PakAlumni Worldwide: The Global Social Network

The Global Social Network

Pakistan Economy "Not in a Good Place"? Atif Mian's Gloom Justified?

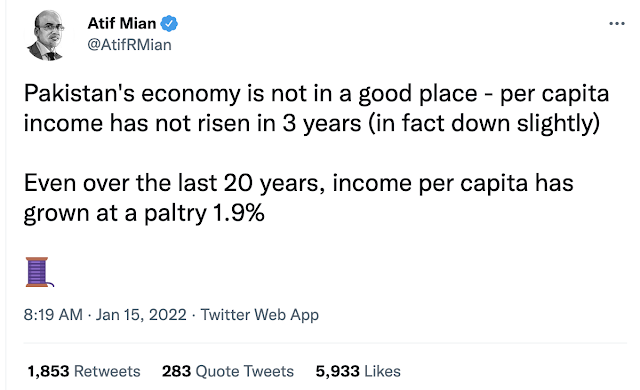

Pakistani-American economist Atif Mian has recently analyzed Pakistan's economy in a series of tweets. He has said "Pakistan's economy is not in a good place", adding that the nation's "per capita income has not risen in 3 years (in fact down slightly)". He has particularly mentioned the country's "exaggerated external demand driven by its rentier economy", "flawed energy policy" and "a broken economic decision system" among the main causes for poor economic performance. Is Atif Mian's diagnosis correct? Is the official reported data Atif Mian using accurate? What is the current PTI government doing or not doing to correct the problems identified by Mr. Mian? Let's try and assess the situation.

|

| Economist Atif Mian's Tweet on Pakistan Economy |

Per Capita Income:

Pakistan's officially reported GDP and per capita incomes are grossly understated. These are based on the last economic census that was done from April 2003 to December 2003 and published in 2005. The last agriculture census was in 2010, and livestock census in 2006, according to Dr. Ishrat Husain, former governor of The State Bank of Pakistan. The country's economy has changed significantly since then, adding several new economic activities while others have become less important. For example, the Quantum Index of Large Scale Manufacturing (QIM) with 2005-06 base year gives a weight to textiles of 20.9% (Yarn 13.7 and cloth 7.2). But the textile industry has moved up to higher value added products as reflected in its exports. The value added textiles (non-yarn and non-cloth) now make almost 80% of the total textile exports. These changes are not reflected in current GDP calculations.

In its 2014 annual report, the State Bank of Pakistan talked about a number of new sectors that are either under-reported or not covered at all: "In terms of LSM growth, a number of sectors that are showing strong performance; (for example, fast moving consumer goods (FMCG) sector; plastic products; buses and trucks; and even textiles), are either under reported, or not even covered. The omission of such important sectors from official data coverage, probably explains the apparent disconnect between overall economic activity in the country and the hard numbers in LSM."

Bangladesh just rebased its GDP in 2020-21 to 2015-16. This has boosted its per capita income by double digits for every year since 2015-16. Bangladesh's per capita income for the 2015-16 fiscal year has now gone up to $1,737 from $1,465 in the old calculation. For the 2019-2020 fiscal, the per capita income has gone up to $2,335 from $2,024. The new GDP estimate covers 21 sectors, up from 15 sectors previously. India last rebased its GDP in 2015, a change that bumped up its per capita GDP by double digits. Nigeria's last rebasing in 2012 increased the size of its economy (GDP) by nearly 90%. Pakistan's current base year is 2005-6. Rebasing which is now long overdue will almost certainly increase Pakistan's per capita income by double digits.

In this age of big data, it is important for Pakistan to ensure that its bureaucracy at Pakistan Bureau of Statistics (PBS) keeps the national economic data as current as possible. PBS should release the results of the Census of Manufacturing Industries CMI 2015-16 and the finance ministry should rebase Pakistan's economy to year 2015-16 to better reflect the current economic realities. This data is extremely important for businesses, investors, lenders and policymakers.

