PakAlumni Worldwide: The Global Social Network

The Global Social Network

Pakistan's Year 2015 in Review

A Happy, Peaceful and Prosperous New Year to all my readers.

The year 2015 turned out to be a good year for Pakistan with the return of general optimism among businessmen, investors and consumers. Economic recovery continued as Pakistan Army's efforts, including its Operation Zarb e Arb and Karachi Operation by Rangers, started to bear fruit with significant decline in terrorism. There were new signs of a thaw in India-Pakistan ties with Indian Prime Minister Modi's surprise year-end visit to Lahore. Efforts to bring peace in Afghanistan took a new positive turn with the hopeful entry of the Taliban into a quadrilateral process involving Afghanistan, Pakistan, China and the United States. Threat of ISIS (Daish) presence rose in South Asia with reports of stepped up ISIS recruitment in Afghanistan and Pakistan.

Highlights:

1. Pakistan economy neared the historic one trillion dollar mark in PPP terms in 2015. The nation's PPP GDP increased from $884 billion to $930 billion, an increase of $46 billion. Pakistan per capita PPP GDP is $4,902 for 2015, up from $4,749 in 2014, according to the IMF. Nominal GDP based on current exchange rates is reported at $270 billion in 2015, up from $246 billion in 2014, an increase of $24 Billion. Pakistan's per capita nominal GDP for 2015 is $1,427.085, up from $1,325.790 in 2014.

2. Pakistan's actual GDP is higher than what the official figures show, according to the State Bank of Pakistan. The SBP annual report for 2014 released in 2015 said: "In terms of LSM growth, a number of sectors that are showing strong performance; (for example, fast moving consumer goods (FMCG) sector; plastic products; buses and trucks; and even textiles), are either under reported, or not even covered. The omission of such important sectors from official data coverage, probably explains the apparent disconnect between overall economic activity in the country and the hard numbers in LSM."

3. Terrorism declined to the lowest level since 2006 as civilian deaths in terrorist incident nearly halved from 1781 in 2014 to 911 in 2015, according to South Asia Terrorism Portal.

