PakAlumni Worldwide: The Global Social Network

The Global Social Network

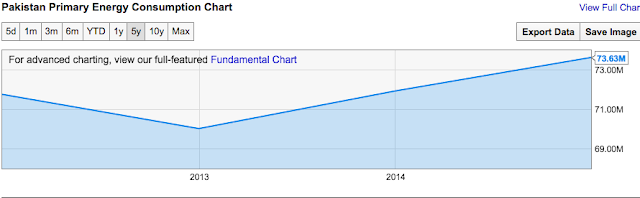

Pakistan Experiencing Strong Growth in Energy Consumption

Pakistan's energy consumption grew by 5.7% in 2015, faster than the 5.2% increase in neighboring India that claims significantly faster GDP growth. Primary energy consumption growth in a country is often seen as a strong indicator of its GDP growth. Ever since the advent of the industrial age, energy has become increasingly important as a driver of farms, factories, communication, transportation, construction, retail and other sectors of the economy. In addition to energy, other important economic indicators include cement and steel consumption, auto sales and air travel which are also growing significantly faster in Pakistan than in India.

Pakistan Primary Energy Consumption Trend (Source: British Petroleum) |

Primary Energy Consumption:

According to British Petroleum Statistical Review of World Energy released in June 2016, the primary energy consumption in Pakistan rose to 78.2 million ton oil equivalent (MTOE) in 2015, compared with 73.2 MTOE in 2014 confirming greater economic activity. It was the third fastest growth in energy consumption in Asia. Only the Philippines (9.7%), Vietnam (9.6%) and Bangladesh (8.7%) saw faster growth than Pakistan's.

Domestic Cement Demand:

All-Pakistan Cement Manufacturers’ Association reported cement industry sold 33 million tons in domestic market in fiscal year 2015-16, posting a robust growth of 17.01 per cent compared to the 28.2 million tons sales during the same period in 2015.

Local Auto Production:

Domestic auto production in Pakistan jumped by 21.57 percent (vs 2.58% growth in India) in fiscal 2016 compared to fiscal 2015, according to data from Pakistan Automobile Manufacturers Association. The data collected by Pakistan Bureau of Statistics (PBS) noted that as many as 168,363 jeeps and cars were manufactured during July-May (2015-16) while 138,490 units were produced last year(July-May 2014-15).

Rising Steel Demand:

Pakistan is experiencing 30% growth in steel imports, according to the State Bank of Pakistan. Local steel production is about 6 million tons. In addition, Pakistani imports of steel this year could surpass $2 billion as China-Pakistan Economic Corridor CPEC-related projects ramp up.

Air Travel Growth:

Pakistan air travel market is among the fastest growing in the world. IATA (International Air Transport Association) forecasts Pakistan domestic air travel will grow at least 9.5% per year, more than 2X faster than the world average annual growth rate of 4.1% over the next 20 years. The Indian and Brazilian domestic markets will grow at 6.9% and 5.4% respectively.

Pakistan saw 23% growth in airline passengers in 2015, according to Anna Aero publication. Several new airports began operations or expanded and each saw double digit growth in passengers. However, Gwadar Airport growth of 73% was the fastest of all airports in Pakistan.

The top 12 airports all saw large double digit increases. Multan grew 64%, Quetta 62% and Faisalabad +61% all climbing one place as a result of all of them seeing a growth of over 60%. Turbat Airport in Balochistan is the newest airport to reach the top 12 in terms of traffic.

Mobile Broadband Uptake:

Mobile broadband subscriptions have rocketed from zero to over 30 million in just two years since 3G/4G service rollout in Pakistan. Rapid growth is continuing with over 1 million new subscribers are signing up for 3G and 4G services every month. An equal or larger number of smartphones are are being sold.

Summary:

A whole series of indicators from auto and steel to manufacturing and construction and telecom services are confirming that economic growth is accelerating in Pakistan. Among the reasons for this growth are significantly improved security situation, political stability and soaring Chinese foreign direct investment (FDI) in CPEC related energy and infrastructure projects. These indicators are attracting investors who have already made Pakistan Stock Exchange the hottest shares market in Asia. KSE-100, Pakistan's main shares index, is up 18% year-to-date compared to 6% increase in India's BSE-30 index. The challenge for Pakistan is to continue to improve security and political stability to reassure investors of superior returns from their investments in the country.

Related Links:

Politcal Stability Returns to Pakistan

Auto and Cement Demand Growth in Pakistan

Pakistan's Red Hot Air Travel Market

China-Pakistan Economic Corridor FDI

-

Comment by Riaz Haq on September 14, 2016 at 7:18pm

-

Why #Pakistan's Stock Market Beats #China's And #India's via @forbes

http://www.forbes.com/sites/panosmourdoukoutas/2016/09/14/why-pakis...

