PakAlumni Worldwide: The Global Social Network

The Global Social Network

Pakistan's Emerging Market Upgrade

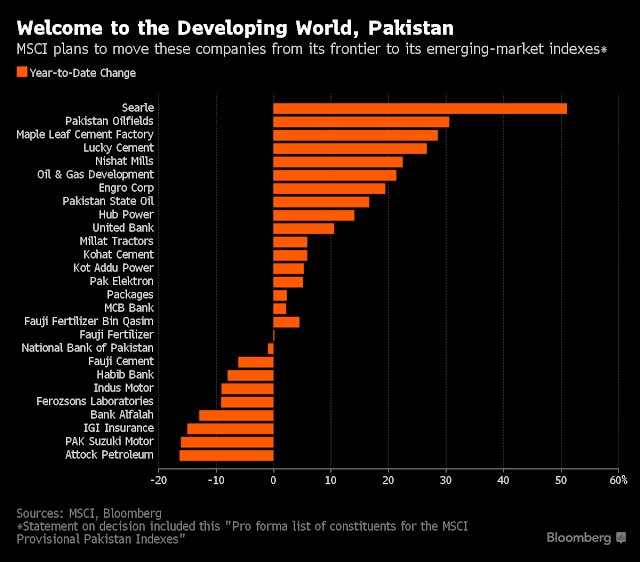

MSCI Pakistan Index will be reclassified to Emerging Markets status, coinciding with the May 2017 Semi-Annual Index Review, according to an MSCI press release on June 14, 2016.

Emerging Market Upgrade:

Pakistan's Karachi Stock Exchange KSE100 Index has rallied 14% in 2016, making it Asia's best performing market so far this year in anticipation of the MSCI announcement.

The upgrade could attract additional $475 million of inflows by the middle of next year as investors rush to buy Pakistani shares, according to analysts quoted by Bloomberg News.

Pakistan was classified as Emerging Market in 1994, a status it retained during the Musharraf years. It was downgraded to frontier status in December 2008, four months after the former president was forced out by PPP and PMLN politicians.

Loss of investor confidence after President Musharraf's departure triggered a major bear market that wiped out nearly $37 billion of market capitalization at the Karachi Stock Exchange. It led to the imposition of a floor on share prices that caused near total paralysis of market activity for more than three months, according to Bloomberg News.

Pakistan is seeing soaring foreign direct investment (FDI) with improving security and the start of several major energy and infrastructure projects as part of China-Pakistan Economic Corridor (CPEC), according to the UK's Financial Times business newspaper.

A New High in FDI:

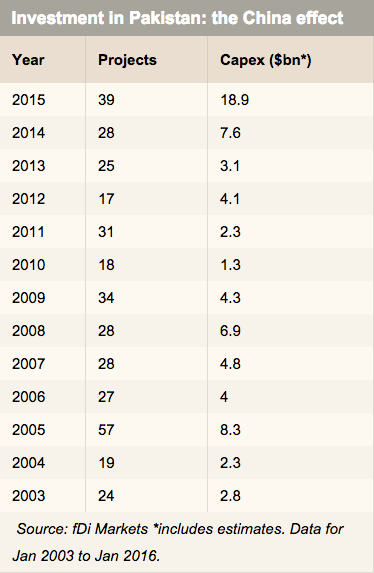

The year 2015 was a bumper year for foreign investment pouring into Pakistan, says the Financial Times. The country saw 39 greenfield investments adding up to an estimated $18.9 billion last year, according to fDi Markets, an FT data service. This is a big jump from 28 projects for $7.6 billion started in 2014, and marks a new high for greenfield capital investment into the country since fDi began collecting data in 2003.

The number of projects in 2015 is the largest since Pakistan attracted 57 greenfield projects back in 2005 on President Musharraf's watch. China is now the top source country for investment into the country, surpassing the second-ranked United Arab Emirates, primarily due to its investments in power.

