PakAlumni Worldwide: The Global Social Network

The Global Social Network

Pakistan's Informal Sector Drives Consumer-Led Economic Boom

Car sales increased 14 percent in February from a year earlier. Cement sales are rising with growing housing demand for increasing population. Lucky Cement, Pakistan’s biggest publicly traded construction materials company, is expected to post record earnings this year. Rising farm prices of bumper crops are pumping hundreds of billions of rupees each year into Pakistan's rural economy.

Contrary to government statistics of a stagnant economy, packed shopping malls and waiting lines at restaurants tell a different story-- the story of growing discretionary incomes of Pakistani consumers today.

So where is the disconnect between these two opposite views of Pakistan's economy? Naween Mangi of Businessweek answers it in her piece "The Secret Strength of Pakistan's Economy". She attributes it to the fast growing informal sector of the nation's economy that evades government's radar, illustrating it with the story of a tire repair shop owner Muhammad Nasir. Nasir steals water and electricity from utility companies, receives cash from his customers in return for his services and issues no receipts, pays cash for his cable TV connection, and pays off corrupt police and utility officials and local politicians instead of paying utility bills and taxes.

Here's an excerpt from Mangi's Businessweek story:

"The rhythms of life in the underground economy remain largely undisturbed. After work, Nasir and his friends sometimes hire a rickshaw to head to the beach or to a religious festival. The driver, part of the flourishing local transport business, doesn’t turn on the meter because he doesn’t have one. On his way home, Nasir stops to buy cooking oil, wheat flour, and sugar at a small grocery store that isn’t officially there. Out of about 1 million shops, up to 400,000 are grocery stores, and most of them are not registered and don’t pay taxes, according to Rafiq Jadoon, president of the City Alliance of Markets Association. In the evening, Nasir unwinds in front of the television. He watches an Indian movie transmitted by a local cable operator to whom he pays a monthly fee—in cash."

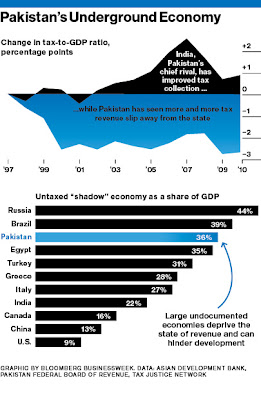

The estimates of the size of Pakistan's underground economy vary from 30% to 50% of the official GDP of just over Rs. 18 trillion (US$200 billion). Businessweek's Mangi claims that the government is losing as much as Rs. 800 billion (US$9 billion) in taxes from the informal sector...nearly enough to wipe out Pakistan's current fiscal deficit.

In my view, there are two major problems that arise from the underground economy described by Mangi. First, the massive tax evasion fosters Pakistan's dependence on foreign aid which comes with strings attached and infringes of national sovereignty. Second, the widespread theft of electricity is largely responsible for the huge circular debt and the ongoing power shortages that affect all aspects of life and scare away investors. The sooner the government and the people realize the severe downsides of the underground economy, the better it will be for Pakistan.

Related Links:

Rural Consumption Boom in Pakistan

Pakistan's Tax Evasion Fosters Aid Dependence

Poll Finds Pakistanis Happier Than Neighbors

Pakistan's Rural Economy Booming

Resilient Pakistan Defies Doomsayers

-

Comment by Riaz Haq on November 16, 2012 at 11:38am

-

Here's an excerpt of a story in "">The News about the size of Pakistan's informal economy:

ISLAMABAD: Pakistan’s informal economy has expanded, reaching 91.4 percent of Gross Domestic Product (GDP). At a PIDE conference on Thursday, economist, M Ali Kemal said, “according to data for 2007-08, our formal GDP is half our actual GDP. However, it is still an under-estimated figure since investment data is not adjusted. The informal economy is 91.4 percent of the formal economy.”

He further said that the formal economy contributed Rs10,242 billion of the estimated Rs19,608 billion that the economy generates. Moreover, the informal economy stands at approximately Rs9,365 billion.

