PakAlumni Worldwide: The Global Social Network

The Global Social Network

Pakistan's Insatiable Appetite For Energy

Pakistan's consumption of oil and gas has rapidly grown over the last 5 years, an indication of the nation's accelerating economic growth. Pakistan is among the fastest growing LNG markets, according to Shell 2017 LNG report.

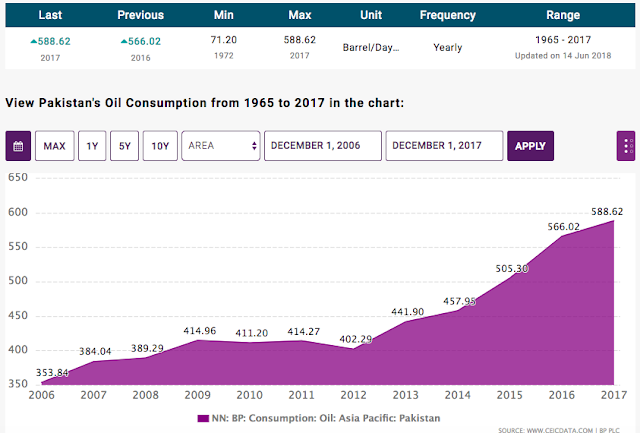

Pakistan Oil Consumption in Barrels Per Day. Source: CEIC.com |

Oil consumption in Pakistan has shot up about 50% from 400,000 barrels per day in 2012 to nearly 600,000 barrels per day in 2017. During the same period, Pakistan's gas consumption has risen from 3.5 billion cubic feet per day to nearly 4 billion cubic feet per day, according to British Petroleum data.

Pakistan is among the fastest growing LNG markets, according to Shell 2017 LNG report. The country has suffered a crippling energy shortage in recent years as demand has risen sharply to over 6 billion cubic feet per day, far outstripping the domestic production of about 4 billion cubic feet per day. Recent LNG imports are beginning to make a dent in Pakistan's ongoing energy crisis and helping to boost economic growth. Current global oversupply and low LNG prices are helping customers get better terms on contracts.

Pakistan Gas Consumption in Billions of Cubic Feet Per Day. Source:... |

Since the middle of the 18th century, the Industrial Revolution has transformed the world. Energy has become the life-blood of modern economies. Energy-hungry machines are now doing more and more of the work at much higher levels of productivity than humans and animals who did it in pre-industrial era.

Every modern, industrial society in history has gone through a 20-year period where there were extremely large investments in the energy sector, and availability of ample electricity made the transition from a privilege of an urban elite to something every family would have. It seems that Pakistan is beginning to recognize it. If Pakistan wishes to join the industrialized world, it will have to continue to do this by having a comprehensive energy policy and making large investments in the power sector. Failure to do so would condemn Pakistanis to a life of poverty and backwardness.

Pakistan is heavily dependent on energy imports to drive its economy. These energy imports put severe strain on the country's balance of payments and forces it to repeatedly seek IMF bailouts.

Pakistan needs to develop export orientation for its economy and invest more in its export-oriented industries to earn the hard currencies it needs for essential imports including oil and gas. At the same time, Pakistan is stepping up its domestic oil and gas exploration efforts. American energy giant Exxon-Mobil has joined the offshore oil and gas exploration efforts started by Oil and Gas Development Corporation (OGDC), Pakistan Petroleum Limited (PPL) and Italian energy giant ENI.

Related Links:

Pakistan Oil and Gas Exploration

US EIA Estimates of Oil and Gas in Pakistan

Pakistan Among Fastest Growing LNG Markets

Methane Hydrate Release After Balochistan Quake

-

Comment by Riaz Haq on November 15, 2018 at 4:54pm

-

Pakistan's gas consumption per capita is 5 times as much as India's. That is staggering difference.

http://world.bymap.org/NaturalGasConsumption.html

2014 figures Pakistan 207 cubic meters per person vs India 42 cubic meters per person

It's also reflected in the total gas consumption figures for 2017:

Pakistan 3.95 billion cubic feet per day

India 5.25 billion cubic feet per day

https://www.ceicdata.com/en/indicator/india/natural-gas-consumption

https://www.ceicdata.com/en/indicator/pakistan/natural-gas-consumption

-

Comment by Sohail Safeer on November 15, 2018 at 6:25pm

-

Great Insight ! Thank you for facts and figures.

