PakAlumni Worldwide: The Global Social Network

The Global Social Network

Pakistan Garment Industry Becoming More Cost Competitive With Bangladesh's?

Low wages and trade preferential deals with Western nations have helped Bangladesh, currently designated "Least Developed Country" (LDC), build a $30 billion ready-made garments (RMG) industry that accounts for 80% of country's exports. Bangladesh is the world's second largest RMG exporter after China. With its designation as LDC (Least Developed Country), garments made in Bangladesh get preferential duty-free access to Europe and America. Rising monthly wages of Bangladesh garment worker in terms of US dollars are now catching up with the minimum wage in Pakistan, especially after recent Pakistani rupee devaluation. Minimum monthly wage in Pakistan has declined from $136 last year to $107 now while Bangladesh has seen it increase from $64 last year to $95 today. Western garment buyers, known for their relentless pursuit of the lowest labor costs, will likely diversify their sources by directing new investments to Pakistan and other nations. Competing on low cost alone may prove to be a poor long term exports strategy for both countries. Greater value addition with diverse products and services will be necessary to remain competitive as wages rise in both countries.

|

| Minimum Monthly Wages in US$ Market Exchange Rate |

Wage Hike in Bangladesh:

The government in Dhaka announced in September that the minimum wage for garment workers would increase by up to 51% this year to 8,000 taka ($95) a month, up from $64 a year ago, according to Renaissance Capital. But garment workers union leaders say that increase will benefit only a small percentage of workers in the sector, which employs 4 million in the country of 165 million people, according to Reuters. Bangladesh government promised this week it would consider demands for an increase in the minimum wage, after clashes between police and protesters killed one worker and wounded dozens.

| Monthly Minimum Wages in US$. Source: Renaissance Capital |

Pakistan Wage Decline:

Pakistani currency has seen about 25% decline in value against the US dollar since January 2018. As a result of this devaluation, the minimum monthly wage in Pakistan has dropped from $136 last year to $107 now while Bangladesh has seen it increase from $64 last year to $95 today. Renaissance Capital projects a further 10% depreciation in Pakistani rupee this year.

Race to the Bottom?

Competing on cost alone is like engaging in the race to the bottom. Neither Pakistan nor Bangladesh can count on being lowest cost producers in the long run. What must they do to grow their exports in the future? The only viable option for both is to diversify their products and services and add greater value to justify higher prices.

Pakistan's Export Performance:

|

|

|

|

| Top 10 Textile Exporters. Source: WTO |

|

| Top 10 Garment Exporters. Source: WTO |

Pakistan's Role:

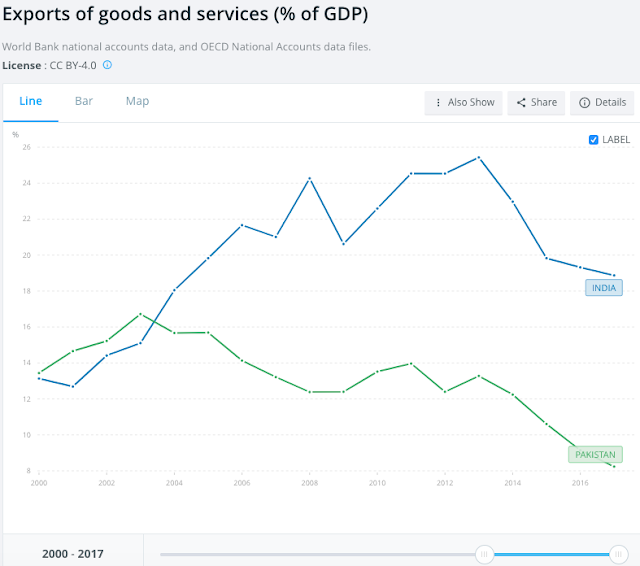

Pakistani currency has seen about 25% decline in value against the US dollar since January 2018. As a result of this devaluation, the minimum monthly wage in Pakistan has dropped from $136 last year to $107 now while in Bangladesh has seen it increased from $64 last year to $95 today. Renaissance Capital projects a further 10% depreciation this year. While this can help Pakistan's RMG exports in the short term, it is not good long term strategy. Competing on cost alone is a race to the bottom. Pakistan's manufactured exports per capita have declined in the last decade. Pakistan's exports have declined from about 15% of GDP to about 8% since 2003. The nation's trade deficits are growing at an alarming rate as the imports continue to far outstrip exports. This situation is not sustainable. Chinese Ambassador Yao Jing has offered a helping hand to increase Chinese investment and trade in Pakistan. Pakistan's new government led by Prime Minister Imran Khan should take the Chinese Ambassador's plan seriously. Finance Minister Asad Umar needs to form a high-powered team of top bureaucrats and leading businessmen on a comprehensive plan to attract investments in export-oriented industries and diversify and grow high-value exports to China and other countries.