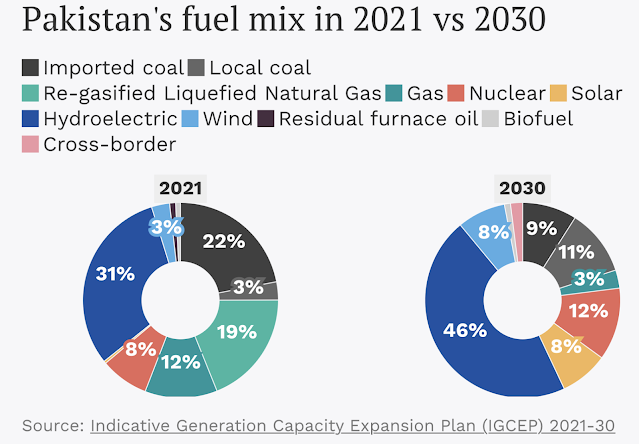

Energy Mix:

|

| Pakistan Power Generation Fuel Mix. Source: Third Pole |

Hydroelectric dams contributed 37,689 GWH of electricity or 27.6% of the total power generated, making hydropower the biggest contributor to power generated in the country. It is followed by coal (20%), LNG (19%) and nuclear (11.4%).

|

| Cost Per Unit of Electricity in Pakistan. Source: Arif Habib |

Nuclear offers the lowest cost of fuel for electricity (one rupee per KWH) while furnace oil is the most expensive (Rs. 22.2 per KWH).

|

| Pakistan Exports Trend 2011-21. Courtesy of Ali Khizer |

|

| Pakistan Textile Exports Trend 2011-21. Courtesy of Ali Khizer |

|

|

|

|

| Pakistan's Current Account Balance vs International Oil Prices. Sou... |

Recent history shows that Pakistan's current account deficits vary with international oil prices. Pakistan's trade deficits balloon with rising imported energy prices. One of the keys to managing external account balances lies in reducing the country's dependence on foreign oil and gas.

Related Links:

Haq's Musings

South Asia Investor Review

Pakistan Among World's Largest Food Producers

Food in Pakistan 2nd Cheapest in the World

Indian Economy Grew Just 0.2% Annually in Last Two Years

Pakistan to Become World's 6th Largest Cement Producer by 2030

Has Bangladesh Surged Past India and Pakistan in Per Capita Income?

Pakistan's Computer Services Exports Jump 26% Amid COVID19 Lockdown

Coronavirus, Lives and Livelihoods in Pakistan

Vast Majority of Pakistanis Support Imran Khan's Handling of Covid1...

Pakistani-American Woman Featured in Netflix Documentary "Pandemic"

Incomes of Poorest Pakistanis Growing Faster Than Their Richest Cou...

Can Pakistan Effectively Respond to Coronavirus Outbreak?

How Grim is Pakistan's Social Sector Progress?

Double Digit Growth in Pakistan's Energy Consumption Confirms Econo...

Trump Picks Muslim-American to Lead Vaccine Effort

COVID Lockdown Decimates India's Middle Class

Pakistan to be World's 7th Largest Consumer Market by 2030

Pakistan's Balance of Payments Crisis

How Has India Built Large Forex Reserves Despite Perennial Trade De...

Conspiracy Theories About Pakistan Elections"

PTI Triumphs Over Corrupt Dynastic Political Parties

Strikingly Similar Narratives of Donald Trump and Nawaz Sharif

Nawaz Sharif's Report Card

Riaz Haq's Youtube Channel

-

Comment by Riaz Haq on January 24, 2022 at 8:06am

-

Pakistan to burn more domestic coal despite climate pledge

Islamabad expands use of lignite to ease burden of expensive imported fuel

https://asia.nikkei.com/Spotlight/Environment/Climate-Change/Pakist...

Work on the third phase of the Thar Coal Block II mine expansion is set to begin this year at an estimated cost of $93 million, according to the Sindh Engro Coal Mining Company (SECMC), a public-private enterprise operating the mine since 2019 in the southeastern district of Tharparkar. The second phase of expansion is underway with the help of China Machinery Engineering Corp. and Chinese bank loans, in addition to local financing. The series of expansions will scale up the annual production of lignite from 3.8 million tons to 12.2 million tons by 2023.

The output from the second phase of expansion will feed two 330 MW coal-fired power plants being built under the $50 billion China Pakistan Economic Corridor projects, part of Chinese President Xi Jinping's flagship Belt and Road Initiative. The power plants are expected to come on line this year.

Lignite is brown coal with low calorific value due to high moisture and low carbon content.

The expansion of the Thar coalfields is aimed at curbing coal imports to ease a staggering current-account deficit made worse by soaring international commodity prices and shipping costs. Pakistan's current-account deficit ballooned to an unprecedented $9.09 billion between July and December last year, as imports continued to outstrip exports during the post-COVID economic recovery. Pakistan had to seek a $3 billion loan and a deferred payment facility on the import of petroleum products from Saudi Arabia last year to stabilize forex reserves.

