PakAlumni Worldwide: The Global Social Network

The Global Social Network

Pakistan Leads the World in Microfinance

Pakistan ranks first in Asia and third in the world in Economist Intelligence Unit's overall microfinance business environment rankings for 2011. Among other Asian nations, only the Philippines at #6 made the top ten list.

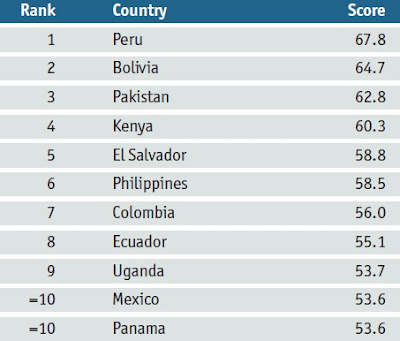

On a scale of 0-100, Pakistan scores 62.8, just behind top-ranked Peru's 67.8 and second-ranked Bolivia's 64.7 in overall global rankings of 55 countries. Among nations in South Asia region, India ranks 27 with a score of 43.1 and Bangladesh ranks 43 with a score of 30.9. Sri Lanka is at #48 with a score of 27.4 followed by Nepal at 51 scoring 26.1.

Among various categories, Pakistan ranks #1 in regulatory framework and practices and #5 in supporting institutional framework.

Here's an excerpt on Asia from the EIU report titled "Global microscope on the microfinance business environment":

"Pakistan and the Philippines again top the regional rankings for East and South Asia. These countries both finished in the top ten globally, signifying strong environments for microfinance. Indeed, Pakistan and the Philippines came first and second globally, respectively, in the Regulatory Framework and Practices category, suggesting strong regulatory regimes and good prospects for MFIs to enter the sector and perform effectively. The Philippines, for example, has had a strong enabling environment for microfinance for more than a decade. Cambodia is third best in Asia and makes it into the top 25% globally. India comes next, but fell precipitously after the crisis that struck the sector last year. Mongolia finished fourth in Asia, but was the region’s most-improved performer."

Recently, Pakistan's central bank governor Haris Anwar said that large segments the nation's population have no bank accounts and many do not understand why it puts them at a disadvantage when it comes to their personal financial management. According to Pakistan Access to Finance Survey (A2FS), only 12 percent of the population has access to formal financial services. Of the remaining 88 percent, only 32 percent are informally served and 56 percent are completely excluded, Anwar said, adding that according to the A2FS analysis, about 40 percent of the financially excluded population reported lack of understanding of financial products as the main reason for financial exclusion.

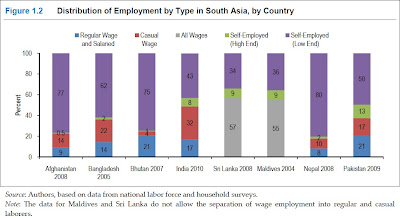

It has long been recognized by poverty alleviation experts that pursuing policies for increasing financial inclusion, such as encouraging microfinance, are absolutely essential to lift tens of millions of people out of poverty in Pakistan, where 50% of the workforce is made up of low-end self-employed. Other efforts toward bringing financial services to the poor and lower middle class in Pakistan include financial literacy initiatives and growth of branchless mobile banking in city slums and rural areas of the country.

Pakistan’s first-ever National Financial Literacy Program was launched earlier this year with the support and collaboration of Asian Development Bank (ADB), Pakistan Banks’ Association (PBA), Pakistan Microfinance Network (PMN), Pakistan Poverty Alleviation Fund (PPAF) and BearingPoint consultants.

The growth of branchless banking in Pakistan is now being held up a success story at international fora. Within a span of just two years, there are now almost 18,000 branchless banking outlets surpassing the 10,000 conventional bank branches, according to Governor Anwar. UBL Omni’s branchless banking service launched in April 2010 by United Bank has won several contracts to disburse payments for nongovernment organizations and government schemes to help those affected by floods. UBL reports that at the end of June it had 5,000 agents disbursing payments to 2 million recipients under these programs. UBL Omni has also started accepting loan repayments for microfinance institutions (MFIs) and providing cash management facilities for businesses.

According to a recent World Bank report titled "More and Better Jobs in South Asia" which shows that 63% of Pakistan's workforce is self-employed, including 13% high-end self-employed. Salaried and daily wage earners make up only 37% of the workforce. Access to money is necessary for many of these entrepreneurs to succeed in realizing their dreams.