“Estimating the size of the underground economy is crucial for policy makers,” said Kemal. According to Economic Survey findings, total consumption for the entire population of the country is Rs17,261.6 billion and private consumption is Rs7,835.31 billion.

The sum of Rs9,426.29 billion is not reported in the formal economy.

During the session on poverty and household consumption, Dr Ashfaque H Khan, Dean NUST Business School (NBS) and Umer Khalid cited findings from a research paper on the consumption pattern of male and female-headed households in Pakistan.

According to their findings, marginal expenditure shares were highest for housing, durables, food and drink for households headed by men while they were highest for durables, followed by housing and food, and drinks for households headed by women. Higher marginal expenditures by households headed by females on education and durables were found in comparison with their male counterparts as these results were consistent in urban and rural areas of Pakistan.

Further, households headed by women were found to have higher budget shares for education, housing, fuels and lighting, clothing and footwear and lower average expenditure on food, drink, transport and communication compared to those headed by men.

The study also examined the consumption behavior of both types of households to determine consumption patterns and how they vary with change in economic status.

This analysis revealed that in the first three expenditure quintiles, the consumption expenditures of households headed by men were higher than those by women.

Moreover, in the last two quintiles, the consumption expenditures for households headed by women were slightly higher than those headed by women.

http://www.thenews.com.pk/Todays-News-3-143058-Size-of-informal-eco...

http://www.pide.org.pk/psde/25/pdf/AGM28/M%20Ali%20Kemal%20and%20Ah...

-

Comment by Riaz Haq on December 12, 2012 at 8:40am

-

Here's Reuters on 70% of Pak lawmakers not filing tax returns:

Almost 70 percent of Pakistani lawmakers did not file income taxes last year, an investigative journalism group said on Wednesday, highlighting deep flaws in a taxation system that has drawn repeated criticism from Western aid donors.

The Center for Investigative Reporting in Pakistan released a report based on leaked tax returns, marking the first time that the records of 446 lawmakers and ministers have been published and focusing scrutiny on individuals ahead of polls next year.

Pakistan's inability to raise revenue has constrained government spending, depriving schools and hospitals of funds and exacerbating a power crisis, causing widespread hardship in the nuclear-armed country of 180 million people.

--------

"This is what the people of Pakistan are upset about," said Jehangir Tareen, a trim, silver-haired businessman who paid the most tax in the National Assembly last year. He tried to set a precedent by making his returns public but no one followed suit."Taxes are the beginning and end of reform in Pakistan," said Tareen, who gave up his seat in parliament in frustration over his inability to push changes. "Right now the rich are colluding to live off the poor."

Umar Cheema, an award-winning journalist heading the Center for Investigative Reporting, said he hoped the report would make members of parliament more accountable to voters.

Cheema took legislators' identity card numbers from their public election nomination papers, then convinced employees at the Federal Board of Revenue to leak the tax returns related to the identity numbers. It took him a year to collect the data.

POOR ENFORCEMENT

The report highlights why Pakistan has failed to improve its tax collection rates: politicians benefit from a lax regime. No one has been convicted of income tax evasion in 25 years and few Pakistanis see a failure to pay tax as shameful.

Although lawmakers have about $25 a month deducted from their basic pay in tax, almost all have second incomes.

They built this system for their own benefit," said tax expert Ikramul Haq. Poor laws and loopholes meant lawmakers often have their income exempt from tax, he said.

Huge swathes of the economy, like agriculture, are virtually exempt. Specially designated products also benefit from "zero-ratings" and are not subject to any tax.

"We want to cut down on zero ratings and loopholes," said Ali Arshad Hakeem, the head of the Federal Board of Revenue. He has vowed to crack down on tax cheats.