In recent years, high volatility in international oil prices, soaring LNG prices and dwindling local gas reserves have spurred public-private spending, particularly Chinese investment, in Pakistan's coal power sector. Until now, four coal-fired power plants with 4.62 GW of total installed capacity have joined the grid, while another three plants with an aggregate capacity of 1.98 GW are expected to come online over the next two years -- all under CPEC. In addition, growing demand from cement factories banking on a global construction boom has tripled coal consumption over the last five years to 21.5 million tons per annum.

Consequently, the share of coal in Pakistan's import bill for the year ended June 2021 shot to 24% from over 2% in previous years, according to data from the Pakistan Bureau of Statistics. Currently, only the power plant at Thar Coal Block II is running on indigenous coal.

A spike in coal power generation is in line with global trends, where countries including China, the U.S. and India have turned to coal to meet heightened demand following the lifting of COVID-19 restrictions.

------------

Authorities contend that the expansion of Thar Coal Block II will reduce the price of indigenous coal from $60 to $27 per ton -- making it the country's cheapest power source and leading to annual savings of $420 million. Pakistan is currently importing coal at around $200 per ton.

"We are compelled to use this cheap source of energy because we cannot keep using dollars to run power plants running on expensive furnace oil and RLNG (re-gasified liquefied natural gas)," Sindh Provincial Energy Minister Imtiaz Shaikh told Nikkei Asia. "We would like to mix 20% Thar coal [in power plants running] with imported coal. Then we will move towards converting coal to liquid and coal to gas."

The cost of operating thermal plants has become punishing due to expensive fuel and the cost of diverting scarce freshwater, which leads to underutilization of the plants, said Omar Cheema, director of London-based renewable energy consultancy Vivantive.

-

Comment by Riaz Haq on January 26, 2022 at 9:26am

-

While jumping 29 percent to $251 million in December, IT exports surged 36 percent to $1.3 billion in the first half of this fiscal year, mostly riding a massive stream of investment pouring into Pakistan’s technology sector, data showed on Saturday.

https://www.thenews.com.pk/print/927335-it-exports-surge-36pc-in-fi...

Technology exports amounted to $667 million in the second quarter. Pakistan’s total IT exports stood at $1.44 billion in FY2020, which increased to $2.1 billion in FY2021.

According to Khurram Schehzad, CEO of Alpha Beta Core, this growth will gather more momentum down the line.

“Increased investment in the startup ecosystem is helping Pakistan develop technology infrastructure, which will in turn increase IT exports growth,” Schehzad said.

However, the recent increase in foreign investments in Pakistan, especially in tech based startups doesn’t reflect in the IT exports.

But Schehzad says it has been helping develop technology infrastructure and increase job opportunities in tech-based companies, which will eventually help increase IT exports further.

“I see IT exports recording a historic high of $2.8 billion to $3 billion in the fiscal year 2022,” an IT sector analyst said.

“But it depends on if the government is willing to incentivise the sector.”

He said the government also needed to establish tech zones to help the sector grow more.

He said around 15,000 IT companies were being established and hiring fresh employees, adding, expansion of the technology sector would subsequently fuel IT exports growth.

Wajid Rizvi, Head of Strategy and Economy at JS Global, expects IT exports to grow to $2.6 billion by the end of FY2022.

“The market-based exchange rate and devaluation of rupee has also enhanced the potential of technology sector exports as the companies/individuals associated with the sector receive their payments mostly in dollars,” Rizvi said.

He added that Pakistan was a net exporter of IT services and the sector had a great potential to grow, evident from a rising trend of software and other IT exports.

-

Comment by Riaz Haq on January 31, 2022 at 7:39am

-

@haqsmusings

·

13h

Unfortunately,

@AtifRMian

only sees #Pakistan’s glass half empty. He refuses to even acknowledge the country’s progress on growing #export & change in #energy mix to lower imports.He ignores transitory high #energy prices causing current account deficits. https://southasiainvestor.com/2022/01/pakistan-economy-not-in-good-...

Omer Zeshan Khan

@OmerZeshanKhan

·

8h

Export growth is low end and for limited time (a bonus). Previous Govt did a few things for localisation (car/mobile/edible oil). Haven’t seen these guys doing anything. They are just sitting and talking. Pakistan’s economy is robust enough to feed people while Govt waits.