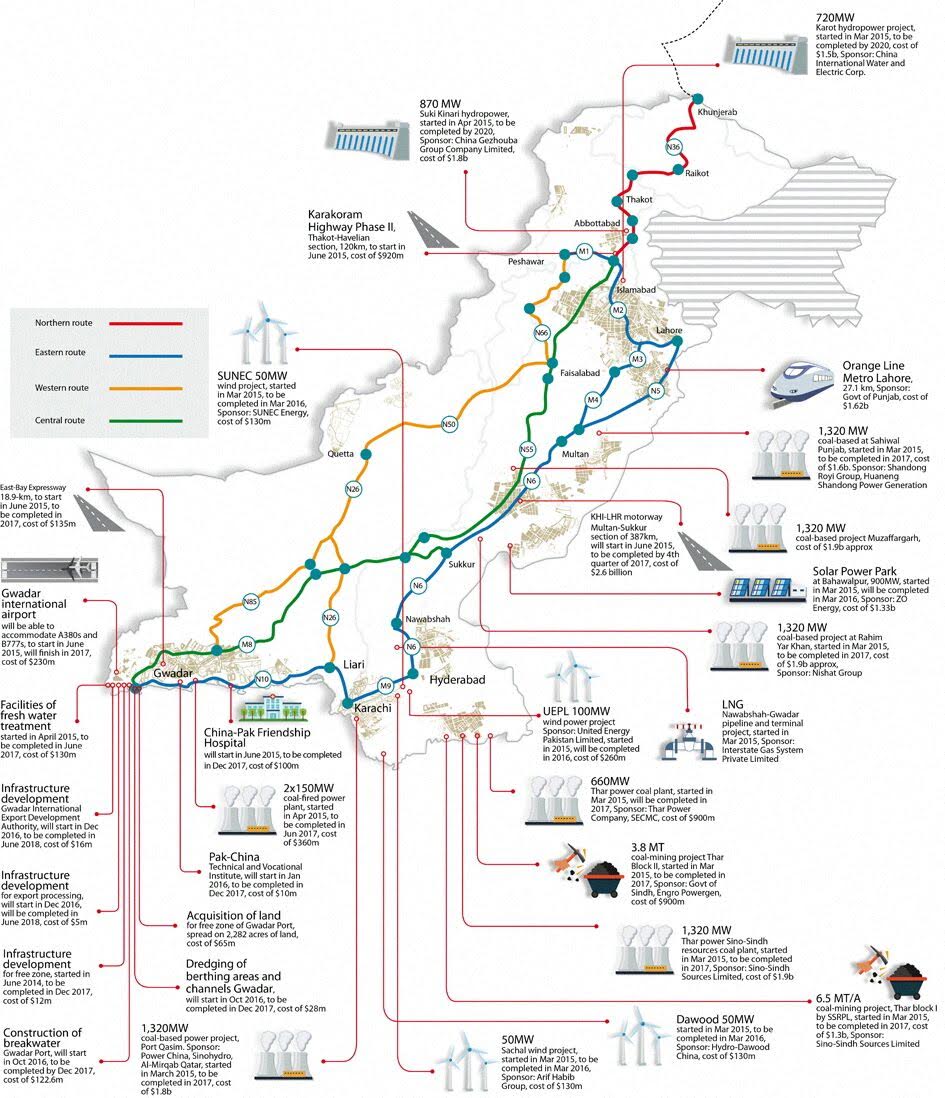

4. China announced plans of massive $46 billion investment in the country as part of the China-Pakistan Economic Corridor (CPEC). Once completed, the this corridor with a sound industrial base and competitive infrastructure combined with low labor costs is expected to draw growing FDI from manufacturers in many other countries looking for a low-cost location to build products for exports to rich OECD nations.

CPEC Projects Map |

5. Hopes for resolving Pakistan's energy crisis rose as liquified natural gas (LNG) prices hit historic new lows and hydrocarbon prices continued to plummet. An LNG terminal started operations at Port Qasim in Karachi and started receiving LNG cargoes.

6. Over 20 million users signed up for 3G and 4G mobile broadband services after initial rollout in late 2014. Double digit growth was recorded in cement consumption and automobile sales, all pointing to accelerating economic growth.

7. Enrollment in grades 13 through 16 exceeded 3 million mark in Pakistan's 1,086 degree colleges and 161 universities. The 3 million enrollment is 15% of the 20 million Pakistanis in the eligible age group of 18-24 years. In addition, there are over 255,000 Pakistanis enrolled in vocational training schools, according to Technical Education and Vocational Training Authority (TEVTA).

8. Prime Minister Nawaz Sharif launched a national health insurance plan in the closing days of 2015, further expanding a basic social safety net that started with Benazir Income Support program for the poor during the PPP years in power.

Lowlights:

1. Out-of-school children declined by just 1% as Pakistan continued to lag behind neighbors, particularly Bangladesh, India and Sri Lanka, on human development indices.

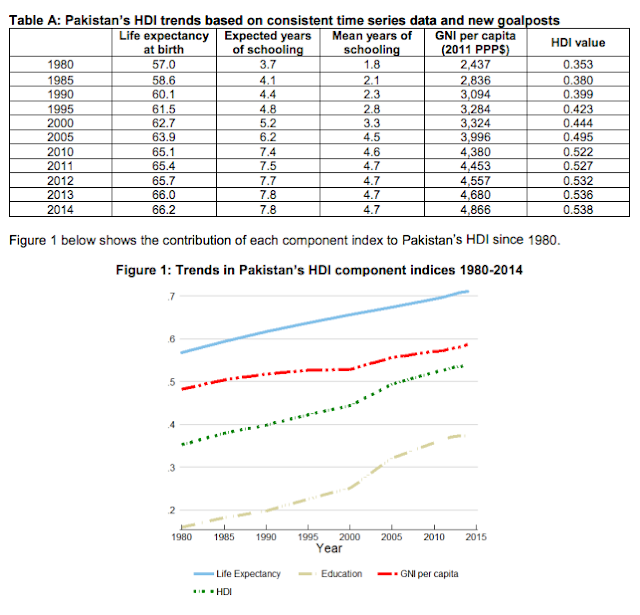

2. The latest human development report for 2015 from UNDP shows human development progress over several decades and confirms it's been the slowest in this decade. Pakistan's HDI grew 13% in 1980s, 11.2% in 1990s, 17.6% in 2000s, and just 3% since 2010. It grew the fastest when President Musharraf was in office from 2000 to 2008.