--------

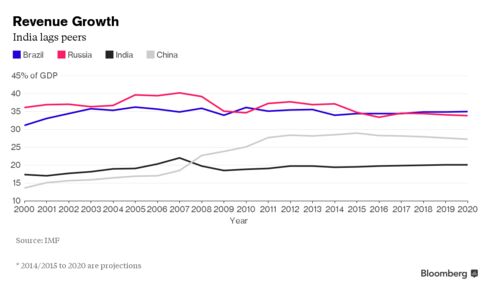

Most countries collect between 20 to 40 percent of their economic output in tax. In Pakistan, less than 10 percent is collected, Franks said.Pakistan revenue authorities say 0.57 percent of adults pay income tax and the number is steadily declining.

"People know that the elites, the government, are corrupt but they don't understand how the corruption works," said report author Cheema.

"If our rulers are not paying for themselves, why should taxpayers in other countries pay for them?"

Part of the problem with going after tax evaders is the poor state of records at the Federal Board of Revenue. It's hard to distinguish ineptitude from corruption, officials said.

About three quarters of the time, people's declarations of what they paid did not match the actual payments, the officials said. An official said authorities never really tried to match up the records: "Oh dear God, no!" he laughed.

http://in.reuters.com/article/2012/12/12/pakistan-tax-idINDEE8BB08X...

-

Comment by Riaz Haq on December 13, 2012 at 9:51pm

-

Here's LA Times on Pakistan's tax collection effort:

The man hired to go after a nation of tax evaders jabs his finger at his laptop screen as he scrolls through a database of wealthy Pakistanis and dissects their spending habits.

He stops at the name of a rich man from Peshawar.

Everything's there, Ali Arshad Hakeem says: the man's photo, his home in a posh Peshawar neighborhood, his frequent trips to Abu Dhabi, his BMW and a bevy of bank accounts.

"We have the universe; now how do we use that universe?" asks Hakeem, Pakistan's new Federal Board of Revenue chairman. Hakeem answers his own question. "My approach is to give them an offer."

Hakeem has the Sisyphean task of overhauling Pakistan's broken income tax system, and he claims to have the remedy. He is asking parliament members — a majority of whom are believed to evade taxes themselves — to approve a national amnesty wiping the slate clean for millions of Pakistanis who have never paid a rupee in taxes, if they agree to a one-time payment of 40,000 rupees, about $420. Then, in 2013, they would have to file a return and pay whatever income tax they owe: for example, about$11,100 on a taxable income of $56,000

-----------

Hakeem, 49, was appointed in July, after a four-year stint as head of the National Database and Registration Authority, the agency that issues the national identity cards. He says his prime target is Pakistan's moneyed upper crust: owners of sprawling two- and three-story marble-floored homes kept white-glove clean by teams of servants.Among them are ministers and politicians, the very people responsible for enacting and executing laws aimed at fixing the system. A 2010 study by the Pakistan Institute of Legislative Development and Transparency, an independent think tank, reported the average worth of a Pakistani lawmaker to be about $850,000, while the richest lawmaker's assets topped $34 million.

According to a study released Wednesday by Pakistani investigative journalist Umar Cheema, two-thirds of Pakistan's federal lawmakers and more than 60% of the Cabinet did not file income tax returns in 2011. One senator, Mushahid Hussain Sayed, paid less than $1 in income taxes in 2011, Cheema says. The report also says President Asif Ali Zardari did not file an income tax return last year, though it adds that an aide said the president did file a return.

"The problem starts at the top," the report states. "Those who make revenue policies, run the government and collect taxes have not been able to set good examples for others."

To track down cheats, Hakeem and his team of young computer experts have combed a variety of national databases to form individual spending and income profiles. One of those experts and a top aide to Hakeem, Samad Khurram, says previous tax amnesties in Pakistan failed because the government had no idea who the tax evaders were.

"Now we know them, their children, their wives, where they travel, what cars they use," Khurram says. "We're saying, 'We know you, we're coming after you, and if you don't pay, we do this….' That's not an amnesty — that's a threat."....