Omer Zeshan Khan

@OmerZeshanKhan

·

·

Riaz Haq

@haqsmusings

·

3h

#ImranKhan’s #NayaPakistan housing program is a good idea, especially the incentives for small & medium mortgages for the lower middle class. It’s boosting #employment in #Construction & #manufacturing sectors as well as the housing stock http://riazhaq.com/2020/07/naya-pakistan-low-cost-home-loans-and.html

Omer Zeshan Khan

@OmerZeshanKhan

·

2h

Can you name one project under Naya Pakistan Housing?

Riaz Haq

@haqsmusings

Replying to

@OmerZeshanKhan

@Muslims4USA

and

@AtifRMian

#Housing #Mortgage financing in #Pakistan jumped 85% last year, according to the State Bank. “Financing under MPMG picked up momentum in 2021 as approvals for financing by banks grew from near zero to Rs117 billion in 2021”

https://twitter.com/haqsmusings/status/1488166329769070596?s=20&...

https://www.thenews.com.pk/amp/923033-banks-disburse-rs355bln-housi...

KARACHI: Credit to the housing and construction sector increased by record Rs163 billion or 85 percent in 2021, mainly driven by the central bank’s rules to encourage mortgages and incentives and penalties for lenders with respect to achieving or failing housing finance targets.

Banks disbursed Rs355 billion housing loans in 2021, compared with Rs192 billion in the previous year, the State Bank of Pakistan said in a statement on Thursday.

Disbursement of low-cost housing loans under the Government Markup Subsidy scheme, also known as Mera Pakistan Mera Ghar (MPMG), reached Rs38 billion last year. In December, banks extended Rs9.3 billion loans to the borrowers; highest monthly disbursement since January 2021.

Analysts said tighter monetary conditions usually affect mortgages as the SBP has jacked up interest rates by 275 basis points in three moves since September. Currently, the policy rate hovers at 9.75 percent.

However, the government’s mark-up subsidy scheme looks to remain protected from an upward move in interest rates as the government is providing subsidy to the mortgage clients for the first 10 years.

Habib Bank, Meezan Bank and Bank Al Habib were the top three contributors, said the SBP.

Banks also made significant progress in the provision of financing under MPMG scheme, introduced in 2020, it added.

“Financing under MPMG picked up momentum in 2021 as approvals for financing by banks grew from near zero to Rs117 billion in 2021. The banks have received requests of financing of Rs276 billion from potential customers, which indicates that approvals and disbursements will keep growing in coming months.”

Bank Alfalah emerged as the leading bank with highest disbursement of Rs3.3 billion followed by nine banks with disbursements of over Rs2 billion each. These include Meezan Bank, Bank Islami, National Bank, Standard Chartered Bank, HBFCL, United Bank, MCB Bank, Bank of Punjab and Habib Bank, said the statement.

Financing for housing and construction and particularly under MPMG witnessed impressive growth on the back of many enabling regulatory environments introduced after extensive consultation with stakeholders, the SBP noted.

Further, the SBP said it advised the banks to increase their housing and construction finance portfolios to at least 5 percent of their domestic private sector advances till December 2021, introducing a set of incentives and penalties to ensure compliance.

-

Comment by Riaz Haq on January 31, 2022 at 8:06pm

-

#Pakistan begins extracting #coal from a 2nd major #mine in #Thar, #Sindh. Block 1 mine has lignite coal deposits of over 3 billion tons (5 billions barrels of crude oil) with an annual output of 7.8 million tons to generate 1320 MW #electricity. #energy https://www.dawn.com/news/1672580

Sino-Sindh Resources Ltd (SSRL) said on Monday it successfully extracted the first shovel of lignite coal at Block 1 of the Thar coalfields near Islamkot Town of Tharparkar, Sindh.

Block 1 boasts lignite coal deposits of over three billion tonnes (equivalent to over 5bn barrels of crude oil) with an annual output of 7.8 million tonnes.

SSRL, whose majority shareholder is Shanghai Electric Group, was granted a mining lease on May 24, 2012, and the project was included in the Joint Energy Working Group by the governments of Pakistan and China.

As soon as the two governments officially announced the China-Pakistan Economic Corridor, the Thar coal project was included in it as an early-harvest project.

---------

After back-to-back meetings between SSRL and the Energy Department of the government of Sindh, the first excavation took place on Jan 23, 2019, for the development of the largest open-pit coal mine in Block 1.

According to the Thar Coal Energy Board, SSRL and Shanghai Electric Group have already signed a coal supply agreement for power generation through two mine-mouth power plants of 660 megawatt each.

Financial close of the project was achieved on Dec 31, 2019. Soon after the first excavation, the SSRL management started importing mining equipment from China and by July 2020 all the required equipment was at the project site.