Pakistan’s equity market has been outperforming China’s and India’s markets by a big margin in recent years. In the last twelve months, Global X MSCI MSCI +% Pakistan ETF was up 20%, beating India’s and China’s comparable ETF’s by almost two to one – see table.

That may come as a big surprise to some. Pakistan has been suffering all sorts of terrorist attacks, which makes it a very unstable country to put your money in. And it has been lagging behind both India and China in key macroeconomic metrics like GDP growth rates and unemployment—see table.

Index/Fund 12-month Performance 5-year Performance

Global X MSCI Pakistan (NYSE:PAK) 20% 400%*

IShares China (NYSE:FXI) 9.80% 16.00%

iShares S&P India 50 (NASDAQ:INDY) 12.77 % 33.0%

iShares MSCI Emerging Markets (NYSE:EEM) 5.38% 1.52%

*In local currency.

Source: Yahoo YHOO +0.98%. Finance and Karachi Exchange 9/5/2016

Pakistan’s, India’s and China’s Key Metrics

Country China India Pakistan

GDP $10866 billion 2074 billion $270 billion

GDP Growth yoy 6.7% 7.1% 4.24%

Unemployment 4.05% 4.9% 5.9%

Inflation Rate 1.3% 5.05% 3.56%

Capital flows -594 HML -$300 million -$1882 million

Government Debt to GDP 43.9% 67.2% 64.8%

What does the collective wisdom of markets see in Pakistan’s markets that others are missing?

A few things. First, terrorist attacks don’t usually affect financial markets, unless they are disruptive to trade, which hasn’t been the case in Pakistan. Second, Pakistan is a frontier rather than an emerging market, and therefore, favored by the numbers game. Third, its market reform efforts have been getting a couple of votes of confidence from overseas like $1 billion in support from the World Bank – and a couple of domestic acquisitions from foreign suitors like the acquisition of Karachi’s K-Karachi by Shanghai Electric Power Co. This has all been music to the ears of foreign investors.

-

Comment by Riaz Haq on October 6, 2016 at 4:52pm

-

September 2016 gasoline (petrol) sales reach 563,000 tons in #Pakistan with rising car & motorcycle sales

http://www.dawn.com/news/1287166/sept-oil-sales-reach-563000-tonnes

KARACHI: Sales of petrol during September 2016 were recorded at 563,000 tonnes below the highest ever sales of 566,274 tonnes recorded in May 2016.

Out of 563,000 tonnes, the share of imported petrol was 422,000 tonnes while local refineries supplied 145,000 tonnes, Oil Companies Advisory Council (OCAC) CEO M Ilyas Fazil said.

He attributed brisk sales of petrol to rising sales of cars — including imported ones which are mostly below 880cc — and other petrol driven vehicles.

He said a number of car owners had switched over to petrol from CNG due to gas load shedding. Higher generator imports are also putting pressure on the higher usage of petrol.

Mr Fazil said country’s stocks of petrol now stand at 220,000 tonnes which are enough to meet the demand for next 12 days. A Pakistan State Oil tanker is currently discharging petrol at Keamari, he added.

Mr Fazil said stock movement of petrol from Karachi to upcountry supply areas continues unabated and “the country remains well supplied.”

Pakistan has achieved highest ever import of 484,207 tonnes of motor gasoline in July 2016.

-

Comment by Riaz Haq on November 5, 2016 at 8:52am

-

#Renault #NISSAN to set up #automobile #manufacturing plant, create 10,000 jobs in #Karachi #Pakistan

http://www.brecorder.com/pakistan/industries-a-sectors/326569-renau...

The entry of the French automobile manufacturer Renault in the Pakistani market is being considered a good omen for the country’s automobile sector.

The entry of the world’s 10th largest automobile manufacturer, and the second largest automaker in France, would not only add fuel to the market competition but would also provide some 10,000 job opportunities in direct and indirect jobs for the Pakistanis, informed the Ghandhara Nissan Limited (GNL) to the Pakistan Stock Exchange (PSX).

"GNL is proud to join hands with Renault, one of the largest global automobile manufacturers and Al-Futtaim, UAE. The company will produce the vehicles at its existing assembly plant located at Port Qasim,” said Sheharyar Aslam, company secretary at GNL, reported local media.

The project will attract investment of around $100 million including approximately 60 percent foreign investment informed the company, calling the new auto policy “a move that will ensure an even playing field to new entrants,” added Aslam.