-

Comment by Riaz Haq on May 5, 2013 at 5:15pm

-

Here's a Telegraph story of Pak tx collector fired by judges for "simply too successful in forcing people to pay more taxes":

In a country where almost no-one pays income tax, including more than two thirds of MPs, it only took seven months for Ali Arshad Hakeem to become a hated man.

As Pakistan's newly minted chief taxman, he built a database designed to monitor the spending habits of millions of people, and work out how much tax they owed.

At the click of a mouse, he could call up details of the elite's holiday habits, electricity bills and bank accounts, complete with photos addresses and vehicle details.

This quiet, technocratic revolution came to a juddering halt last month, when Mr Hakeem was suspended by judges over allegations that his appointment breached government rules that demand each job be filled from a shortlist of three.

In Pakistan's murky world of political appointments and patronage systems, few believe that was the real reason. Instead, his supporters say he was simply too successful in forcing people to pay more taxes. In other words, he was too good at doing his job.

A recent report by Pakistan's Centre for Investigative Reporting revealed that President Asif Ali Zardari and Rehman Malik, interior minister until mid-March when the government stepped down ahead of next week's elections, were among those politicians who paid nothing.

It made gloomy reading for anyone wondering whether there was any will inside Pakistan to reform. "The problem starts at the top," the report stated. "Those who make revenue policies, run the government and collect taxes, have not been able to set good examples for others."

Two of Mr Hakeem's key appointments have since transferred, moving them away from jobs where he said they would have helped bring more than £1.3 billion into government coffers.

"It's gone. And I'm not going to do it again," Mr Hakeem, 49, told The Sunday Telegraph - his relaxed demeanour and easy smile belying the bitterness he feels.

Much of his work has been undone in the short time since he was forced out, he said, and he had no appetite to take on the courts or challenge his suspension. His wife and children had already suffered enough stress.

"I hate it. I worked 20 hours a day. I've taken so much hatred for this, everyone is my enemy and out to get me - and then they sack me. Angry is not even the word," he said.

The decision to oust him will worry international donors who have kept pressure on Pakistan to shake up its anaemic tax system. They fear that without economic growth and an expanding revenue, the country's growing population could tip what is a fragile state into a failed state.

Pakistan is officially classed as a middle income country. It has the resources to build more than 100 nuclear warheads yet depends on handouts to keep its power stations, schools and hospitals running.

http://www.telegraph.co.uk/news/worldnews/asia/pakistan/10037380/Pa...

-

Comment by Riaz Haq on December 8, 2013 at 4:58pm

-

Here's Express Tribune report on rising consumption of branded packaged products in Pakistan:

.....

Stocks of major consumer goods and food companies listed on the Karachi Stock Exchange have appreciated 73.1% to date in 2013, outperforming the benchmark KSE-100 index, which has gained 50.8%.

The numbers were taken from a sample of MNCs listed on the Karachi bourse including Unilever Pakistan, Unilever Foods, Nestle Pakistan, Colgate-Palmolive and Gillette Pakistan. The current year’s market performance of these stocks, according to statistics compiled by Topline Securities, is 10.2 percentage points higher than 62.9% they gained last year.

The Express Tribune, in this report, tries to analyse what factors have been contributing to this growth and keeping these giants interested in a market confronted by deteriorating law and order and crippling power outages.

“Pakistan, with its nearly 200 million population, is simply a too large and attractive market to ignore,” Unilever Pakistan CEO Ehsan Malik said, explaining why the Anglo-Dutch food and consumer goods giant is interested in this market.If being the world’s sixth largest consumer base is not enough, it is the country’s population growth rate that will create a high demand for food and consumer goods in the years to come.

Pakistan will soon become the fourth most populous country in the world, Nestle Pakistan’s Head of Corporate Affairs Waqar Ahmed said.

Pakistan’s population is growing at four million people a year and in four years, he says, the increase in food consumers will be larger than the population of Switzerland (15 million).