Speaking to Dawn, Ministry of Energy spokesperson Muzzammil Aslam said both majority (Shanghai Electric Group) and minority (SSRL) investors in Block 1 are Chinese. Unlike Block 2 where the Sindh government owns a stake of 54.7 per cent, Block I has no direct shareholding by the provincial government, he said.

“Shanghai Electric’s power plant will achieve financial close within this year. It’s a big development because the 1,320MW plant will run on indigenous fuel and produce affordable electricity,” Mr Aslam added.

SSRL officials said the development of the indigenous resource base at Thar will help Pakistan achieve its long-cherished goal of energy security and economic sovereignty.

-

Comment by Riaz Haq on February 1, 2022 at 10:34pm

-

Arif Habib Limited

@ArifHabibLtd

Oil marketing industry sales surged by 18.9% YoY during Jan’22 to 1.80mn tons (7MFY22: 12.91mn tons, +14.5% YoY).

https://twitter.com/ArifHabibLtd/status/1488511560565854222?s=20&am...

-------------

https://tribune.com.pk/story/2341510/oil-sales-surge-20-to-18m-tons...

KARACHI:

The demand for petroleum oil products remained robust despite the uptrend in prices, as wheat harvesting, power generation through oil-fired plants and building of domestic reserves in anticipation of a further hike in international prices generated strong demand in January.

Besides, healthy industrial activities and growing car numbers on roads also contributed to the rising momentum in sales of petroleum products. Overall oil sales surged almost 20% to 1.8 million tons in January 2022 compared to 1.51 million tons in the previous month of December 2021, Arif Habib Limited (AHL) reported on Tuesday. “(High-speed) diesel had a major increase in demand among petroleum products in the wake of wheat harvesting in the country,” AHL Head of Research Tahir Abbas said while talking to The Express Tribune.

Secondly, three major power plants, located in Punjab, ran on diesel due to the widening gas shortfall during winter months. Besides, some other plants ran on furnace oil and its demand picked up as well. Thirdly, oil marketing companies (OMCs) and their dealers (petrol pumps) built inventories during the month in anticipation of a hike in prices of petroleum products in the global as well as domestic markets.

The building of reserves was aimed at making additional profits on likely increase in prices in the domestic market with effect from February 1, 2022. The government, however, decided to keep oil prices unchanged, which “had earlier been expected to increase by Rs12-15 per litre,” he said. The demand for petrol also remained robust in the backdrop of a significant growth in sales of cars and SUVs.

Car sales slowed down, but still remained significant despite the fact that the government took measures to cut imports of luxury cars and restricted bank financing for cars to control the current account deficit (CAD). Sales of diesel increased 20% to 0.74 million tons in January compared to 0.62 million tons in December.

Sales of petrol rose 6.2% to 0.74 million tons in the month under review compared to 0.70 million tons in the previous month. Sales of furnace oil surged 103% to 0.26 million tons in January compared to 0.13 million tons in December 2021. Cumulatively, in the first seven months (July-January) of the current fiscal year 2021- 22, oil sales increased 14.5% to 12.91 million tons compared to 11.27 million tons in the same period of previous year. The growth in demand is mostly seasonal given that wheat harvesting takes place

-

Comment by Riaz Haq on February 2, 2022 at 4:28pm

-

#Pakistan to end reliance on #IMF by boosting #exports, cutting #deficits & tapping #capital markets. #Textile exports are poised to surge 40% to a record $21 billion this year & further to $26 billion next year. Pak also incentivizing #tech exports boom.

https://www.bloomberg.com/news/articles/2022-02-02/pakistan-seeks-t...

Pakistan, which has sought almost 20 bailouts from the International Monetary Fund over half a century, wants to end its reliance on the multilateral lender by shrinking its deficits and tapping the capital markets.

Finance Minister Shaukat Tarin, who has negotiated the last leg of a current $6 billion IMF loan, plans to raise $1 billion via an ESG-compliant Eurobond in March after issuing a similar amount of Sukuk last week. He also targets to shrink the budget shortfall to 5%-5.25% of gross domestic product in the year starting July 1 from 6.1% the previous period and spur growth to 6% from 5%.

“I think this program should be enough,” Tarin, 68, said in an interview in Islamabad. “If we start generating 5%-6% balanced growth, which means sustainable growth, then I don’t think we need another IMF program.”

Prime Minister Imran Khan has been a vocal critic of IMF bailouts, saying “the begging bowl needed to be broken” if Pakistan must command respect in the world. He joins nations, including South Asian peer Sri Lanka, that prefer to maneuver with bilateral loans or commercial borrowings rather than adopt the austerity that accompanies an IMF agreement.