3. Several reports and arrests of ISIS sympathizes and fundraisers indicated rising threat in South Asia from the Iraq-Syria based terror group.

4. Many politicians, particularly in Sindh province, continued to hinder the Pakistan Army Rangers' efforts to bring peace to Karachi.

5. The implementation of National Action Plan to fight terror has received little more than lip service from the civilian leadership in the country, raising fears of the return of terrorism in the future.

Summary:

Decline of terrorism has enabled Pakistan's economy to begin to recover in 2015. It needs to be sustained for the long term. A basic requirement for sustainable development is investment in and focus on human resources of the country. Education and health care must receive top priority to build a peaceful and prosperous Pakistan.

Related Links:

Pakistan's Trillion Dollar Economy

China-Pakistan Industrial Corridor (CPEC)

How Can Pakistan Benefit From Low LNG Prices?

Who's Better For Human Development? Politicians or Musharraf?

-

Comment by Riaz Haq on January 2, 2016 at 9:48pm

-

#China #Pakistan Economic Corridor: 27 sites identified for Special Economic Zones (SEZs)| Business Recorder. #CPEC

http://www.brecorder.com/market-data/stocks-a-bonds/0:/1259793:econ... …

The federal government has identified as many as 27 sites in provinces, Islamabad Capital Territory (ICT) and Gilgit-Baltistan for setting up of Special Economic Zones (SEZs) under the China Pakistan Economic Corridor (CPEC), it is learnt. Sources in the Finance Division and the Planning Commission told Business Recorder that provincial governments have also been requested to allocate land for sites of SEZs.

The federal government has identified seven sites in Balochistan for the establishment of SEZs. The sites identified in Balochistan for industrial estates are as follows: (i) Gwadar with 3,000 acres for mines, minerals, food processing, agriculture and livestock, (ii) industrial estate at Lasbela (1,290 acres, iron steel, hardware, paper industry, pharmaceuticals), (iii) industrial and trading estate at Turbat (1,000 acres, manufacturing), (iv) Dera Murad Jamali with 50 acres, (v) Winder Industrial and Trading Estate, (vi) mini industrial estate Khuzdar (50 acres) and (vii) Bolan Industrial Estate (1,000 acres). The government has identified three sites in Sindh to set up Special Economic Zones, which include Chinese industrial zone near Karachi (2,000 acres, Exclusive Chinese Industrial Estate), Textile City at Port Qasim, Karachi with (1,250 acres) and Marble City at Karachi with (300 acres).

As per official documents, eight sites in Khyber Pakhtunkhawa province have also been identified for special economic zones. They include, marble and granite based industrial estate at Mansehra (80 acres, mining), industrial estate Nowshera (1000 acres, manufacturing), expansion of Industrial Estate Hatter (424 acres, manufacturing), industrial estate at Chitral (80 acres, food processing) as well as Industrial Estate Ghazi (90 acres, manufacturing) and industrial estate Dera Ismail Khan (188 acres, manufacturing).

Industrial estate at border of Kohat and Karak and industrial and economic zone at Bannu (400 acre) in KP have also been identified as sites for SEZ under CPEC. The government has identified seven sites for special industrial zones in Punjab. These included Multan Industrial Estate phase-II (80 acres), Rahim Yar Khan Industrial Estate (450 acres), Bhalwal Industrial Estate (400 acres), DG Khan Industrial Estate (3815 acres), Mianwali Industrial Estate (600 acres), Rawalpindi Industrial Estate (200 acres) and Pind Dadan Khan Industrial City (10000 acres) for agri, textile, food processing, livestock, manufacturing & energy).

Additionally, the existing under-development sites would also be included in SEZs for the CPEC. One site for special economic zones in Gilgit-Baltistan Moqpondass (2,000 kanal, mining & food processing) and one for Islamabad Capital Territory has also been identified under the CPEC.