“The growth of consumption within the Pakistani market dictates that we spend more in order to be able to supply the consumers with the value they deserve. Hence for us, the investment climate within Pakistan is as good as it ever was.”

Nestle is a very good example of the country’s growth potential, Topline Securities Manager Research Zeeshan Afzal said. The Swiss giant almost doubled its sales from Rs41 billion in 2009 to Rs79 billion in 2012.

The data highlights the performance of listed MNCs but unlisted foods and consumer goods companies have also grown manifold.

Mondelez International – a subsidiary of Kraft Group based in Chicago – says Pakistan has been one of their top-five growth markets in the world.The confectionary giant saw a significant growth in their snack brands in Pakistan, which is among the highest in the world. Their Cadbury Dairy Milk and Tang brands alone earn Rs1 billion a year in sales.

In food and consumer goods business, says Afzal, law and order is not that big a problem. The goods are produced by MNCs but the rest is done by distributors who are local people. What matters in this business, he says, is the growth and in Pakistan the growth is driven by volumes and not the price.

Beverages giant Coca-Cola, for example, didn’t need investment from its parent company, it rather invested in its new plants from profits generated by its local operations, the analyst said.

The energy shortage, he said, is also not an issue for most MNCs because of their high profitability.

Explaining the population demographics that have driven this growth, Afzal said more women are entering the workforce contributing to a rise in their family’s incomes.

Rising urbanisation, growing middle class and sophisticated consumption habits, he said, have all contributed to this growth. A big chunk of its population is young while it is one of the top countries adding 20-year-olds to the world.

These people get jobs and establish families, thus contribute to the growth of the consumer goods business.

The country’s food consumption is very high but there is still a lot of room for further growth, believe analysts as well as industry officials...http://tribune.com.pk/story/642820/consumer-goods-multinationals-ba...

-

Comment by Riaz Haq on November 7, 2015 at 9:13am

-

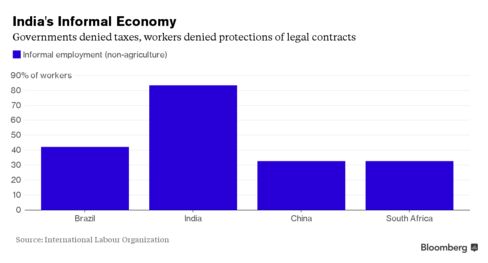

India’s underground economy is booming, and Finance Minister Arun Jaitley wants to keep it that way.

The informal sector is estimated at $780 billion, or about 40 percent of India’s official gross domestic product. It employs more than 90 percent of India’s workforce, according to the government.

“I’m a great supporter of this informal sector," Jaitley said in an interview on Monday. “The informal sector generates more jobs than the organized industry."

The approach goes against the advice of many economists, including those at the International Monetary Fund, which recommends widening the tax net to alleviate India’s chronic shortfalls in fiscal revenue. Indian governments often need to slash infrastructure spending to meet deficit targets that are still among Asia’s highest.

India ranks among the world’s top employers in the informal sector, according to the International Labour Organisation. It puts to work about 400 million people -- more than the entire U.S. population.

In India, it’s nearly impossible to avoid. Retail stores offer discounts for customers if they pay cash, and landlords often take a portion of the monthly rent in stacks of 1,000-rupee notes. Back-alley hawalas transfer billions of dollars around the globe with no questions asked, and thousands of unregistered and underpaid chauffeurs and housemaids don’t file annual income declarations.

“The black economy is growing faster than the white economy and everybody is involved -- the entire country," said Arun Kumar, author of “The Black Economy in India," who came up with the $780 billion estimate by looking at wages, under-the-table transactions and cash-based real estate sales. “This isn’t just a problem among the wealthy -- almost everyone with disposable income participates in the black economy and it’s accepted."