-

Comment by Riaz Haq on December 30, 2021 at 1:52pm

-

Textile manufacturers seem to have gotten their way securing gas supply for captive power generation. The note of thanks that followed had one name missing, that of the Minister that was not entirely sold on the idea. Regardless of the merits of the decision, this should soothe some nerves for Pakistan’s largest dollar earners.

https://www.brecorder.com/news/40143546

The arguments goes that “textile units in Pakistan are incurring power and energy costs 2.4 percentage points more than India and 7.8 percentage points higher than Bangladesh…ideal regionally competitive electricity tariff would be around 7.4 cents/kWh”. There is no denying that textile is an intensely competitive market when it comes to export, and regionally competitive electricity tariff is only a fair demand.

Only that a look at electricity tariffs for industries in the region tells the textile players in Pakistan are not worse off. If anything, they get better power tariffs than both India and Bangladesh, where only Vietnam offers electricity at cheaper rates – even at 9 cents per unit. The research being quoted by the textile lobbyists may well be outdated, as the very sources mentioned in the research indicate that electricity tariff for industries in Bangladesh are close to 11 cents, whereas those in India are north of 10 cents per unit.

In terms of natural gas, there is a clear advantage that competitors have over Pakistani textile players, based on PIDE’s research titled “Regionally Competitive Energy Tariffs and Textile Sector’s Competitiveness” from 2020. BR Research has not been able to independently verify the same. That said the overall picture in terms of regionally competitive tariffs is not as bleak as some representative bodies of the textile sector would paint. Surely, the power tariffs are nowhere close to 7.4 cents, which is being termed as “ideal”.

The second most significant element in conversion cost is labor, which accounts for roughly 29 percent as compared to 35 percent of power and fuel, as per PIDE’s aforementioned research. Pakistan’s labor rates are 80 percent lower than that of India and only 12 percent cheaper than that of Bangladesh. Given the massive currency depreciation in the past two years, the labor wages in dollar terms have only tilted more in favor of Pakistan - as no other currency in the region has seen such a hammering.

As per data provided by the Punjab Bureau of Statistics, wages in textile sector have grown at an average of 2 percent every quarter in rupee terms, since 1QFY19. The data presented in the “Monthly Survey of Industrial Production & Employment in the Punjab” puts the average monthly wage at Rs18,608 per worker in the industry.

The disregard to minimum wage law is best left for another day, but even if one assumes wage rate to have outgrown historic average of 8 quarters, growing by 4 percent quarter-on-quarter instead, the wage rate in dollar terms comes at $115. This is still lower than what it was 12 quarters ago, having seen the lows of $102 during the journey. Granted that the LSM approach will have shortcomings in terms of inclusion, but it is difficult to see the ground reality deviating any significantly from the trend.

One can safely say that Pakistan’s textile is getting electricity at better rates than India and Bangladesh, even though gas is still pricier – which may or may not put Pakistan at par in terms of regionally competitive energy tariffs. One can say with a greater degree of certainty that the rupee hammering has given a head start to Pakistan in terms of labor costs. Let’s not even go into the concessional financing schemes out there. But surely, based on these numbers, this is as competitive as it gets for Pakistan. It is now up to the industry to prove the mettle and show the growth.

-

Comment by Riaz Haq on May 21, 2022 at 8:28am

-

Is #Bangladesh heading toward a #SriLanka-like #economic crisis? #Imports surging to reach $85 billion this year, #exports $50 billion. $35 billion trade deficit, leaving $10 billion current account deficit after #remittances. #energy #food #inflation https://www.dw.com/en/is-bangladesh-heading-toward-a-sri-lanka-like...

Like Colombo, Dhaka has also taken on massive foreign loans to embark on what critics call "white elephant" projects. The economic turmoil in Sri Lanka should serve as a cautionary tale, say experts.

Sri Lanka has been mired in economic turmoil over the past few months, with the country battling severe shortages of essential items and running out of petrol, medicines and foreign reserves amid an acute balance of payments crisis.

The resulting public fury targeting the government triggered mass street protests and political upheaval, forcing the resignation of Prime Minister Mahinda Rajapaksa and his Cabinet, and the appointment of a new prime minister.

