PakAlumni Worldwide: The Global Social Network

The Global Social Network

Pakistan's Fiscal Year 2022 GDP Reaches $1.62 Trillion in Purchasing Power Parity (PPP) Terms

Economic Survey of Pakistan 2021-22 confirms that the nation's GDP grew nearly 6% in the current fiscal year, reaching $1.62 Trillion in terms of purchasing power parity (PPP). It first crossed the trillion dollar mark in 2017. In nominal US$ terms, the size of Pakistan's economy is now $383 billion. In terms of the impact of economic growth on average Pakistanis, the per capita average daily calorie intake jumped to 2,735 calories in FY 2021-22 from 2,457 calories in 2019-20. Pakistan experienced broad-based economic growth across all key sectors in FY 21-22; manufacturing posted 9.8% growth, services 6.2% and agriculture 4.4%. The 4.4% growth in agriculture is particularly welcome; it helps reduce rural poverty. The country's per capita income is $1,798 in nominal terms and $7,551 in PPP dollars. These figures do not yet show up in Google searches. Under former Prime Minister Imran Khan's leadership, Pakistan succeeded in achieving outstanding economic growth and nutritional improvements in spite of surging global food prices amid the Covid19 pandemic. Increasing energy consumption and soaring global energy prices have rapidly depleted Pakistan's forex reserves, forcing the country to seek yet another IMF bailout. History tells us that these bailouts have been forced whenever Pakistan's GDP growth has exceeded 5%. The best way for Pakistan to accelerate its growth beyond 5% in a sustainable manner is to boost its exports by investing in export-oriented industries, and by incentivizing higher savings and investments.

|

| Pakistan Economic Data. Source: IMF April 2022 |

The IMF (International Monetary Fund) has updated its website in April, 2022 with data reported for FY 2020-21. It's not unusual for the IMF data reporting to lag by a year or more. Pakistan's Economic Survey 2021-22 was published in June, 2022.

|

| Sector-wise Economic Growth. Source: Economic Survey of Pakistan 20... |

Pakistan experienced broad-based economic growth across all key sectors in FY 21-22; manufacturing posted 9.8% growth, services 6.2% and agriculture 4.4%. The 4.4% growth in agriculture is particularly welcome; it helps reduce rural poverty.

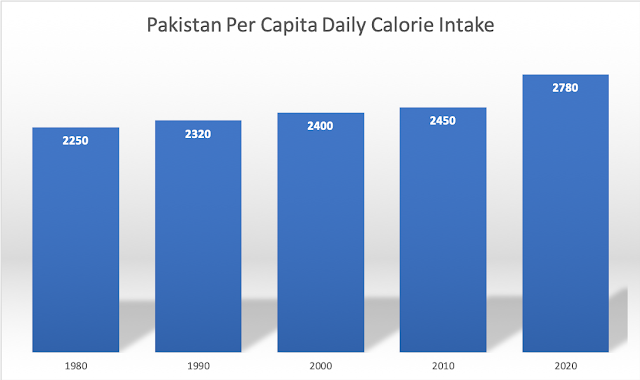

In terms of the impact of economic growth on average Pakistanis, the per capita average daily calorie intake jumped to 2,735 calories in FY 2021-22 from 2,457 calories in 2019-20. The biggest contributor to it is the per capita consumption of fresh fruits and vegetables which soared from 53.6 Kg to 68.3 Kg, less than half of the 144 Kg (400 grams/day) recommended by the World Health Organization. Healthy food helps cut disease burdens and reduces demand on the healthcare system. Under former Prime Minister Imran Khan's leadership, Pakistan succeeded in achieving these nutritional improvements in spite of surging global food prices amid the Covid19 pandemic.

|

| Pakistan Per Capita Daily Calorie Consumption. Source: Economic Surveys of Pakistan |