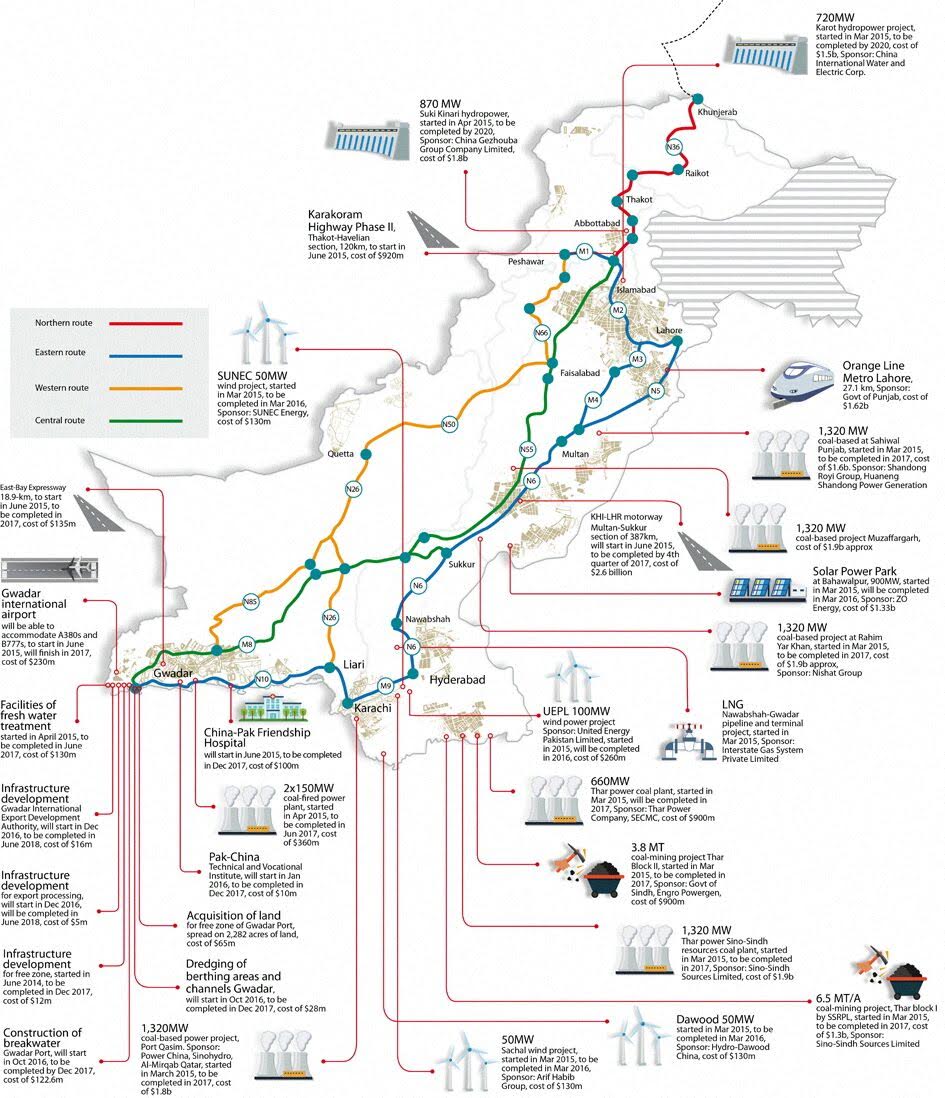

Major CPEC Projects:

China's Shanghai Electric, a power generation and electrical equipment manufacturing company, announced plans last year to establish a 1,320 megawatt coal-based power project in Thar desert using domestic coal, scheduled to launch in 2017 or 2018. Traditional energy and power projects made up two-thirds of last year’s total greenfield investment into Pakistan at $12.9 billion with alternative energy bringing in a further $1.8 billion.

CPEC Projects |

Among the more notable projects, UAE-based Metal Investment Holding Corporation announced plans to partner with Power China E & M International to invest $5 billion to build three coal-fired plants at Karachi’s Port Qasim. In addition, the transportation sector is also showing promise, with 12 projects totaling $3 billion being announced or initiated last year.