-

Comment by Riaz Haq on January 4, 2016 at 9:21pm

-

#Pakistan to develop #CSR framework for public-private partnership for social sector investments and #HDI growth http://www.dawn.com/news/1229464

The Asian Development Bank (ADB) will help Pakistan develop best practices models to strengthen collaboration between the government, businesses and civil society organisations for the delivery of social services and poverty reduction.

The ADB assistance will lead to developing Corporate Social Responsibility (CSR) frameworks and partnership models for effective linkages between public, private and civil society sectors.

The models aims to ‘building capacity of key stakeholders to strengthen partnerships; and establishing philanthropy and civil society organisation (CSO) networks to facilitate sustainable governance structures to contribute to inclusive social sector development and poverty alleviation in Pakistan’.

The ADB technical assistance will also enhance the capacity for resource mobilisation and CSR contribution of private sector and SCOs in Pakistan, according to ADB.

“Pakistan has experienced periods of strong economic growth. However, the resilience of the economy has been tested by exogenous and endogenous shocks and periods of macroeconomic instability. Sustainable social development and poverty alleviation has lagged behind economic growth,” the bank noted.

Pakistan ranks 146th out of 186 countries on the Human Development Index (HDI). Its progress in HDI and achieving the Millennium Development Goals (MDGs) were below many peer countries.

Pakistan’s expenditure on social sector at 0.8 per cent on health and 1.8pc on education is very low by world standards. The result is a large social sector deficit which is a drag on sustainable, inclusive economic growth and poverty alleviation, and creates risks to social stability.

It is clear that the magnitude of the social sector service delivery is beyond the fiscal and institutional capacity of the government, thus other alternatives must be considered to help achieve sustainable development.

In other countries, efforts are being made to create productive and viable linkages with key stakeholders such as the private sector and the civil society to ensure attainment of development goals. This may be a viable option for Pakistan as well.

To mobilise additional CSR and corporate philanthropy and to enhance its effectiveness, it is essential to identify best CSR practices and models, CSO implementing partners, and to form strong and credible linkages between government, philanthropists and civil society.

In order to enhance CSR for inclusive growth in Pakistan, it is crucial to generate relevant knowledge, form synergies, and create an enabling environment where these three segments of society work in partnership.

The ingredients exist to strengthen business and CSO contributions to overall social development and sector service improvement. Pakistan is a giving society, as indicated in several studies.

-

Comment by Riaz Haq on January 6, 2016 at 8:18am

-

BBC News - #India's response to #Pathankotattack was 'a debacle' http://www.bbc.com/news/world-asia-india-35232599 …

It took Indian authorities four days to put down a deadly attack on the Pathankot air force base near the Pakistani border which killed seven Indian soldiers and wounded another 22. The inept handling of the security operation can only be described as a debacle, writes defence analyst Rahul Bedi.

According to official accounts, the National Security Adviser Ajit Doval had advance intelligence of the planned attack on 1 January.

But military analysts said India's response to the attack was amateurish - there were inadequate offensive measures and the multiplicity of forces involved and a lack of suitable equipment rendered the entire operation a near fiasco.

When the attack began, Mr Doval chose to airlift some 150 National Security Guard (NSG) personnel from their base at Manesar, on Delhi's outskirts, to fight in an unfamiliar terrain.

The operational command for the mission was handed over to the NSG, the Defence Service Corps (DSC) and the air force's Garud Special Forces.

The DSC comprises retired and unmotivated military personnel, whilst the Garuds continue to struggle for operational relevance amongst the plethora of India's burgeoning Special Forces.

In what appeared to be an obvious desire to control the operation, Mr Doval ignored the presence of some 50,000 army troops in the Pathankot region, possibly the highest such concentration in the country.

Reports said he requested the army chief for just two columns - 50-60 troops - to provide back-up support to the operation.

The army, say security officials, is experienced in battling Kashmiri insurgents.

The NSG, for its part, was unacquainted with the terrain and took avoidable losses that included Lieutenant-Colonel Niranjan Kumar being killed in a grenade explosion from a booby trapped militant's body.`

Four other NSG personnel were injured in this blast that - in all probability - would not have fooled the army, familiar with such militant ploys of activating a grenade and lying on it as a last offensive act.

The NSG is also strapped for equipment - it has no competent night vision devices and other materiel necessary for an operation of the kind in Pathankot - military sources said.