The trend of higher per capita daily calorie consumption has continued since the 1950s. It has risen from about 2,078 in 1949-50 to 2,400 in 2001-02 and 2735 in 2021-22. The per capita per day protein intake in grams increased from 63 to 67 to about 75 during these years. Health experts recommend that women consume at least 1,200 calories a day, and men consume at least 1,500 calories a day, says Harvard Health Publishing. The global average has increased from 2360 kcal/person/day in the mid-1960s to 2900 kcal/person/day currently, according to the Food and Agricultural Organization (FAO). The USDA (United States Department of Agriculture) estimates that most women need 1,600 to 2,400 calories, while the majority of men need 2,000 to 3,000 calories each day to maintain a healthy weight. Global Hunger Index defines food deprivation, or undernourishment, as consumption of fewer than 1,800 calories per day.

|

| Share of Overweight or Obese Adults. Source: Our World in Data |

The share of overweight or obese adults in Pakistan's population is estimated by the World Health Organization at 28.4%. It is 20% in Bangladesh, 19.7% in India, 32.3% in China, 61.6% in Iran and 68% in the United States.

|

| Major Food Items Consumed in Pakistan. Source: Economic Survey of P... |

The latest edition of the Economic Survey of Pakistan estimates that per capita calories come from the annual per capita consumption of 164.7 Kg of cereals, 7.3 Kg of pulses (daal), 28.3 Kg of sugar, 168.8 liters of milk, 22.5 Kg of meat, 2.9 Kg of fish, 8.1 dozen eggs, 14.5 Kg of ghee (cooking oil) and 68.3 Kg of fruits and vegetables. Pakistan's economy grew 5.97% and agriculture outputs increased a record 4.4% in FY 2021-22, according to the Economic Survey. The 4.4% growth in agriculture has boosted consumption and supported Pakistan's rural economy.

The minimum recommended food basket in Pakistan is made up of basic food items (cereals, pulses, fruits, vegetables, meat, milk, edible oils and sugar) to provide 2150 kcal and 60gram protein/day per capita.

The state of Pakistan's social sector is not as dire as the headlines suggest. There are good reasons for optimism. Key indicators show that nutrition and health in Pakistan are improving but such improvements need to be accelerated.

South Asia Investor Review

Pakistan's Expected Demographic Dividend

Pakistan's Social Sector

World Bank: Pakistan Reduced Poverty, Grew Economy During Covid19 P...

Surging Global Food Prices Amid Covid Pandemic

Pakistan's Balance of Payments Crisis

Panama Leaks in Pakistan

Olive Revolution in Pakistan"

Nay Pakistan Sehat Card: A Giant Step Toward Universal Healthcare

Prime Minister Imran Khan's Effectiveness as Crisis Leader

India in Crisis: Unemployment and Hunger Persists After Waves of Covid

Riaz Haq's Youtube Channel

-

Comment by Riaz Haq on July 23, 2022 at 1:11pm

-

Pakistan's military-run enterprises need upgrade to revive economy

Corporate empire has potential to be globally competitive

By Uzair Younus

https://asia.nikkei.com/Opinion/Pakistan-s-military-run-enterprises-need-upgrade-to-re...

It is time to accept that rather than trying to cut this empire down to size, it may be more fruitful to develop Military Inc. 2.0: a corporate empire that is globally competitive.

Pakistan's military began playing a role in the economy soon after independence. The construction of the 805-km cross-border Karakoram Highway in the Himalayas was a major inflection point. The Frontier Works Organization was formed then with the mission to construct the highway on the Pakistani side.

Today, military-run organizations have their tentacles spread across the entire economy, with the military-owned Fauji Foundation being one of the largest conglomerates in the country. The government has exempted both the Army Welfare Trust and the Fauji Foundation from income taxes, giving them an edge over privately owned companies.

The military also operates housing developments across the country, with the Defence Housing Authority (DHA) a dominant force in the country's real estate sector. While the initial aim was to develop homes for serving and retired military personnel, DHA has since evolved into a multibillion-dollar entity with a presence in all major cities.