Total corporate and personal income tax payers in India amount to about 40 million -- roughly 3 percent of the country’s 1.2 billion people. To expand that, a Finance Ministry-created panel suggested putting levies on farmers in the untaxed rural sector who make more than 5 million rupees ($76,000) per year -- an approach backed by the IMF.

“We think there’s scope to bring the fiscal deficit down in particular with the revenue side," said Thomas Richardson, the resident representative of the IMF in India. “It’s really a task of widening the tax net -- not raising rates, but bringing more people into the tax net."

“Neo-Middle Class"

Jaitley, for one, rejects that idea. Most farmers don’t make much money anyway, he said, and the rest could use the extra cash.

“We need to strengthen the neo-middle class and put more money in their pockets," Jaitley said. “So bringing tax violators into the tax net, yes, but bringing people with marginal incomes into the tax net -- I’m not so excited about it at all."

Instead, Jaitley wants to finance them. This year the government started a program to boost lending to small entrepreneurs like shopkeepers, fruits and vegetable vendors and artisans. Government-run banks have so far disbursed nearly $6 billion in increments of as much as about $15,000.

Part of the problem is India’s strict labor laws for companies with more than 100 employees. They incentivize businesses to stay small, leaving workers with few rights. The government so far has tweaked only a few minor labor laws, and it’s unclear when they will push for more changes.

While Jaitley this year is again struggling to raise revenue, he’s confident he’ll hit his deficit target of 3.9 percent of GDP without slashing funds for roads, bridges and ports. Shortfalls in direct taxes and state assets sales will be compensated by higher-than-expected indirect taxes -- including payments on services and exports.

Jaitley’s support for the informal sector is "practical and pragmatic" as there’s a trade-off between tax revenues that the government can spend and leaving more cash in the hands of the consumer, according to Anand Rathi Financial Services Ltd.

"The cost of collecting the last rupee from the informal sector in terms of tax isn’t cost efficient as earnings are low," economist Sujan Hajra said by phone from Mumbai. "Instead, you derive an indirect benefit by not taxing them in terms of the consumption push."

http://www.bloomberg.com/news/articles/2015-11-03/jaitley-hails-boo...

-

Comment by Riaz Haq on November 14, 2016 at 8:10am

-

#India's cash economy - Why #Modi wiped out 86% of its cash overnight? #DeMonetisation #corruption

http://www.bbc.com/news/world-asia-india-37974423

India is in the middle of an extraordinary economic experiment.

On 8 November, Prime Minister Narendra Modi gave only four hours' notice that virtually all the cash in the world's seventh-largest economy would be effectively worthless.

The Indian government likes to use the technical term "demonetisation" to describe the move, which makes it sound rather dull. It isn't. This is the economic equivalent of "shock and awe".

Do not believe reports that this is primarily about bribery or terror financing, the real target is tax evasion and the policy is very daring indeed.

You can see the effects outside every bank in the country. I am in Tamil Nadu in the south of India and here, as in every other state in the country, queues of people clutching wads of currency stretch halfway down the street.

Mr Modi's "shock and awe" declaration meant that 1,000 and 500 rupee notes would no longer be valid.

These may be the largest denomination Indian notes but they are not high value by international standards - 1,000 rupees is only £12. But together the two notes represent 86% of the currency in circulation.

Think of that, at a stroke 86% of the cash in India now cannot be used.

What is more, India is overwhelmingly a cash economy, with 90% of all transactions taking place that way.

And that is the target of Mr Modi's dramatic move. Because so much business is done in cash, very few people pay tax on the money they earn.

According to figures published by the government earlier this year, in 2013 only 1% of the population paid any income tax at all.

As a result huge numbers of Indians have stashes of tax-free cash hidden away - known here as "black money".

Even the very poorest Indians have some cash savings - maybe just a few thousand rupees stored away for a daughter's wedding, the kids' school fees or - heaven forbid - an illness in the family.

But lots of Indians have much more than that.

It is not unusual for half the value of a property transaction to be paid in cash, with buyers turning up with suitcases full of 1,000 rupee notes.