The first part of Tarin’s plan to halt Pakistan’s boom-bust cycle involves boosting exports. The central bank offered cheap loans to manufacturers and energy tariffs were brought in line with the region. Textile shipments -- more than half of total exports -- are poised to surge 40% to a record $21 billion in the year through June and further to $26 billion next year, according to Khan’s commerce adviser.

Pakistan also plans to extend similar incentives to the technology sector as it seeks to ride a wave of global venture-capital interest in startups. The policies could be unveiled in about a month, Tarin said.

Tarin was appointed in April 2021 and has since renegotiated some of the IMF’s financial conditions, including a smaller increase in utility prices and lower mop up in taxes than the lender had earlier insisted on.

He has adopted some of the structural conditions, which include increasing autonomy for the central bank and putting an end to deficit monetization. Like predecessors, he hasn’t been able to significantly broaden Pakistan’s tax base or sell loss-making state-run firms.

Previous governments accepted IMF conditions in the short term and, when the program ends, policy makers revert to profligate spending, Tarin said. Instead, he vowed to “control our expenses” in the upcoming budget.

“We are trying to now take those steps, which are going to put this economy on an inclusive and sustainable growth path,” said Tarin. “Once it gathers momentum and is sustainable, then I think we will probably see 20-30 years of growth.”

-

Comment by Riaz Haq on February 3, 2022 at 5:25pm

-

A British investor group CDC & Gul Ahmed Metro (GAM) group JV to add 500MW of #renewable power in #Pakistan with significant minority stake in Metro #Wind Power. CDC and GAM are also co-investors in Zephyr Power Limited, an operating 50MW #windfarm. https://www.cdcgroup.com/en/news-insight/news/were-partnering-with-...

The Metro-BII Renewables joint venture aims to add 500 megawatts (MW) low-cost renewable power to Pakistan in the medium term, increasing jobs and expanding economic opportunities

The joint venture will mitigate Pakistan’s carbon emissions, cutting 728,000 tonnes of carbon dioxide per year for the planet

Investment aligns with CDC’s ambition to invest over £3 billion of climate finance over the next five years

CDC Group (soon to become British International Investment – BII) and Gul Ahmed Metro Group (GAM), are today announcing their partnership to form the Metro-BII Renewables joint venture. The new joint venture builds on the existing partnership between the UK’s development finance institution and GAM, a Pakistani family-owned business with expertise in Pakistan’s power sector, and it will aim to develop and operate up to 500MW of renewable energy assets in Pakistan.

Metro-BII Renewables aims to add up to 500 Megawatts (MW) of primarily greenfield low-cost renewable power to Pakistan’s grid over the medium term, and has a current generation capacity of 110MW. The JV will boost clean power generation, providing electricity to over 850, 000 consumers in Pakistan. Moreover, up to 17,000 jobs will be supported across the country, as a result of the increased power capacity. In addition, Metro-BII Renewables will help the country decarbonise as the joint venture’s target capacity size will help avoid an estimated 728, 000 tonnes of carbon dioxide per year, for the planet.

This new joint venture will strengthen collaboration between CDC, which will be renamed British International Investment (BII) in April, and GAM and foster knowledge sharing from both firms’ experience within the local and regional power sector.

Under the terms of the joint venture, CDC will acquire a significant minority stake in Metro Wind Power Limited (MWPL), an under-construction 60MW windfarm project, developed by GAM, the acquisition remains subject to lender and regulatory approval. CDC and GAM are also co-investors in Zephyr Power Limited, an operating 50MW windfarm.

CDC’s capital will provide much-needed equity finance that will support the development of a clean energy platform that is bespoke to Pakistan’s needs, helping to scale power capacity in the country. The deepened partnership will help accelerate greater investments into the renewable power sector in Pakistan. This partnership further underlines CDC’s focus on the renewable sector in Pakistan, where CDC has made over US $160 million in equity and debt investments, over the past five years.

-

Comment by Riaz Haq on February 4, 2022 at 7:28am

-

#CPEC II: #Pakistan, #China ink industrial cooperation agreement in #Beijing. It will increase labor #productivity, enhance #industrial competitiveness, grow exports, sustain diversification in #exports basket. #economy #Beijing2022

https://www.app.com.pk/global/pakistan-china-ink-framework-agreemen... via @appcsocialmedia

ISLAMABAD/BEIJING (China), Feb 4 (APP): Pakistan and China on Friday inked the Framework Agreement on Industrial Cooperation under China Pakistan Economic Corridor (CPEC).