-

Comment by Riaz Haq on November 15, 2018 at 8:19pm

-

The per capita primary commercial energy consumption has increased dramatically since

1947, reflecting rapid rate of industrialization and a shift from non-commercial to commercial

sources of energy. In terms of oil equivalent, per capita commercial energy consumption

in Pakistan was mere 0.02 Ton of Oil equivalent (TOE) in 1947.

https://sdpi.org/publications/files/IP-Report.pdf

5 In 2012, per capita commercial

energy consumption is estimated

at 0.37 TOE, indicating a

compound growth rate of 6.5% for the

period 1947-2012.

6

Oil and gas resources account for

almost three-quarters ofthe energy consumption

in the country7 and natural

gas due to its convenience and cheapness

has proved over the years as the

best source of energy - partly replacing

coal.

8 Therefore, currently 49.5% of energy

needs are dependent on natural

gas, while Oil Imports account for

30.8%, LP 0.5%, Electricity (Hydro, Nuclear

& Imported) 12.5% and Coal

6.6%,

9 thus indicating the maximum dependence on natural gas

-

Comment by Riaz Haq on November 25, 2018 at 4:50pm

-

India Looks To Double Its Natural Gas Usage

https://oilprice.com/Energy/Natural-Gas/India-Looks-To-Double-Its-N...

This week Indian Prime Minister Narendra Modi announced that this administration is working toward establishing a natural gas trading exchange as part of a larger effort to relieve the rapidly developing nation’s reliance on crude oil and its byproducts. A large motivator for the desired shift away from oil is the country’s ever worsening pollution problem.

At a New Delhi ceremony for the laying of a foundation stone for the development of city gas distribution (CGD) networks, Prime Minister Modi said that his government wants to “increase the use of natural gas by 2.5 times by the end of next decade." The plan is already getting underway with the construction of CGD networks in 129 districts auctioned so far.

The CGD networks underway are just one facet of India’s move to develop a transparent natural gas market. The price of gas would be determined on an exchange, with the intention of promoting a significant increase in the use of natural gas in the subcontinent’s total energy mix. The amount of natural gas in the current blend is just 6.5 percent, and Modi’s administration aims to raise the natural gas content to 15 percent between 2028 and 2030.

The Indian government has not yet disclosed the price tag for making this significant switch away from crude and toward natural gas. That being said, analysts have consistently said that using natural gas as fuel for vehicles and households alike is markedly less expensive than LPG, and considerably cleaner than petrol or diesel, a majorly important factor in the smog-choked country with an exponentially expanding middle class. As more people with buying power enter the market with the desire and the means to buy vehicles and power their homes, the importance of clean energy only becomes more dire.

-------------

Another major factor of change in India’s energy industry at the moment is the projected decline of the nation’s traditional offshore assets over the next ten years. This will be offset by the planned deepwater and ultra-deepwater projects set for development in the Krishna-Godavari (KG) basin at the Bay of Bengal, but these projects will also be a major boon to Modi’s desired shift toward natural gas. The upcoming projects in the KG basin are, according to oil and gas analyst GlobalData, anticipated to meet the rapidly growing energy demand - natural gas especially - in India, in addition to reducing the nation’s dependence on imports by as much as 10 percent by 2023.

According to Prime Minister Modi, India has already begun the bidding process for what is now the tenth round of CGD, expanding the coverage to 400 districts (a whopping 70 percent of the country's total population) over the next two to three years. In addition, India is pouring 130 billion rupees (nearly $2 billion U.S. dollars) into constructing a pipeline to eastern India. This is a necessary development, as the east is the site of latent gas demand that has not yet been exploited thanks to the non-existent infrastructure (until now). This pipeline network, paired with the liquefied natural gas (LNG) terminals currently being developed on India’s east coast and the massive CGD network project, are expected to work together to significantly increase natural gas consumption in the Indian subcontinent.