Special Economic Zones:

Beyond the initial phase of power and road projects, there are plans to establish special economic zones in the Corridor where Chinese companies will locate factories. Extensive manufacturing collaboration between the two neighbors will include a wide range of products from cheap toys and textiles to consumer electronics and supersonic fighter planes.

The basic idea of an industrial corridor is to develop a sound industrial base, served by competitive infrastructure as a prerequisite for attracting investments into export oriented industries and manufacturing. Such industries have helped a succession of countries like Indonesia, Japan, Hong Kong, Malaysia, South Korea, Taiwan, China and now even Vietnam rise from low-cost manufacturing base to more advanced, high-end exports. As a country's labour gets too expensive to be used to produce low-value products, some poorer country takes over and starts the climb to prosperity.

Once completed, the Pak-China industrial corridor with a sound industrial base and competitive infrastructure combined with low labor costs is expected to draw growing FDI from manufacturers in many other countries looking for a low-cost location to build products for exports to rich OECD nations.

Key Challenges:

While the commitment is there on both sides to make the corridor a reality, there are many challenges that need to be overcome. The key ones are maintaining security and political stability, ensuring transparency, good governance and quality of execution. These challenges are not unsurmountable but overcoming them does require serious effort on the part of both sides but particularly on the Pakistani side. Let's hope Pakistani leaders are up to these challenges.

Summary:

Pak-China economic corridor is a very ambitious effort by the two countries that will lead to greater investment and rapid industrialization of Pakistan. Successful implementation of it will be a game-changer for the people of Pakistan in terms of new economic opportunities leading to higher incomes and significant improvements in the living standards for ordinary Pakistanis. It will be in the best interest of all of them to set their differences aside and work for its successful implementation.

Related Links:

Chinese to Set New FDI Record For Pakistan

Pak Army Completes Half of CPEC Western Route

Pakistan Launches $8.2 Billion Railway Upgrade

Pak-China Defense Industry Collaboration Irks West

President Musharraf Accelerated Human and Financial Capital Growth ...

China's Investment and Trade in South Asia

China Signs Power Plant Deals with Pakistan

-

Comment by Riaz Haq on June 15, 2016 at 8:05am

-

#Pakistan shares soar to all-time high after #MSCI upgrade

http://www.business-standard.com/article/reuters/pakistan-shares-so...

Pakistan's benchmark index jumped as much as 3% in early trade on Wednesday, climbing to a record high after the country's stock market was reclassified overnight and included in the MSCI's emerging market index category.

By 10.55 a.m. local time (0555 GMT), the benchmark 100-share index of the Pakistan Stock Exchange was up 865.68 points, or 2.3%, at 38,383.43 points.

The index recorded its biggest single-day gain since March 31, 2015, and is one of Asia's best performers this year.

Pakistani brokerages upgraded their outlook on the market and said the main index was now likely to rise above 40,000 by the end of the year.

"Pakistan's market multiple is lower than the emerging market multiple so there will most likely be a re-rating of the Pakistan market in the short term," said Saad Hashmey, chief economist and director of research for Topline Securities.

"It might not be as high as the emerging market but there will be plenty of upside," he added.

The stock exchange was dropped from the MSCI Emerging Markets Index when it imposed a floor on the market during the financial crisis in 2008, effectively trapping local and foreign investors for several months.

Over the past few years officials have been enacting a host of market reforms to regain the trust of investors, including demutualising Pakistan's bourses to weaken the influence of stockbrokers and deepen the investor base.

Intermarket Securities, a local brokerage, said the move by MSCI had prompted it to upgrade its end-of-year target for the benchmark index to 41,000 points.

"The jovial mood following this re-rating event is expected to reflect in market performance today," Intermarket said in an early morning research note.

Traders said large-cap stocks expected to be included in the MSCI Emerging Market index were trading higher. Habib Bank was up 3.83% at 191.30 rupees, while Oil and Gas Development Company jumped 2.95% to 146.60 rupees.

Research firms estimate the MSCI upgrade will result in about $400 million in inflows into Pakistan's stock market by passive tracker funds alone.