The prime minister arrived in Beijing on Thursday to attend the opening ceremony of Winter Olympics and meet the Chinese leadership.

State Minister and Chairman BoI Muhammad Azfar Ahsan and Chairman National Development & Reform Commission (NRDC) He Lifeng signed the accord.

The objective of the Joint Working Group (JWG) on Industrial Cooperation is to attract Foreign Direct Investment (FDI), promote industrialization and development of economic zones, and initiate, plan, execute, and monitor projects, both in public as well as private sector.

The engagement with China under JWG is envisaged to increase labour productivity in Pakistan, enhance industrial competitiveness, increase exports, and sustain diversification in exports basket.

During the 8th Joint Cooperation Committee (JCC) meeting of CPEC held in 2018, both sides had signed a Memorandum of Understanding that formed the basis for future engagements between the parties under the ambit of Industrial Cooperation.

As CPEC entered its second phase which primarily revolves around Special Economic Zones (SEZs) development and industrialization, the need for a comprehensive Framework Agreement became imperative.

Similar agreements have also been signed for Early Harvest CPEC Projects on energy and infrastructure.

With continuous efforts of BOI, both sides reached the consensus to elevate the existing MoU into a Framework Agreement in 2020.

After extensive stakeholder consultations and with the approval of the Prime Minister, BOI shared the Draft Framework with NDRC in November 2020, which has been formulated keeping in consideration the needs of CPEC Phase II.

The signing ceremony of the framework agreement is a significant outcome of the prime minister’s visit and a top agenda from the Chinese side as a testimony to their interest in CPEC.

-

Comment by Riaz Haq on February 7, 2022 at 12:57pm

-

Narratives Magazine

@NarrativesM

Veteran economist Dr. #SalmanShah challenges the perceptions that #PakistanEconomy has gone from bad to worse under the #PTIGovt, arguing that after many tough decisions, it is now on the road to recovery. #NarrativesMagazine

https://twitter.com/NarrativesM/status/1490710786204999688?s=20&...

On the Road to Recovery

Dr. Salman Shah

https://narratives.com.pk/thinktank/on-the-road-to-recovery/

For the record, it is instructive to note that within a few months after the ending of the last programme in September 2016, the IMF was sounding the alarm bells and cautioning the government to take actions to stop the rapid deterioration in critical economic indicators. These warnings were clearly reflected in the July 2017, Article IV, IMF consultation report that inter-alia included the following critical observations:

Exhorted the PML-N government to safeguard the macroeconomic gains of the completed programme through continued implementation of sound policies, and to continue with structural reforms to achieve higher and more inclusive growth.

Warned that foreign exchange reserves have declined since the end of the EFF-supported programme and remain below comfortable levels.

Cautioned that on the structural front, progress in electricity sector reforms has been mixed, with a renewed build-up in circular debt.

Pointed out that massive financial losses of ailing public sector enterprises (PSEs) have continued.

------------------

The banking sector under the leadership of the State Bank of Pakistan is opening up inclusive financing in new areas such as mortgage finance, agriculture finance and SME finance. The State Bank of Pakistan’s Roshan Digital Accounts are facilitating investment by overseas Pakistanis in a big way. The FDI is expected to jump manifold due to launch of phase-II of the CPEC; Chinese corporate sector investment is expected to boom. The board of Investment has been tasked to populate SEZs at a rapid pace. All impediments in the way of the FDI are being proactively reduced.

By the grace of God, Pakistan is now on the road to recovery and growth. The issuance of a global Sukuk Bonds within days of the revival of the IMF programme was well received in the international markets. Heavily oversubscribed, it is already trading at a premium. This indicates the confidence of the international financial markets in the emerging story of Pakistan; its potential and the commitment of its leadership to reform. Barring another black swan event or further escalation of global oil prices, Pakistan’s best days are here to stay. The beginnings of the long-awaited investment surge is taking shape, the stock market is poised to see the return of the foreign portfolio investor, successful completion of a few large ticket privatization transactions will catalyze direct foreign investment towards new highs. For the first time in 40 years we are enjoying relative peace on the borders and peace within. If we are able to persistently build on this momentum, the sixth largest and most youthful country in the world can rapidly progress on the road of development, lift its masses out of poverty and enable it to join the ranks of the prosperous.