-

Comment by Riaz Haq on November 27, 2018 at 1:23pm

-

Vopak expands equity in #LNG #infrastructure in #Pakistan. It will acquire a 44 percent stake in total in Elengy Terminal Pakistan Ltd, whose subsidiary owns the South Asian nation's first liquefied natural #gas import facility. #energy | ET EnergyWorld https://energy.economictimes.indiatimes.com/news/oil-and-gas/vopak-...

Global independent tank storage company Vopak said on Tuesday it will increase its stake in liquefied natural gas (LNG) infrastructure in Pakistan, as the South Asian country turns to LNG imports to curb energy shortages.

Vopak said it will acquire a 44 percent stake in total in Elengy Terminal Pakistan Ltd, whose subsidiary owns the South Asian nation's first liquefied natural gas (LNG) import facility.

The acquisition will involve separate transactions with International Finance Corp (IFC) and Engro Corp and includes a 29 percent stake the company said it would buy in July, Vopak said in a statement.

The purchase is subject to conditions including regulatory and shareholder approvals, and is expected to close in the first quarter of next year, it said.

Elengy Terminal Pakistan's subsidiary Engro Elengy Terminal owns an LNG facility which is located at Port Qasim in Pakistan, adjacent to the Engro Vopak chemical terminal.

The facility has been in operation since 2015 and is the first LNG import facility in Pakistan.

"Pakistan is a market with more than 200 million people and has a growing energy demand in which the share of gas is expected to increase," Vopak said.

"Gas is mainly used for power supply for the growing population, industrial usage and as feedstock for fertilizers."

Once the transaction is completed, Elengy Terminal Pakistan's shareholders will be Engro and Vopak.

-

Comment by Riaz Haq on December 21, 2018 at 8:49am

-

PTI Government unhappy, but Pakistan to stay with coal

https://www.eco-business.com/news/government-unhappy-but-pakistan-t...

Out of the 21 energy projects to be completed on a fast track (by 2019) with a cumulative capacity of 10,400 MW, nine are coal power plants, seven wind power plants, three hydropower, and two are HVDC transmission line projects.

Nearly USD 35 billion of the USD 60 billion worth of loans for producing energy from the China Pakistan Economic Corridor (CPEC) will be used to build new power stations, mainly coal-fired.

The projects completed include two mega coal power plants of 1,320 MW each, one in Punjab’s Sahiwal (commercially operating since May 2017) and the other in Karachi’s Port Qasim (Commercially operating since April 2018) using imported bituminous coal with modern supercritical coal-fired units. According to news reports, the country’s National Accountability Bureau has initiated an alleged corruption probe into both the costly projects.

Another one under completion is in the Thar desert in Sindh, about 400 kilometres from the port city of Karachi. It includes mining and setting up two 330 MW power plants at a cost of USD 2 billion. Once completed, it will be the first large power generation project using local coal.

The Sindh Engro Coal Mining Company has finally reached the coal seam in the desert. According to the company’s chief executive officer, Shamsuddin Shaikh, by October the company would have dug down to 162 metres to be able to dig up “useful” lignite coal. At the same time work at the first of the two power plants is 85 per cent complete and commissioning will begin by November-December this year when it will start supplying power to the national grid on an experimental basis. Once the first plant is fired, it will gobble up 3.8 million tons of coal each year.

Other projects in the pipeline include three 1,320 MW coal power plants. The ones at Rahim Yar Khan (in Punjab), and Hub (in Balochistan) to be completed between December 2018 and August 2019 respectively, will use imported coal. The third one, at Thar Block VI (in Sindh), will use indigenous lignite coal.

That does not mean that Pakistan is going to be completely coal-driven. Vaqar Zakaria, managing director of environmental consultancy firm Hagler Bailly Pakistan, put the figure to “just about 10 per cent of current power generation” which is from imported coal. However, he pointed out that coal-based power generation will increase to about 30 per cent of the country’s capacity requirement in the next three years once plants on Thar coal come online, and those at Hub and Jamshoro expand on imported coal.

Zakaria pointed out that the main argument in favour of Thar coal was the “lower reliance on imported fuel”, and to meet the “demand particularly when hydropower drops in winter” although the capital cost was high as the mines also have to be developed. However, he predicted the country will “see a slowdown in capacity addition in Thar in future”.