Previously, it was learnt that Renault is set to open its manufacturing plant by 2018, as it was announced by the government on Thursday. However, it remains to be seen how the European automaker would cope in the market dominated by Japanese titans i.e. Suzuki, Toyota and Honda.

-

Comment by Riaz Haq on November 17, 2016 at 8:09am

-

#Pakistan eyes doubling #oil product storage capacity from 20 days to 40 days - Oil | Platts News Article & Story http://www.platts.com/latest-news/oil/karachi/pakistan-eyes-doublin... …

Pakistan's government is aiming to double the country's oil product storage capacity by inviting foreign and local companies to build additional facilities, a Ministry of Petroleum official said Thursday.

The country's current storage capacity equates to around 20 days of consumption at 1.2 million-1.3 million mt, and oil marketing companies typically maintain stock levels below that to minimize inventory losses due to price volatility, the official said.

The government will both invite privately-owned domestic and foreign companies to build additional storage capacity and ask oil marketing companies to increase their storage volumes, he said.

"We will provide tax benefits and companies could acquire loans at lower interest rates to hasten the process of increasing the capacity," the official added.

Pakistan's motor gasoline consumption has increased sharply in the past two years as the economy gathers pace, he said.

Consumption averaged 557,000 mt/month over July-October, up from 365,000 mt in fiscal 2015-16 (July-June) and 311,000 mt in fiscal 2014-15.

Raising storage capacity was necessary given the sharp increase in the consumption of oil products in Pakistan, especially gasoline, said Zeeshan Afzal, director of research at Insight Securities.

It would also help meet any shortfall in supply or delay in seaborne cargo arrivals, he said.

Pakistan's gasoline consumption rose 17.5% year on year to 4.385 million mt in fiscal 2015-16, while high speed diesel consumption rose 2.6% to 6.223 million mt and furnace oil sales fell 250,000 mt to 8 million mt, Oil Companies Advisory Committee data showed.

-

Comment by Riaz Haq on December 8, 2016 at 9:45am

-

#SouthKorea's #Kia to start assembling #cars in #Pakistan: local partner | #automobiles #Karachi

http://www.foxbusiness.com/features/2016/12/08/south-korea-kia-to-s...

ISLAMABAD – South Korean carmaker Kia Motor Co <000270.KS> will start assembling cars in Pakistan, according to a local partner that is planning to invest 12 billion rupees ($115 million) to set up a plant and manufacture the Kia vehicles.

Karachi-listed Lucky Cement , which is part of the vast conglomerate Yunus Brothers Group, said in a statement on Thursday it planned to set up a new company to start "manufacturing, assembling" Kia vehicles.

It was not clear how much capital Kia itself would invest in the Pakistani venture. Representatives for the South Korean company could not immediately be reached for comment.

Kia cars had been assembled by Pakistan in the past but disappointing sales led to a halt in manufacturing.

The new venture will also market and sell, besides import and export of, "all types of Kia vehicles, parts and accessories," Lucky Cement told the Pakistan Stock Exchange in a statement.

Kia's re-entry into Pakistan will boost government efforts to shake up the Japanese-dominated car market and loosen the grip of Toyota <7203.T>, Honda <7267.T> and Suzuki <7269.T>, who assemble cars in Pakistan with local partners.

Last month, French carmaker Renault agreed to invest in a new factory in Pakistan and official say they are talking to several other carmakers.

The government believes increased competition should bring down exceptionally high car prices in Pakistan, and in March it introduced a new auto policy favoring new entrants into the market by offering generous import duties.

The incentives have angered existing market players, some of whom have said publicly they should get similar terms.

Pakistan, with a population of nearly 200 million people, is a potentially huge market, but just 180,000 cars were sold in the 2014/2015 fiscal year. That compares with more than 2 million passenger vehicles a year in neighboring India.

-

Comment by Riaz Haq on December 22, 2016 at 8:20pm

-

#Pakistan Market Fertile Ground for #Renault mfg initial $100 m investment in #Karachi #CPEC #FDI http://wardsauto.com/industry/pakistan-market-could-be-fertile-grou... … via @wardsauto

Renault soon could start producing vehicles in Pakistan, a government official says.

The French automaker is negotiating with the government of the Southwest Asia country to build cars in a joint venture with Gandhara Nissan, Renault’s global partner, Miftah Ismail, chairman of Pakistan’s Board of Investment, tells WardsAuto.

Renault proposes initially investing $100 million to expand manufacturing capacity at the currently mothballed Ghandhara Nissan Motors plant in Karachi, which has not produced vehicles since 2010. The plant is located near the capital city’s deep-water port terminal, Port Qasim. Ismail says a Renault technical team visited the plant Nov. 3.