-

Comment by Riaz Haq on February 13, 2022 at 6:45pm

-

At just 30%, #Pakistan has among world's lowest #trade-to-#GDP ratios, leaving lots of room for growth. Most of its export are textiles Pak #exports are relatively more diversified compared to #Bangladesh and #Cambodia, but less diversified than #India's https://www.adb.org/sites/default/files/publication/768386/pakistan...

https://twitter.com/haqsmusings/status/1493052397496594432?s=20&...

https://www.dawn.com/news/1674830

Pakistan exhibits one of the lowest trade-to-GDP ratios in the world showing at just 30 per cent. However, it is not all doom and gloom and the country has a lot of room for improvement, according to the Asian Development Bank (ADB).

One viable strategy that Pakistan can adopt to boost its growth is to further open its economy to trade. At just 30pc, Pakistan exhibits one of the lowest trade-to-GDP ratios in the world, even when taking its size into account, the ADB says in its report titled ‘Pakistan’s Economy and Trade in the Age of Global Value Chains’.

This indicates great potential for improvement. Studies have affirmed numerous benefits to economic openness, including opportunities for specialisation, access to wider markets, the inflow of know-how, and the formalisation of the economy.

Existing patterns indicate that Pakistan’s trade is currently oriented to the United States, Europe, and China. It specialises in textiles, though some of its agricultural products are sold to the Middle East. Interestingly, it does not have a significant trading relationship with its proximate neighbours in South Asia. The only economy for which it is a major market is its northern neighbour Afghanistan, the report points out.

While the vast majority of its export products fall under the textiles grouping, formal measures of export concentration suggest that Pakistan’s exports basket is relatively more diversified, especially compared with other major textile exporters like Bangladesh and Cambodia. However, its exports are less diversified than India.

The report used statistics from 2019 since 2020 was an unusual year [owing to Covid-19] portraying a snapshot of economic openness across various levels of GDP for 166 countries and economies with available data, and for economic openness of Pakistan, it says it is less open than India and Bangladesh. It is only more open than Ethiopia, Brazil and Sudan.

The ADB says Pakistan is a relatively large country, however its trade openness remains remarkably low. Citing example, it says countries that have GDPs comparable to that of Pakistan but with much higher trade-to-GDP include the Philippines, the Netherlands, and Viet Nam. India’s GDP is almost 10 times larger than Pakistan’s, yet trade plays a greater role in its economy, according to the report.

Pakistan has historically experienced uneven growth and remains among the least open economies in the world, even after taking its relatively large size into account.

What it does export is dominated by textile products and rice, though a formal measure of concentration suggests that its exports basket is on the whole quite diversified.

The dominance of textile products in Pakistan’s exports raises the issue of diversification — or potentially the lack of it. Concentrating too much on only a few sectors or products poses risks to an economy since shocks to the dominant sector can more easily cause an economy-wide recession.

Pakistan can adopt to boost its growth to further open its economy to trade. Benefits to economic openness include opportunities for specialisation, access to wider markets, and the inflow of investments, technology, and know-how. There is also evidence that trade promotes the reallocation of labour from the informal to the formal sector.

Twitter Feed

Live Traffic Feed

Sponsored Links

South Asia Investor Review

Investor Information Blog

Haq's Musings

Riaz Haq's Current Affairs Blog

Please Bookmark This Page!

Blog Posts

India-Israel Axis Threatens Peace in South Asia

The bonhomie between Israeli Prime Minister Netanyahu, an indicted war criminal, and Indian Prime Minister Narendra Modi, accused of killing thousands of Muslims, was on full display this week in Israel. Both leaders committed to supporting the Afghan Taliban regime which is accused of facilitating cross-border terrorist attacks by the TTP in Pakistan. Mr. Modi was warmly welcomed by…

ContinuePosted by Riaz Haq on February 27, 2026 at 10:45am — 2 Comments

Modi's AI Spectacle: Chaos and Deception in New Delhi

The India AI Impact Summit 2026, held at Bharat Mandapam in New Delhi, has been marred by chaos, confusion and deception. The events on the ground have produced unintended media headlines for India's Prime Minister Narendra Modi who wants to be seen as the "vishwaguru" (teacher of the world) in the field of artificial intelligence as well. First, there was massive chaos on the opening day, with long…

ContinuePosted by Riaz Haq on February 19, 2026 at 12:00pm — 14 Comments

© 2026 Created by Riaz Haq.

Powered by

![]()

You need to be a member of PakAlumni Worldwide: The Global Social Network to add comments!

Join PakAlumni Worldwide: The Global Social Network