But projects relying on imported coal were questionable, especially those that are being carried out now, said Zakaria. “The earlier ones were justified [by the government] on the basis of load shedding and early induction of power to fill the demand-supply gap like the one at Port Qasim and Sahiwal plants that are already online; but the ones at Hub and Jamshoro cannot be justified on that basis. It is hard to understand why a project on imported coal was added so late in the game,” he said.

-

Comment by Riaz Haq on December 28, 2018 at 9:16pm

-

Pakistan Council Of Renewable Energy Technologies (PCRET) Installs 562 Micro-hydel Power Plants To Electrify 80,000 Houses

https://www.urdupoint.com/en/pakistan/pakistan-council-of-renewable...

Pakistan Council of Renewable Energy Technologies (PCRET), which is working under Ministry of Science and Technology, has installed 562 micro-hydel power plants with total capacity of 9.7 MW during the last five years, electrifying more than 80,000 houses.

An official source from Ministry of Science and Technology told APP that the ministry and its research and development organizations are mandated to develop technologies for socio-economic development of the country.

Technologies have been developed in different sectors like water, renewable energy, electronics, health, Small and Medium sized Enterprises (SMEs), industry, agriculture etc to directly and indirectly benefit a common man.

Listing different technologies developed during the last five years, the official source informed that PCRET has installed 155 small wind turbines in Sindh and Balochistan electrifying 1560 houses and installed 4016 biogas plants.

The council has established 20 KW hybrid system including solar, MHP and wind in collaboration with China for research and training purposes.

PCRET has also designed and stimulated Wind Turbine and solar products including Solar Cooker, Solar Dryer, Solar Water Heater and Solar Desalination.

During the last five years, Pakistan Council of Scientific and Industrial Research (PCSIR) which is also an important department of the ministry has developed Coal Water Slurry Fuel and Reinforced Derived Fuel and solar driven one inch and two inches water pumps. PCSIR has also designed the Solar Powered Reverse Osmosis Plant, the source said.

While National Institute of Electronics (NIE) has developed LED lights, Solar Charge Controller, Automatic Voltage Stabilizer and cascaded multilevel inverter based transformer-less Unified Power Flow Controller, it added.

-

Comment by Riaz Haq on January 13, 2019 at 8:06am

-

#Saudi to set up $10 billion #oil #refinery in #Pakistan."#SaudiArabia wants to make Pakistan's economic development stable through establishing an oil refinery and partnership with Pakistan in #CPEC" Saudi Energy Khalid al-Falih told reporters in #Gwadar https://cnb.cx/2TJMPDz

Saudi Arabia plans to set up a $10 billion oil refinery in Pakistan's deepwater port of Gwadar, the Saudi energy minister said on Saturday, speaking at the Indian Ocean port that is being developed with the help of China.

Pakistan wants to attract investment and other financial support to tackle a soaring current account deficit caused partly by rising oil prices. Last year, Saudi Arabia offered Pakistan a $6 billion package that included help to finance crude imports.

"Saudi Arabia wants to make Pakistan's economic development stable throughestablishing an oil refinery and partnership with Pakistan in the China Pakistan Economic Corridor," Saudi Energy Khalid al-Falih told reporters in Gwadar.

He said Crown Prince Mohammad bin Salman would visit Pakistan in February to sign the agreement. The minister added that Saudi Arabia would also invest in other sectors.

Beijing has pledged $60 billion as part of the China Pakistan Economic Corridor (CPEC) that involves building power stations, major highways, new and upgraded railways and higher capacity ports, to help turn Pakistan into a major overland route linking western China to the world.

"With setting up of an oil refinery in Gwadar, Saudi Arabia will become an important partner in CPEC," Pakistan Petroleum Minister Ghulam Sarwar Khan said.

The Saudi news agency SPA earlier reported that Falih met Pakistan's petroleum minister and Maritime Affairs Minister Ali Zaidi in Gwadar to discuss cooperation in refining, petrochemicals, mining and renewable energy.

It said Falih would finalise arrangements ahead of signing memorandums of understanding.