The military's economic footprint, however, is indicative of broader economic issues plaguing Pakistan. For decades, Pakistan's civilian and military elites have extracted wealth by engaging in highly protected, low-productivity sectors. As a result, Pakistani businesses are both globally uncompetitive and provide shoddy services to domestic consumers.

An example is the DHA project in Karachi, built on land reclaimed from the Arabian Sea. The predominant role enjoyed by the military meant that development of the DHA site occurred without proper access to proper stormwater drainage, resulting in multimillion-dollar homes, paid for in cash, routinely being flooded during monsoon rains.

Political volatility and instability have further compounded the problems, leading to an anemic rate of foreign direct investment, particularly in export-oriented sectors. The result: recurring balance of payments crises that require bailouts.

To emerge from this crisis, Pakistan's military must learn from its strategic ally China. While the Chinese regime also began with military-run organizations developing public infrastructure, over the decades, it has developed companies that have a more global outlook.

In addition, China focused on improving quality by leveraging technology while also investing in global best practices. This ensured that the country built globally competitive businesses that enhanced China's technological reach, such as telecommunications group Huawei Technologies.

Pakistan's military would do well to mimic China's strategy to become globally connected, competitive and innovative.

Such a reconfiguration may solve Pakistan's macroeconomic challenges and recurring external crises, as the military is finding it difficult to muster resources required to compete with an India that is growing at a faster pace and rapidly modernizing its military. This is tilting the balance of power in the region toward India, creating national security risks for Pakistan.

Critics will argue that reorienting the military's corporate empire will only worsen the challenges facing Pakistan's floundering democracy. This concern is valid, but Pakistan's growing economic challenges mean that it is time to prioritize sustainable growth and socioeconomic development.

Changing the military's corporate approach is likely to create the space for broader economic reforms that are urgently needed to end Pakistan's protracted economic decline.

-

Comment by Riaz Haq on July 23, 2022 at 1:12pm

-

Pakistan's military-run enterprises need upgrade to revive economy

Corporate empire has potential to be globally competitive

By Uzair Younus

https://asia.nikkei.com/Opinion/Pakistan-s-military-run-enterprises-need-upgrade-to-re...

Pakistan's economy is facing another crisis as the country reaches a staff-level agreement with the International Monetary Fund to resume the support program that was suspended earlier this year. The finalization of the agreement will unlock inflows of almost $1.2 billion, critical to helping stabilize the country's economy.

This latest crisis is part of the decades-long economic decline of the country, which has been captured by a kleptocratic elite. This system is underpinned by Pakistan's powerful military, which operates a multibillion-dollar corporate empire across various sectors.

To many observers, the military's dominant role in the economy must be curtailed if Pakistan is to achieve sustainable growth. But well-meaning as they might be, these efforts have consistently failed to date, meaning that Military Inc. continues to be the dominant player in Pakistan's economy.

It is time to accept that rather than trying to cut this empire down to size, it may be more fruitful to develop Military Inc. 2.0: a corporate empire that is globally competitive.

Pakistan's military began playing a role in the economy soon after independence. The construction of the 805-km cross-border Karakoram Highway in the Himalayas was a major inflection point. The Frontier Works Organization was formed then with the mission to construct the highway on the Pakistani side.

Today, military-run organizations have their tentacles spread across the entire economy, with the military-owned Fauji Foundation being one of the largest conglomerates in the country. The government has exempted both the Army Welfare Trust and the Fauji Foundation from income taxes, giving them an edge over privately owned companies.

The military also operates housing developments across the country, with the Defence Housing Authority (DHA) a dominant force in the country's real estate sector. While the initial aim was to develop homes for serving and retired military personnel, DHA has since evolved into a multibillion-dollar entity with a presence in all major cities.

The military's economic footprint, however, is indicative of broader economic issues plaguing Pakistan. For decades, Pakistan's civilian and military elites have extracted wealth by engaging in highly protected, low-productivity sectors. As a result, Pakistani businesses are both globally uncompetitive and provide shoddy services to domestic consumers.