The size of this shadow economy is reckoned to be as much as 20% of India's entire GDP.

Mr Modi's demonetisation is designed to drive black money out of the shadows.

At the moment you can exchange up to 4,000 (£48) of the old rupees every day in cash for new 500 (£6) and 2,000 (£24) rupee notes.

There is no limit to the amount that can be deposited in bank accounts until the end of December, but the government has warned that the tax authorities will be investigating any deposits above 250,000 rupees (£2,962).

Breach that limit and you will be asked to prove that you have paid tax. If you cannot, you will be charged the full amount owed, plus a fine of 200% of the tax owed. For many people that could amount to be pretty much the full value of their hidden cash.

This is brave politics. Some of the hardest hit will be the small business people and traders who are Mr Modi's core constituency. They voted for him because they believed he was the best bet to grow the economy and improve their lot. They will not be happy if he destroys their savings.

-

Comment by Riaz Haq on November 4, 2021 at 6:25pm

-

A base year is a benchmark with reference to which national account figures such as GDP, gross domestic saving and gross capital formation are calculated.

According to the new base year, Bangladesh was an economy of Tk 34,840 billion in current prices in FY21, up 15.7 per cent from Tk 30,111 billion as per the previous base year.

https://www.thedailystar.net/business/economy/news/gdp-size-growth-...

"The size of our economy is huge, and the new base year will reflect it," he said, adding that a real scenario would allow the government to make more informed policy decisions.

Zahid Hussain, a former chief economist of the World Bank's Dhaka office, also welcomed the new base year.

He said timely revisions to data on GDP and its components determine the accuracy of national account estimates and their comparability across countries.

With the finalisation of the new series, Bangladesh will be ahead of all other Saarc countries in terms of the recency of the national account's base year.

Only the Maldives (2014) and India (2011-12) come close, while Pakistan (2005-06) and Sri Lanka (2010) are well behind.

"Improved data sources increase the coverage of economic activities as new weights for growing industries reflect their contributions to the economy more accurately," said Hussain.

The last revision was done in 2013.

The size of the agriculture, industry and services sectors has expanded as per the new base year.

The new base year uses data on about 144 crops while computing the contribution of the agriculture sector to the GDP, which was 124 crops in the previous base year.

The gross value addition by the agriculture sector rose to Tk 4,061 billion in current prices in the last fiscal year, up from Tk 3,846 billion in the old estimate, the BBS document showed.

The industrial sector saw the addition of the data on the outputs of Ashuganj Power Station Company, North-West Power Generation Company, Rural Power Company, cold storage for food preservation, Rajshahi Wasa, and the ship-breaking industry.

-

Comment by Riaz Haq on November 12, 2021 at 5:22pm

-

THE size of Pakistan’s informal economy is estimated to be as much as 56 per cent of the country’s GDP (as of 2019). This means that it’s worth around $180 billion a year, and that is a massive amount by any yardstick. by LalaRukh Ejaz IBA Karachi Professor

https://www.dawn.com/news/1610606

The country’s large black economy is inextricably linked to the levels and quality of governance exercised by the state. In the course of fieldwork for my doctoral research for the University of Southampton, I found that many Pakistani women who were setting out starting their own businesses did so in the informal sector. The reasons they gave usually related to their experience of dealing with the bureaucracy and government machinery in Pakistan which they found to be dominated by red tape and tedious and complicated procedures.

This is precisely what drives many people who want to engage in economic activity towards the undocumented economy. The headache of having to deal with a large bureaucracy, of complying with complicated and long registration procedures, of getting approvals and licences from various government agencies and departments make it difficult for most people to operate within a documented framework.

A large black economy is an indication of misgovernance and indicates a failure of the government to ensure that all businesses and entrepreneurial ventures are included in the formal sector. This failure in turn leads to reduced tax revenue collection since all entities outside of the formal economy do not pay any tax to the government.