Since the government of Prime Minister Imran Khan came to power in August, Pakistan has secured economic assistance packages from Saudi Arabia, the United Arab Emirates and China.

In November, Pakistan extended talks with the International Monetary Fund as it seeks its 13th bailout since the late 1980s to deal with a looming balance of payments crisis.

The Pakistani prime minister's office had said on Thursday that Islamabad expected to sign investment agreements with Saudi Arabia and the UAE in coming weeks.

-

Comment by Riaz Haq on January 15, 2019 at 11:01am

-

Access to #electricity: #Pakistan 99%, #India 84%, #Bangladesh 76%. Source: World Bank 2016

https://twitter.com/theworldindex/status/1085029776556023808

-

Comment by Riaz Haq on January 16, 2019 at 8:12am

-

#Pakistan #ExxonMobil offshore drilling site #Kekra-1 143 miles from #Karachi is among top 3 potential "big oil finds" in #Asia

https://www.bloomberg.com/news/articles/2019-01-14/oil-wildcats-to-...“Explorers are getting a little bit more ambitious in this part of the world,” Andrew Harwood, the consultancy’s Asia-Pacific upstream research director, said in an interview in Singapore. “These are huge companies with global portfolios; they’re not spending the money to drill unless they have a reason to be excited.”

Wood Mackenzie expects mergers and acquisition spending in the region to total about $8 billion in 2019 after growing 60 percent to $8.7 billion 2018. Activity will be focused around divestments in Southeast Asia by companies that want to focus spending on U.S. shale.

Here’s a closer look at the three Asia-Pacific prospects Wood Mackenzie is paying the most attention to:

Pakistan

A group including Eni SpA and Exxon Mobil Corp. will start drilling the Kekra-1 well this month in deepwater south of Pakistan. The country’s onshore natural gas production has been declining after years of under-investment, leading to the start of liquefied natural gas imports in recent years. Growing demand for the fuel has made the drillers more confident that they’ll be able to sell any gas from a sizable development, Harwood said.

---------Pakistan: ExxonMobil Begins Drilling off Karachi Coast

https://worldview.stratfor.com/situation-report/pakistan-exxonmobil...

What Happened: ExxonMobil has begun drilling for oil and gas 143 miles off the coast of Karachi in the Arabian Sea, Daily Pakistan reported Jan. 10.Why It Matters: The operations mark the first time an energy company is conducting offshore exploration along Pakistan's coast. An ExxonMobil executive has said the company has been considering launching operations in the region because of Pakistan's growing energy demand.

Background: Only 15 percent of Pakistan's energy consumption is met by domestic production. High energy prices have significantly inflated the country's import bill and contributed to draining its foreign exchange reserves.

Twitter Feed

Live Traffic Feed

Sponsored Links

South Asia Investor Review

Investor Information Blog

Haq's Musings

Riaz Haq's Current Affairs Blog

Please Bookmark This Page!

Blog Posts

India-Israel Axis Threatens Peace in South Asia

The bonhomie between Israeli Prime Minister Netanyahu, an indicted war criminal, and Indian Prime Minister Narendra Modi, accused of killing thousands of Muslims, was on full display this week in Israel. Both leaders committed to supporting the Afghan Taliban regime which is accused of facilitating cross-border terrorist attacks by the TTP in Pakistan. Mr. Modi was warmly welcomed by…

ContinuePosted by Riaz Haq on February 27, 2026 at 10:45am

Modi's AI Spectacle: Chaos and Deception in New Delhi

The India AI Impact Summit 2026, held at Bharat Mandapam in New Delhi, has been marred by chaos, confusion and deception. The events on the ground have produced unintended media headlines for India's Prime Minister Narendra Modi who wants to be seen as the "vishwaguru" (teacher of the world) in the field of artificial intelligence as well. First, there was massive chaos on the opening day, with long…

ContinuePosted by Riaz Haq on February 19, 2026 at 12:00pm — 13 Comments

© 2026 Created by Riaz Haq.

Powered by

![]()

You need to be a member of PakAlumni Worldwide: The Global Social Network to add comments!

Join PakAlumni Worldwide: The Global Social Network