An example is the DHA project in Karachi, built on land reclaimed from the Arabian Sea. The predominant role enjoyed by the military meant that development of the DHA site occurred without proper access to proper stormwater drainage, resulting in multimillion-dollar homes, paid for in cash, routinely being flooded during monsoon rains.

Political volatility and instability have further compounded the problems, leading to an anemic rate of foreign direct investment, particularly in export-oriented sectors. The result: recurring balance of payments crises that require bailouts.

To emerge from this crisis, Pakistan's military must learn from its strategic ally China. While the Chinese regime also began with military-run organizations developing public infrastructure, over the decades, it has developed companies that have a more global outlook.

In addition, China focused on improving quality by leveraging technology while also investing in global best practices. This ensured that the country built globally competitive businesses that enhanced China's technological reach, such as telecommunications group Huawei Technologies.

-

Comment by Riaz Haq on July 23, 2022 at 1:13pm

-

Pakistan's military-run enterprises need upgrade to revive economy

Corporate empire has potential to be globally competitive

By Uzair Younus

https://asia.nikkei.com/Opinion/Pakistan-s-military-run-enterprises-need-upgrade-to-re...

Pakistan's military would do well to mimic China's strategy to become globally connected, competitive and innovative.

Such a reconfiguration may solve Pakistan's macroeconomic challenges and recurring external crises, as the military is finding it difficult to muster resources required to compete with an India that is growing at a faster pace and rapidly modernizing its military. This is tilting the balance of power in the region toward India, creating national security risks for Pakistan.

Critics will argue that reorienting the military's corporate empire will only worsen the challenges facing Pakistan's floundering democracy. This concern is valid, but Pakistan's growing economic challenges mean that it is time to prioritize sustainable growth and socioeconomic development.

Changing the military's corporate approach is likely to create the space for broader economic reforms that are urgently needed to end Pakistan's protracted economic decline.

The experience of the last few years shows that there is, at least in the near term, no political party capable of challenging and dislodging the military from its dominant role.

The next best alternative is to leverage the military's economic empire to transform the country's economy. But the question is: Do Pakistan's generals have it in them to reform in a way that generates wealth for their country?

With millions of younger Pakistanis joining the workforce and failing to find jobs, the time for a different approach is now.

-

Comment by Riaz Haq on July 24, 2022 at 7:37am

-

A Mitchell

@aem76us

@haqsmusings

Every entrepreneur seeking overseas investment in Pakistan should include this article in their supporting documents.

@rogueonomist

provides a clear-headed, factually-based & surprisingly optimistic assessment of the country’s debt situation:

https://twitter.com/aem76us/status/1551207098926637060?s=20&t=S...

-------------

Default: more noise, less substance

OpinionAmmar Habib KhanJuly 24, 2022

https://www.thenews.com.pk/amp/976268-default-more-noise-less-subst...

Over the last few weeks, the noise regarding a sovereign default by Pakistan has gained traction, further amplified by social media activity. The noise is largely devoid of facts, and speculative in nature as it mostly draws strength through parallels with Sri Lanka, which recently 3declared a sovereign default and is undergoing a political and economic crisis of its own.

Although we do have our fair share of political crises, and a perennial balance of payments crisis grounded in mismanagement by successive governments, we are still not even close to a sovereign default. Such noise often gains traction as soon as we get close to the peak of a balance of payments crisis, and eventually subsides. Similar concerns have gained traction at least half a dozen times in the last 25 years, wherein the country has seen much worse crises, but has never defaulted. Pakistan has never been in default on its sovereign debt, except for a technical default that occurred in the last decade of last century due to sanctions that were imposed on the country following nuclear tests.

It is important to first understand what the conditions of a sovereign default are. A sovereign default occurs when a sovereign nation is not able to pay back its creditors, whether the interest or principal amount as per its commitment. In case a default materializes, ideally all creditors sit together and work out a restructuring plan, such that the sovereign can eventually pay back its debt. Pakistan has been an active borrower from the capital markets over the last two decades, but relative to total external debt, debt from global investors or commercial financial institutions is about 17 per cent of total external debt. Similarly, debt from global investors or commercial financial institutions in Foreign Currency (FCY) is around eight per cent of total debt. It is essential to understand the context here.

