 4, 2026 at 8:00pm

EU-India Trade Deal: "Uncapped" Mass Migration of Indians?

The European Union (EU) and India have recently agreed to a trade deal which includes an MOU to allow “an uncapped mobility for Indian students”, according to officials, allowing Indians greater ease to travel, study and work across EU states. India's largest and most valuable export to the world is its people who last year sent $135 billion in remittances to their home country. Going by the numbers, the Indian economy is a tiny fraction of the European Union economy. Indians make up 17.8%…

ContinuePosted by Riaz Haq on January 28, 2026 at 11:00am — 10 Comments

© 2026 Created by Riaz Haq.

Powered by

![]()

You need to be a member of PakAlumni Worldwide: The Global Social Network to add comments!

Join PakAlumni Worldwide: The Global Social Network