-

Comment by Riaz Haq on June 20, 2016 at 10:50pm

-

#China eases rules for #Pakistan’s banks. #CPEC #FDI

http://tribune.com.pk/story/1126610/unprecedented-china-eases-rules...

After successful negotiations by the Ministry of Commerce, Chinese authorities have eased the regulations for Pakistan’s financial sector which will make it easier for Habib Bank Limited (HBL) to establish a branch in China.

HBL will be the first South Asian commercial bank to open a division in China. It will be located in China’s northwest city of Urumqi.

“The bank has received formal approval from the Chinese authorities and will open its branch by the end of this year,” announced Commerce Minister Khurram Dastgir, accompanied by the president and CEO of HBL, at a press conference on Monday.

HBL to open branch in China

The minister said after successful negotiations with the Chinese authorities under the Trade and Investment Agreement 2009, they relaxed their criteria for Pakistan’s banking sector by curtailing the currency reserves limit from $20 billion to $15 billion.

The banking channels will be opened under the Trade and Investment Agreement signed by the two countries. Under the agreement, both sides have agreed to provide concessions to each other in 11 sectors including the banking sector.

Dastgir was optimistic that the step would enhance trade facilitation between the two countries and they would now be able to open letters of credit with HBL instead of a foreign bank.

“This initiative will also help Pakistan’s banking channel to reach the Central Asian countries bordering Urumqi.”

China cuts cost estimate by another $200 million for Gwadar LNG pipeline

Replying to a question, the minister said availability of Pakistan banking channels in China would also be helpful in overcoming the challenges of over and under-invoicing in bilateral trade as most of the businessmen conducted trade through cash.

HBL President Sultan Ali Allana said HBL’s initial plan was to cover the China-Pakistan Economic Corridor trade route and it would then expand its branches to other cities of China.

He said they had got approval from the Chinese authorities and the first branch would be opened in Urumqi before the end of current year.

“HBL has a long-term strategic plan in China and will broaden its channels in other cities in future with appropriate investment,” said Allana.

-

Comment by Riaz Haq on June 24, 2016 at 4:05pm

-

#Pakistan shares index plummets 848 points ( 2.22%) on #Brexit vote http://reut.rs/28TmOQL via ReutersPakistan stocks plunged more than 2 percent and recorded their biggest percentage loss in more than five months as Britain's exit from the European Union rattled global markets.The benchmark 100-share index of the Pakistan Stock Exchange closed down 2.22 percent, or 848.01 points, at 37,389.88, after recovering from an intraday low of 36,826."Markets fell as an impact of Britain's exit from EU, Asian markets fell as well as commodity prices. Oil prices are also down by five percent," said Fawad Khan, head of research, KASB Securities Private Limited.Index heavyweights that led the losses include Oil and Gas Development Co Ltd, which slipped 4.18 percent, while Pakistan Petroleum Limited declined 4.34 percent and Pakistan Oil fields Ltd fell 3.93 percent.Yen has appreciated as a result of Britain's exit, hurting auto sector stocks.Honda Atlas Cars (Pakistan) Ltd lost 5 percent and Pak Suzuki Motor Co Ltd declined 5 percent.

-

Comment by Riaz Haq on June 24, 2016 at 4:06pm

-

Pakistan's stock market had its second worst week of 2016. Its still Asia's best market and only to give double digit returns #Brexit

-

Comment by Riaz Haq on June 25, 2016 at 8:04pm

-

#China-#Pakistan Economic Corridor on track, says #Chinese envoy. #CPEC

http://www.business-standard.com/article/news-ians/china-pakistan-e...

In the energy sector, 16 projects have been sorted out to be implemented first, which can generate 10.4 million kw of electricity in total, Sun said, adding that half of the projects have been under construction, and will help Pakistan ease its power shortages.

A solar power plant in Punjab province's Bahawalpur city, built by the Chinese company ZTE Energy, has recently installed a 300-megawatt generator unit, which can produce 480 million kWh annually, enough to satisfy the daily power consumption of at least 200,000 Pakistani families, Sun said.