It is important to understand the composition of Pakistan’s debt position here. Roughly 63 per cent of debt is PKR based, which means it is domestic debt, subscribed by the population and institutions of the country, largely through banks, which utilize individual and institutional deposits alike to invest in government debt. The sovereign can’t really default on this, as it can theoretically print more currency, and repay earlier PKR-based creditors. Although printing more money creates more problems than it solves; the logical consequence of it is inflation, which means erosion in purchasing power for everyone. Cash in Circulation has substantially increased over the years largely due to the SBP printing more money, which continues to fuel inflation.

External debt (mostly US$) makes up 37 per cent of our total debt. Further breaking down external debt, 24 per cent is due to other sovereign nations (mostly friendly), 57 per cent of external debt is due to multilateral institutions, while another 17 per cent is due to private investors through Eurobonds, Sukuks, and commercial loans. Multilateral institutions have rarely (if ever) called on a default, they negotiate with the borrowing country, no matter how stubborn, and eventually work out a restructuring plan. Similar to what has happened in our case during the last half century, wherein we have reached out to the International Monetary Fund (IMF) on an average of every three years. Debt due to other sovereign nations is an extension of the relationship that exists between the sovereigns.

-

Comment by Riaz Haq on July 24, 2022 at 7:40am

-

Default: more noise, less substance

OpinionAmmar Habib KhanJuly 24, 2022

https://www.thenews.com.pk/amp/976268-default-more-noise-less-subst...

Finally, it is the private investors subscribing to the country’s debt who may call on a default in case an interest or principal payment is not made. These private investors need to be the first ones to be paid, and it is estimated that the country needs to pay $3.1 billion to these investors during the current year. A sovereign with a GDP of more than $380 billion, which has posted growth rates to the north of five per cent during the last two years isn’t really going to default on an amount less than one per cent of its GDP, or just about equivalent to a month of remittances. This is more of a liquidity crisis rather than a credit issue. Rapid rise in commodity prices after the pandemic, as well as geopolitical volatility has put budgets of countries around the world under strain, particularly of commodity importers. However, as recessionary fears materialize globally, there has been a decline in commodity prices across the board, which will provide some respite to Pakistan and provide some breathing space in terms of liquidity.

This time it is slightly different though, as none of the friendly sovereign nations is willing to extend any fresh debt, or rollover, till we get the IMF programme in place, which means till we agree to ensure some kind of fiscal and monetary discipline. We have flirted with default multiple times over the last three decades, but we cannot stay safe from it forever. This may be our last chance, thereby necessitating structural reforms which institutes fiscal, and monetary discipline. An uncontrollable expense budget, and demonstrated inability to generate tax revenues are issues that need to be resolved. Without structural reforms, we may potentially default during the next ten years, because the punch bowl isn’t going to last forever.

The current crisis pales in comparison to many other economic crises that Pakistan has faced earlier. This however does not mean that we should continue living dangerously, and considerably beyond our means. This may be the country’s last chance to put the house in order and gradually move away from import dependent consumption, and reconfigure the economy to be more export oriented, with an expansive and progressive tax base.

A resolution of the decision-making crisis and a much-needed consensus among all political and non-political actors would stave away any risk of sovereign default. If the country continues to inch towards a default this time around, it would solely be a consequence of the current political crisis, in addition to consistently bad policymaking during the last 50 years.

The writer is an independent macroeconomist.

-

Comment by Riaz Haq on July 24, 2022 at 9:34am

-

Pakistan's Financing Needs Fully Met for This Year, Central Bank Chief Says

https://www.voanews.com/a/pakistan-s-financing-needs-fully-met-for-...

Pakistan's $33.5 billion external financing needs are fully met for financial year 2022/23, the central bank chief said on Saturday, adding that "unwarranted" market concerns about its financial position will dissipate in weeks.