The history of microfinance in Pakistan started with the launch of Orangi Pilot Project (OPP) in Kutchi Abadies (shanty towns) of Karachi in early 1980’s, according to a paper published by Abdul Qayyum and Munir Ahmed. In the late 1960s, prior to OPP, a few NGOs in the rural areas of Pakistan began to experiment with microcredit by offering subsidized loans. However, they mostly failed to reach the poor due to abuse and corruption. Now there are dozens of Micro Finance Institutions working in Pakistan. The MFIs in Pakistan can be divided into different groups based on their uniqueness that separates them from other financial institutions and makes them similar in terms of the way they function.

The first group consists of financial institutions with microfinance as a separate product line. The share of microfinance related activities of these institutions is up to 10 percent. This group includes Orix Leasing and the Bank of Khyber –both are profit making organizations and consider microfinance as a separate product line.

The second group refers to the specialized MFI’s, which includes two microfinance banks - The Khushhali Bank and First Microfinance Bank Limited (FMBL) - and two NGOs - KASHF Foundation and Asasah. All these institutions completely focus on provision of financial services and also have commercial focus as well.

Third category MFIs related to activities of the Rural Support Programs which deals with integrated Rural Development Programs with microfinance as one of its activities. These organizations are National Rural Support Programs (NRSP), Punjab Rural Support Programs (PRSP) and Sarhad Rural Support Programs (SRSP). The last group consists of private NGOs. These NGOs are basically integrated development organizations with microfinance as one of their activities. These include Orangi Pilot Project, Sungi Foundation, Taraqee Foundation, Development Action for Mobilization and Emancipation (TRDP), Sindh Agricultural & Forestry Workers Coordinating Organization (SAFWCO) and Development Action for Mobilization and Emancipation (DAMEN), among others.

Khushhali Bank was established in August 2000 as part of the Government of the Islamic Republic of Pakistan's Poverty Reduction Strategy. The Pakistan Microfinance Sector Development Program (MSDP) was developed with the technical assistance and funding of the Asian Development Bank, which provided a US$150 million loan to the government of Pakistan, US$70 million being used for micro-loans provided by KB. Headquartered in Islamabad, KB operates under the central bank's supervision (State Bank of Pakistan) with several commercial banks operating as its primary shareholders.

To broaden access, there are now efforts underway to offer Shariah-compliant microfinance products to those who are reluctant to participate in interest-based banking. Farz Foundation is among the first to do so. It is engaged in Islamic micro-financing for livestock and agriculture among the rural poor.

Pakistan has a long way to go to achieve financial inclusion for the majority of its population. The current efforts on increasing access to money for the poor are a good start on a long journey that may take decades to complete. My readers who are interested in helping the poor in Pakistan by offering small loans of $25 or more have a choice of many websites to do so, including kiva.org which I have been using. The loans to Pakistani recipients are administered through Asasah, a Kiva partner in the country.

Related Link:

Pakistan's Financial Services Sector

Fighting Poverty Through Microfinance

-

Comment by Riaz Haq on May 2, 2012 at 9:26am

-

Pakistan plans disaster insurance, reports Reuters:

Pakistan plans to roll out a national insurance scheme, making it mandatory for every citizen to be covered against risks from natural hazards, the head of the country's disaster management authority said on Wednesday.

Pakistan is highly vulnerable to earthquakes, cyclones, droughts, floods, landslides and avalanches. Devastating floods in 2010 disrupted the lives of 20 million people – many more than the 2004 Indian Ocean tsunami – and cost $10 billion.

"Pakistan is making it mandatory for the entire population to be covered against disaster risks. The idea, at the end of the day, is to cover the lives and livelihoods of the population of the entire country," said Zafar Iqbal Qadir, chairman of the National Disaster Management Authority.

"Most parts of our country are vulnerable … either to disasters, or to poverty, or to both."

Qadir, who was speaking at a regional conference on "managing the risks of climate extremes and disasters in Asia", said Pakistan's cabinet has approved the plan and his agency was working on a comprehensive risk insurance plan that would hopefully be rolled out by the end of the year.

The country had already received a $500-million World Bank loan to set up a fund to pay for the plan, he said.

Authorities also intend to tap private sector money through their corporate social responsibility schemes as well as local philanthropists, he added.

And he said a meeting held with international insurance companies to discuss the issue in Karachi last month was positive.

Last month, a major report by the United Nations said the world needed to prepare better to deal with extreme weather and rising seas caused by climate change, in order to save lives and limit deepening economic losses.

SUBSIDISED PREMIUMS

The U.N. climate panel report forecast that all countries will be vulnerable to an expected increase in heat waves, more intense rains and floods and a probable rise in the intensity of droughts.

It suggested possible strategies to help countries adapt and prepare better such early warning systems, improving building standards and preserving ecosystems such as mangroves.