Many in Bangladesh fear that their country could face a similar situation, given the rising trade deficit and foreign debt burden.

Bangladesh imported goods worth $61.52 billion (€58.48 billion) in the first nine months of the 2021-2022 fiscal year, a rise of 43.9% compared to the same period last year.

Exports, however, rose at a slower pace of 32.9% while remittances from Bangladeshis living abroad — a key source of foreign exchange — dropped about 20% in the first four months of 2022 from the year before, to $7 billion.

'Foreign reserves will go down to a dangerous level'

Muinul Islam, a Bangladeshi economist and former professor at Chittagong University, fears that the trade deficit could grow in the coming years as imports are increasing at a faster pace than exports.

"Our imports are set to reach $85 billion by this year, while exports won't be more than $50 billion. And, the trade deficit of $35 billion can't be bridged by remittances alone," Islam told DW, adding: "We will have to live with around a $10 billion shortfall this year."

The expert also pointed out that Bangladesh's foreign exchange reserves have fallen from $48 billion to $42 billion over the past eight months. He is worried that they may drop further in the coming months, likely down another $4 billion.

"If the trend of more imports against exports continues and we fail to minimize the gap with the remittances, our foreign reserves will go down to a dangerous level in the next three to four years," he stressed, underlining that this would lead to a significant devaluation of the nation's currency against the US dollar.

Massive loans for 'white elephant' projects?

Bangladesh, like Sri Lanka, has also taken on foreign loans in recent years to fund what critics call "white elephant" projects, which are expensive but totally unprofitable.

These "unnecessary projects" could cause trouble when the time comes to repay the debts, Islam said.

"We have taken a loan of $12 billion from Russia for a nuclear power plant which has a production capacity of just 2,400 megawatts. We can repay the debt in 20 years but the installments will be $565 million per year from 2025," he pointed out. "It's the worst kind of a white elephant project."

In total, the country will likely have to repay $4 billion per year from 2024, as installments for foreign loans, Islam estimated.

"I fear Bangladesh won't be able to repay those loans at that time because of the shortage of income from the mega projects," he stressed.

-

Comment by Riaz Haq on September 17, 2022 at 7:02pm

-

The ground under Sheikh Hasina’s feet is shifting

By Avinash Paliwal

https://www.hindustantimes.com/opinion/the-ground-under-sheikh-hasi...

Bangladesh's foreign minister

AK Abdul Momen arrived in

India last month to fight polit-

ical fires. But he found himself

dealing with massive floods

that hit Sylhet and Assam.

Nature has its ways to convey

that not all is well in India's

near-east. Far from the glitz

about Bangladesh's economic

success, on display during the

recent inauguration of the

Padma Bridge, clampdown on

Islamists, and shrewd man-

agement of big power rivalries,

is a parallel potent reality of

Prime Minister Sheikh Has-

ina's authoritarianism,

heightened polarisation, and

economic distress. As an

Indian official mentioned to

me, and a Bangladeshi official

echoed. Hasina "has built a

house of cards"

The economic, social, and

political ground under Has-

ina's feet is shifting in real

time. It is slow enough to be

dismissed as non-urgent, but

sure enough to become press-

ing, if not dealt with urgently.

With general elections due in

2023, and external debt repay-

ment schedules kicking in

from 2024, it is a matter of

time for the veneer of (forced)

stability to lose its sheen. The

risk of dislocation, if not col-

lapse, of this so-called house

of cards has increased in

recent years, and it could

undermine whatever is left of

India's connectivity aspira-

tions in its near east.

Domestically, the Hasina gov-

ernment has exacerbated two

contradictions in a tradition-

ally polarised polity. One, she

is in power, but with little to

no electoral legitimacy. The

Awami League's (AL) manipu-

lation of the 2014 and 20118

elections (a practice not just

reserved for national elections

and against opponents),

unceasing harassment of its

key opponent, the Bangladesh

Nationalist Party (BNP), gag-

ging of media, social media

monitoring using advanced

digital surveillance, and a

forced tilt towards the conser-

vative Islamic Right as a bal-

ancing move after targeting

these formations using force,

has created wide pockets of

intense frustration.

Unlike her father, Sheikh

Mujibur Rahman, who created

a one-party State, but failed to

contain a famine in 1974, Has-

ina has placed her bets on eco-

nomic development. The argu-

ment runs that good economic

performance coupled with lib

eral use of force will make a

one-party State under Has-

ina's leadership sustainable.

But this is where the second

contradiction kicks in.