Fears have risen about Pakistan's stuttering economy as its currency fell nearly 8% against the U.S. dollar in the last trading week, while the country's forex reserves stand below $10 billion with inflation at the highest in more than a decade.

"Our external financing needs over the next 12 months are fully met, underpinned by our on-going IMF program," the acting governor of Pakistan's State Bank, Murtaza Syed, told Reuters in an emailed reply to questions.

Pakistan last week reached a staff level agreement with the International Monetary Fund (IMF) for the disbursement of $1.17 billion in critical funding under resumed payments of a bailout package.

"The recently secured staff-level agreement on the next IMF review is a very important anchor that clearly separates Pakistan from vulnerable countries, most of whom do not have any IMF backing," he said.

-

Comment by Riaz Haq on July 24, 2022 at 2:16pm

-

Mattias Martinsson

@Tundra_CIO

Had the honor to participate in a panel on #SriLanka. Was asked about comparisons to #Pakistan. Will they too default on their commercial debt?

1/X

1) Going into 2022 Sri Lanka's foreign public debt to GDP was 40-45%, vs Pakistan's 20-25% (interval as no final GDP number)

https://twitter.com/Tundra_CIO/status/1551105929927688192?s=20&...

------------------

Mattias Martinsson

@Tundra_CIO

2/X

More importantly the commercial share of #SriLanka's FX debt (the part that is owned by bond investors in London and NY) was 22-25% of GDP, vs #Pakistan's 5-6%. Both had ca USD 18bn in commercial debt, but #Pakistan is a significantly larger economy.

https://twitter.com/Tundra_CIO/status/1551107814159949825?s=20&...

----------------

Mattias Martinsson

@Tundra_CIO

3/X

#SriLanka's government refused IMF negotiations when covid hit (and USD 4bn of tourism revenue was no longer an option). Instead introduced capital controls, hoping that tourism would recover in time for them to make their debt payments. They ran FX reserves down to zero (0)

https://twitter.com/Tundra_CIO/status/1551109782387433472?s=20&...

-----------

Mattias Martinsson

@Tundra_CIO

4/X

I can only explain this as a gamble with 21 million people's lives, which they lost. When #Ukraine #Russia crisis hit the bluff was called. Coffer was empty, no money to buy fuel, no money for medicines, you name it.

https://twitter.com/Tundra_CIO/status/1551110512301285377?s=20&...

--------------------

Mattias Martinsson

@Tundra_CIO

5/X

#SriLanka defaulted on their eurobonds because there was literally 0 USD to pay with. #Pakistan has USD 2bn in maturing eurobonds in 2022, another 2 in 2024. If they want to, they can pay these.

https://twitter.com/Tundra_CIO/status/1551111415221592064?s=20&...

------------

Mattias Martinsson

@Tundra_CIO

6/X

#Pakistan can be forced to enter a debt restructuring but it will then be due to failing negotiations with IMF and friendly states. It will NOT be their commercial debt that trips them. This makes the question of default more of a political discussion, than anything else.

https://twitter.com/Tundra_CIO/status/1551112196305944578?s=20&...

-

Comment by Riaz Haq on July 24, 2022 at 5:18pm

-

Pakistan is facing default on its sovereign debt.

by Wajahat S. Khan

https://www.gzeromedia.com/even-if-pakistan-defaults-its-larger-cha...

After Sri Lanka, it’s the latest emerging economy to falter in the wake of COVID, the war in Ukraine, and skyrocketing inflation. But the stakes are higher: Pakistan borders China, India, Iran, and Afghanistan, and it sits at the crossroads of the Persian Gulf and the Indian Ocean. It’s embroiled in a battle against rising terrorism, and it has nuclear weapons.

But the world’s fifth-most populous country — where 220 million live under a political system plagued by corruption and extremism ± isn’t just broke. Polarized and isolated, it’s going through a period of instability not seen since its civil war in 1971, when it lost a majority of its population as East Pakistan seceded to become Bangladesh.