Throughout the four days the operation lasted, the army was accorded a marginal role - although some 200 soldiers were eventually deployed when fighting stretched beyond 48 hours and after senior ministers - including Prime Minister Narendra Modi, Home Minister Rajnath Singh and Defence Minister Manohar Parrikar - had announced that the operation had been completed successfully.

The congratulatory messages followed the gunning down of four terrorists, but thereafter firing began afresh, and confusion prevailed over how many gunmen were hiding in the tall grass surrounding the air base, spread over some 1,200 hectares.

-

Comment by Riaz Haq on January 6, 2016 at 9:17pm

-

#Pakistan economy looking good. Its shares market deserves an upgrade from frontier to emerging market status. #MSCI http://www.nasdaq.com/article/frontier-markets-does-pakistan-deserv... …

The country (Pakistan) is brimming with untapped potential and a population filled with unfilled dreams. The people are very similar to Indians, and I can say with some certainty that they wish to be an integral part of the capitalist system. They should be given that opportunity, and under the premiership of Nawaz Sharif, I believe they will.

The Pakistan capital markets, and in particular the Karachi Stock Market and its benchmark index KSE100, have over the past few years performed well, returning over 150% cumulatively in local currency since January 7, 2012. China has recently shown great interest in Pakistan and has pledged to assist them in building an economic corridor with a $46 billion network of transportation links as part of China’s “one belt, one road” initiative.

When completed, no doubt, this will add substantially to Pakistan’s GDP growth of 4.2%. Recently, Mr. Sharif spoke at a forum in Sri Lanka where he said, “Democracy creates far better opportunities for both economic growth and cultural progress than the authoritarian regimes. My government has placed strong emphasis on bold economic reforms to achieve significant improvement in all sectors of the economy." But he did not elaborate on what the reforms would be.

As far as investment opportunities, it is of interest to me that Global X recently launched a Pakistan focused ETF (

PAK

), which since its launch in May 2015 has a return of negative 15%. I expected that, in the light of what most Asian stocks have returned in 2015. However again, I am not going to invest in the ETF, but would rather gain exposure by investing in some GDRs being traded on the London Stock Exchange. With all the infrastructure projects being talked about and the tangential business derived from that, for a retail investor, I believe the financial sector would be a great entry point, and in particular banks.The largest Pakistani bank, Habib Bank Ltd. (HBL), is only traded on the Karachi Stock Exchange, but retail investors can purchase shares online. However, the banks I would like to target are Pakistan’s fourth largest bank, MCB Bank (MCBS) which is trading at $3.50 a share, and is at a 52-week low but has tremendous upside; and United Bank (UBLS) which is trading around $6.70 a share, close to its 52-week high. In the coming years, these two banks should outperform. Both banks are part of the PAK ETF which also includes some sectors that I do not think will perform well in the near term. They are of course, oil and gas.

So, in my opinion, Pakistan should be characterized in the near future to emerging market status from frontier market. They deserve it. But more importantly, Pakistan’s youth deserve a bright and rewarding future. Oh, and one last item. Have you ever watched the Coca-Cola Ramzan commercial? You should. You knew I had to bring Coke into this article!

-

Comment by Riaz Haq on January 8, 2016 at 8:14pm

-

#worldbank says #Pakistan economy being pushed forward by strong tailwinds #CPEC #China http://www.dawn.com/news/1231423

Pakistan stands to benefit from three tailwinds over the near- to medium-term, with average growth projected at 5.5 per cent over the forecast period, said the World Bank’s Global Economic Prospects report for 2016.

The report identified the ‘tailwinds’ as rising investments from China under the China-Pakistan Economic Corridor (CPEC); the anticipated return of Iran to the international economic community; and persistently low international oil prices.

The report also pointed out that macroeconomic adjustment in Pakistan under an International Monetary Fund programme is progressing, while efforts to crackdown on violent crime in Karachi, the country’s industrial and commercial hub, are supporting investor confidence.

The CPEC agreement, signed in 2015, “has further bolstered investor optimism, and, if implemented, has the potential to lift long-term growth,” the report predicted.