Bangladesh's external debt to

Gross Domestic Product ratio

has increased to 21.8%, import

spending has shot up by nearly

44%, forex reserves of $42

billion are falling and can

cover about five months'

worth of imports, and the rev-

enue from readymade gar-

ments export and remittances

is not keeping pace with the

fast rising costs to the

exchequer.

Couple this with the global

inflation created by the Rus-

sia-ukraine war and United

Statesled sanctions, and it

becomes clear why Momen is

asking India to remove anti-

dumping duties on Banglade-

shi jute exports. Further com-

plicating this situation is

Dhaka's propensity to accept

external loans for infrastruc-

tural projects at highly inflated

costs, making repayment dif-

ficult. One of the cases in point

is the 2015 Rooppur Nuclear

Power Plant deal with Russia

for which Dhaka is to repay

$13.5 billion. India paid $3 bil-

lion for a similar plant in

Kudankulam.

Why does Dhaka accept such

deals? Because external fin-

ance fuels (limited) infra-

structural growth, chronic

corruption, and keeps the

political illusion of economic

development alive. To be clear

and fair, Bangladesh's eco-

nomic journey has been more

than commendable. But to

expect an economic miracle,

which is bound to dwindle due

to internal or external shocks,

to sustain a corrupt system

pretending to be a democracy

is a tall ask. Herein, Hasina has

ensured that neither the

Islamists nor the BNP

which enjovs public sympathy,

even if it may not get a fair

election - pose a serious

challenge to her.

-

Comment by Riaz Haq on September 17, 2022 at 7:03pm

-

The ground under Sheikh Hasina’s feet is shifting

By Avinash Paliwal

https://www.hindustantimes.com/opinion/the-ground-under-sheikh-hasi...

But her real challenge doesn't

come from known opponents.

It comes from opaque factions

within a securitised State (and

the party) that has made so

much illicit profit that being

out of power is not an option

for them. This leaves Hasina

with an unenviable dilemma.

Either she allows free elections

and risks being ousted or

manipulates them and invites

international opprobrium that

could unleash mass protests

and violence. Bereft of a clear

succession plan, both these

scenarios could tempt oppor-

tunistic adversaries to force a

regime change, of which there

is an unfortunately rich his-

tory in Bangladesh.

Hasina's internal problems are

linked to external dependen-

cies. Politically reliant on New

Delhi, she is finding it increas-

ingly difficult to manage the

ramifications of India's turn

towards Hindu nationalism

that misuses migration from

Bangladesh and the Rohingya

crisis for domestic electoral

gain. Similarly, accepting of

Chinese finance that may not

translate into political sup-

port, Dhaka is struggling to

keep targeted US sanctions

against the Rapid Action Bat-

talion, an anticrime and anti-

terrorism unit of the

Bangladesh Police, for serious

human rights violations, at

bay. Dhaka's replacement of

its ambassador in Washington

DC after a visit by a team of AL

parliamentarians from the

standing committee on foreign

affairs will make little differ-

ence in how the US deals with

Bangladesh.

Add to this, an uptick in

demand for repatriating

Rohingya migrants - some of

whom have been silently

resettled in the Chittagong Hill

Tracts to the locals' displeas-

ure - to Myanmar, including

within Bangladesh's military

establishment, and the situ-

ation becomes even more

volatile. Hasina requires a

political off-ramp to prevent a

foreseeable crisis that can turn

violent. The last thing the sub-

continent needs is turmoil in

Bangladesh

-

Comment by Riaz Haq on April 28, 2023 at 2:07pm

-

America Pays a High Price for Low Wages

https://www.wsj.com/articles/america-pays-a-high-price-for-low-wage...

For decades the U.S. has used wage subsidies to support the country’s lowest-paid workers—a welfare system that keeps the poor down, primarily benefits the wealthy and undermines technological innovation.

In “The Wealth of Nations,” the founding text of free-market economics, Adam Smith took it for granted that workers should be paid enough to cover the living costs of themselves and their dependents. “A man must always live by his work, and his wages must at least be sufficient to maintain him,” wrote Smith. “They must even upon most occasions be somewhat more, otherwise it would be impossible for him to bring up a family, and the race of such workmen could not last beyond the first generation.”

In the last half-century, policy makers of both parties in the U.S. have successfully refuted Adam Smith. It turns out that it is indeed possible to pay wages to workers that are too low for their own maintenance, much less that of their families. This depends on using means-tested welfare programs like the earned-income tax credit (EITC), food stamps and housing vouchers, all of which compensate for wages that are too low for workers to live on.