A serious rethink is needed about the way Pakistan manages itself and its diplomacy. So, are its rulers making the right adjustments?

Debt and doubt are mounting. The Pakistani rupee lost 8.3% of its value last week — an all-time low. Its stocks are the worst performing in Asia, and it has less than two months' worth of foreign exchange reserves, which means Pakistan needs an IMF bailout immediately.

But the country has a habit of not mending its ways: Pakistan is one of the most bailed-out countries on the IMF’s books, having received 22 loans since 1958. It borrows, refuses to reform, then borrows again. Now, the IMF wants more than Pakistan’s empty promises, and assurances from a guarantor like Saudi Arabia before offering another lifeline.

Political turmoil has paralyzed governance. The military remains all-powerful but is threatened by recently ousted Prime Minister Imran Khan. Once an ally of the generals, Khan lost their support this spring and paid for it with a no-confidence vote that saw him replaced by a military-backed coalition of older political dynasties, the Sharifs and Bhuttos. But high prices, power cuts, and removal of public subsidies have quickly eroded support for the new government.

Despite his own track record of maladministration, Khan is gaining the sympathy of the street, turning protests into votes, bashing his former benefactors, and threatening further unrest.

Security and geopolitical problems are also escalating. After backing the Taliban for two decades while pretending to be America’s ally, Pakistan’s gotten more than it bargained for. It’s suffering attacks from terrorists based in Afghanistan, and its relationship with Washington has deteriorated. American diplomatic interest and financial investments have all but dried up. This has pushed Pakistan to embrace China and its expensive loans tied to Beijing’s Belt and Road Initiative.

But as China tries to make inroads, its personnel and projects have been targeted by insurgents, forcing Beijing to go slow on investments there.

Meanwhile, Pakistan’s poisonous relationship with India has only worsened. Narendra Modi’s Hindu-nationalist regime has tightened its grip in Delhi while anti-India generals continue to dominate Islamabad’s foreign policy. Despite a back channel, the two sides barely trade or talk, and instead support proxy militants on each other’s turf. Moreover, Islamabad has seen relations chill with once-friendly neighbors like Saudi Arabia, the UAE, and Iran, all of whom now have warmer ties with New Delhi because of India’s increasing economic clout.

If the most immediate threat is default, can Pakistan avoid it? Even though the rupee saw its biggest drop last week since 1998, its central bank thinks it can meet its obligations for yet another IMF bailout. Others are not so sure.

“Pakistan is significantly closer to default today than it was a few days ago,” says Uzair Younus, director of the Pakistan Initiative at Washington’s Atlantic Council. “Does this mean default is imminent? No, but domestic elites are signaling that they are bracing for impact and a hard landing.”

-

Comment by Riaz Haq on July 24, 2022 at 5:18pm

-

Pakistan is facing default on its sovereign debt.

by Wajahat S. Khan

https://www.gzeromedia.com/even-if-pakistan-defaults-its-larger-cha...

Crucially, the political will to improve the situation seems to be lacking. “There’s little incentive for politicians to cooperate and bring Pakistan back from the brink,” Younus says about the leadership, which is dominated by exploitative landed and industrial classes who maintain their assets abroad.

This was evident on Friday, when the election of the chief ministership of Punjab, the country's largest province, didn’t go to Imran Khan’s candidate despite being poised for a majority. Rather, backroom politicking robbed Khan and his allies of their prize, resulting in protests. With such political wrangling and brinkmanship, there is only one disciplinarian: the Pakistan military.

“The chaos may once more open the door for enhanced involvement of the military in stabilizing the political economy,” says Younus.

Pakistanis aren’t unfamiliar with military interventionism in their daily lives. The world’s sixth-largest military has ruled Pakistan directly or indirectly for most of the last 75 years since independence.

If the military leans in, it could lead to one of two types of scenarios: direct rule, which the army has exercised intermittently for over three decades; or indirect rule, which means the brass appoint an apolitical and technocratic government, a model the generals have also toyed with in the past.