Financing disaster recovery and rebuilding through micro-insurance was another tool, the report said, which would help limit the already-strained cash reserves of poor nations.

"We are considering subsidising premiums for those who can't afford and paying full premium for those who are living below the poverty line," Qadir said, adding that it was essential that those most vulnerable, who are often the poorest, were covered.

Pakistan plans to pre-negotiate payments with insurance companies and also discard the need to file claims, said Qadir, as disaster insurance would need to reach people quickly.

"The best part is that communities which are prone to disasters are currently dependent on someone to come to respond to their needs, someone to feed them and give them shelter. We would remove the dependency syndrome of communities," he said.

"We would like them to be getting (a) response, within a few hours of the disaster occurring, from the insurance world."

http://www.trust.org/alertnet/news/pakistan-plans-hazard-risk-insur...

-

Comment by Riaz Haq on July 5, 2012 at 9:57am

-

Here's a BR report of banking developments in Pakistan:

The Governor of State Bank of Pakistan, Yaseen Anwar on Wednesday said two more international large banks will start their operations in Pakistan soon.

He was responding to a question at 9th Annual Excellence Awards ceremony organized by CFA Society of Pakistan here.

The SBP Governor said a large Turkish bank will start its operation in Pakistan soon while another international bank is due shortly. He pointed out that the country's foreign exchange reserves have once again increased to over $15 billion.

Earlier, speaking at the ceremony, the SBP governor said the fast growing network of branchless banking agents has reached over 26,000 as of March 31, 2012 and total volumes of transactions have increased to 25.3 million, up 23 percent. Deposits have grown by 18 percent to Rs 594 million.

"This fits well into our Financial Inclusion Strategy." In fact Central Bank mandates should have an expanded mandate to include those sectors of Financial Exclusion. This adds to overall growth of the economy and women should be an important component to this effort.

He said the CFA curriculum places due emphasis on the code of ethics and professional conduct for financial analysts and investment professionals. With the growing number of chartered financial analysts, the markets are expected to be better-off from their high ethical standards and improved knowledge of the financial markets, instruments and associated risks.

He pointed out that the World Bank's country review of Pakistan based on OECD Principles on Corporate Governance (Report on Observance of Standards and Codes) rated Pakistan above average on most of the Principles.' Further, in a survey, the World Bank rated Pakistan as the leader on the robustness of corporate governance standards and practices in South Asia.

On the issue of consumer protection, availability of an effective redressal system adds to the confidence of the financial system and ensures that customers are being served without any discrimination. Consumer protection is primarily based on institutional arrangements that include a formal set of disclosure requirement and addressing grievance mechanisms. Besides, customers also desire proper handling and maintenance of their accounts, and privacy of their personal financial information. For cost effective and quick redressal, SBP has issued necessary guidelines to the banks regarding complaint handling along with institutionalization of the Banking Mohtasib Pakistan.

The State Bank has also taken considerable interest in enhancing the capacity of its own human resource as well as that of the banking sector that is an important element for ensuring the effective implementation of the regulatory requirements.

http://www.brecorder.com/pakistan/banking-a-finance/65732-two-inter...

Comment

Twitter Feed

Live Traffic Feed

Sponsored Links

South Asia Investor Review

Investor Information Blog

Haq's Musings

Riaz Haq's Current Affairs Blog

Please Bookmark This Page!

Blog Posts

Modi's AI Spectacle: Chaos and Deception in New Delhi

The India AI Impact Summit 2026, held at Bharat Mandapam in New Delhi, has been marred by chaos, confusion and deception. The events on the ground have produced unintended media headlines for India's Prime Minister Narendra Modi who wants to be seen as the "vishwaguru" (teacher of the world) in the field of artificial intelligence as well. First, there was massive chaos on the opening day, with long…

ContinuePosted by Riaz Haq on February 19, 2026 at 12:00pm — 11 Comments

India-Pakistan Cricket Match: The Biggest Single Event in the World of Sports

Why did Pakistan's decision to boycott the India-Pakistan match in solidarity with Bangladesh in this year's T20 World Cup send shockwaves around the world? And why did it trigger the International Cricket Council's and other cricket boards' urgent efforts to persuade Pakistan to return to the match? The reason has a lot to do with its massive financial impact, estimated to be as much as …

ContinuePosted by Riaz Haq on February 11, 2026 at 4:00pm — 2 Comments

© 2026 Created by Riaz Haq.

Powered by

![]()

You need to be a member of PakAlumni Worldwide: The Global Social Network to add comments!

Join PakAlumni Worldwide: The Global Social Network