Since its creation in 1975, the EITC, a federal wage subsidy for low-income workers and their children, has been expanded repeatedly under Democratic and Republican presidents alike. Many states also have their own versions of the EITC. Liberals like the EITC because it reduces absolute poverty, and conservatives like it because it attaches a work requirement to welfare.

But it is a myth that wage subsidies like the EITC “make work pay.” On the contrary, they make taxpayers pay to rescue workers whose work does not pay enough. Nor are such wage subsidies an alternative to welfare. They are welfare in the form of cash rather than in-kind benefits like food stamps or housing vouchers. The term “refundable tax credit” is just a euphemism for redistributing income.

Wage subsidies also entangle eligible workers in the operations of the welfare state and its complex paperwork. It is puzzling that many critics of big government support the EITC, a costly federal welfare program that partly socializes the incomes of millions of American workers and makes their employers reliant on government spending.

We can call the current American labor market system the low-wage/high-welfare model. It is a success from the perspective of employers who get to pay lower wages. It is also a success for some consumers, since lower wages mean lower prices. The losers include taxpayers, the working poor themselves and workers who are not poor but fear poverty. The low-wage model also saps the incentives for technological innovation, because cheap labor so often substitutes for labor-saving machinery.

-

Comment by Riaz Haq on June 1, 2023 at 4:07pm

-

Fashion cycles are moving faster than ever. A Quartz article in December revealed how fashion brands like Zara, Gap and Adidas are churning out new styles more frequently, a trend dubbed "fast fashion" by many in the industry. The clothes that are mass-produced also become more affordable, thus attracting consumers to buy more.

"It used to be four seasons in a year; now it may be up to 11 or 15 or more," says Tasha Lewis, a professor at Cornell University's Department of Fiber Science and Apparel Design.

The top fast fashion retailers grew 9.7 percent per year over the last five years, topping the 6.8 percent of growth of traditional apparel companies, according to financial holding company CIT.

Fashion is big business. Estimates vary, but one report puts the global industry at $1.2 trillion, with more than $250 billion spent in the U.S. alone. In 2014, the average household spent an average $1,786 on apparel and related services.

https://www.npr.org/2016/04/08/473513620/what-happens-when-fashion-...

--------------

See the World's Unsold Clothing in a Huge Desert Pileup

A satellite image shows where tons of fast-fashion items are heaped in a clothing graveyard in the Atacama Desert

https://gizmodo.com/clothing-pile-chile-atacama-desert-satellite-im...

The world’s fast-fashion addiction is wrecking the planet. It’s also contributing to an enormous and growing pile of clothing that is sitting in Chile’s Atacama Desert.

SkyFi, a company that provides access to satellite imagery, recently shared a striking view of the Atacama Desert. The company explained in a blog post last week that members of its Discord channel had helped find the coordinates for the growing graveyard of trashed garments.

-

Comment by Riaz Haq on November 7, 2023 at 4:56pm

-

Bangladesh's government announced a higher minimum wage for garment workers on Tuesday, raising it 56% to about $113 per month.

https://www.voanews.com/a/bangladesh-increases-garment-workers-mini...'s%20government%20announced%20a%20higher,dead%20and%20several%20more%20injured.

The new wage comes after weeks of violent protests by workers demanding higher salaries, which left two workers dead and several more injured.

The wage increase, which was agreed upon by a panel of factory owners, union leaders and officials, has been criticized as too small, with inflation in Bangladesh running at about 9.5%, increasing the price of basic needs.

Protesting workers have demanded a wage of $208 per month. Demonstrators have clashed with authorities and attacked factories.

The demonstrations were sparked when the Bangladesh Garment Manufacturers and Exporters Association offered to increase wages 25% to only $90 per month.

Low wages in Bangladesh factories have led to the growth in the country's garment industry as garment production and exports account for nearly 16% of Bangladesh's GDP.

Bangladesh employs 4 million workers across 3,500 factories and is currently the second-largest garment-producing nation behind China. The country's factories supply many large clothing brands such as H&M and Gap.

Factory owners have hit back at the protesters' demands, saying that production costs are higher because of rising energy and transportation costs, and that Western brands are offering to pay less for production.

Bangladesh, having primarily focused on exporting to Europe and the United States, is looking to find markets in China, India and Japan.

-

Comment by Riaz Haq on August 31, 2024 at 9:12am

-

Can Pakistan emerge as textile sourcing hub amid BD turmoil?