Pakistan’s black economy is linked to governance.

Given that the size of the black and informal economy is estimated at over half of the country’s GDP, bringing it under the documented net would bring hundreds of billions in tax revenue. Those funds would then be spent on social sector development projects and help the FBR meet its annual revenue collection targets.

The solution is to increase the size of the formal economy and this can be done by making transparent and efficient those institutions tasked with registering and regulating businesses. Instead of harassing businesses and entrepreneurs, agencies like the FBR should act as facilitators and make it easier for new ventures to be registered and come under the documentation net. This would in turn be good for the FBR because achieving the tax collection target would be easier than if they were in the black economy.

Government requirements for new businesses are linked to the general level of governance. A state whose primary aim is to improve the lives of its citizens will prioritise good governance over all other things and will formulate and implement policies that enable this. In fact, such a state will also be able to realise that having such priorities ends up helping it as well, not least because a happy populace is a more economically productive populace.

Unfortunately, in a country like Pakistan, so far, this has not been the case. A multitude of licences and permissions are required from a wide variety of federal, provincial and local government departments to operate a business or a store. Having to comply with all of these requires not only a lot of time on the part of the entrepreneur but also funds for greasing the cogs of the bureaucratic machinery that regulates businesses and commercial enterprises in Pakistan.

The result of this is that a significantly growing number of entrepreneurs, and especially those that happen to be female, are increasingly veering towards the informal sector. This is both good and bad — good because it enables economic activity to take place, and jobs to be created, away from the unwanted glare of government inspectors and officialdom, and bad because the incomes generated from such activity don’t end up getting counted in the national GDP and nor are taxes paid on it.

-

Comment by Riaz Haq on December 30, 2022 at 10:46am

-

Pakistan Economic Survey 2021-22

Chapter 5: Money and Credit

https://www.finance.gov.pk/survey/chapter_22/PES05-MONEY&CREDIT...

Currency in Circulation (CiC)

During the period 01stJuly-29th April, FY2022 CiC witnessed an expansion of Rs 991.7

billion (growth of 14.4 percent) as compared to expansion of Rs 673.0 billion (growth of

11.0 percent) during same period last year. Currency-to-M2 ratio reached 30.7 as on

29thApril, 2022 against 30.2 percent during same period last year. Significant growth in

CiC has been observed particularly in the month of April, 2022 on account of cash

demand during Ramzan and Eid Festive.

Comment

- ‹ Previous

- 1

- 2

- 3

- Next ›

Twitter Feed

Live Traffic Feed

Sponsored Links

South Asia Investor Review

Investor Information Blog

Haq's Musings

Riaz Haq's Current Affairs Blog

Please Bookmark This Page!

Blog Posts

India-Israel Axis Threatens Peace in South Asia

The bonhomie between Israeli Prime Minister Netanyahu, an indicted war criminal, and Indian Prime Minister Narendra Modi, accused of killing thousands of Muslims, was on full display this week in Israel. Both leaders committed to supporting the Afghan Taliban regime which is accused of facilitating cross-border terrorist attacks by the TTP in Pakistan. Mr. Modi was warmly welcomed by…

ContinuePosted by Riaz Haq on February 27, 2026 at 10:45am

Modi's AI Spectacle: Chaos and Deception in New Delhi

The India AI Impact Summit 2026, held at Bharat Mandapam in New Delhi, has been marred by chaos, confusion and deception. The events on the ground have produced unintended media headlines for India's Prime Minister Narendra Modi who wants to be seen as the "vishwaguru" (teacher of the world) in the field of artificial intelligence as well. First, there was massive chaos on the opening day, with long…

ContinuePosted by Riaz Haq on February 19, 2026 at 12:00pm — 13 Comments

© 2026 Created by Riaz Haq.

Powered by

![]()

You need to be a member of PakAlumni Worldwide: The Global Social Network to add comments!

Join PakAlumni Worldwide: The Global Social Network