Renault proposes assembling 16,000 vehicles a year in three shifts at the site and raise annual production capacity to 50,000 per year in two phases. Should the project go ahead, Ismail says, the JV would build both SUVs and sedans at the site, with production starting as early as 2018.

A Renault spokesperson confirms the automaker’s interest in Pakistan production to WardsAuto, adding it also is in talks with Al Futtain, an industrial conglomerate based in the United Arab Emirates.

The automaker’s application follows a September visit to France by a delegation of Pakistani government and business officials led by Finance Minister Ishaq Dar, who urged Renault and rival automaker PSA Peugeot Citroen to consider investing in Pakistan. Dar discussed the government’s new industrial policy regarding the automobile sector, which includes waiving duties on imported assembly plant equipment for foreign automakers locating in the country.

The new policy, in effect since March, envisions doubling yearly production of cars, vans, utility vehicles and light-commercial vehicles to 429,000 units over the next five years. Automakers active in Pakistan in 2015 manufactured 146,024 cars and 82,889 trucks of all types, according to WardsAuto data.

Pakistan wants to diversify a car market currently dominated by Toyota, Honda and Suzuki, whose locally assembled cars are sold at relatively high prices but lag behind imported vehicles in terms of quality and specifications, government officials contend. Customers have complained about having to make payments up-front for new vehicles, then wait up to four months for delivery. Consumer activists note quick delivery often carries a 15% surcharge.

The Ministry of Industries and Production says only 13 of 1,000 Pakistanis own or operate a car, Southwest Asia’s lowest rate of penetration. But with the economy expanding at its fastest pace in eight years – growth in 2016 could reach 4.7%, according to the World Bank – interest rates at a 42-year low, the Pakistan rupee’s stability against the U.S. dollar and an inflation rate of 5.2% and falling, officials believe their country successfully can attract major industrial investors.

South Korean automaker Kia has expressed interest in producing cars within Pakistan, according to Pakistan brokerage firm BIPL Securities.

A delegation from German automaker Volkswagen visited Pakistan in August 2015 and held talks with government officials. However, company spokesman Christoph Adomat told reporters that while “Volkswagen is constantly evaluating market opportunities on a worldwide basis (but) there are no decisions for an investment (by) Volkswagen side in Pakistan.”

Car sales in Pakistan – limited exclusively to Toyota, Honda and Suzuki – totaled 145,820 in 2015, up 32.9% from prior-year, WardsAuto data shows. Deliveries of 78,427 light trucks – all but 912 of them Suzukis or Toyotas – were up 135.3% year-on-year.

-

Comment by Riaz Haq on January 15, 2017 at 8:48am

-

Energy-rich: K-P has 16 trillion cubic feet of gas deposits

http://tribune.com.pk/story/1295031/energy-rich-k-p-16-trillion-cub...

Pakistan is producing only 96,000 barrels of oil per day (bpd), far lower than its demand for 400,000 bpd, which can mostly be met by energy-rich Khyber-Pakhtunkhwa (K-P) that has huge hydrocarbon reserves, says a high official of the province’s energy company.

“Khyber-Pakhtunkhwa has reserves of 16 trillion cubic feet of natural gas and 1.1 billion barrels of oil,” disclosed Nouman Akbar, Director General Human Resources, Corporate Affairs and Marketing of the Khyber-Pakhtunkhwa Oil and Gas Company Limited (KPOGCL).

Speaking to members of the Faisalabad Chamber of Commerce and Industry (FCCI), he said K-P was catering to 57% of Pakistan’s crude oil production and contributing 15% to the demand for natural gas. In addition to these, it accounts for 25% of the liquefied petroleum gas (LPG) production in the country.

Akbar said KPOGCL had been set up to step up work and explore the untapped oil and gas resources in order to make Pakistan self-reliant in energy production.

The government has allocated five blocks to the company, of which exploration work on the Lucky block is in full swing. “The Potohar region is rich in hydrocarbon resources and in many cases gas is oozing out of the soil,” he said.

Similarly, shallow digging also leads to the discovery of oil reserves. At least, 26 spots had been identified where oil and gas reserves were present in abundance and Akbar emphasised that efforts should be expedited in collaboration with the private sector to tap the resources.

He was of the view that at least $110 million were required from the private sector for development of the five exploration blocks. The amount could be made available in the form of shares, which could also be purchased by small investors, he said.

The K-P government has finished geological mapping of the province and is setting up a technical testing laboratory in Peshawar in a bid to conduct analysis of the soil data collected from various sites.

Earlier, soil samples were sent to laboratories of other countries that charged a fee in dollars, but now these tests could be conducted in the country with a nominal fee.