Pakistan’s textile industry faces a series of significant challenges that hinder its ability to capitalise on it

https://www.geo.tv/latest/561011-can-pakistan-emerge-as-textile-sou...

Bangladesh, which has increased its exports to $47 billion per annum, is in massive political and economic turmoil.

Many multi-national companies are in the process of shifting their sourcing operations away from Bangladesh to mitigate risks.

This provides a unique opportunity for Pakistan to step in as an alternative sourcing hub, keeping in view its established textile industry and strategic location. Moreover, increasing exports is crucial for Pakistan to address its foreign exchange shortage, which is expected to exceed $25 billion annually for the next five years.

Pakistan has a long history of textile and garment production, with well-developed infrastructure, skilled labour, and a reputation for high quality and environmental sustainability.

Facts are that Pakistan has access to major markets in Europe, North America, and the Middle East and it can enhance its attractiveness as a potential alternative to Bangladesh. In FY22, Pakistan’s textile exports reached nearly $20 billion, signaling strong potential in the sector.

However, by FY24, exports plummeted to $16.7 billion due to prohibitive increases in energy prices, withdrawal of zero-rating and overall economic deterioration. The withdrawal of zero-rating (SRO 1125) was a significant blow to the industry as it squeezed all liquidity out of the market, leaving manufacturers struggling to maintain operations.

---

If the decision-makers in the country make sure regionally competitive energy tariff at 9 cents per unit electricity supply and $9 per MMBTU gas supply, Pakistan’s textile industry will regain its viability, compete effectively on the global stage and capture garment sourcing shifting away from Bangladesh but several reforms are essential. There are reports that the task force on the power sector is vigorously working out a strategy under which the industrial tariff would be reduced to a reasonable level apart from scaling down the electricity tariff for other consumer categories.

In addition, the taxation regime for domestic supply chain needs to be aligned with that of the import supply chain to create a level playing field. And, more importantly, zero rating (SRO 1125) for the entire textile value chain must be restored. And interest rates should be reduced to single digits to ease the liquidity crisis and encourage higher production and investment. However, some economists say that there are chances that at the end of the current calendar year, interest rate may come down to 12-13%. And finally, the government top notches need to increase their focus on hiking cotton production to a minimum of 15 million bales annually at sustainable basis.

Pakistan’s textile industry faces a series of significant challenges that hinder its ability to capitalise on the shifting global garment sourcing dynamics. A major obstacle is the prohibitive cost of energy. Industrial power tariffs in Pakistan are upwards of 15 cents/kWh, which is almost double the 8.3 cents/kWh in Bangladesh. Moreover, while Bangladesh’s industry benefits from cheap gas at $7.4/MMBtu, industry in Pakistan is being supplied with an RLNG/gas blend at $13/MMBtu.

Labour costs also contribute to the financial strain on Pakistan’s textile sector. The minimum wage for garment workers in Bangladesh is $113 a month, whereas in Pakistan, it stands at $135, a difference of approximately 20%. This wage gap, coupled with higher energy costs, further erodes Pakistan’s competitiveness.

Comment

- ‹ Previous

- 1

- …

- 3

- 4

- 5

- Next ›

Twitter Feed

Live Traffic Feed

Sponsored Links

South Asia Investor Review

Investor Information Blog

Haq's Musings

Riaz Haq's Current Affairs Blog

Please Bookmark This Page!

Blog Posts

EU-India Trade Deal: "Uncapped" Mass Migration of Indians?

The European Union (EU) and India have recently agreed to a trade deal which includes an MOU to allow “an uncapped mobility for Indian students”, according to officials, allowing Indians greater ease to travel, study and work across EU states. India's largest and most valuable export to the world is its people who last year sent $135 billion in remittances to their home country. Going by the numbers, the Indian economy is a tiny fraction of the European Union economy. Indians make up 17.8%…

ContinuePosted by Riaz Haq on January 28, 2026 at 11:00am — 8 Comments

Independent Economists Expose Modi's Fake GDP

Ruling politicians in New Delhi continue to hype their country's economic growth even as the Indian currency hits new lows against the US dollar, corporate profits fall, electrical power demand slows, domestic savings and investment rates decline and foreign capital flees Indian markets. The International Monetary Fund (IMF) has questioned India's GDP and independent economists…

ContinuePosted by Riaz Haq on January 25, 2026 at 4:30pm — 10 Comments

© 2026 Created by Riaz Haq.

Powered by

![]()

You need to be a member of PakAlumni Worldwide: The Global Social Network to add comments!

Join PakAlumni Worldwide: The Global Social Network