Regarding transportation, the ambassador said, phase II of the Karakoram highway, the Multan-Sukkur section of the Lahore-Karachi highway, and the Pakistan portion of a cross-border optical cable project are already underway.

As the largest transportation project under the CPEC, the 392 km-long Multan-Sukkur stretch is expected to create nearly 10,000 jobs at the peak of its construction, the ambassador added.

According to incomplete statistics, the CPEC projects under construction have employed more than 6,000 Pakistani workers by the end of March, besides the employment indirectly created and driven by the projects, Sun said.

Furthermore, Chinese companies participating in CPEC helped residents in remote areas of Pakistan gain access to clean water, electricity and better transportation.

China's Three Gorges Corporation and Tebian Electric Apparatus have provided generators, solar lights and water purification units to residents in remote regions while China Road and Bridge Corporation has repeatedly helped locals build makeshift bridges and water ducts and taken part in rescue and relief operations.

The China Development Bank, Huawei, China State Construction Engineering Corporation, as well as other Chinese entities, have also sponsored Pakistanis to receive further education in China, donated school buses to Gwadar and set up education funds, which have received wide praise from the local population.

The CPEC, which highlights energy, transport, the Gwadar port and industrial cooperation at the current stage and will seek to expand cooperation to such sectors as finance, science and technology, education, poverty alleviation, and urban planning.

"The CPEC is a mutually-beneficial and win-win cooperation, which will contribute to the prosperity and development of China, Pakistan and the region and the building of a community of shared destiny between the two countries," Sun said.

"We will fully implement the important consensus reached by the leaders of China and Pakistan, and push forward the construction of CPEC to benefit the Chinese and Pakistani peoples," Sun added.

Chinese firms are to invest $46 billion in the project over six years, including $33.8 billion in energy projects and $11.8 billion in infrastructure, as part of an agreement inked by the two sides during a visit by Pakistan Prime Minister Nawaz Sharif to China in 2014.

The CPEC is part of China's transnational 'One Belt One Road' (OBOR) initiative, which includes the land-based New Silk Road and the 21st century Maritime Silk Road.

China's access to Gwadar, close to the Strait of Hormuz, a key oil shipping lane, could open up an energy and trade corridor from the Gulf across Pakistan to western China.

The CPEC when completed will also give China land access to the Indian Ocean, cutting the nearly 13,000 km sea voyage from Tianjin to the Persian Gulf through the Strait of Malacca and around India, to a mere 2,000 km road journey from Kashgar to Gwadar.

Comment

Twitter Feed

Live Traffic Feed

Sponsored Links

South Asia Investor Review

Investor Information Blog

Haq's Musings

Riaz Haq's Current Affairs Blog

Please Bookmark This Page!

Blog Posts

Modi's AI Spectacle: Chaos and Deception in New Delhi

The India AI Impact Summit 2026, held at Bharat Mandapam in New Delhi, has been marred by chaos, confusion and deception. The events on the ground have produced unintended media headlines for India's Prime Minister Narendra Modi who wants to be seen as the "vishwaguru" (teacher of the world) in the field of artificial intelligence as well. First, there was massive chaos on the opening day, with long…

ContinuePosted by Riaz Haq on February 19, 2026 at 12:00pm — 10 Comments

India-Pakistan Cricket Match: The Biggest Single Event in the World of Sports

Why did Pakistan's decision to boycott the India-Pakistan match in solidarity with Bangladesh in this year's T20 World Cup send shockwaves around the world? And why did it trigger the International Cricket Council's and other cricket boards' urgent efforts to persuade Pakistan to return to the match? The reason has a lot to do with its massive financial impact, estimated to be as much as …

ContinuePosted by Riaz Haq on February 11, 2026 at 4:00pm — 2 Comments

© 2026 Created by Riaz Haq.

Powered by

![]()

You need to be a member of PakAlumni Worldwide: The Global Social Network to add comments!

Join PakAlumni Worldwide: The Global Social Network