But the World Bank also pointed out that national elections in Pakistan are due in 2018, and warned that “hard won fiscal consolidation gains may be lost if spending ramps up in the pre-election period.”

“In addition, sovereign guarantees associated with the CPEC could pose substantial fiscal risks over the medium term,” the report added.

The report noted that the government of Pakistan usually refers to growth in real GDP “at factor cost” for policy purposes. Real GDP growth at factor cost is projected at 4.5pc in fiscal 2015-16.

The report, which described South Asia as a “bright spot” in next year’s global economic prospects, noted that both India and Pakistan have been on a path of fiscal consolidation over the past three years, and fiscal restraint is curbing demand-side pressures. Lower inflation has enabled central banks in India and Pakistan to cut policy rates to support activity.

The Pakistani currency, which had appreciated in real effective terms since 2013, has stabilised in recent months. The current account deficit has continued to narrow, reflecting lower oil import cost and strong remittance inflows.

The report showed that Pakistan has also made progress in reining in its budget deficit from 8.4pc of GDP in FY13 to 5.3pc in FY15. However, debt levels remain high at 65pc of GDP, the result of years of fiscal slippages, and interest payment costs are about 4.4pc of GDP.

Industrial activity has slowed in Pakistan, while external trade remains weak.

The central bank, with IMF assistance, is gradually strengthening monitoring of financial stability risks, and is in the process of instituting a modern deposit insurance scheme in line with international best practices.

Estimated at around $45bn of investment until 2030, the CPEC initiative will finance a series of transport infrastructure projects. These include $11bn, mostly public investment, in the transport sector, and $33bn in energy projects, also mostly private.

The projects foreseen in the CPEC to receive funding from China also include $4bn Silk Road Fund and partial financing for the $1.65bn Karot hydropower project.

But the report explained that stronger growth and investment in Pakistan “is predicated on reforms to strengthen the business climate, an improvement in the security situation, implementation of the CPEC and an associated easing in energy constraints.”

But the World Bank warns that these “developments might not materialise as expected … risks are mostly of domestic origin and mainly on the downside.”

-

Comment by Riaz Haq on January 14, 2016 at 9:52pm

-

#Pakistan’s trade deficit balloons to $11.92 billion as exports decline in first half of fiscal 2015-16

http://tribune.com.pk/story/1026503/1hfy16-trade-deficit-amounts-to... …

Amid fresh concerns over further loss of competitiveness in global markets, Pakistan’s external trade deficit stood at roughly $12 billion during the first half of this fiscal year (Jul-Dec 2015) -$3 billion more than International Monetary Fund’s projections – owing to steep decline in exports.

Although the trade deficit – gap between exports and imports – marginally contracted when compared to the previous period, it was still above projections, offsetting the positive impact of a reduction in crude oil prices.

IMF forecasts steep development budget cut

The IMF has warned that benefits of lower oil prices will continue to be offset by weak performance of exports.

From July through December, the trade deficit amounted to $11.92 billion, reported the Pakistan Bureau of Statistics on Tuesday. It was $163 million or 1.4% less than the comparative period last year. The deficit was $2.9 billion higher than the IMF’s projections that put the first-half gap in exports and imports at $9.1 billion.

In order to offset the impact of higher trade deficit on foreign currency reserves and building a cushion against future trade and external shocks, the State Bank of Pakistan purchased $5.5 billion from the spot market in the first two years of the IMF programme, revealed a recent IMF report.

On the back of falling commodity prices and a strong rupee against other currencies, exports further plunged to $10.3 billion in July-December period, which is $1.8 billion or 14.4% less than the receipts in the comparative period of the last fiscal year, reported the PBS.

Exports were $770 million less than the IMF’s projections.

The PML-N government has failed to announce a three-year strategic trade policy framework. Prime Minister Nawaz Sharif has reportedly scrapped the proposed framework praepared by Ministry of Commerce, terming it unrealistic.

Imports also contracted in July-December period by 7.9% to $22.2 billion -$1.9 billion less than the comparative period. However, these were $2.1 billion more than the IMF’s projections

Fresh concerns

In its latest report under the ninth review of Pakistan’s economy, the IMF has raised concerns about further loss of competitiveness. “Exports, and consequently (economic) growth will be adversely affected further if Pakistan falls behind its competitors in securing favourable treatment in major markets”, the IMF noted.