While admitting that Pakistan’s economic and political situation is becoming untenable, senior security officials, speaking on condition of anonymity, denied that direct rule is in the cards. But a former Pakistani diplomat said he got a “heads-up to stand by in case of a technocratic set-up by the ‘Establishment’.” That’s Pakistan-speak for the army and its praetorian intelligence apparatus.

Even if autocrats take over or bring in technocrats from Pakistan’s diaspora to run things, certain realities will be hard to change. India, not Pakistan, is Washington’s new best friend in South Asia. And while India has graduated to a $3.3 trillion economy, overtaking the UK as the world’s fifth-largest, Pakistan’s over-investment in remaining a national security state has only unraveled its potential.

Aid packages and military interventions can’t fix that. Pakistan has retained a military it can’t afford and backed proxies it can’t control while allowing its financial and administrative institutions to falter. With an anemic tax regime, stagnant industrialization, a shrinking middle class, the biggest gender income gap in South Asia, and a falling education rate (with nearly half of 5-16-year-olds unenrolled in school), Pakistan needs more than multilateral institutions and donors to come to its aid. It needs economic reforms and a security rethink.

No friend or ally has been able to convince the country to mend its ways. But of all its partners – and there aren’t many – China is the most likely to pick up the tab. Beijing has long seen Islamabad as a bulwark against their common rival, India, but the economic and diplomatic costs of supporting Pakistan, its “Iron Brother,” are mounting. The $65 billion China-Pakistan Economic Corridor, for example, is struggling because of Pakistan’s inability to deliver.

“CPEC was the crown jewel of Xi Jinping’s Belt and Road Initiative and the downward spiral of Pakistan, weighed down after binging on Chinese debt, will undermine China's economic diplomacy,” says Younus.

-

Comment by Riaz Haq on July 24, 2022 at 5:19pm

-

Pakistan is facing default on its sovereign debt.

by Wajahat S. Khan

https://www.gzeromedia.com/even-if-pakistan-defaults-its-larger-cha...

Given its size, location, and its nukes, many Pakistani leaders have often scoffed at the notion of collapse or default, insisting the country is too big to fail. That’s one reason why the country has failed to develop a sounder economic system, relying instead on bailouts.

But Pakistan’s weakness isn’t just financial; it’s also existential. With such divisive politics, it can’t afford another military or technocratic regime. Considering the rough neighborhood it resides in, becoming a Chinese dependent is also dangerous. Critically, with failures on so many fronts — economics, war, democracy, human rights — Pakistan is running out of time to correct its course.

Twitter Feed

Live Traffic Feed

Sponsored Links

South Asia Investor Review

Investor Information Blog

Haq's Musings

Riaz Haq's Current Affairs Blog

Please Bookmark This Page!

Blog Posts

Trump Leads America into an Unpopular War in the Middle East!

President Donald Trump joined Israel in yet another war of choice in the Middle East last week. Polls conducted in the United States immediately after the start of the Iran war show that the majority of Americans do not support it. A YouGov snap poll fielded Saturday — the day of the strikes — found 34% of Americans approve of the U.S. attacks on Iran, with 44%…

ContinuePosted by Riaz Haq on March 3, 2026 at 10:00am — 3 Comments

India-Israel Axis Threatens Peace in South Asia

The bonhomie between Israeli Prime Minister Netanyahu, an indicted war criminal, and Indian Prime Minister Narendra Modi, accused of killing thousands of Muslims, was on full display this week in Israel. Both leaders committed to supporting the Afghan Taliban regime which is accused of facilitating cross-border terrorist attacks by the TTP in Pakistan. Mr. Modi was warmly welcomed by…

ContinuePosted by Riaz Haq on February 27, 2026 at 10:45am — 2 Comments

© 2026 Created by Riaz Haq.

Powered by

![]()

You need to be a member of PakAlumni Worldwide: The Global Social Network to add comments!

Join PakAlumni Worldwide: The Global Social Network