“Plans are also on the cards to establish a most modern refinery for the processing of crude oil. This refinery, expected to be operational within four years, will be able to cater to the needs of the country,” Akbar said.

-

Comment by Riaz Haq on January 15, 2017 at 9:01am

-

Pakistan: Oil consumption, thousand barrels per day

: For that indicator, The U.S. Energy Information Administration provides data for Pakistan from 1980 to 2013. The average value for Pakistan during that period was 285.37 thousand barrels per day with a minumum of 104 thousand barrels per day in 1980 and a maximum of 434 thousand barrels per day in 2013.

-

Comment by Riaz Haq on January 25, 2017 at 6:03pm

-

The government could not fulfill its promise of resolving the power crisis in 2016 as the country imported Rs 282.5 billion worth of power generating machinery in the said year.

Despite claims by the government of bringing improvement in the energy crisis, power generating machinery's demand soared as Pakistan spent Rs 172.9 billion on the import of power generating machinery during July-December of the current fiscal, showing 110 percent growth over same period of last fiscal.

This exorbitant rise clearly indicates that the demand for power generating machinery is continuously putting pressure on the import bill of Pakistan, as precious foreign currency is utilized for the import of generators. It is to be noted that Pakistan's monthly average bill for power generating machinery stood at $52 million by 2012, however the lingering power outages pushed this bill gigantically up to $225 million in December 2016.

The government was continuously claiming addition of significant electricity on the national grid last year, but the statistics indicate that the country is still struggling to prevail over the shortage of energy. New fiscal year is still witnessing a gloomy situation in terms of persisting power shortages, which has led to 12 to 15 hours power load shedding per day in the country.

The State Bank of Pakistan (SBP)'s first quarterly report for the fiscal year 2016-17 (FY17) said that the country's import bill grew in current fiscal year led by an increase in machinery imports, the rise in non-oil imports more than offset the decline in Petroleum Oil Lubricants (POL) imports in the period. Machinery imports surged by 60.0 percent year on year (YoY) in the first quarter of FY17 and reached $ 2.7 billion, surpassing POL imports during the period.

In fact, 94.3 percent of the increase in overall imports in the period was due to the rise in machinery imports, the SBP added. A surge in investment in power generation and distribution infrastructure boosted demand for power generation and electrical machinery. Construction activities related to China-Pakistan Economic Corridor (CPEC) projects also put an upward pressure on imports of products like cranes, weighing machinery and compressors, and vacuum pumps, the report added.

http://dailytimes.com.pk/business/22-Jan-17/pakistan-imports-genera...

-

Comment by Riaz Haq on January 25, 2017 at 6:35pm

-

Pakistan's oil consumption in 2015 rose to 517,000 barrels of oil per day, up from 460,000 in 2014 and 438,000 in 2013, according to British Petroleum.

https://www.quandl.com/data/BP/OIL_CONSUM_D_PAK-Oil-Consumption-Dai...

India's oil consumption in 2015 rose to 4.1 million barrels of oil per day, up from 3.8 million in 2014 and 3.7 million in 2013, according to British Petroleum.

https://www.quandl.com/data/BP/OIL_CONSUM_D_IND-Oil-Consumption-Dai...

Twitter Feed

Live Traffic Feed

Sponsored Links

South Asia Investor Review

Investor Information Blog

Haq's Musings

Riaz Haq's Current Affairs Blog

Please Bookmark This Page!

Blog Posts

EU-India Trade Deal: "Uncapped" Mass Migration of Indians?

The European Union (EU) and India have recently agreed to a trade deal which includes an MOU to allow “an uncapped mobility for Indian students”, according to officials, allowing Indians greater ease to travel, study and work across EU states. India's largest and most valuable export to the world is its people who last year sent $135 billion in remittances to their home country. Going by the numbers, the Indian economy is a tiny fraction of the European Union economy. Indians make up 17.8%…

ContinuePosted by Riaz Haq on January 28, 2026 at 11:00am — 8 Comments

Independent Economists Expose Modi's Fake GDP

Ruling politicians in New Delhi continue to hype their country's economic growth even as the Indian currency hits new lows against the US dollar, corporate profits fall, electrical power demand slows, domestic savings and investment rates decline and foreign capital flees Indian markets. The International Monetary Fund (IMF) has questioned India's GDP and independent economists…

ContinuePosted by Riaz Haq on January 25, 2026 at 4:30pm — 10 Comments

© 2026 Created by Riaz Haq.

Powered by

![]()

You need to be a member of PakAlumni Worldwide: The Global Social Network to add comments!

Join PakAlumni Worldwide: The Global Social Network