In a footnote, the IMF said that Pakistan is not a participant in the forthcoming Trans-Pacific Partnership – a multilateral trade arrangement covering 40% global trade. It said that some of Pakistan’s competitors in textiles and clothing are participating in the arrangement.

Led by the United States, 12 nations mainly from the Pacific Rim have signed the Trans-Pacific Partnership treaty including Vietnam that is a competitor to Islamabad. India and Bangladesh -two other competitors – may also join the arrangement, which could further dent Pakistan’s exports.

While commenting on reasons, the IMF said that the exports declined in first quarter (July-September) owing to falling cotton prices and real exchange rate appreciation. The export competitiveness has suffered from structural factors such as security concerns, power outages, and an unfavourable business climate, as well as from significant real exchange rate appreciation over the past two years, it added.

Slowdown in economic reforms could reverse economic gains: IMF

The real effective exchange rate appreciated by 17% in last two years, said the IMF. Its working suggests that the rupee was overvalued against the US dollar in the range of 5 to 20%, depending upon the methodology applied to work out the real value of the rupee.

-

Comment by Riaz Haq on January 25, 2016 at 8:05pm

-

#Daesh (#ISIS) Threat Could Inadvertently Unite #Afghanistan, #Pakistan and Beyond

http://sputniknews.com/middleeast/20160126/1033698159/daesh-unites-... … via @SputnikInt

The threat posed by Daesh could act to unite factions in Afghanistan and beyond, said Anatol Lieven, Georgetown University professor and Middle East expert, in an interview with Radio Sputnik.

Lieven claims that the emergence of Daesh in the country may potentially lead to the enhancement of peace talks between the government in Kabul and Taliban insurgents.

The two sides, along with groups in neighboring states, could find a commonality in their mutual rejection of the growing influence of the violent extremist group.

“The most important thing about ISIS (another abbreviation for Daesh) is that this is off style both to the government and the Taliban,” Lieven explained. “Indeed it is also off style to all the regional states. In that way, it could be the only force which unites the whole region,” the expert claimed.

Commenting on the recent setbacks of Afghan security forces, which have lost ground in the country to the Islamists, Lieven said he believes the most serious vulnerability is that of weak government forces.

“The problem is, that the Afghan army can hold territory, but they have been very poor, so far, at recapturing territory out in the countryside,” he said.

Afghan law enforcement additionally relies heavily on foreign assistance, especially that of the United States.

“They are wholly dependent – for money, for weapons, for pay – on continued US aid,” Lieven stated.

Kabul must offer something viable to the Taliban if they intend to pacify the country, he said, adding that, “Dividing and conquering also requires genuine and convincing peace offers to the mainstream Taliban.”

Comment

Twitter Feed

Live Traffic Feed

Sponsored Links

South Asia Investor Review

Investor Information Blog

Haq's Musings

Riaz Haq's Current Affairs Blog

Please Bookmark This Page!

Blog Posts

Modi's AI Spectacle: Chaos and Deception in New Delhi

The India AI Impact Summit 2026, held at Bharat Mandapam in New Delhi, has been marred by chaos, confusion and deception. The events on the ground have produced unintended media headlines for India's Prime Minister Narendra Modi who wants to be seen as the "vishwaguru" (teacher of the world) in the field of artificial intelligence as well. First, there was massive chaos on the opening day, with long…

ContinuePosted by Riaz Haq on February 19, 2026 at 12:00pm — 11 Comments

India-Pakistan Cricket Match: The Biggest Single Event in the World of Sports

Why did Pakistan's decision to boycott the India-Pakistan match in solidarity with Bangladesh in this year's T20 World Cup send shockwaves around the world? And why did it trigger the International Cricket Council's and other cricket boards' urgent efforts to persuade Pakistan to return to the match? The reason has a lot to do with its massive financial impact, estimated to be as much as …

ContinuePosted by Riaz Haq on February 11, 2026 at 4:00pm — 2 Comments

© 2026 Created by Riaz Haq.

Powered by

![]()

You need to be a member of PakAlumni Worldwide: The Global Social Network to add comments!

Join PakAlumni Worldwide: The Global Social Network